Global Mea Triazine Market Size, Share, And Business Benefits By Type (Desulfurizer, Fungicides), By End User (Oil and Gas, Medical, Chemical, Agriculture, Biological Energy, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164289

- Number of Pages: 381

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

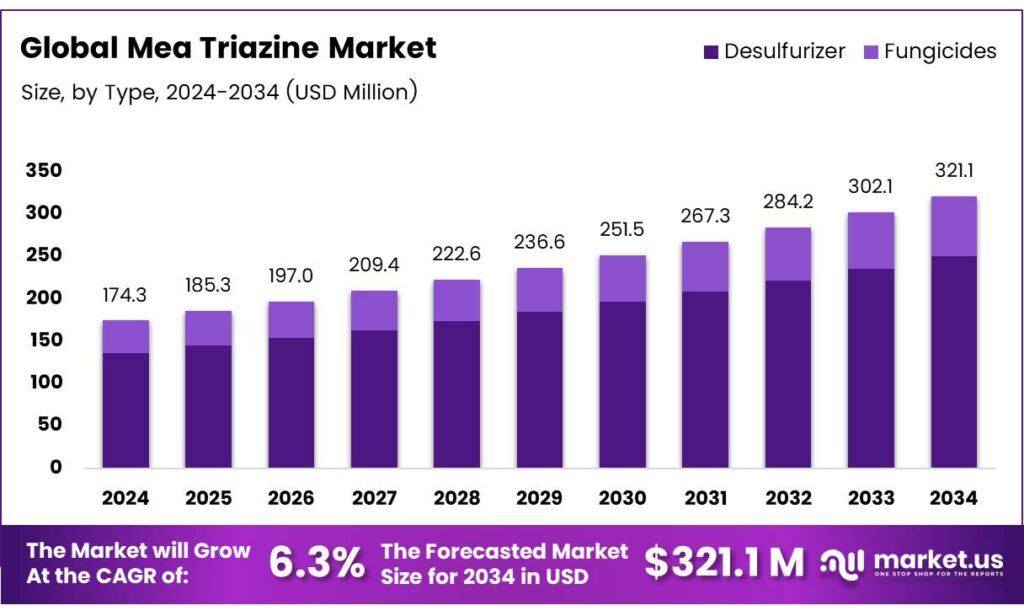

The Global Mea Triazine Market size is expected to be worth around USD 321.1 Million by 2034, from USD 174.3 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

MEA triazine serves primarily as a hydrogen sulfide scavenger and anti-mildew agent. As a scavenger, it removes H2S produced during crude oil and natural gas extraction. This process ensures worker safety in production fields and minimizes H2S corrosion on equipment. Operators inject MEA triazine directly into the desulfurization process. In low-H2S environments, it offers key advantages: convenient operation, low cost, and minimal space requirements.

As an anti-mildew agent, hexahydro-1,3,5-tris(hydroxyethyl)-s-triazine forms the core ingredient of MEA triazine and sym-triazine. Industries widely apply it in metal processing (cutting and grinding fluids), papermaking (paper coatings), painting and coating, electroplating, and leather (lustering agents). Specifications include appearance as a colorless or light yellow transparent liquid; active acid (by titration) at 74-78%; refractive index of 1.47-1.49; pH (as it) ranging 9.0-12.0; and density (25℃) between 1.15-1.16 g/cm³.

For hydrogen sulfide scavenging, add MEA triazine directly into the desulfurization process. For high-sulfur crude, the recommended dosage is 3-5‰. As an anti-mildew agent, dosage varies by industry: papermaking 0.05-0.1%; oil industry 0.01-0.05%; metal processing 0.15-0.3%; painting and coating 0.2%; detergent 0.2-0.3%. Injecting MEA-triazine into produced gas to remove hydrogen sulfide creates wastewater known as spent and unspent scavengers (SUS).

In offshore operations, this wastewater is frequently discharged untreated into the sea, significantly increasing the environmental impact of oil and gas fields. This study explored the feasibility of Hydrothermal Oxidation (HTO) for treating SUS in continuous-flow mode. The reactor operated at 24 MPa and temperatures between 325–350 °C, with residence times of 9–23 minutes and SUS flow rates of 0.48–0.65 L/h. Four SUS samples were tested: two from a North Sea installation and two from nanofiltration processes.

- HTO effectively treated SUS with COD up to 168 g/L under autothermal conditions. Higher COD disrupted temperature control near the critical water. The process cut COD by 91%–99% and TOC by 86%–100%. Ecotoxicity fell over 99% for marine bacteria and 94%–98% for algae. Feed COD affected the buffer capacity, requiring pH control to avoid drops. Main products: ammonium sulfate, acetic acid. Detailed effluent analysis supports HTO as a strong offshore wastewater solution.

