Global Natural Gas Fired Electricity Generation Market Size, Share, And Business Benefits By Technology (Open Cycle, Combined Cycle, Cogeneration), By Source (Sweet Natural Gas, Sour Natural Gas, LNG), By Power Output (Less than 100 MW, 100-500 MW, 500-1000 MW, Above 1000 MW), By Application (Industrial, Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 154682

- Number of Pages: 345

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

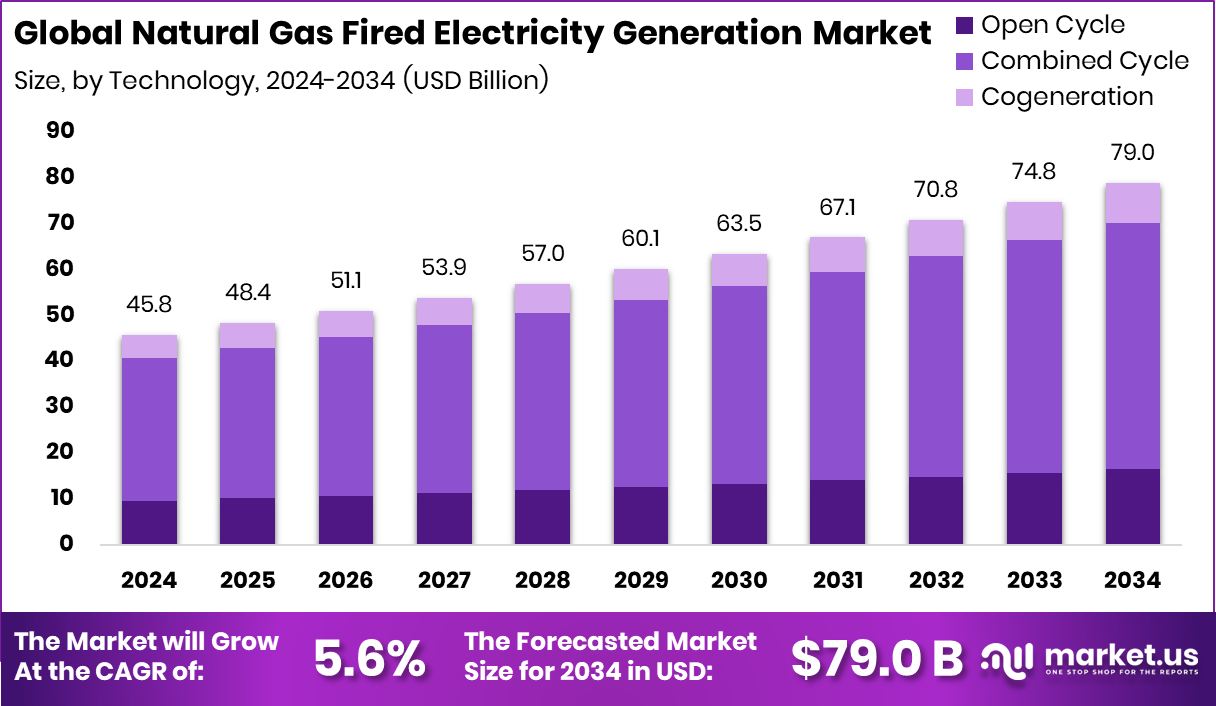

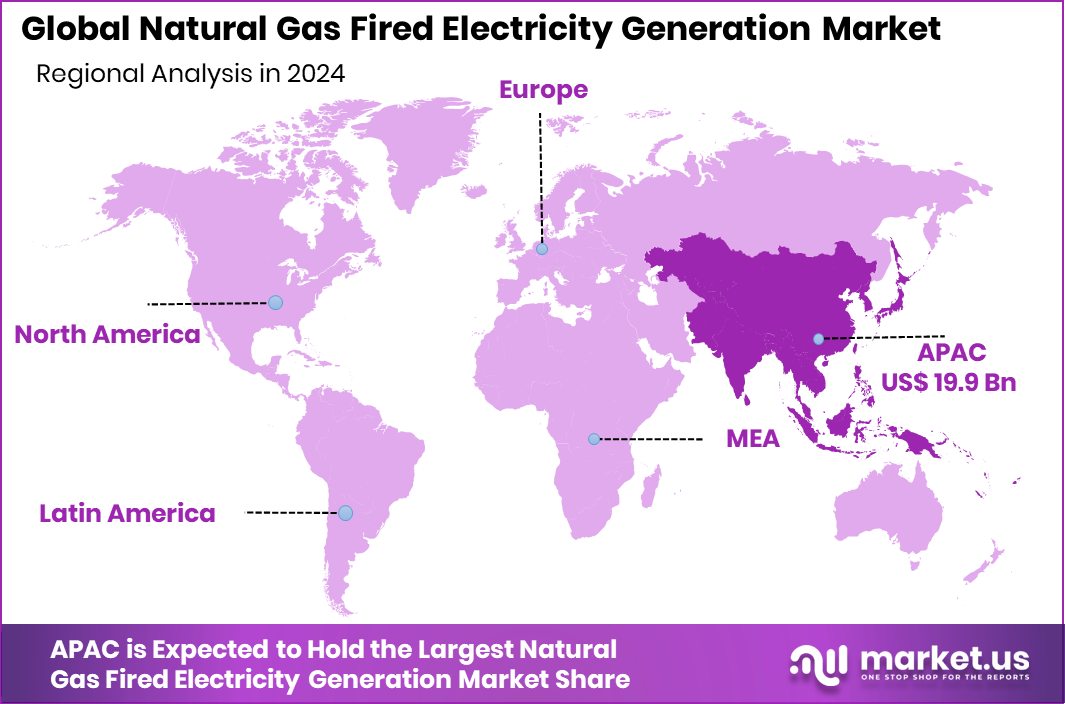

The Global Natural Gas Fired Electricity Generation Market is expected to be worth around USD 79.0 billion by 2034, up from USD 45.8 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034. With a 43.60% share, Asia-Pacific’s natural gas electricity market touched USD 19.9 billion.

Natural Gas-Fired Electricity Generation refers to the process of producing electrical energy using natural gas as the primary fuel source. This method typically involves burning natural gas in turbines or combined cycle power plants to generate electricity. It is considered cleaner than coal and oil-based generation, producing significantly lower carbon dioxide, sulfur dioxide, and particulate emissions. Natural gas-fired plants can be quickly ramped up or down, making them suitable for balancing the fluctuations of renewable energy sources like wind and solar, thus playing a crucial role in modern power grids.

