Global Medical Writing Market By Type (Clinical Writing, Scientific Writing, Regulatory Writing, and Others), By Application (Medical Journalism, Medico Marketing, Medical Education, and Others), By End-user (Contract Research Organizations, Pharmaceutical & Biotechnology Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 100545

- Number of Pages: 198

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

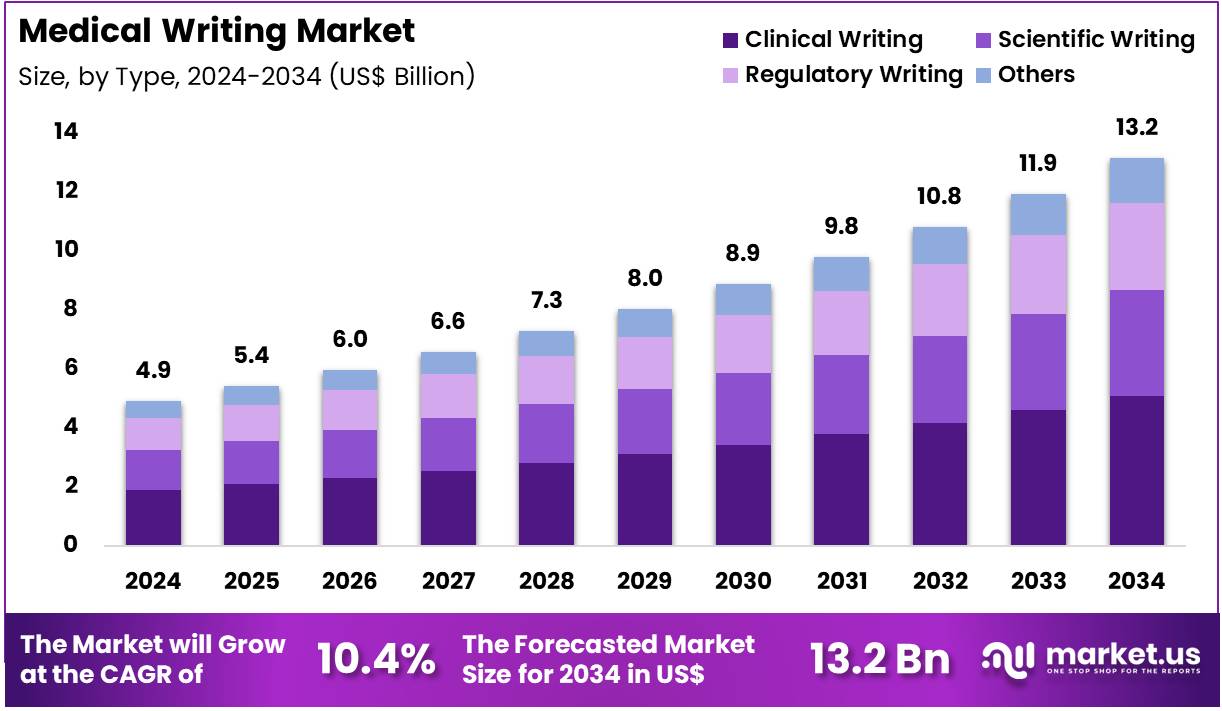

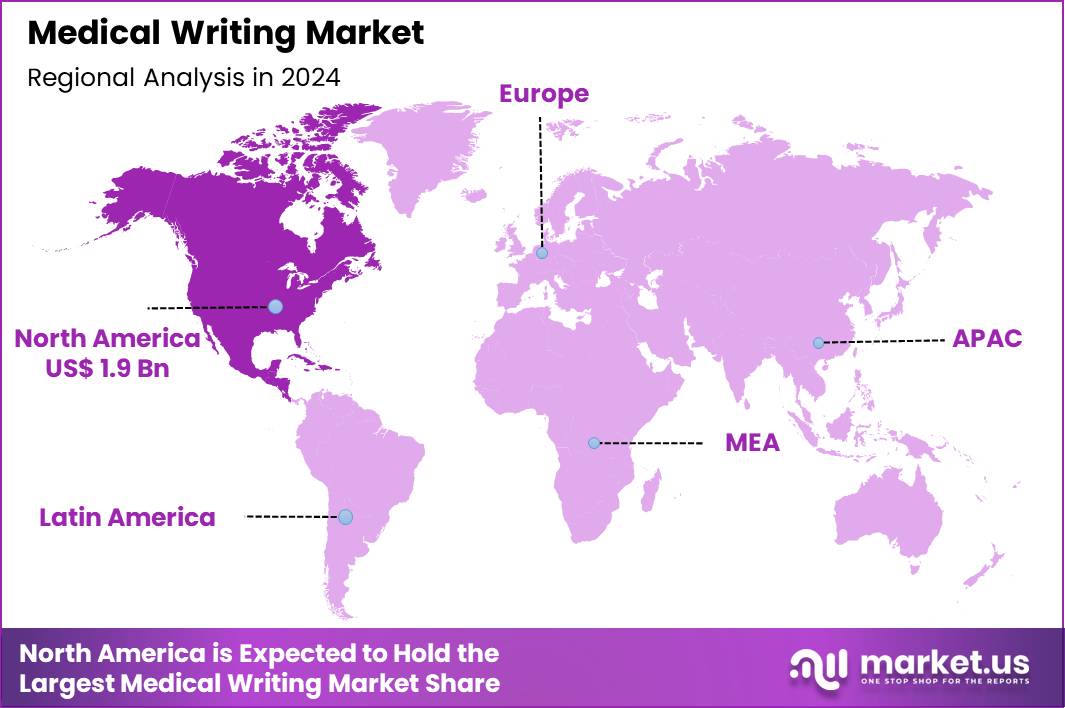

The Global Medical Writing Market size is expected to be worth around US$ 13.2 Billion by 2034 from US$ 4.9 Billion in 2024, growing at a CAGR of 10.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.3% share with a revenue of US$ 1.9 Billion.

Increasing regulatory complexity in clinical trials propels the Medical Writing market, as pharmaceutical sponsors navigate stringent documentation requirements to expedite approvals and ensure compliance. Service providers specialize in crafting investigator brochures that detail study rationale and risk assessments, protocol amendments for adaptive trial designs, and informed consent forms tailored to diverse participant cohorts.

These experts also prepare safety narratives for adverse event reporting and synoptic reports for multidisciplinary review boards. Opportunities arise from evolving guidelines that demand enhanced transparency and patient-centric language in submissions. The U.S. FDA’s initiation of testing for its internal AI tool in June 2025, designed for generating and reviewing submission documents, compels companies to partner with writers skilled in producing structured, AI-compatible content. This development intensifies the need for upgraded processes that align with automated regulatory evaluations.

