Global Lipase Testing Reagents Market By Product Type (Liquid, Enzyme-based, and Dry), By Technology (Synthetic Lipases, Recombinant Lipases, and Natural Lipases), By Application (Clinical Diagnostics, Food Industry, and Biochemical Research), By End-user (Hospitals, Research Institutions, and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163262

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

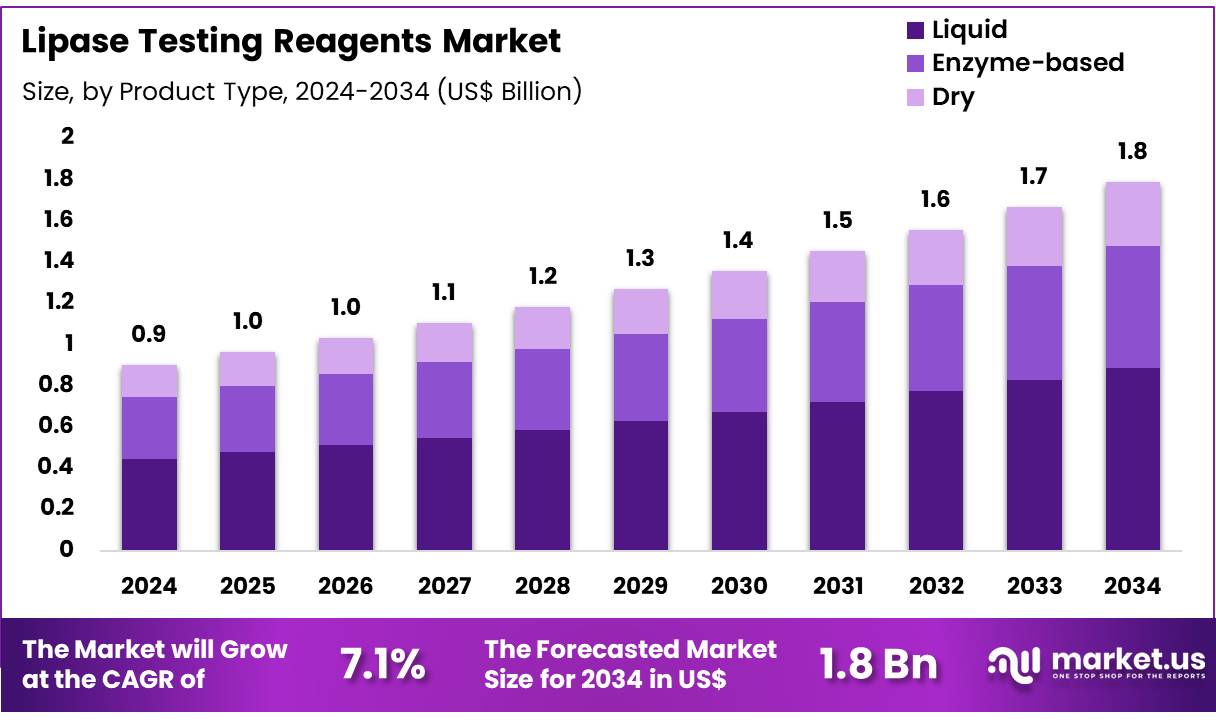

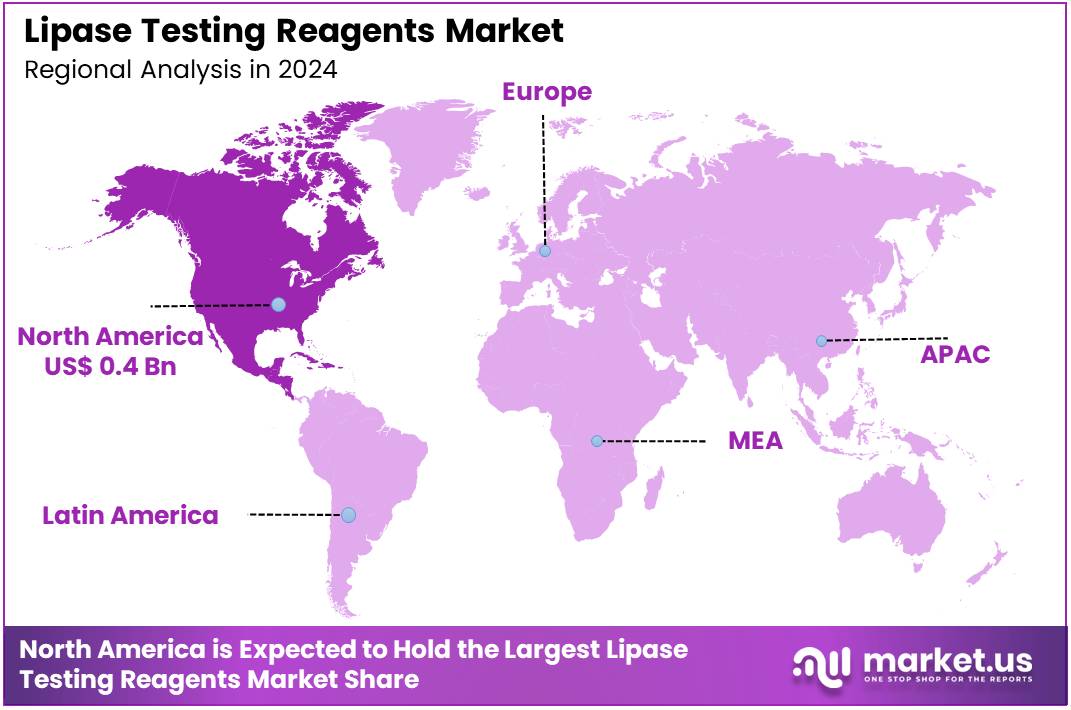

Global Lipase Testing Reagents Market size is expected to be worth around US$ 1.8 Billion by 2034 from US$ 0.9 Billion in 2024, growing at a CAGR of 7.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.5% share with a revenue of US$ 0.4 Billion.

Increasing incidence of pancreatic disorders drives the Lipase Testing Reagents Market, as clinicians prioritize early diagnosis of conditions like acute pancreatitis. Hospitals utilize lipase reagents in emergency settings to confirm pancreatic injury through elevated enzyme levels, guiding urgent treatment decisions. These reagents support gastroenterology by assessing exocrine pancreatic function in patients with chronic abdominal pain.

Research labs employ lipase assays to study metabolic pathways in digestive disorders, advancing therapeutic innovation. High-sensitivity reagents enhance diagnostic accuracy, meeting the demand for reliable results in critical care. This focus on rapid, precise diagnostics fuels market growth by addressing rising healthcare needs.

Growing adoption of point-of-care testing creates opportunities in the Lipase Testing Reagents Market, as portable devices expand diagnostic access. Primary care clinics use lipase reagents to screen for pancreatitis in patients with risk factors like gallstones, streamlining referrals to specialists. These reagents facilitate monitoring of cystic fibrosis patients, assessing pancreatic insufficiency through enzyme levels.

