Global Mail Order Pharmacy Market Size, Share, Statistics Analysis Report By Drug type (Prescription Drugs, Non-prescription Drugs), By Product (Skin Care, Diabetes, Asthma, Blood Pressure, Vitamins, Weight Loss, Others), By End User (Channel, App Only, Online Store), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 134813

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Mail Order Pharmacy Statistics

- Drug type Analysis

- Product Analysis

- End User Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Player Analysis

- Top Opportunities Awaiting for Players

- Recent Developments

- Report Scope

Report Overview

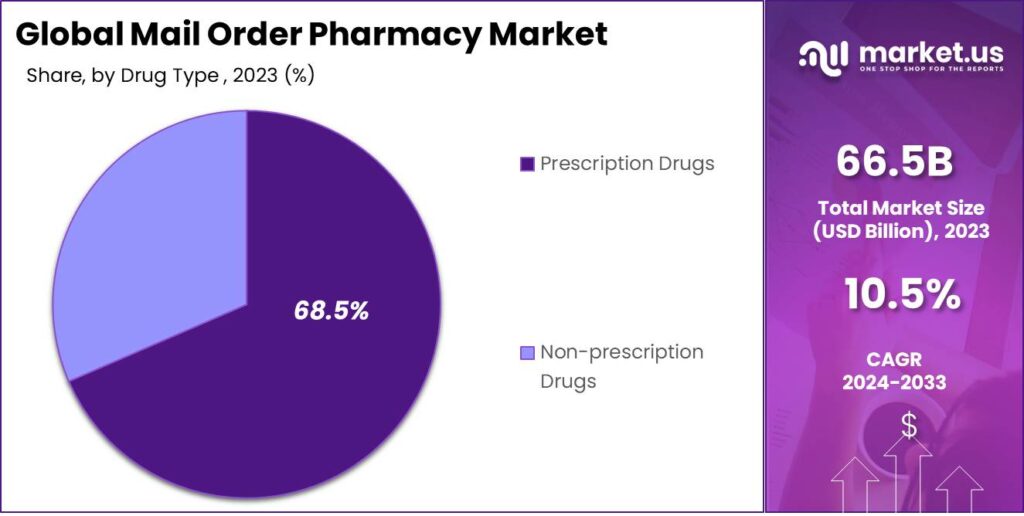

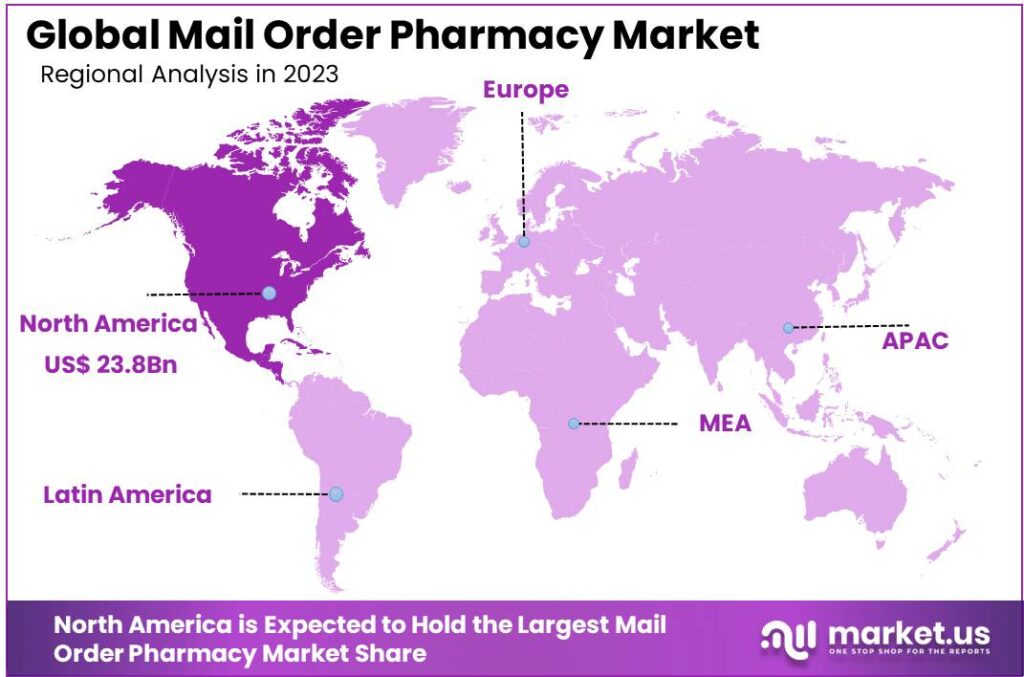

The Global Mail Order Pharmacy Market size is expected to be worth around USD 180.5 Billion By 2033, from USD 66.5 Billion in 2023, growing at a CAGR of 10.50% during the forecast period from 2024 to 2033. North America dominated the mail order pharmacy market in 2023, accounting for over 35.8% of the market share, with revenues reaching USD 23.8 billion.

Mail order pharmacy refers to a service that allows patients to receive their medications through the mail, bypassing traditional physical pharmacies. This model primarily operates over the internet, where patients can manage their prescriptions and place orders online or via mobile apps. The system is designed to offer a convenient solution for obtaining medications, especially for those managing chronic conditions or residing in remote areas.

The mail order pharmacy market has shown substantial growth, driven by increasing consumer demand for more accessible and less time-consuming medical shopping experiences. As of recent estimates, the market was valued at significant billions and is projected to continue expanding at a robust rate over the next decade. This growth is underpinned by an aging population, increasing prevalence of chronic diseases, and a general shift towards online services across sectors.

The convenience and accessibility of mail order pharmacies are significant drivers of this market. Customers appreciate the ability to manage their prescriptions from the comfort of their homes and have their medications delivered directly to their doorsteps. Furthermore, cost-effectiveness plays a crucial role; many mail order pharmacies offer competitive pricing, often coupled with incentives from health insurance plans that include lower copays or discounts on bulk orders.

