Global Measurement While Drilling Market Size, Share Analysis Report By Well Type (Horizontal, Directional, Vertical), By Location (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153710

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

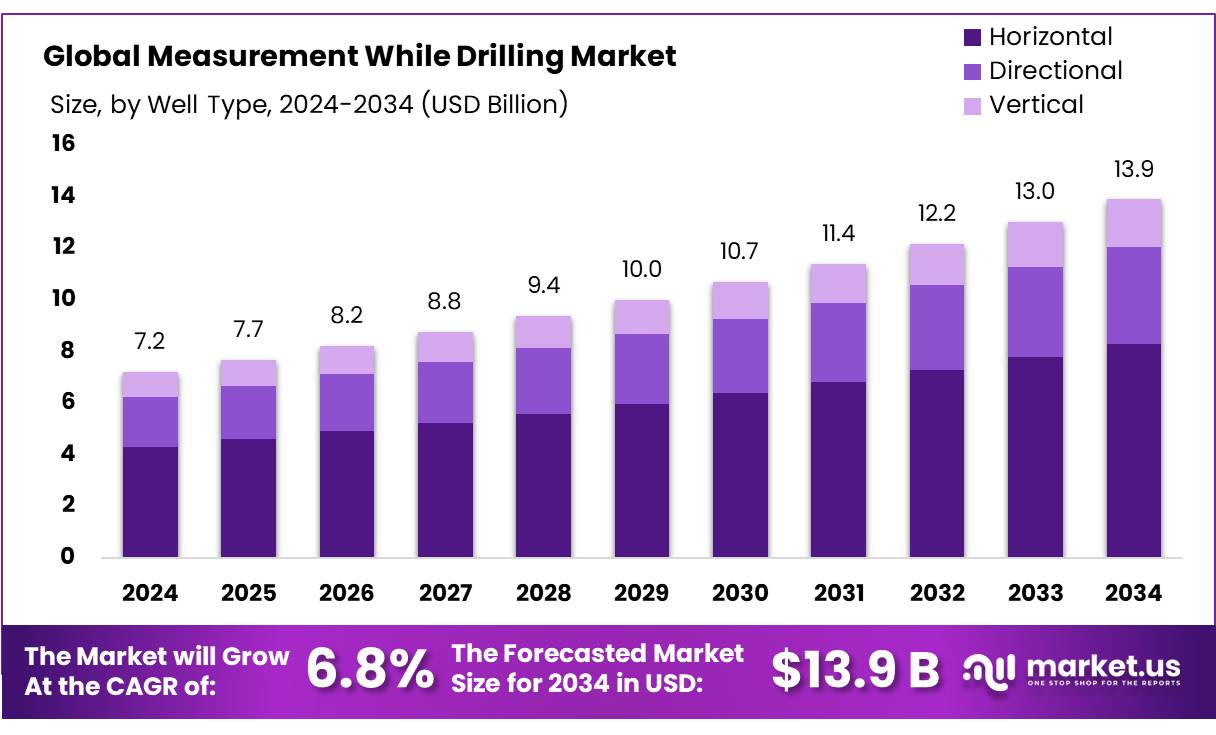

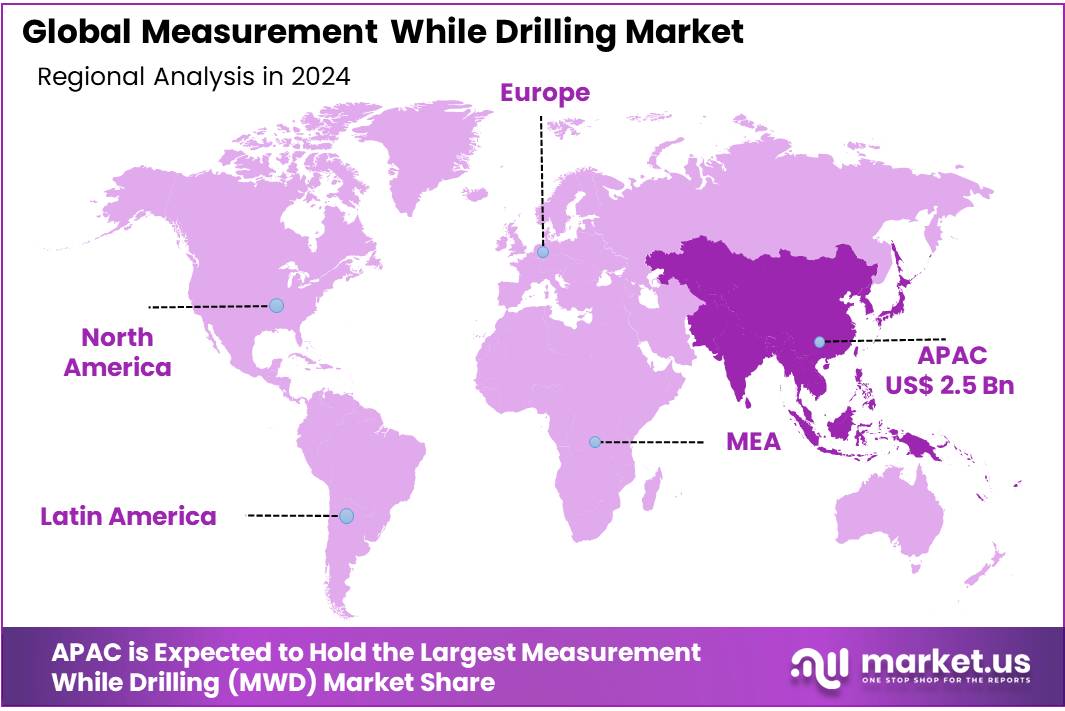

The Global Measurement While Drilling Market size is expected to be worth around USD 13.9 Billion by 2034, from USD 7.2 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) held a dominant market position, capturing more than a 34.9% share, holding USD 2.5 Billion revenue.

Measurement While Drilling is a pivotal technology in modern drilling operations, enabling real-time acquisition of downhole data such as inclination, azimuth, tool face, gamma ray, and pressure. This continuous monitoring facilitates precise wellbore positioning and enhances drilling efficiency. Measurement While Drilling systems typically employ mud-pulse telemetry to transmit data to the surface, allowing for timely adjustments during drilling activities.

Technological advancements continue to shape the Measurement While Drilling landscape. The U.S. Department of Energy has developed high-temperature Measurement While Drilling tools capable of operating at downhole temperatures up to 195°C (383°F), incorporating gamma-ray detectors and triaxial accelerometers to provide comprehensive formation evaluation and directional data. Additionally, the development of robust fiber-optic gyroscopes aims to enhance the reliability and speed of directional measurements in Measurement While Drilling systems.

Government initiatives have also played a crucial role in the development and implementation of Measurement While Drilling technology. For instance, the U.S. Department of Transportation’s Federal Highway Administration has promoted the use of Measurement While Drilling through its Every Day Counts initiative, encouraging state departments of transportation to adopt advanced geotechnical methods for improved site characterization and project delivery.

Furthermore, the U.S. Department of Energy has supported research into high-temperature Measurement While Drilling tools, aiming to enhance the reliability and performance of Measurement While Drilling systems in challenging downhole conditions.

Future growth opportunities in the MWD sector are closely tied to the development of high-temperature and high-pressure tools capable of operating in extreme downhole conditions. The U.S. Department of Energy has supported the development of MWD tools designed to function at temperatures up to 195°C (383°F), which are essential for accessing deep and ultra-deepwater reserves estimated to contain significant natural gas resources.

Key Takeaways

- Measurement While Drilling Market size is expected to be worth around USD 13.9 Billion by 2034, from USD 7.2 Billion in 2024, growing at a CAGR of 6.8%

- Horizontal wells held a dominant market position, capturing more than a 59.7% share in the Measurement While Drilling (MWD) market.

