Global Low-Carbon Propulsion Market By Fuel Type (Compressed Natural Gas (CNG), Liquefied Natural Gas (LNG), Ethanol, Hydrogen, Electric), By Mode (Rail, Road), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Ships, Aircrafts), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 73341

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

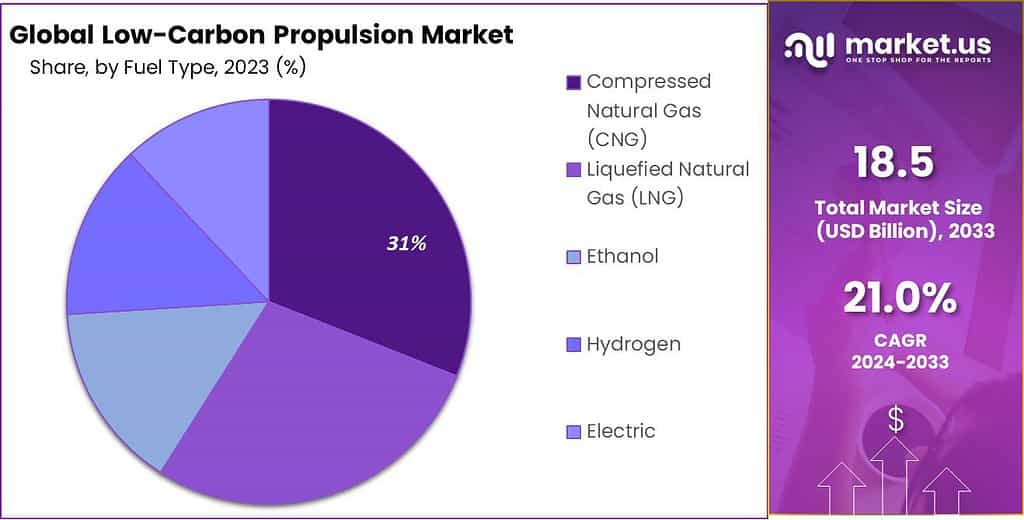

The global Low-carbon propulsion market is projected to have a moderate-paced CAGR of 21.0% during the forecast period. The current valuation of the Low-carbon propulsion industry is USD 18.5 Billion in 2023. The demand for Low-carbon propulsion is anticipated to reach a high of USD 124.5 Billion by the year 2033.

Low-carbon propulsion refers the application of propulsion systems and technology that limit greenhouse gas emissions and decrease carbon footprints. It is the process of implementing greener and more eco-friendly alternatives to traditional fossil fuel-powered engines across a range of forms of transportation like ships, automobiles as well as aircrafts, trains, and ships. The aim of propulsion that is low carbon is to lessen the environmental impact of transportation through cutting CO2 (CO2) as well as other emissions of greenhouse gases.

In simple terms, low-carbon propulsion is the use of environmentally friendly and sustainable technology to power vehicles and decrease emissions. It is focused upon finding solutions to conventional engines that emit less harmful emissions, including greenhouse gases that are responsible for climate change.

Note: Actual Numbers Might Vary In Final Report

The market for propulsion with low carbon is a term used to describe the industry and business that is associated with the creation, production and application of low-carbon propulsion technology and systems. It covers companies engaged in the manufacture of electric vehicles, hybrid vehicles hydrogen-powered fuel cells biofuel-powered vehicles, as well as other environmentally friendly transportation solutions.

Based On Fuel Type

In 2023, the Low-Carbon Propulsion Market exhibited distinct segmentation based on fuel types, with the Compressed Natural Gas (CNG) segment emerging as the dominant force by capturing over a 31% market share. This dominance can be attributed to the widespread adoption of CNG as a cleaner alternative fuel across various modes of transportation, including automobiles and commercial fleets. The numerical data underscores the significance of CNG in the market, reflecting its established position as a preferred low-carbon propulsion fuel.

