Global Menopause Treatment Market Analysis By Product Type (Hormone Replacement Therapy (HRT), Non-Hormonal Treatments, Vaginal Estrogen Products, Herbal Supplements, OTC Products), By Route of Administration (Oral, Transdermal, Vaginal, Injectables), By End-User (Hospitals & Clinics, Home Care, Gynecology Centers, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163184

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

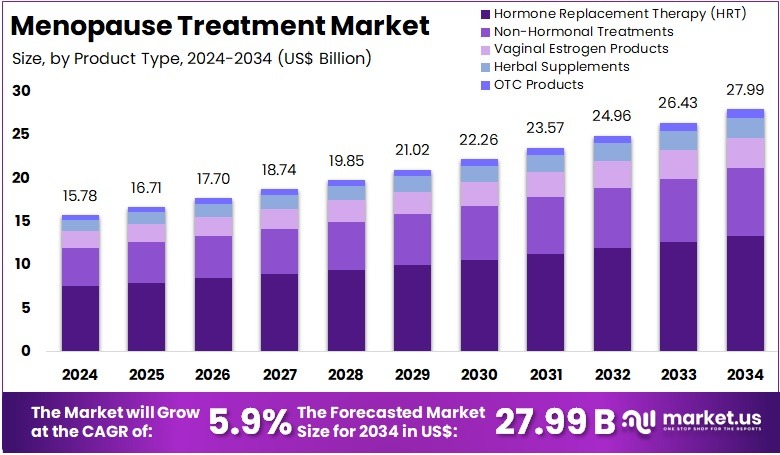

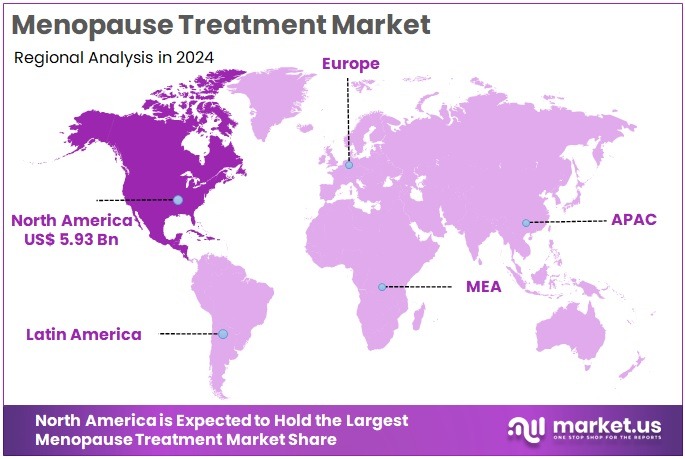

The Global Menopause Treatment Market size is expected to be worth around US$ 27.99 Billion by 2034, from US$ 15.78 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.6% share and holds US$ 5.93 Billion market value for the year.

Menopause treatment refers to medical and therapeutic solutions used to manage symptoms that occur during the transition when a woman’s menstrual cycle ends. These treatments may include hormone replacement therapy (HRT), non-hormonal drugs, supplements, and lifestyle changes. The aim is to reduce hot flashes, mood swings, sleep issues, and bone loss.

The menopause treatment market focuses on products and services developed for symptom relief and long-term health support. Market growth is driven by rising awareness, an increasing aging female population, and advancements in safe treatment options. The demand for personalized and natural therapies has also increased in recent years.

The first growth driver is population ageing. According to the World Health Organization (WHO), the global proportion of people aged 60 years or older will nearly double from 12% in 2015 to 22% by 2050. In addition, the WHO reports that in 2021, women aged 50 and over accounted for 26% of all women and girls globally — up from 22% a decade earlier. Since menopause typically occurs around the age of 45-55, these demographic trends mean a larger pool of women who may require treatment and care in the post‐menopausal phase.

