Global Luxury Car Market By Vehicle Type(Sports Utility, Hatchback, Sedan), By Propulsion Type(Internal Combustion Engine, Electric), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133147

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

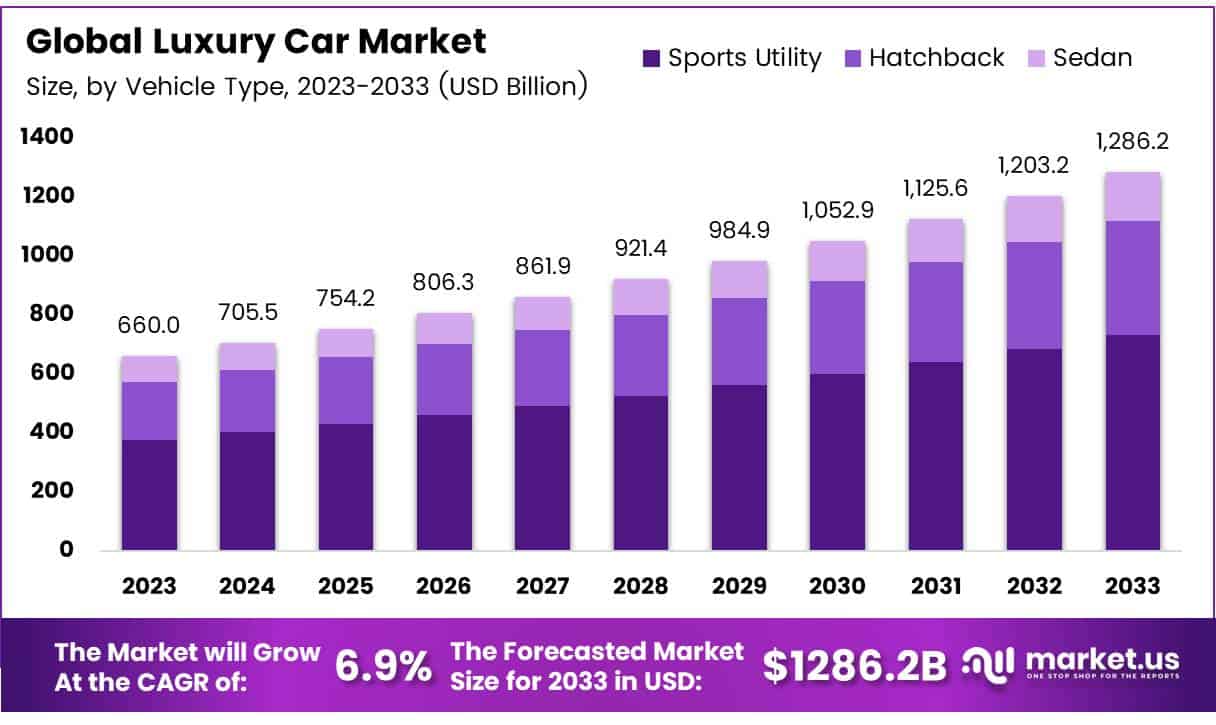

The Global Luxury Car Market size is expected to be worth around USD 1286.2 Billion by 2033, from USD 660.0 Billion in 2023, growing at a CAGR of 6.9% during the forecast period from 2024 to 2033.

A luxury car embodies the pinnacle of comfort, performance, and aesthetics, distinguishing itself from standard vehicles through superior quality, advanced technology, and exclusivity.

These vehicles are typically equipped with premium features such as high-end materials, sophisticated engineering, and innovative technology, catering to consumers who seek prestige and luxury in their automotive choice.

The luxury car market comprises manufacturers, consumers, and stakeholders involved in the production, sale, and distribution of high-end automobiles. This segment of the automotive industry focuses not only on the mechanics and performance but also heavily invests in the brand image, customer service, and overall consumer experience.

The luxury car market is poised for significant growth, driven by rising disposable incomes and a growing preference for luxury goods among the global middle and upper classes. This sector is increasingly leveraging emerging technologies such as electric powertrains and autonomous driving systems, aligning with the global push towards sustainability and innovation.

The integration of these technologies not only enhances vehicle performance but also positions luxury cars as a leader in automotive advancement.

Government investments and regulations play a crucial role in shaping the luxury car market. In regions like Europe and North America, stringent emission regulations have prompted manufacturers to innovate and adopt greener technologies.

