Global Metaverse Wallets Market Report By Type (Desktop Wallets, Mobile Wallets, Web Wallets, Hybrid Wallets), By End-User (Individual, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 129358

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

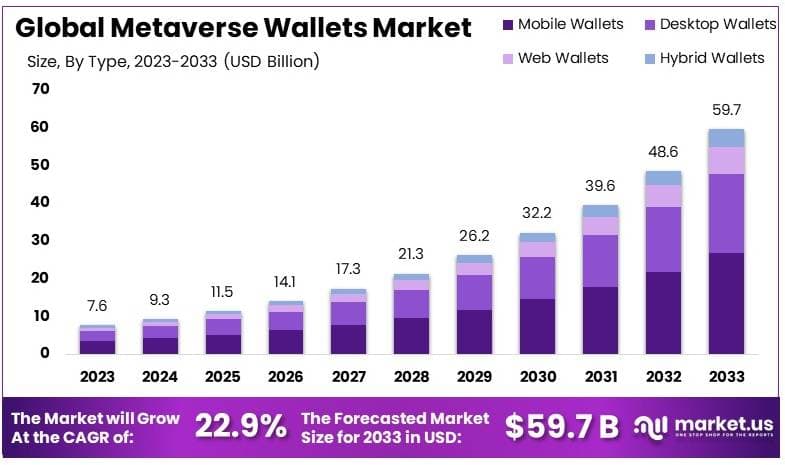

The Global Metaverse Wallets Market size is expected to be worth around USD 59.7 Billion by 2033, from USD 7.6 Billion in 2023, growing at a CAGR of 22.9% during the forecast period from 2024 to 2033.

Metaverse wallets are digital wallets used to store and manage virtual assets in the metaverse. These wallets allow users to securely hold, buy, sell, and trade cryptocurrencies, NFTs (non-fungible tokens), and other virtual items across different virtual worlds. They act as a bridge between users and their digital identity, ensuring safe and transparent transactions in the virtual economy.

The Metaverse Wallets market refers to the growing industry around providing digital wallets specifically designed for metaverse users. As more individuals and businesses engage in virtual environments, the need for secure platforms to store digital assets increases. This market is expanding as the metaverse concept gains traction, driven by the rise of virtual worlds, metaverse NFTs, and decentralized finance (DeFi) applications.

The growth of the Metaverse Wallets market is driven by several factors. First, the increasing popularity of virtual worlds and digital economies has created a higher demand for secure storage of digital assets. Second, the rapid adoption of blockchain technology, which underpins many metaverse transactions, has made decentralized wallets a necessary tool.

There is growing demand for metaverse wallets as more users engage in virtual environments for gaming, socializing, and conducting business. Users need secure solutions to manage their virtual currencies and NFTs, which are essential components of the metaverse economy. As the metaverse expands, this demand will continue to rise, particularly among early adopters of new technologies.

The Metaverse Wallets market presents several opportunities. Companies developing wallets can benefit from partnerships with metaverse platforms and virtual marketplaces. Additionally, integrating advanced features like biometric technology, cross-platform compatibility, and seamless DeFi services could attract more users.

As of 2024, the metaverse attracts over 600 million active users each month, signaling a strong demand for secure and efficient digital wallets. Popular wallets such as Trust Wallet with over 60 million users and MetaMask with 30 million monthly active users are at the forefront of this growth. These wallets play a crucial role in enabling transactions within the expanding virtual ecosystem.

Several factors are driving the growth of the metaverse wallet market. One key growth factor is the rising popularity of NFTs and metaverse in real estate, contributing to a virtual art market worth $2.4 billion. The ability to securely store and trade these digital assets is essential for users navigating virtual worlds.

Additionally, the increasing adoption of AR (augmented reality) and VR (virtual reality) technologies, with an expected 1.7 billion AR users by 2024, is further accelerating demand for digital wallets.

Crypto wallet usage is also experiencing significant growth. As of 2024, there are approximately 91.75 million active crypto wallets, with projections estimating 200 million Bitcoin wallet users by the same year. These figures highlight the growing integration of blockchain technologies within the metaverse, making digital wallets indispensable tools for transactions and asset management.

The growth of the metaverse wallet market is largely driven by the expanding metaverse user base and the increasing demand for virtual asset ownership. By 2026, 25% of the global population is expected to spend at least one hour per day in the metaverse, creating a substantial market for wallet providers.