Innovations in reagent stability enable testing in resource-limited settings, broadening market reach. Automated analyzers integrate lipase assays into routine metabolic panels, improving efficiency in high-volume labs. Such advancements drive market expansion by enhancing accessibility and versatility in clinical applications.

Rising emphasis on diagnostic standardization propels the Lipase Testing Reagents Market, as laboratories adopt advanced reagent formulations for consistency. Lipase reagents support oncology by monitoring pancreatic function in patients undergoing chemotherapy, ensuring comprehensive care. These assays aid in nutritional assessments, detecting malabsorption in patients with gastrointestinal diseases.

Trends toward multiplex testing combine lipase with other biomarkers, optimizing diagnostic workflows. In August 2023, ACL Laboratories revised its lipase testing process, updating reagent formulations and recalibrating reference ranges to align with international standards, enhancing inter-laboratory reliability. This initiative strengthens market growth by fostering trust in lipase testing as a cornerstone of biochemical diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.9 Billion, with a CAGR of 7.1%, and is expected to reach US$ 1.8 Billion by the year 2034.

- The product type segment is divided into liquid, enzyme-based, and dry, with liquid taking the lead in 2023 with a market share of 49.6%.

- Considering technology, the market is divided into synthetic lipases, recombinant lipases, and natural lipases. Among these, synthetic lipases held a significant share of 44.7%.