Growing integration of artificial intelligence in document generation accelerates the Medical Writing market, as organizations leverage hybrid human-AI workflows to boost productivity without sacrificing scientific rigor. Writers oversee the validation of AI-drafted protocols for phase transitions, clinical study reports synthesizing efficacy endpoints, and regulatory dossiers for orphan drug designations. Applications extend to pharmacovigilance updates on integrated safety databases and health technology assessment submissions for reimbursement negotiations.

AI platforms create opportunities for scalable training modules that upskill writers in prompt engineering and output refinement. TrialAssure’s release of its LINK AI 2.0 platform in June 2024 exemplifies this shift, enabling rapid creation of regulatory filings while establishing benchmarks for efficiency and uniformity. Such tools heighten reliance on professional oversight to ensure clinical accuracy and ethical standards.

Rising strategic consolidations in diagnostics and testing sectors invigorates the Medical Writing market, as expanded operations generate surges in research and validation documentation needs. Professionals develop technical files for in vitro diagnostic conformity assessments, post-market surveillance reports on device performance metrics, and market authorization applications for companion biomarkers. They also author validation protocols for analytical method transfers and real-world evidence summaries for payer engagements.

Minority investments unlock opportunities for cross-jurisdictional harmonization of writing standards across merged entities. Labcorp’s acquisition of a minority stake in SYNLAB in September 2024 directly amplifies this demand, as the partnership escalates clinical studies and regulatory filings in specialty testing arenas. This move fosters greater collaboration in preparing comprehensive dossiers for diverse therapeutic landscapes.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.9 billion, with a CAGR of 10.4%, and is expected to reach US$ 13.2 billion by the year 2034.

