Global More Electric Aircraft Market Size, Share, Industry Analysis Report By Aircraft Type (Fixed Wing, Rotary Wing), By Platform (Commercial Aircraft, Military Aircraft), By System (Aircraft Configuration and Management System, Flight Control and Mission Management System, Air Pressurization and Conditioning System, Power Generation and Management System, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook by 2025-2034

- Published date: Sept. 2025

- Report ID: 159772

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

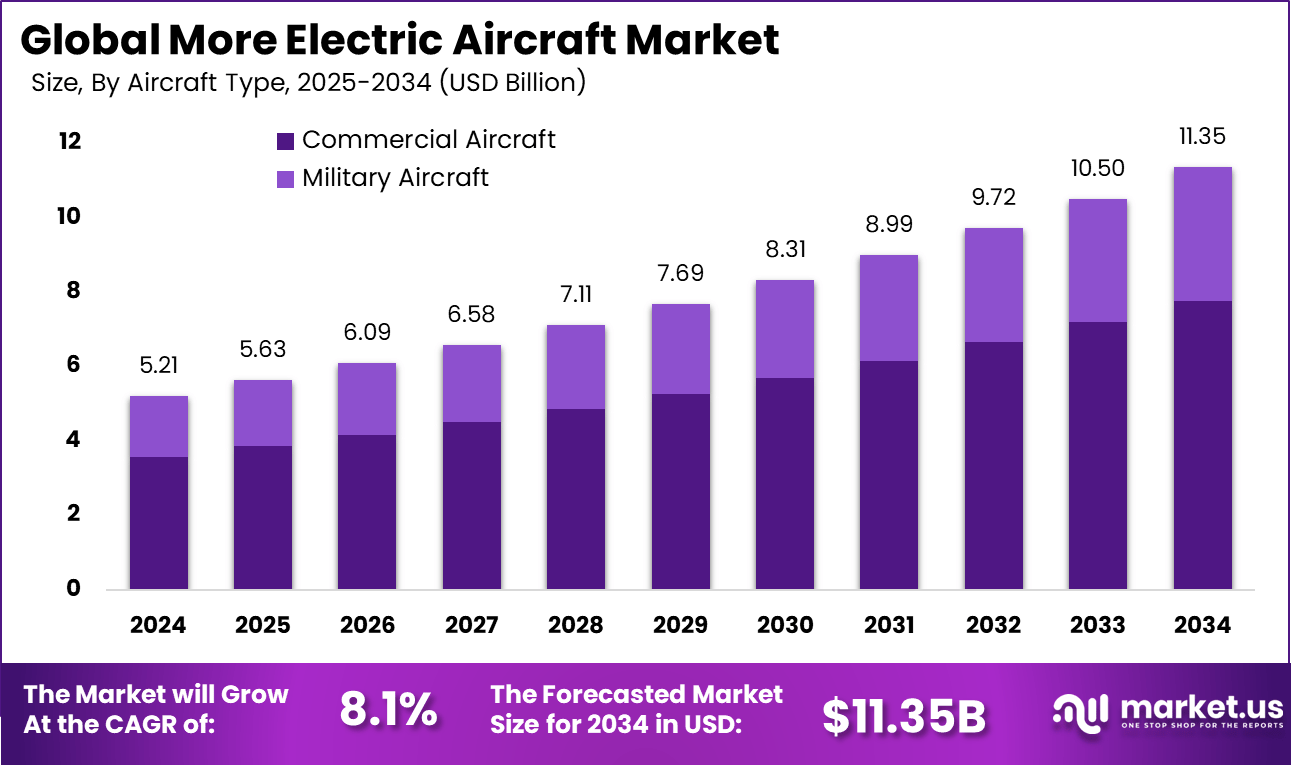

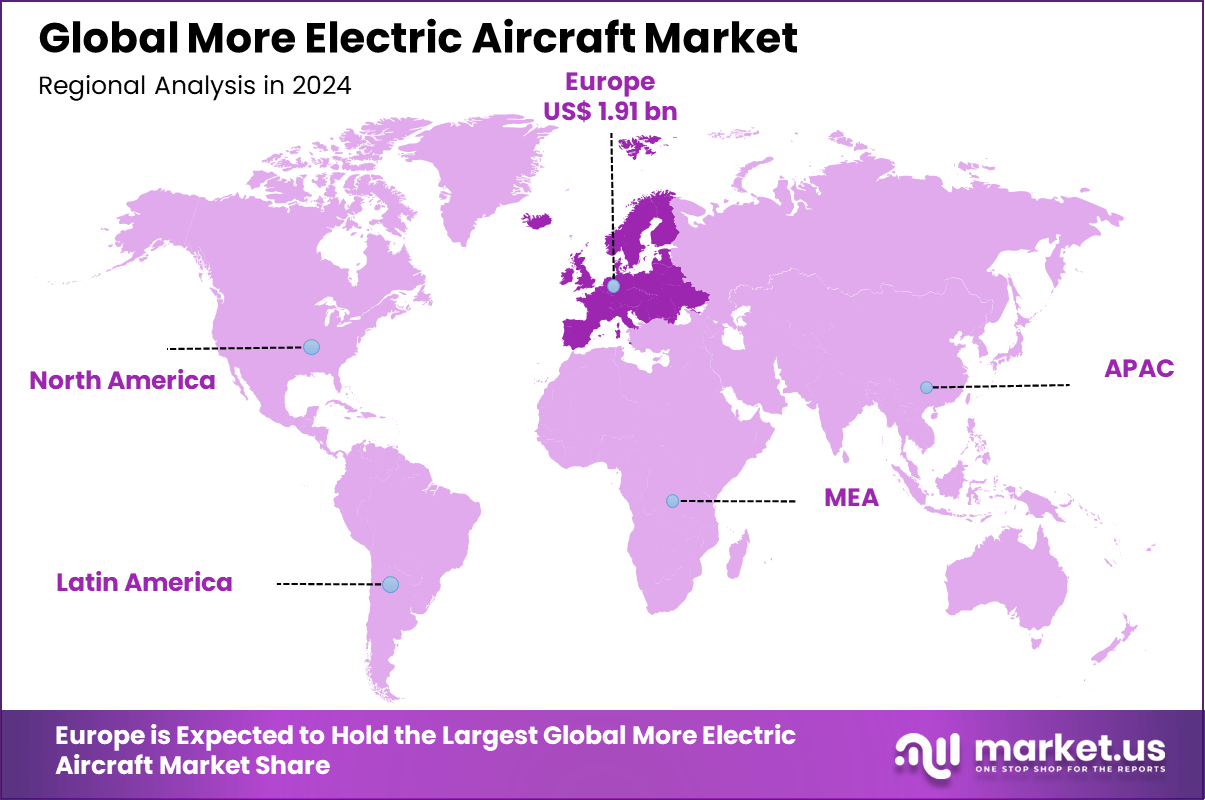

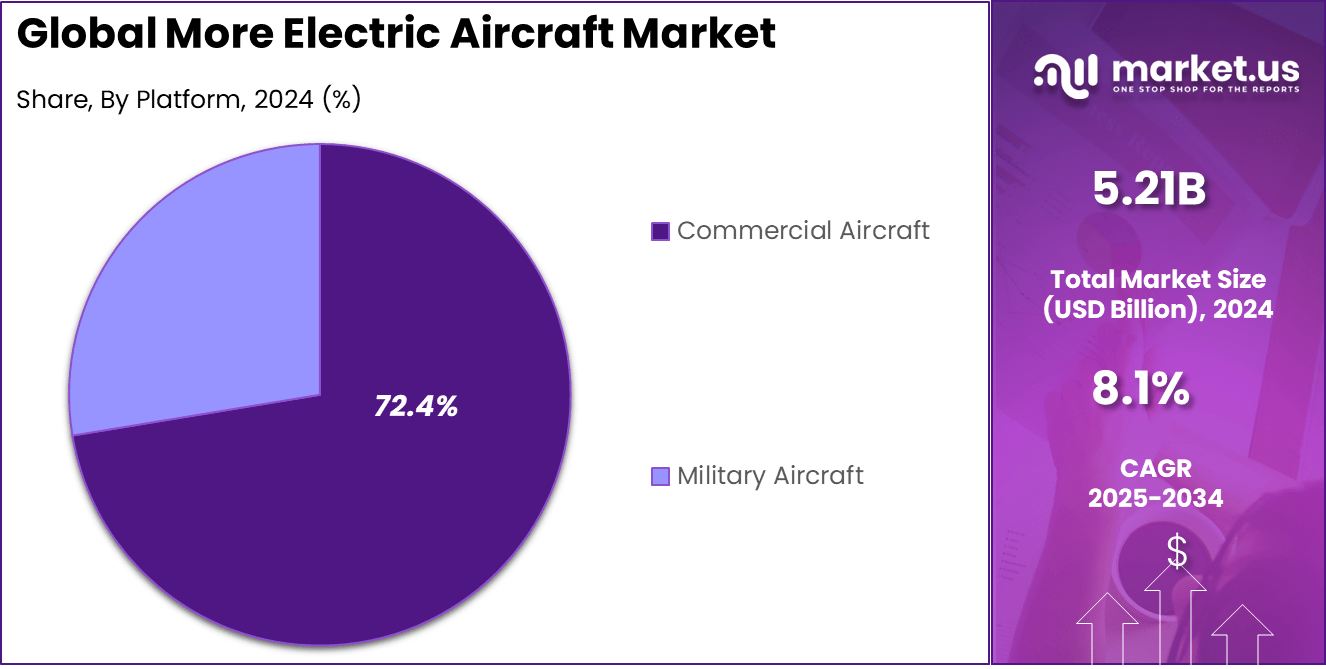

The Global More Electric Aircraft Market size is expected to be worth around USD 11.35 billion by 2034, from USD 5.21 billion in 2024, growing at a CAGR of 8.1% during the forecast period from 2025 to 2034. In 2024, Europe held a dominant market position, capturing more than a 36.84% share, holding USD 1.91 billion in revenue.

The More Electric Aircraft (MEA) Market refers to aircraft architectures in which traditional mechanical, pneumatic, and hydraulic subsystems are replaced (fully or in part) by electrical systems. In these aircraft, electric power drives functions such as actuation, environmental control, flight control systems, landing gear, and other non-propulsive subsystems.

The goal is to reduce weight, improve efficiency, simplify maintenance, and enable a smoother transition toward fully electric or hybrid aircraft in the future. Top driving factors for the MEA market include the rising demand for fuel efficiency and reduction of carbon emissions. Airlines and manufacturers are under pressure from global regulations to cut emissions, driving adoption of electric systems that lower fuel use.

