Global Multilayer Flexible Packaging Market Size, Share, Growth Analysis By Product (Pouches & Sachets, Bags, Wrapping Films, Laminates, Others), By Material (Plastic, Paper, Aluminium Foil), By Layer Structure (3 Layers, 5 Layers, 7 Layers, More than 7 Layers), By End Use (Food, Beverages, Pharmaceuticals, Automotive, Cosmetics and Personal Care, Electricals & Electronics, Textiles & Apparels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161122

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

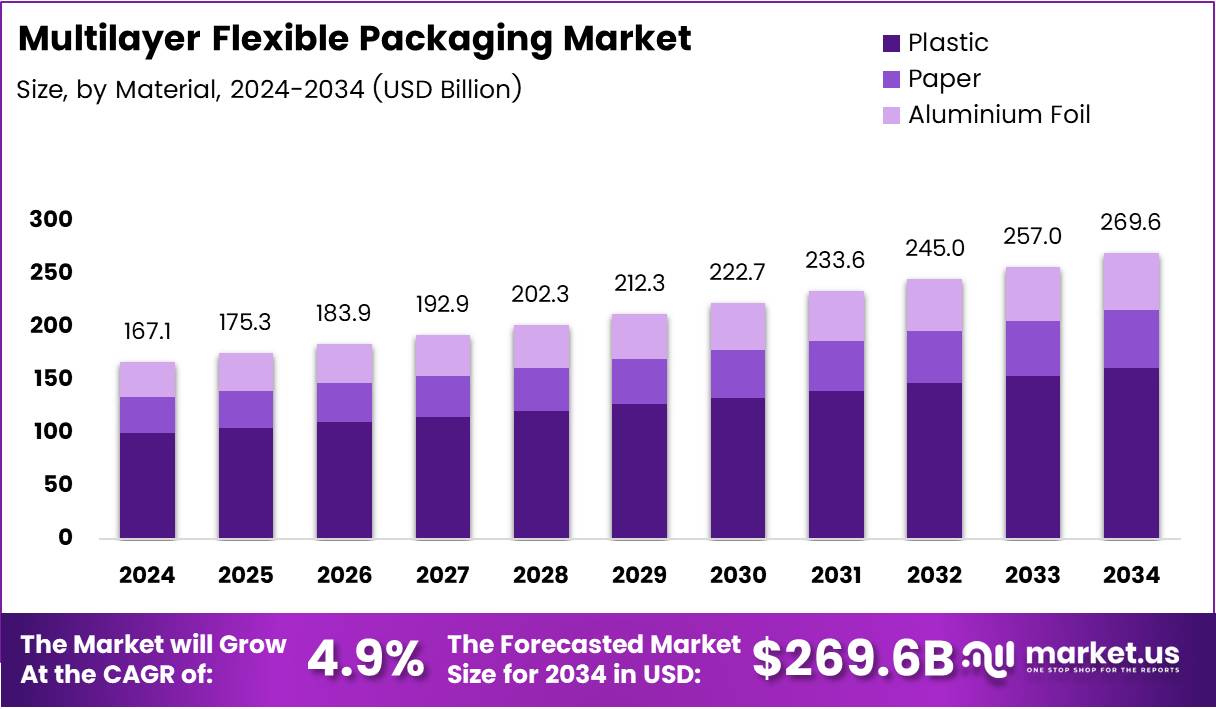

The Global Multilayer Flexible Packaging Market size is expected to be worth around USD 269.6 Billion by 2034, from USD 167.1 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

Multilayer flexible packaging combines multiple polymer layers to enhance barrier protection, durability, and product shelf life. It plays a vital role across food, beverage, pharmaceutical, and e-commerce industries. With its lightweight structure and sustainability advantages, this packaging solution supports cost-efficient logistics and evolving consumer demand for convenience-driven products.

