Global Memory Modules and Solid State Drives Market By Product Type (SSD – SATA, SAS, and PCIe, Memory Modules – DDR, DDR2, DDR3, and DDR4), By Storage Capacity (SSD – Under 500GB, 500GB- 1TB, 1TB- 2TB, and Above 2TB, Memory module- 4GB to 8GB, 16GB, and 32GB & Above), By Application, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and, Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 105911

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

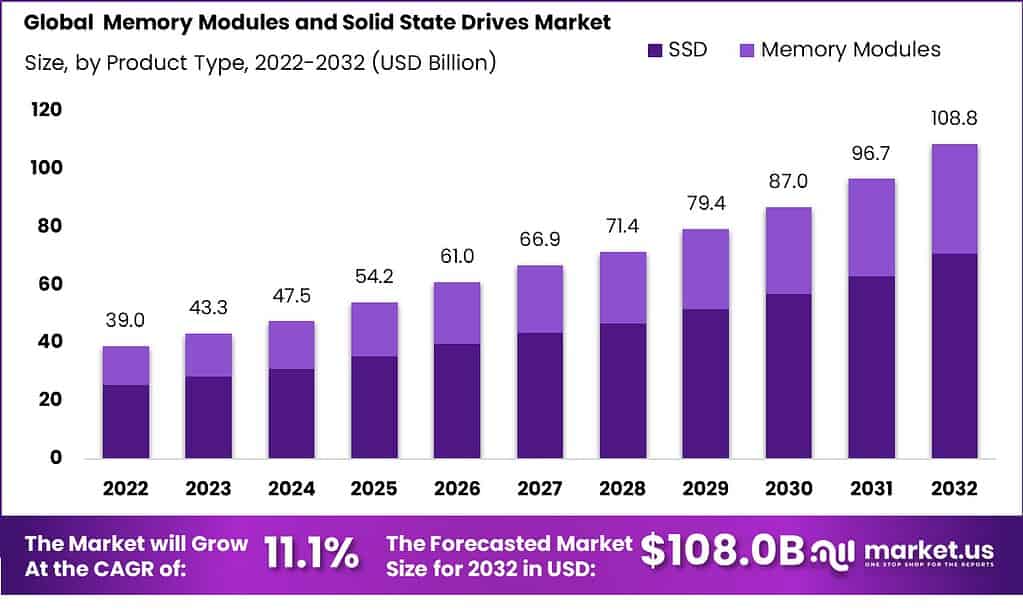

The Global Memory Modules and Solid-State Drives Market Sales Estimated to Surpass USD 108.8 Bn by 2032 From USD 43.3 Bn in 2022, Projected to Achieve 11.1% CAGR during forecast period 2023-2032.

A memory module, also known as RAM, is a printed circuit board that enables convenient installation and replacement within electronic systems, particularly in computers like personal computers, workstations, and servers. On the other hand, a Solid State Drive (SSD) functions as a form of solid-state storage, utilizing assemblies of integrated circuits to securely retain data for an extended period. It operates as a secondary storage solution in the hierarchy of computer storage.

Note: Actual Numbers Might Vary In The Final Report

The market demand for these components has been consistently increasing, especially when comparing the current situation to the period before the pandemic. The shift to online platforms during the COVID-19 pandemic significantly impacted the need for robust technological infrastructure. Both data storage and the seamless operation of devices, facilitated by memory modules and SSDs, became vital. As a result, the Market for these products is experiencing rapid growth.

Key Takeaways

- Market Size and Growth: The Memory Modules and Solid-State Drives Market is estimated to surpass USD 108.8 billion by 2032, exhibiting an impressive 11.1% Compound Annual Growth Rate (CAGR) during the forecast period from 2023 to 2032. This growth can be attributed to the increasing demand for data storage and technological infrastructure, particularly following the shift to online platforms during the COVID-19 pandemic.