According to Market.us, The global hybrid electric aircraft market has been witnessing rapid advancements, driven by the aviation industry’s shift toward cleaner propulsion technologies. In 2023, the market was valued at USD 1.4 billion, with North America holding a leading share of 42.4%, generating about USD 0.60 billion in revenue, at a CAGR of 35.7% through the forecast period.

In parallel, the connected aircraft market is experiencing steady growth as airlines and manufacturers adopt digital solutions to enhance operational efficiency, passenger experience, and safety. Valued at USD 8.2 billion in 2023, the market is projected to progress at a CAGR of 14.3%, reflecting the rising integration of connectivity solutions across commercial and defense aviation sectors.

For instance, in June 2024, Rolls-Royce Deutschland partnered with ITP Aero to develop the Wingman engine, a next-generation propulsion system aimed at improving efficiency and lowering emissions. The collaboration emphasizes sustainable aviation technologies, with the engine incorporating advanced features such as hybrid-electric capabilities to support the industry’s shift toward greener flight solutions.

Key Takeaway

- Fixed-wing aircraft accounted for 68.4%, showing that this category is the leading choice for adopting more electric technologies due to wide usage in civil and defense aviation.

- Commercial aircraft represented 72.4%, confirming that airlines and passenger transport fleets are the main drivers of electrification, as they seek fuel efficiency and reduced emissions.

- Aircraft configuration and management systems held 32.8%, highlighting the focus on integrated power management, optimized control, and onboard efficiency improvements.

- Europe captured 36.84% share, making it a leading regional hub for adoption, supported by strong aerospace manufacturing and green aviation initiatives.

- United Kingdom contributed USD 0.49 billion, emphasizing its role as a key market within Europe, with strong aerospace R&D and industry partnerships.

- UK CAGR of 6.4% reflects steady momentum, supported by government incentives and investments in sustainable aviation projects.

Analysts’ Viewpoint

Increasing adoption of technologies such as advanced power electronics, electric actuators, electric auxiliary power units, and energy-efficient thermal management systems are central to the MEA market growth. The transition from pneumatic and hydraulic components to electric systems is backed by improvements in battery technology and power management, which allow greater operational flexibility and energy savings.

Key reasons for adopting MEA technologies include significant reductions in aircraft weight and fuel burn, both critical for lowering operating costs and emissions. Electric systems also improve aircraft reliability by minimizing moving parts subject to wear and tear, thus lowering maintenance costs and increasing aircraft uptime.

