Global Luer Lock Connector Market By Configuration (Straight Channel, T-Channel, Y-Channel, Others), By Fluid-Displacement Type (Positive, Neutral, Negative), By Connector Type (Male, Female), By End-User (Hospitals, Clinics, Ambulatory Surgical Centers, Maternity Centers, Long-Term Care Facilities, Home-Healthcare Settings, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170790

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Configuration Analysis

- Fluid-Displacement Type Analysis

- Connector Type Analysis

- By End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

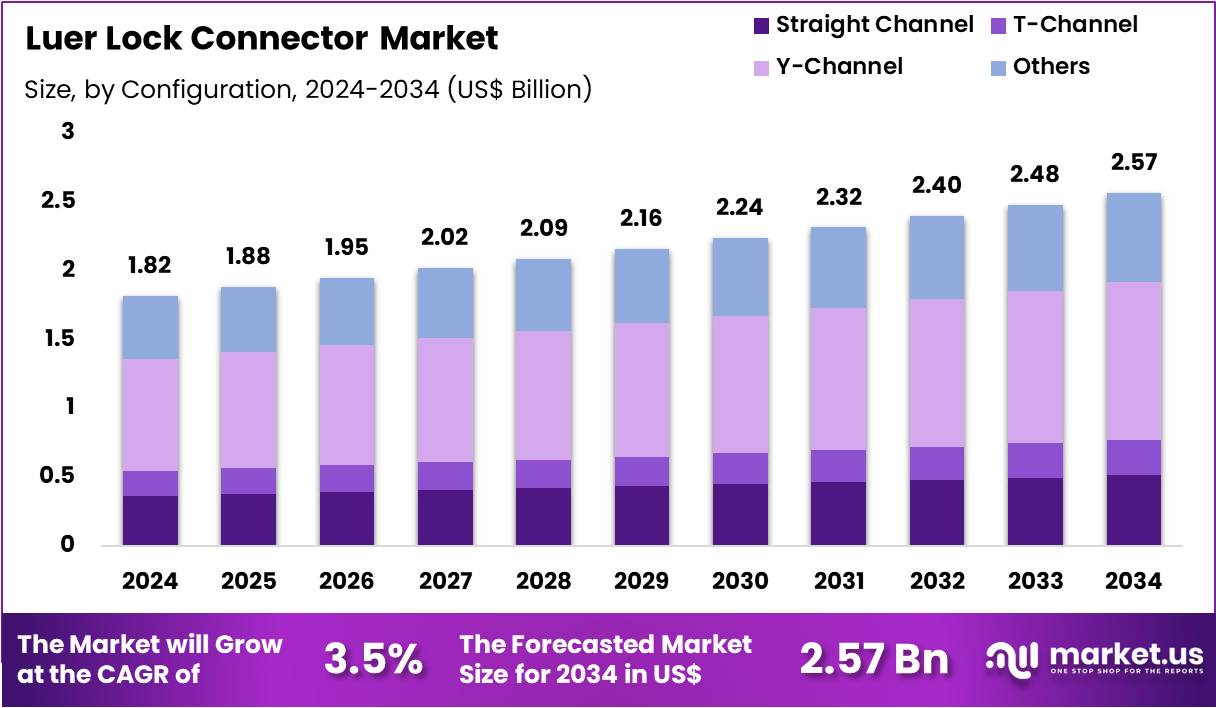

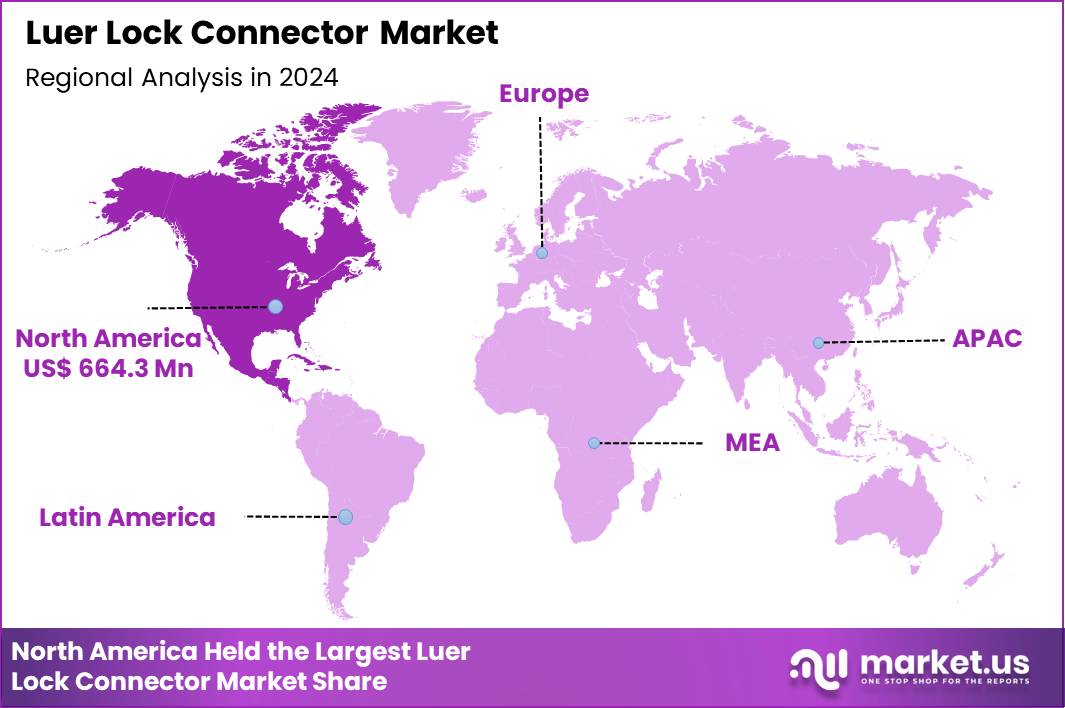

The Global Luer Lock Connector Market size is expected to be worth around US$ 2.57 Billion by 2034 from US$ 1.82 Billion in 2024, growing at a CAGR of 3.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 36.5% share with a revenue of US$ 664.3 Million.

A Luer Lock connector is a standardized medical fitting that ensures secure, leak-proof connections between syringes, needles, catheters, and tubing. It features a tapered male tip that fits into a matching female socket, secured by a threaded collar or hub that screws together via a push-and-twist mechanism. This design surpasses friction-based Luer slip connectors by preventing accidental disconnections under pressure, enhancing safety in high-risk settings like IV therapy and surgeries. Standardized under ISO 80369-7, it minimizes contamination risks with precise seals and broad device compatibility.