The market for Natural gas-fired electricity Generation encompasses the infrastructure, equipment, and services related to the development and operation of power plants powered by natural gas. It includes upstream gas supply logistics, turbine manufacturing, plant construction, and power distribution. With a global shift towards cleaner energy sources and stricter emission norms, the market is witnessing a steady rise in investments from both public and private sectors. According to an industry report, NRG Energy launches a new gas plant in Houston with $216 million from the Texas Energy Fund.

Growth factors include increasing urbanization and industrialization, which are driving higher electricity consumption. In many countries, the retirement of older coal-fired plants and nuclear reactors is creating room for cleaner alternatives, including gas-fired facilities. Moreover, the global push for reducing greenhouse gas emissions is encouraging energy producers to switch to natural gas, which emits around 50% less CO₂ compared to coal. According to an industry report, Texas approves $1.8 billion in funding for solar, battery, and gas microgrid projects.

Demand is also growing due to the reliability and flexibility of natural gas-fired plants. They are often used as backup for intermittent renewable sources, ensuring a consistent energy supply. Additionally, advancements in gas turbine technology are enhancing plant efficiency and lowering operational costs, which is further boosting adoption across regions with strong power demand growth. According to an industry report, Ontario is exploring strategies to reduce $450 billion electricity expenditure.