For example, governments are offering subsidies and tax incentives for electric vehicles (EVs), which include high-end models, thereby making investments in EV technology more attractive for luxury car manufacturers. Additionally, safety and emission standards continue to become more stringent, pushing the luxury car market towards more sustainable and technologically advanced solutions.

In 2023, the luxury car segment saw notable developments in alignment with global automotive trends. According to GOV.UK, there was a significant increase in environmentally conscious consumer behavior, with registrations of zero-emission cars reaching 314,000, marking an 18% increase.

This trend underscores a shift in luxury consumer preferences towards sustainability, impacting luxury car manufacturers who are now intensifying their focus on developing zero-emission and low-emission luxury vehicles.

In international markets, China has continued to assert its dominance as the largest single-country car market. According to Best Selling Cars, China’s automotive market achieved a record-breaking volume with sales surpassing 25 million vehicles. This includes a substantial contribution from the luxury segment, highlighting the country’s critical role in the global luxury car market dynamics.

Meanwhile, in the USA, there was a 12.4% increase in light vehicle sales in 2023, totaling 15.5 million vehicles. This recovery, although still below pre-Covid levels, indicates a resilient demand for luxury vehicles among U.S. consumers, driven by economic recovery and increased consumer confidence.

These data points illustrate the adaptive strategies of the luxury car market to meet evolving consumer demands and regulatory environments. The luxury car manufacturers’ ability to integrate sustainability with luxury is proving to be a key factor in their continued growth and market penetration in both established and emerging markets.

Key Takeaways

- Global Luxury Car Market projected to grow to USD 1286.2 Billion by 2033, from USD 660.0 Billion in 2023, with a CAGR of 6.3%.

- Sports Utility Vehicles dominate the market by vehicle type with a 57.9% share in 2023, driven by demand for versatile, high-comfort vehicles.

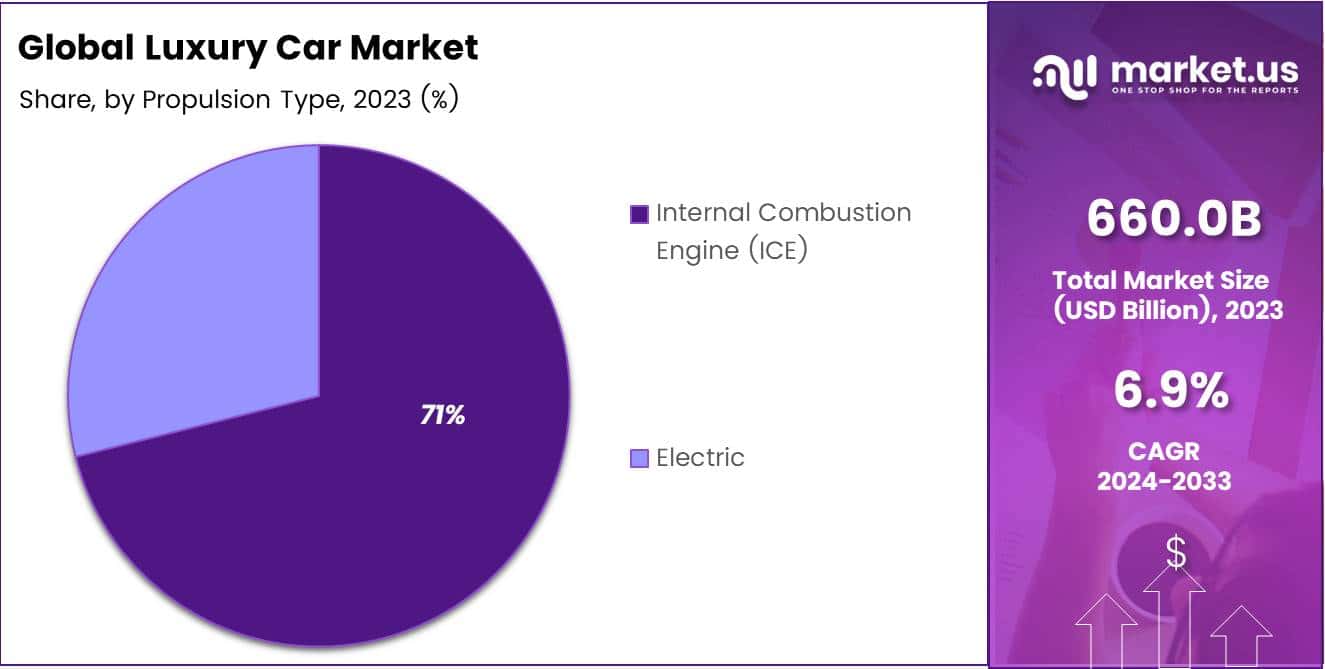

- Internal Combustion Engine (ICE) vehicles maintain a dominant 71% market share by propulsion type due to performance and infrastructure advantages.