The Luer Lock Connector Market represents an essential segment of global medical-device consumables, supporting millions of infusion, injection, catheterization, and diagnostic procedures daily. Luer lock systems provide a secure, leak-proof connection between syringes, tubing, IV sets, catheters, blood-collection lines, and drug-delivery devices. Their standardized design ensures compatibility across nearly all clinical departments, reducing the risk of detachment, medication leakage, and bloodstream infection during fluid administration.

Worldwide emphasis on needle-free access, closed-system drug transfer, infusion accuracy, and infection-control standards significantly amplifies adoption across hospitals, outpatient centers, and emergency-care ecosystems.

The increasing burden of chronic diseases continues to elevate infusion volumes. For example, more than 700 million global infusion procedures occur annually across oncology, dialysis, immunotherapy, and chronic pain-management units. Rising surgical loads over 330 million procedures worldwide each year—further increase the demand for secure connectors used with catheters, IV lines, and flushing systems. To support these needs, manufacturers are introducing connectors with enhanced flow control, antimicrobial coatings, needle-free mechanisms, and improved resistance against blood reflux.

Regulatory agencies such as the FDA, EU MDR, and Health Canada emphasize connector integrity and error-prevention designs, strengthening market momentum.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.82 Billion, with a CAGR of 3.5%, and is expected to reach US$ 2.57 Billion by the year 2034.