- The type segment is divided into clinical writing, scientific writing, regulatory writing, and others, with clinical writing taking the lead in 2024 with a market share of 38.6%.

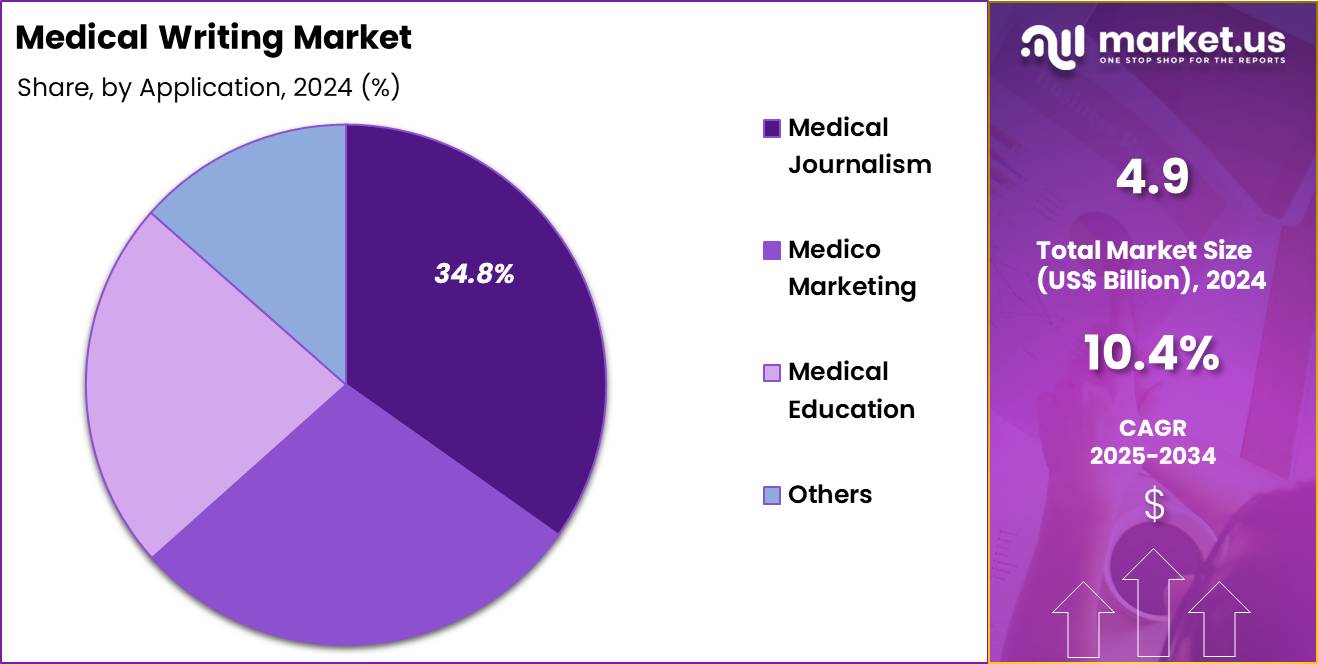

- Considering application, the market is divided into medical journalism, medico marketing, medical education, and others. Among these, medical journalism held a significant share of 34.8%.

- Furthermore, concerning the end-user segment, the market is segregated into contract research organizations, pharmaceutical & biotechnology companies, and others. The contract research organizations sector stands out as the dominant player, holding the largest revenue share of 47.9% in the market.

- North America led the market by securing a market share of 38.3% in 2024.

Type Analysis

Clinical writing, holding 38.6%, is expected to grow strongly due to rising clinical trial volumes across oncology, immunology, rare diseases, and metabolic disorders. The segment expands as companies invest in protocol development, clinical study reports, and patient narratives that satisfy global regulatory expectations. Complex trial designs such as adaptive, decentralized, and biomarker-driven studies create high demand for expert writers who interpret data accurately.

