Meat Processing Equipment Market Report By Product (Slicing Equipment, Blending Equipment, Dicing Equipment, Grinding Equipment, Massaging & Marinating Equipment, Smoking Equipment, Tenderizing Equipment, Others), By Meat Type (Beef, Mutton, Pork, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 22241

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

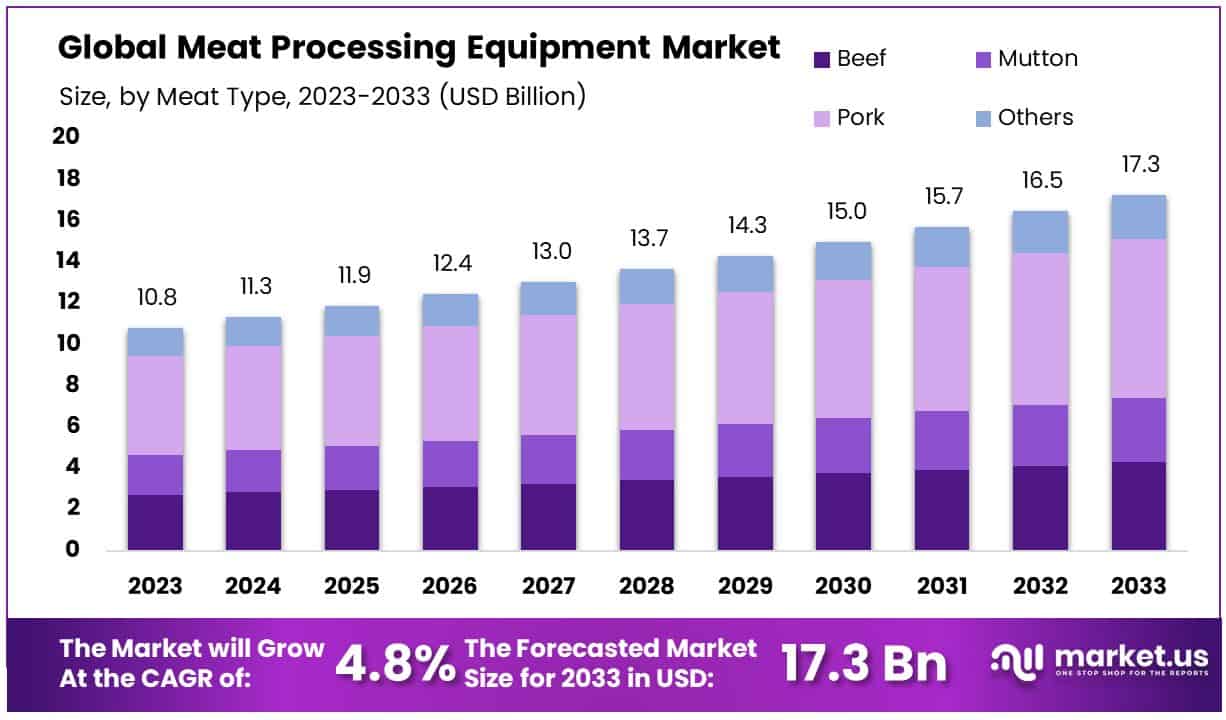

The Global Meat Processing Equipment Market size is expected to be worth around USD 17.3 Billion by 2033, from USD 10.8 Billion in 2023, growing at a CAGR of 4.80% during the forecast period from 2024 to 2033.

The Meat Processing Equipment Market encompasses tools and machinery designed for the transformation of raw meat into ready-to-eat products, ingredients for other food items, and processed meats. This includes equipment for slicing, grinding, tenderizing, and stuffing, among other processes.

Aimed at enhancing efficiency, ensuring safety, and maintaining the nutritional value of meat products, this market caters to meat processing companies, butchers, and food service businesses.

In the dynamic landscape of the Meat Processing Equipment Market, current trends in beef and pork exports play a pivotal role in shaping market demands and growth prospects. With beef exports observing a total volume of 1.29 million metric tons valued at $860.8 million in the recent period, a 12% decrease from the previous record in 2022, the market faces a nuanced challenge.

The top importers of beef, including Japan, China, Taiwan, South Korea, and Canada, indicate a diversified global demand, while exports to Mexico notably surged to a record 1.1 million tonnes, marking a 14% increase from 2022, accompanied by a record export value of $2.35 billion, up 15% from the previous year.

