Global Material Handling Equipment Market Report By Product (Cranes & Lifting Equipment, Industrial Trucks, Continuous Handling Equipment, Racking & Storage Equipment, Others), By Application (E-commerce, Automotive, Food & Beverages, Chemical, Semiconductor & Electronics, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 38663

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Material Handling Equipment Market size is expected to be worth around USD 407.8 Billion by 2033, from USD 229.9 Billion in 2023, growing at a CAGR of 5.9% during the forecast period from 2024 to 2033.

Material handling equipment refers to machinery and tools used to move, store, control, and protect goods and materials during manufacturing, warehousing, and distribution processes. This equipment includes conveyors, forklifts, cranes, and automated systems designed to improve operational efficiency in various industries.

The material handling equipment market consists of companies that manufacture, sell, and service machinery used to manage and move goods within warehouses, factories, and distribution centers. The market is growing rapidly due to the increasing need for automation in logistics and the expansion of industries like e-commerce, retail, and manufacturing. The adoption of advanced technologies such as robotics, automation, and IoT is further transforming this market.

Several factors drive the growth of the material handling equipment market. The surge in e-commerce has led to increased demand for efficient warehouse management solutions. Furthermore, technological advancements like automation and robotics enhance efficiency and reduce operational costs. Growing investments in smart factories and logistics infrastructure also support market expansion, particularly in emerging economies.

The demand for material handling equipment is increasing as companies aim to streamline their supply chains and improve productivity. Businesses in manufacturing, retail, and distribution are seeking to automate their operations to reduce labor costs and improve accuracy in managing goods. This rising demand for automation in warehousing and logistics is expected to continue growing.

By 2025, it is expected that more than 4 million warehouse robots will be installed worldwide in over 50,000 warehouses. Additionally, the push toward automation in manufacturing and logistics is boosting the adoption of material handling systems equipped with AI and IoT.

Opportunities for growth in the material handling equipment sector are expanding as companies embrace automation and digitalization. The rise of warehouse automation, powered by AI and IoT, presents significant potential. Additionally, emerging markets in Asia and Latin America are investing in modern logistics infrastructure, creating opportunities for companies to expand their footprint.

Governments are increasingly investing in logistics and trade infrastructure to support economic growth. This includes funding for smart warehouses and automation-friendly facilities. For example, China, India, and the U.S. are leading efforts in modernizing supply chains through strategic investments in technology.

According to the United Nations Conference on Trade and Development (UNCTAD), global trade in goods and services is expected to grow by $350 billion in the first half of 2024, which is expected to increase the need for advanced material handling solutions.

Technological advancements are rapidly transforming the material handling industry. Automated solutions such as conveyor systems, robotic forklifts, and AI-powered sorting systems are becoming the norm in larger warehouses.

Forklifts are one of the most used machines, handling loads up to 5,000 pounds and lifting goods 10 to 15 feet high. Larger models are used for heavier materials, and pallet jacks are essential for moving loads of up to 5,500 pounds over short distances.

The U.S., China, and India are major contributors to the export of this equipment, supporting growing industries worldwide. With the recovery in global trade expected to increase by $350 billion in 2024, driven by exports from major economies, companies will need more efficient systems to handle the rising volume of goods.

Key Takeaways

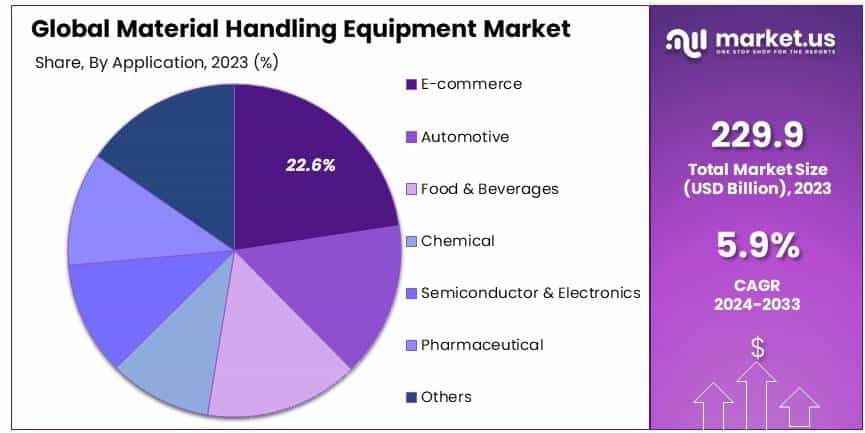

- The Material Handling Equipment Market was valued at USD 229.9 Billion in 2023, and is expected to reach USD 407.8 Billion by 2033, with a CAGR of 5.9%.