Key Takeaways

- The Global Natural Gas Fired Electricity Generation Market is expected to be worth around USD 79.0 billion by 2034, up from USD 45.8 billion in 2024, and is projected to grow at a CAGR of 5.6% from 2025 to 2034.

- Combined cycle technology dominates the Natural Fired Electricity Generation Market, accounting for 67.9% of the market share globally.

- Sweet natural gas is the leading fuel source, contributing 56.2% to total electricity generation capacity.

- Power plants with 100-500 MW output hold a 42.1% share in the overall generation capacity market.

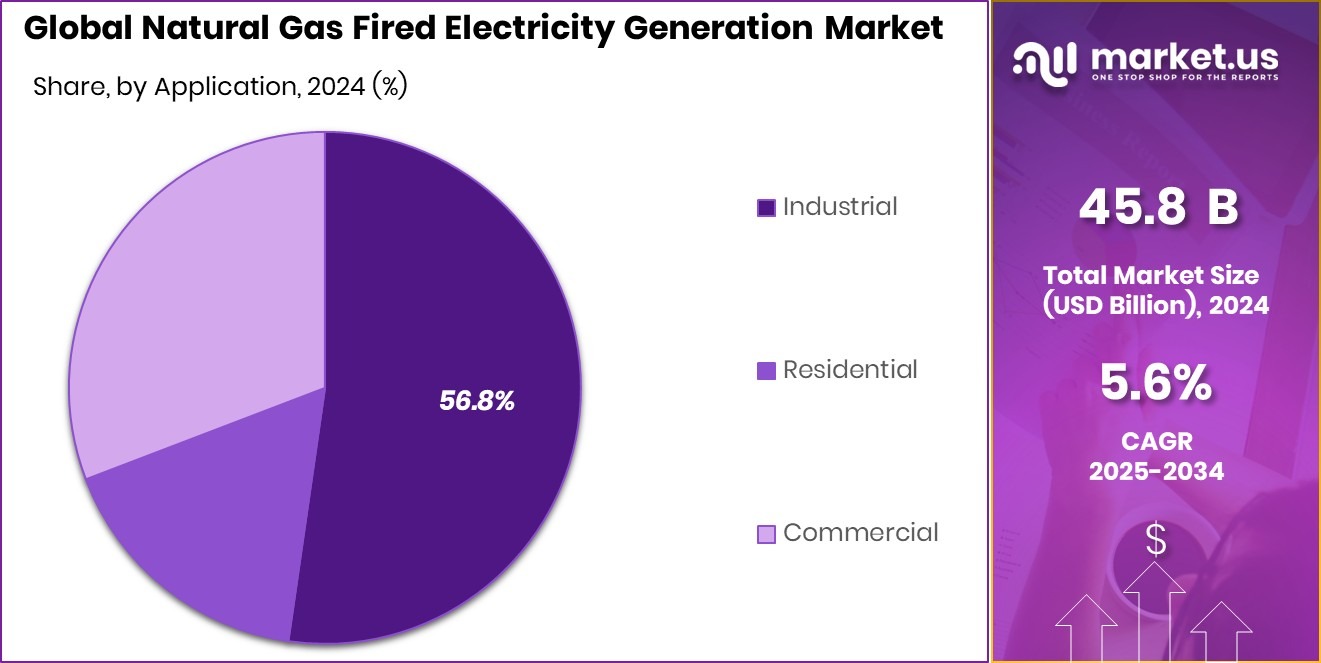

- Industrial application leads demand in the Natural Gas Fired Electricity Generation Market with a 56.8% contribution.

- Asia-Pacific’s strong energy demand supported its USD 19.9 billion market dominance in 2024.

By Technology Analysis

Combined cycle leads the Natural Gas Fired Electricity Generation Market share.

In 2024, Combined Cycle held a dominant market position in the By Technology segment of the Natural Gas Fired Electricity Generation Market, with a 67.9% share. This dominance can be attributed to the higher efficiency levels offered by combined cycle power plants, which utilize both gas and steam turbines to produce electricity from the same fuel source. This dual-process approach significantly enhances thermal efficiency and reduces fuel consumption per unit of electricity generated, making it a preferred choice among power producers aiming to reduce operational costs and emissions.

