Global MICE Market Size, Share, Growth Analysis By Event Type (Meetings, Incentives, Conferences, Exhibitions), By Industry, By Venue Type, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 136423

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

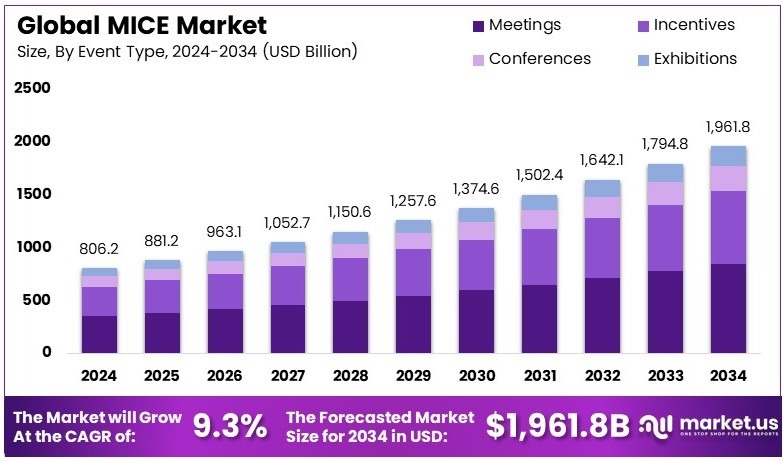

The Global MICE Market size is expected to be worth around USD 1,961.8 Billion by 2034, from USD 806.2 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034.

MICE stands for Meetings, Incentives, Conferences, and Exhibitions. It refers to a specialized sector of the tourism industry focused on organizing business events. These events facilitate networking, knowledge sharing, and business growth, catering to corporate clients and professionals seeking structured gatherings for various business purposes.

The MICE market encompasses all activities and services related to planning and executing meetings, incentives, conferences, and exhibitions. It includes venues, event management companies, travel services, and accommodation providers. This market serves businesses and organizations looking to host events that promote collaboration and professional development.

The MICE industry, encompassing Meetings, Incentives, Conventions, and Exhibitions, is pivotal in global business dynamics. In 2024, it has shown a robust expansion. The market’s growth can be attributed to enhanced corporate spending and global economic recovery. This has led to increased demand for organized business events, showcasing a direct impact on local and broader economic scales.

Government initiatives are crucial in supporting the MICE sector. For instance, in the U.S., the 2022 National Travel and Tourism Strategy aims to attract 90 million international visitors by 2027, potentially generating $279 billion in revenue. Similarly, China’s “Made in China 2025” and the Belt and Road Initiative significantly boost the industry by enhancing infrastructures and international cooperation.

The MICE market is becoming highly competitive, yet opportunities abound as industries seek to globalize their operations. Notable investments, like Amazon’s $148 billion in data centers, reflect the sector’s vibrancy and its critical role in supporting tech-driven services. Furthermore, Microsoft’s investments of $4.8 billion in Italy and $2.7 billion in Brazil emphasize the escalating demand for innovative technology solutions worldwide.

On a local scale, initiatives such as India’s ‘Dekho Apna Desh’ campaign foster domestic tourism and aim to attract 100 million inbound tourists by 2047. This initiative is expected to contribute significantly to the GDP, highlighting the profound influence of government policies on market dynamics and local economies. This strategic push not only bolsters local businesses but also positions the country as a key player on the global tourism stage.

Key Takeaways

- The MICE Market was valued at USD 806.2 Billion in 2024, and is expected to reach USD 1,961.8 Billion by 2034, with a CAGR of 9.3%.

- In 2024, Meetings dominate the event type segment with 41.3%, highlighting its key role in the market.

- In 2024, Healthcare leads the industry segment, underscoring its significant investment in MICE activities.

