Global Luxury Watch Market By Product Type (Electronic and Mechanical), By Distribution Channel (Offline and Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 54624

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

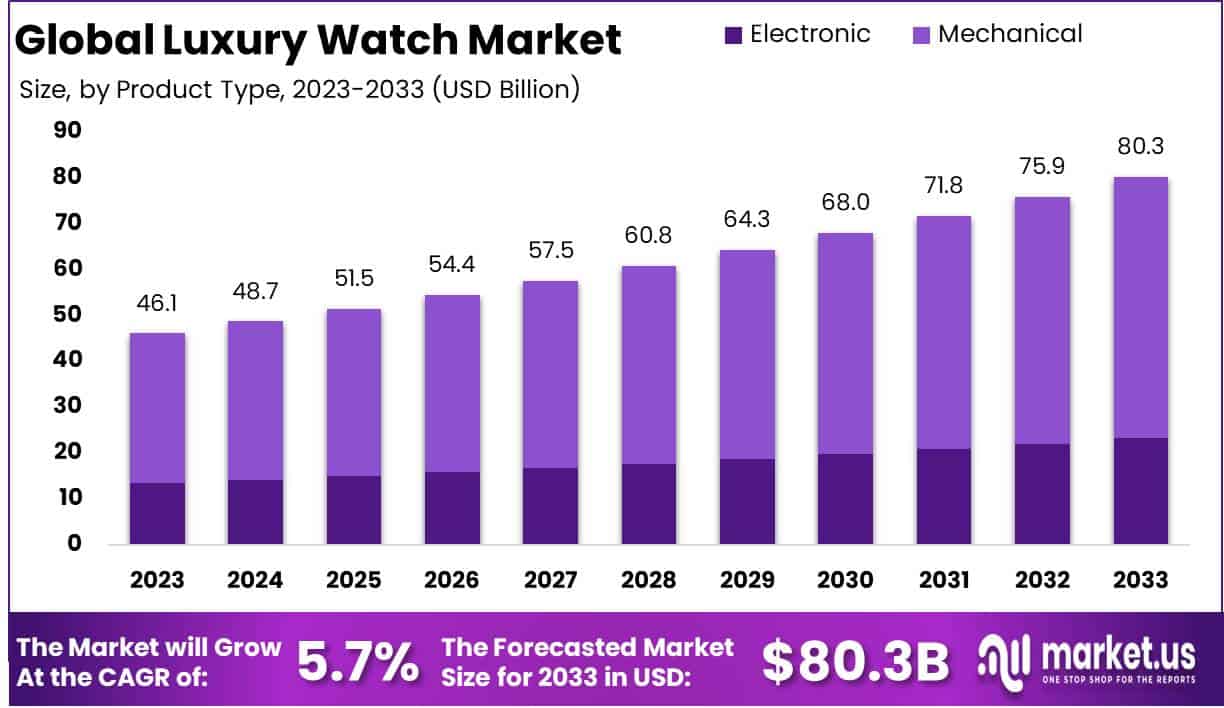

The Global Luxury Watch Market size is expected to be worth around USD 80.3 Billion by 2033 from USD 46.1 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

A luxury watch is a high-end timepiece renowned for its precision, craftsmanship, and premium materials. These watches are often associated with renowned brands, exclusive designs, and heritage.

Beyond functionality, luxury watches are considered symbols of status, style, and elegance, often featuring precious metals, gemstones, and sophisticated mechanisms, making them desirable collectibles.

The luxury watch market encompasses the global production, distribution, and sale of premium timepieces. It includes both established heritage brands and new entrants that offer exclusive designs, limited editions, and customizations.

The market caters primarily to affluent consumers who seek exclusive, high-quality products that deliver value beyond mere utility, positioning luxury watches as both fashion statements and investment pieces.

The growth of the luxury watch market is driven by rising disposable incomes, an increasing number of high-net-worth individuals (HNWIs), and growing demand for personalized luxury goods. The influence of social media, collaborations between luxury brands, and the emergence of digital marketing have also contributed significantly to market expansion.