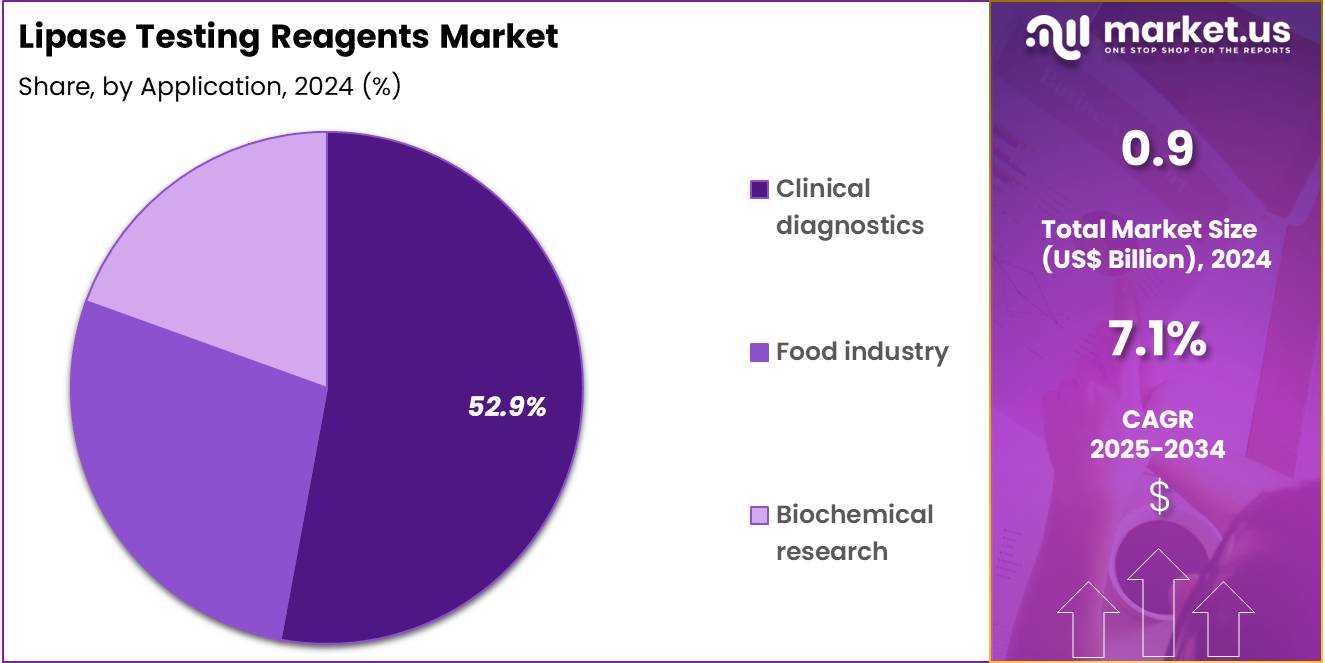

- Furthermore, concerning the application segment, the market is segregated into clinical diagnostics, food industry, and biochemical research. The clinical diagnostics sector stands out as the dominant player, holding the largest revenue share of 52.9% in the market.

- The end-user segment is segregated into hospitals, research institutions, and diagnostic laboratories, with the hospitals segment leading the market, holding a revenue share of 47.8%.

- North America led the market by securing a market share of 39.5% in 2023.

Product Type Analysis

Liquid reagents account for 49.6% of the Lipase Testing Reagents market and are expected to remain the dominant product type due to their stability, ease of use, and suitability for automated analyzers. Laboratories and hospitals prefer liquid formulations for consistent performance and accurate enzyme activity measurement.

The growing prevalence of pancreatic disorders, gastrointestinal diseases, and metabolic syndromes is projected to drive demand for lipase testing in clinical settings. Liquid reagents are also favored for their ready-to-use format, which reduces preparation time and minimizes human error. Manufacturers are investing in developing long-shelf-life liquid reagents with improved temperature stability and precision.

The increasing adoption of fully automated biochemistry analyzers in diagnostic laboratories supports the use of liquid reagents compatible with high-throughput systems. The expansion of preventive health checkups and routine metabolic screenings in hospitals and clinics further accelerates growth.

Research applications in lipid metabolism and enzyme kinetics also contribute to rising demand. Continuous advancements in reagent formulation and automation compatibility are anticipated to sustain liquid reagents’ leadership in the market. The scalability and reproducibility of liquid reagents make them indispensable in both clinical and industrial testing workflows.