Growing clinical research activity in the United States, Europe, China, and India increases the need for standardized documentation. Sponsors prioritize high-quality reporting to speed submissions and reduce review delays, and this priority supports continuous market expansion. Increased outsourcing of phase II and III writing work strengthens the segment further. Digital data-capture platforms generate real-time insights, and clinical writers translate these outputs into regulatory-compliant formats.

Rising transparency requirements in the European Union and US FDA demand precise clinical summaries. Pharmaceutical pipelines expand across biologics and cell-based therapies, and this expansion triggers more trial documentation. Real-world evidence studies gain traction, and their reporting needs support consistent growth. CRO partnerships accelerate global trial execution, and clinical writers play a core role in scientific communication.

Emerging markets host more multicenter trials, and writers with region-specific expertise gain importance. Strong demand for accuracy, regulatory clarity, and scientific integrity keeps clinical writing anticipated to remain the most impactful type segment.

Application Analysis

Medical journalism, holding 34.8%, is anticipated to grow rapidly as healthcare audiences demand more credible, timely, and accessible medical information. Readers seek accurate coverage of drug launches, disease updates, clinical breakthroughs, and public health alerts, and this shift increases demand for skilled journalists. Medical news platforms expand across digital channels, and writers produce content that explains complex science in a clear and responsible manner. Growing health awareness after global health events drives readership across North America, Europe, and Asia.

Companies prioritize transparent communication about therapies, trials, and safety updates, strengthening demand for journalism-driven content. Hospitals, institutes, and associations publish research summaries that require expert reporting. The rise of subscription-based medical newsletters and online news platforms boosts workload for trained journalists. Social media channels require scientific accuracy, and medical writers safeguard content credibility.

Medical conferences generate continuous reporting needs across oncology, neurology, and infectious diseases. Increased patient involvement in healthcare decisions drives demand for fact-checked, trustworthy medical news. Journalistic coverage of digital health, AI in healthcare, and biotech innovation expands steadily. Pharmaceutical companies partner with expert journalists for unbiased educational communication.

As misinformation risks grow, the market increasingly depends on trained professionals who ensure precision and transparency. Expanding digital readership and rising scientific communication needs keep medical journalism projected to remain the dominant application segment.

End-User Analysis

Contract research organizations, holding 47.9%, are projected to remain dominant due to the global shift toward outsourced research and documentation. Pharmaceutical and biotechnology companies rely on CROs for writing clinical protocols, regulatory dossiers, investigator brochures, safety narratives, and study reports. Growing R&D activity across oncology, metabolic disorders, autoimmune diseases, and genetic therapies increases documentation volume.

CROs provide specialized multidisciplinary teams, and this expertise accelerates trial execution. Rising complexity in global trials requires documentation that meets regional regulatory expectations across the FDA, EMA, MHRA, and PMDA. Sponsors depend on CROs to manage writing deliverables for phase II and III programs, strengthening the segment’s growth. Increased biologics and biosimilar development generates high volumes of regulatory and clinical content.

Digital trials expand across decentralized and hybrid models, and CROs produce writing that aligns with new data formats. Real-world evidence studies gain importance, and CRO writers manage detailed outputs and observational summaries. Emerging markets contribute more trial sites, and CROs coordinate cross-border documentation. Outsourcing trends rise as companies reduce internal writing costs and prioritize speed. CROs invest in automation and quality systems that enhance accuracy and consistency.

Strong demand for efficient submission-ready documentation positions them as the preferred end-user group. Growing pipelines and heightened global compliance needs keep CROs anticipated to remain the most influential segment in the medical writing market.

Key Market Segments

By Type

- Clinical Writing

- Scientific Writing

- Regulatory Writing

- Others

By Application

- Medical Journalism

- Medico Marketing

- Medical Education

- Others

By End-User

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Increasing Number of Novel Drug Approvals by FDA is Driving the Market

The escalation in novel drug approvals by regulatory authorities has emerged as a principal driver for the medical writing market, as each approval mandates comprehensive documentation for submissions, labeling, and post-market surveillance. This surge necessitates specialized writing for clinical study reports, investigator brochures, and patient information leaflets to ensure compliance with stringent guidelines.

