Global Membrane Separation Technology Market By Technology(Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis), By Application(Water and Wastewater Treatment, Industry Processing, Food and Beverage Processing, Pharmaceutical and Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 13331

- Number of Pages: 273

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Driving Factors

- Advantages in Resource Optimization: Enhancing Efficiency and Sustainability

- Restraining Factors

- By Technology Analysis

- By Application Analysis

- Key Market Segments

- Growth Opportunities

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

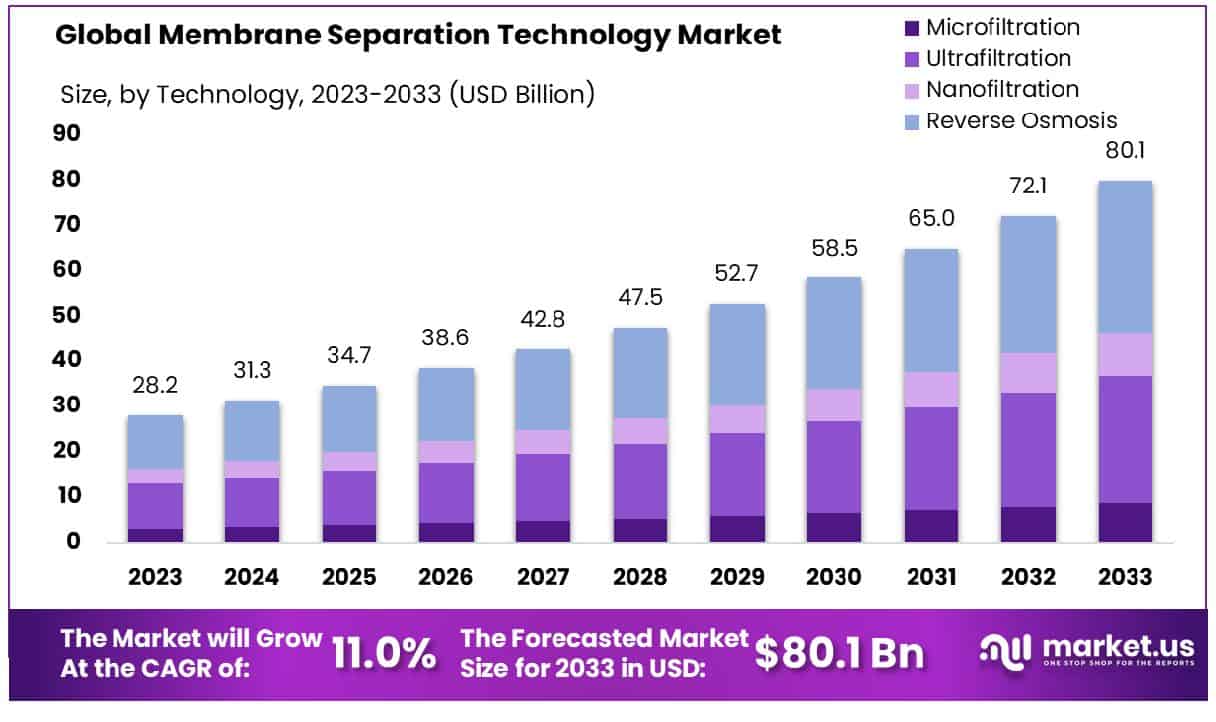

The Global Membrane Separation Technology Market size is expected to be worth around USD 80.1 Billion by 2033, From USD 28.2 Billion by 2023, growing at a CAGR of 11.0% during the forecast period from 2024 to 2033.

The Membrane Separation Technology Market encompasses advanced solutions for segregating materials via semi-permeable membranes. It is pivotal in industries requiring precise filtration, such as water treatment, pharmaceuticals, food & beverage, and chemical processing. This market’s relevance stems from its contribution to sustainability and efficiency, offering methods to purify, concentrate, and separate components while minimizing energy consumption.

For executives and product managers, understanding this market is crucial, as it highlights technological innovations that drive operational excellence and environmental stewardship. The adoption of membrane separation technology is instrumental in enhancing product quality, ensuring regulatory compliance, and fostering sustainable industrial practices.

