Global Nasal Cannula Market By Type (High Flow Nasal Cannula and Low Flow Nasal Cannula), By Material (Silicone and Plastic), By End-Use (Hospitals, Long Term Care Centers, and Ambulatory Healthcare Services), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 16047

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

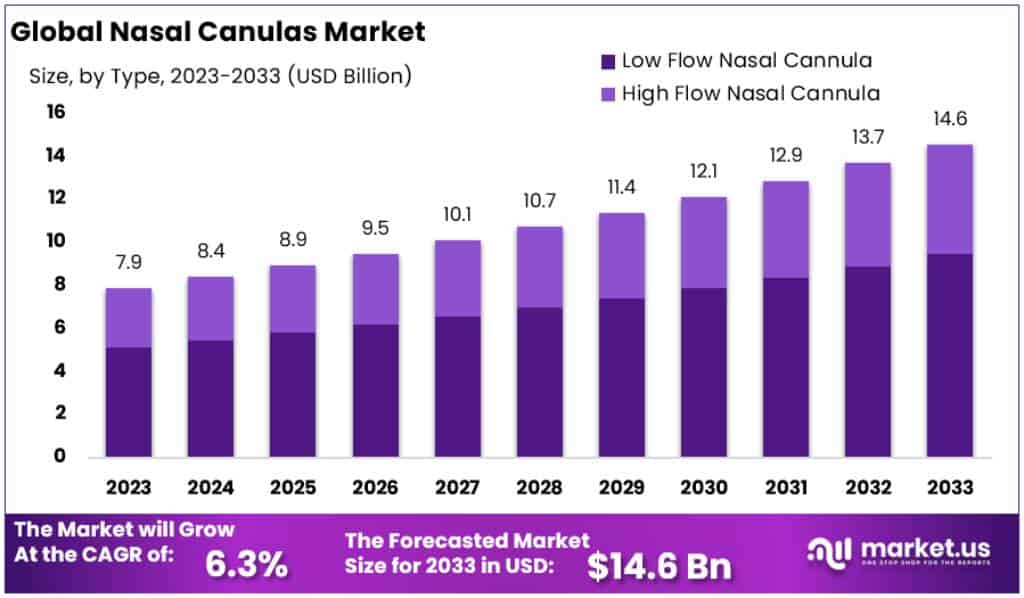

The Global Nasal Cannula Market size is expected to be worth around USD 14.6 Billion by 2033, from USD 7.9 Billion in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

A nasal cannula is a medical device used to deliver supplemental oxygen or increased airflow to individuals who have difficulty breathing due to a medical condition or another reason. It is a thin, flexible tube that wraps around the head, with two prongs that go inside the nostrils to deliver the oxygen.

The other end of the tube is connected to an oxygen supply, such as a tank or a portable oxygen generator. Nasal cannulas are often used in patients with conditions such as COPD, and they are suitable for individuals who require small amounts of supplemental oxygen without rigid control of respiration, such as in oxygen therapy.

The rise in the prevalence of respiratory disease worldwide is a major factor that has contributed to the market’s growth. About 41% of all chronic respiratory diseases were responsible for the increase in morbidity, with asthma and COPD accounting for most of that.

Key Takeaways

- The Global Nasal Cannula Market is projected to reach approximately USD 14.6 billion by the year 2033.

- In 2023, the market size for Nasal Cannulas was estimated at USD 7.9 billion.

- The market is expected to experience a Compound Annual Growth Rate (CAGR) of 6.3% during the forecast period from 2023 to 2033.

- Approximately 41% of all chronic respiratory diseases contribute to increased morbidity, with asthma and COPD being the primary factors.

- In 2023, Low Flow Nasal Cannulas dominated the market, accounting for over 65% of the market share.