Conversely, pork exports presented an upward trend, totaling 2.91 million tonnes, an 8% increase from 2022, making it the third-largest record to date. The export value reached a new high of $8.16 billion, a 6% increase from 2022, with Mexico and other markets showing robust growth. This strong global demand, especially from Mexico and other Western Hemisphere and Asia-Pacific markets, projects a favorable outlook for 2023.

These export trends have significant implications for the Meat Processing Equipment Market. The increased demand for processed meat products in international markets necessitates advanced, efficient, and hygienic processing equipment. Manufacturers and suppliers in this sector must adapt to the evolving demands, focusing on innovation and sustainability to support the meat processing industry’s expansion.

Key Takeaways

- Market Value: The Global Meat Processing Equipment Market is projected to reach USD 17.3 Billion by 2033, marking growth from USD 10.8 Billion in 2023, with a CAGR of 4.80% during the forecast period from 2024 to 2033.

- Dominant Segments:

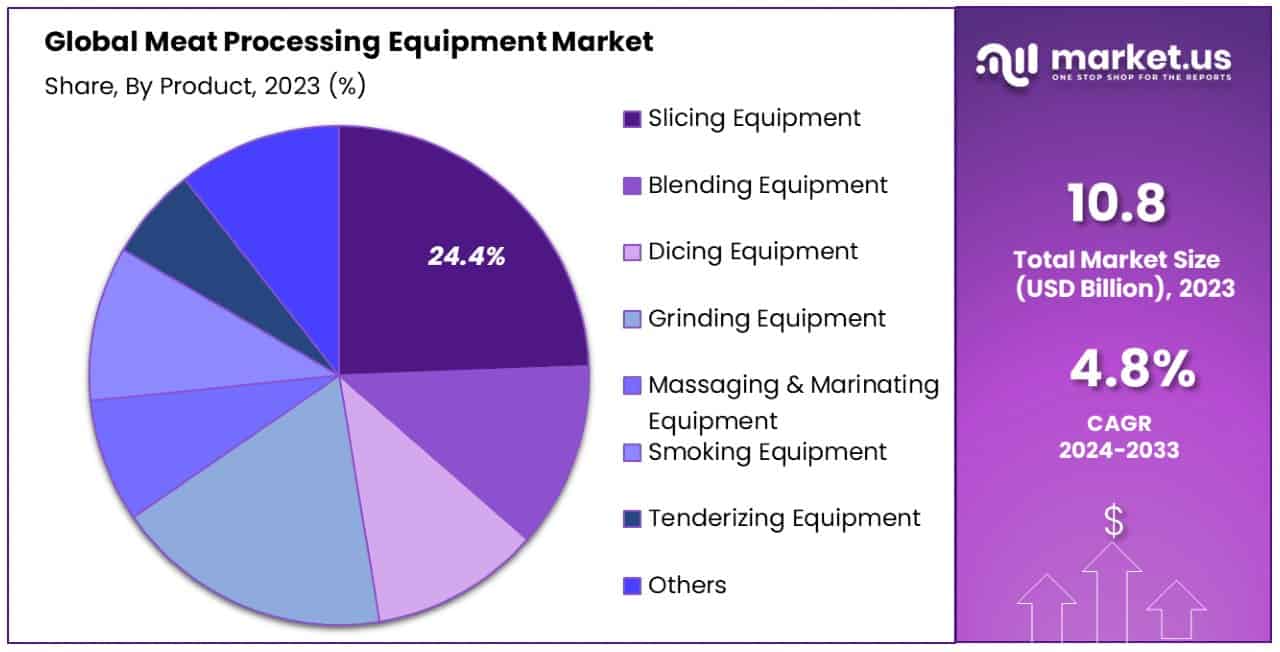

- Product Analysis: Slicing Equipment, Leads with a significant market share of 24.4%, crucial for efficient cutting of meat into precise slices, meeting consumer demand for ready-to-eat and conveniently sized meat products.

- Meat Type Analysis: Pork, Commands a substantial 44.6% share, driven by pork’s global popularity and versatility in culinary applications, necessitating efficient and specialized processing equipment to ensure quality and safety.