Key Takeaways

- The Global Mea Triazine Market is expected to grow from USD 174.3 million in 2024 to USD 321.1 million by 2034 at a 6.3% CAGR.

- The Desulfurizer dominated By Type segment in 2024 with a 78.3% market share.

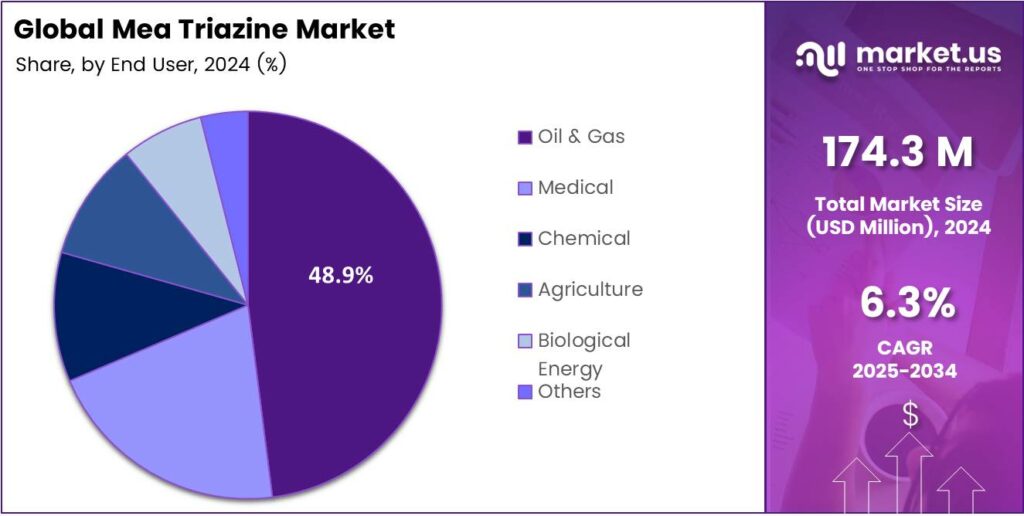

- The Oil and Gas led by the end-user segment in 2024 with a 48.9% share.

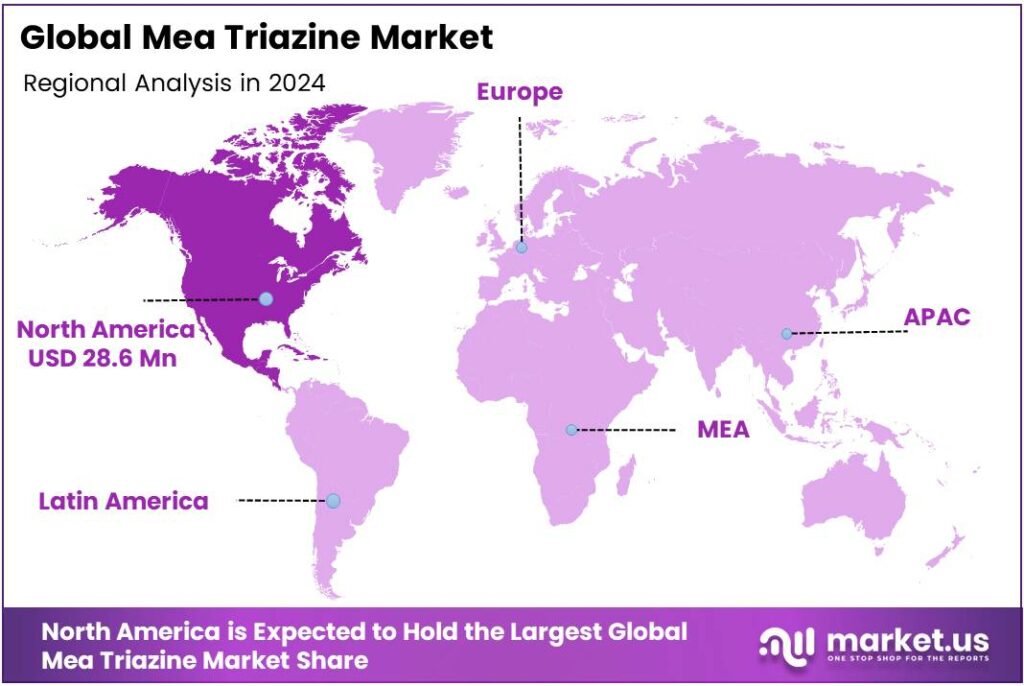

- North America captured 38.5% of global revenue in 2024, worth USD 28.6 million.

By Type Analysis

Desulfurizer dominates with 78.3% due to its widespread use in oil and gas for scavenging hydrogen sulfide.