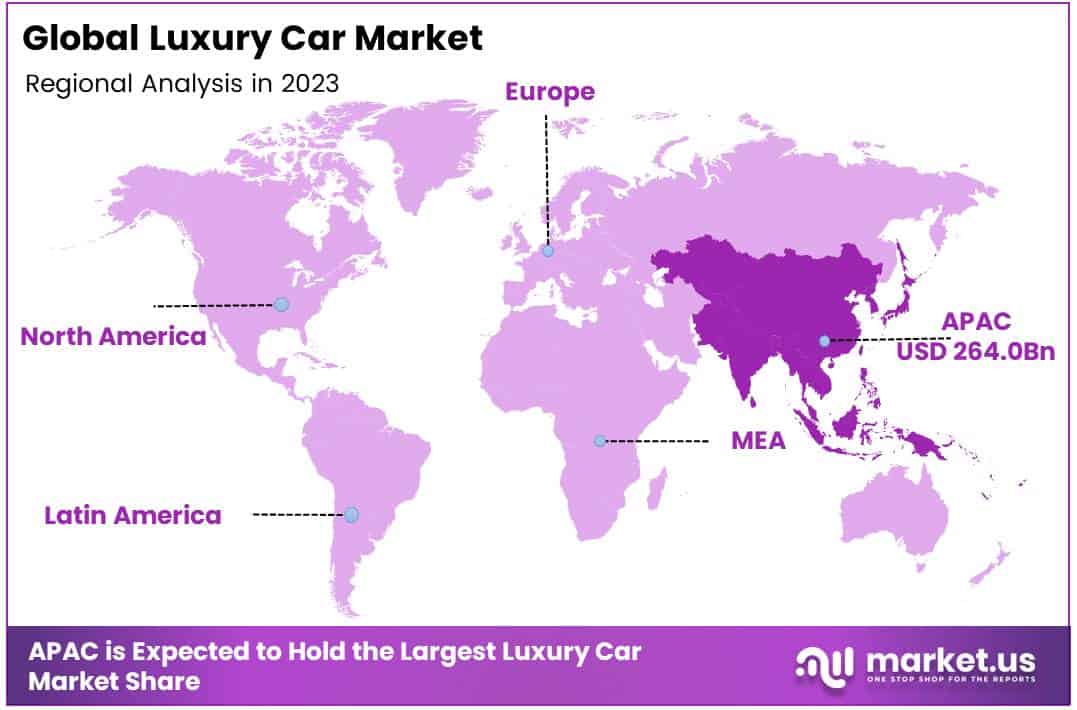

- Asia-Pacific leads regional market share at 40%, driven by increasing affluence and luxury brand preference in China and India.

Vehicle Type Analysis

Sports Utility Dominates Luxury Car Market with 57.9% Share

In 2023, the Sports Utility segment secured a dominant market position in the By Vehicle Type Analysis of the Luxury Car Market, holding a substantial 57.9% share. This prominence is attributed to the increasing consumer preference for versatile vehicles offering enhanced comfort, superior performance, and advanced technological features.

As lifestyles become more dynamic, the demand for luxury SUVs that combine the ruggedness of off-road capability with the elegance of luxury amenities continues to surge.

Conversely, the Sedan segment, traditionally favored for its sophistication and performance, has observed a steady market presence but grows at a slower pace compared to SUVs. Sedans remain popular among consumers who prioritize classic styling and driving experience.

Meanwhile, the Hatchback segment caters to a niche market within the luxury sector, appealing to those seeking compactness and efficiency without compromising on luxury. Although smaller in market share, hatchbacks offer significant opportunities for manufacturers to innovate and attract environmentally conscious consumers, emphasizing sustainability alongside luxury.

This shifting dynamic underscores a broader trend in consumer preferences within the luxury automotive sector, where versatility and sustainability are becoming increasingly significant drivers of market dominance.