Environmental compliance, driven by global and regional regulatory mandates, motivates airlines and manufacturers to advance MEA technologies to meet stricter emissions standards. Furthermore, electric aircraft systems support emerging trends like urban air mobility and electric vertical takeoff and landing (eVTOL), which require efficient, lightweight electric architectures.

Investment and Business benefits

Investment opportunities in the MEA market are rising due to ongoing technological innovation and substantial commitments from aerospace leaders to electrify aircraft subsystems. R&D spending on electric propulsion, power electronics, and system integration continues to grow, driven by government incentives and commercial interest in sustainability.

Investors see potential in companies developing batteries, generators, and electric motors optimized for aviation use. The push for cleaner aviation fuels further boosts investment in advanced electric power sources and hybrid systems, promising long-term returns in reducing aviation’s environmental footprint.

Business benefits from MEA adoption include fuel cost savings, reduced greenhouse gas emissions, lower maintenance expenses, and improved aircraft reliability. Airlines gain operational advantages through more efficient energy use and reduced dependency on fossil fuels. This contributes not only to cost management but also to corporate sustainability commitments increasingly valued by consumers and regulators.

U.K. Market Size

The market for More Electric Aircraft within the U.K. is growing tremendously and is currently valued at USD 0.49 billion, the market has a projected CAGR of 6.4%. The market is growing rapidly due to the country’s strong commitment to reducing carbon emissions and promoting sustainable aviation.

For instance, in February 2023, the UK government announced £113 million in funding to support the development of emission-free electric aircraft, reinforcing the country’s growing dominance in the More Electric Aircraft (MEA) market. This funding is aimed at accelerating innovations in electric propulsion, energy storage, and other key technologies to reduce the aviation industry’s carbon footprint.

In 2024, Europe held a dominant market position in the Global More Electric Aircraft Market, capturing more than a 36.84% share, holding USD 1.91 billion in revenue. This dominance is due to its proactive approach toward sustainability and regulatory support for green aviation technologies.

The European Union’s stringent emissions targets, along with substantial investments in electric aircraft research and development, have driven significant innovation. Additionally, leading aerospace companies in Europe, such as Airbus and Rolls-Royce, are at the forefront of MEA advancements, further strengthening the region’s leadership in the global transition to cleaner aviation.

For instance, in April 2025, Airbus further cemented Europe’s dominance in the More Electric Aircraft (MEA) market with the announcement of significant advancements in electric aircraft technology. The company revealed progress in its E-Fan X project, an electric hybrid aircraft aimed at reducing carbon emissions in aviation. Airbus continues to lead the way in developing electric propulsion systems and lightweight materials, positioning Europe at the forefront of sustainable aviation

Aircraft Type Analysis

In 2024, Fixed-wing aircraft dominated the more electric aircraft market with 68.4% share. These aircraft are leading the shift toward electric systems because their configuration allows for efficient integration of power electronics and energy management systems. The use of electric subsystems reduces reliance on hydraulics and pneumatics, increasing efficiency and lowering overall operational costs.

The strong adoption of fixed-wing aircraft in both civil and defense applications further supports this dominance. Airlines and operators are focusing on lowering fuel consumption and emissions, which makes electrification in fixed-wing models a practical choice. This segment continues to set the foundation for advancements in electric propulsion and next-generation aviation technologies.

For Instance, in March 2023, BETA Technologies announced plans to certify a fixed-wing electric aircraft alongside its electric vertical take-off and landing (eVTOL) models. This move marks a significant step in the development of More Electric Aircraft (MEA), expanding the company’s focus from urban air mobility to commercial aviation.

Platform Analysis

In 2024, the Commercial aircraft accounted for the largest share at 72.4%. Airlines are under increasing pressure to improve their sustainability profile, and electric-powered systems represent a practical step toward lowering carbon output. Key subsystems such as electric actuation, power distribution, and cabin systems are rapidly replacing conventional mechanical designs.

The rise in global air travel has also intensified the need for cost-efficient operations. Commercial carriers are adopting more electric systems to minimize maintenance and improve reliability. This focus makes commercial aviation the front-runner in adopting electrification technologies, while military and business aircraft follow at a slower pace.

