Global Mobile Gaming Market Size, Share Analysis Report By Platform (Android, iOS, Others), By Device (Smartphones, Tablets), By Genre (Action and Adventure, Arcade, Roleplaying, Sports, Other Genres), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149942

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

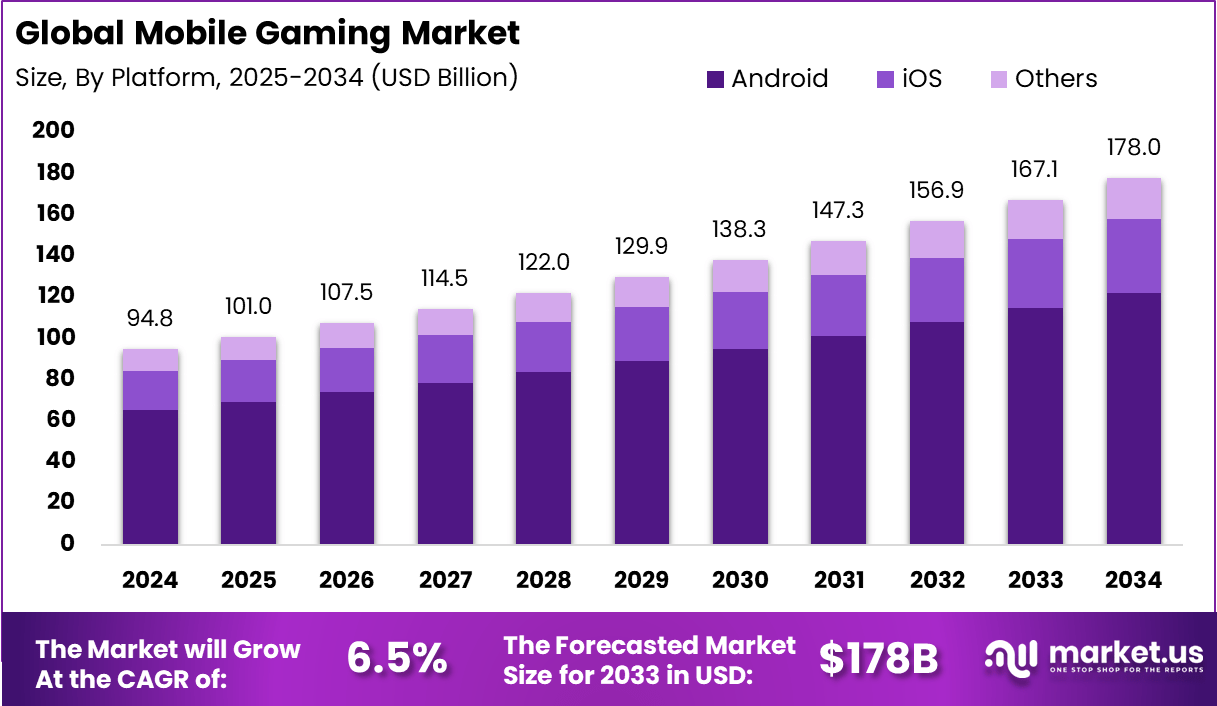

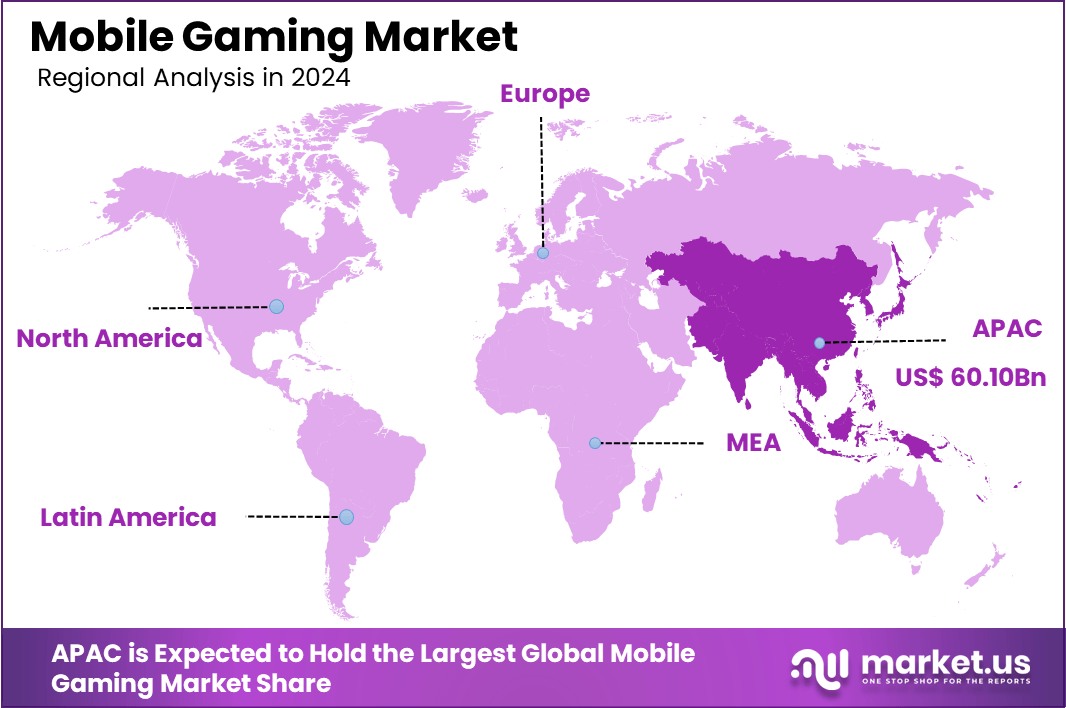

The Global Mobile Gaming Market size is expected to be worth around USD 178 Billion By 2034, from USD 94.8 billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 63.4% share, holding USD 60.10 Billion revenue.

The mobile gaming market has experienced substantial growth over the past decade. Several key factors are propelling the mobile gaming market forward. The widespread adoption of smartphones has expanded the potential user base, while advancements in mobile technology have enhanced gaming experiences.

Additionally, the rise of cloud gaming and the integration of augmented reality (AR) and virtual reality (VR) technologies are attracting new demographics to mobile gaming. The social aspect of gaming, facilitated by multiplayer features and social media integration, also contributes to increased user engagement.

According to Ericsson, the global mobile connectivity landscape is undergoing a rapid transformation driven by the accelerated adoption of 5G technology. By the end of 2029, global 5G subscriptions are projected to exceed ~5.4 billion, accounting for approximately 58% of all mobile subscriptions worldwide. This growth trajectory positions 5G as the leading mobile access technology by 2028, overtaking 4G in both coverage and usage intensity.

The rapid pace of adoption is evident in Q4 2023 alone, when 5G subscriptions grew by 154 million, reaching a total of 1.57 billion globally. In parallel, global smartphone mobile network subscriptions are also witnessing steady expansion. By the end of 2023, total smartphone network subscriptions approached ~7 billion, and this figure is expected to rise beyond 7.8 billion by 2028, reflecting the growing reliance on mobile devices for digital connectivity, content consumption, and commerce.

Demand for mobile games is on the rise, particularly in emerging markets where smartphone adoption is accelerating. The convenience of mobile gaming, coupled with a diverse range of game genres catering to various age groups and preferences, has broadened its appeal. Moreover, the availability of affordable mobile devices and data plans has made mobile gaming more accessible to a wider audience.

As per the latest insights from Udonis, the global gaming industry demonstrated steady growth in 2024, generating over $187.7 billion in total revenue across all platforms, marking a +2.1% year-over-year increase. This sustained expansion underscores the growing demand for interactive entertainment and digital content across global audiences.

