Global Mine Detection System Market Size, Share, Statistics Analysis Report By Deployment (Vehicle Mounted, Ship Mounted, Airborne Mounted, Handheld), By Application (Defense, Homeland Security), By Technology (Radar Based, Laser Based, Sonar Based), By Upgrade (OEMs, MROs), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134592

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

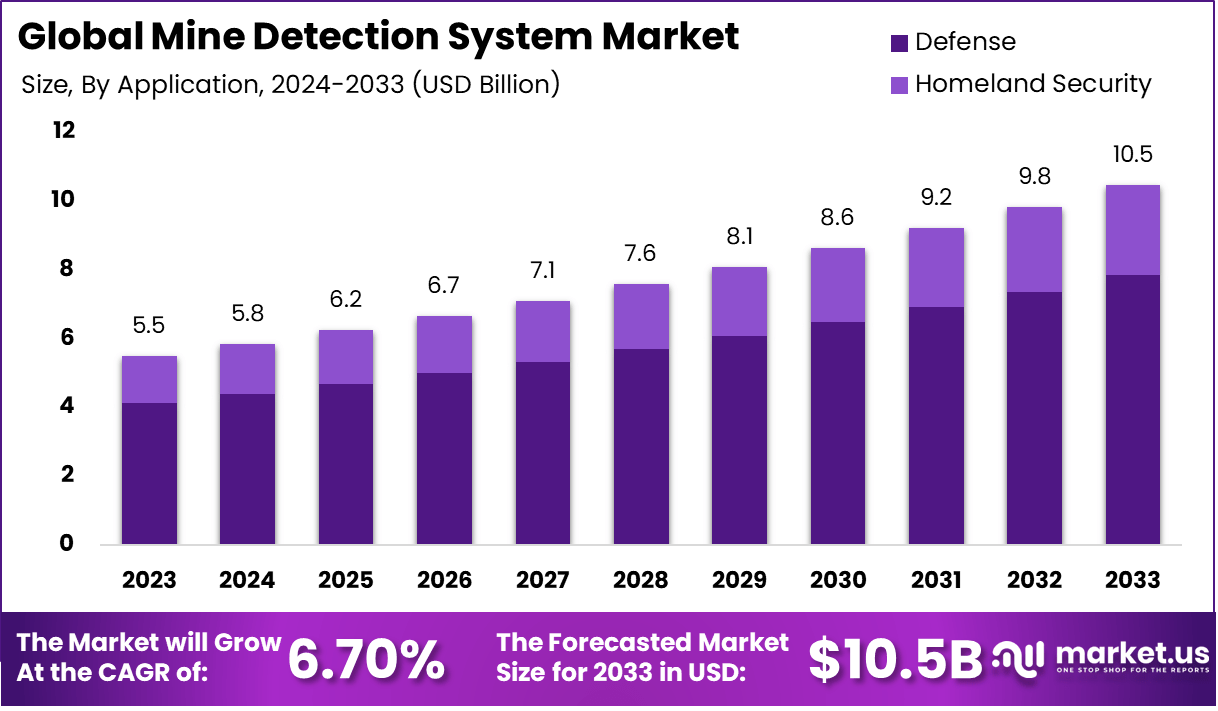

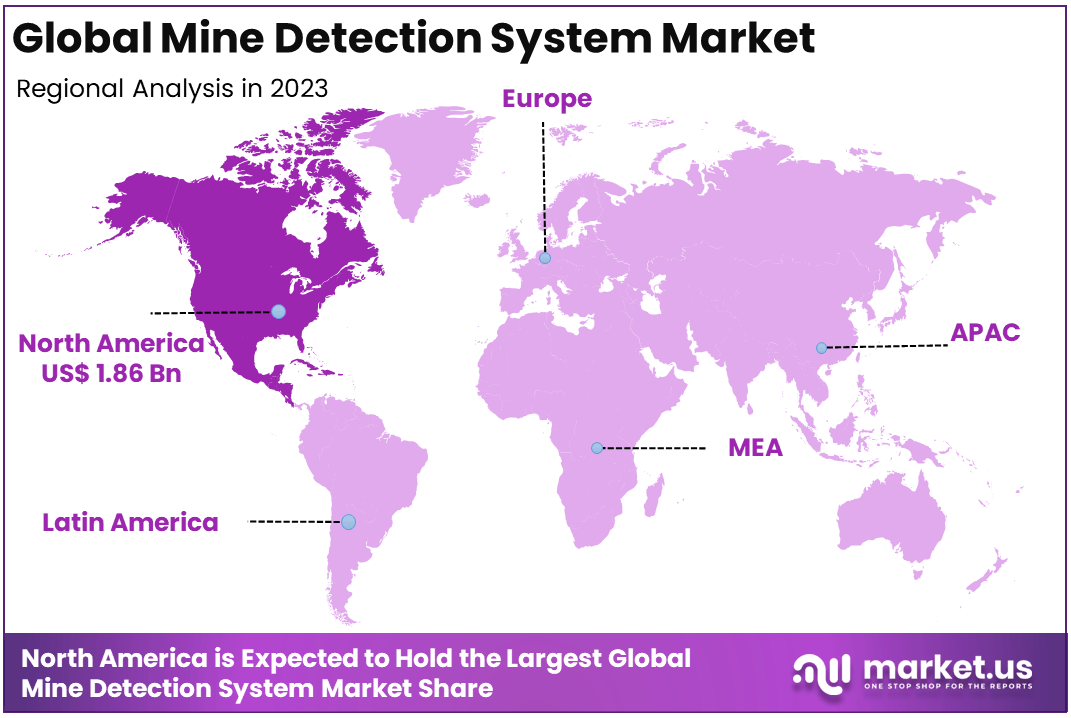

The Global Mine Detection System Market size is expected to be worth around USD 10.5 Billion By 2033, from USD 5.48 Billion in 2023, growing at a CAGR of 6.70% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 34% share, holding USD 1.86 Billion in revenue.

A Mine Detection System refers to a technology designed to identify and locate landmines or unexploded ordnance (UXOs) buried in the ground or submerged in water. These systems play a critical role in ensuring the safety of military personnel, civilians, and humanitarian organizations by preventing accidents caused by landmines left behind after conflicts or wars.

Mine detection can be carried out using various methods, including ground-penetrating radar (GPR), metal detectors, infrared sensors, and even specially trained detection animals. These systems are vital for both military and civilian applications, helping to clear land for redevelopment or use in agriculture and infrastructure projects.

With the increasing global focus on post-conflict recovery and demining, mine detection technologies are becoming more advanced, efficient, and accurate. The systems also cater to a wide range of environments, including land, sea, and underwater, where unexploded devices may still be present.

The Mine Detection System Market is growing rapidly due to the increasing awareness about the dangers posed by landmines and unexploded ordnance, particularly in post-conflict regions. Governments, defense agencies, and international organizations are investing in advanced mine clearance technologies to ensure the safety of civilians and soldiers.