Pharmaceutical entities are compelled to engage medical writers for rapid turnaround on high-quality dossiers, supporting accelerated review pathways like fast-track designations. The volume of approvals correlates directly with demand for regulatory writing services, extending to real-world evidence summaries and health technology assessments. Collaborative frameworks between sponsors and writers streamline content generation, incorporating multimedia elements for enhanced clarity. This driver fosters professional development, with associations offering certifications tailored to evolving submission formats.

Economic incentives from timely approvals justify outsourcing to expert providers, optimizing resource allocation in R&D budgets. Global harmonization efforts, such as those under ICH guidelines, standardize writing requirements, amplifying cross-border opportunities. The trend underscores medical writing’s integral role in bridging scientific data and regulatory success. Healthcare policymakers recognize this linkage, funding initiatives to bolster writing capabilities in public institutions.

Consequently, the market experiences sustained expansion, propelled by innovation in therapeutic modalities. In 2022, the US Food and Drug Administration’s Center for Drug Evaluation and Research approved 37 novel drugs, increasing to 50 in 2024. This progression exemplifies the intensifying documentation imperatives.

Restraints

Lack of Structured Training Programs for New Talent is Restraining the Market

The scarcity of formalized training initiatives for emerging medical writers continues to constrain the market’s capacity to meet growing demands, resulting in skill gaps that prolong onboarding and compromise document quality. Organizations often prioritize immediate productivity over long-term talent cultivation, leading to reliance on ad hoc mentorship rather than systematic apprenticeships. This restraint exacerbates turnover in entry-level roles, as novices struggle with complex regulatory nuances without guided exposure.

Professional associations advocate for curriculum development, yet adoption lags due to resource limitations in smaller firms. The consequence includes delayed project timelines and heightened revision cycles, inflating operational costs for sponsors. Regulatory complexities further amplify the challenge, as evolving standards require continuous upskilling beyond initial training. Equity issues arise, with underrepresented groups facing additional barriers to specialized education.

Market analyses highlight the need for collaborative academe-industry partnerships to address these voids. Without intervention, the restraint perpetuates bottlenecks in high-volume periods, such as end-of-phase submissions. Stakeholders must invest in scalable online modules to democratize access. This structural deficiency not only hampers innovation but also risks non-compliance in critical filings.

A survey by the American Medical Writers Association in 2024 revealed that fewer than 50% of organizations have apprentice programs in place for developing new medical writers. Such findings emphasize the urgency for comprehensive workforce strategies.

Opportunities

Growth in Clinical Trials in the Asia-Pacific Region is Creating Growth Opportunities

The robust expansion of clinical trials in the Asia-Pacific region is generating substantial growth prospects for the medical writing market, as heightened activity demands localized yet globally compliant documentation. This regional surge attracts multinational sponsors seeking cost-effective sites, necessitating bilingual writing for protocols, safety narratives, and efficacy summaries. Opportunities arise in adapting content to diverse ethnic considerations, enhancing inclusivity in trial designs.

Local regulatory alignments, such as those in China and Japan, require tailored submissions, spurring demand for region-specific expertise. Partnerships with contract research organizations facilitate knowledge transfer, enabling scalable service models. The demographic dividend in Asia supports patient recruitment, indirectly boosting writing volumes for recruitment materials and informed consents.

Economic liberalization policies incentivize foreign investments, diversifying client bases beyond traditional markets. Training hubs in emerging economies cultivate hybrid talent, bridging cultural and technical divides. These dynamics position the region as a hub for outsourced writing, with potential for technology-infused workflows. Long-term, successful trials yield exportable models for global replication. This opportunity heralds equitable market distribution, mitigating over-reliance on Western centers.

According to the World Health Organization, the number of clinical trials registered in the Western Pacific region reached 23,250 in 2023, reflecting significant increases primarily from China and Japan. This escalation underscores the transformative potential for specialized documentation services.

