Global MPPT PV Solar Energy Charge Controller Market Size, Share, And Industry Analysis Report By Types (10A to 50A, 60A to 100A), By Application (Residential, Industrial, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 171172

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

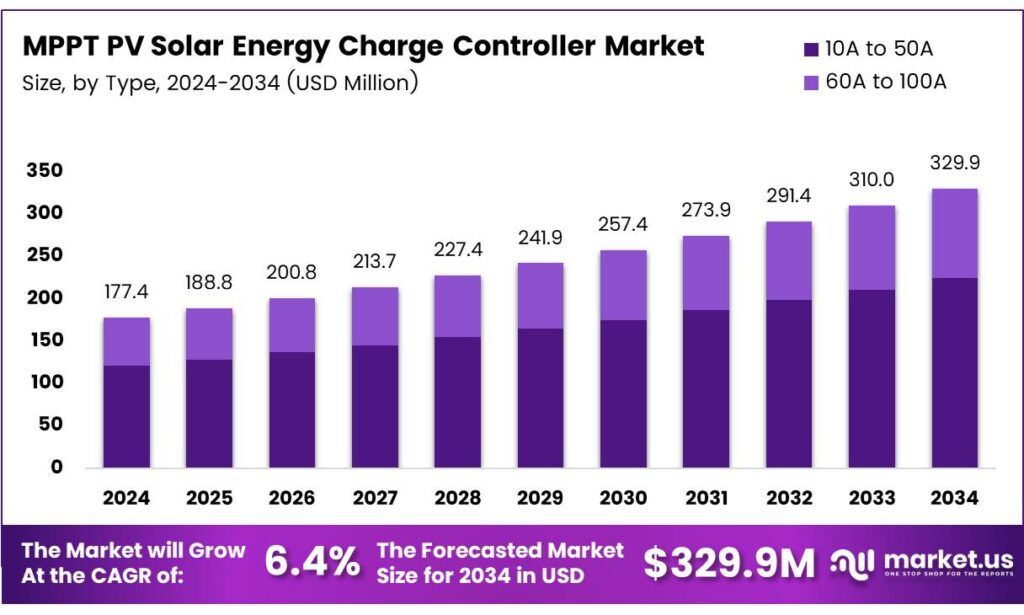

The Global MPPT PV Solar Energy Charge Controller Market size is expected to be worth around USD 329.9 million by 2034, from USD 177.4 million in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The MPPT PV Solar Energy Charge Controller Market represents the control backbone of modern off-grid solar systems. It focuses on devices that regulate power flow between photovoltaic batteries and modules. As off-grid solar adoption expands across rural electrification, telecom towers, and remote infrastructure, demand for intelligent charge controllers continues to strengthen.

MPPT solar charge controllers enable higher energy harvest compared to traditional controllers. By continuously tracking the maximum power point, these systems optimize voltage and current conversion. According to the U.S. National Renewable Energy Laboratory, MPPT technology can improve solar panel energy utilization by 30%, directly increasing system output efficiency.

- Voltage adaptability remains a key market differentiator, as MPPT controllers automatically support battery voltages from 12V to 96V, reducing system design complexity and improving scalability across diverse loads and locations. Their ability to operate reliably between –10°C and +45°C ensures stable performance in harsh climates, while IEC-aligned thermal protection features that limit output or initiate shutdowns further enhance long-term durability and system reliability.

MPPT controllers support multiple battery chemistries, including lead-acid, lithium-ion, and ternary polymer lithium batteries. This flexibility allows seamless integration across residential, commercial, and industrial off-grid systems. According to the International Renewable Energy Agency, battery-based off-grid solar installations remain critical for energy access programs worldwide.

Key Takeaways

- The Global MPPT PV Solar Energy Charge Controller Market is projected to grow from USD 177.4 million in 2024 to USD 329.9 million by 2034, registering a 6.4% CAGR during 2025–2034.

- The 10A to 50A segment leads the market with a dominant share of 67.3% due to its suitability for residential and small commercial systems.