Additionally, the integration of e-commerce in health services, expanding telemedicine, and specialty medications contribute to the market’s growth. There is a growing market demand fueled by the increasing adoption of digital health solutions and the continuous rise in healthcare costs. The mail order pharmacy sector is well-positioned to cater to this demand, offering not only medications but also chronic disease management tools and wellness products.

According to the 2024 J.D. Power U.S. Pharmacy Study, overall satisfaction with mail order pharmacies has risen by 6 points on a 1,000-point scale. In contrast, satisfaction scores for brick-and-mortar chain drug stores have declined significantly, with top performers experiencing drops of over 10 points this year.

The expansion into new geographic areas and scaling up of service offerings present significant opportunities for market players. Additionally, there is a trend towards personalized medicine and the use of AI to optimize service delivery, enhancing the customer experience and operational efficiency. Technological innovations are central to the evolution of the mail order pharmacy landscape.

Advances in AI and machine learning are improving processes like prescription management, inventory control, and patient engagement. These technologies enable more personalized medication management and predictive analytics for better stock management and demand forecasting. Moreover, companies are investing in secure and user-friendly platforms to ensure patient data privacy while making online ordering processes more intuitive.

Key Takeaways

Drug type Analysis

In 2023, the prescription drugs segment secured a commanding market position, capturing more than 68.5% of the global mail order pharmacy market. This dominance is attributed to the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses, which require continuous medication.

The segment’s leadership is also driven by growing consumer trust in mail-order pharmacies for critical prescriptions, supported by robust regulatory frameworks ensuring drug authenticity and safety. Insurance companies and healthcare providers have also played a pivotal role by encouraging mail-order prescriptions through cost-effective healthcare plans.

Additionally, technological advancements such as digital health platforms, telemedicine integration, and e-prescribing have streamlined the prescription fulfillment process. Patients can now receive their prescribed medications with minimal delays, fostering a seamless healthcare experience.