Notably, mobile gaming continues to dominate the industry’s financial landscape, capturing a substantial 49% market share, equivalent to $92 billion in revenue. This segment alone witnessed a +3.0% YoY growth, driven by increasing smartphone penetration, improved in-game monetization strategies, and the rise of mobile esports and casual gaming.

Console gaming remained a significant contributor, accounting for 28% of the global gaming revenue in 2024, which translates to $51 billion. This segment benefited from a consistent player base and new releases from major franchises, supported by enhanced hardware capabilities and immersive gameplay experiences. Meanwhile, PC gaming maintained a 23% share, generating approximately $43 billion in revenue.

Key Takeaways

- The Global Mobile Gaming Market is projected to expand from USD 94.8 Billion in 2024 to about USD 178 Billion by 2034, growing steadily at a CAGR of 6.5% during the forecast period.

- In 2024, the APAC region maintained its dominant position, securing over 63.4% market share, generating around USD 60.10 Billion in revenue, largely fueled by mobile-first economies.

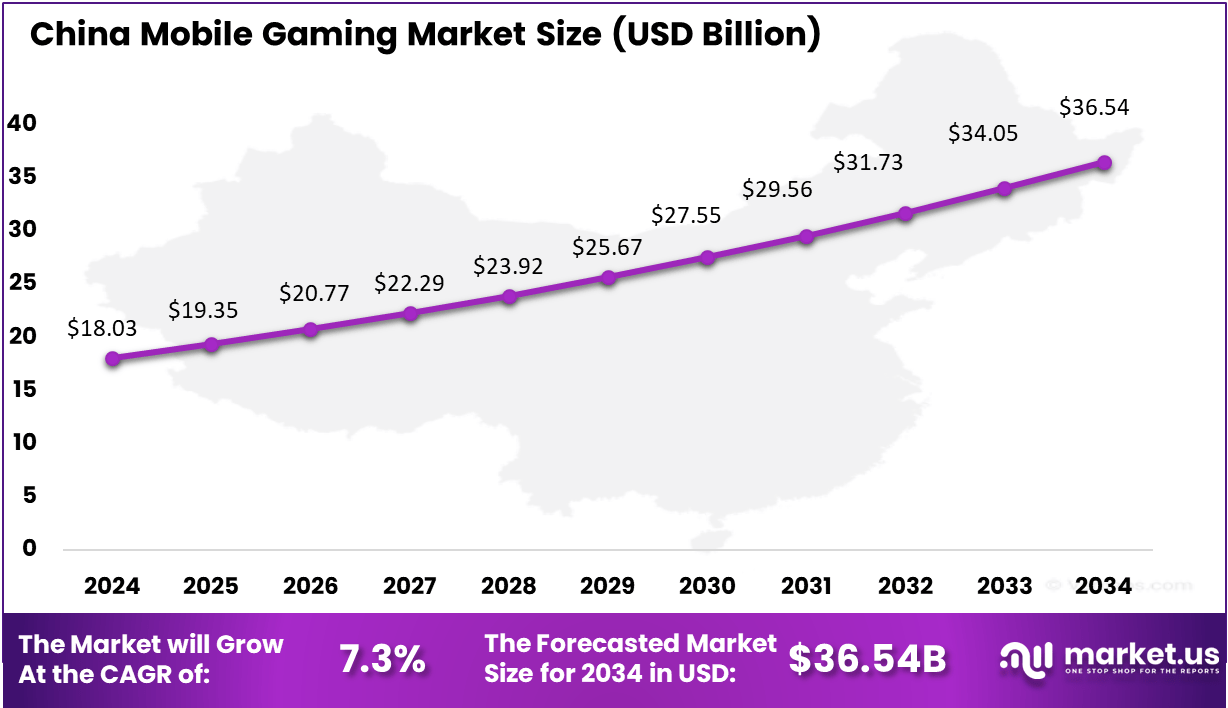

- China alone contributed approximately USD 18.03 Billion in 2024 and is expected to reach nearly USD 36.57 Billion by 2034, registering a CAGR of 7.3%, led by strong in-game monetization and a massive gamer base.

