Global Multi-Function Display (MFD) Market Size, Share, Statistics Analysis Report By Platform (Airborne, Land, Naval), By System (Electronic Flight Displays (EFD), Head-Up Displays (HUD), Helmet-Mounted Displays (HMD), Portable and Flexible Multi-function Displays), By Technology (LED, LCD/AMLCD, TFT, OLED, Synthetic Vision), By Application (Military, Automobile, Aerospace), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142619

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- U.S. MFD Market Size

- Platform Analysis

- System Analysis

- Technology Analysis

- Application Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

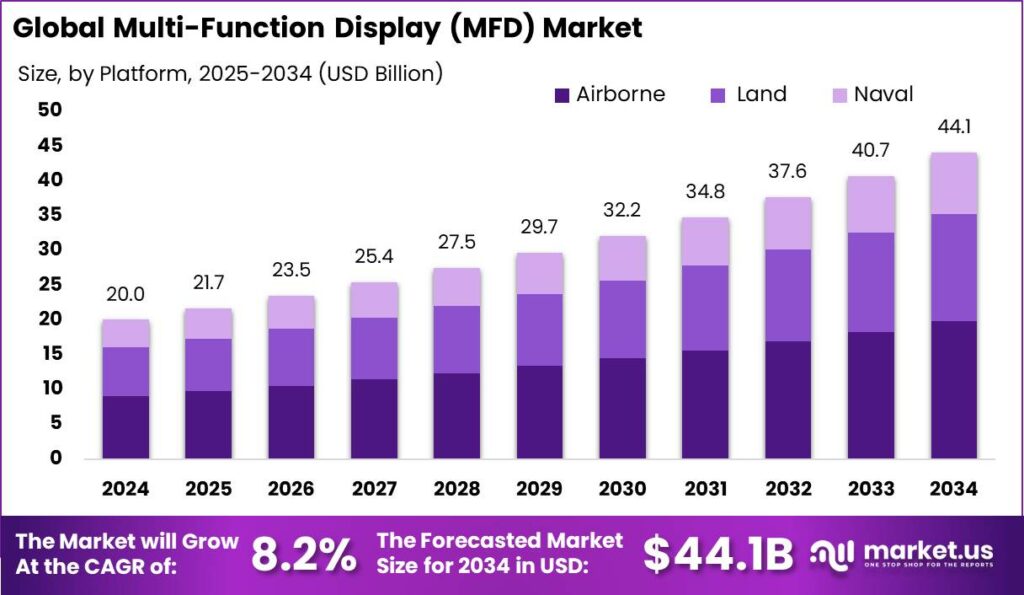

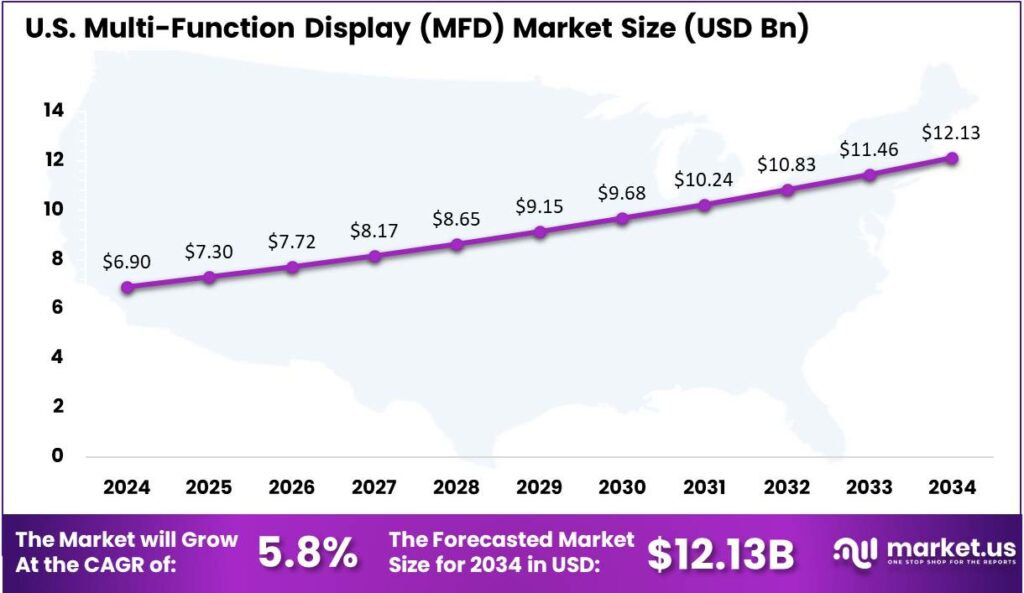

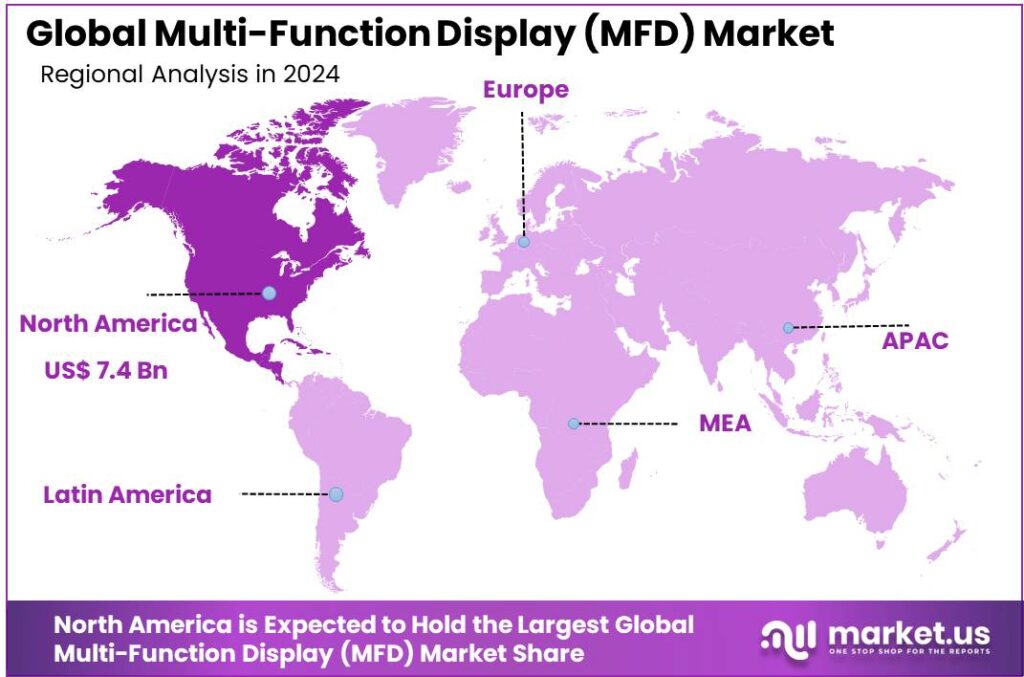

The Multi-Function Display (MFD) Market size is expected to be worth around USD 44.1 Bn By 2034, from USD 20.04 Bn in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024, North America led the MFD market with a 37% share and revenues of USD 7.4 billion. The U.S. MFD market was valued at USD 6.9 billion and is projected to grow at a CAGR of 5.8%.

A Multi-Function Display (MFD) is a compact, versatile device integrated into the instrument panels of vehicles and aircraft, designed to aggregate multiple data sources onto a single screen. MFDs provide essential information such as navigation, weather radar, and engine metrics, enhancing situational awareness and operational efficiency.

The MFD market is witnessing significant growth, driven by technological advancements and increasing adoption across various sectors, including aviation, automotive, and marine industries. The demand for MFDs is particularly high in aviation, where the transition to glass cockpits requires sophisticated display systems that consolidate navigation, communication, and operational functions.