Opportunities also arise from government investments. South Korea, for example, has allocated $48.3 million to support metaverse startups, while Dubai aims to become one of the top 10 metaverse economies by 2030. These investments are likely to spur further innovation in digital wallets, enabling more users to participate in the virtual economy.

Government involvement in the metaverse is increasing, with initiatives aimed at fostering technological innovation and creating frameworks for secure digital transactions. Regulations surrounding blockchain technology and digital assets are becoming more defined, ensuring safer and more transparent financial activities within virtual ecosystems.

For instance, the global blockchain market is expected to grow significantly, with spending on blockchain solutions projected to reach $19 billion by 2024, reflecting strong institutional support for the technology.

Governments are also promoting regulatory clarity to encourage wider adoption of cryptocurrencies and NFTs. This clarity is crucial for metaverse wallet providers, as it helps ensure compliance with evolving digital asset regulations, thus boosting user confidence in using wallets for virtual transactions.

Key Takeaways

- The Metaverse Wallets Market was valued at USD 7.6 Billion in 2023, and is expected to reach USD 59.7 Billion by 2033, with a CAGR of 22.9%.

- In 2023, Mobile Wallets dominate with 45%, driven by the increasing use of smartphones for virtual transactions.

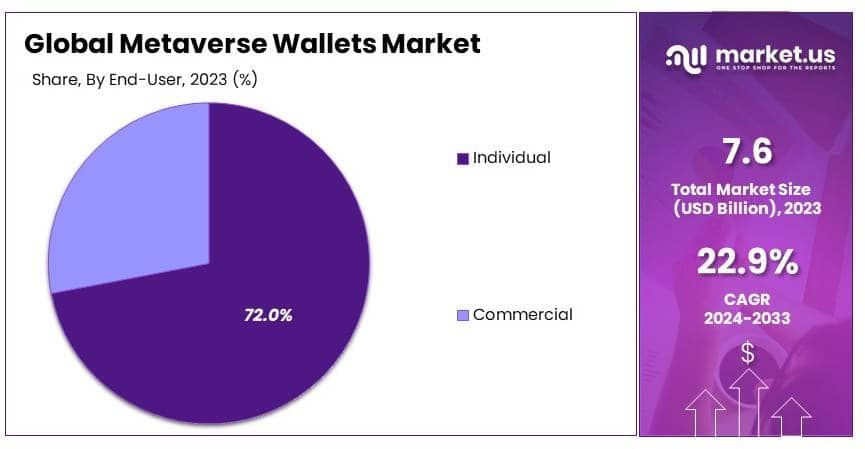

- In 2023, the Individual end-user segment leads with 72%, as more consumers adopt metaverse wallets for personal use.

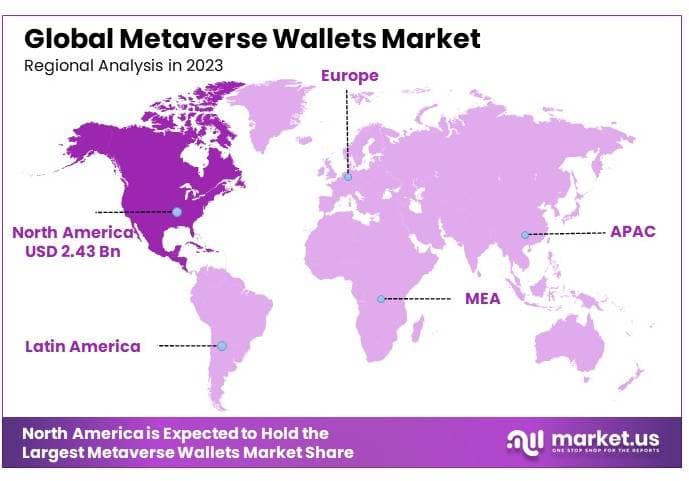

- In 2023, North America dominates with 32%, reflecting the region’s early adoption of metaverse technologies.

Type Analysis

Mobile Wallets dominate with 45% due to convenience, accessibility, and widespread smartphone usage.

In the metaverse wallets market, the “Type” segment is crucial for understanding user preferences and technological adoption. Mobile wallets have emerged as the dominant sub-segment, capturing 45% of the market. This preference is driven by the convenience, accessibility, and ubiquitous presence of smartphones among users globally.

Mobile wallets offer a seamless, user-friendly interface that allows individuals to manage their digital assets and engage with the metaverse from anywhere, at any time. The integration of security features such as biometrics has further enhanced the appeal of mobile wallets, making them a popular choice among metaverse participants.