The global market for membrane separation technology, a pivotal component in diverse industrial applications ranging from water treatment to pharmaceuticals, has witnessed a significant surge in valuation. As of 2021, the market was estimated to be valued at approximately USD 28.3 billion. Projections indicate a robust growth trajectory, with expectations to reach around USD 43.8 billion by 2026. This growth can be attributed to a compound annual growth rate (CAGR) of 9.1% during the forecast period from 2021 to 2026.

Such expansion is underpinned by escalating demand for clean and more efficient separation processes, stringent environmental regulations, and the increasing scarcity of pure water resources globally. Additionally, advancements in technology and a heightened focus on reducing industrial carbon footprints have further propelled the adoption of membrane separation technology across sectors.

The market’s growth is also bolstered by the critical role of membrane technology in enhancing operational efficiency and supporting sustainable practices in industries. As organizations continue to prioritize innovation and sustainability, the membrane separation technology market is poised for substantial growth, reflecting a convergence of environmental imperatives and industrial advancement.

Key Takeaways

- Market Growth: Global Membrane Separation Technology Market size is expected to be worth around USD 80.1 Billion by 2033, From USD 28.2 Billion by 2023, growing at a CAGR of 11.0% during the forecast period from 2024 to 2033.

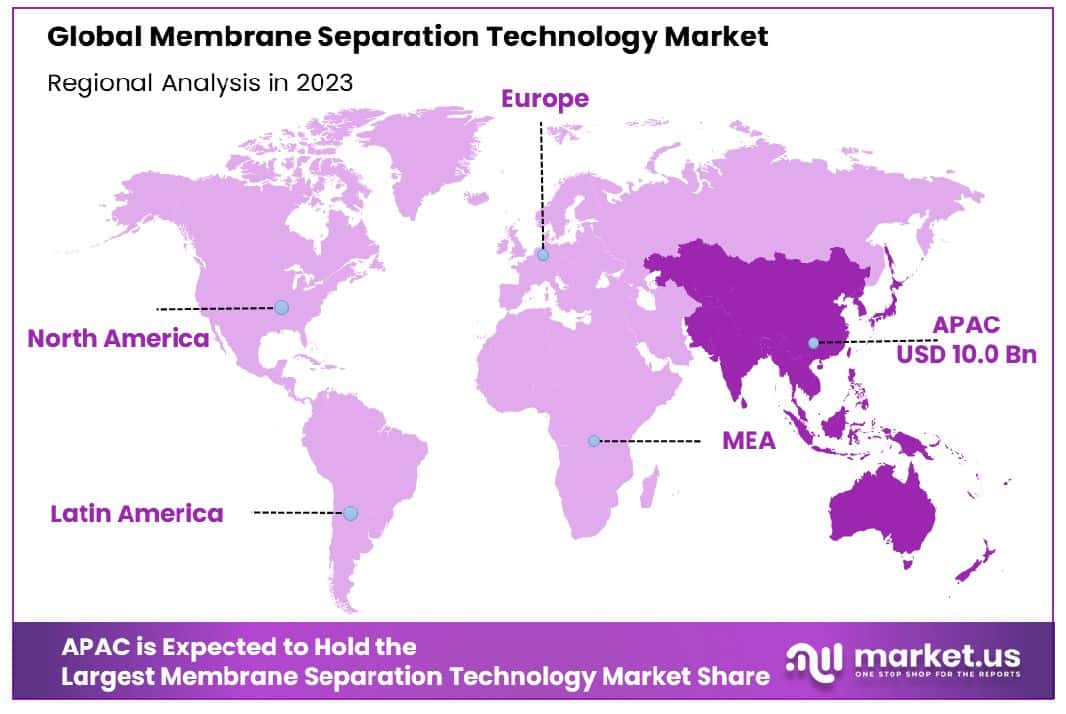

- Regional Dominance: In the Asia-Pacific region, the Membrane Separation Technology Market holds a 35.6% share.

- Segmentation Insights:

- By Technology: Reverse Osmosis technology commands a 42.1% share of the market.