Technology Analysis

Synthetic lipases hold 44.7% of the technology segment and are anticipated to dominate the market due to their superior stability, reproducibility, and adaptability for industrial and clinical applications. These engineered enzymes offer enhanced catalytic efficiency and longer shelf life compared to natural lipases, making them suitable for high-performance diagnostic assays.

The growing need for standardized testing in clinical diagnostics is expected to drive adoption of synthetic lipases as they ensure consistent assay performance. Biotechnology companies are investing in the synthesis of lipases with optimized properties for specific substrates, enhancing test accuracy and reliability. The demand for enzyme-based reagents in biochemistry and food processing also supports market growth.

Advancements in enzyme immobilization and microencapsulation technologies are projected to further increase the efficiency of synthetic lipases. Hospitals and diagnostic laboratories prefer synthetic variants due to their compatibility with automated analyzers and reduced risk of contamination.

Expanding R&D in metabolic disorders and enzyme therapy applications boosts the demand for high-purity synthetic lipases. Increasing awareness about assay quality and diagnostic precision reinforces their dominance. The integration of synthetic lipases into multiparametric biochemical testing platforms strengthens their role in global lipase testing markets.

Application Analysis

Clinical diagnostics represent 52.9% of the application segment and are projected to lead the market as lipase testing becomes an essential part of diagnosing and monitoring pancreatic and metabolic disorders. Lipase assays are widely used for detecting pancreatitis, cystic fibrosis, and other digestive enzyme imbalances. The growing burden of gastrointestinal and metabolic diseases globally drives strong demand for lipase diagnostic testing.

Hospitals and diagnostic laboratories rely on enzyme activity assays to provide rapid and accurate clinical results. The integration of lipase tests into comprehensive liver and pancreas function panels further enhances their clinical relevance. Advancements in enzymatic assay technologies, including colorimetric and turbidimetric methods, are expected to improve test precision and turnaround times.

Preventive healthcare programs emphasizing early detection of pancreatic diseases are increasing test frequency in both outpatient and inpatient settings. The expansion of automated clinical chemistry analyzers compatible with lipase reagents supports high-throughput testing in laboratories.

Increasing awareness of lifestyle-related disorders, including obesity and diabetes, reinforces the role of lipase testing in clinical diagnostics. Government initiatives promoting metabolic health screening also contribute to market expansion. The rising adoption of point-of-care diagnostic systems incorporating lipase assays further boosts accessibility and market penetration.

End-User Analysis

Hospitals account for 47.8% of the end-user segment and are projected to maintain a leading position due to their critical role in patient diagnostics and emergency care. The increasing number of hospital admissions related to pancreatic, hepatic, and gastrointestinal conditions drives high testing volumes for lipase assays. Hospitals integrate lipase testing into comprehensive diagnostic panels for evaluating enzyme activity and identifying metabolic abnormalities.

The rising prevalence of acute pancreatitis and chronic digestive diseases is anticipated to further boost hospital-based testing demand. Large hospital laboratories are adopting automated biochemistry systems capable of performing high-throughput lipase assays with minimal manual intervention. Investments in advanced diagnostic infrastructure and the expansion of multispecialty healthcare centers support growth.

Hospitals benefit from direct procurement of reagents and consumables, ensuring standardized testing and quality control. Training programs for laboratory technicians and improved workflow integration enhance accuracy and reliability. Public awareness initiatives encouraging early diagnosis of pancreatic disorders increase hospital testing frequency.

Collaborations between hospitals and diagnostic reagent manufacturers facilitate technology transfer and innovation. The strong demand for rapid, reliable, and cost-effective diagnostic services positions hospitals as the dominant end-users in the lipase testing reagents market.

Key Market Segments

By Product Type

- Liquid

- Enzyme-based

- Dry

By Technology

- Synthetic Lipases

- Recombinant Lipases

- Natural Lipases

By Application

- Clinical Diagnostics

- Food Industry

- Biochemical Research

By End-user

- Hospitals

- Research Institutions

- Diagnostic Laboratories

Drivers

Increasing Incidence of Acute Pancreatitis is Driving the Market

The heightened occurrence of acute pancreatitis has substantially propelled the lipase testing reagents market, positioning these diagnostic tools as indispensable for confirming enzymatic elevations indicative of pancreatic inflammation.