Other types of wallets like desktop wallets, web wallets, and hybrid wallets also play significant roles in the ecosystem. Desktop wallets, known for their enhanced security features, are preferred by users who require robust security for managing significant digital assets.

Web wallets offer flexibility and ease of use, attracting users who prefer not to download additional software. Hybrid wallets combine features of both mobile and desktop or web wallets, providing versatility and catering to a niche yet important market segment.

While mobile wallets currently dominate, the continued development and refinement of desktop, web, and hybrid wallets are expected to contribute significantly to market growth. These alternatives cater to diverse user needs and preferences, driving innovation and competition within the market.

End-User Analysis

Individual users dominate with 72% due to the growing consumer interest in digital assets and virtual environments.

In the segmentation by end-user, individual users constitute the largest market share at 72%. This dominance is primarily due to the growing interest and participation of consumers in the metaverse and related digital activities.

Individuals are increasingly exploring virtual environments where they can play, socialize, and conduct transactions using digital currencies, necessitating reliable and secure means to manage such assets. Metaverse wallets for individual users are designed to be user-friendly, secure, and easily accessible, supporting a wide range of activities from small transactions to significant investments in virtual real estate and other assets.

The commercial segment, while smaller, is equally vital to the overall growth of the metaverse wallets market. Commercial users include businesses, organizations, and service providers within the metaverse who require wallets to manage larger scale transactions, offer services, and facilitate commerce within virtual events.

The dominance of individual users is a significant driver of market trends, particularly in terms of developing consumer-friendly wallet solutions. However, the commercial segment’s expansion will likely influence future developments in wallet technology, focusing on scalability, multi-user transactions, and enterprise-level security. The integration of these features will be crucial as the metaverse continues to mature, catering to both individual and commercial users.

Key Market Segments

By Type

- Desktop Wallets

- Mobile Wallets

- Web Wallets

- Hybrid Wallets

By End-User

- Individual

- Commercial

Driver

Rising Adoption of Digital Assets Drives Market Growth

The rising adoption of digital assets is a key driver in the growth of the Metaverse Wallets market. As more people embrace cryptocurrencies, NFTs (non-fungible tokens), and other digital assets, the demand for secure and user-friendly wallets to manage these assets is increasing. These wallets provide users with the ability to store, trade, and transact in the virtual world, enhancing the overall metaverse experience.

The integration of blockchain technology further drives the market. Blockchain provides a secure, transparent, and decentralized infrastructure that underpins many metaverse transactions, ensuring the security of digital assets and fostering trust in virtual economies.

The increasing popularity of NFTs and virtual goods is another significant growth factor. As NFTs gain traction as digital collectibles, art, and in-game items, metaverse wallets are becoming essential tools for users to purchase, sell, and showcase their virtual assets, contributing to market expansion.

Additionally, the rapid expansion of the metaverse in gaming industry plays a crucial role in driving the metaverse wallets market. Many gaming platforms are integrating blockchain and metaverse elements, creating demand for wallets that can manage in-game currencies and assets, thus boosting market growth.

Restraint

Security and Privacy Concerns Restraints Market Growth

Security and privacy concerns are major restraining factors for the Metaverse Wallets market. As metaverse wallets hold valuable digital assets, they are often targeted by cybercriminals, leading to concerns about the security of users’ funds and personal information. The lack of robust security measures deters some users from adopting these wallets.

Regulatory uncertainty also hampers market growth. Governments worldwide are still grappling with how to regulate digital assets, creating a cloud of uncertainty for businesses and users alike. This slows down the development and adoption of metaverse wallets, as companies remain cautious about legal compliance.

Limited awareness and understanding of metaverse technology further restrain the market. Many potential users are unfamiliar with how metaverse wallets work, which prevents widespread adoption, particularly among older demographics and less tech-savvy individuals.

High transaction fees on blockchain platforms also pose a barrier to market growth. As blockchain networks like Ethereum become congested, transaction costs can spike, making it costly for users to buy, sell, or transfer assets within the metaverse, limiting the appeal of these wallets.

Opportunity

Integration with Decentralized Finance (DeFi) Platforms Provides Opportunities

The integration of metaverse wallets with Decentralized Finance (DeFi) platforms presents significant growth opportunities. By connecting wallets to DeFi services, users can access lending, staking, and yield farming opportunities within the metaverse, expanding the functionality of these wallets beyond simple asset storage.