Impact of Macroeconomic / Geopolitical Factors

High interest rates and contracting R&D budgets challenge pharmaceutical companies to trim medical writing outsourcing, delaying regulatory submissions in emerging markets. Booming clinical trial enrollments and evolving compliance standards, however, drive sponsors to commission comprehensive dossiers, elevating workloads for specialized agencies.

Surging geopolitical rivalries in supply-chain hotspots like the Taiwan Strait fragment cross-border data exchanges, complicating collaborative authorship and extending project cycles for international consortia. These frictions, on the other hand, spur adoption of secure digital platforms and regional talent pools that enhance document integrity and turnaround speeds.

The US 100% tariff on imported patented pharmaceuticals, implemented October 1, 2025, escalates therapy development costs and pressures firms to reallocate funds away from external writing support. Providers adapt swiftly by expanding domestic operations and negotiating service carve-outs under trade pacts, preserving client relationships.

Latest Trends

Rising Adoption of Artificial Intelligence Tools is a Recent Trend

The integration of artificial intelligence tools into medical writing workflows has solidified as a prominent trend in 2024, augmenting efficiency in drafting, editing, and compliance checks for regulatory documents. AI algorithms assist in literature synthesis and template population, allowing writers to focus on interpretive analysis and strategic narrative development. This trend aligns with digital transformation mandates, incorporating natural language processing for consistency across multinational dossiers.

Professional guidelines from associations emphasize ethical AI use, balancing automation with human oversight to preserve scientific integrity. Pilot implementations in pharma demonstrate reduced turnaround times, particularly for adverse event reporting and meta-analyses. Competitive pressures drive vendor collaborations, embedding AI within collaborative platforms for real-time feedback.

The approach extends to predictive analytics for submission risks, enhancing pre-review preparations. Challenges include data privacy safeguards under GDPR, prompting robust validation protocols. This evolution redefines skillsets, prioritizing AI literacy alongside domain expertise. Future iterations promise multimodal inputs, fusing text with visual data for holistic reports.

Overall, the trend catalyzes productivity gains while safeguarding quality standards. According to the Medical Group Management Association’s October 2024 poll, 43% of medical groups reported adding or expanding use of AI this year. This uptake illustrates the accelerating momentum in documentation practices.

Regional Analysis

North America is leading the Medical Writing Market

The Medical Writing market in North America captured 38.3% of the global share in 2024, stimulated by the proliferation of decentralized trial designs that required intricate remote monitoring narratives and adaptive protocol amendments to accommodate virtual endpoints. Freelance networks affiliated with the American Medical Writers Association proliferated in biotech corridors like Research Triangle Park, delivering specialized synopses for decentralized data capture in vaccine efficacy studies.

The European Medicines Agency’s mutual recognition agreements with the FDA compelled hybrid submission strategies, tasking authors with reconciling transatlantic pharmacodynamic sections for seamless multinational dossiers. Venture ecosystems in Toronto and Montreal fostered AI-hybrid workflows, where drafters collaborated on dynamic safety update reports incorporating real-time pharmacovigilance signals from wearable integrations.

Payer advisories from the Canadian Agency for Drugs and Technologies in Health emphasized patient-centric abstracts, driving refinements in lay summaries for rare pediatric indications. Institutional review boards at centers like MD Anderson Cancer Center mandated enhanced equity disclosures in recruitment plans, elevating the need for culturally attuned consent language in diverse cohorts. Blockchain-secured platforms from innovators like TrialKit expedited version tracking for investigator manuals, curtailing discrepancies in multi-center hematology protocols.

Advocacy groups influenced legislative riders on the Consolidated Appropriations Act, prioritizing transparency in grant proposals for underrepresented disease areas. Cross-disciplinary symposia hosted by the International Society for Medical Publication Professionals disseminated modular formatting best practices, optimizing label expansions for orphan biologics. ClinicalTrials.gov registered 43,674 new studies in 2024, amplifying the imperative for precise, compliant authoring to support escalating research documentation volumes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Forecasters anticipate the regulatory documentation sector in Asia Pacific to flourish during the forecast period, propelled by surging investments in mRNA platform validations that demand exhaustive preclinical summaries and immunogenicity profiles. China enforces rigorous NMPA edicts, directing authoring teams to compile stratified efficacy dossiers for nucleic acid therapeutics in oncology pipelines.