The strong position of combined cycle technology is also supported by growing regulatory pressure to minimize carbon emissions and transition away from coal-based generation. Combined cycle systems emit comparatively lower greenhouse gases, which aligns with global energy transition goals and climate commitments. Additionally, the flexible operational characteristics of combined cycle plants allow them to efficiently support fluctuating grid demands, especially as more renewable sources are integrated.

This capability to provide stable and responsive power further strengthens their appeal in modern power infrastructure planning. As electricity demand continues to rise in both developed and developing economies, the adoption of combined cycle systems is expected to remain a strategic focus in expanding natural gas-based generation portfolios.

By Source Analysis

Sweet natural gas dominates the source segment in electricity generation systems.

In 2024, Sweet Natural Gas held a dominant market position in the By Source segment of the Natural Gas Fired Electricity Generation Market, with a 56.2% share. The preference for sweet natural gas is primarily driven by its lower sulfur content, which reduces the need for extensive processing and minimizes harmful emissions during combustion. This makes it a cleaner and more cost-effective option for power producers focused on meeting environmental standards and regulatory compliance.

The dominance of sweet natural gas is also supported by its easier handling and compatibility with existing gas turbine technologies, resulting in lower maintenance requirements and improved operational efficiency. Its cleaner-burning characteristics contribute to reduced wear on equipment and fewer impurities released into the atmosphere, aligning with the growing emphasis on sustainable and low-emission energy solutions.

Furthermore, the availability of sweet natural gas from several major reserves and its integration into regional and national pipeline infrastructure enhances its accessibility and reliability as a fuel source for electricity generation. As utilities and governments prioritize cleaner fuels to replace coal-based systems, the established advantages of sweet natural gas in terms of environmental performance and operational efficiency have played a key role in securing its leading position within this segment.

By Power Output Analysis

100–500 MW capacity drives major installations in power generation projects.

In 2024, 100–500 MW held a dominant market position in the By Power Output segment of the Natural Gas Fired Electricity Generation Market, with a 42.1% share. This capacity range is widely preferred for its balanced scalability, operational efficiency, and suitability for both regional and national grid integration. Plants within this output range are capable of meeting the energy demands of urban and industrial clusters without the complexities or capital intensity associated with larger installations.

The 100–500 MW range also supports flexible deployment strategies, allowing operators to cater to varying demand profiles across different geographies. These plants offer a practical balance between initial investment, space requirement, and energy output, making them attractive for public and private sector utilities aiming to enhance generation capacity while maintaining cost control.

Additionally, the ability of this capacity range to support both base-load and peak-load operations contributes to its popularity in energy planning. In regions undergoing energy transitions and modernization of power infrastructure, the adoption of medium-scale natural gas plants in this output category is increasingly seen as a strategic approach to ensure energy reliability while adhering to emissions standards. These factors have collectively reinforced the dominance of the 100–500 MW segment in 2024.

By Application Analysis

The industrial sector holds the highest application share in gas generation.

In 2024, Industrial held a dominant market position in the By Application segment of the Natural Gas Fired Electricity Generation Market, with a 56.8% share. This leading position is primarily due to the increasing demand for reliable and efficient power supply in energy-intensive industries such as manufacturing, chemicals, and metallurgy. Industrial operations often require continuous and stable electricity, making natural gas-fired generation a preferred option due to its consistent output and lower emissions compared to conventional fossil fuels.

The dominance of the industrial segment is also supported by the rising need for captive power generation, where industries install their own natural gas-based power units to reduce dependence on grid electricity and improve energy security. This approach not only ensures uninterrupted operations but also allows for better control over energy costs and emissions management.

Moreover, with industries under growing pressure to comply with environmental standards, the cleaner-burning characteristics of natural gas make it an attractive alternative to coal or diesel-based systems. The operational flexibility and relatively lower fuel costs of natural gas systems further contribute to their uptake in industrial settings. These combined factors have significantly strengthened the market position of the industrial application segment in 2024.