The expansion of virtual real estate in the metaverse also offers immense potential. As digital land sales and developments increase, users will need wallets to manage their virtual properties, offering a lucrative opportunity for wallet providers to cater to this growing demand.

Collaborations between tech companies and financial institutions provide additional opportunities. As traditional finance entities explore blockchain and metaverse applications, partnering with wallet providers could create new, innovative solutions for users, enhancing the wallet ecosystem.

Rising demand for interoperable wallets across multiple metaverse platforms is another growth avenue. As more metaverses emerge, users will seek wallets that can operate seamlessly across different platforms, driving demand for solutions that offer cross-platform compatibility and ease of use.

Challenge

Ensuring User Authentication and Identity Challenges Market Growth

Ensuring user authentication and identity verification presents a significant challenge in the Metaverse Wallets market. As users interact in virtual spaces, verifying their identity in a decentralized, secure manner becomes critical to prevent and detect fraud and ensure the legitimacy of transactions, yet it remains a complex issue.

Managing cross-border transactions within the metaverse is another challenge. As users from different countries engage in metaverse economies, wallets must navigate the complexities of international regulations, currency conversions, and varying transaction standards, adding layers of difficulty to cross-border use cases.

Navigating complex legal and ownership issues also challenges the market. Questions around the legal ownership of digital assets, intellectual property, and compliance with local laws create barriers to the smooth operation of metaverse wallets, especially as legal frameworks remain unclear.

Providing a seamless user experience across multiple platforms and devices is yet another challenge. Users expect their wallets to work consistently across desktop, mobile, and VR environments. Achieving this level of interoperability and user-friendliness is essential for market growth but requires continuous technological development.

Growth Factors

Increased Investment in Blockchain and Crypto Technologies Is Growth Factor

The increased investment in blockchain and crypto technologies is a significant growth factor for the Metaverse Wallets market. As more resources are funneled into developing robust, scalable blockchain infrastructure, the metaverse ecosystem will expand, driving demand for secure and reliable wallets.

The rising adoption of Web 3.0 and decentralized applications (dApps) further contributes to market growth. As Web 3.0 platforms gain popularity, metaverse wallets will be essential for users to interact with decentralized applications, creating new use cases for these wallets.

Emerging use cases for digital ownership and asset management are also fueling growth. As users seek to manage their virtual assets, including NFTs, virtual land, and other digital properties, the demand for feature-rich wallets is increasing, supporting the overall expansion of the market.

The continued expansion of metaverse-based commerce and retail experiences is another growth factor. As virtual shopping and transactions become more prevalent, metaverse wallets will be key to facilitating smooth, secure payments, driving further adoption and market growth.

Emerging Trends

Increased Use of AI for Personalization in Metaverse Wallets Is Latest Trending Factor

The increased use of AI for personalization in metaverse wallets is a key trend shaping the market. AI enables wallets to offer customized recommendations, personalized asset management, and tailored experiences based on user behavior and preferences, enhancing user engagement and satisfaction.

The growing focus on privacy-enhancing technologies for metaverse wallets is another important trend. As privacy concerns rise, wallet providers are incorporating advanced encryption and privacy features to ensure users’ transactions and data remain secure and anonymous.

The development of multi-currency and multi-asset support wallets is also gaining traction. As users participate in different metaverses with varying cryptocurrencies and assets, wallets that can handle multiple currencies and asset types seamlessly are becoming increasingly popular.

The rising interest in virtual reality (VR) commerce and payment solutions is a significant trend. As VR commerce grows, wallets that enable seamless, immersive payment experiences within virtual environments will play a crucial role, driving further market development.

Regional Analysis

North America Dominates with 32% Market Share

North America leads the Metaverse Wallets Market with a 32% share, valued at USD 2.43 billion. This dominance is driven by high cryptocurrency adoption, strong tech infrastructure, and the presence of key blockchain companies. The region’s early embrace of metaverse technologies, along with strong investment in digital assets, boosts demand for secure metaverse wallets.

The region benefits from a well-developed financial ecosystem, which supports the integration of digital assets like cryptocurrencies and NFTs. In addition, North America’s regulatory environment is gradually adapting to digital currencies, which helps increase user confidence in metaverse wallets. High disposable income and advanced digital literacy also play key roles in market growth.

North America is expected to maintain its leading position as more consumers and businesses invest in virtual goods and services. As the metaverse expands, the demand for secure and versatile wallets that handle multiple assets will grow, further strengthening the region’s market presence.

