Global Medical Face Shield Market By Material (Polycarbonate (PC), Polyethylene Terephthalate Glycol (PETG), Acetate and Propionate), By Product Type (Anti-Fog shields, Anti-Glare shields and Others), By Usage (Disposable and Reusable), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170811

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

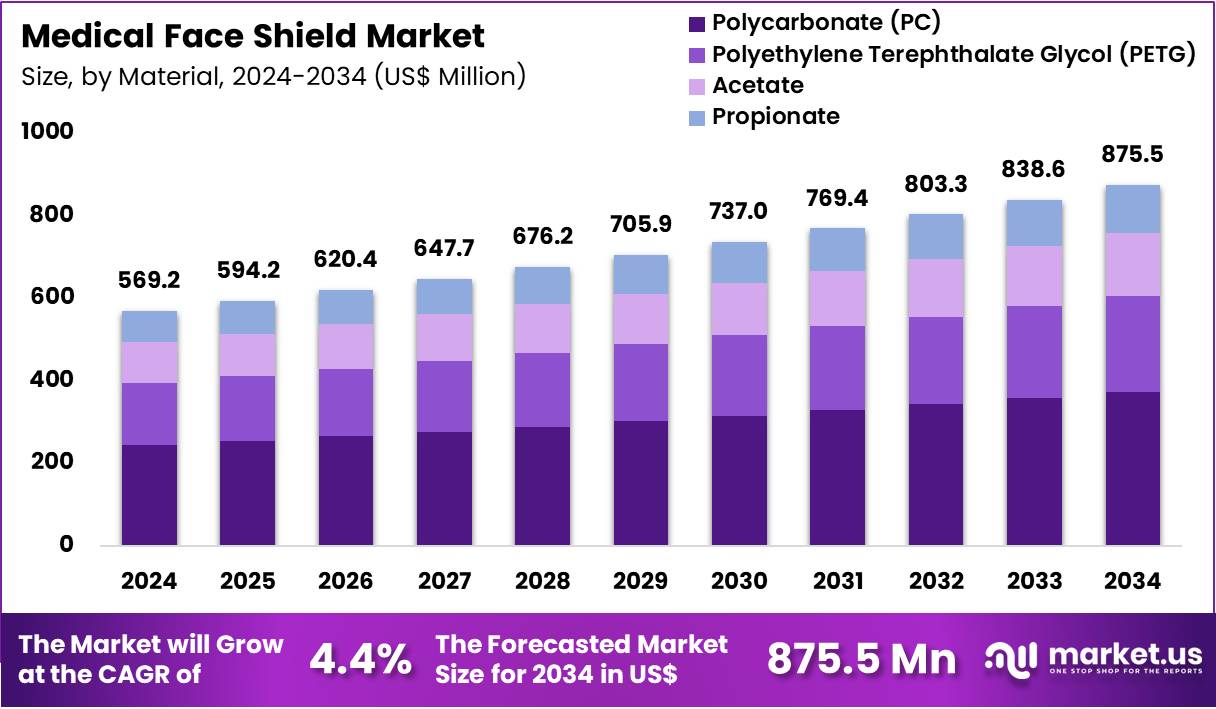

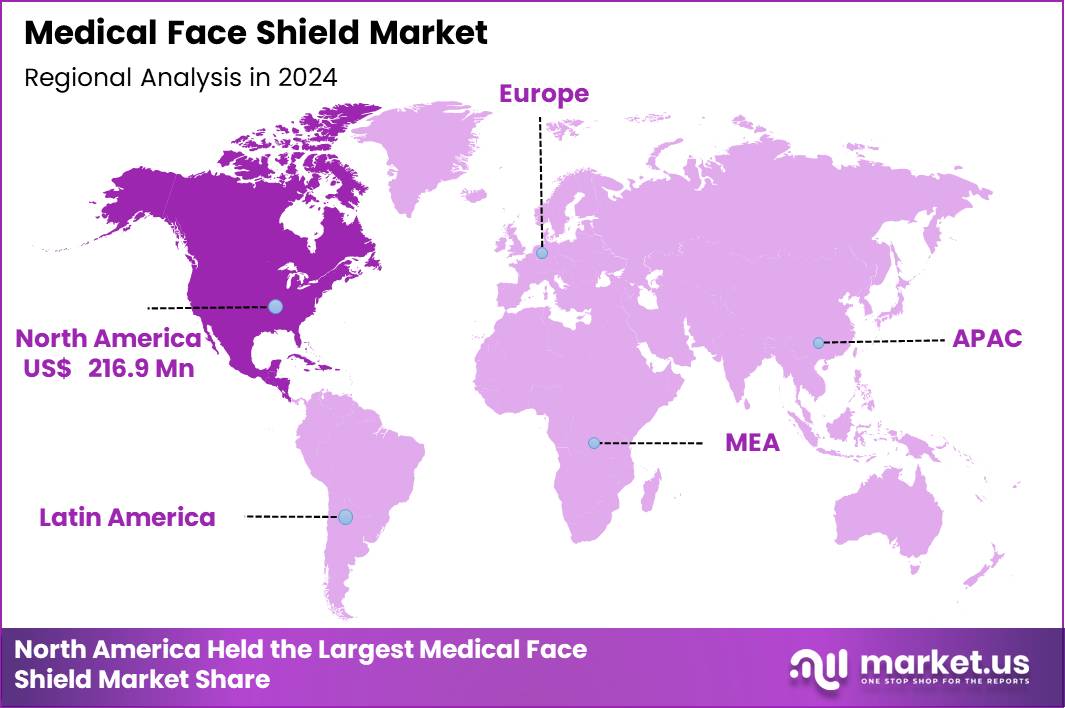

The Global Medical Face Shield Market size is expected to be worth around US$ 875.5 Million by 2034 from US$ 569.2 Million in 2024, growing at a CAGR of 4.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.1% share with a revenue of US$ 216.9 Million.

The Medical Face Shield Market forms a vital component of the global personal protective equipment (PPE) ecosystem, driven by stringent infection-prevention norms, rising clinical procedure volumes, and expanded occupational-safety requirements across healthcare environments.

Face shields serve as essential barriers against splashes, aerosols, bloodborne pathogens, and respiratory droplets during patient interaction, diagnostic work, surgical preparation, and emergency response. Their usage surged globally during public-health events, embedding long-term behavioral practices among hospitals, laboratories, dental facilities, and first-responder systems.

Polycarbonate, PETG, acetate, and propionate have become core materials due to their varying optical clarity, durability, chemical resistance, and weight properties. Hospitals increasingly rely on reusable, anti-fog, and anti-glare variants to ensure consistent visibility during procedures conducted under harsh lighting or extended clinical shifts.

Regulatory agencies such as OSHA, the CDC, and national public-health bodies reinforce the use of face shields in aerosol-generating procedures, dental operations, ENT clinics, laboratory testing zones, and environments dealing with infectious disease screening. Government innovation grants and supply-chain strengthening initiatives also support continuous product development in medical eye-and-face protection.

For instance, In April 2024, Toyota increased its medical face shield manufacturing capacity in Japan, boosting monthly output to 40,000 units.

Global players such as Becton Dickinson, Terumo, Nipro and others are expanding portfolios in the region with safety and prefilled syringes, often linked to chronic disease treatment and vaccination programs. Gulf and wider MENA governments (notably Saudi Arabia, UAE, Qatar, Egypt, Morocco) are pushing local or regional manufacturing via industrial projects and memoranda of understanding to secure syringe and administration‑device supply and support “Vision 2030”–style agendas.

In April 2020, Apple revealed a new face shield design for frontline healthcare workers and began producing the protective equipment in the millions. The company joined a growing list of organizations—including Foster + Partners, Nike, and research teams from MIT and the University of Cambridge that developed their own PPE face shield solutions during the pandemic.