Secondly, high prevalence and persistence of menopausal symptoms are driving demand. A global review published in 2024 found that “most menopause-related symptoms affected about 50% of middle-aged women”. In the United States, more than 1.3 million women enter menopause each year. Further, data from the Centers for Disease Control and Prevention (CDC) show that among U.S. women aged 40-59, 27.1% of post-menopausal women reported trouble falling asleep four or more times in a week, compared with 16.8% of pre-menopausal women. These data indicate significant symptom burden, which supports the need for effective treatment options.

Thirdly, improvements in clinical guidelines and treatment options are expanding the addressable market. For example, the average global age at natural menopause has been reported as 48.8 years, with a range from 47.2 years in Latin America to 51.3 years in Australia. In the U.S., the average age of menopause is about 51 years. With better understanding of symptom timelines and improved treatment pathways, uptake of therapies can improve, supporting market growth.

Fourthly, government policy and health-system initiatives are increasingly recognising menopause as a public health priority. For instance, the U.S. Senate has noted that roughly 6,000 women in the U.S. reach menopause each day. While this refers to the U.S., it signals the scale of public‐health interest. The growing policy recognition helps reduce barriers to care, thereby facilitating market growth.

Fifthly, innovations in non-hormonal therapies are broadening the treatment landscape, thus enabling demand from segments unable or unwilling to use traditional hormone therapy. Although specific numbers of users per product are not yet widely published in official health-organisation databases, the emergence of alternative therapies is noted in clinical literature and regulator announcements.

Finally, improved health-system access and awareness are reducing under-treatment. Although exact global statistics are limited, the literature notes that symptom recognition, service access, and provider education have historically lagged, but are improving. For instance, longitudinal analyses show associations between menopause and multiple age-related diseases — one study estimated that over 75% of age-related diseases may be influenced by menopause, emphasising the importance of treatment and care. As awareness increases, systems respond, and treatment uptake rises, the overall market expands.

Key Takeaways

- The global menopause treatment market is projected to grow from US$ 15.78 Billion in 2024 to approximately US$ 27.99 Billion by 2034, reflecting a 5.9% CAGR.

- Industry analysts indicated that hormone replacement therapy dominated product types in 2024, accounting for over 47.8% of the overall menopause treatment market share.

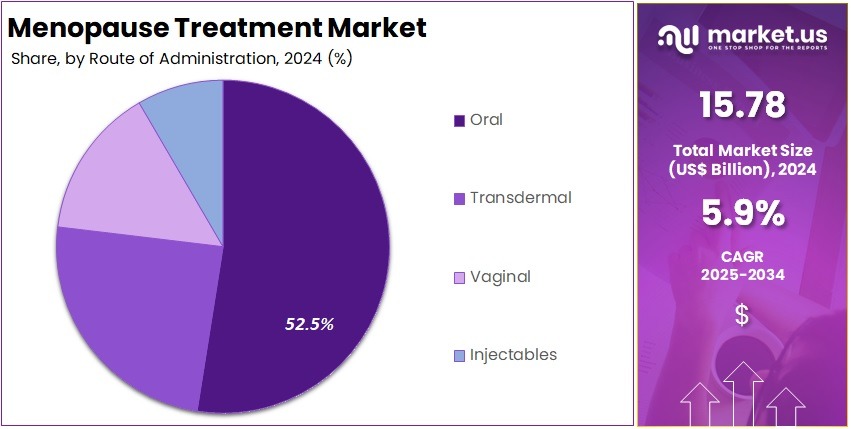

- It was observed that oral administration remained the leading route in 2024, capturing more than 52.5% market share within menopause care solutions.

- Reports showed hospitals and clinics were the primary end-users in 2024, contributing to over 49.9% demand for menopause-related therapies and treatments.

- North America maintained dominance in 2024, achieving a market share exceeding 37.6% and generating nearly US$ 5.93 Billion in revenue.