Additionally, the expansion of the aerospace sector, driven by rising global travel and military expenditures, further bolsters the demand for advanced cockpit systems, including MFDs. Regulatory mandates for upgraded systems in both new and existing aircraft also play a critical role in accelerating the adoption of Multi-Function Displays.

The popularity of MFDs has soared in recent years, largely due to their ability to enhance user experience and system integration. In automotive and aviation sectors, for instance, the shift towards more automated and user-friendly interfaces has made MFDs a central component of dashboard design and functionality.

Significant market opportunities for MFDs lie in the expansion into emerging markets and the integration with next-generation technologies like augmented reality (AR) and Internet of Things (IoT). These technologies could potentially transform MFDs into even more interactive and intuitive platforms, further embedding them into daily operations and user interactions.

One of the emerging trends in the MFD market is the increasing adoption of organic light-emitting diode (OLED) technology, which offers superior display quality and flexibility. This trend is expected to enhance the aesthetic and functional appeal of MFDs, making them more adaptable to different environments and applications.

The expansion of the MFD market is being driven by continuous innovations and the growing integration of these displays in low-cost consumer electronics as well as high-end enterprise systems. The versatility and scalability of MFD technologies are encouraging manufacturers to explore new applications and markets, potentially leading to a broader adoption and deeper market penetration.

Key Takeaways

- The Global Multi-Function Display (MFD) Market is expected to reach a value of USD 44.1 Billion by 2034, up from USD 20.04 Billion in 2024, growing at a CAGR of 8.20% during the forecast period from 2025 to 2034.

- In 2024, the Airborne segment held a dominant position in the MFD market, capturing more than 45% of the market share.

- The Electronic Flight Displays (EFD) segment held a leading market position within the MFD market in 2024, accounting for over 32% of the total market share.

- In 2024, the LCD/AMLCD segment dominated the MFD market with a share of more than 35%.

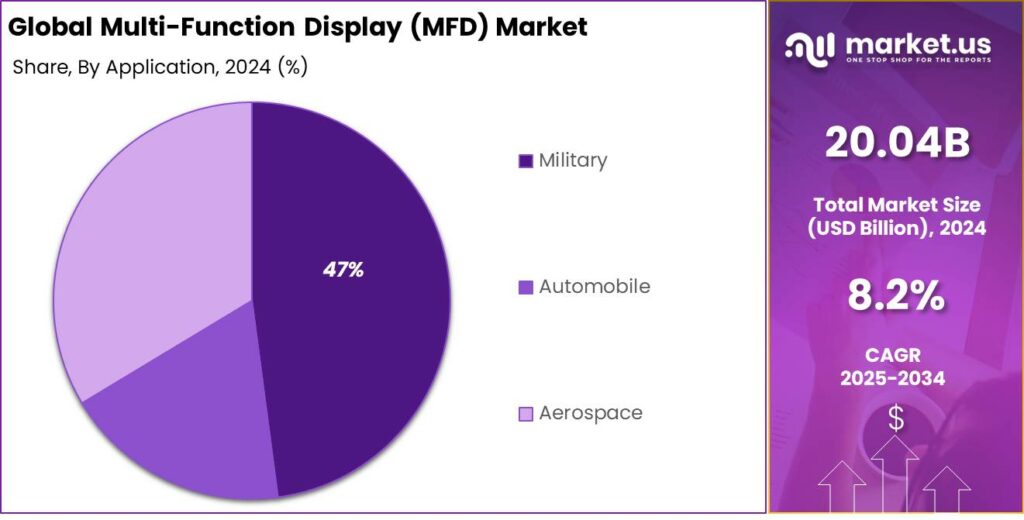

- The Military segment maintained a dominant position in the MFD market in 2024, representing over 47% of the market share.

- North America led the MFD market in 2024, holding a market share of more than 37%, with revenues totaling USD 7.4 billion.

- In 2024, the U.S. Multi-Function Display (MFD) Market was valued at USD 6.9 billion, and it is projected to grow at a CAGR of 5.8%.