- By platform, Android devices dominated the market with a commanding 68.7% share, supported by widespread affordability and accessibility in emerging markets.

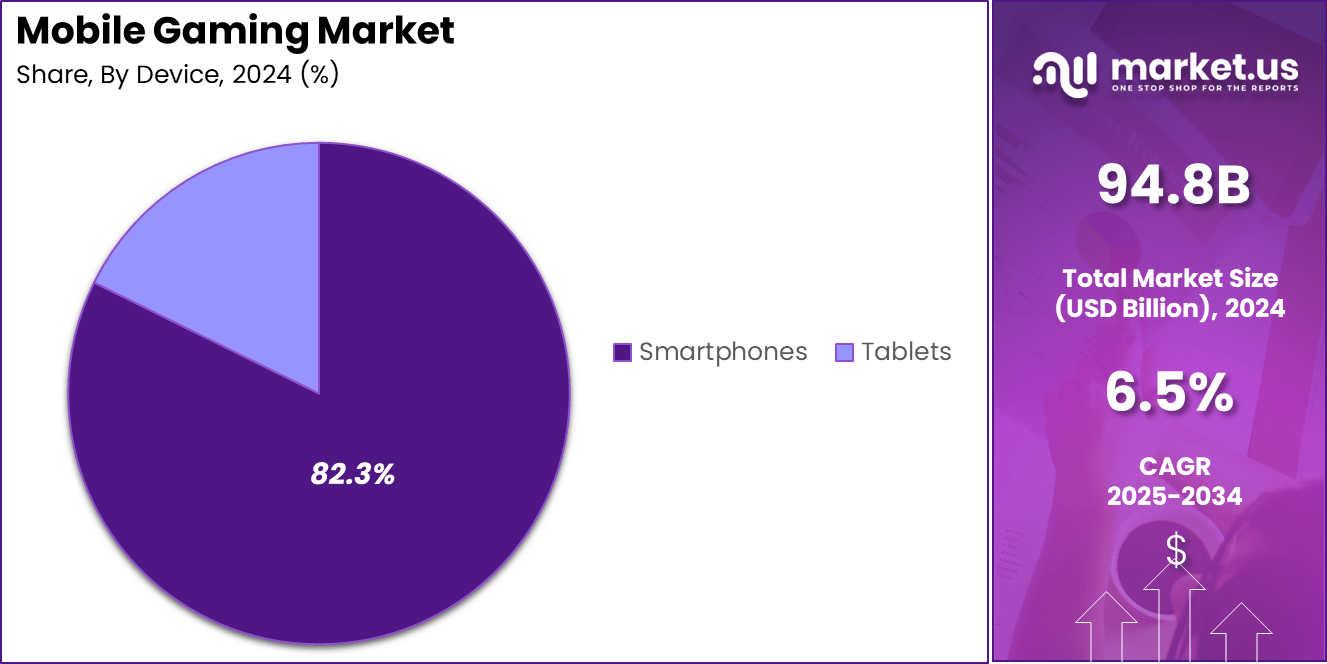

- In terms of device type, Smartphones accounted for a striking 82.3% share in 2024, driven by their ubiquity and high penetration in mobile-first gaming ecosystems.

- Among genres, Action and Adventure games led the market with 42.7% share, benefiting from immersive gameplay, fast-paced formats, and high retention rates among younger demographics.

AI’s Role in Gaming

Artificial Intelligence (AI) is significantly transforming the mobile gaming industry, enhancing player experiences, optimizing monetization strategies, and streamlining game development processes. This technological integration is reshaping how games are designed, played, and monetized, leading to a more personalized and engaging gaming environment.

AI’s impact on mobile gaming is multifaceted. In game development, AI algorithms are utilized for procedural content generation, enabling the creation of dynamic and diverse game environments with reduced manual effort. This not only accelerates development timelines but also allows for more complex and engaging game designs.