- Product Type Analysis: SSDs using the PCIe interface accounted for the largest market share, with a 65.3% share in 2022, highlighting the significant role played by this interface in enhancing the speed of various systems, including PCs, servers, and workstations. DDR3 memory modules dominated the market due to their low latency and power efficiency, making them suitable for servers and gaming applications.

- Storage Capacity Analysis: SSDs with capacities under 500GB are commonly found in budget laptops and tablets, while memory modules with 4GB to 8GB capacities can often be found in entry-level laptops or basic desktops for light tasks like web browsing and office applications.

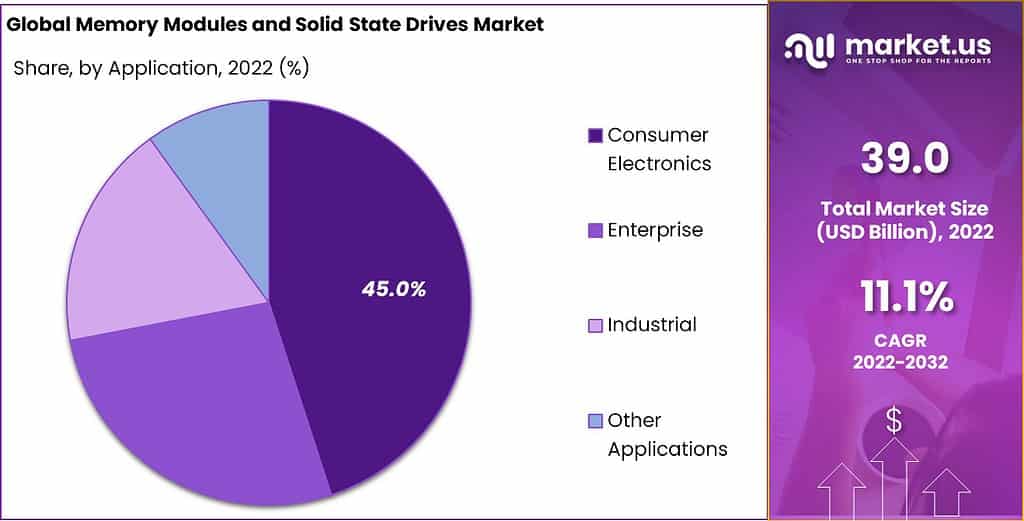

- Application Analysis: Consumer electronics held the largest market share (45.0%) in 2022, followed by industrial and other applications segments; this indicates an increasing need for high-speed technologies such as laptops, desktops, gaming consoles, smartphones and tablets.

- Distribution Channel Analysis: The OEM channel dominated the market, providing products by default assembly, while the aftermarket segment is expected to witness substantial growth in the forecast period.

- Market Drivers: Factors such as the growing demand for storing data, the shift from HDDs to SSDs due to their higher speed and efficiency, and the increasing popularity of UHD content and IoT are driving the growth of the Memory Modules and Solid-State Drives Market.

- Market Restraints: High manufacturing costs, the limited lifespan of NAND Flash in SSDs, and material shortages impacting memory module manufacturing have posed significant restraints on the market.

- Market Opportunities: Increasing technological advancements, especially in data centers and the IT sector, along with the growth in AI applications, are presenting significant opportunities for the Memory Modules and Solid-State Drives Market.

- Market Trends: The emergence of NVMe SSDs, known for their superior performance over traditional SATA-based SSDs, is a notable trend driving market growth, indicating a shift towards faster and more efficient data storage solutions.