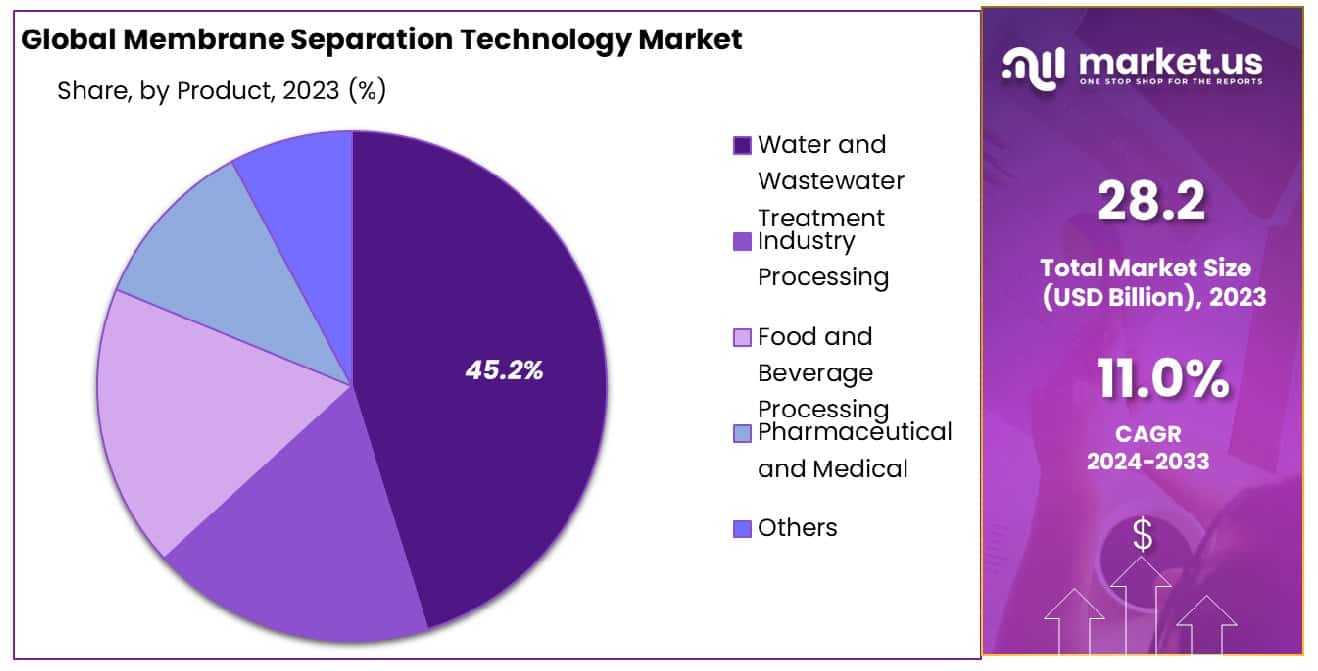

- By Application: Water and Wastewater Treatment holds a 45.2% market share.

- Growth Opportunity: Membrane separation technology growth is fueled by diverse sector applications and escalating demand for clean water in developed nations.

Driving Factors

Growing Demand for Clean Processed Drinking Water: Catalyst for Membrane Separation Technology Adoption

The escalation in the quest for clean, processed drinking water has emerged as a pivotal driver for the expansion of the Membrane Separation Technology Market. This surge is primarily attributed to the increasing global population and the intensifying focus on health and environmental standards, which have heightened the awareness and necessity for purified water access. Membrane separation technology, recognized for its efficiency in removing contaminants and pathogens, meets these requirements effectively.

The technology’s capability to provide high-quality drinking water supports its adoption across various sectors, notably in regions grappling with water scarcity and pollution. This growing demand underpins the market’s expansion, as governments and private entities invest in water treatment infrastructure to ensure the availability of safe drinking water for their populations.

Advantages in Resource Optimization: Enhancing Efficiency and Sustainability

The inherent benefits of membrane separation technology in resource optimization, compared to conventional water treatment methods, significantly contribute to its market growth. This technology offers superior efficiency in water purification and desalination processes, with lower energy consumption and minimal impact on the environment. It allows for the recovery and reuse of vital resources, aligning with global sustainability goals. Most of the industry’s revenue is generated in the USA, with a predicted $94.07 billion in 2023

The operational advantages of membrane separation technology, such as lower operational costs and reduced footprint, make it an attractive option for industries seeking to enhance their environmental performance and economic efficiency. Consequently, the shift towards more sustainable and efficient water treatment methods is driving the adoption of membrane separation technologies, fostering market growth and innovation in this sector.