Japan channels substantial AMED endowments toward longitudinal outcome narratives, embedding genomic annotations in dossiers for CAR-T expansions targeting hematologic malignancies. India mobilizes CDSCO mandates, commissioning experts to articulate bioanalytical method validations for affordable biosimilars in endocrine disorders. South Korea allocates KFDA budgets for integrated risk-benefit analyses, prioritizing digital endpoints in phase III cardiovascular dossiers.

Authorities synchronize PIC/S standards across the bloc, compelling unified nonclinical overviews to expedite filings for inhaled biologics. Incubator alliances in Bengaluru pioneer templated grant applications, fusing economic modeling with translational hypotheses for infectious disease consortia. Supranational bodies like the APEC Life Sciences Innovation Forum circulate harmonized guidelines, refining abstract structures for collaborative antimicrobial resistance studies.

Pharmaceutical consortia in Sydney localize pharmacoeconomic sections, adapting cost-utility frameworks for indigenous health disparities in metabolic trials. The National Medical Products Administration recorded 4,300 clinical trial registrations in China in 2023, signifying the foundational evidentiary surge that bolsters demand for sophisticated authoring expertise.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the Medical Writing market drive expansion by deploying AI-assisted authoring platforms that accelerate clinical study reports while preserving regulatory rigor, securing preferred-provider status with mid-sized biotechs racing toward accelerated approvals. They embed senior experts directly into sponsor teams for seamless IND-to-NDA support, while acquiring niche patient-narrative specialists to meet rising lay-summary and risk-management demands.

Executives establish hybrid delivery centers combining European regulatory depth with cost-efficient Asian scale to enable 24/7 coverage without quality compromise. Trilogy Writing & Consulting GmbH, the Frankfurt-based pure-play leader founded in 2002, delivers submission-ready regulatory documents exclusively through senior writers, rejecting junior-heavy models to achieve unmatched strategic insight, faster timelines, and a superior track record in successful global authorizations for pharma and biotech clients worldwide.

Top Key Players

- Trilogy Writing & Consulting GmBH

- Synchrogenix

- Siro Clinpharm Private Limited

- Quanticate International Limited

- Parexel International Corporation

- Omics International

- Labcorp Drug Development

- IQVIA Holdings Inc.

- Inclin Inc.

- Freyr

- Cactus Communications

- Other Key Players

Recent Developments

- In March 2024, Indegene strengthened its regulatory communication capabilities by acquiring Trilogy Writing & Consulting GmbH. By bringing Trilogy’s established medical writing expertise into its operations, Indegene is positioning itself to handle higher submission workloads and more complex global filings. This type of consolidation highlights the growing demand for experienced writers who can support multinational regulatory requirements.

- In March 2024, Freyr entered into a strategic partnership with a Swiss food and beverage company to support compliance-related documentation. Although outside the pharmaceutical sector, this collaboration demonstrates how regulated industries increasingly depend on structured, technically accurate documentation to meet evolving standards. This broadens the scope of medical writing services beyond traditional life sciences and contributes to overall market expansion.

Report Scope

Report Features Description Market Value (2024) US$ 4.9 Billion Forecast Revenue (2034) US$ 13.2 Billion CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Clinical Writing, Scientific Writing, Regulatory Writing, and Others), By Application (Medical Journalism, Medico Marketing, Medical Education, and Others), By End-user (Contract Research Organizations, Pharmaceutical & Biotechnology Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trilogy Writing & Consulting GmBH, Synchrogenix, Siro Clinpharm Private Limited, Quanticate International Limited, Parexel International Corporation, Omics International, Labcorp Drug Development, IQVIA Holdings Inc., Inclin Inc., Freyr, Cactus Communications, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Trilogy Writing & Consulting GmBH

- Synchrogenix

- Siro Clinpharm Private Limited

- Quanticate International Limited

- Parexel International Corporation

- Omics International

- Labcorp Drug Development

- IQVIA Holdings Inc.

- Inclin Inc.

- Freyr

- Cactus Communications

- Other Key Players