Key Takeaways

- In 2024, the market generated a revenue of US$ 569.2 Million, with a CAGR of 4.4%, and is expected to reach US$ 875.5 Million by the year 2034.

- The Material segment is divided into Polycarbonate (PC), Polyethylene Terephthalate Glycol (PETG), Acetate, and Propionate, with Polycarbonate (PC) taking the lead in 2024 with a market share of 42.7%

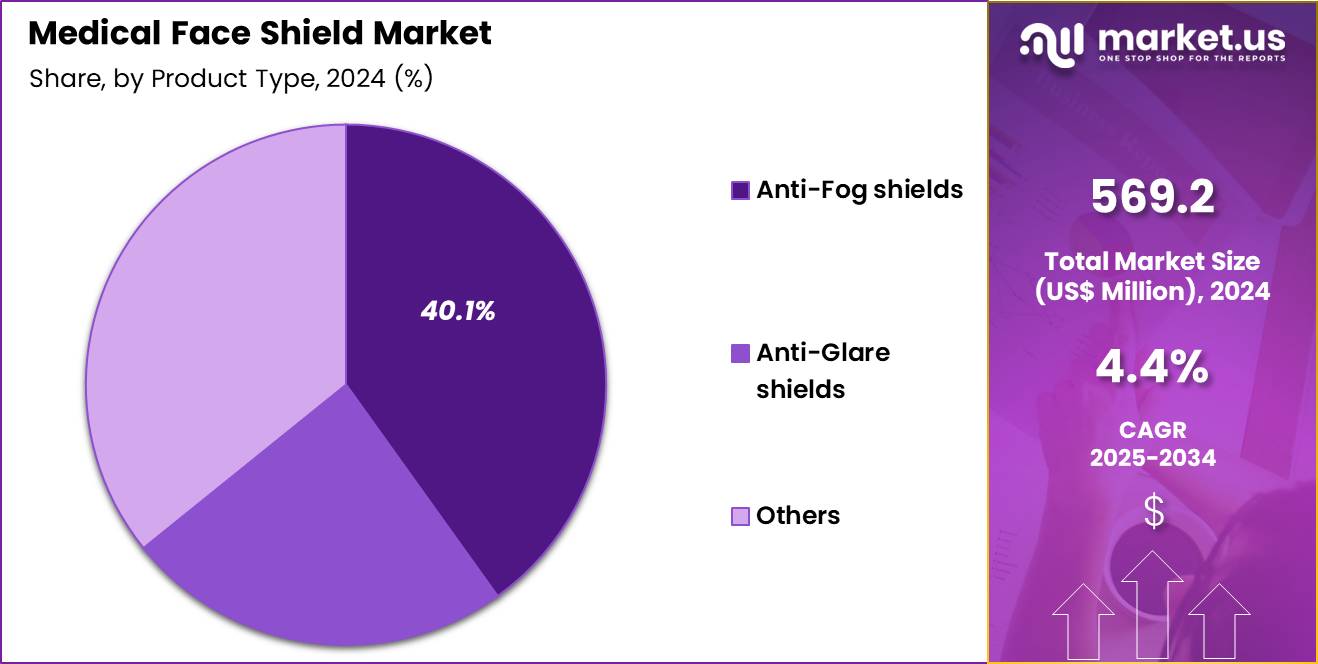

- The Product Type segment is divided into Anti-Fog shields, Anti-Glare shields, and Others, with Anti-Fog shields taking the lead in 2024 with a market share of 40.1%

- The Usage segment is divided into Disposable, and Reusable, with Disposable taking the lead in 2024 with a market share of 65.2%

- The Distribution Channel segment is divided into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies, with Hospital Pharmacies taking the lead in 2024 with a market share of 48.9%

- North America led the market by securing a market share of 38.1% in 2024.

