Global Malaria Rapid Diagnostic Tests (RDTS) Market By Type (Single Species Detection, Multiple Species Detection) End-User (Hospitals, Clinics, Others) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: July 2024

- Report ID: 28131

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

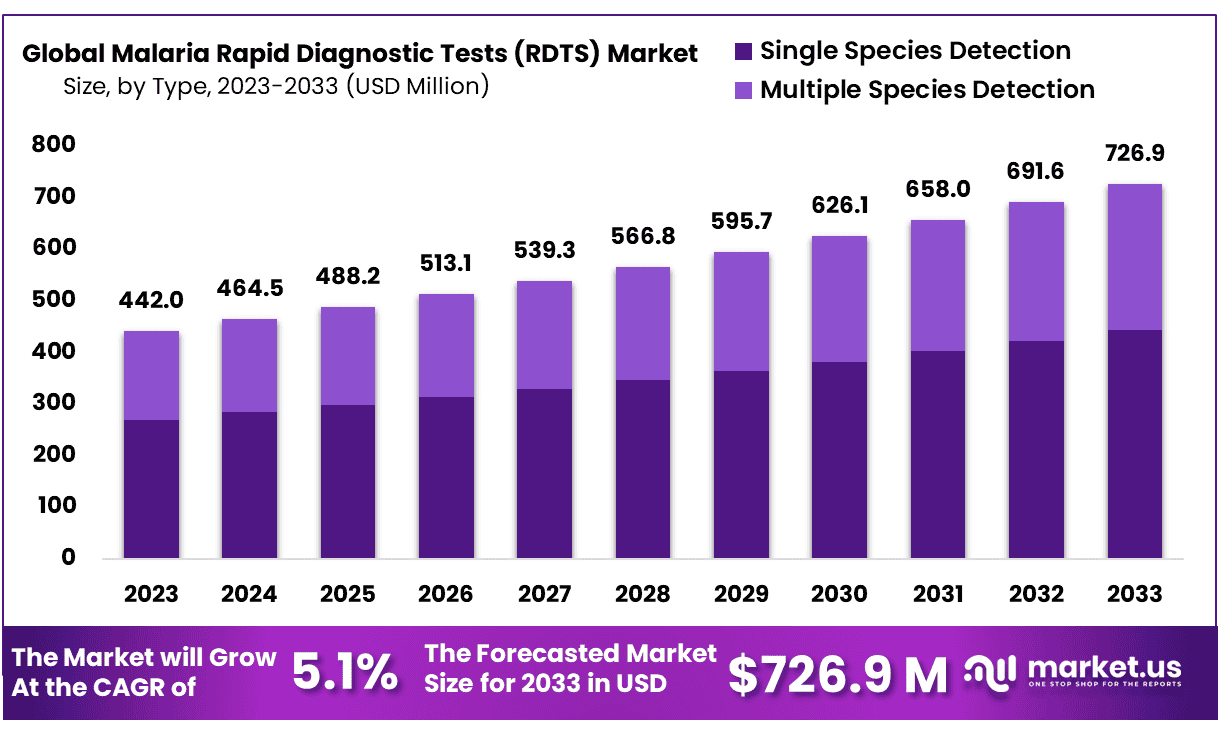

The Global Malaria Rapid Diagnostic Tests (RDTS) Market size is expected to be worth around USD 726.9 Million by 2033 from USD 442.0 Million in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Malaria is predominant in tropical countries because temperature conditions in these regions are suitable for the growth of mosquitos. Malaria Rapid Diagnostic Tests (RDTS) are used to detect the presence of malaria antigen in the blood. RDTs are very easy to use, and no skilled professionals are required to conduct this test. One can conduct this test on his own from where they are. The use of Malaria Rapid Diagnostic Tests (RDTS) is becoming popular especially in rural areas because of its user-friendliness, and the lack of skilled technicians as well as microscopes in rural areas.

Also, the result time of Malaria Rapid Diagnostic Tests (RDTS) is just about 15 to 20 minutes which is quite impressive taking into account its price and availability in the market. No infrastructure is required to carry out rapid diagnostic tests hence reduction in costs which facilitates the market growth. Malaria Rapid Diagnostic Tests (RDTS) is considered an alternative to conventional tests conducted in clinics or pathology labs. Malaria RDTs are comparatively inexpensive and still, their results are excellent. Due to the competitive environment, the prices are declining which is expected to boost the malaria rapid diagnostic tests market further.