The rising geriatric population and the increasing number of individuals managing multiple health conditions have reinforced the prescription drugs segment’s market dominance. As healthcare providers emphasize adherence to treatment plans, mail-order pharmacies have emerged as a critical solution for uninterrupted medication access.

Product Analysis

In 2023, the Diabetes segment held a dominant market position in the mail order pharmacy market, capturing more than a 23% share. This segment’s prominence can be attributed to the high prevalence of diabetes globally, coupled with the chronic nature of the disease which necessitates ongoing medication management.

The Diabetes segment leads the mail-order pharmacy market due to the need for easier healthcare access. Regular monitoring and medication adjustments are essential in diabetes management, and mail-order pharmacies simplify this by delivering medications directly to patients, ensuring uninterrupted treatment and better adherence.

Additionally, technological advancements in the pharmaceutical sector have enhanced the efficiency of mail order services for diabetic supplies. Innovations in prescription management software and automated dispensing technology have streamlined the ordering and delivery process, making it faster and more error-free.

The rise in telehealth has synergistically impacted the Diabetes segment in mail order pharmacies. Patients are increasingly using telehealth services for routine consultations and prescription renewals, which aligns perfectly with the mail order model. This integration of services has made it more convenient for diabetic patients to receive comprehensive care remotely, bolstering the segment’s dominance in the mail order pharmacy market.

End User Analysis

In 2023, the Online Store segment held a dominant market position in the mail order pharmacy market, capturing more than a 44.5% share. This segment’s leadership stems primarily from its wide accessibility and convenience, which appeals to customer base.

Online stores offer seamless interface where consumers can browse, order, and manage their prescriptions with just a few clicks. This ease of use enhances user experience and attracts more consumers looking for hassle-free ways to receive their medications.

The strong performance of the Online Store segment is also due to the comprehensive range of services it offers. Unlike app-only services or channel-based options, online stores provide detailed product descriptions, customer reviews, and side-by-side comparisons of generic and brand-name drugs. Moreover, the integration of advanced technologies like AI and machine learning in online stores has further propelled their market dominance.

The trust factor plays a significant role in the success of online stores. Over the years, these platforms have established robust security measures to protect customer data and built a reputation for reliability and professionalism. As consumers become more security-conscious, their preference for established online stores grows, favoring this segment over others in the mail order pharmacy market.

Key Market Segments

By Drug type

- Prescription Drugs

- Non-prescription Drugs

By Product

- Skin Care

- Diabetes

- Asthma

- Blood Pressure

- Vitamins

- Weight Loss

- Others

By End User

- Channel

- App Only

- Online Store

Driver

Convenience and Accessibility

Mail-order pharmacies have revolutionized medication access by delivering prescriptions directly to patients’ homes, eliminating the need for in-person pharmacy visits. This service is particularly beneficial for individuals with mobility challenges, those residing in remote areas, or patients managing chronic conditions requiring regular medication refills.

The convenience of home delivery ensures consistent adherence to medication schedules, thereby enhancing overall health outcomes. Additionally, mail-order pharmacies often provide 24/7 access to pharmacists via phone or online platforms, offering patients timely support and information. This model not only saves time but also reduces transportation costs.

Restraint

Regulatory and Safety Concerns

The mail-order pharmacy sector faces significant restraints related to regulatory compliance and patient safety. Variations in pharmaceutical regulations across different regions can complicate the delivery process, potentially leading to delays or legal issues. Ensuring the safe and timely delivery of medications, particularly those requiring specific storage conditions, adds another layer of complexity.

Moreover, the rise of illegitimate online pharmacies poses risks of counterfeit or substandard medications reaching consumers, undermining trust in mail-order services. Addressing these concerns necessitates stringent regulatory oversight and robust verification processes to maintain the integrity and safety of the pharmaceutical supply chain.

Opportunity

Increasing Access in Remote and Underserved Communities

Mail order pharmacies present a pivotal opportunity to enhance healthcare access in rural and underserved areas, where traditional pharmacy services are sparse. For many residents in these regions, obtaining necessary medications can be a cumbersome process, often involving lengthy travels to the nearest pharmacy.