Furthermore, as companies pursue eco-friendly manufacturing, multilayer flexible packaging enables recyclability and reduced material use. Businesses are transitioning from rigid to flexible formats to minimize carbon footprint and transportation costs. The growing shift toward sustainable packaging designs positions multilayer films as a strategic choice for circular economy integration.

Moreover, rising regulatory pressure and government incentives for recyclable packaging accelerate market adoption. Authorities across North America and Europe are promoting investments in advanced recycling and barrier film technologies. These initiatives drive innovation, encouraging manufacturers to adopt mono-material and bio-based multilayer packaging solutions for improved end-of-life management.

Additionally, e-commerce expansion fuels strong demand for durable, protective, and lightweight packaging. As online retail logistics intensify, flexible multilayer films offer superior puncture resistance and cost-efficiency in parcel shipping. Companies are leveraging smart materials and digital printing to enhance shelf appeal while maintaining sustainability goals across the packaging value chain.

According to industry sources, the U.S. parcel volume reached 22.37 billion in 2024 (+3.4% YoY) and may exceed 30 billion by 2030, boosting the need for high-barrier mailer and pouch films. Also, as per Global Commitment Report 2023, reusable/recyclable/compostable plastic packaging achieved 70% share (+4 pp vs. 2022).

Furthermore, Flexible Packaging Association noted flexible packaging represents ~21% of the $180.3 billion U.S. packaging market, generating $41.5 billion in 2022 sales. Together, these data highlight the strong foundation and growth prospects of the Multilayer Flexible Packaging Market, driven by sustainability, technology innovation, and regulatory alignment.

Key Takeaways

- The Multilayer Flexible Packaging market is projected to reach USD 269.6 Billion by 2034, growing from USD 167.1 Billion in 2024 at a CAGR of 4.9% (2025–2034).

- Pouches & Sachets dominated by product type with a 34.8% share in 2024, driven by high use in food, beverage, and pharma packaging.

- Plastic led the material segment with a 72.5% share in 2024, owing to lightweight, high-barrier, and cost-efficient characteristics.

- 5 Layer structures accounted for a 39.4% share in 2024, balancing material efficiency with superior moisture and gas protection.

