Global Light Commercial Vehicle Market Size, Share, Growth Analysis By Vehicle (Vans, Pickup Trucks, Light-Duty Trucks), By Gross Weight (6000-9000 lbs, 9000-12000 lbs, 12000-14000 lbs), By Fuel (Gasoline, Diesel, Electric), By Application (Logistics & Transportation, Construction & Mining, Utility Services, Rental & Leasing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159242

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

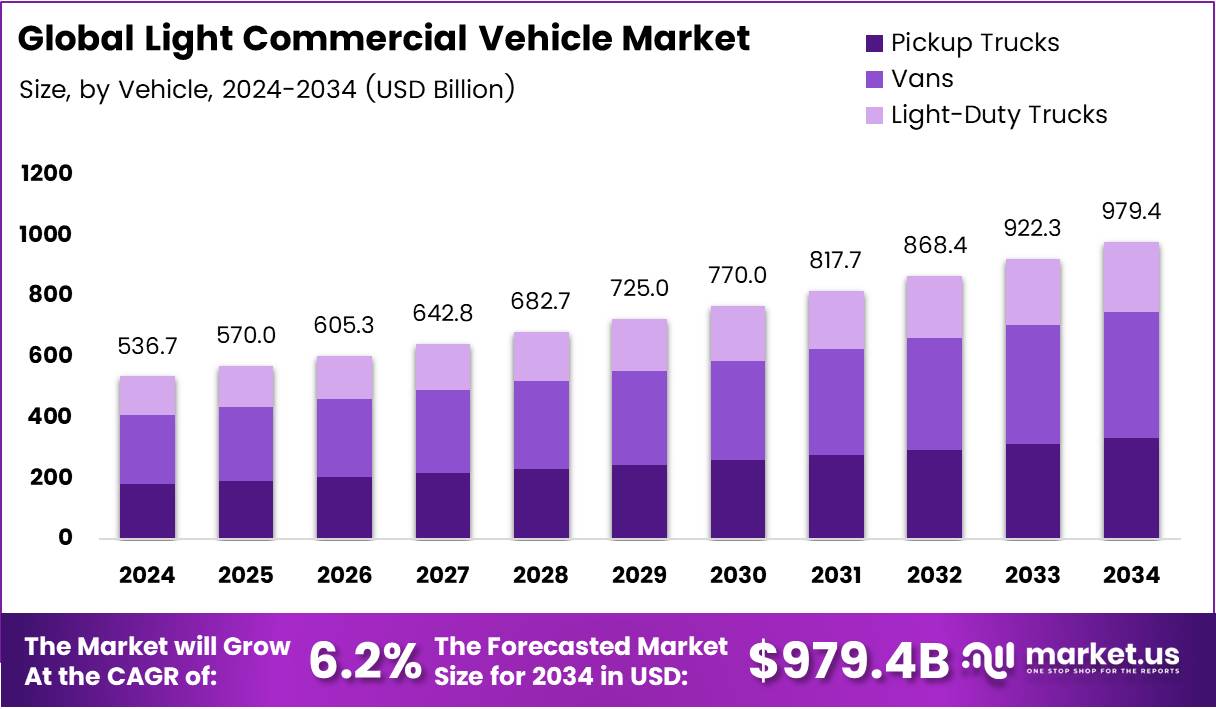

The Global Light Commercial Vehicle Market size is expected to be worth around USD 979.4 Billion by 2034, from USD 536.7 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The Light Commercial Vehicle (LCV) market has seen steady growth driven by the increasing demand for efficient and versatile transportation solutions. Businesses across sectors are seeking LCVs to manage logistics and supply chains effectively. The need for light-duty vehicles that offer both cost efficiency and operational flexibility is expected to drive sustained demand.

One of the primary growth drivers for the LCV market is the continued expansion of e-commerce and logistics industries. As online shopping increases, demand for quick, efficient deliveries also rises, necessitating the use of LCVs. Companies are increasingly opting for LCVs due to their ability to navigate urban environments and transport goods in a cost-effective manner.

Government investments and regulatory changes play a crucial role in shaping the market dynamics. Governments worldwide are pushing for stricter emission standards, encouraging the adoption of electric LCVs. These regulations are driving investments in electric vehicle technology and influencing consumer preferences. In turn, the rise of eco-friendly LCVs presents substantial growth opportunities for automakers in the coming years.