This not only delays treatment but can also lead to poor adherence to medical regimens. By extending their delivery services to these areas, mail order pharmacies can ensure that patients receive their medications promptly and directly at their homes.

Such an expansion not only elevates patient health outcomes but also captures a burgeoning segment of consumers who are in search of more convenient and economical healthcare options.

Challenge

Competition from Retail Giants

The entry of major retailers like Amazon and Walmart into the prescription delivery market intensifies competition for traditional mail-order pharmacies. These corporations leverage extensive logistics networks and substantial resources to offer expedited services, including same-day delivery, setting new consumer expectations.

Traditional pharmacies may struggle to match these capabilities, potentially losing market share. To remain competitive, mail-order pharmacies must innovate and possibly collaborate with technology partners to enhance their service offerings and operational efficiency.

Emerging Trends

Mail-order pharmacies are transforming medication access by offering both convenience and cost savings, driven by several key trends. Pharmacies are increasingly tailoring medication packaging to individual patient needs. This includes blister packs with customized dosages and clear labeling to enhance adherence. Some even incorporate digital reminders, making it easier for patients to manage their medications effectively.

Companies like Walmart and Amazon are entering the mail-order pharmacy market, offering same-day prescription deliveries. Walmart plans to provide nationwide same-day delivery by January 2025, leveraging its extensive network of pharmacy locations.

Pharmaceutical companies are launching platforms to sell medications directly to consumers. And the rise of mail-order pharmacies helps mitigate issues in “pharmacy deserts,” areas with limited access to physical pharmacies. By providing medications directly to patients’ homes, these services ensure that individuals in underserved regions receive necessary treatments.

Business Benefits

The shift towards mail order pharmacy offers substantial business benefits. One of the primary advantages is the potential for cost savings. By operating online, these pharmacies can reduce overhead costs associated with physical storefronts and pass these savings onto customers through lower medication prices.

Additionally, mail order pharmacies are positioned well to handle large-scale management of chronic diseases. They offer tailored services such as personalized medicine packaging and automated refill reminders, which improve medication adherence and patient outcomes.

From a market perspective, the convenience and efficiency of mail order pharmacies are driving their growth and enabling them to capture a larger share of the pharmacy market. This growth is supported by a consumer base that increasingly values the ease and discretion of receiving medications at home.

Regional Analysis

In 2023, North America held a dominant market position in the mail order pharmacy market, capturing more than a 35.8% share with revenues amounting to USD 23.8 billion. This leadership can be attributed to several key factors, including a well-established healthcare infrastructure and a strong emphasis on healthcare innovation and technology integration in pharmaceutical services.

The prevalence of chronic conditions such as diabetes and heart disease in North America also significantly contributes to the growth of the mail order pharmacy market. The convenience of having medications delivered directly to their homes is a crucial service for patients managing long-term treatment regimens. This convenience is paired with the advantage of often lower costs compared to brick-and-mortar pharmacies, driven by lower overhead expenses in the mail order model.

Moreover, regulatory support from governments across the region, particularly in the United States and Canada, encourages the use of mail order pharmacies. Policies aimed at controlling medication costs and expanding healthcare access play a crucial role in promoting the use of such services among a wider population.

The ongoing partnerships between major pharmaceutical companies and mail order pharmacy services in North America drive growth in this sector. These collaborations often focus on enhancing supply chain efficiencies and expanding the range of available medications, improving service delivery. The strategic alliances, combined with high consumer trust in mail order systems, ensure that North America continues to lead the global market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Key players each bring unique strengths to the mail order pharmacy sector, driving competition and innovation that benefit consumers by improving access to medications and enhancing the overall care experience.

The SANICARE Group is a major player in the mail order pharmacy landscape. Known for its robust service offerings, SANICARE provides a wide range of pharmaceutical products directly to customers’ homes. The company has capitalized on the growing trend of online pharmacy services by focusing on user-friendly digital interfaces that make ordering medications straightforward and stress-free.