Restraining Factors

High Capital Investment as a Growth Barrier

The high capital investment necessary for the setup and maintenance of membrane separation technology stands as a primary impediment to its market growth. This technology requires substantial upfront costs not only for the initial establishment of the facilities but also for ongoing maintenance and operation. These financial requirements can deter small and medium-sized enterprises (SMEs) from adopting membrane separation technology, thereby limiting the market’s expansion potential.

Furthermore, the need for continuous technological upgrades to maintain efficiency and competitiveness adds to the operational expenses, further straining the financial resources of companies. This factor significantly impacts market dynamics by restricting entry to well-capitalized players and potentially slowing the pace of innovation and adoption across industries where cost concerns are paramount.

Limited Applicability and Operational Constraints

The technology’s limited applicability to certain substances and specific operating conditions poses another significant challenge. Membrane separation technology, by its nature, is not universally applicable across all types of substances or operational scenarios. This limitation confines the technology’s use to specific industries or applications where its efficacy is proven, thus hindering broader market penetration. For instance, the technology’s performance can be substantially affected by the physicochemical properties of the feed stream, including particle size, concentration, and chemical compatibility.

These constraints necessitate a high degree of customization and optimization for each application, increasing the complexity and cost of deployment. Consequently, this factor acts as a restraint on the market’s growth by narrowing the range of potential applications and making it less attractive for industries with variable or challenging operational conditions.

By Technology Analysis

Reverse Osmosis Dominates With A 42.1% Share In Membrane Technology.

In 2023, the Membrane Separation Technology Market was segmented by technology into four primary categories: Microfiltration, Ultrafiltration, Nanofiltration, and Reverse Osmosis. Among these, Reverse Osmosis held a dominant market position in the “By Technology” segment, capturing more than a 42.1% share. This prominence can be attributed to Reverse Osmosis’ extensive application in purifying water for drinking, industrial processes, and wastewater treatment due to its efficiency in removing a wide range of contaminants, including bacteria, viruses, and dissolved salts.

The substantial market share of Reverse Osmosis underscores its critical role in addressing the growing demand for clean water across various sectors, including residential, commercial, and industrial domains. The technology’s adaptability to both large-scale and small-scale operations enhances its market penetration and utility. Meanwhile, Microfiltration, Ultrafiltration, and Nanofiltration technologies also contribute significantly to the market, catering to specific filtration needs that require the removal of particles, macromolecules, and substances of intermediate sizes, respectively.

Each technology segment complements the others, offering a comprehensive suite of solutions for diverse separation requirements, thereby supporting the overall growth and diversification of the Membrane Separation Technology Market.

By Application Analysis

Water And Wastewater Treatment Leads Applications, Holding a 45.2% Market Share.

In 2023, the Membrane Separation Technology Market was segmented by application into Water and Wastewater Treatment, Industry Processing, Food and Beverage Processing, Pharmaceutical and Medical, and Others. Water and Wastewater Treatment emerged as the leading segment, holding a dominant market position with more than a 45.2% share. This prominence can be attributed to the escalating global demand for clean and safe water, spurred by increasing environmental concerns and stringent regulatory standards for water purity.

The application of membrane separation technology in this sector has been pivotal in addressing the critical need for efficient, cost-effective water purification and recycling processes. Furthermore, the Industry Processing segment followed, benefiting from the technology’s ability to provide precise separation solutions critical for manufacturing processes, thereby enhancing efficiency and sustainability. The Food and Beverage Processing segment also leveraged membrane separation technology to ensure product safety and quality, meeting the rigorous standards of the food industry.

In the Pharmaceutical and Medical sector, the technology’s role in purifying biological preparations and ensuring the sterility of medical products underscored its importance. The Others segment, encompassing various applications, further demonstrated the versatility and broad applicability of membrane separation technology across multiple industries, highlighting its integral role in modern industrial processes.

Key Market Segments

By Technology

- Microfiltration

- Ultrafiltration

- Nanofiltration

- Reverse Osmosis

By Application

- Water and Wastewater Treatment

- Industry Processing

- Food and Beverage Processing

- Pharmaceutical and Medical

- Others

Growth Opportunities

Rapid Growth Across Diverse Sectors

The adoption of membrane separation technology has been accelerating, primarily driven by its diversified applications across critical sectors. The technology’s utility in water treatment processes, alongside its indispensable role in the pharmaceutical, food, and beverage industries, underscores its importance. This broad applicability can be attributed to the technology’s efficacy in ensuring product purity and compliance with environmental standards. The convergence of these sectors’ needs with membrane technology’s capabilities is set to fuel its market growth.