Product Type Analysis

In 2024, the Hormone Replacement Therapy (HRT) Section held a dominant market position in the Product Type Segment of Menopause Treatment Market, and captured more than a 47.8% share. This leadership is credited to strong clinical effectiveness in controlling major symptoms. Analysts state that rising awareness led to higher patient adoption. A larger number of women transitioning into menopause supported consistent demand. Healthcare professionals continued recommending HRT as a reliable option. New dosage forms and safer delivery systems also improved market penetration. The segment remains a major revenue contributor.

Non hormonal treatments maintained a notable share in the market. These products are suitable for patients who cannot take hormones. The growing preference for safer and well tolerated therapies supported demand. Experts highlight that product accessibility has expanded through regulated medical channels. The segment addresses mild to moderate symptoms. The availability of innovative drugs fostered usage growth. Increasing healthcare focus on personalized care also supported segment expansion.

Vaginal estrogen products continued to record steady usage. These products provide targeted relief from vaginal dryness and discomfort. Market specialists observe that minimal systemic effects increase adoption. New formulations improve convenience. Herbal supplements registered strong interest from consumers. Rising demand for natural health solutions expanded this segment. OTC products also showed active uptake. These solutions benefit from easy access in pharmacies and retail outlets. Self care awareness played a key role in strengthening product sales across these categories.

Route of Administration Analysis

In 2024, the Oral Section held a dominant market position in the Route of Administration Segment of Menopause Treatment Market, and captured more than a 52.5% share. This position was driven by high ease of use. Tablets and capsules were widely accepted by patients. They supported regular dosing. They were available in retail settings. Most hormone therapies were offered in oral form. This increased usage levels. Healthcare professionals frequently prescribed these products. As a result, the oral route continued to generate strong revenue.

The Transdermal Section remained the next major contributor. It included patches, gels, and sprays. These solutions offered better tolerance. They avoided digestive system complications. More women preferred these products for long term use. They also supported reduced hormone exposure. The Vaginal Section also held a notable share. It focused on urogenital symptoms. Local application improved comfort. It helped reduce dryness and irritation. Awareness about women’s intimate health improved adoption. Both segments showed rising acceptance due to enhanced safety profiles.

Injectables represented a smaller portion. These treatments required professional administration. This limited patient adoption. They were useful in controlled hormone delivery. They provided longer effects per dose. However, the invasive nature reduced demand. Overall market trends favored convenience. Decisions were influenced by therapy outcomes and minimal side effects. Oral products led due to familiarity. Transdermal and vaginal options gained traction. More personalized menopause care supported this shift. Growth remained steady as awareness and treatment access improved across regions.

End-User Analysis

In 2024, the Hospitals & Clinics Section held a dominant market position in the End-User Segment of Menopause Treatment Market, and captured more than a 49.9% share. This segment was favored for its advanced treatment facilities. Skilled healthcare professionals supported effective care. Accurate diagnosis improved outcomes. Patients trusted hospital-based therapies. Hormone replacement therapy was widely adopted. Non hormonal solutions also gained usage. Regulatory guidelines ensured safety. Hospitals provided full monitoring. Such factors increased utilization. The segment is expected to maintain strength. Investments in clinical infrastructure continue. Awareness about medical treatment for menopause is rising. Strong support will drive ongoing market leadership.

Gynecology Centers gained a considerable share in the menopause treatment market. Specialized services attracted many women. Focused consultations improved patient satisfaction. Trained specialists addressed diverse symptoms. The availability of personalized therapy had a positive impact. Rising awareness about women’s health encouraged timely visits. Preventive care initiatives played a role. Adoption of minimally invasive treatments increased. The segment is predicted to observe further growth. Better access to facilities improved outcomes. Advancements in diagnostic tools supported accuracy. Educational programs strengthened patient engagement.

The Home Care segment demonstrated notable growth in menopause treatment. Women preferred affordable symptom management. Self-care products offered relief. Supplements saw increased demand. Telehealth services made medical guidance accessible. This supported treatment from home. Convenience influenced acceptance. Lifestyle therapies were popular. The Others segment included wellness centers and community health providers. It held a moderate share. Natural treatments gained interest. Holistic solutions supported care. These options expanded patient choice. Continued development of alternative care will enhance market potential in the forecast period.