Liquefied Natural Gas (LNG) represents another notable segment in the market, with its share reflecting the industry’s ongoing exploration of alternative fuel options. LNG’s presence is characterized by its lower carbon emissions compared to traditional fuels, positioning it as an environmentally friendly choice for certain applications, particularly in maritime and heavy-duty transport.

Ethanol, sourced from renewable materials like corn or sugarcane, plays a pivotal role in broadening the spectrum of fuel alternatives within the market. Its attractiveness stems from the prospect of diminishing greenhouse gas emissions, notably in the automotive industry, where ethanol-powered vehicles are gaining momentum as part of the drive towards sustainable transportation.

Hydrogen, lauded for its potential as a zero-emission fuel, is making significant advancements in the Low-Carbon Propulsion Market. This progress underscores hydrogen’s promise as an environmentally friendly fuel option within the industry. With ongoing advancements in hydrogen fuel cell technology, the segment is poised for growth, appealing to industries aiming for a comprehensive reduction in carbon footprints.

Electric propulsion, powered by batteries, stands out as a key player in the market, reflecting the automotive industry’s paradigm shift towards electrification. The segment’s growth is driven by the increasing popularity of electric vehicles (EVs) and the expanding charging infrastructure, signaling a transformative phase in the global transportation landscape.

Note: Actual Numbers Might Vary In Final Report

Based On Mode

In 2023, the Low-Carbon Propulsion market showcased a promising landscape with two major segments, namely Rail and Road, each making significant strides towards sustainable transportation solutions. The Rail segment took center stage, holding a dominant market position by capturing more than 55% of the market share. This impressive lead can be attributed to the growing global emphasis on eco-friendly transportation options, with rail networks being a preferred choice for reducing carbon emissions.

The Rail segment’s stellar performance can be further attributed to several key factors. The increasing demand for environmentally friendly mass transit systems for urban areas has resulted in massive expenditures in infrastructure for rail. Both private and public companies recognize the benefits of rail travel that include less traffic, improved air quality and a lower use of fuel. The technological advancements in the field of rail propulsion including the introduction of hybrid and electric trains that run on renewable energy sources, has been a major factor in making the rail industry more sustainable and attractive. This change has significantly contributed to a significant decrease in carbon emissions from the railway industry.

Additionally, initiatives promoting intermodal transportation solutions have bolstered the Rail segment’s growth. Intermodal transportation integrates various modes of transport, such as rail, road, and sea, to optimize efficiency and reduce environmental impact. The Rail segment has seamlessly integrated with these efforts, providing a sustainable backbone for transporting goods and passengers. The reduction in road congestion and greenhouse gas emissions that result from increased intermodal collaboration have further fueled the demand for rail-based low-carbon propulsion systems.

On the other hand, the Road segment, while facing stiff competition from rail, has been steadily growing and evolving. By 2023, it had the remainder of the market share which is a sign of its strong position in the low-carbon propulsion industry. The rising demand for vehicles that emit less carbon dioxide, which includes electric cars as well as hybrid vehicles, is the driving force behind the rise of this segment. In the world, both government and consumers have embraced the necessity to reduce the impact of air pollution and reduce dependence on fossil fuels. This has led to significant investments in low-carbon propulsion techniques for vehicles on the road.

The progress in the Road segment could have their roots in the rapid development of the electrical vehicles (EV) infrastructure as well as favorable government policies. This includes incentives and subsidies designed to promote the adoption of EVs which are a major contributor to the growth of the low carbon propulsion market in the transportation sector.

Based On Vehicle Type

In 2023, the Low-Carbon Propulsion market demonstrated a diverse landscape, segmented by vehicle types, including Passenger Cars, Commercial Vehicles, Two-Wheelers, Ships, and Aircraft. Notably, the Ships Segment emerged as a dominant player, commanding a substantial market share of over 28%. This significant presence can be attributed to a growing global focus on reducing the carbon footprint of maritime transportation, prompting a surge in the adoption of low-carbon propulsion solutions for ships.

