Global Military Rotorcraft Market Size, Share Analysis Report By Type (Attack Helicopters, Transport Helicopters, Maritime Helicopters, Training Helicopters, and Others), Weight (Light (10 tons)), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151761

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

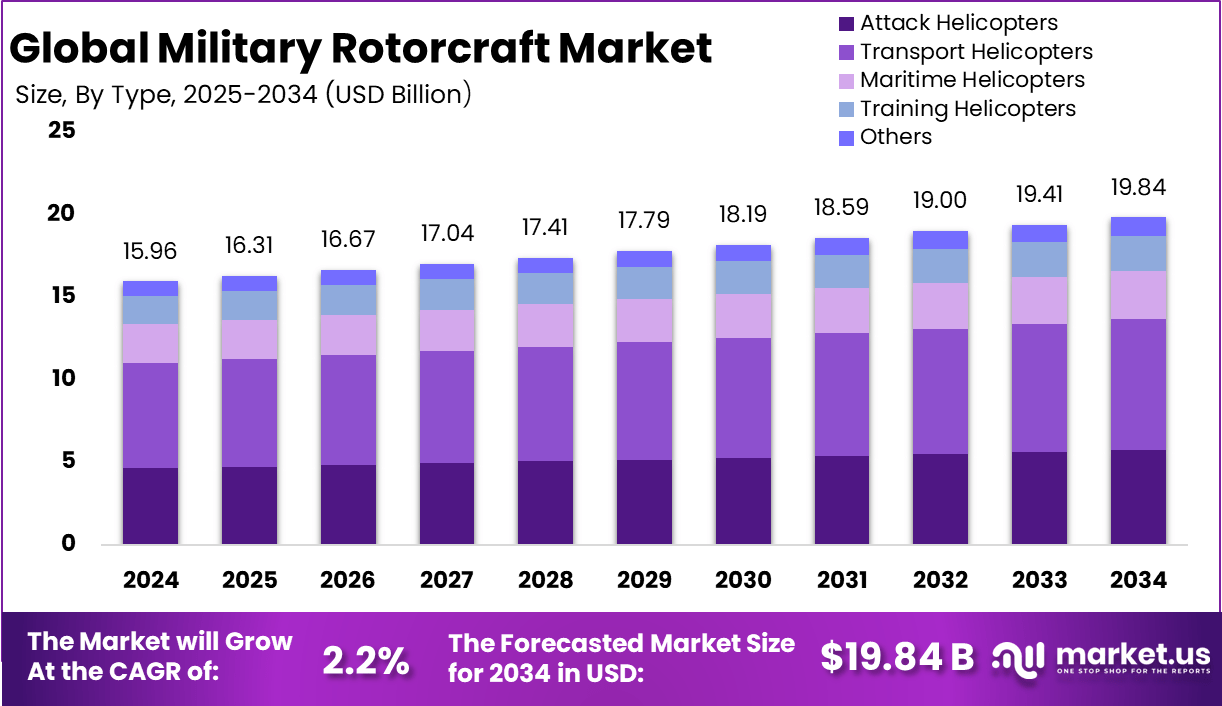

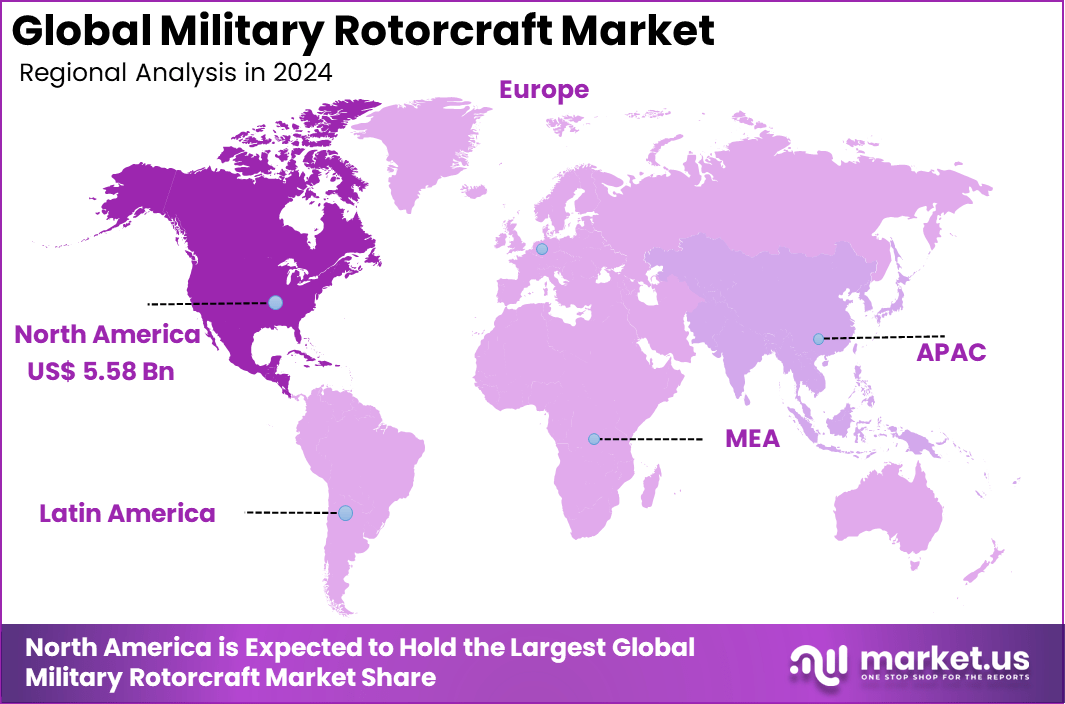

The Global Military Rotorcraft Market size is expected to be worth around USD 19.84 Billion By 2034, from USD 15.96 billion in 2024, growing at a CAGR of 2.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35% share, holding USD 5.58 Billion revenue.

The Military Rotorcraft Market is primarily focused on the attack helicopter segment, which leads due to its critical role in offensive and defensive operations. Such rotorcraft provide versatility across combat scenarios, rapid troop deployment, and critical fire support. The segment has gained traction through nations’ commitment to enhancing defense readiness and strategic superiority. This leadership position has been underpinned by significant budget allocations aimed at modernization and fleet renewal.

The Top Driving Factors for this market include expanding defense budgets, geopolitical tensions, and the imperative to update aging fleets. Governments are channeling increasing resources toward rotorcraft procurement and modernization efforts to ensure readiness in response to emerging threats. Moreover, the evolution of multi-mission requirements – combining reconnaissance, transport, and combat – has driven demand for agile platforms with integrated avionics and advanced propulsion.

The Increasing Adoption of Technologies such as stealth features, autonomous avionics, fly‑by‑wire control systems, and AI‑enabled sensors is notable. Efforts under programs like the U.S. Future Vertical Lift initiative reflect a trend toward rotorcraft capable of high speed, long range, and network‑centric operations. Simultaneously, initiatives by the Rotorcraft Industry Technology Association are improving health monitoring systems, lightweight transmissions, and ice‑simulation certification guidelines.

The current Investment Opportunities lie in fielding next‑generation platforms under modernization initiatives, such as the U.S. FLRAA/ FVL programs, and in retrofitting existing fleets with advanced electronics. There is also scope in developing unmanned rotary systems and integrating AI‑enabled mission packages. Collaborative ventures across OEMs and defense agencies are fostering R&D that aligns with multi‑national defense requirements.

Key Insight Summary

- The Global Military Rotorcraft Market is projected to grow from USD 15.96 billion in 2024 to USD 19.84 billion by 2034, expanding at a modest CAGR of 2.2%, driven by fleet modernization and regional security demands.

- North America led the global market in 2024 with a 35% share, generating approximately USD 5.58 billion in revenue, fueled by strong defense procurement programs.