Regional Mentions:

- Europe: Europe is steadily growing in the Metaverse Wallets Market due to its focus on data protection and digital currency regulation. The region’s strong tech sector and increasing interest in NFTs are also contributing to market growth.

- Asia Pacific: Asia Pacific is rapidly emerging in the Metaverse Wallets Market, driven by the rising popularity of virtual gaming and strong investment in blockchain technology. Countries like China and South Korea are key players.

- Middle East & Africa: The Middle East & Africa are showing early-stage adoption of metaverse wallets. Key factors include growing interest in blockchain technology and government-led digital transformation initiatives.

- Latin America: Latin America is gradually embracing metaverse wallets as digital currencies gain popularity. The region’s focus on financial inclusion through digital platforms is a key driver of market growth, especially in Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the growing Metaverse Wallets Market, Meta, Crypto.com, and Coinbase are leading the charge. These companies have positioned themselves as key players by leveraging their technological expertise and strategic investments in digital assets, blockchain technology, and virtual economies.

Meta (formerly Facebook) is heavily investing in the metaverse with its ambitious plans to create a virtual world where users can interact, work, and transact. Meta’s involvement in building the infrastructure for the metaverse gives it a strong position in the wallets market, as secure and user-friendly wallets are essential for managing digital assets in this new digital environment. Meta’s reach and influence in social media provide it with a vast user base for its future metaverse wallet solutions.

Crypto.com is a significant player in the digital wallet space, especially with its focus on cryptocurrencies and NFTs. With a strong brand in the crypto industry, Crypto.com offers secure wallet services that are integral to the metaverse, where virtual currencies and assets will play a central role. Its strategic partnerships and global presence help solidify its market influence, especially as the metaverse becomes more commercialized.

Coinbase, a major cryptocurrency exchange, has also emerged as a critical player in the metaverse wallet space. Coinbase’s strong reputation for security and compliance makes it a trusted platform for users looking to manage digital assets in the metaverse. By integrating metaverse capabilities with its crypto wallet, Coinbase is strategically positioned to capitalize on the growing demand for safe and versatile digital wallets in virtual environments.

These three companies—Meta, Crypto.com, and Coinbase—are driving the evolution of the Metaverse Wallets Market. Their focus on innovation, user security, and blockchain integration will continue to shape the future of digital wallets, ensuring that users can seamlessly manage assets in the metaverse as it becomes more mainstream.

Top Key Players in the Market

- Meta

- Roblox Corporation

- Decentraland

- Crypto.com

- Fortnite (Epic Games)

- Axie Infinity

- Coinbase

- OpenSea

- Unity Technologies

- Decentral Games

- Other Key Players

Recent Developments

- Rakuten Wallet and CALIVERSE: In August 2024, Rakuten Wallet partnered with CALIVERSE to expand their Web3 and metaverse businesses. The collaboration aims to integrate services like gaming, shopping, and live events into the metaverse using blockchain technology, aligning with Rakuten’s broader digital economy strategy.

- PUBG Publisher and Circle: In February 2024, Circle and PUBG publisher Krafton teamed up to introduce a Web3 wallet in Krafton’s metaverse game, Overdare. The wallet enables players and creators to earn and manage USDC, integrating digital currency into the gaming experience.

- Sony: In March 2024, Sony filed a patent for “super-fungible tokens” (SFTs) aimed at in-game assets, allowing for ownership, trading, and transfer across platforms. This innovative technology highlights Sony’s efforts to merge blockchain with gaming, offering more flexibility than traditional NFTs.

- OKX Wallet and Kava Network: In March 2024, OKX Wallet expanded its functionality by integrating with the Kava Network to offer DeFi services such as staking, lending, and liquidity pools. This partnership aims to diversify financial tools available to OKX users in the decentralized finance space.

Report Scope

Report Features Description Market Value (2023) USD 7.6 Billion Forecast Revenue (2033) USD 59.7 Billion CAGR (2024-2033) 22.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Desktop Wallets, Mobile Wallets, Web Wallets, Hybrid Wallets), By End-User (Individual, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Meta, Roblox Corporation, Decentraland, Crypto.com, Fortnite (Epic Games), Axie Infinity, Coinbase, OpenSea, Unity Technologies, Decentral Games, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Metaverse Wallets MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Metaverse Wallets MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Meta

- Roblox Corporation

- Decentraland

- Crypto.com

- Fortnite (Epic Games)

- Axie Infinity

- Coinbase

- OpenSea

- Unity Technologies

- Decentral Games

- Other Key Players