- The Configuration segment is divided into Straight Channel, T-Channel, Y-Channel, and Others, with Y-Channel taking the lead in 2024 with a market share of 44.8%

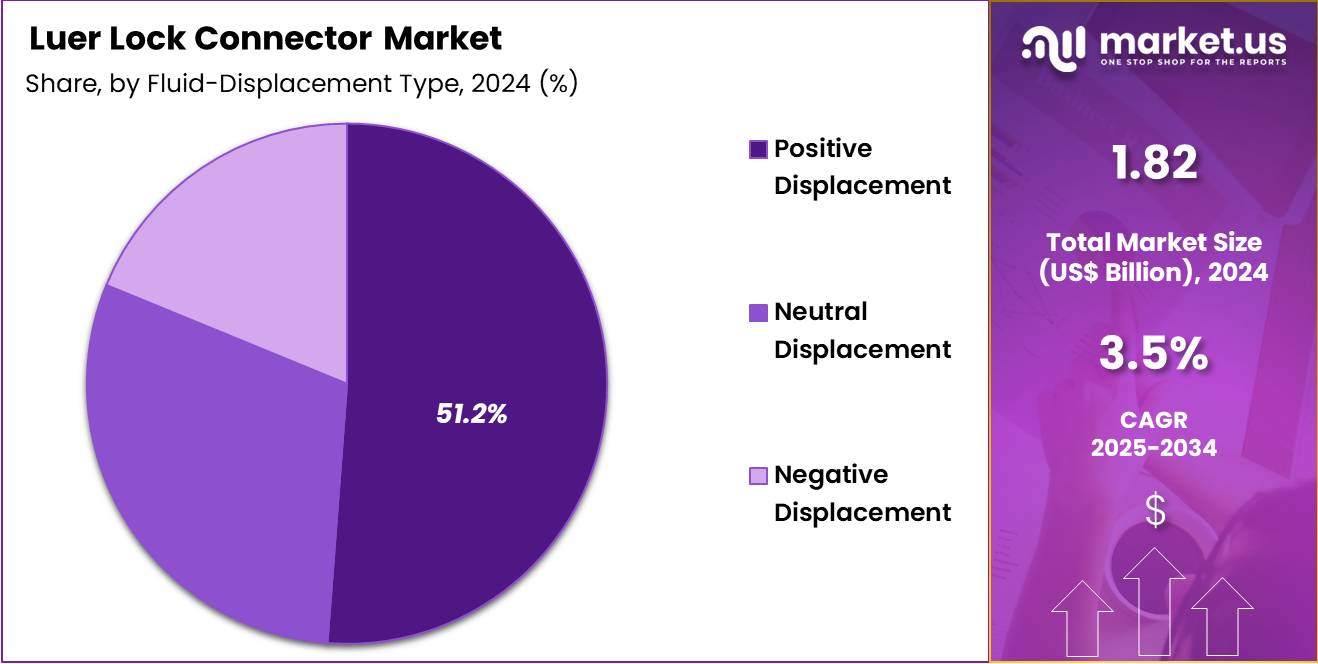

- The Fluid-Displacement Type segment is divided into Positive Displacement, Neutral Displacement, and Negative Displacement, with Positive Displacement taking the lead in 2024 with a market share of 51.2%

- The Connector Type segment is divided into Male Luer Lock Connector, and Female Luer Lock Connector, with Female Luer Lock Connector taking the lead in 2024 with a market share of 62.3%

- The End-User segment is divided into Hospitals, Clinics, Ambulatory Surgical Centers, Maternity Centers, Long-Term Care Facilities, Home-Healthcare Settings, and Others, with Hospitals taking the lead in 2024 with a market share of 37.9%

- North America led the market by securing a market share of 36.5% in 2024.