From a monetization perspective, AI enables personalized in-game offers and dynamic pricing strategies. By analyzing player behavior and preferences, AI systems can tailor promotions and in-app purchases to individual users, enhancing the likelihood of transactions and improving overall revenue. This approach has been shown to increase monetization uplift by approximately 20-30% compared to traditional models.

Moreover, AI enhances player engagement by providing real-time feedback and adapting game difficulty to match player skill levels. This adaptability ensures that players remain challenged but not frustrated, promoting longer play sessions and increased retention rates.

China Mobile Gaming Market

The China Mobile Gaming Market is valued at approximately USD 18.03 Billion in 2024 and is predicted to increase from USD 25.67 Billion in 2029 to approximately USD 36.57 Billion by 2034, projected at a CAGR of 7.3% from 2025 to 2034.

In 2024, the Asia-Pacific (APAC) region solidified its leadership in the global mobile gaming market, capturing over 63.4% of the total market share and generating approximately USD 60.1 billion in revenue. This dominance is attributed to a confluence of factors, including a vast and diverse user base, widespread smartphone adoption, and the proliferation of affordable internet access.

Countries such as China, Japan, South Korea, and emerging markets like India and Indonesia have been instrumental in this growth, driven by both cultural affinity for gaming and technological advancements. China, in particular, has been a significant contributor, accounting for a substantial portion of global mobile gaming revenue.

The success of titles like Tencent’s “Honor of Kings,” which surpassed 100 million daily active users and generated significant revenue, exemplifies the region’s capacity for producing globally impactful games. Moreover, the integration of culturally resonant content and innovative monetization strategies has enhanced user engagement and spending.

Platform Insights

In 2024, the Android segment held a dominant market position in the global mobile gaming industry, capturing more than a 68.7% share. This leadership is primarily attributed to Android’s widespread adoption across diverse geographies, particularly in emerging markets.

The availability of a vast array of affordable devices from manufacturers such as Samsung, Xiaomi, and Realme has made Android the default gaming platform for billions of users worldwide. Furthermore, Android’s open ecosystem allows developers to publish games easily on platforms like Google Play and third-party app stores, significantly increasing reach and accessibility.

The dominance of Android in the mobile gaming market is further reinforced by its substantial contribution to creative assets. In 2024, Android accounted for 72.3% of total creative assets, with casual games contributing over 83% of all Android creatives.

This extensive creative output indicates a robust developer engagement and a dynamic content ecosystem, which are crucial for attracting and retaining a broad user base. The combination of device affordability, open distribution channels, and a vibrant developer community positions Android as the leading platform in the mobile gaming sector.

Device Insights

In 2024, the smartphone segment held a dominant market position in the global mobile gaming industry, capturing more than an 82.3% share. This leadership is primarily attributed to the widespread adoption of smartphones, which offer a convenient and accessible platform for gaming.

The proliferation of affordable smartphones with enhanced processing power has democratized gaming, making it accessible to a broader audience across various demographics and regions. Additionally, the integration of advanced features such as high-resolution displays and powerful GPUs in smartphones has enabled more immersive and graphically rich gaming experiences, further driving user engagement.

The dominance of smartphones in the mobile gaming market is further reinforced by the increasing availability of high-speed internet connectivity, particularly with the rollout of 4G and 5G networks. This advancement has facilitated seamless online multiplayer gaming and faster game downloads, enhancing the overall user experience.

Moreover, the convenience of smartphones allows users to engage in gaming activities anytime and anywhere, contributing to higher user retention rates. The combination of technological advancements, affordability, and convenience positions smartphones as the leading device in the mobile gaming sector.

Genre Insights

In 2024, the Action and Adventure genre held a dominant position in the global mobile gaming market, capturing more than a 42.7% share. This leadership is primarily attributed to the genre’s dynamic gameplay and immersive storytelling, which resonate with a broad spectrum of players.