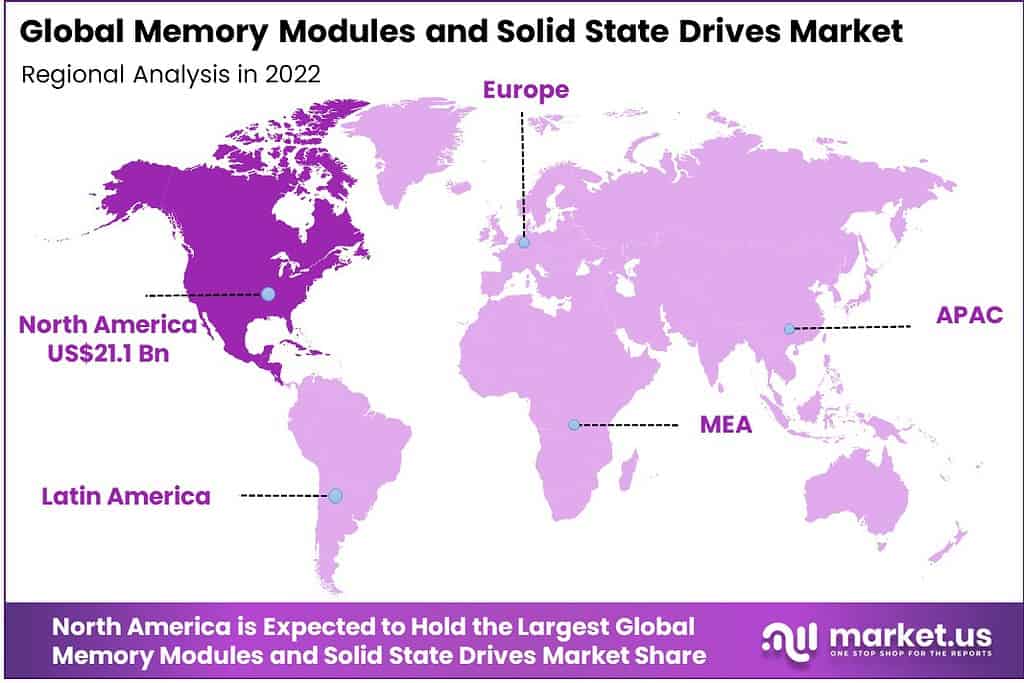

- Regional Analysis: North America holds a significant market share (54.0% in 2022), driven by early technology adoption and infrastructure development. The Asia-Pacific region is expected to witness high growth, especially in countries like China, Japan, South Korea, and India, due to their rapid technological progress and increasing demand for high-speed storage systems.

Product Type Analysis

PCIe Accounted for the Largest Market Share Owing to Increasing Demand from Industries and Growing Technology in All Sectors.

The Memory modules and solid-state drives market is segmented based on interface type into (SSD – SATA, SAS, PCIe) and (Memory modules – DDR, DDR2, DDR3, DDR4). Among these, SSD leads the Market with a 65.3% share. In 2022, PCIe accounted for the highest market share. This interface plays a significant role in PCs, servers, industries, and workstations by helping them increase the speed of their system.

DDR3 Accounted for the Largest Market Share Owing to Increasing Demand from Consumer Electronics followed by Enterprises and Industries.

For Memory Modules, DDR3 held the majority of revenue share. This interface plays a main role in servers and gaming as it has low latency compared to DDR4 and consumes less power than DDR2. Due to the rise in technology, the demand for these memory modules and SSDs is rapidly growing.

Storage Capacity Analysis

SSDs with storage capacities under 500 GB due to their specific applications and Memory Modules, a storage capacity of 4GB to 8GB is commonly used.

The Market is segmented as per storage capacity. Among these, SSDs with capacities ranging under 500 GB are often used in budget laptops, tablets, and devices with relatively modest storage requirements. Also, memory models with 4GB to 8GB storage capacity are often found in entry-level laptops and basic desktop computers. They suit light tasks such as web browsing, office applications, and basic multimedia consumption.

Application Analysis

The Increasing Global Demand for High-Speed Technology Has Led to A Rise in The Production and Installation of SSD and Memory Modules.

Based on applications, the Market is divided into consumer electronics, enterprise, industrial, and other applications. Among these applications, consumer electronics accounted for the largest market share of 45.0% in 2022, followed by industrial and other applications, as consumer electronics consists of laptops, desktops, and gaming consoles. Mobiles consist of smartphones and tablets.