Analysts’ Viewpoint

Investors and companies are particularly interested in sectors where safety and efficiency improvements can lead to significant returns. With ongoing innovations and upgrades, the market for MFDs presents a promising area for development, especially in emerging technologies like AR and AI -enabled systems that could further revolutionize how information is displayed and interacted with in real time.

The regulatory environment is increasingly favoring the adoption of advanced digital display technologies like MFDs. Aviation and automotive industries are particularly affected, where safety and efficiency regulations are pushing for modernized, digital cockpit and control systems. Compliance with these regulations is not only becoming a standard but also a competitive edge in the market.

Recent advancements in MFD technology include the integration of touchscreens, customizable display options, and connectivity with external data sources such as satellites for real-time weather and traffic updates. Future developments are likely to focus on further enhancing the interactive capabilities of MFDs through the use of AR and AI, providing more intuitive and predictive interfaces

U.S. MFD Market Size

In 2024, the U.S. Multi-Function Display (MFD) Market reached a valuation of USD 6.9 billion. It is projected to grow at a compound annual growth rate (CAGR) of 5.8%.

Multi-Function Displays (MFDs) are integral components in various applications such as automotive, aviation, and marine industries. These displays consolidate multiple information sources into a single screen, enhancing operational efficiency and safety.

The growth of the MFD market in the U.S. can be attributed to technological advancements and increasing demands for high-performance display systems across these sectors. The market’s expansion is further driven by trends toward digitalization and automation in critical industries.

As vehicles and aircraft become more connected and autonomous, the demand for advanced display technologies that provide real-time data and analytics has grown. This ongoing technological evolution will continue to fuel market growth, reflecting the integration of innovative features in multi-function displays.

In 2024, North America held a dominant market position in the Multi-Function Display (MFD) market, capturing more than a 37% share with revenues amounting to USD 7.4 billion. This leading position can be attributed to several key factors that underscore the region’s pioneering role in technological advancements and its robust industrial base.

North America’s dominance in the MFD market is driven by the presence of major aerospace and automotive manufacturers, which require advanced display technologies to improve operational efficiency and safety in vehicles and aircraft. The region’s commitment to adopting innovative technologies early in their development also significantly contributes to its market leadership.

Moreover, North America also benefits from significant investments in research and development from both public and private sectors, driving the advancement of MFD technologies. Stringent safety regulations in transportation and defense further fuel the demand for reliable and efficient display systems, reinforcing market growth in the region.

The integration of digitalization and automation across industries in North America accelerates the adoption of advanced MFD systems. As industries become more connected and autonomous, the demand for MFDs that can efficiently process and display complex data grows, ensuring North America’s continued leadership in the global MFD market.

Platform Analysis

In 2024, the Airborne segment held a dominant position in the Multi-Function Display (MFD) market, capturing more than a 45% share.

Leadership in this segment stems from advancements in aviation technology and the integration of digital systems in both commercial and military aircraft. The emphasis on improving pilot situational awareness and operational efficiency drives the demand for MFDs, offering crucial flight information at a glance.

The Airborne segment’s dominance is reinforced by the global growth of air travel. As airlines update fleets to meet rising demand and safety standards, advanced MFD integration becomes crucial. Additionally, retrofitting older aircraft with new MFD systems helps extend their operational life and comply with modern standards.

The military sector also plays a key role in the Airborne segment’s dominance. Increased defense spending focuses on upgrading avionics to improve combat and surveillance capabilities. MFDs are essential in these upgrades, offering vital data integration for mission-critical operations and driving segment growth.

Regulatory requirements and safety mandates worldwide drive the adoption of advanced cockpit systems, including MFDs. Aviation authorities have tightened regulations on aircraft display units to enhance navigation accuracy and prevent accidents, supporting the continued growth and dominance of the Airborne segment in the MFD market.

System Analysis

In 2024, the Electronic Flight Displays (EFD) segment held a dominant market position within the Multi-Function Display (MFD) market, capturing more than a 32% share. This segment’s leadership can be attributed to its critical role in modernizing cockpit interfaces across the commercial and military aviation sectors.