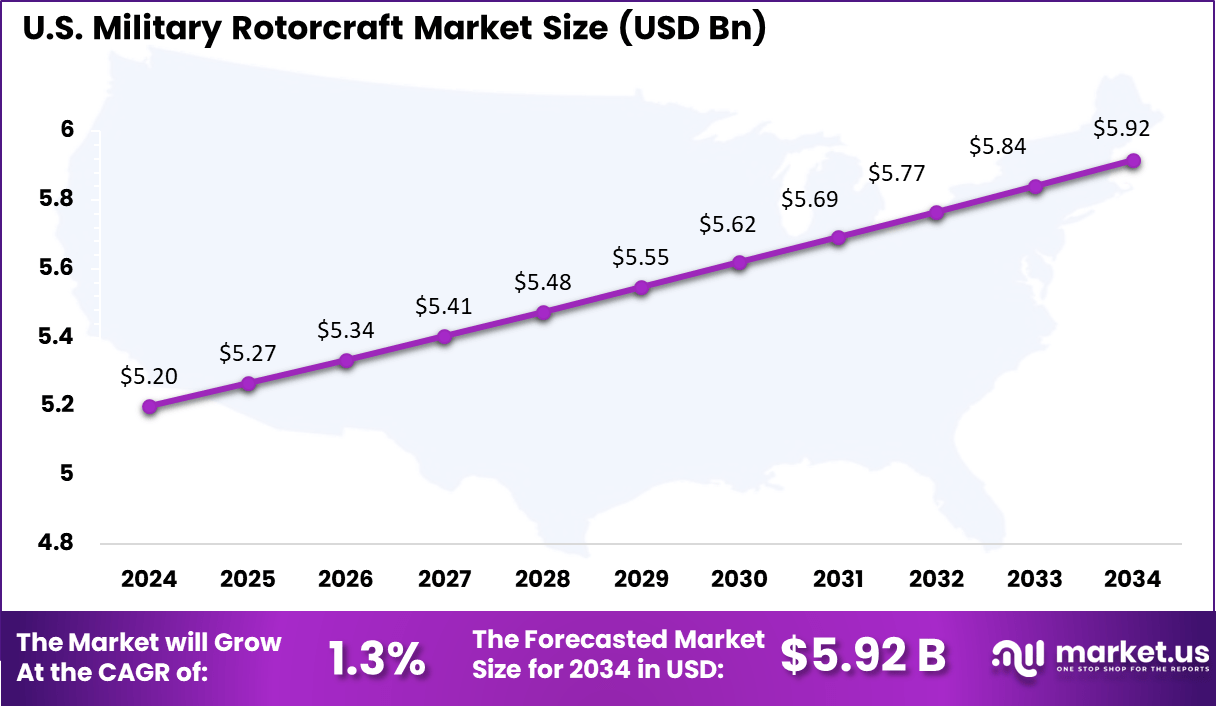

- The U.S. market alone was valued at USD 5.2 billion in 2024 and is expected to grow at a CAGR of 1.3%, reflecting sustained investments in rotary-wing capabilities.

- Among rotorcraft types, Transport Helicopters dominated the market with a 40% share, owing to their critical role in logistics, troop mobility, and disaster response.

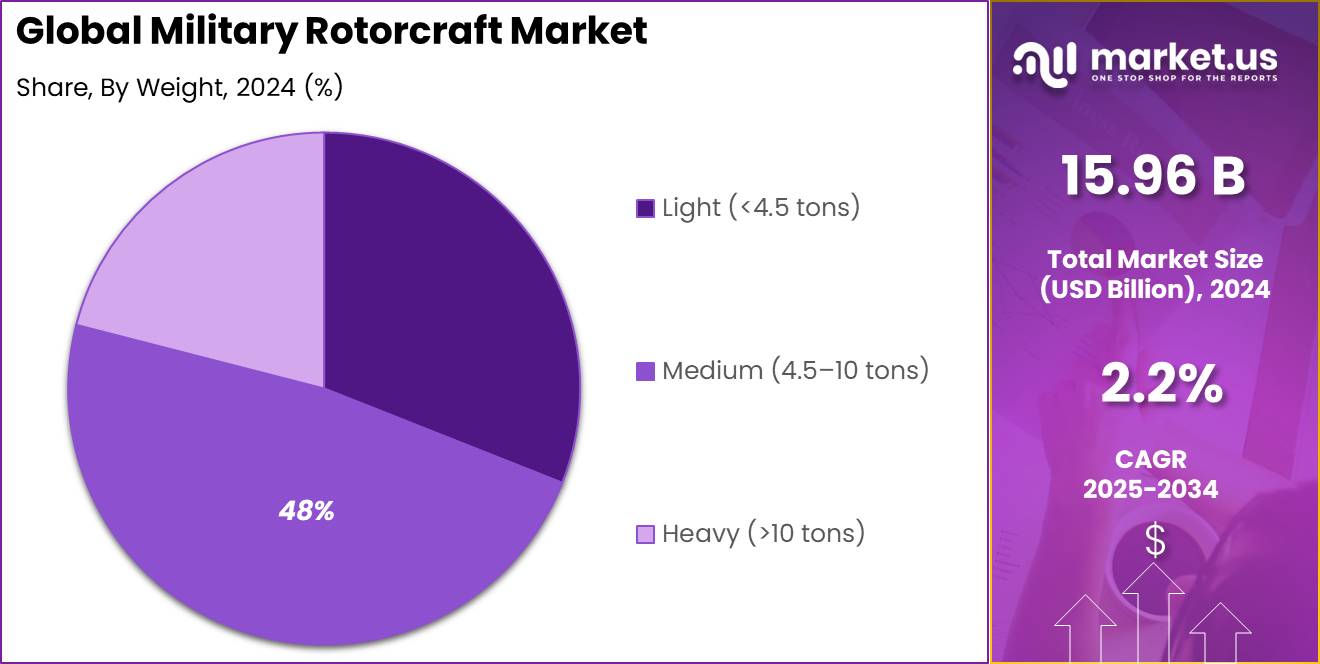

- By weight class, Medium (4.5-10 tons) rotorcraft held the largest share at 48%, due to their versatility across mission profiles including tactical lift, medical evacuation, and reconnaissance.