Key Market Segments

By Technology

- Open Cycle

- Combined Cycle

- Cogeneration

By Source

- Sweet Natural Gas

- Sour Natural Gas

- LNG

By Power Output

- Less than 100 MW

- 100-500 MW

- 500-1000 MW

- Above 1000 MW

By Application

- Industrial

- Residential

- Commercial

Driving Factors

Shift Toward Cleaner Energy Reducing Emissions

One of the main driving factors for the Natural Gas Fired Electricity Generation Market is the growing shift toward cleaner energy sources to reduce air pollution and carbon emissions. Natural gas burns more cleanly than coal or oil, releasing nearly 50% less carbon dioxide. This makes it a practical choice for countries aiming to meet climate goals and improve air quality.

As stricter emission rules are being introduced around the world, governments and power producers are turning to natural gas as a cleaner and more reliable energy source. This shift is helping natural gas-fired power plants expand, especially in regions replacing old coal-fired units. The cleaner profile of natural gas is a strong reason behind the market’s continued growth.

Restraining Factors

High Fuel Price Volatility Affects Project Stability

One of the key restraining factors in the Natural Gas Fired Electricity Generation Market is the high volatility in natural gas prices. Since fuel cost is a major component of electricity generation, sudden increases in gas prices can make operations expensive and unpredictable. This can affect the financial planning and stability of power projects, especially in countries that rely on imported natural gas.

Geopolitical tensions, global supply-demand shifts, and changes in export policies often cause price spikes, which can discourage new investments. For many developing regions, such uncertainty makes long-term natural gas-based power generation less attractive. As a result, fluctuating gas prices continue to be a major challenge limiting the steady growth of this market.

Growth Opportunity

Expansion of LNG Infrastructure Enables Broader Access

One of the most significant growth opportunities in the Natural Gas Fired Electricity Generation Market is the expansion of liquefied natural gas (LNG) infrastructure. As pipelines and storage terminals grow in capability, natural gas can be transported over longer distances, reaching regions that previously lacked reliable access. This development enables more countries and remote areas to adopt gas-fired generation instead of dirtier fuels like coal or diesel.

With improved LNG import and regasification facilities, utilities and industrial users gain access to cleaner energy at competitive costs. Greater access to natural gas supports new power plant projects and the repowering of aging thermal stations. This infrastructure build-out not only accelerates market expansion but also supports efforts toward lower emissions and a more stable electricity supply, creating a strong foundation for future growth.

Latest Trends

Growth in Hybrid Gas‑Renewable Power Plants

One of the latest trends in the Natural gas-fired electricity Generation Market is the increasing development of hybrid power plants that combine natural gas with renewable energy sources such as solar or wind. These hybrid systems are designed to leverage the strengths of both energy types: natural gas provides reliable, flexible backup power, while renewables deliver emissions-free electricity when available.

This combination allows operators to meet peak demand efficiently, reduce overall fuel use, and lower carbon output. The hybrid model also helps smooth out fluctuations in renewable generation, making grid management more predictable and stable. As countries pursue cleaner energy targets, hybrid facilities offer a balanced and affordable way to transition.

Regional Analysis

In 2024, the Asia-Pacific led the market with a 43.60% share, reaching USD 19.9 billion.

In 2024, Asia-Pacific emerged as the dominating region in the Natural Gas Fired Electricity Generation Market, holding a substantial 43.60% share, valued at USD 19.9 billion. This dominance is largely attributed to the region’s rising electricity demand, rapid urbanization, and ongoing transition from coal to cleaner energy sources.

Countries across Asia-Pacific are increasingly investing in gas-fired power infrastructure to meet growing industrial and residential consumption while addressing environmental concerns. The region’s strategic focus on expanding liquefied natural gas (LNG) infrastructure also supports this growth.