Escalating Demand for Clean Water

Developed nations are at the forefront of increasing demand for clean and potable water, a trend that significantly contributes to the expansion of the membrane separation technology market. This demand is not solely motivated by consumption needs but is also driven by a growing awareness of water’s critical role in public health and industrial processes. The United States faced a lower level of water insecurity, with approximately 2 million people not having access to clean drinking water, equivalent to 0.6% of the total population

The technology’s ability to provide efficient, scalable solutions for water purification and desalination addresses these concerns, positioning it as a key player in meeting the global need for clean water.

Latest Trends

Advanced Membrane Materials and Fabrication Techniques

There has been a notable shift towards the development and utilization of novel membrane materials and advanced fabrication techniques. These innovations aim to enhance the membranes’ separation efficiency, durability, and resistance to fouling. For example, the integration of nanomaterials such as graphene oxide and metal-organic frameworks (MOFs) into membrane structures has shown potential in improving water flux and selectivity.

Additionally, 3D printing and laser-based fabrication methods are being explored to create membranes with precise pore sizes and patterns, offering improved performance and tailor-made solutions for specific separation challenges.

Focus on Energy Efficiency and Environmental Sustainability

As global emphasis on sustainability intensifies, there is a growing trend towards optimizing membrane separation processes for energy efficiency and minimal environmental impact. This involves the development of low-energy membrane technologies, such as forward osmosis and membrane distillation, which require less energy compared to traditional reverse osmosis processes.

Moreover, research is being directed toward creating membranes from biodegradable and renewable materials to reduce the environmental footprint of membrane production and disposal. This trend not only aligns with the global drive towards sustainability but also opens up new avenues for the application of membrane technology in eco-sensitive processes and industries.

Regional Analysis

The Asia-Pacific region leads the membrane separation technology market, holding a dominant 35.6% share, driven by rapid industrialization and increasing water purification needs.

The membrane separation technology market exhibits distinctive characteristics and growth trajectories across various regions, reflecting the diverse industrial, environmental, and regulatory landscapes.

In North America, the market is propelled by stringent environmental regulations and the adoption of advanced wastewater treatment solutions, with the United States leading in technological advancements and investments.

Europe follows closely, with its focus on sustainability and energy efficiency driving the adoption of membrane technologies in sectors such as water & wastewater treatment and pharmaceuticals.

The Asia-Pacific region, dominating the global landscape with a 35.6% market share, is witnessing rapid industrialization and urbanization, especially in China and India, which amplifies the demand for clean water and drives significant growth in membrane separation technology applications.

The Middle East & Africa, albeit at a nascent stage, shows promising growth potential due to increasing water scarcity issues and the rising need for desalination technologies.

Latin America, though smaller in comparison, is gradually embracing membrane separation technologies, fueled by growing environmental awareness and industrial growth. Collectively, these regional dynamics underscore the expanding footprint of membrane separation technologies, with Asia-Pacific leading the charge as a result of its robust industrial growth and escalating water purification requirements.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the global Membrane Separation Technology Market, key players have demonstrated significant influence and strategic positioning throughout 2023. SUEZ and Toray Industries Inc. have maintained their leadership through innovative product offerings and expansive global networks, focusing on water and wastewater treatment solutions that cater to the escalating demand for clean and sustainable water resources. Pentair plc, with its robust portfolio in water filtration and purification technologies, has shown remarkable growth, driven by increasing industrial and residential applications.

Merck KGaA has excelled in the biopharmaceuticals sector, where membrane separation technology is critical for the purification and filtration processes, underscoring the company’s commitment to healthcare and life sciences. Hydranautics, a subsidiary of Nitto Denko Corporation, continues to be a frontrunner in the development of energy-efficient and high-performance membrane solutions, particularly for reverse osmosis and nanofiltration applications.

GEA Group Aktiengesellschaft and Hyflux Ltd. have strategically expanded their market presence through technological advancements in membrane bioreactors (MBRs) and ultrafiltration (UF) systems, targeting both municipal and industrial sectors. AXEON Water Technologies and Koch Membrane Systems Inc. have focused on custom and application-specific solutions, thereby enhancing their competitiveness in niche markets.