Analysts’ Viewpoint

Business Benefits from these trends include differentiated value propositions through innovation, lifecycle cost efficiencies, and expanded service‑based models. Manufacturers can secure long‑term contracts for upgrades, maintenance, and support services. Integrated mission systems are enabling OEMs to offer bundled solutions that increase operational readiness and customer loyalty.

The Regulatory Environment is stringent, governed by aviation authorities and defense standards addressing safety, noise, emissions, and avionics interoperability. Compliance demands thorough certification, documentation, and testing procedures. These factors increase development timelines and costs but simultaneously drive innovation in areas like emissions‑reduction and noise control.

Top Impacting Factors include shifting defense procurement policies, introduction of autonomous and unmanned rotorcraft, increasing counter‑insurgency and disaster relief operations, and parallel investments in drone technologies that could complement rotorcraft roles. Adoption of stringent environmental directives and export controls also influences program timelines and international collaboration frameworks.

U.S. Market Size

The U.S. Military Rotorcraft Market was valued at USD 5.2 Billion in 2024 and is anticipated to reach approximately USD 5.92 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 1.3% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 35% share, holding USD 5.58 Billion revenue. The region’s leadership is supported by its sustained defense budget increases, modernization of helicopter fleets, and advanced military programs.

The United States in particular has placed emphasis on upgrading legacy models such as the UH‑60 Black Hawk and is now progressing toward next‑generation platforms like the MV‑75 (formerly V‑280), reflecting a strategic pivot toward enhanced speed, survivability, and multi‑mission flexibility

North America’s market dominance can be attributed to its concentration of aerospace and defense leaders who possess advanced R&D ecosystems and long-standing relationships with military customers . These capabilities enable rapid integration of innovations in avionics, tiltrotor platforms, and autonomous technologies, reinforcing the region’s competitive advantage.

By Type Analysis

In 2024, the Transport Helicopters segment held a dominant market position, capturing more than a 40% share of the military rotorcraft market. This lead can be attributed to the enduring reliance of armed forces on these multi-mission platforms for troop movement, logistics, medical evacuation, and tactical resupply.

Their flexibility in supporting both combat and humanitarian operations has positioned them as essential assets in modern military strategies. The prominence of transport helicopters is reinforced by sustained investment in lifecycle modernization programs and new-generation variants.

Platforms derived from models such as the UH‑60 Black Hawk and CH‑53 series continue to see upgrades in engines, avionics, and composite materials – all designed to extend operational lifespans and enhance mission adaptability.

As armed forces face dynamic security challenges – ranging from conventional warfare to disaster relief – the demand for rotorcraft capable of rapid deployment and carrying diverse payloads has risen sharply. Their ability to perform in austere environments and to integrate with unmanned systems further strengthens their market position.

By Weight Analysis

In 2024, the Medium (4.5-10 tons) segment held a dominant market position, capturing more than a 48% share of the military rotorcraft market. This weight class has emerged as the most favored due to its optimal balance of payload capacity, range, and cost-effectiveness.

Positioned between lighter helicopters, which often lack sufficient operational reach, and heavier platforms that carry higher acquisition and support costs, medium-weight rotorcraft provide versatile solutions that can adapt to a variety of military requirements. The prominence of medium-weight helicopters is reinforced by their strong alignment with military doctrine focused on rapid deployment, logistical agility, and mission flexibility.

These aircraft typically support troop transport, medical evacuation, and tactical supply missions without the excessive operational footprint of heavy-class rotorcraft. Advancements in this category – such as improved composite materials, modern avionics suites, and dual-engine reliability – have increased mission performance while keeping maintenance demands manageable.

Furthermore, ongoing modernization programs in advanced militaries continue to prioritize medium-weight platforms. Their capacity to integrate multi-role capabilities – such as intelligence, surveillance, and reconnaissance (ISR), aerial lift, and disaster response support – makes them highly attractive.