- In 2023, Cranes & Lifting Equipment led the product segment with 34.5%, due to its broad application across industries.

- In 2023, E-commerce dominated the application segment with 22.6%, driven by the growth of online retail and logistics.

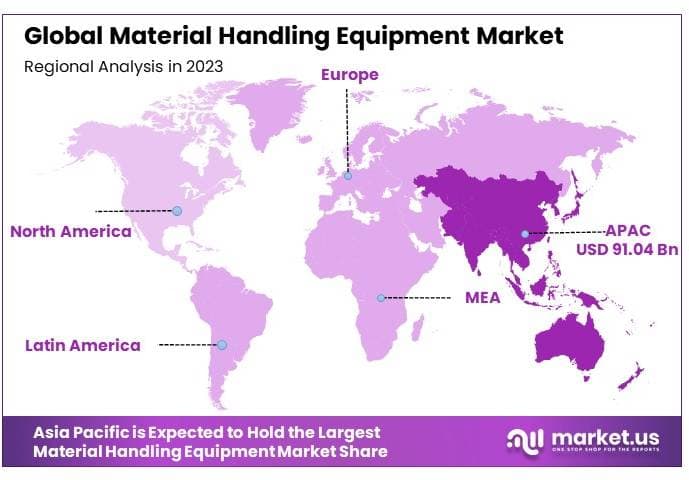

- In 2023, APAC led the regional market with 39.6%, fueled by industrial expansion and increasing automation.

Product Analysis

Cranes & Lifting Equipment dominates with 34.5% due to its essential role in handling heavy industrial loads and increasing automation in warehouses.

In the Material Handling Equipment Market, the “By Product” segment is crucial, focusing on the types of equipment used in various industries for transporting and organizing materials. Cranes & Lifting Equipment emerges as the leading sub-segment within this category, capturing 34.5% of the market.

This dominance is largely due to the critical role these devices play in heavy-load industries and settings requiring significant lifting capabilities, such as construction, manufacturing, and large-scale warehousing. The increasing adoption of warehouse robotics, particularly in developed economies, has also propelled the growth of advanced cranes and lifting technologies.

Other sub-segments under the Product category include Industrial Trucks, Continuous Handling Equipment, Racking & Storage Equipment, and others. These segments cater to different operational needs across industries.

For example, Industrial Trucks are essential for transportation tasks within warehouses and factories and are known for their versatility and range of applications. Continuous Handling Equipment offers solutions for automated movement of goods, which is crucial for industries aiming for efficiency and reduced labor costs.

The significant share of Cranes & Lifting Equipment is underpinned by technological advancements in automation and safety features, which enhance their appeal to industries looking to improve efficiency and worker safety. The future growth of this segment is expected to be influenced by increasing investments in infrastructure development and the expansion of industries such as e-commerce, which require extensive logistics support.

Application Analysis

E-commerce dominates with 22.6% due to the rapid expansion of online retailing and the subsequent need for robust material handling solutions.

Within the Material Handling Equipment Market, the “By Application” segment delineates the usage of equipment based on industry requirements. The E-commerce industry stands out as the dominant sub-segment, holding a 22.6% market share.

This predominance is fueled by the explosive growth of online retail, which demands efficient handling systems to manage and dispatch an ever-increasing volume of orders. The need for speed, accuracy, and reliability in order fulfillment is paramount in e-commerce, driving the adoption of sophisticated material handling systems.