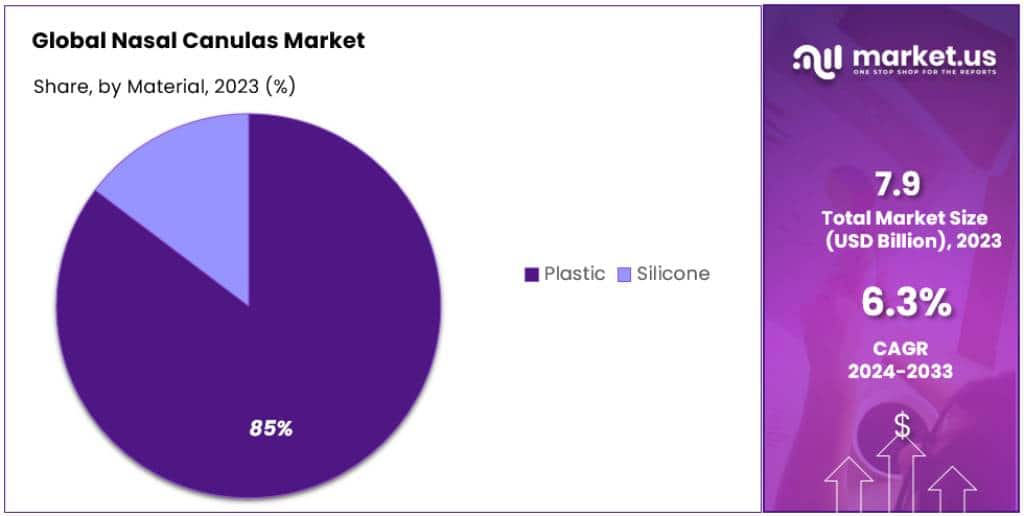

- Plastic nasal cannulas held more than 85.3% of the market share due to their cost-effectiveness, in 2023.

- In 2023, hospitals held a dominant position in the market, with over 44.9% market share.

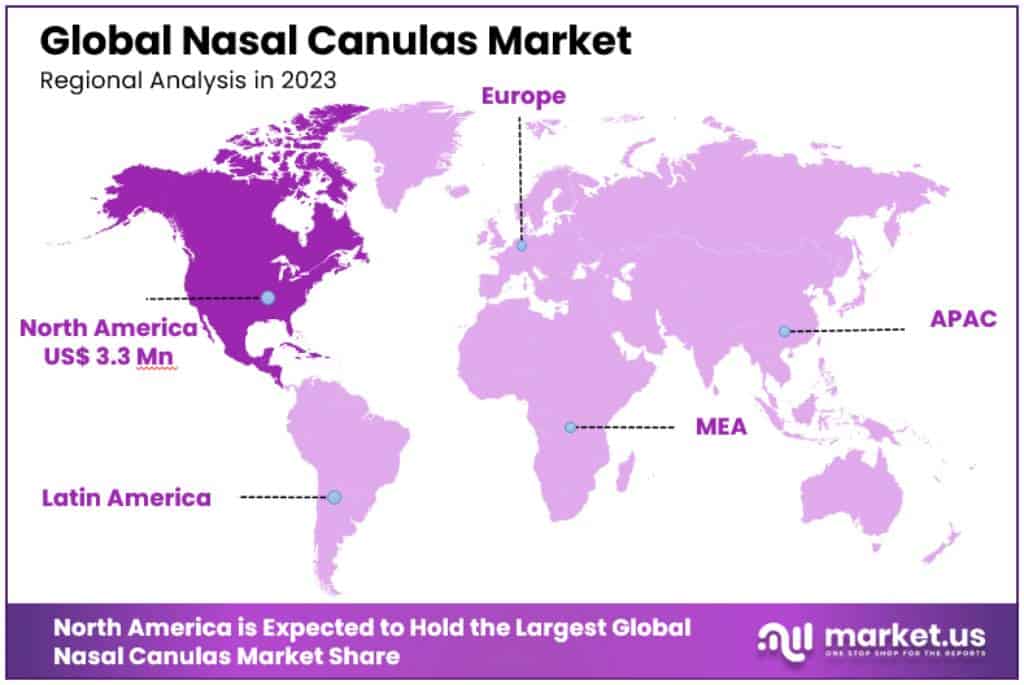

- North America led the market in 2023 with a 42.3% share, driven by the rising incidence of respiratory diseases.

Type Analysis

In 2023, the Low Flow Nasal Cannula segment held a dominant market position, capturing more than a 65% share. This dominance can be attributed to its widespread use in healthcare settings, particularly for patients requiring minimal oxygen support. Low-Flow Nasal Cannulas are preferred due to their ease of use, comfort, and cost-effectiveness, making them suitable for a wide range of patients, from neonates to the elderly. They are typically used in cases where patients need supplemental oxygen at a rate of 1-6 liters per minute, which accounts for a significant portion of the oxygen therapy market.

On the other hand, the High Flow Nasal Cannula segment, though smaller in market size, is rapidly gaining traction. This is primarily due to its ability to provide a higher flow of oxygen, up to 60 liters per minute, which is crucial for patients with more severe respiratory conditions. The High Flow Nasal Cannula is increasingly being recognized for its benefits in delivering heated, humidified oxygen, thus enhancing patient comfort and improving oxygenation. Its growing adoption in acute care settings, such as ICUs and emergency departments, reflects a trend towards more advanced respiratory support options.

Both segments are influenced by factors such as technological advancements, the increasing prevalence of respiratory diseases, and the aging global population. However, the specific growth trajectories and market dynamics of the Low Flow and High Flow Nasal Cannula segments are distinct, and shaped by their unique applications and patient requirements. As healthcare providers continue to seek optimal solutions for oxygen therapy, the evolution of these segments will likely be characterized by innovation and a deeper understanding of patient needs in respiratory care.