There is a consistent demand for luxury watches from collectors, investors, and consumers who view them as a blend of functional luxury and financial investment. This demand is often buoyed by limited editions, iconic models, and heritage collections, which maintain their appeal even during economic fluctuations.

The luxury watch market has a strong opportunity in the digital space, with e-commerce and virtual boutiques offering wider reach. Additionally, the pre-owned luxury watch segment is experiencing rapid growth, fueled by sustainability trends and the desire for rare timepieces.

The Asia-Pacific region, particularly China and India, presents immense opportunities due to a growing base of affluent consumers seeking luxury brands.

According to IFL Watches, the luxury watch market showed robust growth in 2023, led by Rolex, which became the first Swiss brand to exceed CHF 10 billion in sales. Achieving CHF 10.1 billion ($11.5 billion), an 11% increase from the previous year, Rolex captured over 30% of the retail market, as highlighted by Morgan Stanley.

With 1.24 million watches produced, Rolex’s performance underscores its market dominance and reflects the broader trend toward traditional mechanical craftsmanship and high-end timepieces, driving sustained demand in the sector.

According to BusinessBar, Swiss watch exports reached 26.74 billion CHF in 2023, up from 10.3 billion CHF in 2000, reflecting sustained demand for luxury timepieces despite digital disruption. The U.S. and China account for 25% of these imports, with China’s growing affluent class driving rapid market expansion.

While China leads global watch exports by volume 500 million units versus Switzerland’s 17 million the Swiss industry excels in export value, averaging $1,750 per unit compared to China’s $4, underscoring Switzerland’s focus on craftsmanship and high-value products.

Key Takeaways

- The global luxury watch market is projected to grow from USD 46.1 billion in 2023 to USD 80.3 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 5.7% over the forecast period.

- The Mechanical segment dominates the product type category, capturing 71.9% market share in 2023, driven by consumer preference for traditional craftsmanship and exclusivity.

- The Offline distribution channel leads with a 69.5% share, as luxury watch buyers prioritize in-person experiences for high-value purchases.

- Asia-Pacific leads the market with 48.1% share, supported by rising disposable incomes and increasing brand awareness among affluent consumers.

- 20% increase in luxury watch demand in India highlights a strong growth opportunity, driven by a growing middle and upper-middle class and rising interest in luxury goods.

By Product Type Analysis

Mechanical Segment Dominates Luxury Watch Market with 71.9% Share in 2023

In 2023, the Mechanical segment held a dominant position in the luxury watch market by product type, capturing over 71.9% of the market share. This segment’s popularity is driven by a strong consumer preference for traditional craftsmanship, intricate designs, and the prestige associated with mechanical movements.

Collectors and enthusiasts particularly favor mechanical watches, as they symbolize luxury, heritage, and superior engineering. High-end brands like Rolex, Patek Philippe, and Audemars Piguet contribute significantly to the segment’s performance, focusing on limited editions and perpetual calendars that enhance the exclusivity factor.

On the other hand, the Electronic segment, though accounting for a smaller share, is gradually growing. It appeals primarily to tech-savvy consumers and younger buyers who appreciate smart features integrated into luxury designs.

Apple Inc.’s high-end variants of the Apple Watch, including collaborations like the Hermès edition, have notably influenced this segment’s growth trajectory. While it currently trails behind mechanical counterparts, the electronic segment continues to innovate with hybrid models that combine traditional aesthetics with modern functionality, contributing to steady market expansion.

By Distribution Channel Analysis

Offline Segment Dominates Luxury Watch Market with 69.5% Share in 2023

In 2023, the Offline segment held a dominant position in the luxury watch market by distribution channel, capturing over 69.5% of the market share. Brick-and-mortar stores, including exclusive boutiques, multi-brand showrooms, and duty-free shops, continue to be the preferred choice for luxury watch buyers.