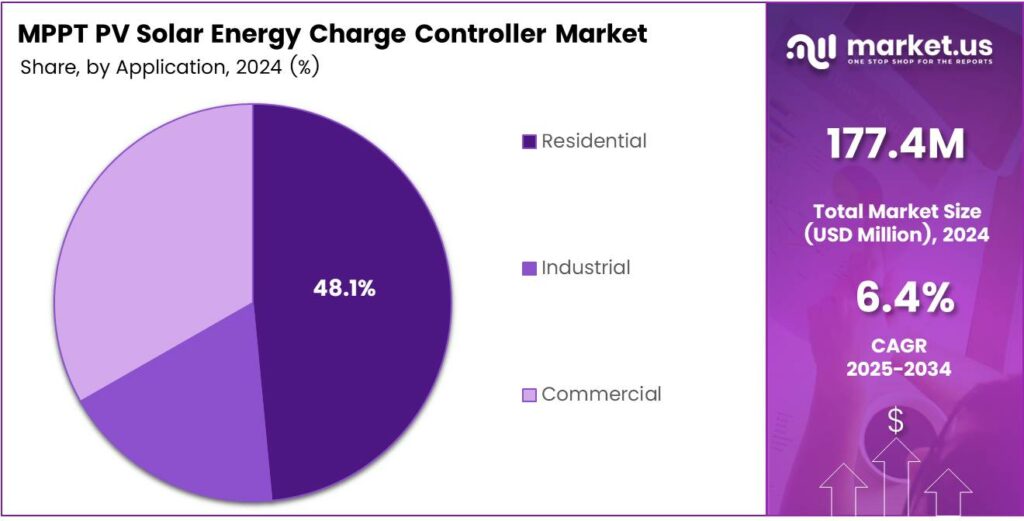

- The Residential segment holds the largest share at 48.1%, driven by rising off-grid and backup solar installations.

- MPPT Technology enhances solar energy utilization by up to 30%, improving overall system efficiency and output.

- North America dominates the global market with a share of 43.9%, valued at USD 77.8 million in 2024.

By Types Analysis

10A to 50A dominates with 67.3% due to its suitability for small and mid-sized solar systems.

In 2024, 10A to 50A held a dominant market position in the By Types Analysis segment of the MPPT PV Solar Energy Charge Controller Market, with a 67.3% share. This range is widely preferred for residential and small commercial systems. Moreover, it supports flexible installation, easier replacement, and stable charging performance across varied off-grid conditions.

In contrast, 60A to 100A controllers serve higher-capacity solar setups where power demand is greater. These units are typically adopted in larger installations requiring stronger current handling. As a result, adoption remains steady, supported by expanding commercial rooftops and growing interest in scalable off-grid and hybrid solar configurations.

By Application Analysis

Residential dominates with 48.1% driven by rising off-grid and backup solar installations.

In 2024, Residential held a dominant market position in the By Application Analysis segment of the MPPT PV Solar Energy Charge Controller Market, with a 48.1% share. This dominance reflects growing household adoption of rooftop and off-grid solar systems. Additionally, MPPT controllers improve energy harvest efficiency, making them attractive for homeowners seeking reliable power management.

The Industrial application segment focuses on a stable energy supply for equipment and operations. MPPT controllers help regulate charging under variable load conditions. Consequently, industries adopt these systems to improve power reliability, reduce downtime, and support decentralized solar installations where grid access remains inconsistent or cost-sensitive.

Meanwhile, Commercial applications include offices, retail spaces, and service facilities using solar for cost control. MPPT charge controllers enable better energy utilization and system monitoring. Therefore, commercial users increasingly integrate these controllers to support medium-scale solar systems while maintaining operational efficiency and predictable power performance.

Key Market Segments

By Types

- 10A to 50A

- 60A to 100A

By Application

- Residential

- Industrial

- Commercial

Emerging Trends

Integration of Digital Monitoring and Advanced Protection Features Shapes Market Trends

One major trending factor in the MPPT PV solar energy charge controller market is the integration of digital monitoring systems. Users increasingly prefer controllers that provide real-time performance data through mobile apps or display panels, improving system visibility and control.

- Functions such as overload, short-circuit, reverse polarity, and overheating protection improve system safety and extend equipment life, making MPPT controllers more reliable. The International Renewable Energy Agency (IRENA), solar PV capacity reached 1,865 GW globally by the end of 2024, up significantly from previous years, with over 451 GW of new solar PV capacity added in 2024 alone, the largest increase of any renewable energy source.

Modern MPPT controllers are designed to operate efficiently between –10°C and +45°C, supporting deployment in harsh climates and expanding geographic reach. Compact design and modular scalability are gaining attention as well. Smaller, lightweight controllers that can be easily upgraded help installers manage diverse project sizes.

Drivers

Rising Adoption of Off-Grid and Hybrid Solar Systems Drives Market Growth

The MPPT PV solar energy charge controller market is mainly driven by the fast adoption of off-grid and hybrid solar systems. Many rural and remote areas still lack reliable grid access, pushing households and businesses toward standalone solar solutions. MPPT controllers help maximize power output from solar panels, making these systems more efficient and dependable.

