Global Metal Matrix Composites Market By Matrix Type (Aluminum MMC, Copper MMC, Magnesium MMC, Super Alloys MMC, Others), By Reinforcement Type (Continuous, Discontinuous, Particles), By Reinforcement Material (Alumina, Silicon Carbide, Carbon Fiber, Others), By End-Use (Automotive And Transportation, Aerospace And Defense, Electrical And Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151023

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

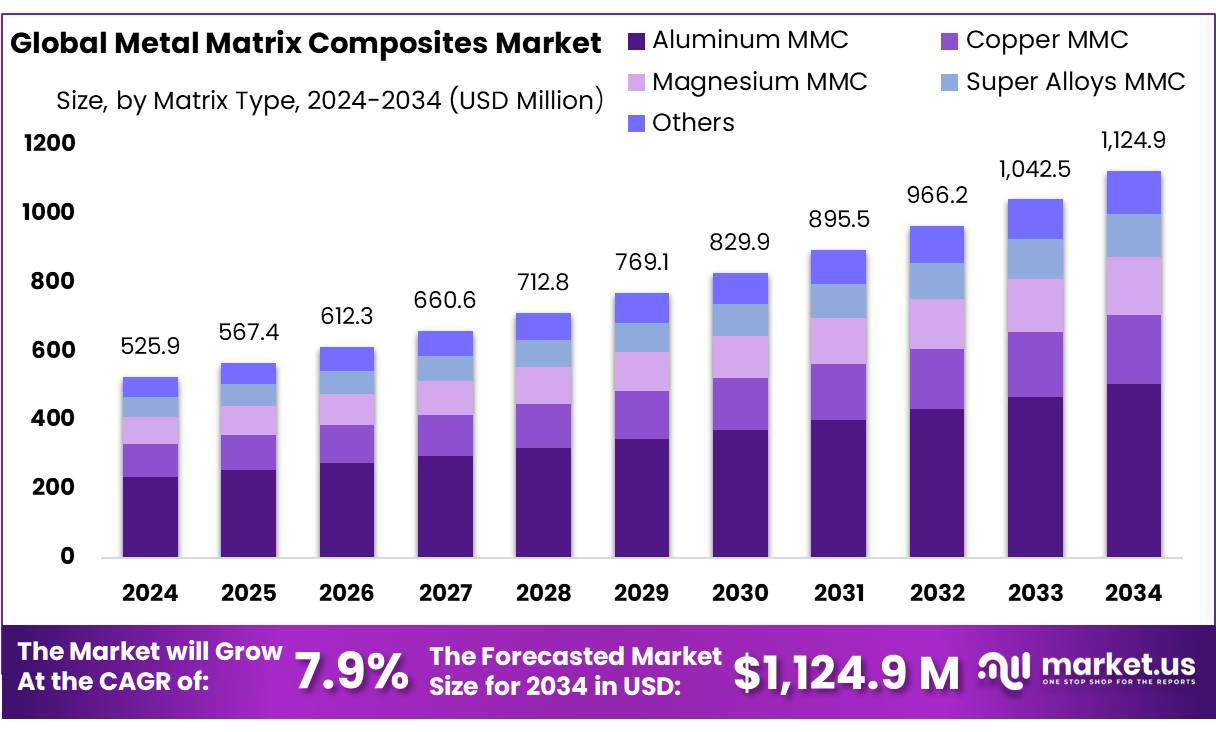

The Global Metal Matrix Composites Market size is expected to be worth around USD 1124.9 Million by 2034, from USD 525.9 Million in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034.

The introduction to MMCs emphasizes their composition a lightweight metal matrix such as aluminum, magnesium or titanium, reinforced with ceramic fibers, particulates, or whiskers. This combination delivers enhanced strength-to-weight ratios, thermal stability, and wear resistance compared to monolithic alloys.

Historically, early MMCs were explored by NASA and the U.S. Department of Defense (DoD) during the 1960s and 1970s for aerospace applications, including boron/aluminum filament composites used in the Space Shuttle structure. Today, a broader adoption across industrial domains is evident, underscoring the foundational role of MMCs in high-performance engineering.