This is driven by the emphasis on in-person purchasing experiences, which include personalized services, expert consultations, and the ability to physically assess high-value watches before purchase. Brands like Rolex, Patek Philippe, and The Swatch Group prioritize their offline retail networks to maintain brand prestige and customer trust.

Conversely, the Online segment is steadily expanding as e-commerce adoption rises among consumers seeking convenience and a broader product range. Leading players are increasingly investing in direct-to-consumer (DTC) websites, secure transactions, and virtual try-on technologies to enhance the online buying experience.

While online currently holds a smaller share compared to offline, it is experiencing faster growth, fueled by younger and digitally savvy consumers who seek both new and pre-owned luxury watches through online channels.

Key Market Segments

By Product Type

- Electronic

- Mechanical

By Distribution Channel

- Offline

- Online

Driver

Rising Consumer Affluence and Status Symbolism

The luxury watch market is witnessing robust growth due to increased consumer affluence and the strong association of luxury watches with status and success. As disposable incomes grow, particularly among affluent individuals in developed markets and the expanding middle class in emerging economies, there is a greater inclination to purchase luxury watches.

These watches are not just seen as time-telling devices but as symbols of prestige, craftsmanship, and exclusivity. Moreover, with the increasing presence of younger consumers entering the luxury space, there’s a shift in preferences toward high-end, aspirational brands that offer both heritage and prestige.

The global luxury watch market has seen a rise in sales, especially in regions like Asia-Pacific, which has accounted for nearly 30% of the global luxury goods demand. This increased demand for premium products aligns with the broader trend of consumers seeking to showcase their success and taste through tangible, branded goods.

Furthermore, luxury watches continue to hold strong appeal among collectors, adding to the segment’s growth momentum. Limited editions and exclusive releases from luxury brands drive demand by creating a sense of urgency and uniqueness among consumers.

With the affluent class looking to diversify their asset portfolios, high-end timepieces are increasingly considered collectible investments, known for their high resale value. This combination of consumer affluence, status symbolism, and investment potential makes rising disposable incomes a powerful driver for luxury watch demand globally.

Restraint

Economic Uncertainty and Fluctuating Consumer Confidence

The luxury watch market, while resilient, is highly sensitive to economic volatility and fluctuating consumer confidence. Economic downturns, geopolitical tensions, or sudden financial market shifts can dampen consumer spending, especially on discretionary items like luxury watches.

The recent global economic uncertainties have led to cautious spending behaviors among consumers, impacting overall demand in the luxury segment.

For instance, during periods of economic slowdown, the sales of high-end timepieces often experience a temporary slump, as individuals may prioritize essential spending or delay significant purchases.

Additionally, currency fluctuations can affect the affordability and pricing of imported luxury watches, particularly in markets with less stable currencies.

While luxury brands have attempted to mitigate these risks by diversifying geographically and introducing more accessible price points, the market still remains vulnerable to broader economic conditions.

The impact of economic uncertainties is also evident in the shifting consumer sentiment, where potential buyers might adopt a ‘wait-and-see’ approach during uncertain periods, leading to slower sales cycles.

Therefore, while economic growth supports market expansion, economic downturns or uncertainties serve as significant restraints, limiting rapid growth potential in the global luxury watch market.

Opportunity

Expansion in Emerging Markets

Emerging markets represent a significant growth opportunity for the luxury watch industry. Countries such as China, India, and other Southeast Asian nations have been experiencing substantial economic growth, which has led to an expanding middle and upper-middle class with increasing purchasing power.

The demand for luxury watches in these regions has been growing steadily, driven by a cultural emphasis on prestige, gifting traditions, and an appetite for branded luxury products.

For example, the luxury watch segment in India has seen a 20% increase in demand over recent years, driven by rising disposable incomes and a growing interest in luxury lifestyle products.

Additionally, luxury watch brands are strategically expanding their presence in these markets through new retail stores, online platforms, and partnerships with local distributors to cater to local tastes and preferences.