Propulsion Type Analysis

ICE Maintains 71% Share in Luxury Car Propulsion Market

In 2023, the Internal Combustion Engine (ICE) held a dominant market position in the By Propulsion Type Analysis segment of the Luxury Car Market, securing a 71% share. This significant market share underscores the enduring preference for ICE vehicles among luxury car buyers, despite the growing environmental concerns and the push towards electric vehicles (EVs).

The luxury segment’s loyalty to ICE can be attributed to the superior performance, traditional driving experience, and established infrastructure that ICE vehicles offer.

Conversely, electric vehicles, representing the emerging trend towards sustainability in automotive technology, have begun to capture interest but still hold a smaller portion of the market. As automotive manufacturers continue to innovate and expand their EV offerings, the market landscape may shift.

However, for 2023, ICE remains the preferred choice for a majority of luxury car consumers, reflecting a transitional phase in automotive propulsion technologies where traditional powertrains coexist with emerging electric alternatives.

Key Market Segments

By Vehicle Type

- Sports Utility

- Hatchback

- Sedan

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric

Drivers

Embracing Technological Innovation in Luxury Cars

Technological advancements are significantly propelling the luxury car market forward. Innovations like electric and hybrid powertrains are not only eco-friendly but also offer enhanced performance, drawing a broader consumer base who seek sustainability without compromising on power.

Advanced infotainment systems and autonomous driving capabilities are setting new standards in comfort and convenience, making these cars highly attractive to tech-savvy buyers.

Moreover, the prestige associated with luxury car brands continues to be a strong selling point, as owning such a vehicle symbolizes status and success. This brand prestige is crucial in maintaining consumer loyalty and attracting new customers who aspire to elevate their social standing.

Additionally, luxury cars hold their value better than mainstream vehicles, ensuring that owners see a better return on investment when it’s time to sell. This strong resale value further enhances the appeal of luxury cars as a wise financial decision, adding to their desirability among investment-conscious consumers.

Restraints

High Costs Challenge Luxury Car Ownership

One must consider the significant restraints affecting potential buyers. Primarily, the high cost of ownership stands out as a considerable hurdle. The initial purchase price of luxury cars is notably higher than that of standard vehicles, which can deter first-time buyers or those on a more modest budget.

Beyond the purchase, owners face elevated expenses in maintenance, insurance, and repairs. Luxury vehicles often require specialized services and parts, which are not only costlier but may also be less readily available, leading to higher ongoing costs.

Additionally, the market’s sensitivity to economic shifts poses another challenge. During economic downturns, consumer spending on non-essential luxury items tends to decrease dramatically. This volatility can lead to fluctuations in sales, affecting market stability and predictability. These factors combine to create a barrier to growth and expansion within the luxury car market, highlighting the need for manufacturers to address these issues to attract and retain customers.

Growth Factors

Embrace Eco-Friendly Vehicles in the Luxury Car Market

The luxury car market stands on the brink of significant transformation, primarily driven by the growing consumer inclination towards sustainability. Electric and hybrid models represent a key growth opportunity, appealing to environmentally conscious consumers seeking eco-friendly yet luxurious transportation solutions.

Additionally, integrating digital enhancements such as artificial intelligence (AI) and the Internet of Things (IoT) can revolutionize the driving experience. These technologies enable advanced diagnostics, personalized settings, and superior driver assistance features, setting new standards in luxury and convenience.

Another promising avenue is the expansion of certified pre-owned programs, which makes luxury cars more accessible by lowering the financial barrier for potential buyers. This strategy not only broadens the market base but also boosts brand loyalty and customer retention by providing high-quality, reliable second-hand vehicles.

These strategic focuses promise to propel the luxury car market forward, adapting to shifting consumer preferences and technological advancements.

Emerging Trends

Health and Wellness Features Drive Luxury Car Trends

In the ever-evolving landscape of the luxury car market, a significant trend gaining momentum is the integration of health and wellness features.

Modern luxury vehicles are increasingly equipped with advanced air purification systems, ambient lighting that adjusts to enhance comfort, and sophisticated HVAC systems designed to provide an optimal environment for passengers. These enhancements address growing consumer demand for vehicles that go beyond mere transportation, offering a sanctuary of well-being and safety.

