Global Mesquite Flour Market By Type(Raw, Roasted), By Form(Organic, Conventional), By End User(Households, Food and Beverages Industry, Food Service Industry, Others), By Distribution Channel(Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132242

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

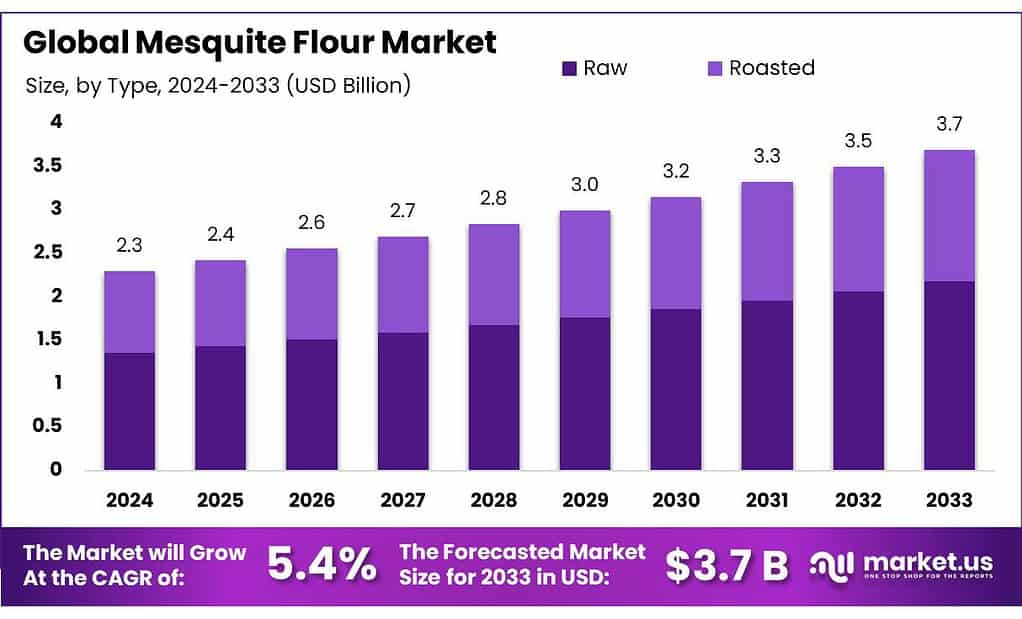

The Global Mesquite Flour Market size is expected to be worth around USD 3.7 Bn by 2033, from USD 2.3 Bn in 2023, growing at a CAGR of 5.4% during the forecast period from 2024 to 2033.

Mesquite flour, made from the pods of the Prosopis glandulosa tree, is a nutrient-rich, gluten-free flour with a growing presence in the specialty flour market. Native to the arid regions of the southwestern U.S. and northern Mexico, mesquite flour is prized for its high protein content and low glycemic index, making it an attractive option for health-conscious consumers. As global interest in alternative flours rises, mesquite flour has positioned itself as a versatile ingredient in a wide array of food applications.

The global specialty flour market is expanding rapidly, with U.S. exports reaching approximately $1 billion in 2023. This growth highlights the increasing demand for innovative and healthier flour alternatives in international markets.

In addition to exports, U.S. imports of specialty flours totaled around $600 million in 2023, driven by a surge in demand for gluten-free options like mesquite flour. This trend reflects changing consumer preferences and highlights the opportunity for domestic and international suppliers to capitalize on this growing market segment.

India, a key player in the global flour market, exported $1.2 billion worth of wheat and specialty flours in 2023. While specific data on mesquite flour is not available, India’s shift towards producing healthier flour alternatives suggests significant potential for expansion in this niche. Meanwhile, Australia has experienced a steady 20% annual increase in mesquite flour imports, fueled by growing consumer interest in native and sustainable ingredients.

Private investments are also playing a crucial role in advancing the mesquite flour industry. A recent funding round raised $5 million to support a startup focused on sustainable mesquite harvesting and processing, emphasizing the industry’s commitment to scaling production and meeting rising consumer demand. These developments highlight mesquite flour’s growing importance in the global specialty flour market and its potential for long-term growth.

Key Takeaways

- Mesquite Flour Market size is expected to be worth around USD 3.7 Bn by 2033, from USD 2.3 Bn in 2023, growing at a CAGR of 5.4%.

- Raw Mesquite Flour held a dominant market position, capturing more than a 59.2% share.

- Organic Mesquite Flour held a dominant market position, capturing more than a 62.4% share.