This market includes various product types such as handheld mine detectors, robotic demining systems, and vehicle-mounted detection systems. The growth is also fueled by technological advancements in sensors, artificial intelligence (AI), and automation, which are enhancing the efficiency and effectiveness of mine detection operations.

Several factors are driving the growth of the mine detection system market. The increasing number of post-conflict zones around the world, especially in regions such as the Middle East, Africa, and Southeast Asia, has led to a greater demand for effective demining technologies. These areas often suffer from the aftermath of wars, with landmines posing significant risks to civilians, particularly in agricultural or residential areas.

International organizations like the United Nations (UN) and the International Committee of the Red Cross (ICRC) are also providing funding for mine-clearance initiatives, further boosting market growth. Additionally, advancements in sensor technology, robotics, and AI have significantly improved the accuracy, speed, and cost-effectiveness of mine detection systems.

The demand for mine detection systems is primarily driven by the ongoing need for demining efforts in conflict-affected regions, as well as the growing awareness of the safety hazards posed by landmines. Developing countries that have experienced conflicts, especially in Asia, Africa, and the Middle East, are expected to remain the largest markets for mine detection systems.

This demand is also supported by increasing governmental and non-governmental efforts to clear landmines to facilitate reconstruction, agriculture, and settlement. Additionally, the military’s demand for mine detection systems for strategic operations and troop safety is a key factor fueling market growth.