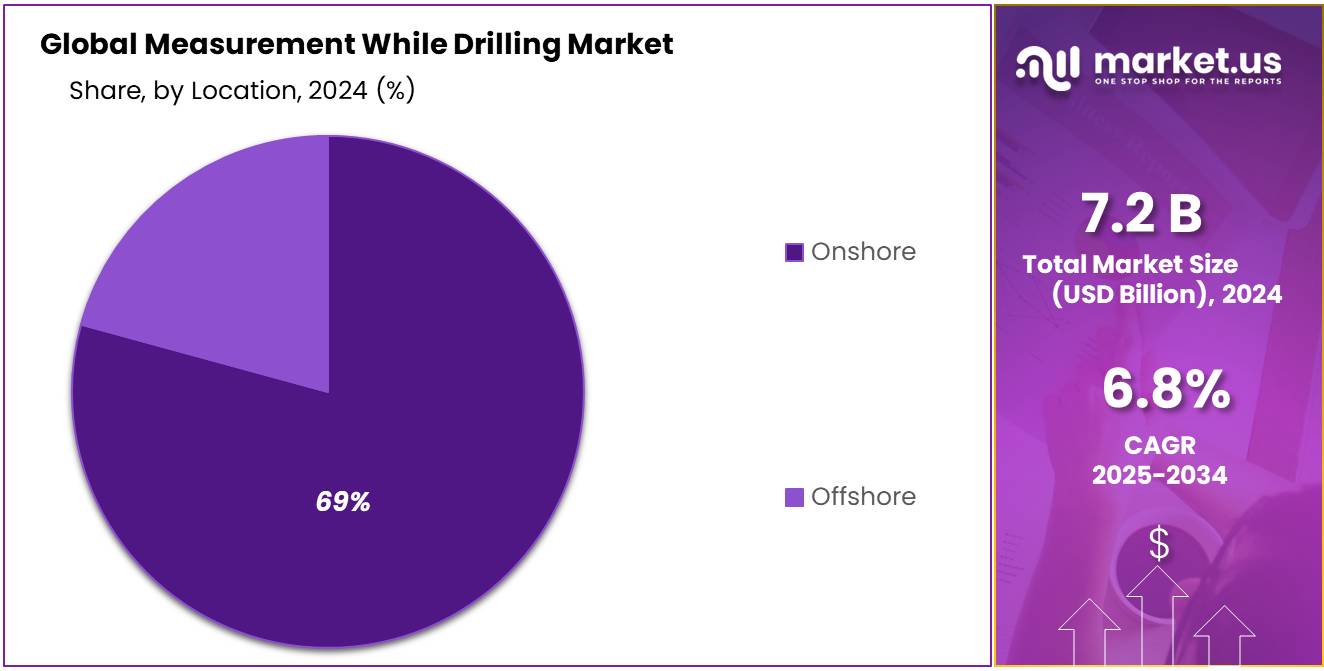

- Onshore locations held a dominant market position, capturing more than a 69.1% share in the Measurement While Drilling (MWD) market.

- Asia Pacific (APAC) region held a dominant market position in the Measurement While Drilling (MWD) sector, capturing 34.9% of the global market, valued at USD 2.5 billion.

By Well Type Analysis

Horizontal Well Type Dominates with 59.7% Market Share in 2024

In 2024, Horizontal wells held a dominant market position, capturing more than a 59.7% share in the Measurement While Drilling (MWD) market by well type. Horizontal drilling has seen significant adoption due to its ability to access previously unreachable reserves, particularly in shale oil and gas fields. The ability to drill more efficiently over a larger horizontal area allows for better resource extraction and operational cost savings.

The preference for horizontal wells has continued to grow year-on-year, driven by the increasing demand for unconventional oil and gas reserves. Horizontal drilling technology enables operators to drill longer, more controlled wells, significantly enhancing recovery rates. As drilling technologies evolve, it is expected that horizontal wells will continue to dominate in the MWD market due to these advantages, particularly in regions where shale oil and gas production is significant.

By Location Analysis

Onshore Market Dominates with 69.1% Share in 2024

In 2024, Onshore locations held a dominant market position, capturing more than a 69.1% share in the Measurement While Drilling (MWD) market by location. Onshore drilling has remained the preferred choice due to its cost-effectiveness and operational flexibility. This segment continues to lead as the majority of global oil and gas production occurs in onshore fields, where drilling is more economically feasible compared to offshore operations.

The strong position of onshore drilling is supported by the increasing exploration and production activities in regions with mature oil fields. As oil and gas companies aim to improve operational efficiencies and enhance recovery from existing onshore reservoirs, MWD technology plays a critical role in providing real-time data, improving wellbore positioning, and optimizing drilling parameters.

Key Market Segments

By Well Type

- Horizontal

- Directional

- Vertical

By Location

- Onshore

- Offshore

Emerging Trends

Integration of Artificial Intelligence and Machine Learning in Measurement While Drilling Systems

A significant trend shaping the future of Measurement While Drilling (MWD) technology is the integration of Artificial Intelligence (AI) and Machine Learning (ML) to enhance real-time data analysis and decision-making processes. This advancement allows for the automation of complex drilling operations, leading to improved efficiency and safety.

For instance, AI algorithms can analyze data from Measurement While Drilling systems to predict potential drilling hazards, optimize drilling parameters, and provide actionable insights to operators. This not only reduces human error but also enables proactive adjustments during drilling operations, enhancing overall performance.