Material Analysis

Polycarbonate represents the dominant material holding 42.7% market share due to its impact resistance, heat tolerance, and optical clarity crucial for high-risk medical tasks. PC shields are widely used in emergency rooms, ICUs, trauma care, and surgical preparation areas where staff face rapid aerosol bursts during intubation, bronchoscopy, suctioning, and resuscitation.

PC retains clarity even after repeated disinfection cycles, making it suitable for reusable shield designs. During the pandemic era, major hospitals in the US manufactured PC shields using 3D-printing collaborations to address demand surges, with some institutions producing over 40,000 units per month. PC is also preferred in dental and ENT clinics where precision visual fields are essential.

PETG shields are lightweight and flexible, making them increasingly preferred in outpatient clinics, vaccination centers, pediatrics, community-health campaigns, and high-volume triage units. They withstand chemical disinfectants commonly used in hospitals without cracking. Acetate shields are valued for chemical resistance and superior anti-fog performance.

These shields are frequently used in laboratory environments including microbiology, hematology, virology, and pathology units where exposure to solvents and disinfectants is routine. Propionate shields serve niche applications requiring lightweight structures and glare resistance. They are commonly adopted in dermatology procedures, ophthalmology assessments, and clinical photography rooms where lighting contrast can hinder detailed work.

Product Type Analysis

Anti-fog shields hold the largest product-type share of 40.1% as fogging disrupts visibility during procedures requiring precision, such as IV insertion, dental scaling, suturing, wound cleaning, ultrasound-guided injections, and respiratory assessments. Moisture buildup occurs frequently in high-intensity zones like emergency departments and COVID-isolation wards. Anti-fog coatings maintain clarity for 6–8 hours of clinical activity, making them indispensable during long shifts. Dental associations globally mandated anti-fog shields during aerosol-heavy procedures, significantly accelerating adoption.

Anti-glare variants support environments with strong overhead lighting such as operating rooms, dermatology lasers, ophthalmology suites, and dental surgery bays. Glare reduction improves accuracy when handling reflective surgical instruments, bright LED lamps, or loupes.

These shields are also used in teaching hospitals where students and trainees require consistent visibility under variable lighting conditions. The “Others” category includes biodegradable shields, disposable economy shields, pediatric-sized shields, and extended-coverage surgical models.

Usage Analysis

Disposable medical face shields dominated the market in usage with 65.2% market share due to infection-prevention protocols requiring single-use PPE in patient-facing procedures. Outpatient departments, maternity wards, dialysis units, oncology day-care centers, and primary-care clinics handle massive daily patient volumes, leading to continuous turnover.

Disposable shields are essential in drive-through testing centers and mass-vaccination sites; during peak vaccination periods, some countries administered over 5 million doses per day, requiring corresponding PPE consumption. Disposable shields also support emergency transport teams that cannot reuse equipment due to contamination risks.

Reusable shields hold an important but smaller segment, especially in hospitals adopting sustainability strategies. They are widely used in surgical units, academic hospitals, and specialty clinics where staff undergo long continuous shifts. Some reusable shields withstand over 150 disinfection cycles, reducing waste significantly.

UV-C sterilization cabinets and hydrogen-peroxide disinfection systems are increasingly used to sanitize reusable shields without degrading optical clarity. Cost efficiency and environmental benefits continue to strengthen the reusable segment, particularly in Europe and the Asia Pacific.

Distribution Channel Analysis

Hospital pharmacies and institutional procurement departments make up the dominant distribution channel accounting for 48.9% market share due to large-scale, recurring, and standardized PPE purchasing. Intensive care units, operating rooms, infectious-disease wards, and emergency departments require 24/7 shield availability. Procedures such as intubation, suctioning, bronchoscopy, and endoscopy have mandatory eye-and-face-protection protocols enforced by OSHA and CDC guidelines. High utilization in multi-specialty hospitals, maternity units, and trauma centers drives substantial demand.