In 2024, Desulfurizer held a dominant market position in the By Type Analysis segment of the Mea Triazine Market, with a 78.3% share. This segment thrives because it effectively removes sulfur compounds from fuels. Consequently, industries prioritize it for environmental compliance. Moreover, its reliability boosts product quality in refining processes.

Fungicides also play a key role in the Mea Triazine Market. They combat fungal infections effectively in various applications. Although smaller, this segment grows through agricultural needs. Transitioning to sustainable practices further enhances its appeal. Thus, fungicides contribute to crop protection and yield improvement across regions.

By End User

Oil and Gas dominate with 48.9% due to their critical role in drilling and production operations.

In 2024, Oil and Gas held a dominant market position in the By End User Analysis segment of the Mea Triazine Market, with a 48.9% share. This sector relies on Mea Triazine for H2S scavenging in wells. Therefore, it ensures safety and efficiency in extraction. Additionally, rising global energy demands propel its usage.

Hence, innovations in formulations support ongoing expansion. The Medical end-user segment utilizes Mea Triazine in pharmaceutical intermediates. It aids in developing effective drugs and treatments. Consequently, this area fosters growth through healthcare advancements. Moreover, regulatory approvals accelerate its integration. Thus, Medical contributes uniquely to the market’s diversity.

Chemical end users incorporate Mea Triazine in synthesizing various compounds. This supports the efficient production of resins and coatings. Transitioning to eco-friendly processes boosts its adoption. As a result, the segment sustains steady demand. Furthermore, industrial versatility ensures long-term relevance in the manufacturing sector.

Key Market Segments

By Type

- Desulfurizer

- Fungicides

By End User

- Oil and Gas

- Medical

- Chemical

- Agriculture

- Biological Energy

- Others

Emerging Trends

Growing Importance of H₂S Scavenging Applications for MEA Triazine

The demand for efficient hydrogen sulfide (H₂S) removal in the oil & gas and water-treatment sectors has emerged as a major growth driver for the MEA Triazine (monoethanolamine triazine) market. As industrial operations expand, especially in upstream oil & gas production and wastewater handling, the need for reliable H₂S scavenging chemicals is increasing.

From a regulatory and policy perspective, governments are tightening emission and effluent norms, which indirectly support this trend. In India, the Central Pollution Control Board (CPCB) has published guidelines on water treatment and sewer-gas hazards that highlight the risk of toxic gases like H₂S in wastewater systems.

Although the guidelines do not name MEA Triazine specifically, they create a regulatory environment where effective H₂S scavengers become necessary. In parallel, the government’s push for Zero Liquid Discharge (ZLD) and stricter industrial effluent policies further stimulate demand for treatment chemicals capable of managing H₂S and related corrosive/ toxic species.

Drivers

Tougher H₂S safety limits in oil, gas, and wastewater

The clearest force lifting MEA-triazine demand is the steady tightening of hydrogen sulfide (H₂S) exposure limits across workplaces that handle sour gas and odorous effluents. Regulators draw a hard line: in the United States, OSHA’s legal ceiling is 20 ppm with a 50 ppm 10-minute maximum peak; NIOSH recommends an even stricter 10 ppm 10-minute ceiling and classifies 100 ppm as immediately dangerous to life and health.

These numbers are not abstract; crews feel the difference between a plant that reliably scavenges H₂S and one that doesn’t. As operators move to comply, they choose fast-acting scavengers that fit existing units, and MEA-triazine is the default in many amine-free or polishing applications because it reacts rapidly with dissolved and gaseous H₂S without new capital hardware.

- The push is not only American. In Great Britain, the legally binding Workplace Exposure Limit sets 5 ppm (8-hr TWA) and 10 ppm (15-min STEL) for H₂S under COSHH; incident-management guidance underscores that 500 ppm can be fatal within minutes. These figures raise the bar for refineries, gas plants, terminals, biogas/landfill gas upgrades, and even wastewater units that experience H₂S spikes.

Restraints

Rising By-product & Wastewater Treatment Burden with MEA-Triazine

- One significant restraint for MEA‑triazine lies in the by-products it generates and the resulting load on wastewater treatment systems. Research indicates that in standard operations using MEA-triazine scavengers, the chemical is often only 70–75% utilised before breakthrough occurs, meaning up to 25–30% of the chemical remains unreacted, wasted, or contributes to the spent-solution burden.

Even more critical is the fact that when MEA-triazine reacts with H₂S, it forms a range of soluble and sometimes insoluble by-products which may persist in the water stream or oil phase. Some of the reaction solid by-products, such as dithiazine or trithiane compounds, can accumulate, distil into middle distillate cuts, or precipitate to form fouling material.

Such a fate complicates downstream separation, disposal, and effluent compliance. One review of triazine-based scavengers states that traditional triazine alternatives “can lead to issues such as scaling, high chemical consumption, and increased wastewater treatment costs.

