Global Mobile Image Sensor Market Size, Share Report By Type (CCD Image Sensors, CMOS Image Sensors), By Image Processing Technology (2D and 3D), By Resolution (Up to 5 MP, 5 MP to 12 MP, 12 MP to 16 MP, and Above 16 MP), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153889

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

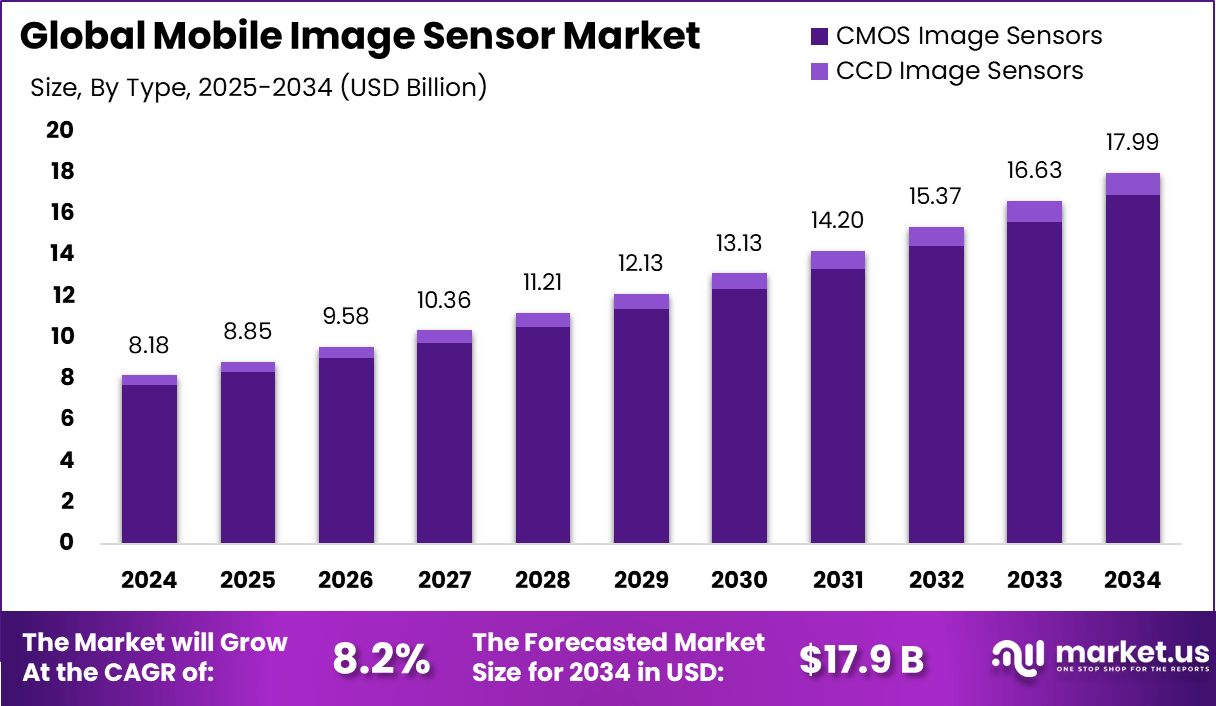

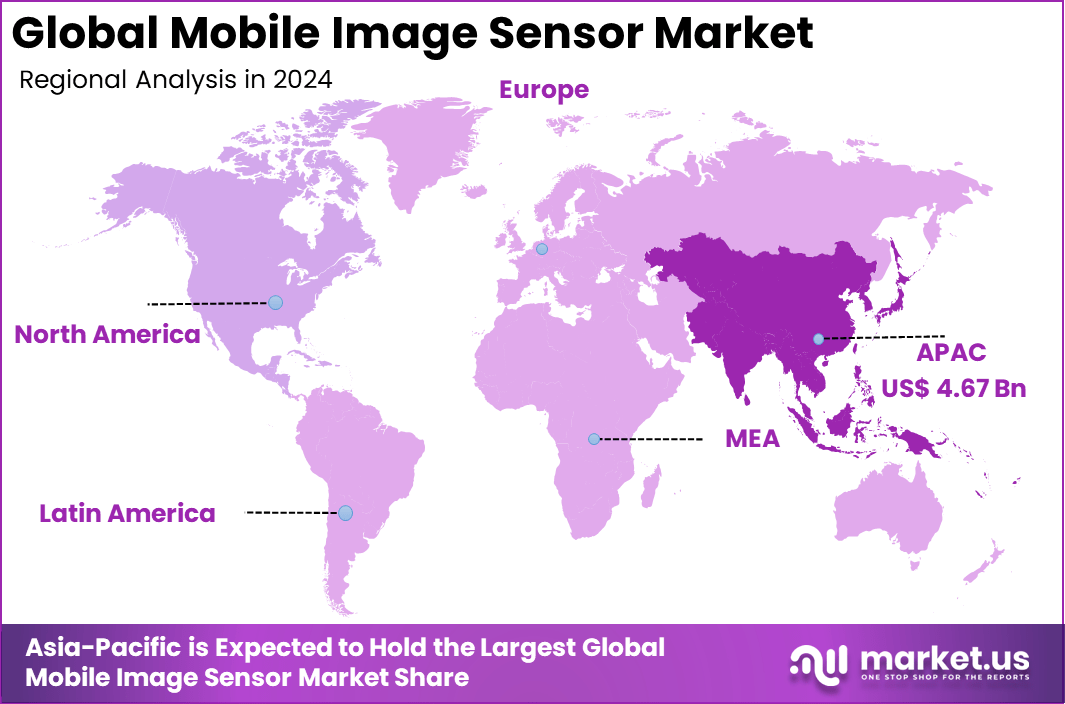

The Global Mobile Image Sensor Market size is expected to be worth around USD 17.9 billion by 2034, from USD 8.18 billion in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 57.1% share, holding USD 4.67 billion in revenue.

A mobile image sensor is a semiconductor device that captures light and converts it into digital signals, enabling cameras in smartphones to produce images and videos. These sensors are primarily of two types: CMOS (Complementary Metal-Oxide Semiconductor) and CCD (Charge-Coupled Device), with CMOS dominating the mobile sector due to its lower power consumption and faster processing speeds.

The market growth is fueled by factors such as increasing smartphone penetration, rising demand for high-resolution photography, and advancements in 3D sensing and AI-powered imaging. For instance, Apple’s iPhone and Samsung’s Galaxy series leverage advanced CMOS sensors with over 48 MP resolution, supporting features like night mode and real-time image processing.