For instance, in September 2025, Qantas launched its first commercial flights using the Airbus A321XLR in Australia. This new aircraft is part of Qantas’ strategy to modernize its fleet with more fuel-efficient and longer-range models. The A321XLR, while not fully electric, is an example of the aviation industry’s move toward sustainability by adopting more efficient, low-emission aircraft.

System Analysis

In 2024, The aircraft configuration and management system segment contributed 32.8%. These systems are critical because they monitor and control the performance of electric subsystems, which ensures safety and efficiency in flight operations. By optimizing power allocation and load management, they enable airlines to operate more efficiently.

Growing demand for intelligent monitoring systems also contributes to this segment’s weight. As aircraft design evolves, advanced management systems will be needed to oversee increasingly complex electric architectures. This makes the configuration and management category one of the most strategic foundations for progress in more electric aircraft.

For Instance, in February 2024, a groundbreaking project focused on dynamic routing and aircraft configuration for greener aviation was launched under the European Union’s Horizon Europe program. The project aims to optimize aircraft configuration and management systems, integrating more electric aircraft technologies to enhance fuel efficiency and reduce emissions.

Growth Factors

Growth in the more electric aircraft market stems from rising demands to improve fuel efficiency, meet stricter emission regulations, and reduce maintenance costs. Fuel can account for 20% to 30% of airline operating expenses, so replacing hydraulic systems with electric ones directly impacts operating costs and environmental objectives.

Technological advances in high-power motors, Silicon Carbide (SiC), and Gallium Nitride (GaN) electronics have contributed approximately +2.1% to expected CAGR growth. Electric propulsion components and system integration accounted for major investments during 2024-2025, driving early revenue growth. Regions like North America and Europe lead due to policy focus on sustainability and strong aerospace industries

Key Market Segments

By Aircraft Type

- Fixed Wing

- Rotary Wing

By Platform

- Commercial Aircraft

- Military Aircraft

By System

- Aircraft Configuration and Management System

- Flight Control and Mission Management System

- Air Pressurization and Conditioning System

- Power Generation and Management System

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Drivers

Demand for Fuel Efficiency and Reduced Emissions

One major driver for the more electric aircraft market is the increasing demand for fuel efficiency alongside the need to reduce harmful emissions. As traditional aircraft use hydraulic and pneumatic systems powered by fossil fuels, switching to electrical systems significantly lowers aircraft weight and fuel consumption. This results in less carbon dioxide released into the atmosphere, helping airlines and manufacturers meet stricter international environmental regulations.

Aircraft like the Airbus A350 XWB and Boeing 787 Dreamliner incorporate these electric systems to achieve better fuel economy and greener operations. This growing environmental awareness pushes the industry toward adopting more electric solutions to enhance operational efficiency and sustainability.

For instance, in December 2024, Elbit Systems highlighted its ongoing innovations in the aerospace and defense sectors, emphasizing the development of cutting-edge technologies for electric aircraft and more sustainable aviation solutions. The company showcased its advancements in electronic warfare, self-protection systems, and its contributions to next-generation aircraft technologies.

Restraint

High Initial Capital Investment

A significant restraint for the more electric aircraft market is the very high initial capital needed to design, develop, and certify electric aircraft systems. Introducing electrical components to replace well-established hydraulic and pneumatic architectures requires large investments in research and development.

For aerospace manufacturers, upgrading manufacturing facilities and retraining technicians adds to the upfront costs. Smaller players and new entrants face financial barriers that limit their ability to compete or innovate rapidly. Additionally, certification and regulatory approval processes for new electric technologies in aviation are time-consuming and costly. These systems must demonstrate safety, reliability, and compliance with industry standards before widespread adoption.

For instance, in October 2024, BETA Technologies raised more than $300 million in additional equity capital to fund the growth and commercialization of its electric aircraft technologies. This substantial investment highlights the high initial capital required to develop More Electric Aircraft (MEA). The funds will support BETA’s continued advancement of electric vertical take-off and landing (eVTOL) aircraft and hybrid-electric propulsion systems.

Opportunities

Advancement in Battery and Power Electronics Technology

The development of advanced batteries and high-density power electronics presents a significant opportunity for growth in the more electric aircraft market. Improved batteries with greater energy density can extend flight ranges and enable electric propulsion on longer routes, overcoming a traditional limitation of electric aircraft.

Innovations in power electronics, such as silicon carbide (SiC) and gallium nitride (GaN) semiconductors, are enhancing efficiency, reliability, and reducing weight in electric motors and power control units. investments in solid-state batteries and advanced electric propulsion systems could enable hybrid-electric and fully electric aircraft to scale up beyond regional and short-haul flights.