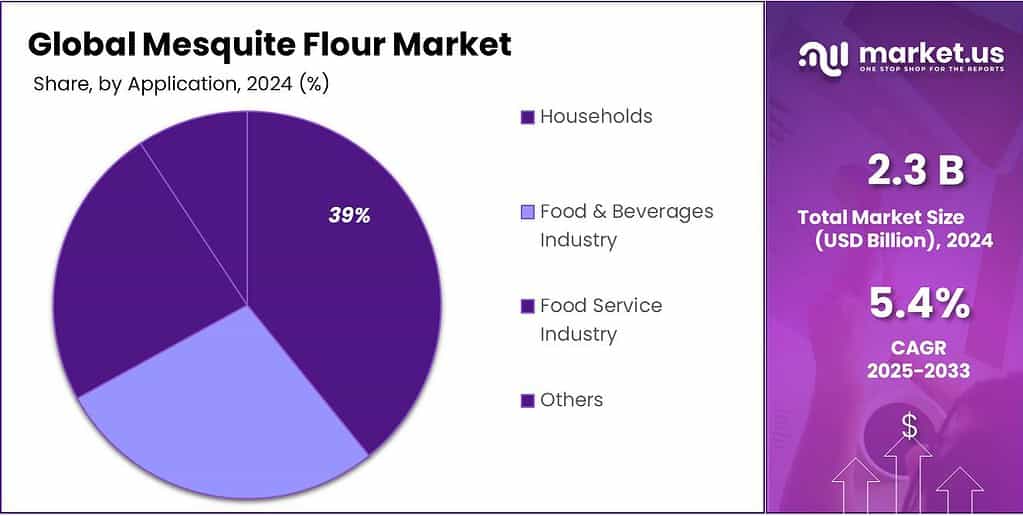

- Households held a dominant market position in the mesquite flour market, capturing more than a 38.3% share.

- Supermarkets/Hypermarkets held a dominant market position in the distribution of mesquite flour, capturing more than a 37.1% share.

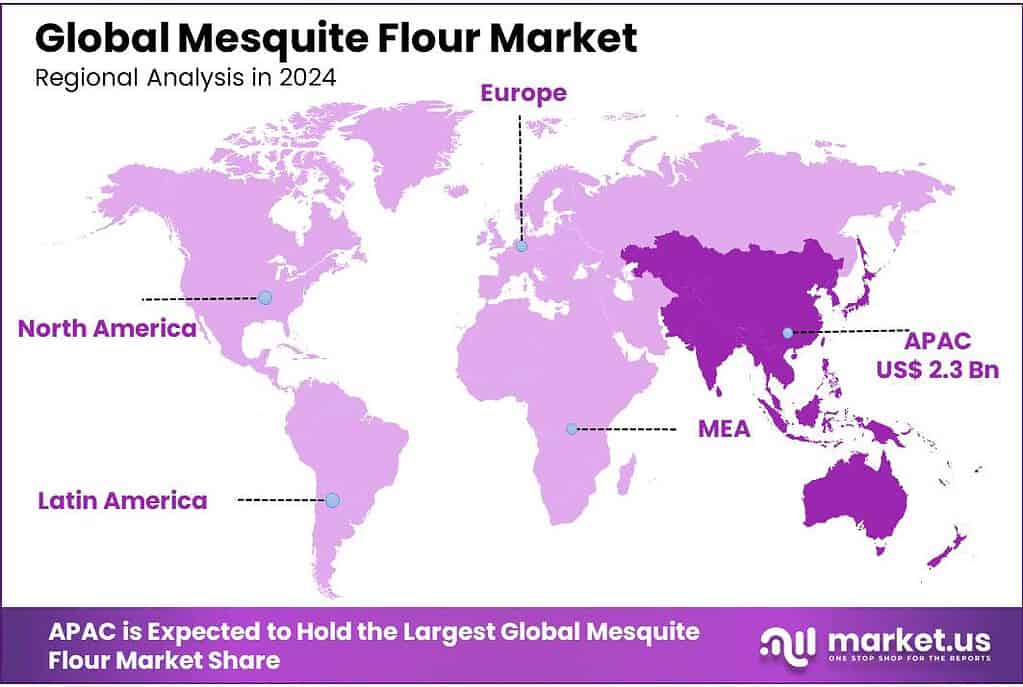

- Asia Pacific (APAC) is currently the dominating region in the mesquite flour market, holding a 39% share with a market valuation of USD 0.93 billion.