Head-Up Displays (HUDs) are a key segment in the MFD market, projecting vital data onto a transparent display within the pilot’s or driver’s line of sight. The segment’s growth is fueled by rising safety concerns and the demand for advanced driver-assistance systems (ADAS) in automotive and aviation. As vehicles and aircraft become more autonomous, HUDs’ role in delivering real-time data intuitively is expected to increase.

The Helmet-Mounted Displays (HMD) segment is growing due to its increasing use in military operations and virtual training. HMDs offer an immersive, personalized experience, delivering critical information directly within the user’s visual field, which is essential for rapid situational awareness and response in combat and training scenarios.

The Portable and Flexible Multi-function Displays segment is emerging as a versatile area in the MFD market. These adaptable displays, suitable for handheld devices and wearable technology, meet the growing demand for mobile, user-friendly solutions in sectors like personal electronics, healthcare, and field operations.

Technology Analysis

In 2024, the LCD/AMLCD segment held a dominant market position in the Multi-Function Display (MFD) market, capturing more than a 35% share. This leadership can be attributed to several inherent advantages of LCD/AMLCD technology that make it particularly suited for various applications in the MFD market.

LCD/AMLCD displays are highly regarded for their reliability and durability, making them ideal for harsh environments like automotive and aerospace industries. With excellent sunlight readability and low power consumption, these displays are perfect for vehicles and aircraft, where long operational life and efficiency are crucial.

Advancements in LCD/AMLCD technology have boosted their market appeal, with improved resolution and contrast ratios enhancing visibility in various lighting conditions. Their adaptability to different display sizes also expands applications, from small car dashboards to large aviation cockpit displays.

The cost-effectiveness of LCD/AMLCD technology, compared to newer technologies like OLED, makes it a preferred choice for manufacturers seeking to balance performance with cost. This is especially appealing in sectors with budget constraints, such as commercial transportation and certain consumer electronics.

Application Analysis

In 2024, the Military segment held a dominant position in the Multi-Function Display (MFD) market, capturing more than a 47% share. This substantial market share can be attributed to the increasing integration of advanced technological solutions in military equipment.

The Military segment’s dominance is reinforced by substantial global defense investments, as countries prioritize modernizing their capabilities to address security concerns and geopolitical tensions. This has driven the adoption of advanced technologies, with MFDs playing a crucial role in propelling the segment’s growth.

The military’s strict requirements for robust, reliable systems drive ongoing advancements in MFD technology. These developments focus on durability and multifunctionality in extreme conditions, ensuring that the technology aligns with military standards and further strengthens the segment’s dominance.

The trend towards digitalization and network-centric military operations supports the sustained demand for MFDs in this segment. As armed forces worldwide transition towards more integrated and technology-driven systems, the importance of MFDs in providing a cohesive and efficient operational platform increases.

Key Market Segments

By Platform

- Airborne

- Land

- Naval

By System

- Electronic Flight Displays (EFD)

- Head-Up Displays (HUD)

- Helmet-Mounted Displays (HMD)

- Portable and Flexible Multi-function Displays

By Technology

- LED

- LCD/AMLCD

- TFT

- OLED

- Synthetic Vision

By Application

- Military

- Automobile

- Aerospace

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Embrace of Cutting-Edge Display Tech

The multi-function display (MFD) market is experiencing significant growth, primarily driven by the rising adoption of advanced display technologies across various industries. In the aviation sector, the integration of electronic flight displays (EFDs) has enhanced pilot situational awareness and operational efficiency by consolidating critical flight information into a single interface.

This trend is not limited to aviation; the automotive industry is also witnessing increased incorporation of MFDs in vehicles, providing drivers with integrated navigation, communication, and entertainment options. The continuous advancements in display technologies, such as high-resolution screens and touch interfaces, have further bolstered the demand for MFDs, as they offer improved visibility and user experience in diverse applications.