For instance, in June 2025, the UK government announced a £250 million funding initiative for green aerospace projects as part of its industrial strategy. This investment is aimed at accelerating the development of sustainable aviation technologies, including More Electric Aircraft (MEA). The funding will support innovations in electric and hybrid-electric propulsion systems, energy storage, and the necessary infrastructure to reduce carbon emissions in the aviation sector.

Challenges

Safety and Reliability Concerns

Safety and reliability remain key challenges in the adoption of more electric aircraft technologies. Aircraft systems must operate perfectly under all conditions, and electrical systems raise concerns such as potential overheating, electromagnetic interference, and vulnerability to failures unlike traditional hydraulic or mechanical systems.

Demonstrating that electric components can deliver the same or higher reliability while ensuring passenger and crew safety is a demanding hurdle. Moreover, integrating complex electrical systems within airframes requires careful design and rigorous testing to avoid unforeseen risks. Regulatory bodies demand exhaustive certification procedures to assess these risks fully.

For instance, in August 2025, the FAA cleared the certification path for electric vertical take-off and landing (eVTOL) aircraft under its new Powered Lift rules. While this marks a significant step forward for the industry, regulatory and certification hurdles remain a challenge for the broader adoption of More Electric Aircraft (MEA). The complex certification process involves rigorous safety standards, extensive testing, and validation to ensure reliability.

Key Players Analysis

The More Electric Aircraft Market is driven by major aerospace power system providers such as GE Aviation, Honeywell International Inc., and Rolls-Royce Holdings plc. These companies are at the forefront of developing advanced electric propulsion systems, high-voltage power distribution units, and electric environmental control systems.

Defense and avionics leaders including BAE Systems plc, Elbit Systems Ltd., Raytheon Technologies Corporation, and Thales Group are actively contributing to the MEA landscape through integrated flight control systems, electric actuation, and mission-critical electronic systems.

Firms like AMETEK Inc., Safran, and Bombardier Inc. are expanding their roles by offering specialized electrical subsystems, including generators, converters, and cabin electrical solutions. Their contributions are vital for narrow-body, business jet, and regional aircraft electrification efforts.

Top Key Players in the Market

- AMETEK Inc.

- BAE Systems plc

- Bombardier Inc.

- Elbit Systems Ltd.

- GE Aviation

- Honeywell International Inc.

- Raytheon Technologies Corporation

- Rolls-Royce Holdings plc

- Safran

- Thales Group

- Others

Recent Developments

- September 2025: GE Aerospace teamed up with BETA Technologies with a $300 million investment to co-develop a hybrid electric turbogenerator for advanced air mobility, including long-range VTOL aircraft, aiming to enhance flight range and payload while improving sustainability.

- August 2025: BAE Systems partnered with Embraer Defense & Security on a joint study for electric vertical takeoff and landing (eVTOL) aircraft variants. BAE has invested $10 million into the Eve Urban Air Mobility company, focusing on sustainable technologies and defence applications.

- June 2024: GE Aerospace announced progress on a hybrid electric demonstrator engine with NASA. This engine integrates electric motor/generators into a high-bypass turbofan, aimed at enhancing engine performance and supporting hybrid electric commercial flight capabilities. Component-level electric motor testing has been completed, with significant testing underway in Ohio.

Report Scope

Report Features Description Market Value (2024) USD 5.21 Bn Forecast Revenue (2034) USD 11.35 Bn CAGR(2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Aircraft Type (Fixed Wing, Rotary Wing), By Platform (Commercial Aircraft, Military Aircraft), By System (Aircraft Configuration and Management System, Flight Control and Mission Management System, Air Pressurization and Conditioning System, Power Generation and Management System, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AMETEK Inc., BAE Systems plc, Bombardier Inc., Elbit Systems Ltd., GE Aviation, Honeywell International Inc., Raytheon Technologies Corporation, Rolls-Royce Holdings plc, Safran, Thales Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  More Electric Aircraft MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

More Electric Aircraft MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AMETEK Inc.

- BAE Systems plc

- Bombardier Inc.

- Elbit Systems Ltd.

- GE Aviation

- Honeywell International Inc.

- Raytheon Technologies Corporation

- Rolls-Royce Holdings plc

- Safran

- Thales Group

- Others