Configuration Analysis

Y-channel configurations hold the largest usage base accounting for 44.8% market share in 2024 as they enable multisite infusions, pressure monitoring, and synchronized fluid delivery. They are used extensively across oncology infusion suites, ICU departments, pediatrics, and dialysis units. In chemotherapy, where over 18 million global infusion sessions occur annually, Y-channel connectors help clinicians manage saline flushes, antiemetic pre-medications, and anticancer drugs through a single access point. Y-channels also reduce line changes during high-dependency care, minimizing catheter-related bloodstream infection (CRBSI) risks.

Straight-channel connectors are also widely used for single-line drug administration, irrigation, and blood collection tasks where direct, uninterrupted flow is required. They are common in IV bolus dosing, contrast-agent injection for imaging, arterial blood-gas sampling, and vaccine delivery programs.

Public vaccination campaigns such as seasonal influenza drives administering over 170 million doses annually rely heavily on straight-channel Luer lock syringes for accuracy and safety. T-channel connectors support dual-line management and are routinely used in anesthesia circuits, neonatal IV therapy, wound irrigation systems, and diagnostic contrast mixing. They enable simultaneous administration of fluids or medications without disconnection, reducing exposure to contamination

Fluid-Displacement Type Analysis

Positive-displacement connectors dominated clinical use and held majority market share of 51.2% because they reduce catheter occlusions and maintain line patency after syringe disconnection. These connectors are widely deployed in oncology, dialysis, pediatric IV therapy, and TPN (Total Parenteral Nutrition) administration. Studies show that positive-displacement systems can reduce occlusion events by up to 70%, lowering the need for catheter replacement and decreasing nursing workload. Their role is especially critical in chemotherapy, where frequent saline and heparin flushes require secure, reflux-mitigating systems.

Neutral connectors provide a balanced pressure profile suitable for routine inpatient and outpatient procedures. They are frequently used in general medicine wards, maternity units, rehabilitation centers, and ambulatory surgical facilities. These devices support safe flushing protocols without significant positive or negative reflux, making them ideal for medium-term catheterization.

Neutral systems are also preferred in pediatrics to minimize flow disturbances during medication administration and hydration therapy. Negative-displacement connectors are primarily used in specialized infusion protocols where controlled backflow is necessary for secure catheter needle removal.

Connector Type Analysis

Female connectors dominated the market usage with 62.3% market share because they form the receiving interface on IV lines, catheters, needleless valves, stopcocks, and fluid-transfer systems across all departments. They are essential for closed-system drug preparation, reducing aerosol exposure during hazardous-drug handling in oncology and pharmacy clean rooms.

With more than 40 million central-line placements annually, female Luer connectors are integral to maintaining sterile, secured access points. Enhanced female connectors with antimicrobial features or blood-reflux barriers are increasingly adopted in critical care.

Male Luer connectors appear predominantly on syringes, sampling devices, and infusion accessories requiring insertion into female ports. They are widely used during arterial blood gas sampling—performed over 20 million times annually—contrast injection in CT/MRI scans, and medication reconstitution processes. Manufacturers have introduced male connectors with anti-slip grips, color indicators, and enhanced torque strength to reduce accidental dislodgement during high-pressure infusion scenarios.

By End-User Analysis

Hospitals represent the largest end-user segment which held 37.9% share due to high procedure volumes across emergency medicine, intensive care, surgery, oncology, cardiology, and maternity departments. Each inpatient bed may require multiple daily fluid interventions, translating into thousands of Luer-based interactions per facility.

For example, an average ICU patient receives 5–15 infusion-line manipulations per day involving medication changes, flushes, or monitoring. Hospitals also rely on Luer systems during imaging procedures, anesthesia induction, wound irrigation, and central-line maintenance.

Clinics, including dermatology, gynecology, ENT, and dental clinics, use Luer lock connectors for injections, local anesthesia, minor procedures, vaccine delivery, and diagnostic sampling. ASCs utilize Luer lock systems extensively during pre-operative IV access, anesthesia circuits, intra-operative flushing, and post-operative medication delivery. The global rise of outpatient surgeries exceeding 130 million annually has increased demand for reliable connectors that support rapid turnover while ensuring sterility and patient safety.