The mine detection system market is poised to witness significant opportunities in the coming years. As new technologies emerge, such as AI-driven autonomous mine-clearance vehicles, there will be opportunities to improve operational efficiency and reduce human risk in hazardous demining environments.

Moreover, partnerships between governmental agencies, non-profit organizations, and private companies are expected to provide a robust market for both commercial and humanitarian demining projects. Another major opportunity lies in the growing demand for underwater mine detection systems, as naval forces and maritime organizations seek to clear waterways of explosive threats.

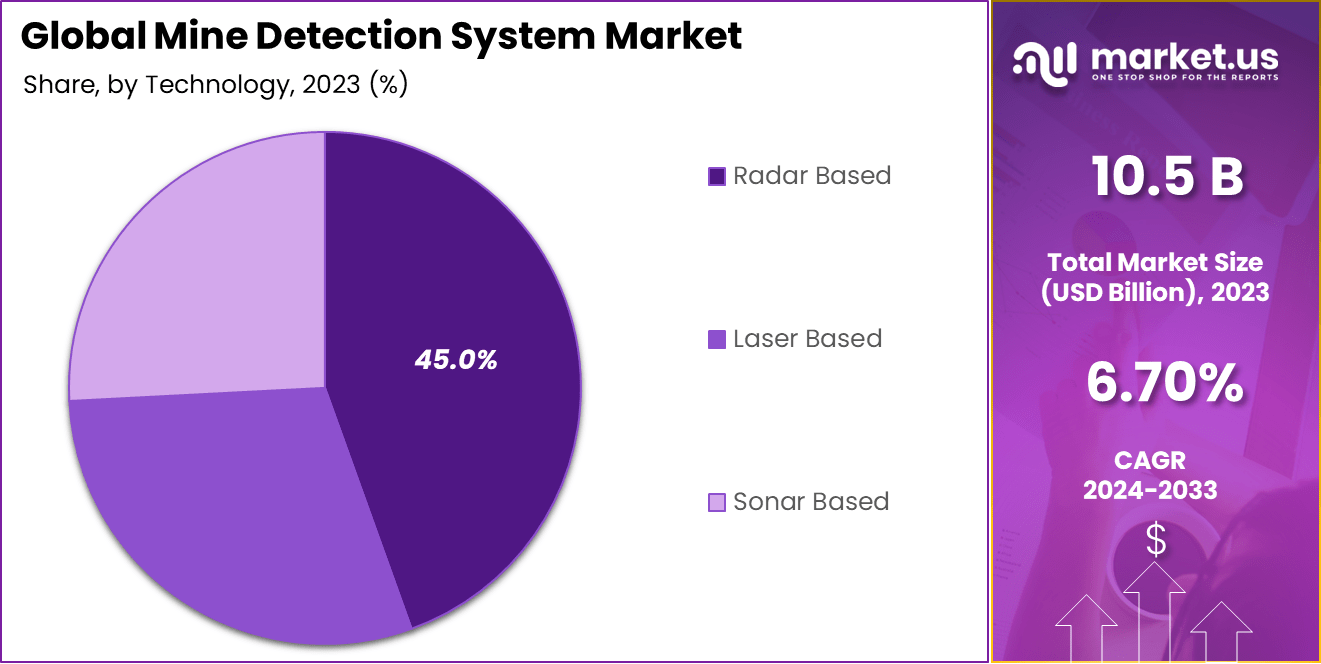

In terms of technology segmentation, radar-based systems currently dominate the market, accounting for about 70% of the total share, which translates to roughly $3.94 billion in 2023. Laser-based systems are also gaining traction, representing approximately 15% of the market share, valued at around $845 million, while sonar-based systems account for about 10%, or $563 million. The remaining 5% is attributed to other emerging technologies, such as handheld detectors and robotic systems.

In Europe, the mine detection system market is valued at approximately $1.2 billion, driven by ongoing demining efforts in countries like Bosnia and Herzegovina and Ukraine, where landmines pose significant risks to civilian populations. The Asia-Pacific region is also witnessing rapid growth, with countries like India and China investing heavily in advanced mine detection technologies.