Several key factors contribute to the Ships Segment’s leadership in the low-carbon propulsion market. In the first place, strict environmental laws along with international treaties have led marine companies search for sustainable propulsion solutions. In the process, ship owners have been increasingly embracing technology like liquefied natural gases (LNG) and hydrogen fuel cells and hybrid systems to fuel their vessels, drastically cutting emissions. Additionally, the maritime industry’s determination to fund the development and research of sustainable, innovative propulsion options has fuelled the sector’s growth.

The demand for cleaner shipping alternatives and the rising awareness of the environmental impact of traditional marine fuels have driven the adoption of low-carbon propulsion systems in the Ships Segment. The maritime industry’s transition towards cleaner energy sources aligns with global efforts to combat climate change and reduce greenhouse gas emissions from transportation, making it a pivotal driver in the low-carbon propulsion market.

In addition to the Ships Segment, the Passenger Cars and Commercial Vehicles segments have also shown remarkable growth in the low-carbon propulsion market. Its Passenger Cars Segment, for instance, has seen an increase in the usage of hybrid and electric vehicles, supported by growing awareness of the public and incentives from government to encourage clean energy transportation. It is also the Commercial Vehicles Segment, encompassing buses, trucks and other vehicles that are heavy-duty is also adopting low-carbon propulsion techniques to lower operating costs and comply with strict emission standards.

Furthermore, the Aircraft segment, while facing unique challenges in adopting low-carbon propulsion systems due to the technical complexities involved, is gradually exploring alternative fuel sources and more efficient engine designs to reduce its environmental impact.

Looking ahead, the Low-Carbon Propulsion market’s various segments are poised for continued growth, driven by the collective effort to reduce greenhouse gas emissions across all modes of transportation. Even though Ships Segment Ships Segment currently enjoys a prominent position, other segments such as Passenger Cars, Commercial Vehicles and Two-Wheelers are predicted to take significant steps in the pursuit of greener and more environmentally sustainable solutions to transportation. These developments highlight the industry’s dedication to the environment and a more sustainable and sustainable future.

Driving Factors

- Environmental Regulations: The global push for stricter environmental regulations is fueling the widespread adoption of low-carbon propulsion systems across industries. This movement is geared towards mitigating carbon footprints and aligning with stringent emission standards.

- Consumer Awareness: A growing consciousness among consumers regarding the environmental impact of traditional fuel-based vehicles is steering the demand towards low-carbon propulsion alternatives. This shift is particularly evident in the increasing preference for electric and hybrid vehicles.

- Government Incentives: Governments worldwide are taking proactive measures by offering a range of incentives, subsidies, and tax benefits to stimulate the widespread adoption of low-carbon vehicles. These incentives aim to make eco-friendly transportation options more accessible and appealing to the general public.

- Technological Advancements: The ongoing advancements in low-carbon propulsion technologies, coupled with notable improvements in battery technology and charging infrastructure, are significantly elevating the efficiency and overall appeal of eco-friendly vehicles. This technological progress is instrumental in driving the global transition towards more sustainable transportation solutions.

Restraining Factors

- High Initial Costs: The initial cost of acquiring low-carbon vehicles, particularly electric cars, remains relatively high compared to traditional vehicles, hindering mass adoption despite long-term cost savings.

- Limited Charging Infrastructure: Insufficient charging infrastructure, especially in certain regions, poses a challenge as consumers may be deterred by concerns about the availability and convenience of charging stations.

- Range Anxiety: The limited range of some electric vehicles before requiring a recharge contributes to range anxiety among consumers, impacting their willingness to fully embrace low-carbon propulsion options.

- Dependency on Rare Materials: The production of certain low-carbon propulsion technologies relies on rare materials, leading to concerns about the environmental and ethical implications of resource extraction.