Investment opportunities in this market are robust, appealing not just to established players but also to new innovators. There’s a significant push toward R&D in areas such as quantum-dot technology, embedded AI, 3D sensing, and environmentally conscious manufacturing. As the demand for advanced sensors grows both in consumer markets and in sectors like automotive and healthcare, those willing to innovate efficiently and sustainably stand to capture substantial value.

The business benefits of investing in mobile image sensors are tangible and wide-reaching. Businesses can differentiate products in a crowded marketplace, increase brand loyalty through enhanced user experiences, and open doors to new verticals such as immersive AR/VR applications or AI-powered diagnostic tools. Speed to market, rapid innovation cycles, and the ability to meet rapidly shifting consumer expectations are all increasingly tied to advanced image sensor integration.

Scope and Forecast

Report Features Description Market Value (2024) USD 8.18 Bn Forecast Revenue (2034) USD 17.9 Bn CAGR(2025-2034) 8.2% Leading Segment CMOS Image Sensors: 94.1% Largest Market Asia Pacific: 57.1% Market Share Largest Country China [2.61 Bn Market Revenue, CAGR: 8.8%] Key Takeaways

- The market is valued at USD 8.18 billion in 2024 and is projected to expand at a CAGR of 8.2% through 2034, supported by continuous advancements in smartphone camera technology.