Key Market Segments

By Product Type

- Hormone Replacement Therapy (HRT)

- Non-Hormonal Treatments

- Vaginal Estrogen Products

- Herbal Supplements

- OTC Products

By Route of Administration

- Oral

- Transdermal

- Vaginal

- Injectables

By End-User

- Hospitals & Clinics

- Home Care

- Gynecology Centers

- Others

Drivers

Expanding Population of Menopausal Women

The growth of the menopausal population is increasing the demand for menopause treatment. A larger number of women are entering the age group where menopausal symptoms commonly occur. Hot flashes, night sweats, sleep problems, and bone loss are widely observed among aging women. These symptoms often require medical support. As the female population ages, the need for both prescription and non-prescription therapies is rising. Healthcare providers are also expanding services to improve access. This factor supports steady market expansion.

Awareness about menopause is improving. Women are increasingly informed about available therapies through digital health platforms. Better health literacy encourages timely diagnosis and care adoption. More women now seek expert guidance instead of tolerating symptoms. This shift is increasing consultations in clinics and specialty centers. The availability of accurate medical information strengthens treatment choice. It contributes to the growth of hormone and non-hormonal options. Retail channels for supplements and OTC products are also expanding.

Healthcare systems are prioritizing menopause treatment. Hospitals and clinics are adopting structured care pathways. This improves patient engagement and long-term symptom management. Public health initiatives increasingly highlight menopause as a major women’s health need. This change drives investment in technology, telehealth, and specialized care solutions. Pharmaceutical companies are focusing on innovative and safer therapies. The rise in the addressable patient pool ensures strong commercial potential. As a result, global market growth is expected to remain consistent and resilient.

Restraints

Safety Concerns and Regulatory Burdens

Safety concerns are limiting the adoption of hormone-based treatments in menopause care. Many physicians and patients remain cautious about long-term hormone replacement therapy. Risks such as breast cancer and thromboembolic events reduce confidence in treatment decisions. Side effects like weight gain and mood changes also impact patient willingness to continue therapy. As a result, the potential clinical benefits are often overshadowed by perceived risks. This situation slows demand growth despite a large menopausal population seeking relief from persistent symptoms.

Stringent regulatory requirements contribute to this restraint within the menopause treatment market. Hormonal therapies must undergo extensive safety testing. This increases development time and costs. Regulatory reviews focus heavily on long-term risk evaluation. These processes delay the introduction of new products and innovative treatment options. Companies face high barriers before commercializing hormonal drugs. As a result, limited product availability reduces therapeutic diversity across key regional markets.

This restraint creates significant unmet needs for women managing menopausal symptoms. Many patients discontinue or avoid hormone treatments due to safety fears. Healthcare providers also prefer more conservative approaches when risks appear uncertain. Non-hormonal alternatives are available, but they may not fully address vasomotor or urogenital symptoms. The hesitation toward hormonal therapies restricts market growth potential. Demand exists, but adoption remains constrained. Greater patient education and improved safety profiles will be essential to support wider therapeutic acceptance in the future.

Opportunities

Rising adoption of non-hormonal, natural, and tech-enabled solutions

The menopause treatment market is benefiting from the rapid adoption of non-hormonal and natural solutions. Demand is rising for therapies that avoid the risks associated with hormone replacement treatment. Selective serotonin reuptake inhibitors are increasingly used to manage vasomotor symptoms such as hot flashes. Neurokinin-3 receptor antagonists are also demonstrating strong clinical progress. Botanical products and phytoestrogen-based supplements are receiving positive attention due to their perceived safety. Investment is shifting toward products with fewer side effects and broader patient suitability.