- Regional Analysis:

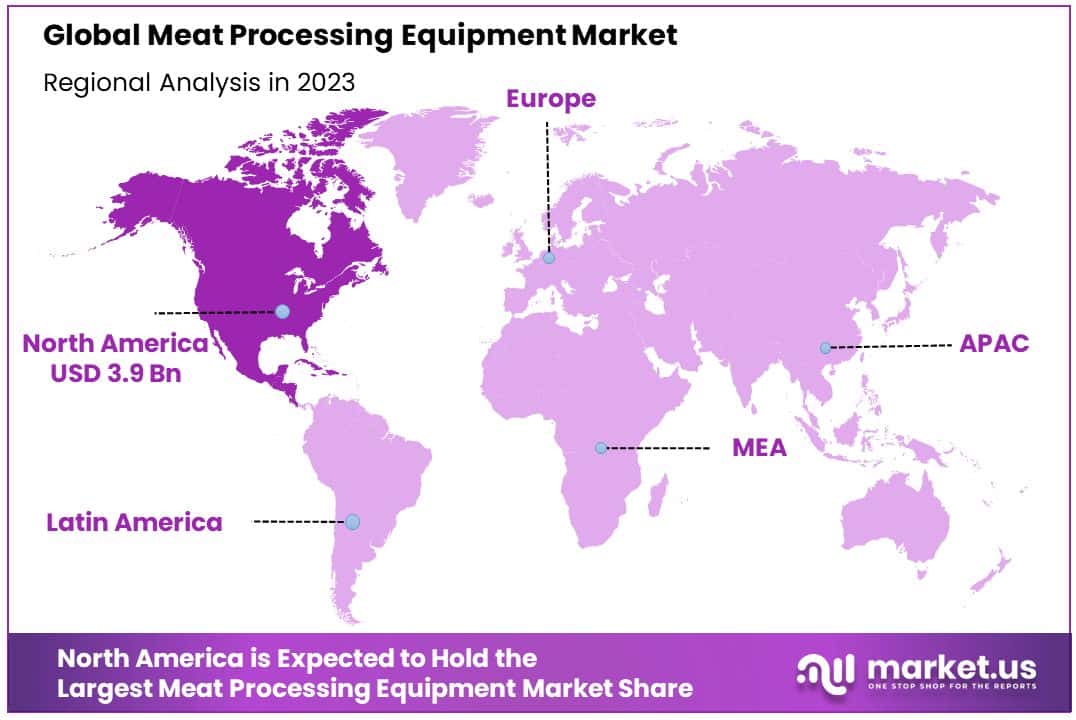

- North America: Dominates with a 36.5% market share, supported by robust food processing industries and technological advancements, driving innovation and growth in the sector.

- Europe: Holds a significant market share at 29.8%, with a focus on food safety, quality, and innovation, backed by stringent regulatory standards, fostering sustained market growth.

- Market Key Players: Major players include GEA Group, JBT Corporation, ITW Works, The Middleby Corporation, Alfa Laval AB, Bettcher Industries, Bizerba, Minerva Omega Group, Apache Corporation, RZPO – FISH and MEAT Processing Equipment Machinery, Deli Spices (Pty) Ltd, Grasselli.

- Analyst Viewpoint: The meat processing equipment market is witnessing steady growth driven by increasing demand for processed meat products, consumer preferences for convenience, and stringent food safety regulations. Dominant segments such as slicing equipment and pork processing equipment underscore the market’s adaptability to evolving consumer trends and culinary preferences.

Driving Factors

Increasing Demand for Processed Meat Products Drives Market Growth

The escalating global appetite for processed meat products significantly fuels the expansion of the Meat Processing Equipment Market. Consumer preferences have notably shifted towards convenient food options like sausages, bacon, ham, and ready-to-eat meals, mirroring the changing dynamics of lifestyle and dietary habits. This surge in demand necessitates the deployment of sophisticated and automated processing technologies to streamline production and fulfill market requirements efficiently.

Renowned entities such as Tyson Foods and JBS have recognized this trend, channeling investments into cutting-edge processing apparatuses to serve the escalating consumer demand effectively. The integration of these technologies ensures that the meat processing sector can keep pace with consumption patterns, projecting a trajectory of sustained growth. This demand-driven landscape underscores the pivotal role of consumer preferences in steering market dynamics, necessitating ongoing advancements in processing capabilities to cater to evolving dietary trends.