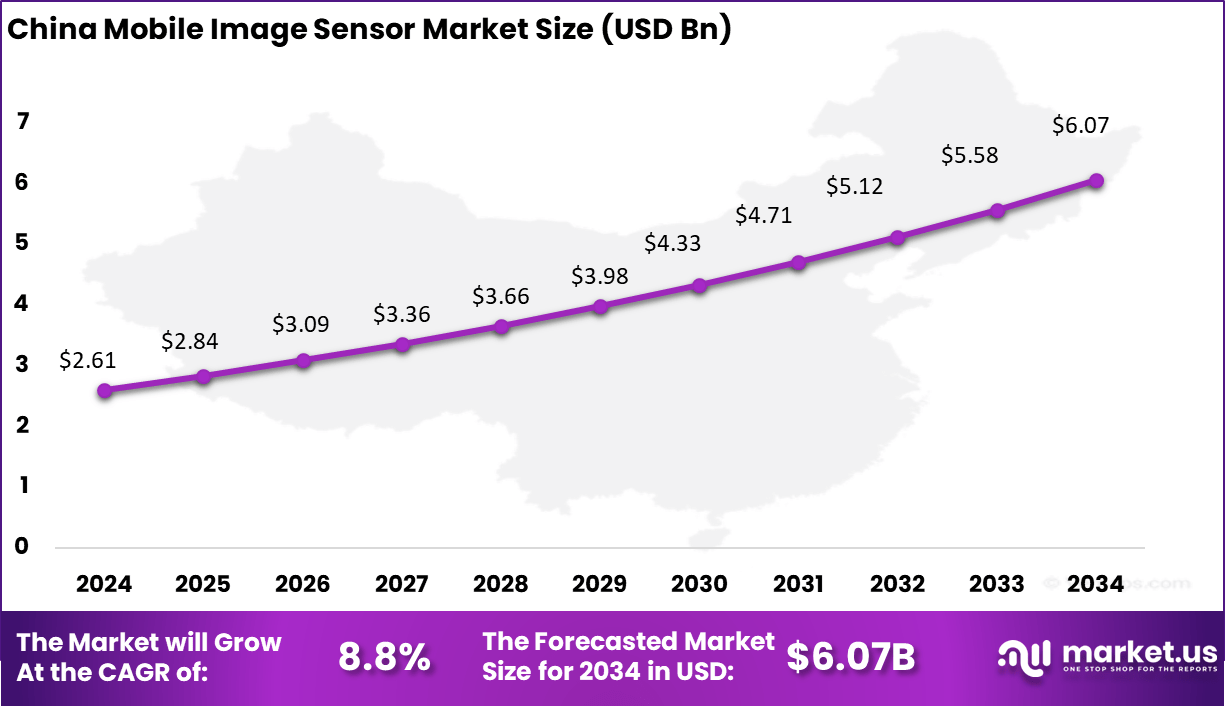

- Asia Pacific dominates with a 57.1% share, underpinned by large-scale production hubs in countries like China, which alone contributes USD 2.61 billion and is growing at 8.8% CAGR.

- CMOS image sensors command a dominant 94.1% share by type, preferred for their compact design, faster performance, and power efficiency over CCD alternatives.