Key driving factors include escalating demand for lightweight yet durable materials across automotive, aerospace, defense, electronics, and industrial sectors. For instance, MMC integration in automotive components contributes to lighter vehicles and improved energy efficiency, directly aligning with global carbon reduction targets. The U.S. ManTech Composites Institute—a consortium of over 120 members across industry, academia, and government—supports MMC advancement through DoD-funded innovation platforms.

In India, the Defence Research & Development Organisation (DRDO)—with a budget nearing INR 5.94 lakh crore (2023–24)—actively supports domestic R&D into advanced materials like MMCs. Moreover, India’s defence manufacturing output surpassed ₹1.27 lakh crore (FY 2023-24), a significant 60% increase from FY 2019 20, indicating growth in in-house demand for high-performance composites

Government agencies are actively funding R&D and manufacturing scale-up for MMC and related materials. In the U.S., the Department of Energy (DOE) allocated USD 30 million in February 2023 through its Advanced Materials & Manufacturing Technologies Office to support domestic production of lightweight composites, including MMCs. Later, in mid 2024, DOE awarded USD 136 million to support 66 projects targeting energy-efficient industrial technologies and critical materials. Moreover, the National Nanotechnology Initiative fosters cross-agency funding relevant to MMCs via nanoscale material development.

Key Takeaways

- Metal Matrix Composites Market size is expected to be worth around USD 1124.9 Million by 2034, from USD 525.9 Million in 2024, growing at a CAGR of 7.9%.

- Aluminum MMC held a dominant market position, capturing more than a 44.9% share in the global metal matrix composites market.

- Discontinuous held a dominant market position, capturing more than a 51.4% share in the global metal matrix composites market.

- Silicon Carbide held a dominant market position, capturing more than a 45.6% share in the metal matrix composites market.

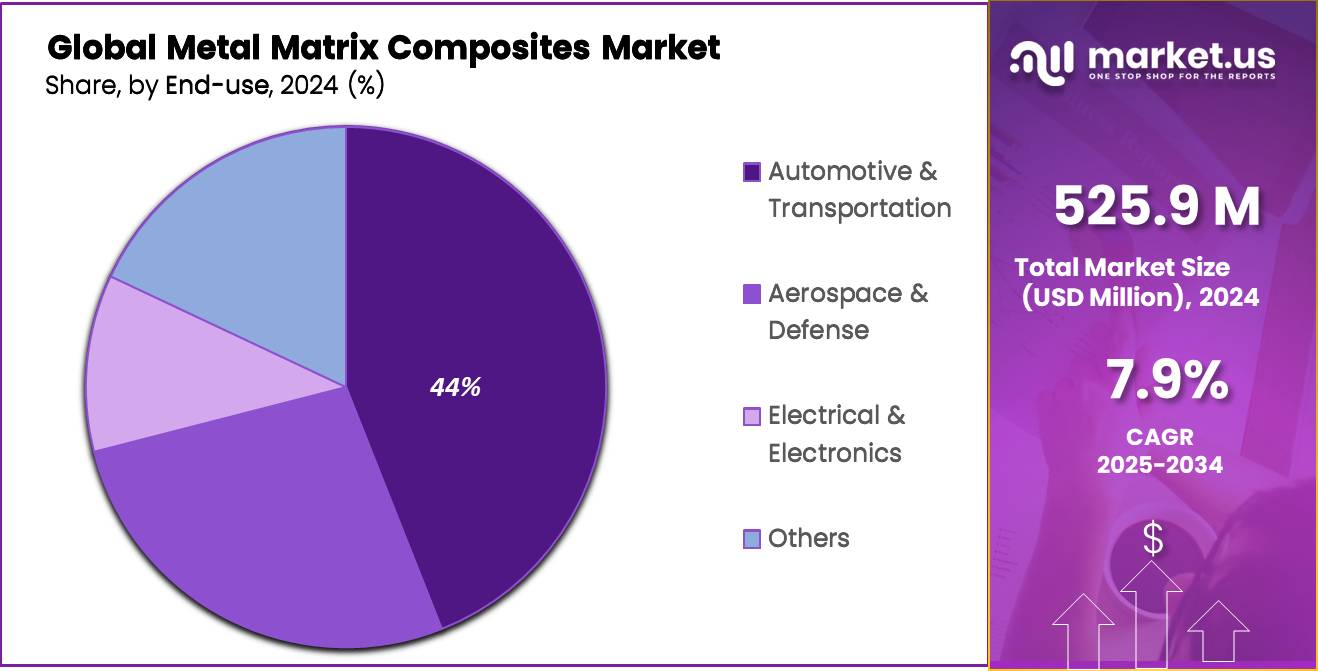

- Automotive & Transportation held a dominant market position, capturing more than a 44.3% share in the global metal matrix composites market.