Key Market Segments

By Configuration

- Straight Channel

- T-Channel

- Y-Channel

- Others

By Fluid-Displacement Type

- Positive Displacement

- Neutral Displacement

- Negative Displacement

By Connector Type

- Male Luer Lock Connector

- Female Luer Lock Connector

By End-User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Maternity Centers

- Long-Term Care Facilities

- Home-Healthcare Settings

- Others

Drivers

Growing global dependence on infusion therapy and drug delivery

Growing global dependence on infusion therapy, drug delivery, and diagnostic procedures continues to accelerate the use of Luer lock connectors across hospitals and outpatient settings. Healthcare systems conduct over 700 million infusion procedures annually, including chemotherapy, electrolytes, parenteral nutrition, and long-term antibiotic therapy, all requiring secure Luer interfaces.

Catheter-related bloodstream infections (CRBSIs) affect nearly 250,000 patients every year across advanced economies, prompting strict adoption of connectors with leak-proof and contamination-resistant designs. In surgery, more than 330 million procedures occur worldwide annually, each requiring precise fluid delivery, anesthesia management, and blood sampling supported by Luer-based systems.

Needle-free Luer valves have expanded rapidly as the WHO and CDC recommend minimizing sharps exposure; over 385,000 needlestick injuries occur yearly in the US alone, strengthening the transition to Luer lock systems. Increasing chronic disease prevalence such as oncology, renal disorders, and cardiovascular disease requires continuous clinical monitoring and infusion access, further anchoring connector usage. Growing use of minimally invasive procedures, which now account for over 60% of all surgeries, also increases demand for specialized connectors for catheters, endoscopes, and imaging injectors.

Restraints

Operational and safety-related constraints

Despite strong demand, several operational and safety-related constraints limit wider adoption of Luer lock connectors. Misconnections remain a significant clinical risk; reports from global patient-safety organizations document hundreds of cases annually where Luer systems were mistakenly connected to feeding tubes, pneumatic devices, or epidural lines, resulting in severe adverse events. Although standards such as ISO 80369 aim to reduce these incidents, transition costs and device reconfigurations pose challenges for facilities.

Supply-chain instability during geopolitical disruptions and pandemic-era shutdowns highlighted vulnerabilities in global plastic resin, medical-grade polymer, and component manufacturing. Medical device recalls related to cracking, valve malfunction, or flow inconsistency also shape purchaser hesitancy, particularly in high-risk departments like oncology and intensive care. Waste generation is another barrier: healthcare waste exceeds 5 million tons annually worldwide, and disposable connectors contribute to this burden due to single-use infection-control protocols.

Long-term care and home-care settings face training limitations, where improper flushing or connection techniques can increase catheter occlusion risk. Financial pressure on hospitals, especially in emerging economies, further restricts rapid adoption of upgraded connector technologies such as antimicrobial surfaces or closed-system valves, which often cost more than standard Luer fittings. All these constraints collectively slow seamless market penetration.

Opportunities

Accelerating innovation in secure fluid-management technologies

Accelerating innovation in secure fluid-management technologies is creating major opportunities within the Luer lock connector market. Antimicrobial-coated connectors capable of reducing bacterial colonization by up to 99% are increasingly adopted across ICUs, oncology infusion units, NICUs, and dialysis centers. Closed-system drug-transfer connectors are expanding due to rising exposure concerns with hazardous drugs; over 14 million healthcare workers handle cytotoxic agents worldwide, strengthening demand for safer connections.

Home-based infusion therapy is experiencing rapid growth as aging populations increase and chronic disease care shifts out of hospitals—over 3 million patients in the US alone now receive home infusions annually. This trend supports high adoption of needle-free Luer valves, portable pumps, and easy-to-handle tubing systems. Opportunities also emerge in emergency medical services, which conduct more than 250 million ambulance runs yearly, requiring robust connectors that withstand vibration, rapid manipulation, and high-pressure delivery.