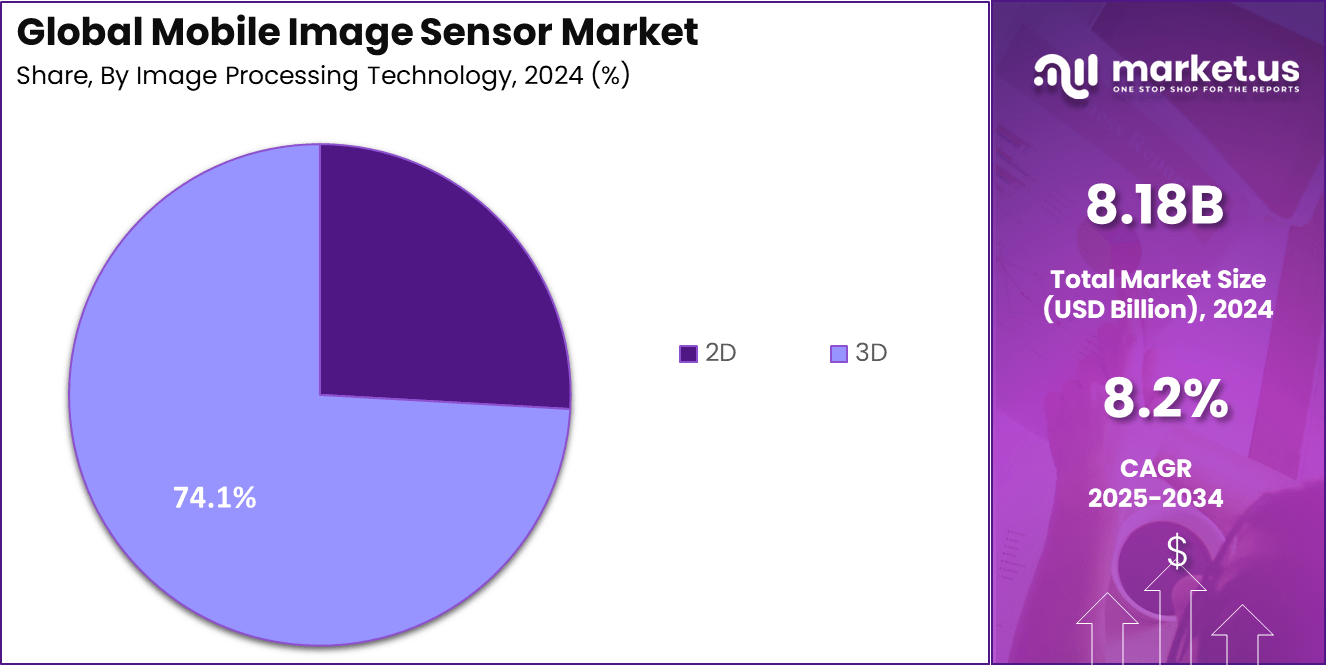

- In terms of image processing, 3D technology leads with 74.1% market share, gaining traction due to its critical role in facial recognition, AR/VR features, and LiDAR-based depth sensing.

- By resolution, the Above 16 MP segment holds the top position with 59.7% share, reflecting rising consumer preference for high-definition photography and multi-lens smartphone configurations.

China Market Size

The China mobile image sensor market is witnessing robust growth, fueled by the country’s strong electronics manufacturing ecosystem and increasing demand for high-performance smartphone cameras. In 2024, the China image sensor market was valued at approximately USD 2.61 billion, with projections indicating a CAGR of 8.8% in the coming years.

Domestic production of CMOS sensors reached 52.7 billion CNY (≈USD 7.3 billion) in 2024, marking a notable 28% year-over-year increase. China’s leading smartphone manufacturers, such as Huawei, Xiaomi, Oppo, Vivo, and NIO, are incorporating advanced camera modules such as Sony’s IMX890, IMX766, and IMX707 into devices featuring triple 50 MP setups and periscope zoom lenses.

In 2024, APAC held a dominant market position, capturing more than a 57.1% share, holding USD 4.67 billion revenue in the global mobile image sensor market. This leadership was primarily driven by the high concentration of smartphone manufacturing hubs across countries such as China, South Korea, Japan, and India.

These nations host extensive electronics supply chains and house major fabrication units for semiconductor components, including image sensors. The rapid rate of smartphone adoption, combined with local production advantages, has led to consistent demand for mid-to-high-end imaging components. Another reason for APAC’s stronghold is its booming consumer electronics ecosystem supported by tech-savvy populations and rising disposable incomes.