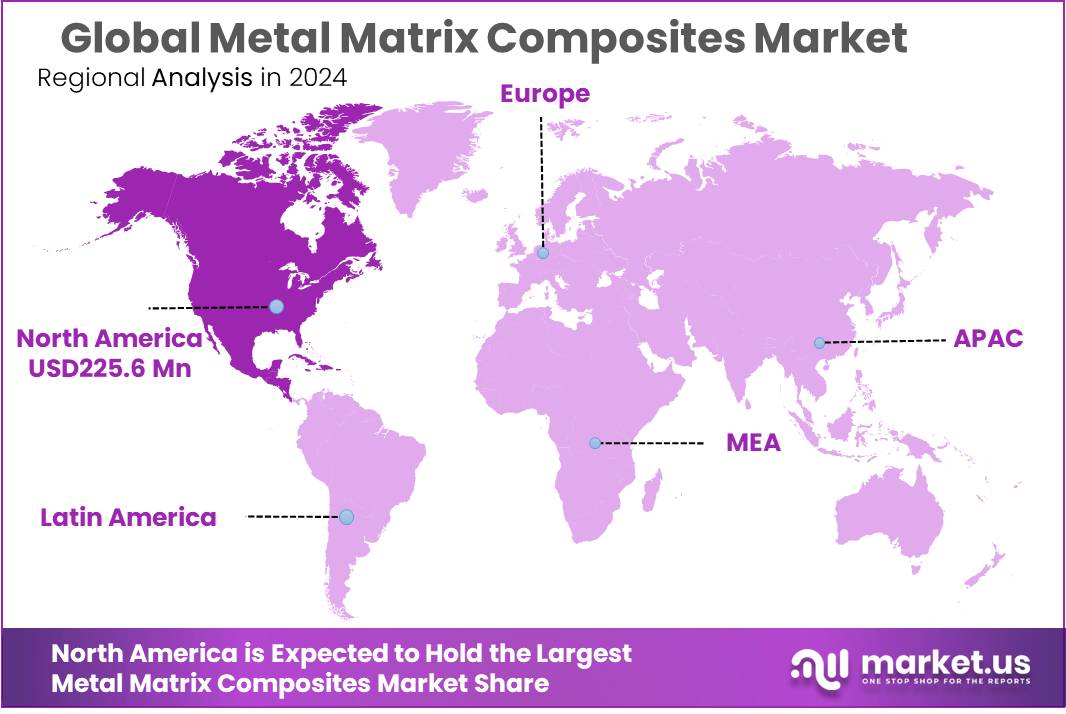

- North America led the global Metal Matrix Composites (MMC) market, capturing a substantial 42.9% share, equivalent to approximately USD 225.6 million.

By Matrix Type

Aluminum MMC dominates with 44.9% share due to its light weight and high strength balance

In 2024, Aluminum MMC held a dominant market position, capturing more than a 44.9% share in the global metal matrix composites market. This strong lead is driven by its lightweight nature, excellent thermal conductivity, and superior corrosion resistance, making it ideal for use in high-performance automotive, aerospace, and electronics components. The combination of aluminum with ceramic reinforcements like silicon carbide or alumina provides a significant improvement in wear resistance and mechanical strength without compromising the ease of fabrication.

Industries are increasingly turning to aluminum-based MMCs to meet fuel efficiency and emissions regulations while maintaining component durability. Moreover, as electric vehicles and renewable energy systems continue to grow in 2025, the use of aluminum MMCs in battery enclosures, heat sinks, and structural parts is expected to rise steadily. The cost-efficiency of aluminum alloys and their compatibility with powder metallurgy and casting techniques further contribute to the sustained demand across global markets.