By Type

In 2023, Raw Mesquite Flour held a dominant market position, capturing more than a 59.2% share. This type of mesquite flour is preferred for its natural flavor and nutritional benefits, as it retains all the natural enzymes and nutrients found in the mesquite pod.

Consumers opt for raw mesquite flour primarily for its health benefits, including a high fiber content and a low glycemic index, which makes it a popular choice among those seeking healthier baking alternatives. Its subtle sweetness and ability to enhance the flavor profiles of various baked goods without overpowering them also contribute to its widespread popularity.

Roasted Mesquite Flour, while holding a smaller market share, is valued for its richer and more intense flavor. This variety undergoes a roasting process that deepens its taste, making it a favored ingredient in recipes that require a stronger mesquite presence.

Roasted mesquite flour is particularly popular in specialty baking and gourmet cooking where its distinctive flavor can stand out, enhancing everything from breads to barbecue rubs. Despite its smaller share, the demand for roasted mesquite flour continues to grow as culinary enthusiasts and chefs seek out unique and flavorful ingredients.

By Form

In 2023, Organic Mesquite Flour held a dominant market position, capturing more than a 62.4% share. This segment’s popularity is largely driven by the growing consumer demand for organic and natural food products, reflecting a broader trend towards healthier and more sustainable dietary choices.

Organic mesquite flour is processed without the use of synthetic chemicals or pesticides, appealing to health-conscious consumers who prioritize clean eating. Its benefits are not only limited to health but also extend to environmental sustainability, which resonates well with today’s eco-aware shoppers.

Conventional Mesquite Flour, while holding a smaller portion of the market, remains significant due to its affordability and availability. It is produced in larger quantities using traditional farming methods and is a staple in many households and businesses that value cost-effectiveness over organic certification.

Although it occupies a lesser share compared to organic, conventional mesquite flour continues to be a practical choice for consumers not strictly following organic diets, offering the distinct sweet, nutty flavor of mesquite at a more accessible price point.

By End User

In 2023, Households held a dominant market position in the mesquite flour market, capturing more than a 38.3% share. This segment’s strong performance is attributed to the increasing popularity of mesquite flour as a gluten-free and nutritious alternative to traditional wheat flour.

Households are turning to mesquite flour for its health benefits, such as high fiber content and low glycemic index, which are particularly appealing to health-conscious consumers and those managing dietary restrictions. The flour’s unique flavor profile, which adds a sweet, nutty taste to baked goods, also contributes to its widespread use in home cooking and baking.

The Food & Beverages Industry also constitutes a significant portion of the market, utilizing mesquite flour in a variety of products ranging from breads and pastries to beverages. This industry values mesquite flour for its ability to enhance flavors and its appeal as a natural and healthy ingredient.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position in the distribution of mesquite flour, capturing more than a 37.1% share. This channel’s prominence is largely due to its wide reach and the ability to offer a diverse range of products under one roof, making it convenient for consumers to access mesquite flour along with other grocery items. Supermarkets and hypermarkets typically provide a variety of mesquite flour options, including both organic and conventional forms, catering to a broad customer base.

Convenience Stores also play a vital role, especially in urban areas where quick shopping trips are common. These stores offer mesquite flour on a smaller scale, suitable for spontaneous purchases or immediate needs without the variety or volume found in larger stores.

Specialty Stores are crucial for distributing mesquite flour, particularly catering to health-conscious consumers looking for organic and health-specific products. These stores often provide a curated selection that appeals to niche markets interested in unique and dietary-specific ingredients.

Online Stores have seen significant growth in the distribution of mesquite flour, driven by the convenience of home delivery and the availability of wide-ranging products not always available in brick-and-mortar stores. This channel’s growth is further amplified by the increasing consumer preference for online shopping.

Key Market Segments

By Type

- Raw

- Roasted

By Form

- Organic

- Conventional

By End User

- Households

- Food & Beverages Industry

- Food Service Industry

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Driving Factors

Rising Popularity of Plant-Based Diets

The global trend towards plant-based and vegan lifestyles significantly fuels the demand for mesquite flour, known for its high protein content and suitability in meatless meal preparations. As awareness and adoption of these diets increase, so does the consumption of mesquite flour, making it a staple in health-conscious households.

Nutritional Benefits and Dietary Shifts

Mesquite flour is rich in protein, fiber, and essential minerals, catering to the growing consumer preference for nutritious and health-enhancing foods. This aligns well with the rising demand for gluten-free and nutrient-dense food options, driving mesquite flour’s popularity among those with dietary restrictions and the health-focused public.