Automation and Efficiency Improvements Elevate Market Prospects

The imperative for enhanced efficiency, diminished labor costs, and amplified productivity has steered the Meat Processing Equipment Market towards automation. Innovations in equipment, including slicers, dicers, tenderizers, and packaging machines, have revolutionized production processes. These advancements offer dual benefits: they not only expedite production rates but also guarantee consistent product quality while minimizing labor inputs.

Leading innovators like GEA Group and Marel are spearheading the development of automation solutions tailored for the meat processing sector. Such technological advancements are instrumental in reshaping production landscapes, facilitating scalability, and ensuring that the industry remains competitive. The strategic focus on automation reflects a broader industry trend towards optimizing operations, which is critical for sustaining growth in the face of escalating global meat consumption and the corresponding need for efficient production methodologies.

Food Safety and Regulatory Compliance Catalyze Market Expansion

In an era marked by stringent food safety standards and regulatory mandates, the demand for specialized meat processing equipment has surged. These regulations necessitate apparatuses designed with hygienic features, including easy-to-clean surfaces and antimicrobial materials, to uphold food safety and meet compliance requirements. The enactment of regulations such as the Food Safety Modernization Act (FSMA) in the United States exemplifies the regulatory pressures exerted on the meat processing industry.

This regulatory landscape compels meat processors to adopt advanced equipment solutions to ensure the safety and quality of their products. Consequently, the focus on regulatory compliance not only influences equipment design and functionality but also drives market growth by necessitating upgrades and innovations in processing technologies. This dynamic illustrates the critical interplay between regulatory frameworks and market evolution, emphasizing the necessity for industry players to adapt continuously to maintain compliance and ensure consumer safety.

Growth of the Meat Export Market Stimulates Equipment Demand

The expansion of the global meat export market presents lucrative opportunities for the Meat Processing Equipment Market. As international trade in meat products intensifies, there is a growing need for processing equipment capable of accommodating diverse product specifications, including various cuts, packaging formats, and labeling requirements. Companies like Smithfield Foods and Cargill are tapping into this potential by investing in specialized processing technologies tailored for the export sector. This strategic move enables them to access broader markets and cater to the nuanced demands of international consumers.

The burgeoning export market thus not only broadens the operational horizon for meat processors but also acts as a catalyst for the development and adoption of versatile processing solutions. The interconnection between export market growth and equipment demand highlights the global nature of meat trade, underscoring the importance of adaptability and innovation in equipment design to navigate and capitalize on the complexities of international commerce.

Restraining Factors

High Investment Costs and ROI Concerns Restrain Market Growth

The requirement for hefty initial investments significantly limits the growth of the Meat Processing Equipment Market. Acquiring advanced processing equipment demands substantial capital, a daunting barrier particularly for small and medium-sized enterprises (SMEs). These companies find it challenging to allocate large funds for state-of-the-art machinery, given the uncertainty regarding the return on investment (ROI) and the length of the payback period.

This financial strain stifles the market’s expansion, as potential buyers hesitate to commit to purchases that may not yield immediate or guaranteed financial benefits. The apprehension over ROI further exacerbates the reluctance to invest, leading to a slower adoption rate of new technologies within the industry. Consequently, the high upfront costs and ROI concerns directly impact the market’s growth trajectory, hindering the widespread implementation of innovative processing solutions.

Complexity of Equipment Operations and Maintenance Hinders Market Expansion

The advanced nature of modern meat processing equipment, characterized by sophisticated technologies and automation systems, presents significant operational and maintenance challenges. This complexity requires specialized skills for effective operation, creating a gap in the labor market for adequately trained personnel. Meat processing companies, particularly those with limited resources, struggle to find and retain skilled workers capable of managing these complex systems efficiently.

The scarcity of qualified operators not only leads to operational inefficiencies and increased downtime but also poses safety risks, compounding the challenges faced by the industry. Furthermore, the technical intricacies of maintaining state-of-the-art equipment can escalate operational costs and complicate routine processes. These factors collectively contribute to market growth constraints, as potential adopters weigh the benefits against the practical difficulties and costs associated with operating and maintaining advanced meat processing equipment.