Furthermore, the global annual casualties from landmines and unexploded ordnance are estimated at around 4,000, highlighting the urgent need for effective mine detection systems. Humanitarian demining efforts are crucial, with organizations like the United Nations Mine Action Service (UNMAS) reporting that over 60 countries are still affected by landmines.

Key Takeaways

- Market Growth: The global Mine Detection System market is projected to grow from USD 5.48 billion in 2023 to USD 10.5 billion by 2033, reflecting a solid CAGR of 6.70%.

- Dominant Deployment Type: Vehicle-mounted mine detection systems lead the market, capturing a significant share of 40% in 2023, driven by their ability to cover large areas and detect mines in challenging terrains more efficiently.

- Defense Focus: The Defense sector remains the largest application area for mine detection systems, accounting for 75% of the market share in 2023, as military operations continue to focus on mine clearance for security and safety.

- Technology Preference: Radar-based mine detection technology holds a dominant position, comprising 45% of the market share in 2023, due to its ability to detect mines at deeper depths and in various soil conditions.

- OEM Upgrades: Original Equipment Manufacturers (OEMs) are driving the market, holding a 60% share in upgrades, as continuous enhancements in mine detection equipment help improve accuracy and speed of clearance operations.

- Regional Dominance: North America leads the market, accounting for 34% of the total market share in 2023, due to heavy investments in defense and advanced technologies for mine detection and demining operations.

By Deployment

In 2023, the Vehicle-Mounted segment held a dominant market position, capturing more than a 40% share in the Mine Detection System market. This segment’s leadership is primarily driven by the increased demand for efficient and mobile mine detection capabilities in large, challenging terrains such as conflict zones and post-conflict regions.

Vehicle-mounted systems offer the flexibility to be deployed across diverse environments, from deserts to rugged landscapes, and provide enhanced operational efficiency by allowing mine clearance teams to cover larger areas more quickly than handheld or stationary systems.

The adoption of vehicle-mounted systems is further boosted by their ability to be equipped with advanced technologies such as ground-penetrating radar (GPR), metal detectors, and electromagnetic induction sensors.

These technologies enhance detection accuracy, enabling vehicles to identify mines buried at deeper levels, which is crucial in military and humanitarian operations. Additionally, the systems’ mobility allows for quick redeployment, a significant advantage in fast-paced military scenarios or disaster relief operations.

Moreover, vehicle-mounted mine detection systems contribute to operator safety by keeping personnel at a safe distance from potential threats. In the defense sector, where ensuring the safety of soldiers and civilians is paramount, the use of these systems has become a standard practice. Vehicles also provide the added benefit of carrying additional equipment and personnel, facilitating faster response times during mine clearance missions.

By Application

In 2023, the Defense segment held a dominant market position, capturing more than a 75% share of the Mine Detection System market. The overwhelming share of this segment is driven by the critical need for advanced mine detection technologies in military operations, where the presence of landmines and improvised explosive devices (IEDs) poses a serious threat to both personnel and equipment.

Defense forces across the globe rely on mine detection systems to secure military routes, protect personnel, and ensure the safe deployment of troops and vehicles, making this application the largest segment in the market.

The increasing frequency of armed conflicts, especially in regions with historical landmine contamination, has significantly driven demand for mine detection systems in defense applications. As modern warfare evolves, the need for more sophisticated detection methods becomes paramount, particularly in asymmetric warfare scenarios where enemy forces may deploy mines to disrupt supply lines or block troop movements. Vehicle-mounted and robotic systems are increasingly integrated into defense operations, offering automated, accurate, and swift mine detection while minimizing the risk to soldiers.

Additionally, the growing focus on military modernization, along with increased defense spending in countries facing ongoing conflicts or security threats, continues to spur the demand for advanced mine detection solutions. Nations are investing heavily in technology upgrades for mine clearance operations, aiming to improve the efficiency and safety of their defense forces in high-risk areas.

By Technology

In 2023, the Radar-Based segment held a dominant market position, capturing more than a 45% share of the Mine Detection System market. The radar technology’s ability to detect landmines and unexploded ordnance (UXO) through soil or other surface materials makes it the preferred choice for mine detection.

Radar-based systems can accurately scan large areas, providing reliable results with minimal risk to operators. This makes radar-based systems essential for both defense and humanitarian mine-clearing operations.