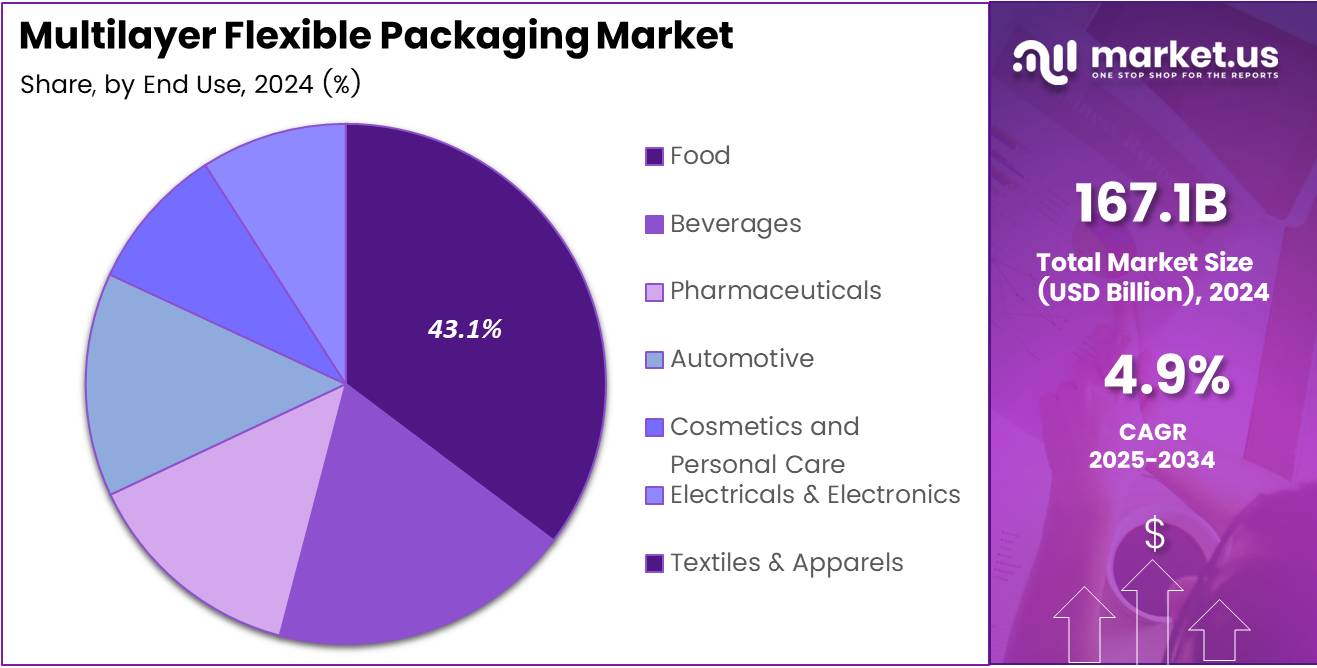

- Food end use dominated with a 43.1% share in 2024, fueled by rising demand for packaged and ready-to-eat foods.

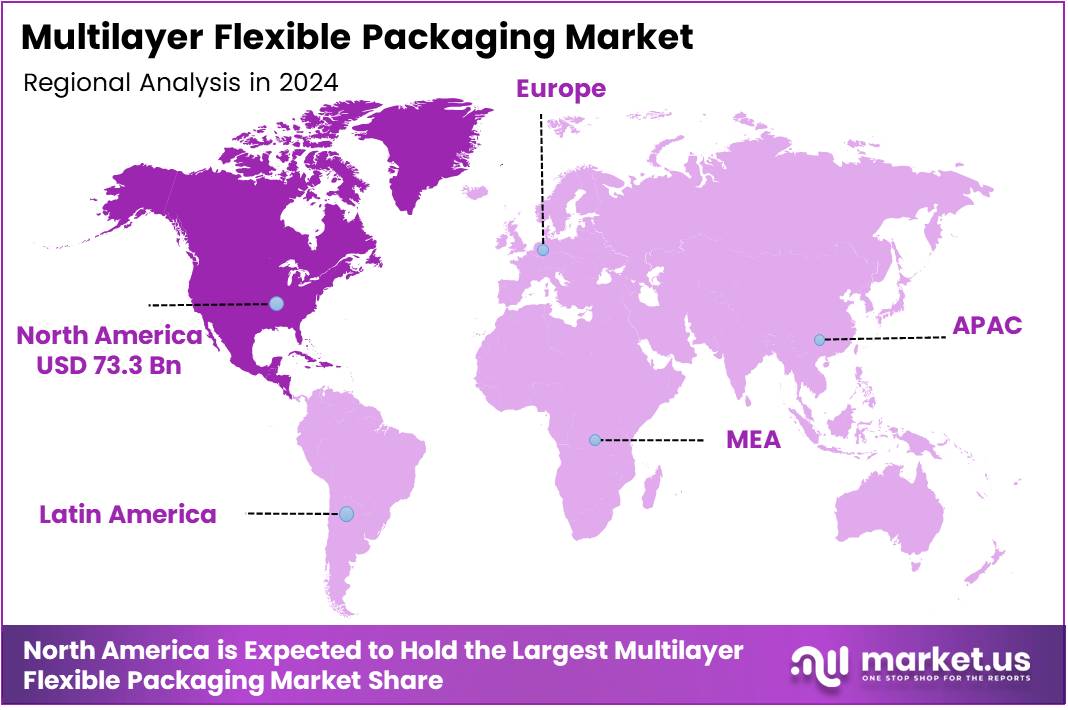

- North America led the global market with a 43.9% share, valued at USD 73.3 Billion in 2024, supported by strong food, beverage, and pharma sectors.