Product Analysis

In the diverse landscape of the Meat Processing Equipment Market, slicing equipment emerges as the dominant sub-segment, holding a significant market share of 24.4%. This predominance is attributed to the equipment’s critical role in the processing line, facilitating the efficient cutting of meat into consistent and precise slices, a fundamental requirement across various meat products.

Slicing equipment caters to a wide array of applications, from commercial deli operations to large-scale meat processing facilities, underscoring its indispensability in meeting consumer demand for ready-to-eat and conveniently sized meat products. The preference for pre-sliced meats among consumers, driven by the appeal of convenience and time-saving, further bolsters the demand for advanced slicing technologies. These machines are engineered for precision, speed, and flexibility, allowing processors to adjust thickness and slice types to suit different products and preferences, thereby enhancing product appeal and customer satisfaction.

The prominence of slicing equipment in the market is further supported by ongoing technological advancements aimed at improving efficiency, reducing waste, and ensuring safety. Innovations such as automated load and unload features, integrated weighing systems, and advanced hygiene standards align with the industry’s focus on productivity and food safety. However, the segment’s growth is not isolated; it complements and is complemented by other equipment types essential for comprehensive meat processing solutions.

Blending, dicing, grinding, massaging and marinating, smoking, and tenderizing equipment, alongside others, collectively contribute to the sector’s expansion. Each of these sub-segments addresses specific stages in meat processing, ensuring versatility and comprehensive capabilities within the industry. For instance, blending equipment is pivotal for creating uniform mixtures of meat with spices or additives, enhancing flavor and consistency, while grinding equipment is essential for producing ground meat products, highlighting the interconnected nature of these segments.

Meat Type Analysis

In the context of meat types processed, pork holds a commanding position in the Meat Processing Equipment Market, accounting for 44.6% of the sector. This substantial share can be attributed to pork’s global popularity and its versatility in culinary applications, ranging from fresh cuts to processed products like sausages, bacon, and ham.

The high consumption rates of pork products, especially in regions with strong culinary traditions involving pork, such as East Asia and Europe, necessitate efficient and specialized processing equipment. Pork processing involves a variety of operations, from initial slaughtering to final product packaging, each requiring specific equipment to ensure quality and safety. Slicing equipment, for example, plays a crucial role in producing ready-to-eat pork products, aligning with consumer preferences for convenience and quality.

The dominance of pork in the meat processing industry is not without its challenges, including stringent food safety regulations and the need for sustainable processing practices. However, these challenges also drive innovation within the market, leading to the development of advanced processing solutions that address food safety concerns, enhance operational efficiency, and reduce environmental impact. Other meat types, such as beef, mutton, and a category encompassing various other meats, also contribute to the market’s diversity and growth.

Each meat type requires tailored processing approaches and equipment, reflecting the market’s adaptability and responsiveness to consumer demand and regulatory requirements. Beef processing, for instance, demands equipment capable of handling larger cuts, while mutton processing benefits from technologies suited for its specific fat content and texture.

Key Market Segments

By Product

- Slicing Equipment

- Blending Equipment

- Dicing Equipment

- Grinding Equipment

- Massaging & Marinating Equipment

- Smoking Equipment

- Tenderizing Equipment

- Others

By Meat Type

- Beef

- Mutton

- Pork

- Others

Growth Opportunities

Plant-based and Alternative Protein Products Offer Growth Opportunity

The surging interest in plant-based and alternative protein products carves out a notable growth avenue for the Meat Processing Equipment Market. As consumer preferences increasingly lean towards vegetarian diets or alternatives to traditional meat, the demand for specialized processing equipment escalates. This shift necessitates machines capable of handling plant-based ingredients and technologies designed to mimic the texture and taste of meat in products like plant-based burgers, sausages, and nuggets.

Noteworthy companies are spearheading this movement, propelling the need for innovative processing solutions. This trend not only broadens the market’s scope but also encourages equipment manufacturers to diversify their offerings and explore new technological frontiers in food processing, marking a significant pivot towards accommodating evolving dietary trends and expanding market boundaries.