The other sub-segments within the Application category include Automotive, Food & Beverages, Chemical, Semiconductor & Electronics, Pharmaceutical, and others. Each of these industries has unique requirements that influence their reliance on different types of material handling equipment.

For instance, the Automotive industry utilizes specialized handling systems tailored for the movement and assembly of automotive parts, while the Food & Beverages sector needs equipment that adheres to strict hygiene and handling standards.

E-commerce’s dominance in the application segment is further solidified by the shift toward online shopping, a trend accelerated by the COVID-19 pandemic. The continuous evolution of consumer behaviors, favoring convenience and speed, necessitates advanced logistical solutions, thereby bolstering the demand for effective material handling systems.

As the e-commerce sector continues to expand, it is anticipated to drive innovation and investment in material handling technologies, particularly those offering automation and AI-driven solutions to enhance order processing and delivery efficiencies.

Key Market Segments

By Product

- Cranes & Lifting Equipment

- Industrial Trucks

- Continuous Handling Equipment

- Racking & Storage Equipment

- Others

By Application

- E-commerce

- Automotive

- Food & Beverages

- Chemical

- Semiconductor & Electronics

- Pharmaceutical

- Others

Driver

E-commerce Expansion Drives Market Growth

The material handling equipment market is primarily driven by the rapid expansion of e-commerce. As online shopping grows, there is increasing demand for efficient warehouse and distribution solutions, requiring bulk material handling systems to manage high volumes of goods.

Automation in warehousing and manufacturing is another key driver, with companies seeking to improve efficiency and reduce labor costs. Automated systems for material handling enable faster operations, reduced human error, and higher accuracy in inventory management, further fueling market growth.

Additionally, global trade and logistics infrastructure development are contributing factors. As trade networks expand and countries invest in infrastructure improvements, the need for sophisticated material handling equipment increases. This development allows for smoother operations in warehouses, ports, and factories worldwide.

The demand for flexible material handling solutions also drives market growth. Businesses are seeking versatile equipment that can adapt to varying load types and warehouse configurations, allowing them to optimize space and resources efficiently. This need for flexibility and adaptability in the supply chain continues to push demand for material handling equipment.

Restraint

High Initial Costs Restraints Market Growth

Despite its potential, the material handling equipment market faces several restraining factors. High initial costs, especially for automated systems and large-scale machinery, create barriers for many businesses. Smaller companies, in particular, find it difficult to justify these large capital expenditures, slowing the adoption of new technologies in some sectors.

A lack of skilled workforce further restricts market growth. Operating and maintaining advanced equipment often requires specialized training, which is not always readily available, especially in emerging markets. This shortage can limit the implementation of more complex systems, delaying growth in regions where skilled labor is scarce.

Moreover, limited adoption among small and medium enterprises (SMEs) poses a challenge. These businesses often have constrained budgets and may not prioritize investing in high-tech material handling solutions, preferring manual or semi-automated systems instead. This trend restricts the overall expansion of the market.

Fluctuating raw material prices are another restraining factor, impacting the manufacturing costs of material handling equipment. Volatility in the prices of steel, aluminum, and other materials can lead to unpredictable pricing for equipment, making it difficult for manufacturers and buyers to plan long-term investments.

Opportunity

Growth in Emerging Markets Provides Opportunities

There are multiple growth opportunities within the material handling equipment market. One of the most significant is the increasing demand in emerging markets, where infrastructure development and industrialization are rapidly advancing. Countries in regions such as Asia-Pacific, Africa, and Latin America are investing heavily in logistics, warehousing, and manufacturing, creating a strong need for material handling solutions.

Sustainability is another opportunity, as companies seek green and eco-friendly equipment to reduce their carbon footprint. Material handling equipment manufacturers that focus on producing energy-efficient and environmentally friendly machines are poised to benefit from this trend.

The integration of advanced software and analytics also presents growth potential. By incorporating data-driven insights and real-time analytics, companies can optimize their material handling processes, enhancing efficiency and reducing downtime. This trend opens up opportunities for companies to provide smart solutions that improve operational performance.