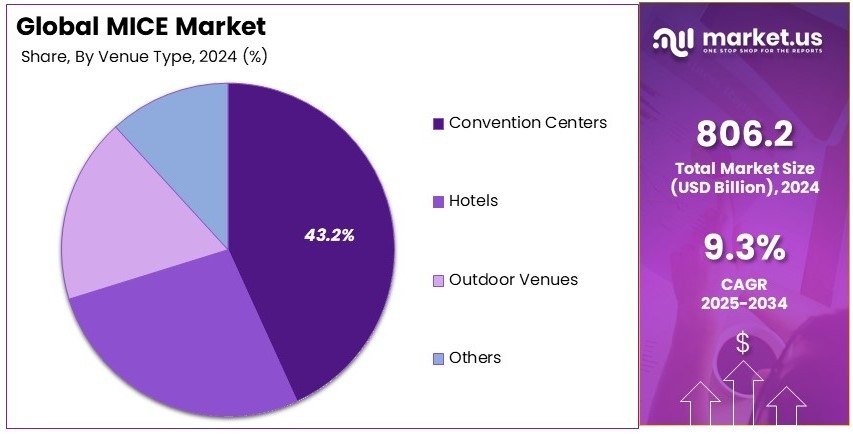

- In 2024, Convention Centers dominate the venue type segment with 43.2%, emphasizing their importance for events.

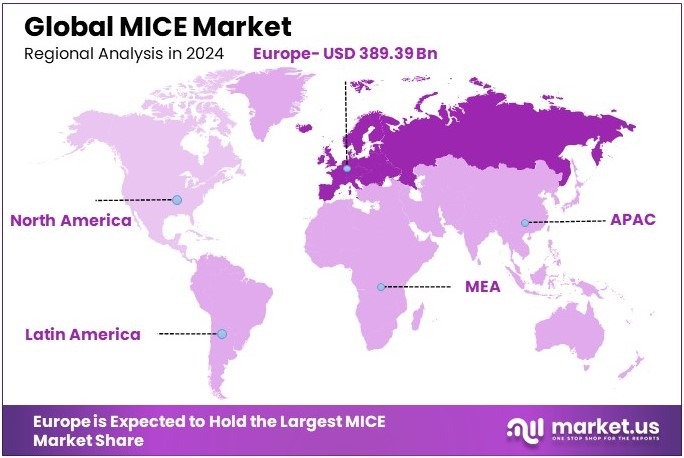

- In 2024, Europe holds the dominant region with 48.3%, contributing USD 389.39 Billion.

Business Environment Analysis

In the MICE (Meetings, Incentives, Conventions, and Exhibitions) market, saturation is becoming apparent in major cities, where supply occasionally surpasses demand. However, new opportunities are emerging in less saturated markets which are beginning to attract global attention for their untapped potential.

Furthermore, the target demographic for MICE services is evolving, with a notable shift towards corporate clients and tech-savvy professionals who value digital integration and innovative event solutions like virtual events. This shift is prompting providers to tailor their offerings more strategically to meet these specific needs.

Moreover, differentiation in the MICE market is increasingly focused on technology and unique customer experiences. Providers are integrating virtual reality and augmented reality solutions to create immersive environments that distinguish their services from traditional offerings.

Additionally, value chain analysis indicates that collaborations across different sectors are vital. Successful MICE operators are partnering with local enterprises to enhance the attendee experience and optimize operational efficiencies, which also supports local economies.

Subsequently, these developments are opening new investment opportunities. There is a growing interest in developing regions where governments are incentivizing infrastructure development to support large-scale events, which in turn boosts local business ecosystems.

Finally, the interaction with adjacent markets like leisure travel and corporate training is becoming more pronounced. Many MICE providers are broadening their offerings to include elements of leisure and educational experiences, appealing to a broader audience and creating more integrated service packages.

Event Type Analysis

Meetings dominate with 41.3% due to their essential role in facilitating corporate strategy discussions and decision-making processes.

The MICE (Meetings, Incentives, Conferences, and Exhibitions) market is segmented primarily by event type, among which Meetings hold a significant position.

Meetings, as a sub-segment, account for 41.3% of the market, primarily due to their integral role in fostering communication and collaboration among business professionals. This segment’s dominance can be attributed to the increasing global expansion of companies and the need for physical spaces where strategic decisions and partnerships can be formed.

