Global Military Tactical Radio Market Size, Share Analysis Report By Type (Handheld Radio, Manpack Radio, Vehicle-Mounted Radio, Base Station Radio, Airborne Radio, Naval Radio), By Frequency (Very High Frequency (VHF), Ultra-High Frequency (UHF), High Frequency (HF), Others (Multiband, SHF, EFH)), By Technology (Conventional Radios, Software-Defined Radios (SDR)), By Application (Command & Control Communication, Surveillance & Reconnaissance, Electronic Warfare, Others), By End Use (Army, Navy, Air Force), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150062

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

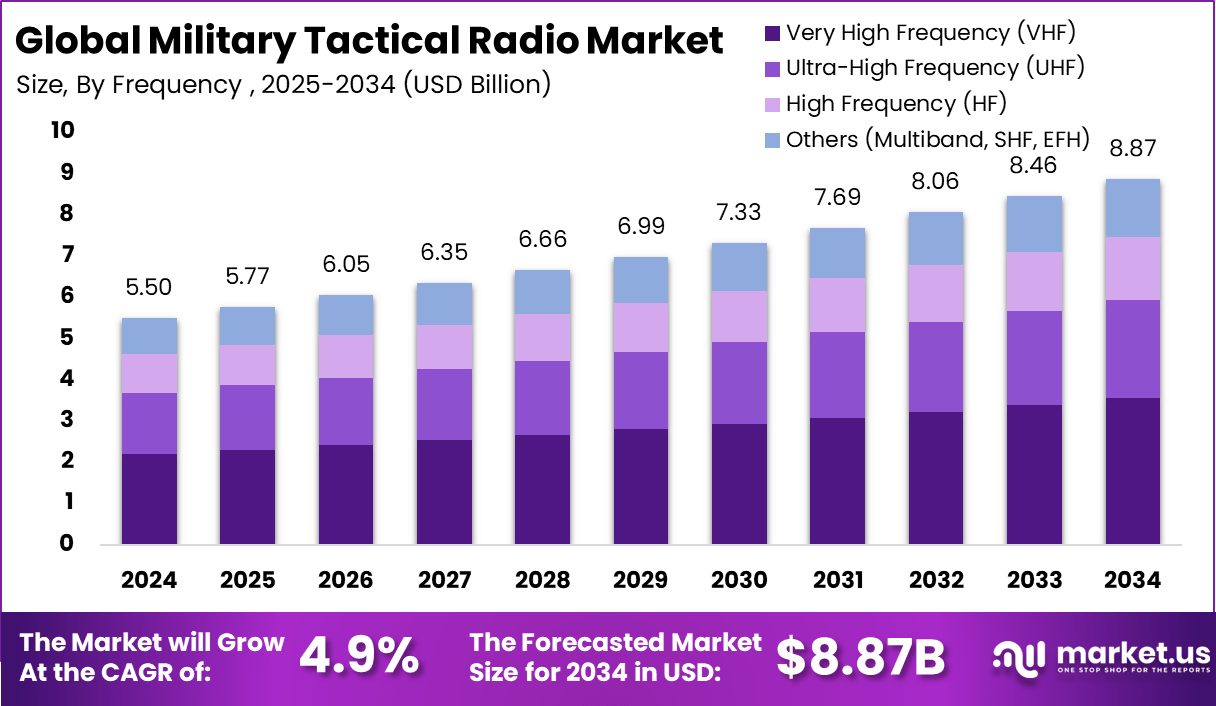

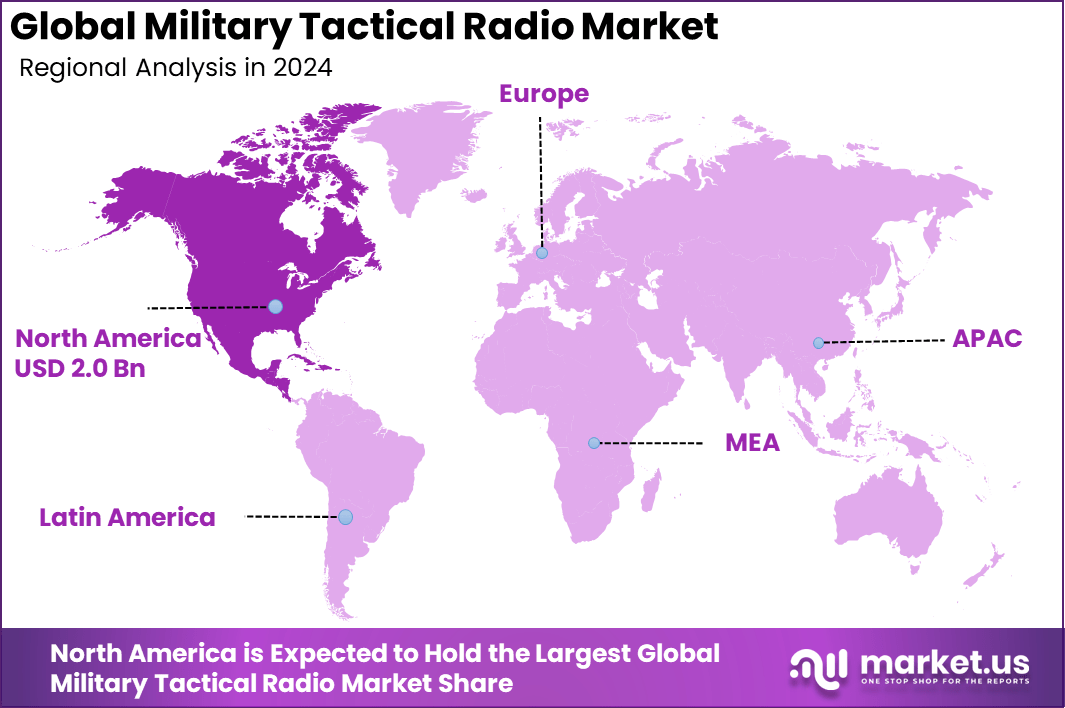

The Global Military Tactical Radio Market size is expected to be worth around USD 8.87 Billion By 2034, from USD 5.50 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.8% share, holding USD 2.07 Billion revenue.

The global military tactical radio market has been experiencing steady growth, driven by the increasing need for secure and efficient communication systems in defense operations. The growth of the military tactical radio market is primarily driven by the increasing demand for secure, resilient, and real-time communication among military forces operating in complex environments. The need for interoperability among different military units and allied forces has further propelled the adoption of advanced tactical radios.

Key Takeaways

- The Global Military Tactical Radio Market is projected to reach USD 8.87 Billion by 2034, rising from USD 5.50 Billion in 2024, at a CAGR of 4.9% between 2025 and 2034.

- In 2024, North America led the market, holding a 37.8% share, with revenue worth USD 2.07 Billion, driven by strong defense modernization initiatives.