The technology works by emitting electromagnetic waves that penetrate the ground and reflect when they encounter objects like landmines, providing precise data on their location and depth. Radar-based systems are highly versatile and can be deployed in various configurations, including vehicle-mounted, handheld, and even aerial systems, offering flexibility in different mine detection scenarios. Their efficiency in detecting both metallic and non-metallic mines further contributes to their dominance in the market.

The growing preference for radar-based systems is also linked to their ability to operate in harsh environmental conditions, including wet, rocky, or highly vegetated terrain, where other technologies may be less effective.

This robustness and adaptability make radar-based mine detection particularly valuable in military and defense operations, where operations often take place in complex environments, including conflict zones or previously mined regions.

By Upgrade

In 2023, the OEMs (Original Equipment Manufacturers) segment held a dominant market position, capturing more than a 60% share of the Mine Detection System market. OEMs play a crucial role in the development and production of new mine detection systems, which are equipped with the latest technological advancements.

Their dominance in the market is primarily driven by the continuous need for innovative and high-performance equipment to enhance the efficiency and effectiveness of mine detection operations, especially in the defense and security sectors.

OEMs are responsible for designing and manufacturing mine detection systems that incorporate the latest technologies, such as radar, laser, and sonar-based systems. These advanced systems are essential for improving detection accuracy, reducing operational time, and increasing the safety of personnel involved in mine clearance operations. The rapid advancements in sensor technologies and the growing demand for systems that can detect both metallic and non-metallic mines contribute significantly to the growth of the OEM segment.

Additionally, OEMs tend to have strong partnerships with military and defense organizations, ensuring that they meet the specific needs and requirements of these sectors. This collaboration further strengthens their position in the market, as they can provide tailored solutions that align with evolving defense strategies and government regulations. OEMs also play a vital role in providing warranties, maintenance, and service packages for their products, ensuring high performance over the product lifecycle.

Key Market Segments

By Deployment

- Vehicle Mounted

- Ship Mounted

- Airborne Mounted

- Handheld

By Application

- Defense

- Homeland Security

By Technology

- Radar Based

- Laser-Based

- Sonar Based

By Upgrade

- OEMs

- MROs

Driving Factors

Growing Military and Defense Applications

The mine detection system market is primarily driven by the increasing demand from the defense and military sectors. As military operations across various regions continue to rely on demining and mine-clearance operations, the need for advanced mine detection systems has become more critical. These systems are essential for ensuring the safety of soldiers and civilians in post-conflict areas, as well as in regions affected by conflicts where mines pose an ongoing threat.

In recent years, defense agencies worldwide have been increasingly adopting mine detection technologies, including radar-based, sonar-based, and laser-based systems. These systems are capable of detecting both metallic and non-metallic mines, which enhances their effectiveness in challenging environments. With the growing number of minefields in conflict zones and the increasing complexity of modern warfare, the adoption of high-tech mine detection equipment is expected to rise.

The escalating threats from landmines, unexploded ordnance (UXO), and improvised explosive devices (IEDs) in war-torn regions, such as those in the Middle East, Africa, and parts of Asia, are further propelling the demand for advanced mine detection systems. Military and defense organizations are investing heavily in technologies that can ensure faster, more accurate, and safer demining operations. Additionally, governments are allocating substantial funds to improve their defense and homeland security capabilities, thereby driving the overall growth of the market.

Restraining Factors

High Cost of Advanced Mine Detection Systems

Despite the growing demand for mine detection systems, the high cost of these advanced technologies remains one of the key restraints limiting widespread adoption, particularly in low- and middle-income countries. The cost of acquiring, operating, and maintaining state-of-the-art mine detection systems—such as radar-based and sonar-based systems—can be prohibitively high, making it challenging for many governments, especially in conflict-prone regions, to invest in these technologies.

Additionally, the training required to operate these sophisticated systems adds to the overall cost burden. Skilled personnel are needed to handle, maintain, and troubleshoot these systems effectively. The lengthy training process further complicates adoption, especially for smaller defense organizations that may lack the resources to invest in both the systems and the personnel needed to deploy them.