Incentives focus on rewarding employees or partners, boosting morale and performance. Though smaller in percentage, they play a pivotal role in employee retention and motivation.

Conferences are geared towards education and networking, contributing significantly to the dissemination of industry-specific knowledge and trends.

Exhibitions are key for marketing and sales opportunities, providing platforms for businesses to showcase innovations and expand market reach.

Industry Analysis

The Healthcare sector leads with a notable percentage due to the ongoing technological advancements and increased healthcare spending globally.

In the MICE market, the Industry segment showcases diverse growth trajectories among which Healthcare emerges as a leader.

The prominence of the Healthcare sector in MICE activities is driven by continuous advancements in medical technology and the growing need for professional development through conferences and seminars. This sector benefits significantly from such events, which provide platforms for professionals to exchange information, regulatory updates, and recent research findings.

The IT and Telecommunications sector utilizes MICE events for product launches and tech updates, reflecting its rapid innovation cycle and the need for constant professional learning.

Banking, Financial Services, and Insurance (BFSI) sectors rely on MICE activities to navigate complex regulatory environments and foster connections that support financial stability and growth.

The Manufacturing sector’s integration with MICE events focuses on innovation showcases and industrial advancements, vital for maintaining competitive edges.

Retail and Consumer Goods sectors leverage exhibitions significantly to promote new products and engage directly with market demographics, thus driving consumer interest and sales.

The Other industries segment includes sectors not classified but are increasingly utilizing MICE events for cross-industry learning and sustainability practices, marking their growth in market share.

Venue Type Analysis

Convention Centers are predominant with 43.2% due to their large capacities and specialized facilities for major events.

The Venue Type segment of the MICE market is critical in determining the success of an event. Convention Centers, being the dominant sub-segment, offer extensive facilities that can accommodate large-scale events, which is a significant factor in their 43.2% market share.

These venues are designed to host thousands of attendees and provide the technological and logistical support needed for complex events such as international conferences and large exhibitions.

Hotels serve as versatile venues, supporting smaller, more frequent events like meetings and incentives, providing convenience and high-service standards essential for business interactions.

Outdoor Venues offer a unique environment for events that require less formal settings or activities that combine business with leisure, enhancing attendee experience.

The Other venues category includes academic venues, public spaces, and more, which cater to niche markets and are chosen based on their specific attributes and the nature of the event.

Key Market Segments

By Event Type

- Meetings

- Incentives

- Conferences

- Exhibitions

By Industry

- Healthcare

- IT and Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Retail and Consumer Goods

- Others

By Venue Type

- Convention Centers

- Hotels

- Outdoor Venues

- Others

Driving Factors

Global Business Expansion Fuels MICE Market Growth

The expansion of global businesses significantly propels the Meetings, Incentives, Conferences, and Exhibitions (MICE) market. As corporations continue to operate on an international scale, the need for cross-border meetings and collaborations increases, driving demand for MICE services. For example, multinational companies often organize annual conferences in different countries to align their global teams and strategies.

Additionally, the rising demand for experiential events aligns with businesses’ objectives to create memorable and engaging experiences for participants. Events such as interactive workshops and team-building activities enhance attendee satisfaction and foster stronger business relationships.

The growing popularity of hybrid events, which combine in-person and virtual elements, further supports market growth by offering flexible solutions that cater to a broader audience. For instance, during the COVID-19 pandemic, many organizations successfully transitioned to hybrid formats, maintaining engagement while adhering to safety protocols.

Furthermore, government initiatives aimed at promoting business tourism play a crucial role in stimulating the MICE market. These initiatives often include incentives such as tax breaks, improved infrastructure, and streamlined visa processes, making destinations like Singapore and Dubai more attractive for hosting large-scale events.

Barriers to Growth

Operational Challenges Limit MICE Market Expansion

The MICE market faces several operational challenges that can impede its growth. One significant restraint is the limited availability of skilled professionals in the event management sector. The complexity of organizing large-scale events requires expertise in logistics, marketing, and technology. For example, a shortage of experienced event planners can lead to suboptimal event execution and lower attendee satisfaction.