Restraint

Restraint in Integration and Compatibility

Another restraint in the MFD market is the challenge of integrating these displays into existing platforms and ensuring compatibility with various systems. MFDs must interface seamlessly with other avionics, automotive electronics, or marine navigation systems, which can be complicated due to differing protocols and standards.

Compatibility issues may arise, leading to increased development times and costs, as well as potential operational inefficiencies. These integration challenges can deter organizations from adopting MFDs, especially when existing systems require significant modifications to accommodate the new technology. The need for specialized training to operate and maintain MFDs adds to overall costs, creating a financial challenge for smaller companies and limiting adoption across various user segments.

Opportunity

Rising Demand in Emerging Markets

The MFD market presents substantial growth opportunities, particularly in emerging markets where industries such as automotive, aviation, and defense are rapidly expanding. As these sectors modernize, there is an increasing demand for advanced display technologies to enhance operational efficiency and safety.

For instance, the rising adoption of electric vehicles (EVs) in these regions necessitates sophisticated MFDs to manage and display critical information like battery status and navigation. Manufacturers that can offer cost-effective and adaptable MFD solutions tailored to the specific needs of emerging markets are well-positioned to capitalize on this growing demand.

The MFD market is benefiting from advances in user interface design and touchscreen technology, improving control systems. With features like real-time data visualization, AI, and augmented reality, MFD adoption is set to grow in industries like smart manufacturing and healthcare.

Challenge

Rapid Technological Advancements

A significant challenge in the MFD market is keeping pace with rapid technological advancements. Continuous innovation in display technologies, such as the development of OLED and flexible displays, requires manufacturers to invest heavily in research and development to stay competitive.

Additionally, integrating new features like augmented reality (AR) and artificial intelligence (AI) into MFDs necessitates ongoing updates to both hardware and software components. This relentless pace of technological change can strain resources and requires a strategic approach to product development and lifecycle management to ensure that MFD offerings remain relevant and meet evolving customer expectations.

Emerging Trends

Modern MFDs are increasingly integrating touchscreens, voice commands, and customizable layouts. These advancements allow users to interact more intuitively with the system, reducing workload and enhancing situational awareness. The latest displays are more user-friendly, with touchscreens, voice commands, and customizable layouts.

The incorporation of AR into MFDs is transforming how information is presented. In the automotive sector, BMW has introduced a system where the entire windshield acts as a HUD, displaying crucial data like speed, navigation, and safety alerts, reducing distractions and keeping the driver focused on the road.

The shift from traditional LCDs to more advanced display technologies like OLED and LED has resulted in clearer visuals, better color accuracy, and reduced power consumption. These improvements are particularly beneficial in environments where display clarity is crucial, such as cockpits and control rooms.

Business Benefits

The adoption of MFDs offers several advantages to businesses. MFDs consolidate multiple functions into a single display, streamlining operations, speeding up information processing, and enhancing decision-making in time-sensitive fields like aviation and maritime.

MFDs help in optimizing space by replacing several individual devices with a single unit. This is particularly beneficial in environments with limited space, such as small aircraft cockpits or compact office spaces, allowing for more efficient use of available area.

The intuitive interfaces of modern MFDs enhance user experience by providing easy access to various functions. In workplaces, interactive displays facilitate better collaboration and engagement during meetings, leading to increased productivity and more effective communication among team members.

Key Player Analysis

Rockwell Collins, now part of Collins Aerospace, is a leading player in the MFD market, offering high-tech solutions for aviation and defense. The company has a strong reputation for designing user-friendly, reliable cockpit displays that integrate various functionalities, providing pilots with real-time data for better decision-making.

SAAB AB, a Swedish defense and aerospace company, is another key player in the MFD market, primarily focused on military and defense applications. They specialize in creating advanced, modular MFD systems that offer flexibility and functionality, making them ideal for combat aircraft, naval systems, and ground vehicles.