The region has shown a steady increase in demand for mobile cameras with better low-light performance, multi-lens configurations, and AI-powered imaging. Moreover, governments in the region have been pushing semiconductor self-sufficiency, leading to strategic investments in sensor fabrication and innovation.

By Type Analysis

The type segment of the global mobile image sensor market is primarily categorized into CMOS (Complementary Metal-Oxide-Semiconductor) image sensors and CCD (Charge-Coupled Device) image sensors, with CMOS sensors dominating the market, accounting for 94.1% of the total market share in 2024.

The dominance of CMOS technology is driven by its superior attributes, such as lower power consumption, faster readout speeds, reduced manufacturing costs, and integration flexibility, making it ideal for mobile devices where space and battery life are limited. Modern smartphones heavily rely on CMOS sensors to support advanced imaging features like AI-enhanced photography, 4K/8K video recording, slow-motion capture, night mode, and HDR.

Flagship smartphones such as the iPhone 15 Pro and Samsung Galaxy S24 Ultra utilize cutting-edge stacked CMOS sensors that enable multi-frame processing and high-speed autofocus, enhancing image quality in various lighting conditions. In contrast, CCD sensors, once popular for their high image fidelity in low-light, have become nearly obsolete in mobile phones due to their higher power demands and cost.

The trend toward multi-camera setups featuring wide-angle, ultra-wide, telephoto, and depth-sensing modules further fuels CMOS demand, as multiple sensors must work simultaneously without compromising efficiency. As mobile photography advances, CMOS sensors will remain the backbone of innovation in the mobile image sensor segment.

By Image Processing Technology Analysis

The Image Processing Technology segment of the global mobile image sensor market is divided into 2D and 3D technologies, with 3D image processing emerging as the dominant segment, accounting for 74.1% of the market share in 2024. The shift toward 3D technology is being driven by the growing need for enhanced user experiences in facial recognition, augmented reality (AR), depth mapping, and computational photography.

Unlike 2D sensors, which only capture width and height information, 3D sensors capture depth, enabling more immersive and secure features. For example, Apple’s TrueDepth camera system uses structured light 3D sensing to enable Face ID, Animoji, and portrait mode effects.

Similarly, Samsung’s Galaxy series and flagship models from Xiaomi and Oppo now incorporate Time-of-Flight (ToF) or LiDAR sensors to support AR apps, 3D scanning, and low-light enhancements. The use of 3D sensors is also expanding into mobile gaming and virtual try-on applications in e-commerce.

As smartphones integrate AI-powered processors, real-time 3D image processing allows for scene recognition, background separation, and improved autofocus. This evolution supports consumer demand for professional-grade mobile photography and interactive applications, solidifying 3D technology’s role as a transformative force in mobile image sensor innovation.

By Resolution Analysis

The Resolution segment in the global mobile image sensor market is segmented into Up to 5 MP, 5 MP to 12 MP, 12 MP to 16 MP, and Above 16 MP, with the “Above 16 MP” segment dominating the market with a 59.7% share in 2024.

This dominance is driven by the increasing demand for ultra-high-resolution cameras in smartphones, enabling users to capture highly detailed images and videos, especially for social media, content creation, and professional photography. Modern smartphones now regularly feature cameras ranging from 48 MP to 200 MP.

For example, Samsung’s Galaxy S24 Ultra incorporates a 200 MP primary sensor, allowing for exceptional zoom capabilities and detailed cropping without loss of quality. Similarly, Xiaomi and Realme have introduced mid-range models with 64 MP and 108 MP sensors, appealing to photography enthusiasts at affordable price points.

This trend is also fueled by consumers’ growing expectations for 4K/8K video recording, advanced zoom, and AI-based image enhancement, all of which require high-resolution sensors. As smartphone manufacturers compete on camera specs, especially in Asia-Pacific and North America, the adoption of high-resolution CMOS sensors continues to accelerate.