Additionally, stringent government regulations pose hurdles for event organizers, as compliance with local laws and international standards can be time-consuming and costly. Regulations such as obtaining permits, adhering to safety protocols, and meeting environmental guidelines can increase the overall cost and complexity of hosting events. For instance, organizing a large conference in a city with strict noise ordinances may require additional planning and resources.

Fluctuations in global economic conditions also play a critical role in restraining market growth. Economic instability can lead to reduced corporate budgets for events, postponement or cancellation of planned gatherings, and a general decrease in business travel. During economic downturns, companies might prioritize essential expenditures over organizing large-scale events.

Investment Opportunities

Technological Advancements Unlock MICE Market Potential

The adoption of artificial intelligence (AI) in event planning streamlines various processes, from attendee registration to personalized agenda creation, improving efficiency and participant experience. For instance, AI-powered chatbots can handle attendee inquiries in real-time, providing instant support and information.

Additionally, the expansion of virtual and augmented reality (VR/AR) experiences transforms traditional events by offering immersive environments that engage participants in new ways. These technologies allow for virtual site inspections, interactive exhibits, and enhanced networking opportunities.

The growth of boutique and niche events caters to specialized interests, allowing organizers to target specific audiences with customized content and unique experiences. This focus on niche markets can lead to higher engagement and satisfaction rates among participants. For example, a technology-focused MICE event can offer specialized workshops and keynote sessions tailored to tech enthusiasts and professionals.

Furthermore, the rise in incentive travel programs creates opportunities for businesses to reward and motivate their employees through exclusive travel experiences. These programs often include high-end accommodations, unique activities, and personalized itineraries, making them attractive incentives that drive participation and loyalty.

Future Market Trends

Current Trends Shape the Future of the MICE Market

The surge in demand for hybrid and digital events highlights the need for flexible and accessible event formats that cater to both in-person and virtual attendees. This trend not only broadens the reach of events but also accommodates varying participant needs, making MICE activities more inclusive.

The focus on sustainable and eco-friendly practices is another pivotal trend, driven by increasing environmental awareness and corporate responsibility. Event organizers are prioritizing green initiatives such as reducing waste, using renewable energy sources, and promoting smart transportation options.

Additionally, there is an increasing preference for personalization in event experiences, as attendees seek tailored content and interactions that resonate with their individual interests and professional goals. Personalized agendas, customized networking opportunities, and bespoke event materials contribute to higher engagement and satisfaction levels.

Furthermore, the promotion of women-centric events underscores the importance of diversity and inclusion within the MICE industry. These events provide platforms for women leaders, entrepreneurs, and professionals to connect, share insights, and advance their careers, fostering a more balanced and equitable business environment.

Regional Analysis

Europe Dominates with 48.3% Market Share in the MICE Market

Europe leads the MICE (Meetings, Incentives, Conferences, and Exhibitions) Market with a significant 48.3% share, representing USD 389.39 billion. This dominant position is driven by its well-established infrastructure for events, a high concentration of corporate headquarters, and strong governmental support for the tourism and events sector.

The region benefits from advanced transport links and high-quality venues, which are crucial for attracting international business events. Additionally, Europe’s rich cultural heritage and stable economic environment make it a preferred destination for corporate and leisure events alike.

Looking forward, Europe’s influence on the global MICE Market is expected to continue growing. The ongoing development of green and digital event solutions is likely to attract even more global participants, reinforcing its leading position in the industry.

Regional Mentions:

- North America: North America holds a significant share of the MICE Market, driven by the United States’ strong corporate sector and advanced event technology services. The region is known for its capacity to host large-scale international events, which plays a crucial role in its market performance.

- Asia Pacific: Asia Pacific is rapidly growing in the MICE Market, with countries like China, Singapore, and Australia leading the way. The region’s booming economy and increasing governmental support for tourism are pivotal in driving its market share.