Retail pharmacies supply shields to small clinics, dental practices, physiotherapy centers, elderly-care homes, and general consumers. During influenza and RSV seasonal peaks, community pharmacies experienced PPE surges as local populations sought protection during travel, childcare, and workplace exposure. Online channels grew rapidly as telemedicine and home-care programs expanded.

Procurement through digital platforms increased sharply as small clinics sought uninterrupted PPE access during supply shortages. Online sales also grew due to remote workers, schools, and public commuters adopting shields during respiratory-illness cycles. E-commerce platforms often carry specialty shields not widely available in retail outlets, such as pediatric face shields and anti-blue-light variants used in digital-learning environments.

Key Market Segments

By Material

- Polycarbonate (PC)

- Polyethylene Terephthalate Glycol (PETG)

- Acetate

- Propionate

By Product Type

- Anti-Fog shields

- Anti-Glare shields

- Others

By Usage

- Disposable

- Reusable

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising Infection-Prevention Standards Across Healthcare Systems

Growing global emphasis on infection-prevention protocols acts as a major driver for the Medical Face Shield Market. Healthcare-associated infections (HAIs) affect 7% of patients in high-income regions and up to 15% in low- and middle-income countries, according to the WHO, increasing the need for enhanced frontline protection. Aerosol-generating procedures such as intubation, bronchoscopy, dental drilling, suctioning, and nasopharyngeal swabbing significantly elevate contamination risks.

During COVID-19, the CDC documented that frontline workers faced 3.4 times higher exposure risk in aerosol-heavy environments, prompting hospitals to integrate face shields into standard PPE kits. Face shields became essential in emergency departments where daily patient interactions often exceed 150–250 contacts per clinician, especially during viral surges.

Dental associations in the US and Europe made shields mandatory after evidence showed aerosol spread could travel over 2 meters during drilling. Vaccination centers administering millions of doses daily in 2021–2022 also mandated shields to protect workers handling high patient volumes. Laboratories conducting PCR testing numbering more than 2.5 billion tests globally relied on shields during specimen handling.

Restraints

Environmental Disposal Challenges and Material-Waste Burden

A major restraint for the Medical Face Shield Market is the growing environmental burden associated with PPE disposal. During the pandemic years, the UN reported that approximately 75% of used PPE, including face shields, ended up in landfills or oceans. A single large hospital can discard over 1.5–3 tons of PPE waste per day, much of which includes plastic-based components such as polycarbonate and PETG.

Most shields are non-biodegradable and require high-temperature incineration, contributing to emissions and pressure on waste-management infrastructure. In regions with limited incineration capacity, improperly disposed face shields contributed to clogged waterways and microplastic formation; researchers documented face-shield debris in over 30 global coastal regions between 2020–2023.

Reusable shields attempt to mitigate waste, but compliance issues restrict widespread adoption—shields must withstand up to 70–150 disinfection cycles without optical degradation, a requirement many low-cost designs fail to meet. Additionally, disinfectants containing alcohol or hydrogen peroxide can cloud or warp cheaper materials, shortening lifespan. Regulations banning certain plastic types also complicate procurement for hospitals.

Opportunities

Innovation in Sustainable, Reusable, and Smart Face Shields

A significant opportunity arises from rapid innovation in eco-friendly and reusable face shield materials. Biodegradable polymers are advancing, with some formulations tested to degrade up to 40% faster than traditional plastics under landfill conditions. Universities and research labs are partnering with manufacturers to develop shields using PLA bioplastics, bamboo-fiber composites, and recycled PET.

The US healthcare system generates over 5 million tons of medical waste annually, creating strong incentives for sustainable alternatives. Reusable shields are gaining momentum as hospitals pursue waste-reduction strategies; several models now tolerate 150–200 disinfection cycles while retaining optical clarity. Opportunities also emerge in “smart PPE”—for instance, shields with anti-microbial coatings capable of reducing surface bacterial load by 99.9%, as seen in early-stage antimicrobial polymer trials.