Sustainability initiatives create openings for recyclable polymers, bio-based fittings, and longer-life disposable connectors. Rising adoption of minimally invasive and image-guided procedures—growing at 8–10% annually across many regions—drives demand for precision connectors for angiography, contrast injection, and catheter-based interventions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic volatility and geopolitical disruptions exert a significant influence on the Luer Lock Connector Market by affecting raw-material supply, manufacturing capacity, transportation networks, and healthcare procurement strategies. Medical-grade polymers such as polycarbonate, ABS, and PVC—widely used in Luer connectors—are heavily dependent on petrochemical value chains.

Global crude-oil price fluctuations of 30–50% during unstable economic cycles directly impact material costs, forcing manufacturers to adjust pricing or reduce production volumes. Geopolitical tensions affecting major shipping corridors, including the Red Sea and South China Sea, have resulted in shipping delays exceeding 20–40 days, disrupting the timely distribution of connectors to hospitals and emergency-care facilities.

Pandemic-era export restrictions on medical supplies demonstrated the fragility of global supply chains, with several countries limiting outbound shipments of tubing sets, syringes, and Luer components creating acute shortages in regions reliant on imports. Inflationary pressures increase operational expenses, from molding-machine energy consumption to sterility-assurance processes, raising procurement costs for healthcare providers.

Workforce shortages further strain production; for example, many medical-device factories in Southeast Asia and Latin America reported absenteeism rates exceeding 15–20% during health emergencies. Additionally, geopolitical instability often triggers surge demand for emergency stockpiling by military hospitals, disaster-response agencies, and public-health authorities, creating short-term supply imbalances and price surges across global markets.

Latest Trends

Rapid shift toward needle-free, closed-system, and anti-reflux technologies

A major trend shaping the Luer lock connector market is the rapid shift toward needle-free, closed-system, and anti-reflux technologies that improve safety and reduce contamination risks. Hospitals increasingly rely on needle-free valves to prevent accidental needlestick injuries, which total more than 2 million globally each year. Another strong trend is the integration of antimicrobial surfaces, where silver-ion and chlorhexidine-based coatings are incorporated to reduce microbial attachment along infusion pathways.

Smart infusion systems are also emerging; some advanced connectors now incorporate pressure indicators or color-coded alerts to minimize misconnection errors, aligning with ISO 80369 standards. Increased use of high-pressure injectors in radiology supporting CT and MRI contrast procedures performed over 90 million times annually drives demand for connectors capable of withstanding elevated PSI ratings without leakage.

The rise of portable and wearable infusion devices used in oncology, pain management, and endocrinology is creating demand for lighter, compact Luer designs tailored for mobility. Growth of decentralised healthcare, including mobile clinics and home diagnostics, pushes manufacturers to develop tamper-proof and easy-locking connectors suited for non-hospital environments.

Regional Analysis

North America is leading the Luer Lock Connector Market

North America held 36.5% market share in 2024. The region leads the Luer lock connector market due to its extensive infusion therapy workload, advanced healthcare infrastructure, and strong regulatory emphasis on patient safety. The region conducts over 95 million emergency department visits annually and performs more than 50 million surgical procedures, each requiring secure Luer systems for anesthesia, hydration, and medication delivery. The CDC estimates 250,000 catheter-related bloodstream infections yearly across US hospitals, increasing reliance on closed-system, needle-free connectors.

Oncology infusion volumes continue to rise, with over 1.9 million new cancer cases each year, generating sustained demand for multi-line Y-channel connectors and anti-reflux displacement systems. Radiology departments performing 70+ million CT scans annually further expand usage of high-pressure Luer interfaces for contrast injection. Strong presence of device manufacturers, faster regulatory adoption cycles, and high per-capita healthcare spending collectively position North America as the dominant regional market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific represents the fastest-growing region due to rapid healthcare expansion, rising chronic disease burden, and increased procedural volumes. Countries such as China and India collectively perform over 100 million inpatient surgeries each year and support some of the world’s highest infusion loads in oncology, dialysis, and infectious-disease management.