Key Features and Trends

Feature/Trend Details Shift to CMOS Technology CMOS image sensors have become the dominant standard for energy efficiency and imaging quality. Higher Resolutions Demand for sensors above 50MP, especially in flagship smartphones. Advanced Camera Functions Features like optical zoom, HDR, low-light/night modes, and better autofocus. Multi-Camera & Miniaturization Compact, multi-lens configurations in thin devices. Integration of AI Capabilities Real-time scene recognition, smart editing, and AR/3D sensing. Enhanced Power Efficiency Sensor designs that prolong battery life and lower device heat. Biometric & Security Applications Fingerprint, facial authentication, and payment security. AR/VR and 3D Sensing Growth in sensors used for AR apps, facial mapping, and depth perception. Driving Factor

Advancements in 3D sensing and facial recognition technologies

One of the major driving factors in the global mobile image sensor market is the advancement of 3D sensing and facial recognition technologies, which are revolutionizing how smartphones perceive and interact with their environment. 3D image sensors capture depth information along with standard RGB data, enabling precise facial mapping, gesture recognition, and spatial awareness.

This technology is a cornerstone for facial recognition systems like Apple’s Face ID, which uses a TrueDepth camera incorporating structured light to project over 30,000 infrared dots on the user’s face for secure authentication. Apple’s use of 3D sensing has set industry benchmarks, prompting other manufacturers like Huawei (e.g., Mate series) and Xiaomi to adopt similar solutions.

These capabilities are also expanding into augmented reality (AR) and virtual try-on experiences in apps, significantly improving user interaction. 3D sensing in mobile devices is driven by growing consumer demand for biometric security and immersive content. In addition, Android smartphone brands such as Oppo and Vivo are integrating time-of-flight (ToF) and structured light sensors to enhance portrait photography and secure facial unlock features.

Restraining Factor

Pricing pressure from low-cost smartphone manufacturers is limiting sensor margin potential.

As brands like Xiaomi, Realme, Transsion (Itel, Tecno), and Infinix compete aggressively in price-sensitive markets such as India, Africa, and Southeast Asia, they prioritize cost efficiency in smartphone components, including image sensors. These brands often target budget-conscious consumers with smartphones priced under USD 150, making it challenging to integrate premium, high-cost sensors.

As a result, sensor suppliers are forced to offer lower-priced, mid-tier CMOS sensors, which restricts revenue growth and technological differentiation. For example, in India, one of the largest smartphone markets, over 75% of smartphone shipments in 2023 were in the sub-$250 category, dominated by budget and mid-range offerings.

In such scenarios, manufacturers typically opt for 5 MP to 12 MP image sensors with limited 3D or AI capabilities to keep costs low, putting pressure on image sensor vendors like Sony, Samsung, and Omnivision to compete on price rather than innovation. This dynamic slows adoption of higher-end technologies like stacked CMOS, periscope zoom lenses, and advanced 3D sensing, especially in the low-cost segment, thereby restraining overall market profitability despite high unit volumes.

Growth Opportunity

Automotive and wearable device integration

The integration of mobile image sensors into automotive and wearable devices presents a significant growth opportunity for the market beyond traditional smartphones. In the automotive sector, image sensors are increasingly used in Advanced Driver Assistance Systems (ADAS), including applications like driver monitoring, lane departure warning, collision avoidance, and parking assistance.

For instance, Sony’s CMOS sensors are being integrated into various automotive camera modules to support real-time image capture under varying lighting conditions. In the wearables market, devices such as smartwatches, AR glasses, fitness trackers, and health-monitoring gadgets are increasingly incorporating image sensors for functions like gesture recognition, eye tracking, and biometric monitoring.

The popularity of smart glasses like Meta Ray-Ban and Snap Spectacles, which use miniature CMOS sensors for image and video capture, underscores this trend. Additionally, wearable health devices are using optical sensors for continuous monitoring of heart rate, oxygen levels, and facial detection. These emerging applications offer sensor manufacturers a chance to diversify their product portfolio and tap into high-growth verticals.