Opportunity

Biogas & Biomethane scale-up that requires strict H₂S removal

A powerful tailwind for MEA-triazine is the rapid build-out of biogas and biomethane, where hydrogen sulfide (H₂S) must be removed before upgrading or use. The International Energy Agency reports biomethane is growing at roughly 20% per year, yet still only about 10 bcm equivalent globally, leaving huge headroom as more plants come online.

- Every new digester or upgrader needs reliable H₂S control, and triazine scavengers are a familiar, fast-acting option that drops straight into existing gas paths with minimal hardware. Policy targets turn that headroom into firm demand. In Europe, the REPowerEU plan calls for 35 bcm/year of biomethane, supported by tens of billions in investment.

That scale implies thousands of units handling raw biogas that typically contains H₂S from feedstocks like manure, organics, and sewage, each unit requiring continuous purification. MEA-triazine is often chosen to protect downstream membranes, engines, and pipelines from sulfide attack and sulfuric acid corrosion. The World Bank’s tracking shows 148 bcm of natural gas was flared, and it launched the Global Flaring & Methane Reduction (GFMR) partnership to accelerate cuts.

Regional Analysis

North America leads with a 38.5% share and a USD 28.6 Million market value.

In 2024, North America held a dominant position in the global MEA Triazine market, capturing 38.5% of total revenue, valued at approximately USD 28.6 million. The region’s strong foothold stems from its well-developed oil and gas processing, petrochemical, and industrial wastewater treatment sectors, all of which rely heavily on hydrogen sulfide (H₂S) scavenging technologies.

The United States, with its vast shale gas reserves and expanding offshore production, remains the key contributor to market growth. Continuous advancements in refining operations, along with the implementation of stringent environmental regulations by the U.S. Environmental Protection Agency (EPA) and the Occupational Safety and Health Administration (OSHA).

The regional industry also benefits from the growing adoption of gas sweetening and water-treatment systems that prioritize operational safety and sustainability. The integration of triazine-based scavengers in midstream and downstream applications, especially in refineries, pipelines, and natural gas treatment units, has strengthened the region’s market leadership.

The North American market is expected to maintain steady growth as oil producers focus on flare reduction, enhanced recovery, and zero-emission goals under national energy transition policies. The region’s emphasis on upgrading refinery infrastructure and improving process efficiency ensures that MEA Triazine will remain a critical chemical component in safeguarding operational integrity and environmental compliance across multiple industrial sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hexion is a dominant force in the MEA triazine market. Its strength lies in a robust production capacity, extensive distribution network, and deep technical expertise in specialty chemicals. Hexion likely supplies triazines to a wide range of end-use industries, including oil & gas for hydrogen sulfide scavenging, and water treatment. The company’s strong R&D focus and established market presence position it as an innovator and key supplier.

Ecolab is a pivotal player, distinguished by its direct application of triazines in its comprehensive water, hygiene, and energy technologies services. Rather than just a supplier, Ecolab leverages triazines as a critical component in its integrated treatment programs, particularly for oilfield and industrial water systems. Its powerful brand, global service footprint, and focus on digital, data-driven solutions create a strong captive market.

Sintez OKA is a significant specialized chemical manufacturer based in Russia, with a strong focus on the MEA region. The company produces a wide portfolio of amines and derivatives, including triazines, catering primarily to the oil and gas industry for gas purification and sour gas treatment. Its competitive edge often comes from cost-effective production and strategic focus on emerging energy markets.

Top Key Players in the Market

- Hexion

- Ecolab

- Sintez OKA

- Baker Hughes

- Dow Chemical

- Stepan Company

- Eastman Chemical Company

- Foremark Performance Chemicals

- Others

Recent Developments

- In 2024, Hexion advanced its sustainability efforts in chemical production, aligning with MEA triazine’s role in H2S removal for cleaner oil & gas operations. The company is committed to incorporating sustainable attributes in all new products, including potential enhancements to triazine-based scavengers for reduced environmental impact.

- In 2024, Ecolab’s Growth & Impact Report highlights record performance, including biocide advancements tied to MEA triazine for microbial control in oil & gas and papermaking. Ecolab acquired Barclay Water Management, enhancing digital monitoring for H2S and biocide applications in North American water systems

Report Scope

Report Features Description Market Value (2024) USD 174.3 Million Forecast Revenue (2034) USD 321.1 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Desulfurizer, Fungicides), By End User (Oil and Gas, Medical, Chemical, Agriculture, Biological Energy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hexion, Ecolab, Sintez OKA, Baker Hughes, Dow Chemical, Stepan Company, Eastman Chemical Company, Foremark Performance Chemicals, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Hexion

- Ecolab

- Sintez OKA

- Baker Hughes

- Dow Chemical

- Stepan Company

- Eastman Chemical Company

- Foremark Performance Chemicals

- Others