HUBER SE, Pall Corporation, and 3M Company have leveraged their technological expertise to develop membranes that offer superior separation capabilities, contributing to their strong positions in various applications, including medical, pharmaceutical, and food and beverage industries. Corning Incorporated’s innovations in membrane technology have paved the way for advanced applications in gas separation and emissions control.

Asahi Kasei Corporation and DuPont de Nemours Inc. have capitalized on their chemical and material science expertise to develop high-performance membrane materials that meet the stringent requirements of diverse industries, including water treatment, healthcare, and chemical processing. Their focus on sustainability and efficiency reflects the industry’s overarching trend towards environmentally friendly and energy-saving technologies.

Market Key Players

- SUEZ

- Toray Industries Inc

- Pentair plc

- Merck KGaA

- Hydranautics

- GEA Group Aktiengesellschaft

- Hyflux Ltd.

- AXEON Water Technologies

- Koch Membrane Systems Inc.

- HUBER SE

- Pall Corporation

- 3M Company

- Corning Incorporated

- Asahi Kasei Corporation

- DuPont de Nemours Inc

Recent Development

- In February 2024, GEA invests €18 million in a US technology center in Janesville, Wisconsin, to advance sustainable meat, dairy, seafood, and egg alternatives, facilitating pilot-scale production and innovation acceleration.

- In January 2024, NEA and NTU co-developed Singapore’s WTERF for Waste-to-Energy research, offering a plug-and-play test-bedding facility to enhance thermal waste treatment technologies and boost efficiency in resource recovery and electrical output.

- In November 2023, ZwitterCo, a Massachusetts startup, inaugurates a 30,000-square-foot Innovation Center in Woburn to accelerate the development of advanced wastewater treatment membranes using zwitterionic technology, enhancing water reuse and sustainability.

Report Scope

Report Features Description Market Value (2023) USD 28.2 Billion Forecast Revenue (2033) USD 80.1 Billion CAGR (2024-2033) 11.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology(Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis), By Application(Water and Wastewater Treatment, Industry Processing, Food and Beverage Processing, Pharmaceutical and Medical, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape SUEZ, Toray Industries Inc, Pentair plc, Merck KGaA, Hydranautics, GEA Group Aktiengesellschaft, Hyflux Ltd., AXEON Water Technologies, Koch Membrane Systems Inc., HUBER SE, Pall Corporation, 3M Company, Corning Incorporated, Asahi Kasei Corporation, DuPont de Nemours Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected size of the Global Membrane Separation Technology Market by 2033?Global Membrane Separation Technology Market size is expected to be worth around USD 80.1 Billion by 2033, From USD 28.2 Billion by 2023, growing at a CAGR of 11.0% during the forecast period from 2024 to 2033.

List the segments encompassed in this report on the Global Membrane Separation Technology Market?Market.US has segmented the Global Membrane Separation Technology Market by geographic North America, Europe, APAC, South America, and Middle East and Africa, By Technology(Microfiltration, Ultrafiltration, Nanofiltration, Reverse Osmosis), By Application(Water and Wastewater Treatment, Industry Processing, Food and Beverage Processing, Pharmaceutical and Medical, Others)

List the key industry players of the Membrane Separation Technology Market?SUEZ, Toray Industries Inc, Pentair plc, Merck KGaA, Hydranautics, GEA Group Aktiengesellschaft, Hyflux Ltd., AXEON Water Technologies, Koch Membrane Systems Inc., HUBER SE, Pall Corporation, 3M Company, Corning Incorporated, Asahi Kasei Corporation, DuPont de Nemours Inc

Name the key areas of business for the Membrane Separation Technology Market?China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC

What are the factors driving the Membrane Separation Technology Market?Key factors that are driving the Membrane Separation Technology Market growth include a Growing Demand for Clean Processed Drinking Water: Catalyst for Membrane Separation Technology Adoption , Advantages in Resource Optimization: Enhancing Efficiency and Sustainability

Membrane Separation Technology MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Membrane Separation Technology MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SUEZ

- Toray Industries Inc

- Pentair plc

- Merck KGaA

- Hydranautics

- GEA Group Aktiengesellschaft

- Hyflux Ltd.

- AXEON Water Technologies

- Koch Membrane Systems Inc.

- HUBER SE

- Pall Corporation

- 3M Company

- Corning Incorporated

- Asahi Kasei Corporation

- DuPont de Nemours Inc