The Malaria RDT evaluation program initiated by WHO and Foundation for Innovative New Diagnostics (FIND) to make pre-purchase performance evaluation and pre-distribution quality control makes the process more transparent. Healthcare professionals are increasingly giving importance to WHO compliant RDT products which in turn increases the quality of RDTs offered by manufacturers which are predicted to assist in the market progress.

Key Takeaways

- Market Size: Malaria Rapid Diagnostic Tests (RDTS) Market size is expected to be worth around USD 726.9 Million by 2033 from USD 442.0 Million in 2023.

- Market Growth: The market growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

- Type Analysis: The domination of Single Species Detection, which currently holds a commanding 61.1% share of the market.

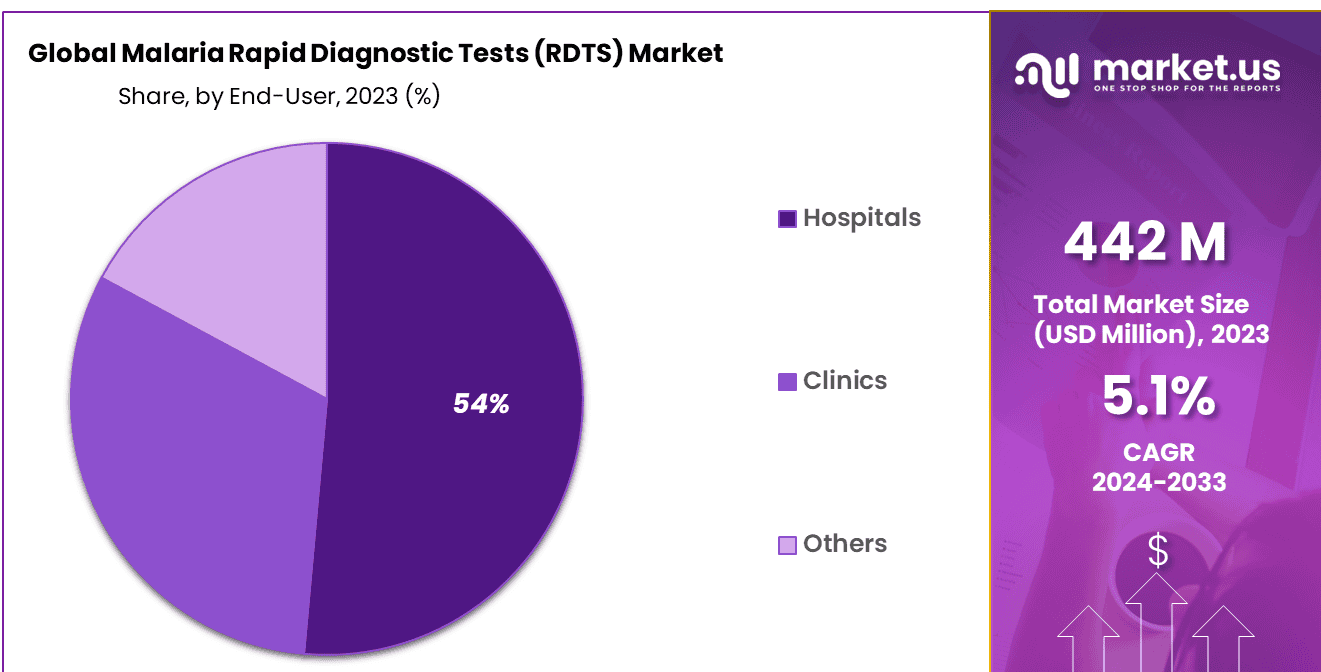

- End-Use Analysis: Hospitals stand out as the dominant players, commanding a substantial 54% market share.