In March 2024, UW Medicine, working with Design That Matters, unveiled a new face shield model constructed using 3D-printed horseshoe-shaped plastic strips.

Fog-resistant nanocoatings developed for aviation visors are now being adapted for clinical environments, showing 80–90% longer fog-free performance than traditional coatings. Innovations in modular shield designs—replaceable visors with reusable headbands—cut material consumption by over 60% per user annually.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic volatility and geopolitical instability exert a significant influence on the Medical Face Shield Market by disrupting raw-material supply chains, manufacturing capacity, and global PPE distribution. Polycarbonate and PETG rely heavily on petrochemical derivatives, making shield production sensitive to fluctuations in crude-oil prices; during major price spikes in 2022, several manufacturers reported material cost increases of 20–35%, affecting procurement budgets for hospitals.

Geopolitical conflicts that disrupt maritime routes, such as Black Sea and Red Sea tensions, have created delays of 2–4 weeks in PPE shipments, forcing healthcare systems to stockpile essential supplies. Trade restrictions imposed during public-health emergencies also impacted availability; more than 80 countries enacted PPE export controls in 2020–2021, illustrating how geopolitical decisions can rapidly tighten global supply.

Inflationary pressure continues to elevate the cost of plastics, labor, packaging, and energy, influencing shield pricing and inventory planning across health networks. Climate-related disruptions further complicate logistics, with extreme weather events causing periodic shutdowns of manufacturing hubs in Asia. Meanwhile, currency fluctuations affect cross-border purchasing for developing economies, limiting their access to higher-quality reusable shields.

Together, these macroeconomic and geopolitical dynamics shape long-term procurement strategies, pushing healthcare systems to diversify suppliers, increase domestic production, and strengthen resilience in PPE supply planning.

Latest Trends

Shift Toward Anti-Fog, Anti-Glare, and High-Precision Visual Shields

A defining trend in the Medical Face Shield Market is the shift toward advanced visibility-enhancing shield technologies. Anti-fog coatings have become essential as clinicians frequently work in humid environments, with shields exposed to condensation from masks, respirators, and long shifts. Studies show that fogging can reduce visual clarity by up to 80%, impairing precision during IV insertion, suturing, dental drilling, and endoscopy.

Anti-fog shields now maintain fog-free visibility for 6–10 hours, supporting uninterrupted procedures. Anti-glare shields are increasingly adopted in operating rooms, dermatology suites, and dental clinics where LED surgical lights produce high luminance; glare can reduce visual acuity by 20–30%, affecting accuracy.

Micro-textured optical surfaces and multi-layer coatings are emerging to mitigate this. High-clarity shields used in ophthalmology and microsurgery now transmit over 92% of visible light, enhancing fine-detail tasks. Pediatric shields with color-coded frames are trending in children’s hospitals to reduce patient anxiety.

Regional Analysis

North America is leading the Medical Face Shield Market

North America represents the largest regional market with 38.1% market share for medical face shields, driven by its extensive healthcare infrastructure, high patient throughput, and strict occupational-safety standards. The region conducts some of the world’s highest procedure volumes, including over 860 million physician office visits annually in the US, each requiring consistent PPE use. Emergency departments handle over 130 million annual visits, where face shields are essential for aerosol-generating interventions such as intubation, suctioning, and trauma care.

Dental practices—numbering more than 200,000 across the US and Canada—adopt face shields for routine procedures due to high aerosol exposure. OSHA mandates face and eye protection for tasks involving bodily fluids or chemical disinfectants, reinforcing adoption across hospitals, ambulatory surgery centers, and diagnostic labs. The US also benefits from strong domestic manufacturing capacity, with universities and industrial partners producing millions of shields during crisis periods. Combined, these structural strengths position North America as the dominant region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region in the medical face shield market, supported by rapidly expanding healthcare infrastructure, rising infectious-disease burden, and substantial diagnostic testing volumes. Countries including China, India, Indonesia, and Vietnam continue to scale hospitals, community clinics, and public-health programs, resulting in significantly higher PPE usage.