For many countries, especially those in conflict zones with limited budgets, the cost of acquiring advanced mine detection systems can be a significant deterrent. Although some manufacturers provide cheaper alternatives or smaller-scale systems, these may not always offer the level of precision and safety required for large-scale demining operations. As a result, countries with limited budgets may opt for less effective, lower-cost solutions that could compromise the safety and success of mine clearance missions.

Growth Opportunities

Advancements in Technology for Improved Detection

The ongoing advancements in detection technologies present significant growth opportunities for the mine detection system market. Technologies such as artificial intelligence (AI), machine learning, and improved sensor technologies are revolutionizing the mine detection process. With the integration of these advanced technologies, mine detection systems are becoming more efficient, faster, and more accurate.

For example, AI-enabled mine detection systems can analyze vast amounts of data in real time, leading to more precise identification of potential mine locations and reducing false positives. This is particularly important in regions with dense vegetation, complex terrains, or urban environments where traditional mine detection methods may be less effective.

Additionally, the miniaturization of detection technologies has opened up opportunities for mobile and handheld devices, allowing for greater flexibility in various settings. These compact, portable systems are particularly advantageous for search-and-rescue operations and smaller-scale demining missions. By integrating machine learning algorithms, these systems can continuously learn from previous detections, improving their accuracy over time.

Challenging Factors

Operational Limitations in Challenging Environments

One of the major challenges faced by the mine detection system market is the difficulty of operating in challenging and hostile environments. Many regions affected by landmines and unexploded ordnance (UXOs) are located in areas with harsh terrain, extreme weather conditions, or dense vegetation, which can significantly limit the effectiveness of mine detection systems.

For instance, in mountainous, forested, or swampy regions, traditional mine detection systems may struggle to accurately detect mines due to the difficulty of penetrating the ground and reaching mines buried at varying depths. In some cases, mines may be buried in areas that are difficult to access, such as remote regions or conflict zones, further complicating the detection process.

Additionally, environmental factors such as rain, high humidity, or extreme temperatures can interfere with the functionality of mine detection systems, affecting their performance and increasing the likelihood of false positives. These operational limitations present a major challenge, as they hinder the ability to detect and clear mines quickly and safely.

Growth Factors

The mine detection system market is witnessing significant growth, driven by several key factors. One of the most prominent drivers is the increasing demand for advanced mine-clearance technologies in defense and humanitarian efforts. As geopolitical tensions persist, and post-conflict regions continue to deal with the aftermath of landmines and unexploded ordnance, mine detection systems are crucial in ensuring public safety and enabling reconstruction efforts.

The growing focus on safeguarding military personnel and civilians from mines and explosives is pushing defense organizations to adopt advanced detection solutions. Additionally, technological advancements in radar, sonar, and laser systems are enhancing the accuracy, speed, and safety of mine detection operations, contributing to the market’s growth.

Emerging Trends

One of the emerging trends in the mine detection system market is the integration of automation and AI in detection systems. Automation allows for quicker, more efficient mine-clearance operations, reducing human exposure to danger. AI algorithms are being developed to improve detection accuracy, providing real-time analysis and distinguishing between threats and non-threatening objects.

Additionally, unmanned vehicles, such as drones and robotic platforms, are increasingly being used for mine detection, reducing risks and improving operational efficiency. The trend towards using multifunctional systems that can detect both metallic and non-metallic mines is also gaining traction.

Business Benefits

Mine detection systems offer a range of business benefits, particularly in the defense and construction sectors. By using advanced detection technologies, companies can reduce the risk of damage to infrastructure and personnel, thereby ensuring a safer environment for military operations, humanitarian missions, and construction activities.

Additionally, the adoption of these systems can streamline operations, minimize costly delays, and improve overall efficiency. As governments and defense agencies continue to allocate budgets for modernizing their mine detection capabilities, there are substantial opportunities for companies operating in this space to expand their market share and drive long-term growth.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 34% share, holding USD 1.86 Billion in revenue. North America’s dominance in the mine detection system market can be attributed to several factors, including strong defense spending, technological innovation, and an increasing need for advanced security measures.