By Product Analysis

Pouches & Sachets dominate with 34.8% due to their lightweight structure and superior convenience in storage and transportation.

In 2024, Pouches & Sachets held a dominant market position in the By Product Analysis segment of the Multilayer Flexible Packaging Market, with a 34.8% share. Their increasing use in food, beverage, and pharmaceutical packaging drives this dominance. These packs offer excellent barrier protection, repeatability, and ease of use, aligning with consumer convenience trends.

Bags are gaining traction as eco-friendly alternatives, especially in retail and industrial applications. They offer enhanced product visibility and customization options, making them suitable for branding purposes. Rising e-commerce activities and the demand for sustainable packaging solutions further contribute to the steady growth of this sub-segment.

Wrapping Films play a crucial role in preserving product freshness and preventing contamination. They are extensively used across food and beverage industries for sealing and wrapping perishable goods. Continuous innovations in film materials and cost-effective packaging solutions support the segment’s steady expansion.

Laminates are increasingly adopted for their superior strength and printability. They provide extended shelf life and are preferred for high-barrier packaging applications. The flexibility to combine multiple materials offers manufacturers enhanced protection and aesthetic appeal for premium products.

Others include specialty packaging types catering to niche sectors. Their usage is driven by customized design requirements and product-specific needs. Although their market share is comparatively smaller, advancements in materials and production techniques are enhancing their adoption across diverse industries.

By Material Analysis

Plastic dominates with 72.5% due to its versatility, durability, and cost-efficiency in packaging applications.

In 2024, Plastic held a dominant market position in the By Material Analysis segment of the Multilayer Flexible Packaging Market, with a 72.5% share. The material’s lightweight nature, high barrier properties, and cost-effectiveness make it ideal for packaging food, beverages, and pharmaceuticals. Technological advancements in recyclable plastics also support sustainable growth.

Paper is witnessing growing demand as industries shift toward eco-friendly solutions. Its biodegradability and recyclability appeal to environmentally conscious consumers and brands. Paper-based multilayer packaging is increasingly used for dry foods, snacks, and personal care items, contributing to moderate but consistent market expansion.

Aluminums Foil remains crucial for products requiring superior barrier protection against light, oxygen, and moisture. It is widely used in pharmaceuticals, dairy, and snack packaging. Although its share is lower than plastics, its excellent preservation properties and compatibility with various laminates ensure sustained market relevance.

By Layer Structure Analysis

5 Layers dominate with 39.4% owing to their enhanced barrier efficiency and cost optimization benefits.

In 2024, 5 Layers held a dominant market position in the By Layer Structure Analysis segment of the Multilayer Flexible Packaging Market, with a 39.4% share. These structures offer an optimal balance between material use and performance, ensuring superior protection against moisture, gas, and odor transmission across industries.

3 Layers structures are favored for less demanding packaging applications, such as snacks and dry foods. Their affordability and lightweight nature make them popular among small-scale manufacturers seeking economical yet effective packaging solutions.

7 Layers are gaining importance due to their high mechanical strength and premium protection. They are primarily used for perishable and high-value products requiring advanced preservation. This segment benefits from innovation in co-extrusion technologies.

More than 7 Layers cater to specialized applications that demand extreme protection and durability. Though representing a smaller share, these structures find use in pharmaceuticals and industrial goods packaging, where extended shelf life and barrier precision are critical.

By End Use Analysis

Food dominates with 43.1% driven by rising demand for convenient, safe, and extended-shelf-life packaging.

In 2024, Food held a dominant market position in the By End Use Analysis segment of the Multilayer Flexible Packaging Market, with a 43.1% share. Growing consumption of packaged and ready-to-eat foods has fueled demand for multilayer packaging that maintains freshness, flavor, and hygiene standards.