India alone performs over 50 million diagnostic tests per month, each involving specimen handling where shields are required. High-density urban populations accelerate transmission risks, increasing protective-equipment demand among healthcare workers. The region also leads global PPE manufacturing, with China and Southeast Asia producing billions of face shields and components annually, improving affordability and supply stability.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include 3M, Honeywell International, Cardinal Health, Kowa Company, Medline Industries, Kimberly Clark, AlphaProTech, Sanctuary Health, Thermo Fisher Scientific, BioClean, Prestige Ameritech, Ansell, Lakeland Industries, Bullard, and Other key players.

3M plays a central role in the medical face shield market due to its long-standing expertise in protective equipment design, material science, and high-volume manufacturing. The company produces polycarbonate and PETG-based shields widely used in hospitals, dental clinics, and emergency-response units, with models engineered for anti-fog performance and extended clinical wear. During global PPE shortages, 3M expanded production through automated lines and cross-industry partnerships, supplying millions of shields to frontline workers.

Honeywell International contributes through its advanced safety-engineering capabilities, offering durable, impact-resistant shields designed for high-risk medical settings and laboratory environments. Its products emphasize comfort, optical clarity, and compatibility with respirators, making them essential in emergency medicine and diagnostic workflows. Honeywell’s global distribution network supports rapid supply during public-health emergencies.

Cardinal Health strengthens the market through hospital-focused procurement solutions, offering both disposable and reusable shields tailored for clinical workflow efficiency. Its extensive supply chain ensures consistent availability across large health systems, outpatient clinics, and surgical centers, making it a major institutional supplier.

Top Key Players

- 3M

- Honeywell International

- Cardinal Health

- Kowa Company

- Medline Industries

- Kimberly Clark

- AlphaProTech

- Sanctuary Health

- Thermo Fisher Scientific

- BioClean

- Prestige Ameritech

- Ansell

- Lakeland Industries

- Bullard

- Other key players

Recent Developments

- In June 2020, Hula Global introduced protective face shields designed for workers across service industries including restaurants, retail, salons, grocery facilities, food plants, and the medical sector.

- In April 2020, Boeing supplied its first batch of 3D-printed face shields to support healthcare workers combating COVID-19. The U.S. Department of Health and Human Services received the initial shipment of 2,300 units, which FEMA then routed to the Kay Bailey Hutchison Convention Center in Dallas, Texas, an alternate care facility for COVID-19 patient

- In March 2020, MIT began large-scale production of disposable face shields to support the COVID-19 response. The MIT team developed a single-piece design that can be rapidly mass-manufactured through die cutting, enabling machines to produce thousands of shields per hour to meet nationwide hospital demand.

Report Scope

Report Features Description Market Value (2024) US$ 569.2 Million Forecast Revenue (2034) US$ 875.5 Million CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material (Polycarbonate (PC), Polyethylene Terephthalate Glycol (PETG), Acetate and Propionate), By Product Type (Anti-Fog shields, Anti-Glare shields and Others), By Usage (Disposable and Reusable), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, Honeywell International, Cardinal Health, Kowa Company, Medline Industries, Kimberly Clark, AlphaProTech, Sanctuary Health, Thermo Fisher Scientific, BioClean, Prestige Ameritech, Ansell, Lakeland Industries, Bullard, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- Honeywell International

- Cardinal Health

- Kowa Company

- Medline Industries

- Kimberly Clark

- AlphaProTech

- Sanctuary Health

- Thermo Fisher Scientific

- BioClean

- Prestige Ameritech

- Ansell

- Lakeland Industries

- Bullard

- Other key players