Companies are also engaging in targeted marketing campaigns that emphasize heritage, craftsmanship, and exclusivity, resonating with emerging market consumers who aspire to own prestigious global brands.

This regional expansion not only drives direct sales but also helps luxury watch brands establish long-term brand loyalty, positioning them well for sustained growth in the coming years.

Trends

Integration of Smartwatch Features with Traditional Luxury

The integration of smartwatch features into traditional luxury timepieces is a notable trend reshaping the market. As consumers become more tech-savvy, they increasingly expect timepieces to offer more than just classic aesthetics they seek functionality such as fitness tracking, notifications, and health monitoring.

This trend is pushing traditional luxury watchmakers to incorporate smart features while maintaining the hallmark design and craftsmanship of luxury watches.

In recent years, several leading brands have launched hybrid models that blend high-end materials, precision engineering, and digital connectivity, catering to modern consumer preferences.

For instance, luxury smartwatches have witnessed a 15% increase in sales, reflecting growing consumer interest in this innovative blend of tradition and technology.

This trend appeals not only to tech enthusiasts but also to younger luxury consumers, including Millennials and Gen Z, who are more likely to prioritize functionality alongside design.

By merging the timeless appeal of luxury watches with contemporary digital capabilities, brands can attract a wider demographic and enhance product appeal in a tech-driven world.

As smartwatches continue to evolve, this integration presents a dynamic growth path for the luxury watch sector, offering new avenues for engagement and product differentiation.

Regional Analysis

Asia-Pacific Leads Luxury Watch Market with 48.1% Share in 2023

The Asia-Pacific region dominates the luxury watch market, accounting for 48.1% of the global market share in 2023. The strong demand is fueled by affluent consumer bases in countries like China, Japan, and India, where rising disposable incomes, increasing brand awareness, and a growing preference for high-end timepieces drive growth.

The region also benefits from a robust retail network, duty-free zones, and strategic marketing initiatives by leading brands. Furthermore, Hong Kong and Singapore serve as vital luxury watch trading hubs, supporting regional market expansion.

North America is another significant player in the luxury watch market, driven by the U.S., which has a well-established luxury goods market and a strong consumer base with a penchant for prestigious watch brands. The increasing trend of watches as investment assets, coupled with a high demand for limited editions, supports steady growth in this region.

The luxury watch market in North America is also buoyed by online sales channels and retail innovations, enhancing accessibility and customer engagement.

In Europe, the luxury watch market is characterized by a deep-rooted heritage of watchmaking in countries such as Switzerland, Germany, and France. Swiss-made watches remain synonymous with quality and craftsmanship, driving the region’s demand.

Despite a relatively mature market, Europe continues to show steady growth due to a strong preference for mechanical watches and growing interest among young consumers for vintage and pre-owned luxury watches.

The Middle East & Africa market for luxury watches is shaped by high-net-worth individuals (HNWIs) and a pronounced demand for bespoke, limited-edition pieces, particularly in the UAE and Saudi Arabia.

The region’s affinity for luxury goods, coupled with increasing tourism and a thriving retail sector, supports market growth. Luxury brands’ strategic partnerships and marketing campaigns aligned with regional festivals and events further enhance brand visibility and consumer engagement.

Latin America exhibits moderate growth in the luxury watch market, with Brazil and Mexico as key markets. While economic fluctuations pose challenges, there is a growing segment of consumers interested in luxury watches as symbols of status and success.

The adoption of e-commerce has also facilitated broader access to luxury brands, supporting market expansion in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global luxury watch market in 2024 continues to be characterized by a mix of established heritage brands, diversified luxury conglomerates, and technological disruptors.

Rolex SA maintains its status as a market leader, driven by exceptional brand equity, precision, and craftsmanship. Its enduring appeal among high-net-worth individuals (HNWIs) supports strong demand, particularly for iconic models like the Submariner and Daytona.