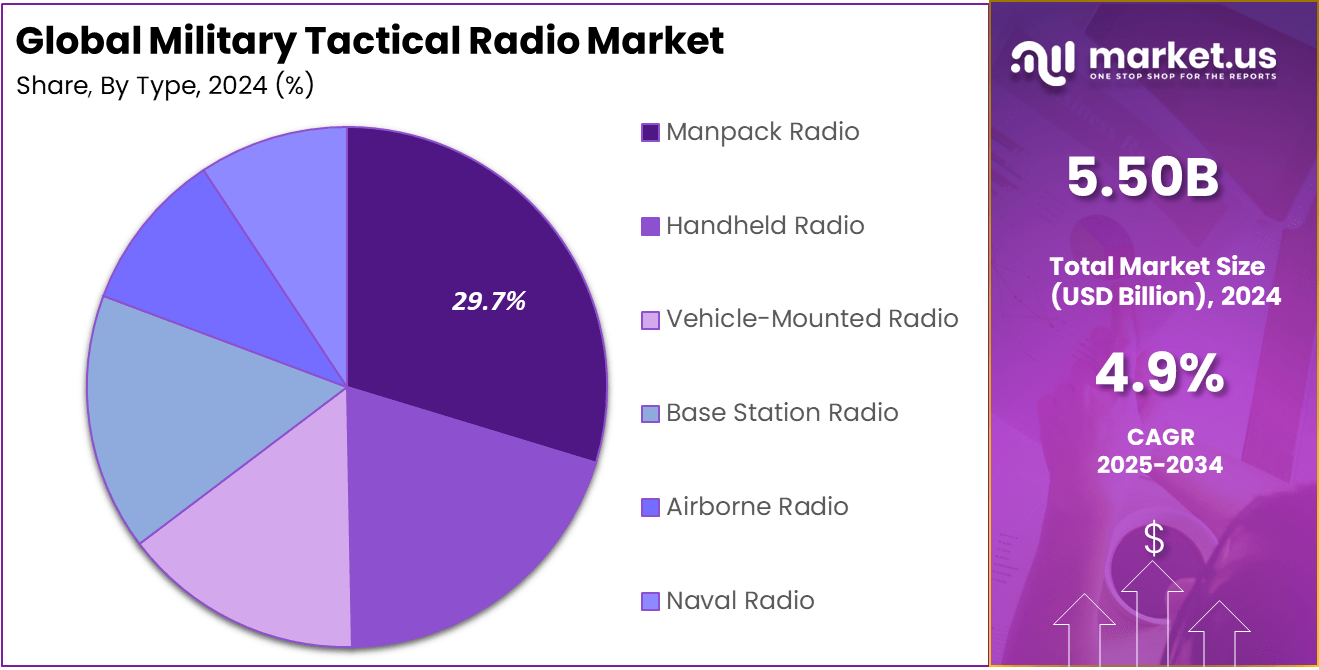

- By type, Manpack Radio emerged as the leading segment, accounting for 29.7% of the global share in 2024, due to its portability and battlefield adaptability.

- Under frequency classification, Very High Frequency (VHF) radios dominated the segment, favored for reliable mid-range communication in combat zones.

- In terms of technology, Conventional Radios held the top position in 2024, supported by legacy system integration and ease of deployment.

- For application, Command & Control Communication was the leading use case, as it is critical for real-time decision-making and operational coordination.

- Among end users, the Army segment led the global market in 2024, supported by increasing field-level deployments and mobile tactical operations.

The demand for military tactical radios is influenced by the growing emphasis on network-centric warfare and the necessity for seamless communication in joint operations. The increasing complexity of modern warfare, characterized by rapid mobility and decentralized command structures, necessitates reliable communication systems that can operate effectively in diverse and challenging environments.

The adoption of technologies such as software-defined radios (SDRs) and AI-driven communication systems has been on the rise in the military tactical radio market. SDRs offer flexibility by allowing radios to be reprogrammed to support new frequencies and waveforms, enhancing interoperability and future-proofing communication systems.

The primary reasons for adopting advanced technologies in military tactical radios include the need for enhanced interoperability, improved spectrum efficiency, and increased resilience against electronic warfare threats. These technologies enable military forces to maintain secure and reliable communication in contested and dynamic environments, ensuring effective coordination and mission success.

Impact of AI

Artificial Intelligence (AI) is significantly transforming military tactical radio systems, enhancing communication capabilities on the battlefield. By integrating AI, these radios can now process information more efficiently, enabling faster and more accurate decision-making. This advancement is crucial for soldiers operating in complex and rapidly changing environments.

AI enhances tactical radios by improving signal clarity and resilience, allowing devices to filter out noise effectively and deliver essential information, even in congested spectrum environments . This capability ensures that critical communications are maintained, which is vital for mission success and the safety of military personnel.

Real-world applications underscore AI’s impact on military operations. For example, during “Operation Spiderweb,” Ukraine deployed AI-equipped drones capable of autonomously identifying and striking targets even after losing communication signals, demonstrating AI’s role in enhancing operational autonomy and effectiveness.

Moreover, AI-powered radios can adapt to changing conditions by analyzing vast amounts of data in real-time, facilitating better situational awareness and coordination among units. This adaptability is particularly important in modern warfare, where the ability to respond swiftly to dynamic scenarios can be the difference between success and failure.

North America Growth

In 2024, North America held a dominant position in the global military tactical radio market, capturing over 37.8% of the market share and generating approximately USD 2.0 billion in revenue. This leadership is primarily attributed to the substantial defense expenditures of the United States, which continues to invest heavily in modernizing its military communication infrastructure.

The U.S. Department of Defense (DoD) has prioritized the procurement of advanced tactical radio systems to enhance secure and reliable communication across various military operations. The presence of leading defense contractors, such as L3Harris Technologies and Raytheon Technologies, further reinforces North America’s market dominance.