Sustainability and Environmental Impact

Consumers are increasingly favoring sustainable and ethically produced foods. Mesquite flour is produced from trees that thrive in arid conditions, requiring minimal water, which promotes sustainable agriculture practices. This aspect is particularly appealing in regions prone to drought, where sustainable farming practices are essential.

Culinary Flexibility and Flavor Profile

The unique, slightly sweet, and nutty flavor profile of mesquite flour enhances its versatility in culinary applications, making it a favored ingredient in both savory and sweet dishes. Its ability to be used in baking, smoothies, and as a natural sweetener expands its use across various culinary domains.

Growing Interest in Indigenous and Traditional Foods

There is a notable trend towards rediscovering and integrating indigenous foods into modern diets. Mesquite flour, with its roots in the culinary heritage of the Southwestern United States and parts of Mexico, benefits from this trend as consumers seek authentic and traditional food experiences.

Restraining Factors

Limited Supply and High Production Costs

One of the primary constraints on the mesquite flour market is the limited supply of mesquite trees, which are native only to certain geographic areas. This limited availability can make scaling up production challenging and costly. The unique growing requirements and the specialized process needed to turn mesquite pods into flour add to the production costs, making mesquite flour more expensive compared to more readily available flours like wheat or millet. These factors restrict accessibility and affordability for a broader consumer base.

Consumer Unfamiliarity

Another significant barrier is the general unfamiliarity with mesquite flour among consumers worldwide. Many potential buyers are hesitant to try mesquite flour due to a lack of awareness about its taste and culinary uses. This unfamiliarity can deter first-time buyers, slowing market penetration and growth.

Competition from Other Flour Alternatives

Mesquite flour also faces intense competition from a range of established gluten-free and grain-free alternatives, such as almond and coconut flour. These alternatives already have strong market presences and are often preferred by consumers due to their established reputations and widespread availability.

Growth Opportunity

Expansion in Health-Conscious Markets

Health and wellness are increasingly becoming priorities for consumers around the globe, and mesquite flour’s low glycemic index and high dietary fiber content make it an attractive option. The global health trend towards gluten-free and low-carb diets is particularly beneficial for mesquite flour, with the market projected to grow significantly.

Innovative Food Applications

Mesquite flour is being recognized for its versatility in various culinary applications, from baking to flavoring. Its sweet, nutty flavor enhances the profile of bread, pancakes, and even beverages. As the food industry continues to innovate, mesquite flour can be incorporated into a wider range of products, thus expanding its market reach. Manufacturers are looking to explore new product lines that cater to both taste and health, providing ample opportunities for mesquite flour’s incorporation.

Geographical Market Expansion

While traditionally popular in North America, particularly in the southwestern regions, mesquite flour has potential for significant growth in other regions as well. The Asia-Pacific market, for instance, is seeing a surge in demand for natural and organic food products, which presents a lucrative opportunity for mesquite flour. The market in this region is particularly ripe for development, with a strong interest in sustainable and eco-friendly food sources.

Latest Trends

Increasing Demand for Gluten-Free and Plant-Based Products

There’s a significant shift towards gluten-free and plant-based diets, driven by health consciousness and dietary restrictions. Mesquite flour, inherently gluten-free and high in protein, aligns perfectly with this trend. It offers a nutritious alternative to traditional flours, appealing to a broad consumer base looking for healthful food options. The market for gluten-free products continues to expand, with mesquite flour expected to play a pivotal role in this sector.

Focus on Sustainable and Eco-Friendly Ingredients

Sustainability is becoming a critical factor in consumer purchasing decisions. Mesquite trees, from which the flour is derived, are drought-resistant and contribute positively to the ecological balance, making mesquite flour a sustainable choice. This attribute is increasingly marketed to environmentally conscious consumers, highlighting the low water requirement and the beneficial impact of mesquite cultivation on arid and semi-arid ecosystems.

Culinary Innovation and Diverse Applications

Mesquite flour is gaining popularity not only for its health benefits but also for its unique flavor profile, which adds a sweet, nutty taste to baked goods. Its versatility is being explored in various culinary innovations ranging from bakery products to barbecue seasonings and gourmet snacks. As chefs and home cooks alike seek new flavors and textures, mesquite flour is finding its way into a wider array of dishes, enhancing its marketability and consumer appeal.

Regional Analysis

Asia Pacific (APAC) is currently the dominating region in the mesquite flour market, holding a 39% share with a market valuation of USD 0.93 billion. This leadership is driven by increasing health awareness and rising consumer spending on natural and organic food products in countries like China, India, and Australia.