Technology-enabled devices are creating new growth avenues. Solutions designed for pelvic floor strengthening and vaginal health improve quality of life while expanding therapeutic options beyond pharmaceuticals. Personalized digital tools support symptom management and patient monitoring. These offerings enhance accessibility and support a more consumer-centric care model. Manufacturers who integrate clinical effectiveness with convenience are expected to capture significant market share as healthcare delivery becomes more patient-driven.

Emerging markets offer substantial potential for expansion. Awareness of women’s health is increasing in Asia-Pacific, Latin America, and the Middle East. Healthcare access is improving. Middle-income populations are allocating more spending toward wellness solutions. The preference for natural and safe treatments strengthens the commercial outlook for non-hormonal therapies. Companies capable of addressing safety perceptions and affordability barriers will gain an advantage. The shift toward integrative care models supports accelerated growth for businesses that combine innovation, accessibility, and regulatory compliance in menopause treatment portfolios.

Trends

Personalized and Technology-Enabled Menopause Care

Healthcare providers are shifting toward personalized menopause treatment. Symptom profiling is being used to understand individual experiences. Genetic and hormonal biomarker testing is being applied to support accurate diagnosis. Tailored dosing strategies are helping improve treatment safety. Combination therapy with low-dose hormonal options and lifestyle changes is expanding. These methods are strengthening treatment outcomes. This trend reflects a move away from one-size-fits-all solutions. The focus is now on meeting specific needs for every patient to support better adherence and satisfaction.

Digital health integration is transforming access and engagement in menopause care. Telemedicine clinics are expanding service reach and reducing delays in consultations. Mobile applications allow women to track symptoms and receive timely guidance. AI-driven support tools are improving clinical decision-making. These technologies enable continuity of care. Treatment adjustments can be made faster. Patient involvement is also increasing. The result is a more supportive care ecosystem with higher responsiveness to evolving symptoms.

Menopause is increasingly viewed as a significant quality-of-life concern. This recognition is driving broader interest from healthcare and consumer wellness brands. New products are focusing on holistic relief, including sleep, mood, and metabolic health. More companies are developing solutions that blend clinical care with self-management. Customization, technology adoption, and integrative care models are guiding innovation. Market opportunities are expected to rise as awareness and demand grow. This trend supports a more inclusive and proactive approach to menopause treatment in the global healthcare landscape.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 37.6% share and holds US$ 77.1 Million market value for the year. It is explained that the region benefits from advanced healthcare systems. Awareness of women’s health is rising. Hormonal and non-hormonal therapies are widely used. Healthcare spending remains high. Reimbursement support is strong. Skilled medical professionals help with early diagnosis. Long-term treatment needs keep prescription demand steady. These elements support continued market expansion.

Experts state that awareness campaigns in the United States and Canada help women identify menopause symptoms. Diagnosis rates increase every year. Specialized centers guide proper care. Women seek safer therapies. Natural and non-hormonal options gain visibility. Research investments encourage innovation. New formulations enter the market. The aging female population also pushes the demand for treatment. Life expectancy continues to rise. This adds long-term pressure on care services and maintains steady market growth.

Industry observers mention that digital health tools support access to treatment. Telemedicine helps with regular consultations. Online pharmacies simplify medication refills. Data monitoring improves symptom control. This strengthens patient outcomes. Healthcare infrastructure continues to advance. Innovation in therapies remains a key focus. The region is expected to maintain leadership in the future. Stable demand for effective treatment solutions is seen. North America stays a major revenue source for menopause treatment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global menopause treatment market is influenced by companies with strong prescription portfolios. AbbVie and Pfizer are active in hormone therapy for menopausal symptoms. AbbVie focuses on localized estrogen therapies for genitourinary conditions. Pfizer offers systemic and local estrogen products, which support a wide user base. Their strong physician networks and brand recognition help maintain stable market shares. These companies are expected to retain leadership as demand for safe and effective menopause therapies increases across major regions.