Beverages rely heavily on multilayer packaging for safety and aesthetic presentation. Flexible pouches and laminated films help preserve carbonation and prevent leakage, supporting strong market adoption, particularly in juices and dairy products.

Pharmaceuticals use multilayer packaging for its superior barrier and tamper-proof qualities. It ensures product integrity and extends shelf life, essential for drugs and medical supplies. Increasing global healthcare needs continue to propel this segment.

Automotive applications include protective films and wraps used for lubricants and spare parts. Durability and resistance to chemicals make multilayer solutions essential in this industry.

Cosmetics and Personal Care benefit from the aesthetic flexibility of multilayer packaging. Attractive designs and protection from environmental factors make it ideal for creams, lotions, and other skincare products.

Electricals & Electronics use these packages to protect components from moisture and static interference. Growing demand for electronic devices fuels steady market expansion.

Textiles & Apparels use multilayer packaging to prevent damage during transport and storage. It helps retain product quality and appearance, ensuring customer satisfaction.

Others include industrial and specialty sectors where customized packaging solutions are essential. Though smaller in share, the segment shows consistent demand for protective and functional multilayer materials.

Key Market Segments

By Product

- Pouches & Sachets

- Bags

- Wrapping Films

- Laminates

- Others

By Material

- Plastic

- Polypropylene (PP)

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polyvinylidene Chloride (PVDC)

- Ethylene Vinyl Alcohol (EVOH)

- Ethylene Vinyl Acetate (EVA)

- Polyvinyl Chloride (PVC)

- Paper

- Aluminium Foil

By Layer Structure

- 3 Layers

- 5 Layers

- 7 Layers

- More than 7 Layers

By End Use

- Food

- Meat, Poultry, and Seafood

- Bakery & Confectionery

- Snacks

- Dairy

- Pet Food

- Baby Food

- Others

- Beverages

- Pharmaceuticals

- Automotive

- Cosmetics and Personal Care

- Electricals & Electronics

- Textiles & Apparels

- Others

Drivers

Rising Adoption of Sustainable and Recyclable Flexible Packaging Materials Drives Market Growth

The multilayer flexible packaging market is witnessing strong growth due to the increasing shift toward sustainable and recyclable materials. Consumers and industries are becoming more aware of the environmental impact of plastic waste, pushing packaging manufacturers to develop eco-friendly alternatives. This trend is encouraging the use of biodegradable films and recyclable polymer structures that reduce carbon footprint while maintaining packaging performance.

The food and beverage industry is one of the main drivers of demand for multilayer flexible packaging. These materials provide excellent protection against moisture, oxygen, and contamination, ensuring longer shelf life and freshness. Similarly, the pharmaceutical sector is adopting multilayer packaging for its ability to safeguard sensitive medicines from light and air exposure.

Technological innovations in barrier films and printing techniques are further boosting the market. New coating technologies and advanced printing allow for improved product presentation and brand appeal, enhancing consumer trust. Additionally, the rapid growth of e-commerce and global distribution networks has fueled demand for lightweight, durable, and safe packaging that can withstand long transportation cycles.

Restraints

High Cost of Multilayer Film Recycling and Recovery Processes Restrains Market Growth

Despite its growing demand, the multilayer flexible packaging market faces several challenges. Recycling multilayer films remains expensive and technically complex. These materials often combine multiple plastic types, making separation and recovery difficult. This limitation reduces the overall recyclability rate and increases processing costs for manufacturers.

Stringent environmental regulations on plastic waste and disposal are also affecting market performance. Governments across regions are imposing strict rules on single-use plastics, pushing companies to invest more in compliant packaging solutions. While beneficial for sustainability, this adds financial pressure and slows market adoption.

The complex manufacturing and lamination procedures involved in multilayer packaging also contribute to higher production costs. Precision equipment, adhesives, and temperature control are required to maintain film quality, increasing the overall expense. Furthermore, fluctuations in raw material prices, particularly for polymers and adhesives, create uncertainty in production planning and profitability, restraining consistent market growth.