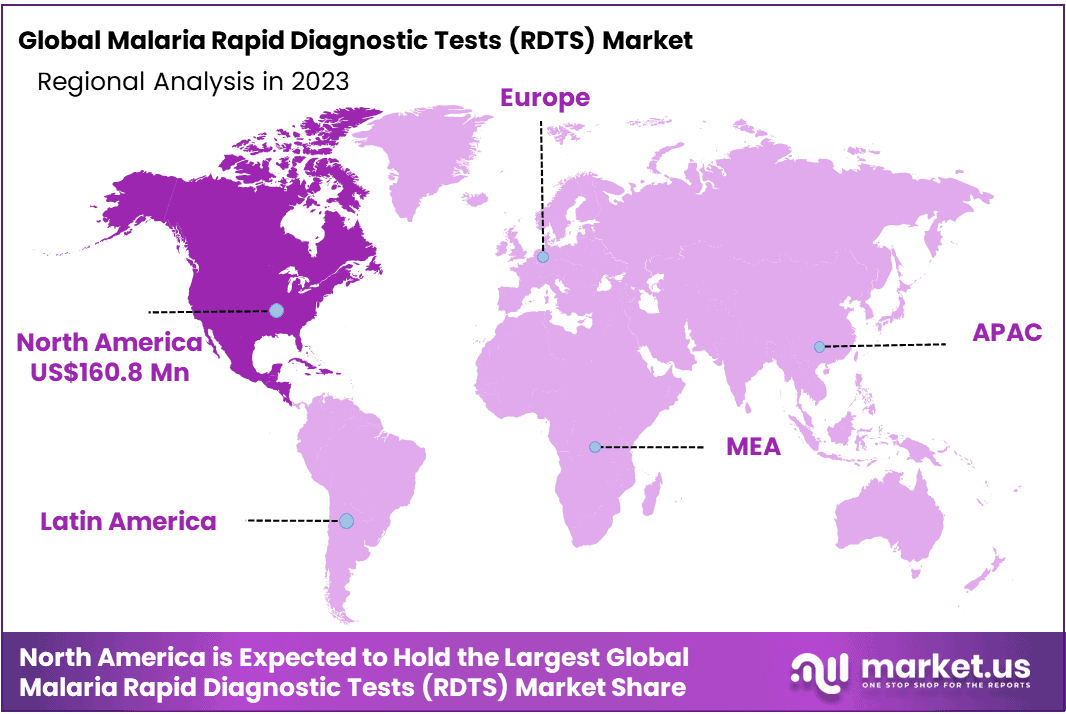

- Regional Analysis: APAC is projected to hold 36.4% and holding USD 160.2 Million market share for malaria diagnostics industry by 2023.

- Technological Advancements: Innovations in RDT technology are improving test sensitivity and specificity, leading to better disease management and control.

- Government Initiatives: Supportive government policies and funding for malaria eradication programs are driving the adoption of RDTs.

- Accessibility: Efforts to improve the accessibility and affordability of RDTs in low-resource settings are enhancing market penetration.

- Healthcare Integration: Integration of RDTs into primary healthcare systems is increasing, enabling prompt and effective malaria treatment.

- Public Health Impact: The widespread use of RDTs is significantly reducing malaria morbidity and mortality rates, particularly in high-burden areas.

- Private Sector Role: Increased involvement of private sector companies in developing and distributing advanced RDTs is boosting market growth.

Type Analysis

In the realm of diagnostic tools for combating malaria, Rapid Diagnostic Tests (RDTs) have emerged as a pivotal player, significantly impacting the healthcare landscape. Within this sector, a noteworthy trend has taken shape: the domination of Single Species Detection, which currently holds a commanding 61.1% share of the market.

Single Species Detection RDTs, as the name suggests, are tailored to identify a specific malaria parasite species, most commonly Plasmodium falciparum. These tests provide a rapid and accurate means of diagnosis, crucial for timely treatment and disease management. Their dominance can be attributed to their precision and efficiency in regions where a particular malaria species prevails, ensuring targeted interventions.

However, the Malaria RDTs market is not confined solely to single species detection. Multiple Species Detection RDTs are gaining ground, catering to areas with mixed malaria infections. These tests offer a comprehensive approach by identifying various malaria parasite species simultaneously, aiding healthcare providers in diverse epidemiological contexts.

The market’s shifting dynamics underscore the need for versatility in malaria diagnostics, balancing the dominance of Single Species Detection with the growing demand for Multiple Species Detection RDTs. This evolving landscape promises continued advancements in the fight against malaria, fostering cautious optimism for improved healthcare outcomes and global malaria control efforts.

End-user Analysis

In the Malaria Rapid Diagnostic Tests (RDTs) market, the distribution of these crucial diagnostic tools is significantly influenced by the end-users. Currently, hospitals stand out as the dominant players, commanding a substantial 54% market share.

Hospitals play a pivotal role in the battle against malaria, given their capacity to handle a wide range of medical conditions, including severe cases of the disease. The preference for RDTs in hospital settings can be attributed to their precision and reliability, ensuring timely and accurate diagnosis for patients. Moreover, hospitals often serve as referral centers, where patients from various regions seek treatment, making the availability of rapid and effective diagnostic tests paramount.