The United States, as a global leader in defense technology, heavily invests in mine detection systems to ensure the safety of its military personnel during peacekeeping missions and post-conflict operations. This increased demand for advanced mine detection solutions is also driven by the U.S.’s ongoing military involvement in conflict-prone regions, where demining is a critical operation.

Technological advancements in radar-based and sonar-based mine detection systems are a key driver of North America’s market growth. North American companies, such as Lockheed Martin and Raytheon Technologies, are constantly innovating, providing cutting-edge solutions that enhance detection accuracy and operational efficiency. These advancements are also helping in military operations by reducing risk exposure to soldiers and enabling quicker, more precise demining efforts.

Furthermore, the market is supported by favorable government initiatives. The U.S. Department of Defense (DoD) and the Canadian government continuously fund and deploy mine clearance operations, further increasing the demand for state-of-the-art mine detection systems. With strategic investments in research and development, North America is expected to maintain its leadership in the global mine detection system market, especially with the growing emphasis on automated and AI-driven solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

BAE Systems is a prominent player in the mine detection system market, known for its advanced defense technology and commitment to innovation. The company has expanded its presence through strategic acquisitions and partnerships.

For instance, in recent years, BAE Systems has focused on enhancing its defense and security capabilities, including the development of advanced landmine detection technologies. Their mine detection systems, such as the Husky vehicle-mounted system, are widely used by military forces for clearing minefields in hostile environments.

Israel Aerospace Industries (IAI) is another key player that has made significant strides in the mine detection market. Known for its cutting-edge technology in unmanned systems and aerospace, IAI has leveraged its expertise to develop advanced mine detection solutions.

The company recently launched the JUDICA system, which combines radar and electro-optical technologies to detect buried landmines with high precision. IAI has also expanded its market presence by forming strategic alliances with various defense contractors worldwide, positioning itself as a top choice for military and security agencies seeking reliable mine detection systems.

Raytheon Technologies is a global leader in defense and aerospace, and its mine detection systems are some of the most advanced on the market. The company has focused on expanding its product portfolio through research and development of advanced radar and sensor technologies used in mine detection.

Raytheon’s expertise in providing high-quality, reliable, and versatile detection systems like GPR (Ground Penetrating Radar) and EMI (Electromagnetic Induction) sensors allows for accurate and quick detection of landmines, minimizing the risk to personnel. In addition, Raytheon’s strategic acquisitions, such as its purchase of Forcepoint in 2020, have bolstered its capabilities in cybersecurity, supporting the protection of its mine detection systems from cyber threats.

Top Key Players in the Market

- BAE Systems Plc

- Israel Aerospace Industries

- Raytheon

- General Dynamics Corporation

- DCD Group

- L-3 Communications Holdings Inc.

- Harris Corporation

- Chemring Group Plc.

- Northrop Grumman Corporation

- Schiebel Gmbh

- Other Key Players

Recent Developments

- In June 2023: BAE Systems launched an upgraded version of its Husky vehicle-mounted mine detection system, incorporating advanced radar and sensor technology.

- In August 2023: Israel Aerospace Industries (IAI) unveiled its next-generation unmanned ground vehicle (UGV) for mine detection, designed to autonomously navigate and detect landmines using a combination of radar and ground-penetrating radar (GPR) technologies.

Report Scope

Report Features Description Market Value (2023) USD 5.48 Bn Forecast Revenue (2033) USD 10.5 Bn CAGR (2024-2033) 6.70% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Deployment (Vehicle Mounted, Ship Mounted, Airborne Mounted, Handheld), By Application (Defence, Homeland Security), By Technology (Radar Based, Laser Based, Sonar Based), By Upgrade (OEMs, MROs) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape BAE Systems Plc, Israel Aerospace Industries, Raytheon, General Dynamics Corporation, DCD Group, L-3 Communications Holdings Inc., Harris Corporation, Chemring Group Plc., Northrop Grumman Corporation, Schiebel Gmbh, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mine Detection System MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Mine Detection System MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BAE Systems Plc

- Israel Aerospace Industries

- Raytheon

- General Dynamics Corporation

- DCD Group

- L-3 Communications Holdings Inc.

- Harris Corporation

- Chemring Group Plc.

- Northrop Grumman Corporation

- Schiebel Gmbh

- Other Key Players