Finally, the growing demand for Automated Guided Vehicles (AGVs) provides another growth avenue. AGVs, which offer automated transportation of goods within warehouses and factories, are increasingly being adopted to streamline operations, reduce labor costs, and improve safety.

Challenge

Rapid Technological Advancements Challenges Market Growth

The material handling equipment market faces several challenges that could hinder its growth. One significant challenge is the rapid pace of technological advancements. While innovation drives growth, it also requires continuous investment in research and development. Companies must constantly upgrade their systems and processes to stay competitive, which can be a financial strain.

Regulatory compliance is another major challenge. Different regions have varying safety, environmental, and operational standards, making it difficult for companies to maintain consistent practices across borders. Navigating these regulations can increase costs and complexity for businesses operating globally.

Supply chain disruptions, as seen during the COVID-19 pandemic, present additional challenges. Interruptions in the availability of raw materials, components, or even transportation can delay production and delivery, impacting market growth.

Finally, high maintenance and operational costs challenge market players. As material handling equipment becomes more advanced, maintaining these machines becomes more expensive. This includes the cost of spare parts, regular servicing, and the skilled labor required for repairs, all of which can reduce profit margins.

Growth Factors

Expansion of Logistics and Supply Chain Networks Is Growth Factor

Several factors are driving growth in the material handling equipment market. The expansion of logistics and supply chain networks globally is one of the key growth factors. As trade increases and more businesses require efficient movement of goods, the demand for advanced material handling solutions rises.

The increasing need for efficient warehouse solutions is another important factor. As warehouses grow in size and complexity, businesses require more sophisticated equipment to manage inventory and streamline operations.

Globalization of manufacturing processes further fuels market growth. As manufacturers expand their operations internationally, they rely on material handling equipment to maintain efficiency and consistency across multiple production sites.

The rise in demand for bulk material handling equipment is also a growth factor. Industries such as mining, agriculture, and construction require large-scale equipment to move heavy loads, driving demand for specialized material handling solutions in these sectors.

Emerging Trends

Adoption of Robotics and AI Is Latest Trending Factor

Several trends are shaping the material handling equipment market. The adoption of robotics and artificial intelligence (AI) is one of the most prominent, as companies increasingly use these technologies to automate processes and improve efficiency. AI-driven solutions can enhance decision-making, optimize routing, and predict maintenance needs.

The integration of real-time data and IoT is also a significant trend. Connected devices and sensors allow for continuous monitoring of equipment, enabling predictive maintenance and reducing downtime. This trend helps businesses improve the efficiency of their operations.

Cloud-based Warehouse Management Systems (WMS) are gaining popularity as well. These systems offer centralized control and real-time visibility of inventory and material flow, improving overall supply chain management.

Lastly, the shift towards electric and energy-efficient equipment is a growing trend. With rising environmental concerns, companies are looking for sustainable alternatives to traditional fossil-fuel-powered machines. Electric forklifts and energy-efficient conveyors are increasingly in demand as businesses aim to reduce operational costs and their environmental impact.

Regional Analysis

Asia Pacific Dominates with 39.6% Market Share

Asia Pacific leads the Material Handling Equipment Market with a 39.6% share, equating to USD 91.04 billion. This dominance is driven by rapid industrialization, expanding e-commerce, and large-scale infrastructure development in countries like China, India, and Japan. The region benefits from the increasing demand for automation in manufacturing and logistics sectors, significantly boosting market growth.

The region’s fast-paced economic growth, urbanization, and investments in smart factories and warehouses make it a crucial player in the material handling industry. Additionally, government initiatives to improve infrastructure further support the market’s expansion.

Asia Pacific is expected to maintain its leading position as industries increasingly adopt automated material handling solutions. Growing e-commerce demand and technological advancements in robotics and AI will further drive market growth in the region.

Regional Mentions:

- North America: North America shows steady growth in the Material Handling Equipment Market, driven by automation in warehouses and strong demand from the retail and manufacturing sectors. Advanced technologies and high labor costs push companies to invest in efficient material handling solutions.

- Europe: Europe holds a strong presence, driven by sustainable and automated solutions in logistics and manufacturing. The region’s focus on green technologies and energy-efficient equipment further boosts market growth.