Clinics, while holding a significant presence in the market, occupy a slightly smaller share. However, they remain essential in extending healthcare services to communities, especially in remote or underserved areas. Clinics provide accessible points of care, offering diagnostic solutions that aid in early detection and treatment of malaria, thus contributing significantly to the overall efforts in disease control.

The dominance of hospitals, complemented by the essential role of clinics, reflects a well-rounded approach to malaria diagnosis and management. This collaborative effort across healthcare settings holds promise for more effective malaria control and underscores the importance of tailored diagnostic strategies for diverse end-users.

Key Market Segments

Type

- Single Species Detection

- Multiple Species Detection

End-User

- Hospitals

- Clinics

- Others

Drivers

Global Health Initiatives

One key driver of Malaria RDTs market growth is ongoing global health initiatives to combat malaria. Organizations such as World Health Organization (WHO) have actively promoted RDTs as effective tools for early diagnosis and effective treatment, leading to an increase in RDT demand especially in malaria-endemic regions.

These rapid diagnostic tests are particularly useful in rural areas where access to hospitals, labs, trained technicians as well as equipment such as microscopes to diagnose Malaria, is somewhat limited which is predicted to drive the RDTs market forward.

However, the Slow process of prequalification by the World Health Organization of RDTs could affect the growth of the Malaria Rapid Diagnostic Tests (RDTS) Market. Nonetheless, the Global Fund as well as Government initiatives such as the United States President’s Malaria Initiative (PMI), etc. are investing in preventing and curing Malaria which is expected to widen the rapid diagnostic tests market scope.

Advancements in RDT Technology

RDT technology has seen steady improvements. Manufacturers are developing more accurate, sensitive, and user-friendly RDTs; additionally, multi-species RDTs capable of detecting multiple strains of malaria parasites simultaneously have gained in popularity, improving diagnostic capabilities.

Trends

Point-of-Care Testing

The movement towards point-of-care testing has gained ground. Healthcare facilities and community health workers alike are using RDTs for on-site malaria diagnosis due to increased demand in remote regions with limited access to traditional labs for prompt results.

Digital Integration

Another emerging trend is the incorporation of digital technology with RDTs. Some RDTs now come equipped with smartphone apps or cloud-based platforms that enable healthcare providers to upload test results and patient information quickly and efficiently – improving record keeping as well as real-time disease tracking.

Restraints

Cost Constraints

Cost remains one of the primary barriers to adoption of RDTs in resource-constrained settings, even though RDTs tend to be less expensive than traditional microscopy in terms of initial procurement costs and ongoing supplies needed. This can pose challenges for healthcare systems when trying to implement this technology into everyday practice.

Quality Control and Standardization

Assure that quality controls and standardization remain consistent across RDT brands and manufacturers is often challenging. Variation in test performance can lead to misdiagnosis and compromise trust in RDTs.

Opportunities

Intensifying Focus in High Burden Regions

Extending RDT use into areas with high malaria burden such as sub-Saharan Africa and Southeast Asia presents an immense market growth potential, since these regions possess unmet needs for accurate diagnostic tools that are readily accessible.

Research and Development

Manufacturers can leverage RDT research and development investments to further increase accuracy and sensitivity, open new markets and promote adoption. Innovations that reduce costs while simultaneously improving performance could open up additional markets and accelerate adoption rates.

Regional Analysis

The Malaria Rapid Diagnostic Tests (RDTS) Market can be divided into five regions: North America, Western Europe, Eastern Europe, APAC and Latin America. According to regional analysis, APAC is projected to hold 36.4% and holding USD 160.2 Million market share for malaria diagnostics industry by 2023 due to its increased prevalence due to Anopheles gambiae being hard to control.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Key Player Analysis

The market report provides comprehensive insights into the major players operating within the Malaria Rapid Diagnostic Tests (RDTs) Market through its competitive landscape and company profile sections. The evaluation of these key market players is based on various factors, including their product and/or service offerings, financial performance, significant developments, strategic approaches, market positioning, geographical reach, and other critical attributes.

Within these chapters, there is also a focus on conducting SWOT analyses, identifying strengths, weaknesses, opportunities, and threats, as well as highlighting winning strategies, current priorities, and competitive threats for the top three to five players in the market.

Market Key Player

- Abbott Laboratories

- Apacor Ltd.