Material Analysis

In 2023, plastic nasal cannulas held a dominant market position, capturing more than an 85.3% share. This substantial market share can be primarily attributed to the cost-effectiveness and widespread availability of plastic cannulas. They are commonly used in various healthcare settings due to their affordability, which is particularly significant in markets with budget constraints. Plastic nasal cannulas are lightweight and generally comfortable for short-term use, making them a practical choice for a broad range of patients requiring oxygen therapy.

Silicone nasal cannulas, though occupying a smaller segment of the market, are gaining popularity for their enhanced comfort and durability. Silicone, being a softer and more flexible material, reduces the risk of skin irritation and pressure ulcers, especially in long-term care scenarios. This makes silicone cannulas a preferred option for patients requiring continuous oxygen therapy, such as those with chronic respiratory conditions. The higher cost of silicone cannulas is often justified by their longevity and patient comfort, appealing to a specific segment of the market focused on quality and patient experience.

End-use Analysis

In 2023, hospitals held a dominant position in the nasal cannula market, capturing more than a 44.9% share. This dominance is largely due to the critical role hospitals play in providing acute care and emergency services, where oxygen therapy is frequently required. Hospitals are equipped with a wide range of medical facilities and typically have a higher patient influx, thereby necessitating a large supply of nasal cannulas. The need for nasal cannulas in hospitals is further amplified by the rising incidence of respiratory illnesses and the growing number of surgeries requiring post-operative oxygen therapy.

Ambulatory healthcare services, while holding a smaller share, are an increasingly significant segment in the nasal cannula market. These services, which include outpatient care centers and day surgery centers, are becoming more prevalent due to their convenience and cost-effectiveness. As these centers handle a growing number of procedures and treatments that may require oxygen therapy, the demand for nasal cannulas in this segment is expected to rise.

Long-term care centers also represent a notable segment in the nasal cannula market. These centers cater to patients requiring extended care, including those with chronic respiratory conditions. The use of nasal cannulas in these settings is essential for providing long-term oxygen therapy, contributing to patient comfort and improved health outcomes.

The ‘Others’ category, encompassing various small-scale healthcare and home care settings, also forms a part of the nasal cannula market. This segment includes home healthcare services, which are gaining popularity due to the growing trend of at-home treatment for chronic diseases and the aging population.

Key Market Segments:

Based On Type

- Low Flow Nasal Cannula

- High Flow Nasal Cannula

Based On Material

- Plastic

- Silicone

Based On End-use

- Hospitals

- Ambulatory Healthcare Services

- Long-Term Care Centers

- Others

Drivers

- Rising Incidence of Respiratory Diseases: The global increase in respiratory conditions such as asthma and COPD is a significant driver. For example, in America alone, around 25 million people had asthma in 2020, with a higher prevalence in females (9.8%) compared to males (6.1%). This growing patient base necessitates more nasal cannulas for oxygen therapy, boosting market demand.

- Product Innovation and Launches: Key market players are focusing on innovative products to expand their portfolios. An example is the launch of the Freedom X oxygen nasal cannula by 3B Medical in August 2020, designed to reduce nose irritation and enhance patient comfort.

Restraints

- Side Effects: Long-term use of nasal cannulas can cause nasal dryness and discomfort. Additionally, there are risks of lung damage and eye issues due to prolonged oxygen therapy.

- Pulmonary Oxygen Toxicity: Excessive oxygen in the body from prolonged use can damage airways, a condition known as pulmonary oxygen toxicity.

Opportunities

- Home Healthcare Adoption: The trend towards home-based care offers significant opportunities for the nasal cannula market. Patients prefer the comfort and cost-effectiveness of receiving care at home.

- Technological Advancements: The development of portable, user-friendly nasal cannula devices enhances their use in home settings, offering greater mobility and independence to patients.

Challenges

- Managing Risks: Addressing the side effects and risks associated with long-term nasal cannula use remains a challenge. Patient education and careful monitoring are crucial to mitigate these risks.

- Balancing Cost and Quality: Ensuring the affordability of advanced nasal cannula models while maintaining high quality and patient comfort poses a challenge, especially in cost-sensitive markets.

Trends

- Shift Towards Patient-Centered Care: The increasing focus on patient comfort and accessibility in respiratory care, aided by technological innovations, is a key trend.

- COVID-19 Impact: The pandemic accelerated the shift towards home healthcare, including the use of nasal cannulas, as patients and healthcare providers sought to minimize infection risks in hospital settings.

- Educational Efforts: Increased efforts by healthcare providers to educate patients on managing their respiratory conditions at home are leading to higher adoption rates of nasal cannulas.