These companies are at the forefront of developing cutting-edge communication technologies, including software-defined radios (SDRs) and cognitive radios, which offer enhanced interoperability and resilience against electronic warfare threats. Additionally, the region’s focus on integrating advanced technologies into military operations has led to increased adoption of tactical radios that support wideband networking and secure data transmission.

By Type Analysis

In 2024, the Manpack Radio segment held a dominant market position, capturing more than a 29.7% share in the global military tactical radio market. This leadership is attributed to the increasing demand for versatile and secure communication systems that can be easily carried by soldiers in various operational scenarios.

Manpack radios offer a balance between portability and functionality, providing extended range and advanced features compared to handheld units, while being more mobile than vehicle-mounted systems. The prominence of the Manpack Radio segment is further reinforced by the integration of advanced technologies such as software-defined radio (SDR) capabilities, which allow for interoperability across different communication platforms and adaptability to various mission requirements.

Additionally, the emphasis on network-centric warfare and the need for real-time data transmission have made Manpack radios an essential component in modern military operations. The ongoing modernization programs and defense investments across various countries continue to drive the adoption of these systems, solidifying their leading position in the tactical radio market.

By Frequency Analysis

In 2024, the Very High Frequency (VHF) segment held a dominant position in the military tactical radio market, capturing the largest market share among frequency categories. This prominence is primarily attributed to VHF radios’ widespread use in line-of-sight (LOS) communication for ground and air operations.

Operating within the 30 to 300 MHz frequency range, VHF radios offer reliable performance in diverse terrains, including forests, mountains, and urban environments, making them essential for tactical units operating in such conditions. The growing demand for secure and interference-resistant VHF communication systems has encouraged manufacturers to enhance encryption and frequency-hopping features.

As militaries focus on improving battlefield coordination and situational awareness, the VHF segment remains a critical component of tactical communication networks. The integration of advanced technologies, such as software-defined radios (SDRs), has further bolstered the capabilities of VHF systems, enabling interoperability across different communication platforms and adaptability to various mission requirements.

Additionally, the VHF segment’s dominance is supported by its cost-effectiveness and ease of deployment, especially in regions with budget constraints. The balance between performance and affordability makes VHF radios a preferred choice for many defense forces worldwide. The ongoing modernization programs and defense investments across various countries continue to drive the adoption of these systems, solidifying their leading position in the tactical radio market.

By Technology Analysis

In 2024, the conventional radios segment held a dominant position in the military tactical radio market, accounting for a significant share of global deployments. This dominance is attributed to their proven reliability, simplicity, and cost-effectiveness.

Conventional radios, particularly those operating in the Very High Frequency (VHF) band, have been extensively utilized for line-of-sight communication in various military operations. Their straightforward design ensures ease of use and maintenance, making them a preferred choice for many defense forces, especially in regions where advanced infrastructure is limited.

The widespread adoption of conventional radios is further supported by their compatibility with existing military communication systems. Many armed forces have established protocols and training programs centered around these radios, facilitating seamless integration into current operations.

Additionally, the lower acquisition and operational costs associated with conventional radios make them an attractive option for countries with budget constraints. While the market is gradually transitioning towards more advanced technologies like software-defined radios (SDRs), the entrenched presence and dependability of conventional radios ensure their continued relevance in the near term.

By Application Analysis

In 2024, the command and control communication segment held a dominant position in the military tactical radio market, capturing a significant share of global deployments. This leadership is primarily attributed to the increasing demand for real-time situational awareness and enhanced decision-making capabilities in battlefield environments.

Modern military operations increasingly rely on seamless communication between commanders and deployed units to ensure the rapid and accurate dissemination of mission-critical information. The growing adoption of integrated communication networks – combining voice, data, and video – is significantly improving operational efficiency and responsiveness.

The prominence of the command and control communication segment is further reinforced by the integration of advanced technologies such as software-defined radios (SDRs), which allow for interoperability across different communication platforms and adaptability to various mission requirements.

Additionally, the emphasis on network-centric warfare and the need for real-time data transmission have made command and control communication systems an essential component in modern military operations. The ongoing modernization programs and defense investments across various countries continue to drive the adoption of these systems, solidifying their leading position in the tactical radio market.

By End Use Analysis

In 2024, the Army segment held a dominant position in the military tactical radio market, capturing more than a 27.4% share. This leadership is primarily attributed to the Army’s extensive operational requirements across diverse terrains and mission profiles.