Robotics and Automation in Meat Processing Enhance Market Prospects

The adoption of robotics and automation technologies in the meat processing industry signals a robust growth opportunity for equipment manufacturers. Robots, characterized by their ability to perform precise and labor-intensive tasks efficiently, are revolutionizing meat processing operations. These automated systems offer unmatched consistency and safety, significantly reducing the likelihood of workplace injuries while enhancing operational efficiency. The versatility of robotic systems, capable of executing a wide range of tasks from cutting to packaging, offers meat processors the flexibility to streamline their operations.

This technological advancement is especially appealing to large-scale processors aiming to optimize productivity and minimize labor costs. As the industry gravitates towards automation, the demand for robotic and automated processing solutions is expected to surge, driving innovation and expansion within the Meat Processing Equipment Market. This trend underscores the industry’s move towards high-tech solutions to meet the challenges of modern meat processing, promising a future marked by efficiency, safety, and technological sophistication.

Trending Factors

Internet of Things (IoT) and Connected Equipment Are Trending Factors

The incorporation of the Internet of Things (IoT) into meat processing equipment marks a significant trend within the industry. IoT-enabled devices offer the advantage of real-time monitoring and data analytics, empowering meat processors to enhance operational efficiency, reduce downtime, and maximize equipment utilization. This technological advancement facilitates remote management of equipment, allowing for timely adjustments and preventive maintenance actions based on data insights.

The trend towards IoT and connected equipment reflects the industry’s move towards smarter, more efficient production facilities where decision-making is driven by accurate, real-time data. This shift not only optimizes production processes but also supports quality control and traceability, crucial factors in today’s market. As a result, IoT integration is rapidly becoming a standard expectation in meat processing equipment, signaling a broader trend towards digitalization and connectivity in manufacturing operations.

Emphasis on Energy Efficiency and Sustainability Are Trending Factors

The focus on energy efficiency and sustainability has emerged as a driving trend in the meat processing equipment market. Manufacturers are increasingly prioritizing the development of equipment that supports sustainable operations by utilizing less energy and water, thereby reducing operational costs and minimizing environmental impact. This trend is propelled by growing environmental awareness among consumers and regulatory pressures, prompting processors to adopt green technologies and practices.

Equipment that offers improved resource efficiency not only aligns with these environmental goals but also provides long-term financial benefits through reduced utility costs. The emphasis on sustainability is becoming a key consideration in equipment selection, influencing purchasing decisions and shaping the development of new technologies. As the industry progresses, the integration of energy-efficient and sustainable solutions is expected to continue gaining momentum, reflecting a collective move towards more responsible and cost-effective processing practices.

Regional Analysis

North America Dominates with 36.5% Market Share

North America’s commanding 36.5% share in the Meat Processing Equipment Market is a testament to the region’s robust food processing industry and advanced technological adoption. This dominance is driven by a high demand for processed meat products, stringent food safety regulations, and a strong focus on innovation and efficiency improvements. The region’s market is characterized by the presence of key industry players and a competitive landscape that fosters technological advancements, including automation and sustainable processing solutions.

The regional dynamics of North America reflect a mature market with well-established meat processing standards and practices. These factors contribute significantly to the region’s leading position, enabling it to set trends and standards that influence global market directions.

North America’s influence is expected to continue shaping the Meat Processing Equipment Market. Technological innovations and sustainability initiatives within the region are likely to spur further growth, setting a benchmark for operational efficiency and environmental responsibility in the meat processing industry globally.

Market Share and Growth Rates for Other Regions:

- Europe: Europe holds a significant portion of the market, with a 29.8% share. The region’s focus on food safety, quality, and innovation, coupled with its stringent regulatory environment, supports sustained growth in the meat processing equipment sector.

- Asia Pacific: Asia Pacific is a rapidly growing region in the Meat Processing Equipment Market, with a 26.2% share. Driven by increasing meat consumption, urbanization, and rising disposable incomes, this region presents a dynamic market with substantial growth opportunities.

- Middle East & Africa: This region accounts for 4.3% of the market. Despite its smaller share, the Middle East & Africa is experiencing growth due to expanding meat processing industries and increasing demand for processed meat products.

- Latin America: Latin America holds a 3.2% market share, with growth driven by rising meat consumption and the modernization of meat processing facilities. The region’s potential for growth is supported by its agricultural capabilities and increasing focus on export-quality meat production.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Within the Meat Processing Equipment Market, several key players have established significant positions through strategic innovation, comprehensive product offerings, and global market influence. GEA Group and JBT Corporation lead with advanced technological solutions, enhancing processing efficiency and automation capabilities. Their impact extends across various stages of meat processing, from initial cutting to final packaging, emphasizing their commitment to innovation and reliability.