BAE Systems PLC is a major player in the global MFD market, offering state-of-the-art displays primarily for military aviation and defense sectors. The company’s MFD solutions are recognized for their advanced design, durability, and capability to handle complex data and interfaces, which are crucial in high-stakes environments.

Top Key Players in the Market

- Rockwell Collins

- SAAB AB

- BAE Systems PLC

- Thales SA

- Garmin Ltd.

- Barco NV

- Raymarine

- Northrop Grumman Corporation

- Honeywell Aerospace

- Esterline Technolgies Corporation

- Avidyne Corporation

- Aspen Avionics Inc.

- Universal Avionics Systems Corporation

- Astronautics Corporation of America

- Samtel Group

- Other Key Players

Top Opportunities Awaiting for Players

- Integration into Electric Vehicles (EVs): The rapid adoption of EVs presents a substantial opportunity for MFD manufacturers. MFDs serve as central interfaces in EVs, providing real-time information on battery status, energy consumption, and navigation. As the EV market expands, the demand for advanced display systems is expected to rise correspondingly.

- Advancements in Autonomous Driving Systems: The progression towards autonomous vehicles necessitates sophisticated display solutions capable of presenting complex data intuitively. MFDs can enhance driver assistance systems by integrating sensor data, navigation, and safety information, thereby improving user experience and safety.

- Modernization of Avionics in the Aerospace Sector: The aerospace industry is undergoing significant upgrades to its avionics systems, with MFDs playing a crucial role in enhancing pilot situational awareness and flight safety. The increasing complexity of aircraft systems drives the need for integrated display solutions.

- Growth in Maritime Navigation Systems: The maritime sector’s emphasis on safety and efficiency has led to the integration of MFDs into navigation systems. These displays provide real-time data on vessel position, weather conditions, and route information, thereby improving operational effectiveness.

- Expansion in Consumer Electronics: The consumer electronics market’s demand for innovative and multifunctional devices offers opportunities for MFD integration. Products such as portable monitors and smart displays cater to the growing need for versatile and connected devices among consumers.

Recent Developments

- In January 2024, Simrad Yachting, a leader in marine electronics, has unveiled the NSX® ULTRAWIDE – the world’s first fully-featured ultrawide marine display. Offering up to 63% more screen space than the NSX*, it combines the benefits of dual screens into one sleek, immersive display, elevating both dashboard aesthetic and charting experience.

- In March 2024, Furuno Electric has launched rugged multi-function displays (MFDs) for tugboats and workboats. These all-glass MFDs feature a RotoKey control knob, TZtouchXL touchscreen, edge-swipe functions, customizable quick pages, and a hexacore processor for quick data monitoring.

Report Scope

Report Features Description Market Value (2024) USD 20.04 Bn Forecast Revenue (2034) USD 44.1 Bn CAGR (2025-2034) 8.20% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Airborne, Land, Naval), By System (Electronic Flight Displays (EFD), Head-Up Displays (HUD), Helmet-Mounted Displays (HMD), Portable and Flexible Multi-function Displays), By Technology (LED, LCD/AMLCD, TFT, OLED, Synthetic Vision), By Application (Military, Automobile, Aerospace) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rockwell Collins, SAAB AB, BAE Systems PLC, Thales SA, Garmin Ltd., Barco NV, Raymarine, Northrop Grumman Corporation, Honeywell Aerospace, Esterline Technolgies Corporation, Avidyne Corporation, Aspen Avionics Inc., Universal Avionics Systems Corporation, Astronautics Corporation of America, Samtel Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Multi-Function Display (MFD) MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Multi-Function Display (MFD) MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rockwell Collins

- SAAB AB

- BAE Systems PLC

- Thales SA

- Garmin Ltd.

- Barco NV

- Raymarine

- Northrop Grumman Corporation

- Honeywell Aerospace

- Esterline Technolgies Corporation

- Avidyne Corporation

- Aspen Avionics Inc.

- Universal Avionics Systems Corporation

- Astronautics Corporation of America

- Samtel Group

- Other Key Players