Titles such as PUBG Mobile, Genshin Impact, and Minecraft exemplify this trend, offering expansive worlds, real-time combat, and intricate narratives that engage users for extended periods. The increasing sophistication of mobile hardware has further enabled developers to deliver console-quality experiences on handheld devices, enhancing the appeal of action and adventure games.

Moreover, the integration of multiplayer functionalities and social features in these games has fostered community building and competitive play, driving higher user retention rates. The genre’s versatility allows for a blend of various gameplay elements, including exploration, puzzle-solving, and strategic combat, catering to diverse player preferences.

As mobile gaming continues to evolve, the Action and Adventure segment is expected to maintain its leading position, propelled by ongoing technological advancements and the genre’s inherent capacity to deliver engaging and multifaceted gaming experiences.

Key Market Segments

By Platform

- Android

- iOS

- Others

By Device

- Smartphones

- Tablets

By Genre

- Action and Adventure

- Arcade

- Roleplaying

- Sports

- Other Genres

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The mobile gaming industry is undergoing significant transformations, driven by technological advancements and evolving player preferences. One notable trend is the rise of cloud gaming, which enables users to stream high-quality games directly to their devices without the need for expensive hardware.

This development is facilitated by improvements in 5G technology and cloud infrastructure, making gaming more accessible and convenient for a broader audience. Another emerging trend is the integration of artificial intelligence (AI) into mobile gaming experiences.

For instance, Microsoft’s introduction of Copilot for Gaming offers players personalized game recommendations and real-time assistance, enhancing engagement and user satisfaction. These AI-driven features are setting new standards for interactivity and personalization in mobile games.

Business Benefits

Mobile gaming presents substantial business opportunities due to its expansive and diverse user base. The industry’s revenue is projected to reach $164.8 billion by 2029, underscoring its economic significance. This growth is attributed to the widespread adoption of smartphones and the increasing availability of affordable internet access, particularly in emerging markets.

Moreover, mobile gaming offers flexible monetization strategies, including in-app purchases, advertisements, and subscription models. These avenues allow developers and publishers to generate consistent revenue streams while catering to various consumer preferences. The ability to adapt monetization approaches to different markets and demographics enhances profitability and supports sustained industry growth.

Driver

Rising Smartphone Penetration

The global expansion of smartphone usage is a primary catalyst for the growth of mobile gaming. Affordable devices and improved mobile internet access have made gaming more accessible, especially in emerging markets. For instance, in 2023, global smartphone mobile network subscriptions nearly reached 7 billion, with projections to surpass 7.7 billion by 2028.

This widespread adoption enables a broader audience to engage with mobile games, contributing to the industry’s expansion. Advancements in mobile technology, such as enhanced processing power and graphics capabilities, have further enriched the gaming experience.

The proliferation of 4G and 5G networks facilitates smoother gameplay and faster downloads, making high-quality games more accessible to users worldwide. These technological improvements have not only attracted new players but also increased engagement among existing users, driving revenue growth in the mobile gaming sector.

Restraint

Data Privacy Concerns

Data privacy has emerged as a significant concern in the mobile gaming industry. With games collecting vast amounts of user data, including personal information and behavioral patterns, players are increasingly wary of how their data is used and protected.

In 2024, data privacy remained a concern for consumers, with 15% of gamers expressing reluctance to share personal information due to data breaches. This apprehension can hinder user acquisition and retention, affecting overall market growth. Regulatory frameworks like the General Data Protection Regulation (GDPR) in the EU and the California Consumer Privacy Act (CCPA) in the U.S. impose strict guidelines on data collection and usage.

Compliance with these regulations requires significant investment in data protection measures, which can be challenging for smaller developers. Failure to adhere to these standards not only risks legal repercussions but also damages brand reputation, further restraining market expansion.

Opportunity

Expansion in Emerging Markets

Emerging markets present a substantial opportunity for mobile gaming growth. Regions like Africa, Southeast Asia, and Latin America are experiencing rapid increases in smartphone adoption and internet accessibility.