LVMH, with brands such as TAG Heuer and Hublot, leverages its broad luxury ecosystem to strengthen its watch segment. It focuses on innovative marketing strategies and collaborations, appealing to younger, fashion-conscious consumers.

Patek Philippe SA maintains its stronghold in the ultra-luxury segment, emphasizing heritage and limited production, which drives high resale values and collector interest.

The Swatch Group Ltd., with a diverse portfolio including brands like Omega and Blancpain, aims for balanced growth across mid-range to high-end segments.

It prioritizes vertical integration and Swiss-made authenticity to maintain market leadership. Audemars Piguet remains a preferred choice for collectors, with limited edition releases that fuel exclusivity and strong market presence.

Apple Inc., with its Apple Watch, impacts the luxury watch market by bridging technology and prestige. While primarily a smartwatch, its high-end variants, such as the Hermès edition, compete in the luxury segment, appealing to tech-savvy consumers.

A. Lange & Söhne and Seiko Watch Corporation focus on fine mechanical craftsmanship, while Fossil Group, Inc. and Citizen Watch Company of America, Inc. target accessible luxury and fashion-forward designs.

Meanwhile, other key players adopt niche strategies, including vintage reissues, sustainable materials, and e-commerce expansions to cater to evolving consumer demands in 2024.

Top Key Players in the Market

- Rolex SA

- LVMH

- Patek Philippe SA

- The Swatch Group Ltd.

- Audemars Piguet

- Apple Inc.

- A. Lange & Söhne

- Fossil Group, Inc.

- Seiko Watch Corporation

- Citizen Watch Company of America, Inc.

- Other Key Players

Recent Developments

- In 2023, Rolex became the first Swiss watch brand to exceed CHF 10 billion in sales, as reported by IFL Watches and Morgan Stanley. Achieving sales of 10.1 billion Swiss francs (approximately $11.5 billion), Rolex saw an 11% increase compared to the previous year. With this milestone, Rolex solidified its leadership position, capturing over 30% of the global retail market share. This success was driven by the production of 1.24 million watches, underscoring Rolex’s dominance in the luxury watch sector.

- In 2024, Chanel announced a strategic partnership with independent watchmaker MB&F, acquiring a 25% stake. This collaboration aligns with Chanel’s efforts to expand its presence in the high-end watch market, reflecting a significant move for both brands in the competitive luxury landscape.

- In 2024, Cristiano Ronaldo ventured into the luxury watch segment by launching his collection in collaboration with Jacob & Co. The collection, named Flight of CR7 and Heart of CR7, includes two models featuring 44mm cases and elements inspired by Ronaldo’s illustrious football career. Priced at £45,000, these timepieces represent the star athlete’s entry into the high-end watch market.

- In 2024, LVMH entered a landmark 10-year sponsorship deal with Formula 1, covering its Louis Vuitton, Moët Hennessy, and TAG Heuer brands. Scheduled to begin in 2025, this partnership follows LVMH’s €150 million investment in the Paris Olympics, marking another significant step in its strategy to align with high-profile sports events.

Report Scope

Report Features Description Market Value (2023) US$ 46.1 Bn Forecast Revenue (2033) US$ 80.3 Bn CAGR (2023-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type (Electronic, Mechanical), Distribution Channel (Offline, Online) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC, Latin America: Brazil, Mexico, and Rest of Latin America, Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa Competitive Landscape Rolex SA, LVMH, Patek Philippe SA, The Swatch Group Ltd., Audemars Piguet, Apple Inc., A. Lange & Söhne, Fossil Group, Inc., Seiko Watch Corporation, Citizen Watch Company of America, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rolex SA

- LVMH

- Patek Philippe SA

- The Swatch Group Ltd.

- Audemars Piguet

- Apple Inc.

- A. Lange & Söhne

- Fossil Group, Inc.

- Seiko Watch Corporation

- Citizen Watch Company of America, Inc.

- Other Key Players