- Middle East & Africa: The Middle East & Africa are seeing rising demand for material handling equipment due to infrastructure projects and expanding logistics sectors. Investment in modernizing industries contributes to the region’s market growth.

- Latin America: Latin America is growing, with investments in industrial automation and manufacturing processes driving the Material Handling Equipment Market. Economic development in countries like Brazil and Mexico supports steady market growth.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Material Handling Equipment Market, Toyota Industries Corporation, Daifuku Co., Ltd., and Kion Group AG dominate, each playing a vital role in shaping the market landscape through technological advancements and strategic market positioning.

Toyota Industries Corporation is a leader in the material handling industry, primarily through its focus on automation and robotics. The company’s advanced forklifts and automated systems are widely used across industries, reinforcing its position as a top provider of efficient and reliable equipment. Toyota’s innovation in warehouse automation and its commitment to energy-efficient solutions enhance its influence in the market.

Daifuku Co., Ltd. specializes in logistics automation and material handling systems. It holds a strong global presence, particularly in Asia, and is renowned for its highly automated and smart solutions for warehouses and production lines. Daifuku’s ability to integrate advanced software and robotics into its systems makes it a preferred partner for companies seeking to optimize logistics operations, giving it a significant market advantage.

Kion Group AG is another key player, known for its comprehensive material handling solutions, from forklifts to warehouse automation. Kion’s strategic focus on expanding its product portfolio and incorporating new technologies, such as automated guided vehicles (AGVs), strengthens its market positioning. The company’s presence across multiple sectors, including manufacturing and e-commerce, further amplifies its market influence.

These three companies drive market growth through their focus on automation, innovation, and operational efficiency. Their global reach and commitment to integrating advanced technologies into material handling solutions will continue to influence the industry’s future direction.

Top Key Players in the Market

- Daifuku Co., Ltd.

- Liebherr Group

- Schaefer System International Ltd.

- Toyota Industries Corporation

- Beumer Group

- Jungheinrich AG

- Godrej Group

- Kion Group AG

- Action Construction Equipment Ltd.

- Hyster-Yale Materials Handling, Inc.

- Swisslog Holding AG

- Crown Equipment Corporation

- Mitsubishi Logisnext Co., Ltd.

- KUKA AG

- Other Key Players

Recent Developments

- On December 2023, Packsize X5® has been honored with the Material Handling Product News 2023 Readers’ Choice Product of the Year award for its innovative X5® solution. This recognition highlights Packsize’s commitment to sustainability and innovation in the packaging industry.

- On Oct 2023, Hyundai Construction Equipment India recently unveiled a range of new products to cater to various industries, including infrastructure, mining, and material handling. The launch included four excavator models, a couple of forklift models, and wheel loaders.

- On August 2023, Cannon Equipment recently introduced a new product called CartPilot™, which adds power to nearly any material handling cart. This innovative drive system allows users to easily move large loads around warehouses or other industrial settings without needing additional equipment.

Report Scope

Report Features Description Market Value (2023) USD 229.9 Billion Forecast Revenue (2033) USD 407.8 Billion CAGR (2024-2033) 5.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cranes & Lifting Equipment, Industrial Trucks, Continuous Handling Equipment, Racking & Storage Equipment, Others), By Application (E-commerce, Automotive, Food & Beverages, Chemical, Semiconductor & Electronics, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Daifuku Co., Ltd., Liebherr Group, Schaefer System International Ltd., Toyota Industries Corporation, Beumer Group, Jungheinrich AG, Godrej Group, Kion Group AG, Action Construction Equipment Ltd., Hyster-Yale Materials Handling, Inc., Swisslog Holding AG, Crown Equipment Corporation, Mitsubishi Logisnext Co., Ltd., KUKA AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Material Handling Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Material Handling Equipment MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BEUMER Group

- Honeywell International Inc.

- Swisslog Holding AG

- Daifuku Co., Ltd.

- Mecalux, S.A

- Kion Group AG

- SSI Schaefer AG

- Murata Machinery Ltd.

- Other Key Players