Key Market Segments

By Type

- Attack Helicopters

- Transport Helicopters

- Maritime Helicopters

- Training Helicopters

- Others

By Weight

- Light (<4.5 tons)

- Medium (4.5–10 tons)

- Heavy (>10 tons)

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Market Dynamics

Category Title Summary Driver Modernization of Legacy Fleets The global military rotorcraft sector is being driven by the need to replace aging fleets with modern helicopters equipped with improved avionics, payload capabilities, and extended mission range. This modernization is reinforced by strategic defense programs that prioritize readiness and advanced air mobility. Restraint High Lifecycle Cost and Technical Complexity Despite advancements, the sector faces resistance due to the high capital, operational, and maintenance costs associated with next-generation rotorcraft. Delays and cost overruns in past programs highlight the ongoing challenge of cost-effective fleet deployment. Opportunity AI-enabled Autonomy and Tilt-Rotor Platforms Significant opportunities are emerging from AI integration for autonomous flight, mission management, and maintenance. Additionally, tilt-rotor designs offer hybrid capabilities that bridge the gap between helicopters and fixed-wing aircraft, expanding tactical and logistical applications. Challenge Market Fragmentation and Regulatory Burden The market is hindered by fragmented supply chains and varied compliance standards, which delay procurement and increase cost uncertainty. Regulatory frameworks across regions further complicate certification and export activities, challenging global market expansion. Key Player Analysis

The global military rotorcraft market is highly competitive, led by established defense giants and specialized aerospace firms. Rostec State Corporation, Lockheed Martin Corporation, and The Boeing Company hold significant influence through their extensive defense contracts and long-standing manufacturing capabilities.

These firms benefit from strong government ties and high R&D investments, enabling them to lead in advanced rotorcraft technology. Their portfolios include multi-mission helicopters used in tactical, maritime, and search-and-rescue roles, which contributes to their sustained dominance across NATO and allied defense markets.

Textron Inc., Airbus SE, and Leonardo S.p.A. are also prominent players, offering versatile platforms known for their agility and interoperability. Airbus and Leonardo have strengthened their presence in both European and international defense programs, while Textron’s Bell subsidiary supports U.S. Army rotorcraft modernization initiatives.

Top Key Players

- Rostec State Corporation

- Lockheed Martin Corporation

- The Boeing Company

- Textron Inc.

- Airbus SE

- Leonardo S.p.A

- Korea Aerospace Industries Ltd.

- China Aviation Industry Changhe Aircraft Industry (Group) Co., Ltd.

- Hindustan Aeronautics Limited (HAL)

- MD Helicopters, LLC

- Kaman Corporation

- Turkish Aerospace Industries Inc.

- Other Key Players

Recent Developments

- In June 2025, Lockheed (Sikorsky division) is actively seeking European partners for NATO’s Next‑Generation Rotorcraft Capability (NGRC) programme, aimed at replacing mid‑lift helicopters by late 2030s.

- In April 2024, the Ministry of Defence (MoD) of Greece formalized its commitment to modernizing its rotary-wing fleet by signing a Letter of Acceptance (LOA) for the procurement of 35 Sikorsky UH-60M Black Hawk helicopters. This acquisition falls under the United States Foreign Military Sales (FMS) program, reinforcing bilateral defense cooperation and strategic alignment between the two nations.

Report Scope

Report Features Description Market Value (2024) USD 15.96 Bn Forecast Revenue (2034) USD 19.84 Bn CAGR (2025-2034) 2.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Attack Helicopters, Transport Helicopters, Maritime Helicopters, Training Helicopters, and Others), Weight (Light (<4.5 tons), Medium (4.5–10 tons), Heavy (>10 tons)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rostec State Corporation, Lockheed Martin Corporation, The Boeing Company, Textron Inc., Airbus SE, Leonardo S.p.A, Korea Aerospace Industries Ltd., China Aviation Industry Changhe Aircraft Industry (Group) Co., Ltd., Hindustan Aeronautics Limited (HAL), MD Helicopters, LLC, Kaman Corporation, Turkish Aerospace Industries Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Military Rotorcraft MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Military Rotorcraft MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rostec State Corporation

- Lockheed Martin Corporation

- The Boeing Company

- Textron Inc.

- Airbus SE

- Leonardo S.p.A

- Korea Aerospace Industries Ltd.

- China Aviation Industry Changhe Aircraft Industry (Group) Co., Ltd.

- Hindustan Aeronautics Limited (HAL)

- MD Helicopters, LLC

- Kaman Corporation

- Turkish Aerospace Industries Inc.

- Other Key Players