North America follows with steady development driven by abundant shale gas reserves and a mature grid system, favoring combined cycle technologies. Europe is witnessing moderate growth as several nations continue to phase out coal and enhance their reliance on cleaner alternatives like natural gas. In the Middle East & Africa, market growth is supported by gas-rich economies investing in domestic power capacity to support economic diversification.

Latin America represents an emerging market, where natural gas is increasingly being integrated into national energy mixes to stabilize grids and reduce dependency on hydropower. While all regions contribute to global market development, Asia-Pacific remains the clear leader in both market share and value, supported by a strong policy push toward low-emission power generation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ansaldo Energia S.p.A. has been recognized for its high‑efficiency gas turbine offerings and tailored engineering solutions. The company’s advanced gas turbines and combined cycle systems contribute to reduced emissions and enhanced performance. Its focus on upgrading older plants and offering turnkey services strengthens its position in regions seeking modern and cleaner generation solutions.

Bharat Heavy Electricals Limited (BHEL) plays a prominent role in markets with expanding infrastructure needs, particularly in developing economies. Its integrated approach—from turbine manufacturing to plant commissioning—allows utilities to access locally supported solutions. BHEL’s reliability and cost‑effective project delivery continue to appeal to nations balancing economic development with cleaner energy transitions.

BP participates through its upstream and midstream natural gas operations, driving supply assurance for gas‑fired generation. The company’s ability to secure and deliver gas supply contributes to stable fuel sourcing and underpins larger power projects. BP’s integrated gas portfolio supports the viability of natural gas generation in regions transitioning away from coal.

Centrax Gas Turbines delivers modular, mid‑capacity gas turbine units that are particularly suitable for industrial and mid‑scale power applications. The company’s standardized and flexible products cater to operators seeking scalable solutions with faster deployment cycles. This positioning helps Centrax address opportunities where mid‑size generation is preferred for load balancing and regional grid support.

Chevron contributes through its global gas production and liquefied natural gas capabilities, ensuring supply continuity for gas‑fired power plants. Chevron’s investment in gas infrastructure and export terminals enhances the availability of fuel for generation markets worldwide. Its upstream strength supports natural gas generation projects in import‑dependent regions.

Top Key Players in the Market

- Ansaldo Energia S.P.A.

- Bharat Heavy Electricals Limited

- BP

- Centrax Gas Turbines

- Chevron

- Enagas

- ExxonMobil

- Gasunie

- General Electric

- Kawasaki Heavy Industries, Ltd.

Recent Developments

- In August 2024, BHEL secured its first-ever order to demonstrate methanol firing in a gas turbine at the 350 MW Kayamkulam Combined Cycle Power Plant in Kerala. The project covers technology support, supply of equipment, and erection and commissioning. The first phase tests the turbine at 30‑40% load, with full‑load demonstration planned thereafter.

- In February 2024, Ansaldo Energia signed a major contract for the Reconstruction of Almaty CHPP‑3 in Kazakhstan. The project includes two AE94.2 gas turbines, two generators, and auxiliary services. This combined cycle plant is fueled by natural gas and is designed with hydrogen‐blend capability up to 40%, aimed at higher efficiency and lower emissions.

Report Scope

Report Features Description Market Value (2024) USD 45.8 Billion Forecast Revenue (2034) USD 79.0 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Open Cycle, Combined Cycle, Cogeneration), By Source (Sweet Natural Gas, Sour Natural Gas, LNG), By Power Output (Less than 100 MW, 100-500 MW, 500-1000 MW, Above 1000 MW), By Application (Industrial, Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ansaldo Energia S.P.A., Bharat Heavy Electricals Limited, BP, Centrax Gas Turbines, Chevron, Enagas, ExxonMobil, Gasunie, General Electric, Kawasaki Heavy Industries, Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Natural Gas Fired Electricity Generation MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Natural Gas Fired Electricity Generation MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ansaldo Energia S.P.A.

- Bharat Heavy Electricals Limited

- BP

- Centrax Gas Turbines

- Chevron

- Enagas

- ExxonMobil

- Gasunie

- General Electric

- Kawasaki Heavy Industries, Ltd.