Government initiatives are playing a crucial role in promoting the adoption of AI and ML in Measurement While Drilling systems. In the United States, the Department of Energy’s National Energy Technology Laboratory (NETL) has been at the forefront of supporting research and development in advanced drilling technologies. Through funding and collaborative projects, NETL encourages the integration of AI and ML to improve drilling efficiency and reduce environmental impacts. These efforts are aligned with the broader objective of enhancing energy production capabilities while minimizing ecological footprints.

The adoption of AI and ML in Measurement While Drilling systems is also being driven by industry demand for more efficient and cost-effective drilling operations. Operators are increasingly seeking technologies that can provide real-time insights and predictive analytics to optimize drilling performance. The integration of AI and ML into Measurement While Drilling systems addresses this need by enabling intelligent decision-making based on comprehensive data analysis.

Drivers

Government Initiatives and Technological Advancements Driving MWD Adoption

A significant factor propelling the adoption of Measurement While Drilling (MWD) technology is the concerted effort by governments worldwide to enhance energy security and environmental sustainability. For instance, China’s strategic initiatives to reduce dependence on imported oil have led to substantial investments in domestic oil production. Between 2018 and 2023, Chinese state-owned companies invested over $10 billion in exploration and production, focusing on deep drilling in regions like the Tarim Basin and offshore fields. These efforts have resulted in a 13% increase in China’s oil production since 2018, with the Bohai oil field alone accounting for 50% of this growth.

In the United States, the Department of the Interior has introduced reforms to its orphaned well grant programs, totaling $2.71 billion, to expedite the remediation of abandoned oil and gas wells. By eliminating mandatory methane measurements and streamlining environmental review processes, these changes empower states to act more swiftly and efficiently in well remediation efforts. This regulatory shift not only accelerates environmental cleanup but also underscores the growing importance of real-time data acquisition technologies, like MWD, to ensure safe and effective drilling operations .

Furthermore, technological advancements in MWD systems are enhancing their capabilities. The U.S. Department of Energy’s National Energy Technology Laboratory has developed high-temperature MWD tools capable of operating at downhole temperatures up to 195ºC. These tools integrate gamma-ray detectors and triaxial accelerometer and magnetometer suites to provide comprehensive formation identification and directional data. Such innovations expand the applicability of MWD technology in extreme drilling conditions, facilitating more efficient and accurate resource extraction.

Restraints

High Implementation and Maintenance Costs

One of the primary challenges hindering the widespread adoption of Measurement While Drilling (MWD) technology is the substantial financial investment required for its implementation and ongoing maintenance. The cost of Measurement While Drilling systems encompasses not only the initial purchase of sophisticated downhole tools and surface equipment but also the expenses associated with training personnel, integrating the technology into existing operations, and conducting regular maintenance to ensure optimal performance.

These financial burdens can be particularly daunting for small and medium-sized enterprises (SMEs) operating in the oil and gas sector, especially in regions where access to capital is limited. According to the U.S. Small Business Administration, securing financing for capital-intensive projects remains a significant hurdle for SMEs in the oil and gas industry.

To address these financial challenges, some companies are exploring cost-sharing models, leasing options, and collaborative partnerships to mitigate the initial investment burden. Additionally, advancements in Measurement While Drilling technology are leading to more cost-effective solutions, with improved durability and reduced maintenance requirements, thereby lowering the total cost of ownership over time. Despite these efforts, the high implementation and maintenance costs remain a significant barrier to the widespread adoption of Measurement While Drilling technology, necessitating continued innovation and supportive policies to facilitate its broader use in the industry.

Opportunity

Government Incentives and Technological Advancements Fueling MWD Growth

A significant growth opportunity for Measurement While Drilling (MWD) technology lies in the increasing governmental support for energy exploration and the adoption of advanced drilling technologies. Governments worldwide are recognizing the importance of efficient and sustainable energy extraction methods, leading to favorable policies and investments that promote the use of MWD systems.

In the United States, the Department of Energy (DOE) has been at the forefront of supporting the development of high-temperature Measurement While Drilling tools. Through initiatives like the NETL High Temperature Measurement-While-Drilling Development project, the DOE has invested in research to enhance the operating temperature of Measurement While Drilling tools to 195ºC and above. This advancement is crucial for accessing deep and high-temperature reservoirs, thereby expanding the potential for energy extraction in challenging environments.

These governmental efforts are complemented by technological advancements in MWD systems. For instance, the introduction of high-speed telemetry systems has significantly improved data transmission rates, enabling real-time monitoring and decision-making during drilling operations. Such innovations enhance the efficiency and safety of drilling activities, making Measurement While Drilling technology more attractive to energy companies.