DocMorris stands out in the mail order pharmacy industry primarily due to its innovative approach to healthcare. As one of the first to integrate digital health solutions with traditional pharmacy services, DocMorris offers a unique platform where patients can not only order their medications but also receive expert health advice through virtual consultations.

Optum Rx Inc. is part of the larger Optum health services platform, which gives it a significant advantage in terms of resources and integration with broader healthcare services. Specializing in managing prescription plans, Optum Rx focuses on making prescription medications affordable and accessible. Their use of advanced data analytics helps in personalizing patient care plans, which optimizes treatment outcomes and enhances patient satisfaction.

Top Key Players in the Market

- The SANICARE Group

- DocMorris

- Optum Rx Inc.

- Express Scripts Holding Company

- eDrugstore.MD

- Zur Rose AG

- Walgreen Co

- CVS Health Corporation

- CanadaDrugs.com

- WellDyneRx

Top Opportunities Awaiting for Players

The mail-order pharmacy market is experiencing significant growth, presenting several promising opportunities for industry players.

- Embracing E-commerce and Digital Health Platforms: The rise of e-commerce and digital health platforms is reshaping how patients access medications. By integrating user-friendly online stores and pharmacy apps, companies can enhance customer convenience and expand their reach. This digital shift aligns with the increasing consumer preference for online shopping and telemedicine services.

- Addressing Chronic Disease Management: With a growing prevalence of chronic conditions, there’s a heightened demand for consistent medication management. Mail-order pharmacies can play a crucial role by ensuring timely delivery of essential medications, thereby improving patient adherence and health outcomes.

- Catering to an Aging Population: The global aging population often faces mobility challenges, making traditional pharmacy visits difficult. Mail-order services offer a convenient solution, delivering medications directly to their homes and ensuring uninterrupted access to necessary treatments.

- Offering Cost-Effective Solutions: Mail-order pharmacies can provide medications at competitive prices, appealing to cost-conscious consumers. By streamlining operations and leveraging bulk purchasing, these services can pass savings onto customers, making healthcare more affordable.

- Expanding Specialty Pharmacy Services: The demand for specialty medications is on the rise. Mail-order pharmacies can capitalize on this by offering specialized services that cater to complex medication needs, ensuring patients receive appropriate therapies with necessary support.

Recent Developments

- In the first quarter of 2023, CVS Health completed the acquisitions of Signify Health and Oak Street Health, aiming to enhance its healthcare services and expand its reach in the mail-order pharmacy market.

- In May 2024, Optum Rx announced the launch of a new drug pricing model, the Optum Rx Clear Trend Guarantee, set to begin in 2025. This value-based pricing model aims to help insurers manage drug costs more effectively by combining costs from various sources, including retail pharmacies, home delivery, specialty drugs, and rebates, to ensure transparent pricing linked to patient outcomes.

- By January 2025, Walmart plans to roll out nationwide same-day delivery for prescription drugs, leveraging its extensive network of nearly 4,600 pharmacy locations to strengthen its mail-order services.

Report Scope

Report Features Description Market Value (2023) USD 66.5 Bn Forecast Revenue (2033) USD 180.5 Bn CAGR (2024-2033) 10.50% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug type (Prescription Drugs, Non-prescription Drugs), By Product (Skin Care, Diabetes, Asthma, Blood Pressure, Vitamins, Weight Loss, Others), By End User (Channel, App Only, Online Store) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The SANICARE Group, DocMorris, Optum Rx Inc., Express Scripts Holding Company, eDrugstore.MD, Zur Rose AG, Walgreen Co, CVS Health Corporation, CanadaDrugs.com, WellDyneRx Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Mail Order Pharmacy MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Mail Order Pharmacy MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- The SANICARE Group

- DocMorris

- Optum Rx Inc.

- Express Scripts Holding Company

- eDrugstore.MD

- Zur Rose AG

- Walgreen Co

- CVS Health Corporation

- CanadaDrugs.com

- WellDyneRx