- MPPT controllers can increase solar energy harvest by up to 30% compared to conventional controllers. In 2024, solar PV additions accounted for over 77% of all renewable power capacity increases, contributing 452.1 GW to global renewable capacity expansion, an unprecedented figure in the history of energy growth.

The ability of MPPT controllers to work with multiple battery types, such as lead-acid and lithium-ion, improves system flexibility. Their wide voltage adaptability, typically from 12V to 96V, simplifies system design and reduces installation complexity, further supporting market growth. As solar installations increase, demand for advanced charge controllers naturally rises.

Restraints

High Initial Cost of Advanced Controllers Limits Market Expansion

One major restraint in the MPPT PV solar energy charge controller market is the higher upfront cost compared to basic PWM controllers. For cost-sensitive users, especially in developing regions, the price difference can delay adoption despite long-term efficiency benefits.

Limited technical awareness is another challenge. Many small installers and end users are not fully aware of the performance advantages of MPPT technology. This lack of knowledge often leads to the selection of cheaper, less efficient alternatives. System compatibility issues also act as a restraint. MPPT controllers must be carefully matched with panel voltage, battery type, and system size.

Incorrect selection or installation can reduce performance and discourage users from adopting advanced controllers. Harsh environmental conditions, such as extreme heat, dust, and humidity, can impact controller lifespan if low-quality products are used. Concerns over durability and maintenance costs make some buyers hesitant, especially in remote areas where service support is limited.

Growth Factors

Expansion of Energy Storage and Smart Solar Systems Creates New Opportunities

The growing use of energy storage systems presents strong growth opportunities for the MPPT PV solar energy charge controller market. As battery adoption increases, efficient charging and protection become critical, boosting demand for advanced MPPT solutions.

- MPPT controllers with communication features like monitoring apps and remote diagnostics support better energy management. Solar projects in key markets like Asia-Pacific and India are contributing a lion’s share of new installations, supported by policy targets such as India’s ambitious renewable expansion goals that have propelled solar module manufacturing capacity from 38 GW to 74 GW in FY 2024–25.

Electrification of agriculture, telecom towers, and EV charging infrastructure further supports market expansion. These applications require reliable off-grid power, where MPPT controllers play a key role in maintaining a stable energy supply. Increasing solar investments and falling panel prices encourage new installations, creating steady demand for efficient charge controllers across multiple end-use sectors.

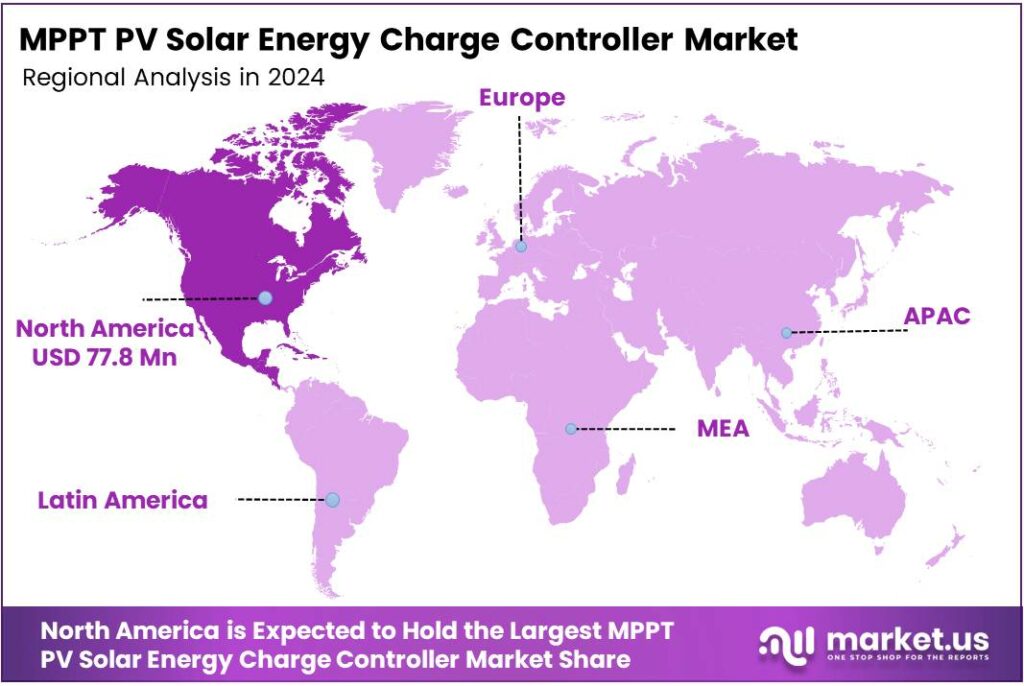

Regional Analysis

North America Dominates the MPPT PV Solar Energy Charge Controller Market with a Market Share of 43.9%, Valued at USD 77.8 million