Growth Factors

Development of Biodegradable and Compostable Multilayer Packaging Solutions Creates Growth Opportunities

The growing focus on sustainable packaging is opening new opportunities in the multilayer flexible packaging market. Companies are increasingly developing biodegradable and compostable films that meet both performance and environmental standards. These innovations allow brands to reduce waste and appeal to eco-conscious consumers.

Investments in circular economy initiatives are also accelerating growth. Closed-loop recycling systems are being developed to recover and reuse packaging materials efficiently, reducing dependency on virgin plastics. Such initiatives align with global sustainability goals and create long-term market opportunities for eco-friendly packaging solutions.

Emerging economies are becoming promising markets due to rising consumption of packaged foods and beverages. Rapid urbanization, changing lifestyles, and increasing disposable incomes are boosting demand for convenient and safe packaging options. Moreover, the integration of smart packaging technologies—such as QR codes and sensors for traceability—is expected to enhance product safety, improve logistics efficiency, and attract innovative manufacturers.

Emerging Trends

Shift Toward Mono-Material and Easily Recyclable Packaging Designs Shapes Market Trends

One of the most prominent trends in the multilayer flexible packaging market is the move toward mono-material structures. These designs simplify recycling processes and reduce environmental impact without compromising performance. Manufacturers are focusing on single-polymer films that can be efficiently recycled, supporting circular economy objectives.

Digital printing and customization are also transforming the market. Brands are using advanced printing technologies to create personalized and eye-catching packaging that enhances shelf visibility and consumer engagement. This shift allows companies to differentiate themselves in competitive markets while reducing lead times and material waste.

Another emerging trend is the growing collaboration between packaging producers and waste management firms. Such partnerships aim to improve material recovery, recycling efficiency, and waste reduction. Furthermore, there is an increasing emphasis on developing lightweight, high-barrier films that extend product shelf life and reduce transportation costs. These combined trends are shaping the future of sustainable and high-performance multilayer flexible packaging.

Regional Analysis

North America Dominates the Multilayer Flexible Packaging Market with a Market Share of 43.9%, Valued at USD 73.3 Billion

North America holds the dominant position in the global multilayer flexible packaging market, accounting for 43.9% of the total share and valued at USD 73.3 Billion. The region’s strong presence is attributed to the well-established food, beverage, and pharmaceutical industries, which extensively utilize advanced packaging materials for extended shelf life and product protection. Moreover, increasing sustainability initiatives and the adoption of recyclable flexible packaging solutions are further driving regional growth.

Europe Multilayer Flexible Packaging Market Trends

Europe represents a significant share of the multilayer flexible packaging market, driven by stringent environmental regulations and consumer demand for eco-friendly packaging solutions. The region’s mature industrial base, coupled with ongoing innovations in barrier film technologies, supports consistent market expansion. Sustainable material adoption and circular economy initiatives remain key factors shaping the European market landscape.

Asia Pacific Multilayer Flexible Packaging Market Trends

The Asia Pacific region is witnessing rapid growth in the multilayer flexible packaging market, supported by the expanding food processing and e-commerce sectors. Rising disposable incomes, urbanization, and increasing demand for convenient packaging formats are propelling market adoption. Countries such as China and India are emerging as key contributors, owing to their large consumer base and evolving packaging standards.

Middle East and Africa Multilayer Flexible Packaging Market Trends

The Middle East and Africa market for multilayer flexible packaging is experiencing steady growth, primarily driven by the expansion of the food and beverage and healthcare industries. The demand for durable and lightweight packaging materials is increasing as manufacturers seek cost-effective and sustainable solutions. Economic diversification initiatives in several Gulf countries are also boosting industrial packaging investments.