By Reinforcement Type

Discontinuous Reinforcement leads with 51.4% share owing to cost-efficiency and easier processing

In 2024, Discontinuous held a dominant market position, capturing more than a 51.4% share in the global metal matrix composites market by reinforcement type. This segment includes short fibers, whiskers, and particulates—materials that are easier to produce and integrate into matrix metals compared to continuous fibers. Discontinuous reinforcements are widely used in automotive and industrial components where moderate strength improvements are needed without the high costs associated with continuous reinforcements. Their uniform distribution within the matrix helps enhance stiffness, wear resistance, and thermal performance, especially in aluminum-based MMCs.

In 2025, their adoption is expected to rise further due to their compatibility with mass-production methods like powder metallurgy and casting, which align well with scaling demands in electric vehicles and lightweight machinery. The cost-effectiveness, simpler fabrication process, and mechanical reliability offered by discontinuous reinforcements continue to make them the preferred choice across various industrial applications.

By Reinforcement Material

Silicon Carbide leads with 45.6% share due to its superior hardness and thermal stability

In 2024, Silicon Carbide held a dominant market position, capturing more than a 45.6% share in the metal matrix composites market by reinforcement material. Its popularity is largely driven by its exceptional mechanical properties, including high hardness, low thermal expansion, and excellent thermal conductivity. These qualities make it especially valuable in industries like aerospace, automotive, and electronics, where components must withstand high temperatures and mechanical stress.

Silicon carbide is most commonly used in aluminum-based MMCs, improving wear resistance, load-bearing capacity, and dimensional stability. As industries continue shifting toward lighter and more durable materials in 2025, the demand for silicon carbide-reinforced composites is expected to remain strong. Additionally, its ability to improve fuel efficiency and reduce emissions in vehicles further boosts its use in engine parts, brake discs, and structural components. The availability of silicon carbide powders and the maturity of processing techniques like stir casting and powder metallurgy make it a practical and scalable choice for manufacturers.

By End-Use

Automotive & Transportation leads with 44.3% share driven by lightweight and fuel-efficient design needs

In 2024, Automotive & Transportation held a dominant market position, capturing more than a 44.3% share in the global metal matrix composites market by end-use. The growing demand for lightweight, high-performance components in vehicles has significantly contributed to this leadership. Metal matrix composites, especially those reinforced with silicon carbide or alumina, offer superior strength-to-weight ratios and thermal conductivity, making them ideal for brake rotors, drive shafts, pistons, and other powertrain elements.

These materials also extend the lifespan of critical components under high load and temperature conditions. The ease of integrating MMCs through existing fabrication methods further supports their widespread use in both traditional internal combustion engine vehicles and next-generation electric mobility platforms.

Key Market Segments

By Matrix Type

- Aluminum MMC

- Copper MMC

- Magnesium MMC

- Super Alloys MMC

- Others

By Reinforcement Type

- Continuous

- Discontinuous

- Particles

By Reinforcement Material

- Alumina

- Silicon Carbide

- Carbon Fiber

- Others

By End-Use

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Others

Drivers

Increasing Demand for Lightweight and High-Performance Materials in Aerospace and Automotive Sectors

The growing need for lightweight, high-performance materials in the aerospace and automotive sectors is a major driving factor for the Metal Matrix Composites (MMC) market. In the aerospace industry, materials that provide enhanced strength, durability, and reduced weight are crucial for improving fuel efficiency, operational performance, and overall cost-effectiveness of aircraft. Similarly, in the automotive industry, there is an increasing demand for components that offer both lightness and strength, contributing to improved fuel efficiency, reduced emissions, and better overall performance.

In 2022, the global aerospace industry saw a rise in the adoption of advanced composites, including MMCs, to meet the stringent requirements for performance and fuel efficiency. This growth has directly influenced the demand for materials like MM composites, which are increasingly being used in both commercial and military aviation applications.