Acute pancreatitis, characterized by abrupt glandular autodigestion, mandates swift lipase quantification to surpass diagnostic thresholds, typically three times the upper limit of normal, thereby expediting clinical decision-making. This driver gains prominence amid etiological factors such as biliary lithiasis and hypertriglyceridemia, which precipitate emergency presentations requiring immediate reagent deployment in automated analyzers.

Healthcare protocols, endorsed by gastroenterological consortia, integrate lipase assays into initial abdominal pain evaluations, optimizing differential diagnoses against mimics like perforated viscus. The condition’s rising caseload correlates with expanded reagent inventories, as laboratories prioritize formulations resistant to interferents for reliable kinetics. Public health imperatives underscore lipase’s prognostic utility, influencing procurement strategies in acute care networks.

The Centers for Disease Control and Prevention, via its National Hospital Ambulatory Medical Care Survey, reported 8.8 million emergency department visits for diseases of the digestive system as the primary diagnosis in 2022, with acute pancreatitis representing a substantial portion necessitating lipase confirmation. This visitation volume, reflective of ambulatory burdens, affirms the sustained demand for robust reagent supplies.

Advancements in chromogenic substrates enhance assay linearity, accommodating variable patient matrices. Economically, its application curtails diagnostic odysseys, substantiating fiscal commitments to centralized distribution. Global harmonization of reference intervals further disseminates standardized kits to transitional economies. This pancreatitis escalation not only intensifies reagent utilization but also anchors the market within emergent gastroenterologic priorities.

Restraints

Elevated Reagent Costs and Reimbursement Constraints is Restraining the Market

The prohibitive pricing of precision-engineered lipase testing reagents, compounded by fragmented reimbursement modalities, persists in impeding the market’s equitable dissemination across diverse healthcare echelons. These reagents, engineered with stabilized chromophores for extended viability, incur premium costs that strain operational budgets in decentralized laboratories. This restraint engenders discretionary prescribing, confining advanced variants to quaternary institutions while consigning community outlets to legacy options with suboptimal precision.

Insurer stipulations, necessitating outcome validations for incremental reimbursements, protract negotiations and curtail innovation diffusion. Producers contend with volatile substrate sourcing, eroding profitability and constraining economies of scale. The resultant allocation inequities amplify untreated case escalations, burdening systemic expenditures.

The Centers for Medicare & Medicaid Services documented Medicare Part B spending on clinical diagnostic laboratory tests totaled $ 8.4 billion in 2022, notwithstanding subsequent Clinical Laboratory Fee Schedule adjustments that capped reimbursements for enzymatic assays including lipase formulations.

Such delineations evince containment imperatives, as annual updates from 2022 through 2024 moderated escalations amid inflationary pressures. Practitioner apprehensions regarding unrecovered investments perpetuate allegiance to bundled alternatives, diluting reagent-centric revenues.

Petitions for performance-tiered compensations proceed methodically, encumbered by longitudinal evidence scarcities. These pecuniary strictures not only attenuate throughput but also vitiate the market’s prophylactic aspirations.

Opportunities

Advancements in Point-of-Care Lipase Testing Platforms is Creating Growth Opportunities

The maturation of ambulatory lipase assay apparatuses has engendered profound developmental vistas, permitting instantaneous enzymatic appraisals that expedite therapeutic inaugurations in peripheral care milieus. These compact apparatuses, leveraging electrochemical transduction for sub-ten-minute resolutions, obviate phlebotomy latencies, consonant with decentralized health evolutions.

Prospects abound in consortia with apparatus architects, underwriting corroborations for amalgamated configurations profiling lipase contiguous to inflammatory markers. This portability synchronizes with peripatetic paradigms, refining asset apportionments in congested infrastructures. State acquisitions for vanguard diagnostics additionally stimulate magnification, ameliorating metropolitan-peripheral schisms.

This progression substantiates fiscal rationales, as expeditious verifications forestall intensification outlays. Reagent compaction, attuned to cassette architectures, amplifies pertinence to expeditionary therapeutics. As concordance norms evolve, datum confluences to archival systems unveil econometric revenues. These itinerant archetypes not only variegate terminus demographics but also consolidate the market into durable sanitary conveyance archetypes.