As governments continue to invest in energy infrastructure and technological advancements, the MWD market is poised for substantial growth. The combination of supportive policies and cutting-edge technology creates a conducive environment for the widespread adoption of Measurement While Drilling systems, offering significant opportunities for stakeholders in the energy sector.

Regional Insights

APAC Region Holds 34.9% Share of the Measurement While Drilling Market in 2024

In 2024, the Asia Pacific (APAC) region held a dominant market position in the Measurement While Drilling (MWD) sector, capturing 34.9% of the global market, valued at USD 2.5 billion. The growth in the APAC region is primarily driven by increasing oil and gas exploration activities, particularly in countries like China, India, and Southeast Asia, where there is a rising demand for energy and natural resources.

The demand for Measurement While Drilling technology in APAC is further supported by the region’s expanding oil and gas industry, with a growing focus on both onshore and offshore drilling projects. Key countries such as China and India have made significant investments in oil exploration and production to meet the rising energy demands, thereby propelling the adoption of advanced drilling technologies, including MWD systems. These systems are crucial for real-time monitoring of downhole conditions, which enhances the efficiency and safety of drilling operations.

Moreover, the APAC region is seeing a rapid expansion of shale gas exploration, particularly in China, where unconventional oil and gas reserves are becoming an increasingly important source of energy. The use of MWD systems helps optimize drilling performance and reduce non-productive time, which is vital for extracting these resources efficiently.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Halliburton is a leading provider of Measurement While Drilling services, offering advanced drilling technologies to enhance drilling efficiency and safety. With a global presence, the company focuses on delivering cutting-edge measurement and wellbore services for the oil and gas industry. Halliburton’s MWD systems are widely used in both onshore and offshore drilling operations, providing real-time data and optimization solutions to improve drilling performance. The company’s strong focus on innovation and technology has positioned it as a leader in the Measurement While Drilling market.

Baker Hughes is a key player in the Measurement While Drilling market, providing innovative measurement solutions to support drilling operations worldwide. The company’s Measurement While Drilling systems offer real-time data on wellbore conditions, aiding in decision-making and operational optimization. Baker Hughes’ technological expertise and broad portfolio of drilling services are highly valued in both the oil and gas industry. Its commitment to improving drilling performance and minimizing environmental impact has positioned the company as a leader in the Measurement While Drilling market.

COSL is a prominent oilfield services company in China, providing Measurement While Drilling systems and related services to optimize drilling efficiency. The company focuses on offering advanced solutions to monitor wellbore conditions, improve safety, and enhance operational efficiency. With a strong presence in offshore and onshore drilling projects, COSL leverages cutting-edge technologies to support the growing energy demands in the APAC region. The company’s Measurement While Drilling services are critical for ensuring accurate data collection and real-time decision-making during drilling operations.

Top Key Players Outlook

- Halliburton

- Schlumberger

- COSL-China Oilfield Services Limited

- Baker Hughes

- C&J Energy Services

- Trican Well Service Ltd.

- Superior Energy Services

- Weatherford

- Calfrac Well Services Ltd.

- Allied Oil & Gas Services

- Sanjel Energy Services

- Gulf Energy SAOC

Recent Industry Developments

In 2024, Schlumberger, reported a total revenue of $36.92 billion, with its Well Construction segment, encompassing MWD services, generating $13.36 billion, accounting for approximately 36.17% of the company’s total revenue.

In 2024, COSL reported a total revenue of RMB 48.22 billion, marking a 9.5% increase from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 7.2 Bn Forecast Revenue (2034) USD 13.9 Bn CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Well Type (Horizontal, Directional, Vertical), By Location (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Halliburton, Schlumberger, COSL-China Oilfield Services Limited, Baker Hughes, C&J Energy Services, Trican Well Service Ltd., Superior Energy Services, Weatherford, Calfrac Well Services Ltd., Allied Oil & Gas Services, Sanjel Energy Services, Gulf Energy SAOC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Measurement While Drilling MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Measurement While Drilling MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Halliburton

- Schlumberger

- COSL-China Oilfield Services Limited

- Baker Hughes

- C&J Energy Services

- Trican Well Service Ltd.

- Superior Energy Services

- Weatherford

- Calfrac Well Services Ltd.

- Allied Oil & Gas Services

- Sanjel Energy Services

- Gulf Energy SAOC