For example, in 2024, Africa’s gaming market revenue surpassed $1 billion, up from $862.1 million in 2022, driven by a young, tech-savvy population and increased mobile connectivity. These markets offer untapped potential for developers to introduce culturally relevant and localized gaming content.

The demand for mobile games in these regions is also fueled by the affordability of smartphones and the popularity of free-to-play models. Developers who tailor their games to local preferences and languages can establish a strong foothold in these markets. Moreover, partnerships with local companies can facilitate better market penetration and user engagement, making emerging markets a focal point for future growth strategies.

Challenge

Monetization Complexity

Monetizing mobile games effectively remains a complex challenge. While in-app purchases, advertisements, and subscription models offer revenue streams, balancing profitability with user experience is delicate. Aggressive monetization tactics can lead to user dissatisfaction and churn.

In 2024, the mobile gaming market faced challenges, with consumer spend declining for the second straight year to $107.3 billion, highlighting the need for sustainable monetization strategies. Additionally, the saturation of app stores with numerous games increases competition, making user acquisition more expensive and retention more difficult.

Developers must innovate in their monetization approaches, ensuring they provide value to players without compromising the gaming experience. This includes implementing fair pricing models, offering meaningful rewards, and avoiding intrusive ads, all of which require careful planning and execution.

Key Player Analysis

Tencent has made significant strides in sustainable data center operations. In November 2024, the company launched a renewable-powered hybrid microgrid project at a data center in Huailai County, Hebei Province, China, utilizing onsite wind power, solar PV, and battery energy storage.

Electronic Arts has focused on environmental sustainability through various initiatives. The company has been working with cloud partners committed to powering their data centers with renewable energy . EA has also implemented energy-efficient measures in its offices, such as LED lighting, automated room sensors, and efficient air conditioners.

Following its acquisition by Microsoft in October 2023, Activision Blizzard has been part of broader sustainability initiatives. The company has focused on reducing its environmental impact by improving the quality of its environmental data, increasing the use of renewable energy, and reducing water consumption across its operations.

Top Key Players Covered

- Tencent Holdings Ltd.

- Electronic Arts

- Activision Blizzard

- Nintendo

- Ubisoft

- Zynga

- GungHo Online Entertainment

- Kabam Games Inc.

- NetEase Inc.

- TakeTwo Interactive

- Others

Recent Developments

- In March 2025, Scopely acquired Niantic’s gaming division, including Pokémon GO and other AR titles, for USD 3.6 billion. The deal also brought in Niantic’s AR platforms and companion apps, while Niantic spun off its geospatial unit into a new company, Niantic Spatial. Scopely aims to retain the existing teams and game plans, ensuring continuity and updates for players.

- In February 2025, Xsolla partnered with Pocket Gamer Connects to support developers at key global events in five cities. The partnership focuses on helping studios with monetization, user acquisition, and analytics. With AppsFlyer integration, developers can now track Web Shop revenue as in-app events and optimize spending across campaigns with no extra coding.

- In January 2024, MobileX became the exclusive wireless sponsor of X Games Aspen 2024, marking its first major event collaboration. Held in Colorado, the sponsorship aligned MobileX’s brand with the high-energy sports crowd and promoted its customizable wireless plans to a younger, engaged audience.

Report Scope

Report Features Description Market Value (2024) USD 94.8 Bn Forecast Revenue (2034) USD 178 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Android, iOS, Others), By Device (Smartphones, Tablets), By Genre (Action and Adventure, Arcade, Roleplaying, Sports, Other Genres) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tencent Holdings Ltd., Electronic Arts, Activision Blizzard, Nintendo, Ubisoft, Zynga, GungHo Online Entertainment, Kabam Games Inc., NetEase Inc., TakeTwo Interactive, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tencent Holdings Ltd.

- Electronic Arts

- Activision Blizzard

- Nintendo

- Ubisoft

- Zynga

- GungHo Online Entertainment

- Kabam Games Inc.

- NetEase Inc.

- TakeTwo Interactive

- Others