Ground forces necessitate reliable, secure, and interoperable communication systems to coordinate maneuvers, relay intelligence, and maintain situational awareness in real-time. The increasing emphasis on network-centric warfare and the integration of advanced technologies, such as software-defined radios (SDRs), have further propelled the Army’s demand for sophisticated tactical communication solutions.

The Army’s focus on modernizing its communication infrastructure has led to significant investments in next-generation tactical radios that offer enhanced capabilities, including multi-band frequency support, encryption, and resistance to electronic warfare. These advancements ensure seamless communication across various units and platforms, thereby improving operational efficiency and mission success rates.

Furthermore, the Army’s involvement in multinational operations and joint exercises underscores the need for interoperable communication systems, reinforcing its position as the leading end-user in the military tactical radio market.

Key Market Segments

By Type

- Handheld Radio

- Manpack Radio

- Vehicle-Mounted Radio

- Base Station Radio

- Airborne Radio

- Naval Radio

By Frequency

- Very High Frequency (VHF)

- Ultra-High Frequency (UHF)

- High Frequency (HF)

- Others (Multiband, SHF, EFH)

By Technology

- Conventional Radios

- Software-Defined Radios (SDR)

By Application

- Command & Control Communication

- Surveillance & Reconnaissance

- Electronic Warfare

- Others

By End Use

- Army

- Navy

- Air Force

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

The military tactical radio landscape is undergoing significant transformation, driven by the integration of advanced technologies to meet the demands of modern warfare. A notable trend is the incorporation of Artificial Intelligence (AI) into communication systems, enhancing real-time decision-making and adaptability in complex operational environments.

AI-driven radios are capable of dynamic spectrum allocation, interference mitigation, and autonomous network management, thereby improving the resilience and efficiency of military communications. Another emerging trend is the development of software-defined radios (SDRs) with multi-band and multi-mode capabilities.

These radios offer flexibility in frequency usage and can be reprogrammed to support various communication standards, facilitating interoperability among different military units and allied forces. The shift towards SDRs is also influenced by the need for secure and reliable communication in electronic warfare scenarios, where traditional radios may be susceptible to jamming and interception .

Business Benefits

Investing in advanced military tactical radios yields substantial operational advantages. Enhanced communication capabilities enable seamless coordination among units, leading to improved situational awareness and faster decision-making processes.

This is particularly crucial in dynamic combat situations where timely information exchange can determine mission success. Moreover, modern tactical radios support data encryption and secure transmission protocols, ensuring the confidentiality and integrity of sensitive information .

From a strategic perspective, the adoption of cutting-edge communication systems contributes to force modernization and readiness. It allows military organizations to stay ahead of technological advancements and adapt to evolving threats.

Furthermore, the scalability and interoperability of modern radios facilitate joint operations with allied forces, enhancing collaborative defense efforts. These benefits underscore the importance of continued investment in the development and deployment of advanced tactical communication solutions .

Driver

Rising Demand for Secure and Real-Time Communication

The increasing need for secure and real-time communication in military operations is a significant driver for the tactical radio market. Modern warfare requires seamless coordination among various units, necessitating reliable communication systems that can operate in diverse and challenging environments.

Tactical radios equipped with advanced encryption and frequency-hopping capabilities ensure that military communications remain secure and resistant to interception or jamming. This demand is further amplified by the need for interoperability among different branches of the armed forces and allied nations during joint operations.

Moreover, the shift towards network-centric warfare emphasizes the importance of real-time data sharing and situational awareness. Tactical radios serve as critical nodes in the battlefield communication network, enabling the transmission of voice, data, and video. Integrating these radios with other systems improves efficiency and decision-making, boosting their use in military operations.

Restraint

High Costs Associated with Advanced Tactical Radios

The development and procurement of advanced tactical radios involve substantial financial investments, posing a significant restraint to market growth. These radios incorporate sophisticated technologies such as software-defined capabilities, secure communication protocols, and ruggedized hardware to withstand harsh operational conditions.

The costs associated with research and development, testing, certification, and production can be prohibitive, especially for countries with limited defense budgets. Additionally, the integration of new tactical radios into existing military infrastructure may require further investments in training, maintenance, and support systems.