North America holds the leading position due to the strong adoption of off-grid and hybrid solar systems across residential, commercial, and utility-scale applications. The region’s dominance is reinforced by advanced grid infrastructure and steady deployment of lithium-ion battery-based solar setups, keeping its share at 43.9% and market value at USD 77.8 million.

Europe shows consistent growth supported by renewable energy mandates and a strong focus on energy efficiency. MPPT charge controllers are increasingly adopted in residential rooftop solar, agricultural solar pumping, and small commercial installations. Demand is further supported by the region’s emphasis on battery storage integration and reliable performance under variable climatic conditions.

Asia Pacific is emerging as a high-growth region due to expanding off-grid solar installations in rural and semi-urban areas. Governments are promoting decentralized solar systems to improve electricity access and reduce grid dependency. MPPT controllers are widely used in telecom towers, small industries, and residential systems, driven by cost sensitivity and scalability needs.

Latin America is gradually expanding its MPPT PV solar energy charge controller market, supported by renewable energy programs and rural solar projects. Off-grid solar systems are increasingly deployed in agriculture, remote housing, and small commercial facilities. The need for efficient power conversion and battery protection in variable weather conditions continues to drive adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Phocos is well-positioned in MPPT charge controllers where uptime matters more than “extra features,” especially for rural electrification and harsh-field deployments. In 2024, its value is in designing for durability, stable charging behavior, and simple installation workflows that reduce service calls. As off-grid programs scale, Phocos benefits from buyers who prioritize proven reliability and long operating life over glossy interfaces.

Morningstar continues to be a reference brand for engineered performance and predictable thermal management, which helps in telecom power, industrial sites, and critical off-grid assets. Its strength is long-term product consistency, conservative ratings, and strong system protection logic that integrators trust. In 2024, Morningstar’s opportunity is to package MPPT with clearer monitoring and compliance-ready documentation for institutional and government-backed projects.

Beijing Epsolar (often recognized through broad model availability) competes on breadth, fast iteration, and accessible pricing across common current ranges. In 2024, it is advantageous in value-led markets where installers want widely available MPPT options with practical features like communication ports and configurable battery settings. The key watch-out is ensuring consistent quality across channels, because service experience can shape repeat purchases in fragmented distribution.

OutBack Power is typically associated with higher-power off-grid systems where integration, expandability, and installer familiarity drive selection. In 2024, it can gain from hybrid system growth—pairing PV, batteries, and generators—where charge controllers must coordinate cleanly and handle high PV input conditions. Its near-term edge comes from ecosystem fit and support expectations in premium off-grid and backup power segments.

Top Key Players in the Market

- Phocos

- Morningstar

- Beijing Epsolar

- OutBack Power

- Victron Energy

- Studer Innotec

- Remote Power

- Renogy

Recent Developments

- In 2024, Phocos, a provider of off-grid solar power solutions, has focused on enhancing compatibility and reliability in its product ecosystem, though specific new MPPT charge controller launches have been limited in recent years. Phocos announced expanded compatibility for its Any-Cell ESS-L energy storage system with select third-party inverters, improving integration for solar systems including those using MPPT controllers.

- In 2024, Morningstar Corporation, a U.S.-based leader in solar charge controllers, introduced several innovations in its MPPT lineup, focusing on system integration, software updates, and new accessories. Morningstar announced the availability of its GenStar MPPT controllers and SureSine inverter line, enabling all-Morningstar off-grid systems with enhanced charging efficiency and now shipping globally.

Report Scope

Report Features Description Market Value (2024) USD 177.4 Million Forecast Revenue (2034) USD 329.9 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (10A to 50A, 60A to 100A), By Application (Residential, Industrial, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Phocos, Morningstar, Beijing Epsolar, OutBack Power, Victron Energy, Studer Innotec, Remote Power, Renogy Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  MPPT PV Solar Energy Charge Controller MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

MPPT PV Solar Energy Charge Controller MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Phocos

- Morningstar

- Beijing Epsolar

- OutBack Power

- Victron Energy

- Studer Innotec

- Remote Power

- Renogy