ITW Works and The Middleby Corporation further augment the market’s competitive landscape through their diverse range of equipment tailored for meat processing applications. These companies excel in offering solutions that meet the industry’s evolving needs, including energy efficiency and sustainability.

Alfa Laval AB and Bettcher Industries distinguish themselves with specialized equipment focusing on quality and precision, ensuring compliance with food safety standards and operational excellence. Meanwhile, Bizerba and Minerva Omega Group contribute with cutting-edge slicing and processing technologies that cater to the demands for precision and versatility.

Emerging players like Apache Corporation, RZPO, Deli Spices (Pty) Ltd, and Grasselli are rapidly gaining traction by addressing niche segments, including spice integration and specialized meat cutting equipment. Their focus on specific market needs demonstrates the diverse and dynamic nature of the industry.

Collectively, these companies shape the Meat Processing Equipment Market through a blend of innovation, strategic market positioning, and a keen focus on addressing the complex challenges faced by meat processors today. Their contributions not only drive technological advancements but also set industry standards, influencing market trends and future developments.

Market Key Players

- GEA Group

- JBT Corporation

- ITW Works

- The Middleby Corporation

- Alfa Laval AB

- Bettcher Industries

- Bizerba

- Minerva Omega Group

- Apache Corporation

- RZPO – FISH and MEAT Processing Equipment Machinery

- Deli Spices (Pty) Ltd

- Grasselli

Recent Developments

- On March 11, 2024, Fortifi Food Processing Solutions officially launched as a unified platform of global leading brands and products within the food processing equipment and automation solutions industry.

- On February 23, 2024, White Veal Meat Packers Ltd. in Cookstown received funding through the Sustainable Canadian Agricultural Partnership (Sustainable CAP) program to enhance its operations. This funding, part of the Meat Processors Capacity Improvement Initiative, supports the purchase and installation of conveyors for boxing and trim/deboning lines.

- On February 20, 2024, the Highgate butcher shop received government funding through the Meat Processors Capacity Improvement Initiative, a program under the Sustainable Canadian Agricultural Partnership.

- On June 2023, the UK government allocated over £30 million to enhance sustainable food production by providing funding for new equipment and technology. This substantial investment of £31 million aims to boost farm productivity, improve environmental sustainability, and aid in slurry management.

Report Scope

Report Features Description Market Value (2023) USD 10.8 Billion Forecast Revenue (2033) USD 17.3 Billion CAGR (2024-2033) 4.80% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Slicing Equipment, Blending Equipment, Dicing Equipment, Grinding Equipment, Massaging & Marinating Equipment, Smoking Equipment, Tenderizing Equipment, Others), By Meat Type (Beef, Mutton, Pork, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GEA Group, JBT Corporation, ITW Works, The Middleby Corporation, Alfa Laval AB, Bettcher Industries, Bizerba, Minerva Omega Group, Apache Corporation, RZPO – FISH and MEAT Processing Equipment Machinery, Deli Spices (Pty) Ltd, Grasselli Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected size of the Global Meat Processing Equipment Market by 2033?The market is expected to be worth around USD 17.3 Billion by 2033. The CAGR is projected to be 4.80% during the forecast period.

What are the dominant segments within the market?Slicing equipment and pork processing equipment are dominant, with slicing equipment leading with a market share of 24.4%.

Which region dominates the Meat Processing Equipment Market?North America dominates with a market share of 36.5%.

What segments are covered in the market analysis?The analysis covers segments such as slicing equipment, blending equipment, dicing equipment, and grinding equipment, among others.

Which are some key players in the market?Major players include GEA Group, JBT Corporation, ITW Works, The Middleby Corporation, and Alfa Laval AB, among others.

Meat Processing Equipment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Meat Processing Equipment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Mepaco Group

- Minerva Omega Group s.r.l

- Tomra Systems ASA

- JBT Corporation

- Talsabell S.A.

- Nemco Food Equipment, LTD.

- Middleby Corporation

- Marel

- Other Key Players