Key Market Segments

Type

- CCD Image Sensors

- CMOS Image Sensors

Image Processing Technology

- 2D

- 3D

Resolution

- Up to 5 MP

- 5 MP to 12 MP

- 12 MP to 16 MP

- Above 16 MP

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The global mobile image sensor market is highly competitive, dominated by a few major players who account for the majority of the market share. As of 2024, Sony leads the market with an estimated 40–45% share, due to its strong portfolio of high-performance CMOS sensors widely adopted in premium smartphones like Apple’s iPhones and Samsung’s Galaxy S series.

Sony’s sensors, such as the IMX989 and IMX890, are known for their exceptional low-light performance and support for high-resolution photography, including 4K and 8K video capabilities. Samsung Electronics holds a significant share with its ISOCELL sensor lineup, including the 200 MP ISOCELL HP2, featured in the Galaxy S24 Ultra.

Samsung not only uses its sensors internally but also supplies them to other OEMs. OmniVision Technologies, now part of Will Semiconductor (China), is a growing competitor, especially in the mid-range segment and automotive applications, providing versatile CMOS sensors with 3D sensing and HDR support.

Other notable players include Canon, STMicroelectronics, LG Innotek, Sharpvision, and Sunny Optical, each offering niche capabilities in imaging modules. Increasing demand for AI-based processing, 3D imaging, and compact sensor design continues to drive R&D investment and strategic partnerships among these companies, keeping the market dynamic and innovation-focused.

Top Key Players

- Samsung Electronics

- Sony

- Canon

- Fujitsu Microelectronics Inc

- LG Innotek

- Sharpvision

- SiliconFile

- Sunny Optical Technology

- STMicroelectronics

- Toshiba

- IBM Microelectronics

- Elpida

- Other Key Players

Recent Developments

- June 2025: Sony introduced the LYT-828, a new 50 MP stacked CMOS sensor featuring Hybrid Frame-HDR (HF-HDR) technology and over 100 dB dynamic range. Designed for smartphone main/sub cameras, it enhances high-contrast imaging, significantly reducing noise and blowout.

- November 2024: Sony announced the IMX925-a 24.55 MP industrial-grade, back-illuminated stacked CMOS sensor with global shutter tech (“Pregius S”), delivering 394 fps and twice the energy efficiency compared to predecessors.

- June 2024: Samsung launched three new ISOCELL sensors- HP9 (200 MP telephoto), GNJ, and JN5, featuring ultra-fine pixel designs, Tetra²pixel binning, and consistent imaging across modules. These are being featured across premium series such as Xiaomi 15 Ultra, Vivo X100, and X200 Ultra.

- April 2025: OmniVision launched the OV50X, a flagship 1‑inch 50 MP smartphone sensor with Dual Analog Gain HDR and Quad‑Phase Detection autofocus, offering 8K HDR video at 180 fps and 110 dB dynamic range. Evaluations are ongoing for deployment by year-end.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (CCD Image Sensors, CMOS Image Sensors), By Image Processing Technology (2D and 3D), By Resolution (Up to 5 MP, 5 MP to 12 MP, 12 MP to 16 MP, and Above 16 MP) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Samsung Electronics, Sony, Canon, Fujitsu Microelectronics Inc, LG Innotek, Sharpvision, SiliconFile, Sunny Optical Technology, STMicroelectronics, Toshiba, IBM Microelectronics, Elpida, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mobile Image Sensor MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Mobile Image Sensor MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Electronics

- Sony

- Canon

- Fujitsu Microelectronics Inc

- LG Innotek

- Sharpvision

- SiliconFile

- Sunny Optical Technology

- STMicroelectronics

- Toshiba

- IBM Microelectronics

- Elpida

- Other Key Players