Impact of Macroeconomic / Geopolitical Factors

Rising inflation and limited access to capital are pressuring developers in the lipase testing reagents market, leading them to postpone advancements in chromogenic substrate formulations while focusing on essential buffer stability amid reduced diagnostic funding. U.S.-China export restrictions and Baltic Sea shipping disruptions are limiting supplies of synthetic chromophores from European suppliers, extending linearity validation timelines and increasing certification costs for cross-border lab collaborations.

To navigate these obstacles, some developers are partnering with Minnesota-based chromophore producers, adopting validation standards that accelerate FDA endorsements and secure pancreatitis research grants. Growing acute pancreatitis diagnosis rates are directing NIH allocations into high-sensitivity reagent panels, enhancing adoptions in gastroenterology clinics.

U.S. tariffs of 25% on imported medical devices and components are elevating costs for Asian-sourced substrates and indicators, compressing budgets for hospital testing and occasionally delaying global assay alignments. In response, developers are leveraging IRA innovation credits to establish Oklahoma synthesis labs, introducing spectrophotometric enhancers and building expertise in reagent lyophilization.

Latest Trends

Clinical Chemistry Advancements Strengthen Lipase Testing Capabilities

In 2024, significant advancements in clinical chemistry technology marked a major improvement in lipase testing reagents and integrated enzyme diagnostics. Enhanced lipase substrates were incorporated into the cobas platform, enabling faster results—within ten minutes through advanced spectrophotometric analysis.

The expansion reflects a broader shift toward integrated systems capable of simultaneous amylase and lipase evaluations, streamlining pancreatitis diagnosis and improving workflow efficiency. Regulatory approvals confirmed strong reliability, accelerating adoption across multiple healthcare markets. These innovations align with the growing trend of digital integration in laboratories, where AI-based interpretation tools enhance diagnostic accuracy.

The upgraded reagents are designed to withstand variable environmental conditions, ensuring stable performance in diverse settings. Strong revenue growth in clinical chemistry testing during 2024 highlights the growing global demand for precise, rapid enzymatic analysis. These technological improvements reinforce leadership in diagnostic innovation and set the foundation for future AI-driven advancements in clinical chemistry.

Regional Analysis

North America is leading the Lipase Testing Reagents Market

In 2024, North America secured a 39.5% share of the global lipase testing reagents market, advanced by surging demand for rapid serum assays in emergency departments to confirm acute pancreatitis diagnoses, where elevated levels guide urgent interventions for gallstone-related flares, the leading etiology in 40% of cases.

Clinical protocols increasingly favored chromogenic substrates for enhanced specificity over amylase, enabling differentiation of biliary from alcoholic origins in high-throughput labs, with turnaround times reduced to under 15 minutes via automated spectrophotometers.

The National Institutes of Health’s focus on digestive disorders supported reagent validations for chronic pancreatitis monitoring, correlating with expanded testing in gastroenterology practices for exocrine insufficiency assessments among aging cohorts. Demographic factors, including rising alcohol consumption trends, amplified utilization in urban centers, where point-of-care strips mitigated delays in triage for abdominal pain presentations.

Innovations in stabilized formulations minimized batch variability, appealing to reference laboratories for reliable quantification in multicenter trials. These evolutions reflected the region’s emphasis on efficient pancreatic pathology diagnostics. The National Institute of Diabetes and Digestive and Kidney Diseases reported acute pancreatitis hospitalizations exceeding 275,000 annually in the United States, based on data from 2009 onward, with sustained relevance through 2022-2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National regulators in Asia Pacific project the lipase testing reagents sector to proliferate during the forecast period, as escalating pancreatitis burdens in agrarian economies necessitate accessible assays for early detection in remote populations. Officials in South Korea and Indonesia allocate funding for chromogenic kits, equipping peripheral clinics to quantify enzyme elevations in malnourished cohorts prone to tropical pancreatitis variants.

Laboratory administrators collaborate with regional institutes to standardize nephelometric methods, anticipating precise evaluations of hypertriglyceridemia-linked flares in urban lipid profile screenings. Oversight entities in India and Thailand subsidize portable strips, enabling community medics to assess abdominal crises without central referrals.