Regional Analysis

In 2023, North America is leading the nasal cannula market with a 42.3% share, amounting to USD 3.3 million. This dominance is primarily due to the rising incidence of respiratory diseases like COPD and asthma, which account for approximately 80% of healthcare spending on chronic diseases in the region. The presence of both local and international manufacturers has made advanced nasal cannulas more accessible and affordable, further driving market growth. For instance, in 2022, the U.S. alone generated over USD 2.9 billion in revenue from the nasal cannula market. One notable development was the launch of Luisa, an advanced ventilator by Movair in October 2021, which can switch between high-flow nasal cannula (HFNC) and non-invasive ventilation modes.

Asia Pacific is projected to be the fastest-growing region during the forecast period, spurred by the high prevalence of asthma and COPD, coupled with an aging population. The region’s market expansion is also supported by increasing healthcare spending and the rise of local manufacturers.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis:

The global nasal cannula market is experiencing growth due to several key factors. The increasing number of respiratory diseases, a growing elderly population, and a surge in adoption are major contributors to this growth. The Covid-19 pandemic has particularly spiked the demand for nasal cannulas, prompting manufacturers to ramp up production.

This market is diverse with several leading players. Becton, Dickinson and Company are among the top companies dominating this space. These companies are continually innovating their products, expanding geographically, and forming partnerships to strengthen their market position. For example, high-flow nasal cannula (HFNC) therapy, recommended by institutions like the U.S. National Institutes of Health (NIH) and the World Health Organization (WHO) for certain COVID-19 patients, is an area of focus for these companies.

Маrkеt Кеу Рlауеrѕ:

- Allied Healthcare Products, Inc.

- Flexicare Medical Ltd.

- Teleflex Incorporated

- ResMed Inc.

- Fisher & Paykel Healthcare Limited

- Vapotherm Inc.

- Salter Labs

- Well Lead Medical Co. Ltd.

- Fairmont Medical

- Other Key Players

Recent Developments

- November 2023: Smiths Medical introduces its new Optiflow™ 5 HFNC system, designed for both adult and pediatric patients.

- November 2023: Teleflex Medical launches the Arrow® HFNC Optiflow® Comfort cannula, featuring a soft, flexible design for improved patient comfort.

- November 2023: The European Medicines Agency (EMA) grants marketing authorization for the Air Liquide OxyVita™ HFNC system.

- November 2023: The World Health Organization (WHO) releases a new report on the global burden of chronic respiratory diseases, highlighting the need for improved access to oxygen therapy.

- October 2023: Medtronic announces the launch of its new Puritan Bennett™ HFNC 900+ system, featuring enhanced features for patient comfort and care.

- October 2023: The U.S. Food and Drug Administration (FDA) approves the Philips Respironics Trilogy Evo Mobile oxygen concentrator system for use with HFNC therapy.

- October 2023: The American Association for Respiratory Care (AARC) publishes its updated guidelines for the use of HFNC therapy.

Report Scope

Report Features Description Market Value (2023) USD 7.9 Billion Forecast Revenue (2033) USD 14.6 Billion CAGR (2023-2032) 6.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Low Flow Nasal Cannula and High Flow Nasal Cannula) By Material (Plastic and Silicone) By End-use (Hospitals, Ambulatory Healthcare Services, Long Term Care Centers and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Allied Healthcare Products, Inc., Flexicare Medical Ltd., Teleflex Incorporated, ResMed Inc., Fisher & Paykel Healthcare Limited, Vapotherm Inc., Salter Labs, Well Lead Medical Co. Ltd., Fairmont Medical and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What is the size of the Nasal Cannula market in 2023?A: The Nasal Cannula market size is USD 7.9 Billion in 2023

Q: What is the projected CAGR at which the Nasal Cannula market is expected to grow at?A: The Nasal Cannula market is expected to grow at a CAGR of 6.3% (2023-2033).

Q: List the segments encompassed in this report on the Nasal Cannula market?A: Market.US has segmented the Nasal Cannula market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type (Low Flow Nasal Cannula and High Flow Nasal Cannula) By Material (Plastic and Silicone) By End-use (Hospitals, Ambulatory Healthcare Services, Long Term Care Centers and Others)

Q: List the key industry players of the Nasal Cannula market?A: Allied Healthcare Products, Inc., Flexicare Medical Ltd., Teleflex Incorporated, ResMed Inc., Fisher & Paykel Healthcare Limited, Vapotherm Inc., Salter Labs, Well Lead Medical Co. Ltd., Fairmont Medical and Other Key Players engaged in the Nasal Cannula market.

-

-

- Allied Healthcare Products, Inc.

- Flexicare Medical Ltd.

- Teleflex Incorporated

- ResMed Inc.

- Fisher & Paykel Healthcare Limited

- Vapotherm Inc.

- Salter Labs

- Well Lead Medical Co. Ltd.

- Fairmont Medical

- Other Key Players