Latin America Multilayer Flexible Packaging Market Trends

Latin America is gradually emerging as a potential market for multilayer flexible packaging, supported by the growing packaged food and personal care sectors. The region is witnessing a shift toward flexible, lightweight, and cost-efficient packaging solutions to meet changing consumer preferences. Improvements in manufacturing infrastructure and increased foreign investments are expected to enhance market penetration in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Multilayer Flexible Packaging Company Insights

The global multilayer flexible packaging market in 2024 continues to evolve, driven by sustainability goals, technological advancements, and changing consumer preferences.

Amcor Plc remains a leading force, leveraging its extensive R&D capabilities to develop eco-friendly packaging solutions. The company’s focus on recyclable and reusable materials strengthens its competitive edge as brands shift toward circular economy models, particularly in food and beverage applications.

Mondi Group maintains a strong position through its integrated value chain and emphasis on paper-based flexible alternatives. Its innovation in high-barrier multilayer films that combine performance with recyclability highlights its adaptability to global sustainability regulations. Mondi’s strategic investments in capacity expansion also enhance its footprint in Europe and emerging markets.

Sealed Air Corporation continues to diversify its portfolio with advanced multilayer solutions designed to extend product shelf life and reduce food waste. Its adoption of smart packaging technologies and focus on automation aligns with the increasing demand for efficiency and traceability in supply chains. Sealed Air’s commitment to innovation and customer-centric strategies solidifies its relevance across end-use industries.

Huhtamaki Oyj reinforces its market standing through innovation in lightweight, sustainable multilayer packaging. Its focus on renewable and compostable materials caters to the growing preference for environmentally responsible options. The company’s global manufacturing presence and agile product development enable it to respond swiftly to regional market needs and evolving regulatory frameworks.

Overall, these players are shaping the multilayer flexible packaging industry’s transformation toward sustainability, performance optimization, and consumer-driven innovation.

Top Key Players in the Market

- Amcor Plc

- Mondi Group

- Sealed Air Corporation

- Huhtamaki Oyj

- Constantia

- Sonoco Products Company

- UFlex Ltd

- ProAmpac

Recent Developments

- In 2025, British sustainable materials startup Xampla raised USD 14 million to scale up production of its biodegradable films, packaging linings, and natural polymer materials. The funding will accelerate commercialization of sustainable alternatives to single-use plastics across food and home care sectors.

- In March 2025, Constantia Flexibles acquired a majority stake in Aluflexpack AG, a leading European flexible packaging producer. The deal strengthens Constantia’s position in food and pharmaceutical packaging, expanding its footprint in premium foil-based solutions.

- In November 2024, Amcor announced a scrip merger / acquisition of Berry Global, valued at about USD 8.4 billion. The transaction creates one of the world’s largest packaging companies, integrating Amcor’s sustainability expertise with Berry’s manufacturing scale.

- In May 2024, Dow agreed to sell its laminating adhesives business—serving flexible packaging—to Arkema for approximately USD 150 million. The divestment aligns with Dow’s portfolio optimization strategy, while Arkema expands its adhesive solutions for sustainable packaging.

Report Scope

Report Features Description Market Value (2024) USD 167.1 Billion Forecast Revenue (2034) USD 269.6 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Pouches & Sachets, Bags, Wrapping Films, Laminates, Others), By Material (Plastic, Paper, Aluminium Foil), By Layer Structure (3 Layers, 5 Layers, 7 Layers, More than 7 Layers), By End Use (Food, Beverages, Pharmaceuticals, Automotive, Cosmetics and Personal Care, Electricals & Electronics, Textiles & Apparels, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor Plc, Mondi Group, Sealed Air Corporation, Huhtamaki Oyj, Constantia, Sonoco Products Company, UFlex Ltd, ProAmpac Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multilayer Flexible Packaging MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Multilayer Flexible Packaging MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor Plc

- Mondi Group

- Sealed Air Corporation

- Huhtamaki Oyj

- Constantia

- Sonoco Products Company

- UFlex Ltd

- ProAmpac