- Middle East & Africa: The Middle East and Africa are emerging as key players in the MICE Market, with significant investments in infrastructure and a strategic geographic location that bridges the Eastern and Western business worlds.

- Latin America: Latin America is increasingly recognized in the MICE Market, bolstered by its diverse cultural offerings and growing economic stability. The region is enhancing its capacities for hosting international business events, contributing to its market growth.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the MICE (Meetings, Incentives, Conferences, and Exhibitions) market, four key players stand out due to their extensive global networks, comprehensive service offerings, and innovative solutions tailored to diverse client needs.

Marriott International is a dominant force with its vast portfolio of properties equipped with state-of-the-art facilities for meetings and conferences. Marriott’s global presence allows it to host events of any scale, supported by a strong focus on customer service and customization, making it a preferred choice for corporate events and conventions.

Hilton Worldwide follows closely, offering a similar range of services with the added benefit of its loyalty programs and a reputation for high standards in hospitality. Hilton’s venues are strategically located across major cities and business hubs, ensuring accessibility and convenience for event organizers and attendees.

InterContinental Hotels Group (IHG), known for its luxurious accommodations and high-end services, caters to upscale market segments. IHG’s hotels are often chosen for high-profile meetings and incentives, providing bespoke experiences and meticulous attention to detail that meet the expectations of a discerning clientele.

CWT Meetings & Events specializes in the end-to-end management of corporate events, distinguishing itself with expert planning services that cover everything from venue selection to post-event analysis. This focus on comprehensive event solutions allows CWT to deliver exceptional value, ensuring client objectives are met with precision.

Together, these companies not only lead in terms of market share but also drive innovation within the MICE industry. They set benchmarks in sustainability, technology integration, and customer engagement, shaping future trends and expectations. Their combined efforts contribute significantly to the robust growth of the MICE market, affirming their roles as pivotal players in this dynamic industry.

Major Companies in the Market

- Marriott International

- Hilton Worldwide

- InterContinental Hotels Group (IHG)

- CWT Meetings & Events

- BCD Meetings & Events

- Freeman

- Informa

- Reed Exhibitions

- Messe Frankfurt

- GL Events

- Viad Corp

- American Express Meetings & Events

- Microsoft

Latest Advancements

- Thailand Convention and Exhibition Bureau (TCEB), Visa International (Thailand), T2P Co. Ltd, Central Group: In September 2024, introduced the Thailand MICE Visa Prepaid Card, offering MICE travelers discounts on accommodation, shopping, dining, transport, and meeting packages as part of the “Thailand MICE Privileges” campaign.

- Thailand Convention and Exhibition Bureau (TCEB): In July 2024, launched the “Thailand MICE One Stop Service” to streamline visa applications, expedite immigration, provide VIP airport greetings, and facilitate equipment imports for business travelers and event visitors.

- Moscow City Tourism Committee: In August 2024, initiated a training program to enhance business travel from India to Russia by educating Indian travel professionals about Moscow’s MICE offerings and business opportunities.

Report Scope

Report Features Description Market Value (2024) USD 806.2 Billion Forecast Revenue (2034) USD 1,961.8 Billion CAGR (2024-2034) 9.3% Base Year for Estimation 2024 Historic Period 2019-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Event Type (Meetings, Incentives, Conferences, Exhibitions), By Industry (Healthcare, IT and Telecommunications, Banking, Financial Services and Insurance [BFSI], Manufacturing, Retail and Consumer Goods, Others), By Venue Type (Convention Centers, Hotels, Outdoor Venues, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Marriott International, Hilton Worldwide, InterContinental Hotels Group (IHG), CWT Meetings & Events, BCD Meetings & Events, Freeman, Informa, Reed Exhibitions, Messe Frankfurt, GL Events, Viad Corp, American Express Meetings & Events, Microsoft Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Marriott International

- Hilton Worldwide

- InterContinental Hotels Group (IHG)

- CWT Meetings & Events

- BCD Meetings & Events

- Freeman

- Informa

- Reed Exhibitions

- Messe Frankfurt

- GL Events

- Viad Corp

- American Express Meetings & Events

- Microsoft