- Arkray

- Atomo Diagnostics

- Biosynex

- Recombigen Laboratories Private Limited

- Triveni Traders & Diagnostic Private Limited

- Cupid Limited

- Levram Life Sciences Private Limited

- Green Grapes Diagnostics

- Other Key Players

Recent Developments

- Abbott Laboratories (June 2024): Abbott Laboratories launched the Malaria QuickTest Ultra, an advanced RDT with enhanced sensitivity and specificity for malaria detection. The new product is designed to deliver accurate results within 15 minutes, aiding in the rapid diagnosis and treatment of malaria, especially in high-prevalence areas.

- Apacor Ltd.(May 2024): Apacor Ltd. announced the acquisition of a leading diagnostic technology firm to bolster its malaria RDT portfolio. This acquisition aims to integrate cutting-edge technologies into their existing products, improving diagnostic accuracy and expanding their market reach.

- Arkray (April 2024): Arkray introduced the ARK Malaria Detect Pro, a new rapid diagnostic test featuring advanced immunoassay technology for better detection of Plasmodium species. The product is designed to enhance diagnostic capabilities in remote and resource-limited settings.

- Atomo Diagnostics (March 2024): Atomo Diagnostics launched its innovative RDT, Malaria SmartCheck, which incorporates user-friendly design and high-precision results. The test kit is aimed at providing healthcare workers with an easy-to-use, reliable tool for malaria diagnosis in the field.

- Biosynex (February 2024): Biosynex announced a strategic merger with a prominent biotechnology company to expand its RDT offerings. The merger is expected to enhance their product development capabilities and strengthen their position in the global malaria diagnostics market.

Report Scope

Report Features Description Market Value (2023) USD 442.0 Million Forecast Revenue (2033) USD 726.9 Million CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(Single Species Detection, Multiple Species Detection);End-User-(Hospitals, Clinics, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Abbott Laboratories, Apacor Ltd., Arkray, Atomo Diagnostics, Biosynex, Recombigen Laboratories Private Limited, Triveni Traders & Diagnostic Private Limited, Cupid Limited, Levram Life Sciences Private Limited, Green Grapes Diagnostics, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Malaria Rapid Diagnostic Tests (RDTs)?Malaria RDTs are diagnostic tools used to quickly and accurately detect the presence of malaria parasites in a patient's blood. They are essential for early diagnosis and treatment of malaria.

How big is the Malaria Rapid Diagnostic Tests (RDTS) Market?The global Malaria Rapid Diagnostic Tests (RDTS) Market size was estimated at USD 442.0 Million in 2023 and is expected to reach USD 726.9 Million in 2033.

What is the Malaria Rapid Diagnostic Tests (RDTS) Market growth?The global Malaria Rapid Diagnostic Tests (RDTS) Market is expected to grow at a compound annual growth rate of 5.1%. From 2024 To 2033.

Who are the key companies/players in the Malaria Rapid Diagnostic Tests (RDTS) Market?Some of the key players in the Malaria Rapid Diagnostic Tests (RDTS) Markets are Abbott Laboratories, Apacor Ltd., Arkray, Atomo Diagnostics, Biosynex, Recombigen Laboratories Private Limited, Triveni Traders & Diagnostic Private Limited, Cupid Limited, Levram Life Sciences Private Limited, Green Grapes Diagnostics, Other Key Players.

How do Malaria RDTs work?These tests typically use a small blood sample from a patient and detect specific malaria antigens or proteins. The presence of these antigens indicates an active malaria infection.

Why are Malaria RDTs important?Malaria RDTs are crucial for timely and accurate diagnosis, especially in regions with limited access to laboratories. They enable rapid identification of malaria cases, aiding in prompt treatment and reducing the spread of the disease.

What are the advantages of Malaria RDTs over traditional methods like microscopy?Malaria RDTs offer quick results, require minimal training to use, and are suitable for point-of-care testing, making them more accessible in remote areas. They also have a lower risk of human error compared to microscopy.

Malaria Rapid Diagnostic Tests (RDTS) MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Malaria Rapid Diagnostic Tests (RDTS) MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Apacor Ltd.

- Arkray

- Atomo Diagnostics

- Biosynex

- Recombigen Laboratories Private Limited

- Triveni Traders & Diagnostic Private Limited

- Cupid Limited

- Levram Life Sciences Private Limited

- Green Grapes Diagnostics

- Other Key Players