Growth Opportunities

- Urban Mobility Solutions: The increasing focus on urban mobility solutions presents an opportunity for the growth of low-carbon propulsion in shared transportation, such as electric scooters, bikes, and rideshare services.

- Investment in Infrastructure: Opportunities lie in investing in the development of charging infrastructure, creating a supportive ecosystem that encourages more consumers to adopt low-carbon vehicles.

- Collaborations and Partnerships: Collaborations between automotive companies and technology firms can drive innovation in low-carbon propulsion, leading to the development of more efficient and affordable solutions.

- Emerging Markets: Untapped markets in developing regions present growth opportunities as rising awareness, and evolving consumer preferences create a conducive environment for the adoption of low-carbon propulsion.

Challenges

- Battery Disposal Concerns: The disposal and recycling of batteries from electric vehicles pose environmental challenges, necessitating the development of sustainable and efficient recycling solutions.

- Infrastructure Development Costs: Establishing a widespread charging infrastructure requires substantial investment, posing a financial challenge for governments and private entities.

- Resistance to Change: Consumer reluctance and attachment to traditional vehicles may slow the transition to low-carbon propulsion, requiring efforts to overcome resistance through education and awareness.

- Global Supply Chain Issues: Disruptions in the global supply chain, particularly for rare materials used in low-carbon technologies, can impact production and pose challenges to the industry.

Key Market Trends

- Rise of Electric SUVs: The growing popularity of electric SUVs represents a notable trend, reflecting consumer preferences for larger, more versatile electric vehicles.

- Integration of AI and Connectivity: The integration of artificial intelligence (AI) and connectivity features in low-carbon vehicles is a trend shaping the industry, enhancing user experience and efficiency.

- Focus on Lightweight Materials: Automotive manufacturers are increasingly incorporating lightweight materials in vehicle construction to improve energy efficiency and extend the range of electric vehicles.

- Circular Economy Initiatives: Initiatives promoting a circular economy, such as reusing and recycling components of electric vehicles, are gaining prominence, aligning with sustainability goals in the low-carbon propulsion market.

Key Market Segments

Based On Fuel Type

- Compressed Natural Gas (CNG)

- Liquefied Natural Gas (LNG)

- Ethanol

- Hydrogen

- Electric

Based On Mode

- Rail

- Road

Based On Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Ships

- Aircrafts

Regional Analysis

In 2023, North America emerged as a frontrunner in the Low-Carbon Propulsion Market, securing a dominant market position with a substantial share exceeding 38.3%. This notable presence can be attributed to a robust commitment to environmental sustainability, stringent regulatory frameworks promoting clean energy adoption, and a burgeoning demand for eco-friendly transportation solutions.

The demand for Low-Carbon Propulsion in North America was valued at USD 7.03 billion in 2023 and is anticipated to grow significantly in the forecast period. The region has witnessed a significant surge in the adoption of low-carbon propulsion technologies across various segments, including passenger cars and commercial vehicles. Additionally, a proactive approach by governments in providing incentives for electric and hybrid vehicles has accelerated the transition toward cleaner transportation alternatives.

Meanwhile, in Europe, the market exhibited a strong foothold with a considerable share, driven by a similar emphasis on environmental responsibility and ambitious targets to reduce carbon emissions. The Asia-Pacific (APAC) region showcased rapid growth, fueled by increasing awareness, supportive government initiatives, and a rising demand for sustainable mobility.

Latin America, the Middle East, and Africa are also witnessing gradual shifts towards low-carbon propulsion, albeit at a slightly slower pace. While North America currently leads the charge, the global market landscape reflects a collective commitment across regions to embrace and drive the transition toward low-carbon propulsion for a more sustainable future.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players analysis for low-carbon propulsion is the study and analysis of the most leading companies that operate in the market for low-carbon propulsion. It is a process of analyzing the strategies, innovation in the marketplace, their market presence, and contributions of these leading players in the creation and use of environmentally sustainable and sustainable propulsion technology. The analysis offers insights into the market dynamics, competitive landscape and the future of the industry for low-carbon propulsion.