The total cost of ownership, including lifecycle management and upgrades, can deter some defense agencies from adopting the latest communication technologies. This financial barrier may lead to prolonged use of legacy systems, potentially compromising the effectiveness and security of military communications.

Opportunity

Integration of Artificial Intelligence and Internet of Things

The integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies into tactical radios presents a significant opportunity for market expansion. AI can enhance the functionality of tactical radios by enabling features such as intelligent signal processing, adaptive communication protocols, and predictive maintenance.

These capabilities can improve the efficiency and reliability of military communication systems, allowing for more responsive and autonomous operations. The incorporation of IoT enables tactical radios to connect with a wide array of sensors and devices across the battlefield, facilitating real-time data collection and analysis.

This interconnected network enhances situational awareness and decision-making processes. The convergence of AI and IoT in tactical radios supports the development of smart communication systems that can adapt to dynamic operational environments, thereby offering a competitive advantage to military forces.

Challenge

Interoperability Issues Among Diverse Communication Systems

Achieving interoperability among various communication systems remains a critical challenge in the tactical radio market. Military operations often involve joint missions with different branches of the armed forces and allied nations, each utilizing distinct communication equipment and protocols.

The lack of standardization can hinder effective communication, leading to operational inefficiencies and potential security vulnerabilities. Efforts to address interoperability issues include the development of software-defined radios and adherence to common communication standards.

However, the implementation of these solutions requires coordination among multiple stakeholders, including defense agencies, manufacturers, and international partners. Overcoming technical, logistical, and policy-related obstacles is essential to ensure seamless communication across diverse military platforms and coalition forces.

Key Player Analysis

L3Harris Technologies has solidified its position in the military tactical radio market through significant contracts and strategic partnerships. In January 2025, the U.S. Army awarded L3Harris nearly $300 million for the production of Manpack and Leader radios under the Handheld, Manpack & Small Form Fit (HMS) program.

Northrop Grumman has been actively advancing its tactical communication technologies. In September 2024, the company demonstrated a hybrid SATCOM solution using commercial internet, connecting air- and ground-based military platforms, as part of the Air Force Research Laboratory’s Global Lightning program.

Thales Group has introduced innovative products to strengthen its tactical radio offerings. In June 2024, Thales unveiled its HF XL series of tactical wideband High Frequency radios, significantly increasing data bandwidth and supporting secure, long-range communication up to 10,000 km.

Top Key Players Covered

- L3Harris Technologies

- Northrop Grumman Corporation

- Thales Group

- BAE Systems

- Raytheon Technologies

- General Dynamics Corporation

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Rohde & Schwarz

- Cobham plc

- ASELSAN A.S.

- FLIR Systems, Inc.

Recent Developments

- In March 2025, a strategic partnership was announced between EDGE Group and Thales Group to strengthen the UAE’s defense communication capabilities. This collaboration focuses on delivering advanced military radios and compact IFF (Identification Friend or Foe) transponders to EARTH, a subsidiary under EDGE.

- In September 2024, Northrop Grumman completed its first demonstration connecting air- and ground-based military platforms to commercial satellite communications, aiming to enhance tactical communication capabilities.

Report Scope

Report Features Description Market Value (2024) USD 5.50 Bn Forecast Revenue (2034) USD 8.87 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Handheld Radio, Manpack Radio, Vehicle-Mounted Radio, Base Station Radio, Airborne Radio, Naval Radio), By Frequency (Very High Frequency (VHF), Ultra-High Frequency (UHF), High Frequency (HF), Others (Multiband, SHF, EFH)), By Technology (Conventional Radios, Software-Defined Radios (SDR)), By Application (Command & Control Communication, Surveillance & Reconnaissance, Electronic Warfare, Others), By End Use (Army, Navy, Air Force) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape L3Harris Technologies, Northrop Grumman Corporation, Thales Group, BAE Systems, Raytheon Technologies, General Dynamics Corporation, Leonardo S.p.A., Elbit Systems Ltd., Rohde & Schwarz, Cobham plc, ASELSAN A.S., FLIR Systems, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Military Tactical Radio MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Military Tactical Radio MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- L3Harris Technologies

- Northrop Grumman Corporation

- Thales Group

- BAE Systems

- Raytheon Technologies

- General Dynamics Corporation

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Rohde & Schwarz

- Cobham plc

- ASELSAN A.S.

- FLIR Systems, Inc.