The region’s robust growth is fueled by the expanding middle class, which is keen on adopting healthier lifestyle choices. Additionally, APAC’s vast agricultural sector provides ample opportunities for integrating mesquite cultivation and flour production into local economies, supporting sustainable agricultural practices.

North America follows closely, where mesquite flour has its roots in the traditional diets of indigenous peoples, particularly in the southwestern United States. The market in this region benefits from the growing trend towards gluten-free and plant-based diets, with mesquite flour being utilized in various health-oriented food applications. The U.S. and Canada are significant contributors, with consumers increasingly seeking out mesquite flour for its nutritional benefits and unique flavor profile.

Europe is also seeing a rise in the demand for mesquite flour, particularly driven by the clean eating movement. European consumers are turning to mesquite flour as an alternative to traditional wheat flours, driven by its gluten-free property and sustainability appeal.

Latin America and the Middle East & Africa are emerging markets where mesquite flour is gaining popularity due to its environmental benefits, as these regions are prone to arid climates where mesquite trees thrive naturally. These areas are exploring mesquite flour not only for its health benefits but also as a means to combat soil erosion and promote sustainable land use.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Mesquite Flour market features a diverse array of players, ranging from small-scale local producers to more established brands that are expanding their presence in global health food markets. Key players like Arrowhead Mills and TERRASOUL SUPERFOODS are well-known in the natural and organic food sector, offering a range of gluten-free and sustainable products, including mesquite flour. These companies are recognized for their commitment to quality and sustainability, appealing to health-conscious consumers looking for nutritious baking alternatives.

Desert Harvesters and San Xavier Co-op Farm are examples of community-focused organizations that promote the use of native and traditional foods like mesquite. These players are crucial in educating consumers about the benefits of mesquite flour and its uses, thereby fostering a deeper connection to culturally significant foods and sustainable agriculture practices. Similarly, companies like Loving Earth and Lucero Organic Farms emphasize organic and eco-friendly products, which resonate well with global trends towards environmentally responsible consumption.

Smaller niche companies such as The Mesquitery and Food Conspiracy Co-op focus on local production and supply, which supports local economies and reduces the carbon footprint associated with long-distance food transport. On the other hand, brands like Z Natural Foods and Zint LLC extend their reach through online platforms, offering mesquite flour to a broader audience via e-commerce, which is becoming a vital sales channel in the food industry.

Top Key Players in the Market

- Alovitox

- Arrowhead Mills

- Casa de Mesquite

- Desert Harvesters

- Food Conspiracy Co-op.

- Loving Earth

- Lucero Organic Farms

- Mesquite Valley Growers

- MRM

- Native Seeds/SEARCH, and Skeleton

- San Xavier Co-op Farm

- TERRASOUL SUPERFOODS

- The Mesquitery

- The Source Bulk Food

- Z Natural Foods

- Zint LLC.

Recent Developments

In 2023 Alovitox focuses on catering to the growing demand for organic and natural food products. Their mesquite flour is appreciated for its nutritional benefits, such as high fiber and protein content, which aligns well with the global shift towards healthier, plant-based diets.

In 2023 Arrowhead Mills focuses on providing high-quality, sustainably sourced mesquite flour that appeals to health-conscious consumers who are increasingly looking for products that support a healthy lifestyle without compromising on taste or quality.

Report Scope

Report Features Description Market Value (2023) USD 2.3 Bn Forecast Revenue (2033) USD 3.7 Bn CAGR (2024-2033) 5.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Raw, Roasted), By Form(Organic, Conventional), By End User(Households, Food and Beverages Industry, Food Service Industry, Others), By Distribution Channel(Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alovitox, Arrowhead Mills, Casa de Mesquite, Desert Harvesters, Food Conspiracy Co-op., Loving Earth, Lucero Organic Farms, Mesquite Valley Growers, MRM, Native Seeds/SEARCH, and Skeleton, San Xavier Co-op Farm, TERRASOUL SUPERFOODS, The Mesquitery, The Source Bulk Food, Z Natural Foods, Zint LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alovitox

- Arrowhead Mills

- Casa de Mesquite

- Desert Harvesters

- Food Conspiracy Co-op.

- Loving Earth

- Lucero Organic Farms

- Mesquite Valley Growers

- MRM

- Native Seeds/SEARCH, and Skeleton

- San Xavier Co-op Farm

- TERRASOUL SUPERFOODS

- The Mesquitery

- The Source Bulk Food

- Z Natural Foods

- Zint LLC.