The demand for these things is also growing as technology is growing at par. Due to technological advancement, everyone is looking for high-end speed and storage in lower space consumption. The gaming craze has a huge demand for the mobile phones market and fast and secure transfer of data memory modules and SSDs is demanded in consumer electronics and mobile sectors.

Note: Actual Numbers Might Vary In The Final Report

Distribution Channel Analysis

OEM Channel Holds Major Share in the Market

The Market is divided into OEM (Original Equipment Manufacturer) and Aftermarket based on the distribution channel. The aftermarket consists of a market for spare parts and accessories. OEM dominates the Market’s distribution channel, as they provide products by assembling these SSDs and modules by default. At the same time, the aftermarket segment is likely to witness high growth during the forecast period.

Key Market Segments

By Product Type

- SSD

- SATA

- SAS

- PCIe

- Memory Modules

- DDR

- DDR2

- DDR3

- DDR4

By Storage Capacity

- SSD

- Under 500GB

- 500GB- 1TB

- 1TB- 2TB

- Above 2TB

- Memory Modules

- 4GB to 8GB

- 16GB

- 32GB and above

By Application

- Consumer Electronics

- Enterprise

- Industrial

- Other Applications

By Distribution Channel

- OEM

- Aftermarket

Drivers

Growth Demand from the Consumer Electronics Sector

Due to the growing need for storing data across various end-use applications, the Solid State market is getting driven. Most companies are getting digitalized in the current scenario, so it has become important for industries to store data, as SSD provides high speed and efficiency in data storage. At the same time, HDDs (Hard Disk Drives) are becoming outdated in the rapidly growing Market. HDDs are very slow compared to SSDs. So, SSD is also acting as a replacement for HDD, which is driving the SSD market ahead. Cloud Computing is another factor that is driving the Market.

Various individuals and businesses are using cloud computing. Therefore, the technological advancement in the SSD is fostering the growth of the global Market. While there is an increase in the application of semiconductors in different sectors of industries, such as consumer electronics, enterprise, and IT & telecom, it is fueling the memory modules market.

The rapid expansion of the Internet of Things (IoT) creates opportunities for new applications requiring less power and high-capacity memory modules. The growing popularity of UHD (Ultra-High Definition) content is driving the memory modules market. Also, as new technological innovations are taking place, the rise of semiconductor memory is taking place. The new technological advancement in Memory Modules is fostering the growth of the global Market.

Restraints

High Manufacturing Cost and Low Lifespan

Certain restraints are affecting the Solid State Drive Market. Solid State Drives are comparatively more costly than Hard Disk Drives, restraining cost-sensitive consumers from using SSDs at large. The limited lifespan of NAND Flash used in SSD also restrains the Market. Frequent and intensive reading/writing can reduce the life span of SSDs.

Memory market module manufacturing requires rare materials and metals. The shortage of those materials can cause restraints. The manufacturing of these modules is very costly. Factory closure and labor shortage also created restraints during the COVID period.

Opportunity

Increasing technological advancements

SSD use in data centers is increasing due to their high efficiency compared to HDD and the rising demand for more storage capacity. Increasing demand for SSD from Data centers and the IT sector tends to propel the demand for SSD in the future. Enterprise SSDs are preferable to clients’ SSDs due to the protection benefits. An increase in automation and digitalization in all sectors of industries tends to propel the Market.

The growth and adoption of new technology foster the opportunity for the memory modules market. The increasing application of semiconductors in electronic devices and gadgets also creates an opportunity for memory modules. Growth in AI in today’s scenario is fostering an opportunity.

Trends

Emergence of NVMe SSDs

The rise of NVMe SSDs can be attributed to their remarkable performance edge over conventional SATA-based SSDs. The NVMe protocol effectively minimizes delays and enhances data transfer rates, making it a favored selection for consumer and enterprise uses. This shift is anticipated to continue as a favorable trajectory in the coming times.