Similarly, in the automotive sector, the growing shift towards electric vehicles (EVs) has further boosted the adoption of MMCs. These materials are ideal for reducing the weight of EVs, enhancing the efficiency of battery systems and increasing the driving range of electric vehicles. According to a report from the European Commission, the lightweighting of vehicles, especially through the use of advanced materials like MM composites, can contribute to a reduction in CO2 emissions by up to 15%.

Government initiatives supporting the development and adoption of lightweight materials are also fueling the market. For instance, the U.S. Department of Energy’s lightweight materials research program aims to improve the efficiency of materials used in automotive manufacturing, which has encouraged the integration of MM composites in vehicle production.

Restraints

High Production Costs and Complexity

One significant restraining factor for the Metal Matrix Composites (MMC) market is the high production costs and complex manufacturing processes associated with these materials. While MM composites offer superior strength, durability, and lightweight properties, their production is significantly more expensive compared to traditional materials like steel and aluminum. The high cost is primarily due to the specialized raw materials required, complex processing techniques such as powder metallurgy, and the need for advanced equipment for fabrication.

For example, the automotive industry has faced challenges in adopting MMCs in mass production due to the higher initial cost of components made from these materials. According to a study by the European Commission, the cost of producing advanced composite materials can be up to 10 times higher than traditional metal components. This is particularly challenging for industries like automotive and aerospace, where cost efficiency is critical for large-scale production and competitive pricing.

In the food packaging sector, which also utilizes MMCs for specialized applications, the production of these materials incurs substantial costs related to sourcing raw materials such as silicon carbide or aluminum oxide. These materials are not only expensive but also require high-energy-consuming processes to manufacture, further driving up costs. The high price tag associated with MMCs is a significant barrier for companies in the food packaging industry, where cost-effectiveness and sustainability are top priorities.

Opportunity

Expansion of Metal Matrix Composites in the Electric Vehicle (EV) Market

A significant growth opportunity for the Metal Matrix Composites (MMC) market lies in their increasing application in the electric vehicle (EV) industry. As global demand for electric vehicles continues to rise, the automotive sector is seeking innovative materials to enhance vehicle performance, reduce weight, and improve energy efficiency. MMCs are well-suited for these purposes due to their high strength-to-weight ratio, thermal conductivity, and ability to withstand high temperatures.

In 2023, global electric vehicle sales surpassed 10 million units, accounting for approximately 14% of the global automotive market share. The International Energy Agency (IEA) has forecasted that EV sales could reach around 30% of total vehicle sales by 2030, signaling robust growth in this sector. This rapid adoption presents a huge opportunity for the integration of MMCs in EV manufacturing, especially in critical components such as battery casings, motor housings, and heat exchangers.

Governments worldwide are also supporting the transition to electric vehicles with policies such as tax incentives, subsidies, and infrastructure investments. For example, the U.S. Department of Energy has introduced several initiatives aimed at accelerating the adoption of advanced materials in EV manufacturing. In addition, the European Union’s Green Deal aims to reduce carbon emissions by at least 55% by 2030, further pushing the need for lightweight, energy-efficient materials in the automotive sector, including MMCs.

Trends

Adoption of Additive Manufacturing in Metal Matrix Composites

A notable trend in the Metal Matrix Composites (MMC) market is the increasing adoption of additive manufacturing (AM), commonly known as 3D printing, for producing complex MMC structures. This advancement is transforming industries by enabling the creation of intricate, lightweight components with enhanced mechanical properties.

Additive manufacturing allows for precise control over the distribution of reinforcement materials within the metal matrix, resulting in components that are tailored to specific performance requirements. This capability is particularly beneficial in sectors like aerospace and automotive, where the demand for customized parts with optimized strength-to-weight ratios is high.

For instance, companies like CPS Technologies are utilizing AM techniques to produce MMC components such as propulsion system parts, landing gear struts, and thermal protection systems. These components benefit from improved thermal conductivity and wear resistance, which are critical in high-performance applications.

The integration of AM in MMC production also contributes to sustainability efforts by reducing material waste and energy consumption compared to traditional manufacturing methods. As industries continue to prioritize environmental considerations, the adoption of AM for MMCs aligns with the broader trend of sustainable manufacturing practices.