Administrative systems anticipate linking reagent outputs to digital platforms, facilitating rapid triaging for biliary obstructions in migrant groups. Regional chemists innovate enzyme-stabilized variants, integrating with surveillance cohorts to profile ethanol-induced spikes in coastal laborers. These integrations yield a dynamic arena for pancreatic enzyme diagnostics.

The Global Burden of Disease Study 2021 estimated 364,447 years lived with disability due to pancreatitis in 2017, with age-standardized rates rising 9.2% globally by that period, extending trends into 2022-2024 for Asia Pacific regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the Lipase Testing Reagents Market fuel growth by launching high-sensitivity enzymatic assays that integrate with automated analyzers, streamlining pancreatitis diagnosis in high-volume labs. They forge partnerships with diagnostic distributors to embed kits in hospital procurement systems, ensuring consistent supply and adoption.

Companies invest in shelf-stable reagent formulations, reducing logistics costs and appealing to budget-conscious facilities. Leaders acquire specialized biotech firms to enhance assay portfolios with dual-marker tests for improved diagnostic accuracy. They target growth in South Asia and Africa, aligning with local health screening programs to secure subsidized contracts. Additionally, they offer digital reporting tools with subscription models, boosting clinician engagement and steady revenue.

Siemens Healthineers AG, founded in 1847 and headquartered in Erlangen, Germany, develops advanced diagnostic solutions, including clinical chemistry assays for global healthcare systems. Its Atellica platform delivers precise lipase testing, supporting rapid gastrointestinal disorder detection with automated workflows.

Siemens Healthineers focuses on R&D to improve assay stability and system interoperability. CEO Bernd Montag leads operations across 70 countries, prioritizing innovation and sustainability. The company collaborates with labs to standardize testing protocols, enhancing clinical reliability. Siemens Healthineers maintains its market leadership through cutting-edge technology and strategic global expansion.

Top Key Players

- Trinity Biotech plc

- Tosoh Corporation

- Sysmex Corporation

- Siemens Healthineers AG

- Sekisui Diagnostics, LLC

- PerkinElmer, Inc.

- Ortho Clinical Diagnostics

- Merck KGaA

- Hoffmann-La Roche Ltd

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Becton, Dickinson and Company

- Abbott Laboratories

Recent Developments

- In March 2025, Beckman Coulter launched its DxC 500i analyzer after receiving regulatory clearance in the U.S. The platform merges chemistry and immunoassay functionalities into one unit, supporting analytes like lipase through faster and more automated processing. By enhancing precision and throughput while minimizing manual effort, this system strengthens the technological base for enzyme testing and supports clinical laboratories’ transition toward unified diagnostic workflows.

- In September 2025, DiaSys India was featured among Medgate’s Top 100 Medical Device Brands, reflecting its increasing prominence in the Asian clinical diagnostics industry. This acknowledgment highlights the company’s contributions to high-performing enzyme assays, including lipase reagent development. The brand’s growing recognition reinforces market confidence in its diagnostic portfolio, driving adoption of its reagents among hospitals and diagnostic centers expanding biochemical testing services.

Report Scope

Report Features Description Market Value (2024) US$ 0.9 Billion Forecast Revenue (2034) US$ 1.8 Billion CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Liquid, Enzyme-based, and Dry), By Technology (Synthetic Lipases, Recombinant Lipases, and Natural Lipases), By Application (Clinical Diagnostics, Food Industry, and Biochemical Research), By End-user (Hospitals, Research Institutions, and Diagnostic Laboratories) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trinity Biotech plc, Tosoh Corporation, Sysmex Corporation, Siemens Healthineers AG, Sekisui Diagnostics, LLC, PerkinElmer, Inc., Ortho Clinical Diagnostics, Merck KGaA, F. Hoffmann-La Roche Ltd, Danaher Corporation, Bio-Rad Laboratories, Inc., bioMérieux SA, Becton, Dickinson and Company, Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lipase Testing Reagents MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Lipase Testing Reagents MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Trinity Biotech plc

- Tosoh Corporation

- Sysmex Corporation

- Siemens Healthineers AG

- Sekisui Diagnostics, LLC

- PerkinElmer, Inc.

- Ortho Clinical Diagnostics

- Merck KGaA

- Hoffmann-La Roche Ltd

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Becton, Dickinson and Company

- Abbott Laboratories