Regional Analysis

North America Region Holds Significant Share of the Market

North America held the largest market share of 54.0% in 2022. Due to the early adoption of new technologies like the Cloud, Internet of Things, Big Data, and High-End Cloud Computing, North America has improved the infrastructure needed for the integration of advanced technologies. These all factors are supporting the growth of the North America region in memory modules and solid-state drives market.

Asia-Pacific region is likely to witness high growth during the forecast period. The Asia-Pacific region stands out for its noteworthy technological progress, attributed to various factors. Notably, countries like China, Taiwan, Japan, and South Korea are at the forefront, displaying a swift surge in the semiconductor requirement, thereby driving industrial expansion. With these nations ascending the technological ladder, a substantial need arises for advanced high-speed storage systems, further amplifying their demand.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Industry leaders are effectively upholding their dominance by significantly emphasizing expanding their product portfolios through various strategic approaches.

Prominent participants in this Market are implementing diverse strategies, including collaborations, investments to broaden their product range, mergers, and acquisitions. The manufacturing aspect has gained paramount importance due to the constrained availability and increased materials expenses. Manufacturers can uphold their competitive advantage by enhancing manufacturing efficiency or innovating for novel applications.

Market Key Players

Intense competition characterizes the Market, as enterprises consistently innovate to deliver enhanced performance, reliability, and storage options. These endeavors address the dynamic requirements of consumers, businesses, and data centers.

The following are some of the major players in the industry

- Samsung

- Sk Hynix

- Mycron Technology

- Kingston Technology

- Infineon Technology

- Winbond

- Powerchip

- Nanya Technology

- Transcend Information

- Elpida

- Other Key Players

Recent Development

- October 2022: The P44 Pro SSD (solid-state storage drive), a powerful client SSD for today’s most exacting workloads, has been revealed by Solidigm. The P44 Pro is the world’s greatest SSD for enthusiasts due to its outstanding speed and excellent power economy.

- March 2022: A new fabrication facility is being developed at Kioxia Corporation’s Kitakami factory in Japan for a possible expansion of its distinctive 3D Flash memory BiCSFLASHTM manufacturing. This facility’s construction is expected to start in April 2022 and be complete in 2023.

Report Scope

Report Features Description Market Value (2023) US$ 43.3 Bn Forecast Revenue (2032) US$ 108.8 Bn CAGR (2023-2032) 11.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- (SSD – SATA, SAS, PCIe) (Memory Modules – DDR, DDR2, DDR3, DDR4), By Storage Capacity (SSD – Under 500GB, 500GB- 1TB, 1TB- 2TB, and Above 2TB), (Memory module- 4GB to 8GB, 16GB, 32GB and Above), By Application (Consumer Electronics, Enterprise, Industrial, and Other Applications), By Distribution Channel (OEM, Aftermarket) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Samsung, SK Hynix, Micron Technology, Kingston Technology, Infineon Technologies, Winbond, Powerchip, Nanya Technology, Transcend Information, Elpida, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the difference between memory modules and SSDs?Memory modules (also known as RAM) are volatile memory that stores data that is currently being used by the computer. SSDs are non-volatile memory that stores data that is saved even when the computer is turned off.

How big is the Memory Modules and Solid-State Drives Market?The Global Memory Modules and Solid-State Drives Market Sales Estimated to Surpass USD 108.8 Billion by 2032 From USD 39.0 in 2022, Projected to Achieve 11.1% CAGR during forecast period 2023-2032.

Who is the leader in SSD?Moving into 2023, Samsung will fend off challenges from its rivals and remain firmly as the leader in the enterprise SSD market

What are the benefits of using SSDs over traditional hard drives?SSDs offer several advantages over traditional hard drives, including: * Faster boot times and application load times * Increased data transfer speeds * Greater shock and vibration resistance * Longer lifespan

Memory Modules and Solid State Drives MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Memory Modules and Solid State Drives MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung

- Sk Hynix

- Mycron Technology

- Kingston Technology

- Infineon Technology

- Winbond

- Powerchip

- Nanya Technology

- Transcend Information

- Elpida

- Other Key Players