Top Company Profiles

- Tesla

- BYD Company Ltd.

- YUTONG

- Proterra

- Nissan

- Bombardier

- Siemens

- Alstom

- Toyota

- Honda Motor Co. Ltd.

- HYUNDAI MOTOR GROUP

- MAN Energy Solutions SE

- GENERAL ELECTRIC

- NFI Group Inc.

- Cummins Inc.

Recent Development

- In 2021, General Motors has declared intentions to inject $27 billion into electric and autonomous vehicles by 2025, underscoring their dedication to low-carbon propulsion.

- In 2021, Meanwhile, Ford has revealed the all-electric Ford F-150 Lightning, a transformative electric iteration of their beloved pickup truck. This unveiling has sparked considerable interest and anticipation within the market.

- In 2021, Tesla continued to dominate the market with the opening of new Gigafactories in Texas and Berlin, aiming to increase production capacity for electric vehicles.

- In 2021, Volkswagen accelerated its electric vehicle plans with the launch of the ID.4, the first model in their ID series, and announced plans to build six battery factories in Europe by 2030.

Report Scope

Report Features Description Market Value (2023) US$ 18.5 Bn Forecast Revenue (2033) US$ 124.5 Bn CAGR (2024-2033) 21.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Fuel Type (Compressed Natural Gas (CNG), Liquefied Natural Gas (LNG), Ethanol, Hydrogen, Electric), By Mode (Rail, Road), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, Ships, Aircrafts) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Tesla, BYD Company Ltd., YUTONG, Proterra, Nissan, Bombardier, Siemens, Alstom, Toyota, Honda Motor Co. Ltd., HYUNDAI MOTOR GROUP, MAN Energy Solutions SE, GENERAL ELECTRIC, NFI Group Inc., Cummins Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Low-Carbon Propulsion Market?The Low-Carbon Propulsion Market refers to the industry focused on developing and implementing propulsion systems with reduced carbon emissions, aiming to create more environmentally sustainable modes of transportation.

What are the driving factors behind the growth of the Low-Carbon Propulsion Market?Key drivers include stringent environmental regulations, increasing consumer awareness of environmental impacts, government incentives, and continuous technological advancements in low-carbon propulsion technologies.

How big is Low-carbon propulsion market?The global Low-carbon propulsion market is projected to have a moderate-paced CAGR of 21.0% during the forecast period. The current valuation of the Low-carbon propulsion industry is USD 18.5 Billion in 2023. The demand for Low-carbon propulsion is anticipated to reach a high of USD 124.5 Billion by the year 2033.

What are the challenges faced by the Low-Carbon Propulsion Market?Challenges include high initial costs, limited charging infrastructure, range anxiety, disposal concerns for batteries, resistance to change from traditional vehicles, and global supply chain issues for rare materials used in low-carbon technologies.

How are technological advancements influencing the Low-Carbon Propulsion Market?Continuous advancements in low-carbon propulsion technologies, such as improvements in battery technology and charging infrastructure, are enhancing the efficiency and appeal of eco-friendly vehicles, driving the market's evolution.

What are the key market trends in the Low-Carbon Propulsion industry?Key trends include the rise of electric SUVs, integration of AI and connectivity features, a focus on lightweight materials in vehicle construction, and initiatives promoting a circular economy through reusing and recycling components of electric vehicles.

Low-Carbon Propulsion MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Low-Carbon Propulsion MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Tesla

- BYD Company Ltd.

- YUTONG

- Proterra

- Nissan

- Bombardier

- Siemens

- Alstom

- Toyota

- Honda Motor Co. Ltd.

- HYUNDAI MOTOR GROUP

- MAN Energy Solutions SE

- GENERAL ELECTRIC

- NFI Group Inc.

- Cummins Inc.