Market leadership is also supported by firms combining hormone therapy expertise with strong R&D capabilities. Bayer is known for advanced transdermal hormone delivery solutions. The company invests in nonhormonal innovations to expand patient eligibility. Novartis participates through branded estradiol patches that remain widely prescribed. Their geographic coverage and strong product approvals help secure stable revenue streams. Both companies are positioned well due to their trusted brands and long-established presence in women’s health treatments for menopause.

Generics manufacturers strengthen affordability and drive high therapy adoption. Viatris (formerly Mylan) plays a key role in offering low-cost estradiol drugs across multiple formulations. Teva also supports wide access through authorized generics and competitive pricing. Their contribution increases treatment penetration in emerging and developed markets. Price competition restricts the premium strategies of branded companies. However, demand for cost-effective therapies boosts sustained revenue. These players maintain essential supply and support healthcare system goals for broader hormonal therapy coverage.

Other participants ensure differentiated options for patients with unique needs. Amgen and Eli Lilly focus on postmenopausal osteoporosis management, which is closely linked to menopause care. HRA Pharma provides nonhormonal products addressing vaginal dryness. Theramex expands hormonal therapy availability in Europe and international markets. Additional companies such as Abbott and Mitsubishi Tanabe explore supportive women’s health categories. Their combined roles fill therapeutic gaps and expand patient choice. These companies strengthen competitive diversity while supporting long-term growth in the menopause treatment market.

Market Key Players

- AbbVie Inc.

- Bayer AG

- Pfizer Inc.

- Mylan N.V.

- Novartis International AG

- HRA Pharma

- Amgen Inc.

- Theramex

- Abbott Laboratories

- Teva Pharmaceuticals

- Eli Lilly and Co.

- Mitsubishi Tanabe Pharma Corporation

- Endo International plc

- Ferring Pharmaceuticals

- Other key players

Recent Developments

- In May 2024: An updated U.S. labeling entry for Estrace (estradiol) vaginal cream 0.01% was posted on DailyMed, listing Allergan, Inc. (an AbbVie company) as packager. Estrace is indicated for treatment of moderate to severe vulvar and vaginal atrophy due to menopause. The DailyMed record shows “Updated May 29, 2024” and includes AbbVie branding on the package image.

- Aug 2024: A New Drug Application (NDA) for elinzanetant, a non-hormonal therapy for moderate to severe vasomotor symptoms (VMS) due to menopause, was submitted to the U.S. FDA. The filing was supported by positive Phase III data from OASIS-1, OASIS-2, and OASIS-3.

- September 2024: A competitive medical education grant program focused on Menopause Hormone Therapy (MHT) was launched by Pfizer, with an estimated total available budget of about $600,000 and individual awards up to $250,000 to support clinician education on evidence-based MHT use.

Report Scope

Report Features Description Market Value (2024) US$ 15.78 Billion Forecast Revenue (2034) US$ 27.99 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hormone Replacement Therapy (HRT), Non-Hormonal Treatments, Vaginal Estrogen Products, Herbal Supplements, OTC Products), By Route of Administration (Oral, Transdermal, Vaginal, Injectables), By End-User (Hospitals & Clinics, Home Care, Gynecology Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AbbVie Inc., Bayer AG, Pfizer Inc., Mylan N.V., Novartis International AG, HRA Pharma, Amgen Inc., Theramex, Abbott Laboratories, Teva Pharmaceuticals, Eli Lilly and Co., Mitsubishi Tanabe Pharma Corporation, Endo International plc, Ferring Pharmaceuticals, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AbbVie Inc.

- Bayer AG

- Pfizer Inc.

- Mylan N.V.

- Novartis International AG

- HRA Pharma

- Amgen Inc.

- Theramex

- Abbott Laboratories

- Teva Pharmaceuticals

- Eli Lilly and Co.

- Mitsubishi Tanabe Pharma Corporation

- Endo International plc

- Ferring Pharmaceuticals

- Other key players