Additionally, luxury car manufacturers are embedding augmented reality interfaces and cutting-edge safety technologies as standard features, significantly elevating the driving experience. These innovations not only promise enhanced safety and navigation but also position luxury cars as the epitome of modern driving luxury, appealing to safety-conscious and tech-savvy consumers alike.

Regional Analysis

Asia-Pacific Dominates the Global Luxury Car Market with 40% Market Share and USD 264.0 Billion in Value

The luxury car market exhibits distinct regional characteristics and growth dynamics, with Asia-Pacific emerging as the leading region, capturing approximately 40% of the market share and valued at USD 264.0 billion.

This robust performance is driven by increasing affluence, particularly in China and India, where rising disposable incomes and a growing preference for luxury brands are fueling demand.

Regional Mentions:

North America, the market continues to expand steadily, supported by a strong economic framework and a high propensity among consumers to invest in luxury vehicles that offer superior performance and advanced technologies. Europe remains a critical market, home to many of the world’s most renowned luxury car manufacturers. The region’s market is bolstered by deep-rooted automotive heritage and a significant emphasis on innovation and luxury.

Middle East & Africa (MEA) and Latin America are experiencing gradual growth in the luxury car segment. In the MEA, the market is supported by the affluent consumer base in the Gulf Cooperation Council (GCC) countries, who have high purchasing power and a taste for high-end luxury cars.

Latin America, though smaller in scale compared to other regions, is witnessing an uptick in demand due to improving economic conditions and the increasing presence of luxury car brands.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global luxury car market in 2023, three key players—Mercedes-Benz Group AG, Tesla, and BMW Group—have particularly distinguished themselves through innovative strategies and market positioning.

Mercedes-Benz Group AG continues to set benchmarks in luxury and performance, reinforcing its brand prestige. The company has focused on integrating advanced digital technologies and sustainability into its vehicle design, aiming to lead in the electric vehicle (EV) transition among traditional luxury automakers.

Tesla has sustained its disruptive impact in the luxury car market, primarily driven by its dominance in the electric vehicle sector. With cutting-edge technology and an aggressive expansion strategy, Tesla has not only consolidated its market share but also defined consumer expectations for electric cars.

BMW Group leverages its strong brand heritage and engineering excellence to maintain a significant presence in the market. BMW’s strategy has been to blend traditional luxury with modern sustainability, pushing forward with its electrification agenda. The introduction of new models with advanced drivetrain technologies and digital services aims to cater to a market that values both performance and environmental consciousness.

Top Key Players in the Market

- Mercedes-Benz Group AG

- Volkswagen

- Tesla

- TOYOTA MOTOR CORPORATION (Lexus)

- Volvo Car Corporation

- Aston Martin

- BMW Group

Recent Developments

- In March 2024, Stellantis announced a significant investment of €5.6 billion in South America, representing the largest financial commitment ever made in the region’s automotive sector. This investment aims to boost production capabilities and expand market reach.

- In March 2024, Hyundai committed to a massive $50 billion investment to enhance its electrification efforts, underscoring its strategic focus on becoming a leader in electric vehicle technology and expanding its sustainable vehicle lineup.

- In July 2023, Mercedes declared its intention to invest $45 billion in its luxury electric vehicle (EV) lineup, positioning itself as a major contender in the luxury EV market and aiming to surpass Tesla in terms of innovation and market share.

- In November 2024, Volkswagen increased its investment in Rivian by $800 million, bringing the total investment to $5.8 billion. This move aims to deepen Volkswagen’s stake in the electric vehicle market and enhance collaborative efforts in EV technology.

- In November 2023, Nissan announced an investment of $ 2.8 billion in Brazil, confirming the production of two new SUVs and a turbo engine. This investment reflects Nissan’s commitment to expanding its product lineup and enhancing manufacturing capabilities in the region.

Report Scope

Report Features Description Market Value (2023) USD 660.0 Billion Forecast Revenue (2033) USD 1286.2 Billion CAGR (2024-2033) 6.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type(Sports Utility, Hatchback, Sedan), By Propulsion Type(Internal Combustion Engine, Electric) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mercedes-Benz Group AG, Volkswagen, Tesla, TOYOTA MOTOR CORPORATION (Lexus), Volvo Car Corporation, Aston Martin, BMW Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mercedes-Benz Group AG

- Volkswagen

- Tesla

- TOYOTA MOTOR CORPORATION (Lexus)

- Volvo Car Corporation

- Aston Martin

- BMW Group