Diagnostic testing volumes continue to surge, with India alone processing more than 50 million lab tests monthly across public and private networks each requiring precise sample-handling connectors. Expanding maternity and neonatal care services, especially in Southeast Asia, increase demand for small-bore and pediatric-compatible Luer systems. Government investments in emergency-care infrastructure, including thousands of new ambulances and trauma centers, also accelerate connector consumption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Braun Melsungen AG, Baxter International Inc., Becton, Dickinson and Company (BD), Smiths Medical, ICU Medical Inc., Elcam Medical, TE Connectivity, Nordson Corporation, Qosina Corporation, Merit Medical Systems, Medline Industries, Gerresheimer AG, Hamilton Medical, Cole-Parmer, and Others.

- Braun Melsungen AG plays a major role in advancing infusion and vascular-access safety, supplying extensive Luer lock IV sets, stopcocks, and needle-free valves widely used in hospitals, ICUs, and oncology infusion suites.

Baxter International Inc. supports global fluid-management protocols through Luer-based infusion systems integrated across its pumps, parenteral nutrition platforms, and medication-delivery devices, strengthening reliability in critical-care and home-infusion settings.

Becton, Dickinson and Company (BD) remains one of the largest contributors to Luer standardization worldwide, offering syringes, connectors, catheters, and needle-free access systems central to high-volume procedures such as blood sampling, anesthesia, and chronic-disease infusion therapy. Collectively, these companies reinforce safety, compatibility, and performance across all Luer-dependent clinical workflows.

Top Key Players

- Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company (BD)

- Smiths Medical

- ICU Medical Inc.

- Elcam Medical

- TE Connectivity

- Nordson Corporation

- Qosina Corporation

- Merit Medical Systems

- Medline Industries

- Gerresheimer AG

- Hamilton Medical

- Cole-Parmer

- Others

Recent Developments

- In September 2025, ICU Medical Inc., a global medical technology company focused on IV therapy and critical care, announced that the U.S. FDA had granted new 510(k) clearance for its Clave needlefree connector portfolio. The clearance adds a new labeling claim referencing peer-reviewed data showing that hospitals using Clave connectors at high volumes experienced a 19% reduction in relative CLABSI risk, along with lower related healthcare costs and improved patient outcomes.

- In November 2022, the FDA issued an alert to healthcare professionals noting that certain Luer-activated valve (LAV) connectors, also known as needleless Luer access or needleless connectors, featuring internal pin designs may be incompatible with prefilled glass syringes.

- In April 2022, Qosina, a reliable supplier of OEM single-use components for the medical and pharmaceutical sectors, responded to the global Zytel® nylon shortage by expanding its luer lock connector line. The company introduced new Vydyne®-based connectors, which are now available in stock for immediate delivery.

Report Scope

Report Features Description Market Value (2024) US$ 1.82 Billion Forecast Revenue (2034) US$ 2.57 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Configuration (Straight Channel, T-Channel, Y-Channel, Others), By Fluid-Displacement Type (Positive, Neutral, Negative), By Connector Type (Male, Female), By End-User (Hospitals, Clinics, Ambulatory Surgical Centers, Maternity Centers, Long-Term Care Facilities, Home-Healthcare Settings, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Braun Melsungen AG, Baxter International Inc., Becton, Dickinson and Company (BD), Smiths Medical, ICU Medical Inc., Elcam Medical, TE Connectivity, Nordson Corporation, Qosina Corporation, Merit Medical Systems, Medline Industries, Gerresheimer AG, Hamilton Medical, Cole-Parmer, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company (BD)

- Smiths Medical

- ICU Medical Inc.

- Elcam Medical

- TE Connectivity

- Nordson Corporation

- Qosina Corporation

- Merit Medical Systems

- Medline Industries

- Gerresheimer AG

- Hamilton Medical

- Cole-Parmer

- Others