Regional Analysis

North America dominates with 42.9% share and USD 225.6 million value, driven by aerospace and automotive demand

In 2024, North America led the global Metal Matrix Composites (MMC) market, capturing a substantial 42.9% share, equivalent to approximately USD 225.6 million in market value. This regional dominance is propelled by strong demand from aerospace, automotive, and electronics sectors in the United States and Canada

North America’s strength in aerospace applications is well documented. MMCs are used in aircraft brake systems, landing gear, spacecraft components, and high-performance electronic heat sinks—all critical to flight safety and efficiency. In the automotive sector, MMCs are increasingly incorporated into brake rotors, engine pistons, and structural parts, particularly as electric vehicle production ramps up and manufacturers seek lighter vehicle designs

Government support also plays a significant role. The U.S. Department of Energy’s initiatives to fund lightweight composite materials for energy efficiency and defense applications, and Canada’s R&D tax incentives for advanced manufacturing, create a favorable environment for MMC development.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M’s Advanced Metal Matrix Composite (AMMC) technology blends aluminum with boron carbide to produce high density neutron absorbers featuring excellent clad-to-core bonding and near-zero porosity. Produced entirely in-house at 3M Technical Ceramics, these composites support nuclear and defense applications where reliability under extreme conditions is essential. AMMCs demonstrate superior thermal conductivity and robust structural integrity, making them well-suited for constrained environments and critical safety systems.

ADMA Products specializes in titanium-based MMCs, using powder metallurgy to embed ceramic particles within Ti 6Al 4V alloys. These composites offer enhanced stiffness, wear resistance, and creep performance, matching or surpassing conventionally forged titanium in mechanical strength. ADMA’s 27-foot extrusions of Ti 6Al 4V reflect its manufacturing capabilities, which support high-spec aerospace, defense, and industrial applications—while also aiming to reduce material cost through blended element powder processing.

CeramTec produces tailored MMC preforms using aluminum alloys reinforced with 35–70% ceramic content. This flexibility allows precise control over mechanical and thermal characteristics, useful in high-stress zones like aircraft components, brake discs, antenna waveguides, and satellite parts. The company’s expertise in fine-machining ceramics ensures smooth finishes and consistent composite performance across demanding tribological and thermal-load environments.

Top Key Players in the Market

- 3M

- ADMA Products Inc.

- Ceram Tec

- CPS Technologies Corporation

- Denka Company Limited

- Destsce Edelstaslwerke GmbH

- Ferrotec Corporation

- Materion Corporation

- MTC Powder Solutions AB

- Plansee Group

- Sumitomo Electric Industries Ltd

- Thermal Transfer Composites LLC

- TISICS Ltd

Recent Developments

In 2024, CeramTec GmbH, headquartered in Germany, achieved EUR 746 million in revenue and employed around 3,750 professionals across its global sites.

In 2025, CPS Technologies Corporation (NASDAQ: CPSH) achieved record revenue of $7.5 million, marking a return to profitability with a net income of $0.1 million.

Report Scope

Report Features Description Market Value (2024) USD 525.9 Mn Forecast Revenue (2034) USD 1124.9 Mn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Matrix Type (Aluminum MMC, Copper MMC, Magnesium MMC, Super Alloys MMC, Others), By Reinforcement Type (Continuous, Discontinuous, Particles), By Reinforcement Material (Alumina, Silicon Carbide, Carbon Fiber, Others), By End-Use (Automotive And Transportation, Aerospace And Defense, Electrical And Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, ADMA Products Inc., Ceram Tec, CPS Technologies Corporation, Denka Company Limited, Destsce Edelstaslwerke GmbH, Ferrotec Corporation, Materion Corporation, MTC Powder Solutions AB, Plansee Group, Sumitomo Electric Industries Ltd, Thermal Transfer Composites LLC, TISICS Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Metal Matrix Composites MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Metal Matrix Composites MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- ADMA Products Inc.

- Ceram Tec

- CPS Technologies Corporation

- Denka Company Limited

- Destsce Edelstaslwerke GmbH

- Ferrotec Corporation

- Materion Corporation

- MTC Powder Solutions AB

- Plansee Group

- Sumitomo Electric Industries Ltd

- Thermal Transfer Composites LLC

- TISICS Ltd