Furthermore, the shift toward fuel-efficient vehicles aligns with both regulatory pressures and consumer demand for sustainability. Companies are increasingly prioritizing energy-efficient and environmentally friendly vehicles, helping push the market toward cleaner and more technologically advanced models. This shift presents an exciting opportunity for market players to innovate and diversify their offerings.

According to industry reports, new LCV registrations in 2024 saw an increase of 7% with 30,786 registrations compared to 28,854 in 2023. Additionally, pickup trucks are more prevalent in some states, accounting for 16.5% of all vehicles. However, light truck sales fell 0.4% to 12.97 million units (SAAR) in June, following a decline in May and April. Furthermore, purchases of domestically made light trucks decreased 1.8% to 9.99 million units. These statistics highlight both challenges and opportunities within the market.

Key Takeaways

- The Global Light Commercial Vehicle Market size is expected to reach USD 979.4 Billion by 2034, growing from USD 536.7 Billion in 2024, at a CAGR of 6.2%.

- Vans lead the market with a significant 42.5% share, driven by their adaptability for urban logistics and last-mile delivery.

- The 6000-9000 lbs gross weight category dominates with a 53.8% market share, offering optimal payload and fuel efficiency.

- Gasoline-powered light commercial vehicles hold 52.3% of the market share due to lower costs and widespread refueling infrastructure.

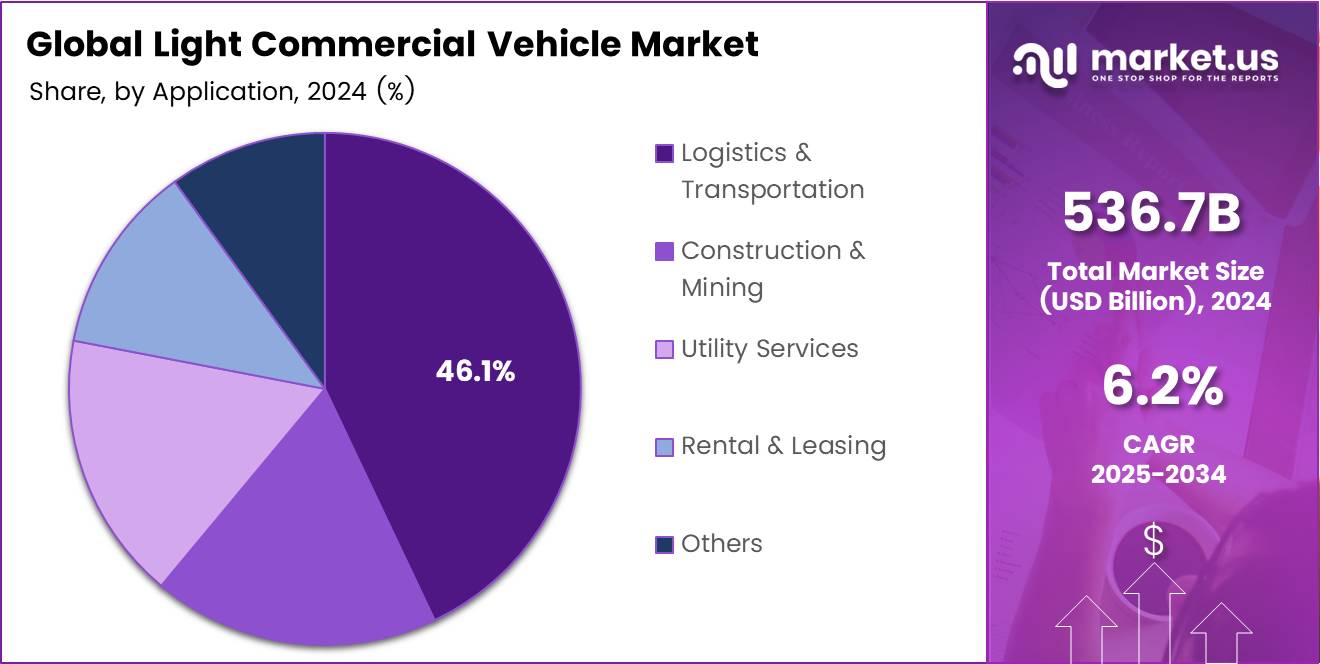

- Logistics and transportation applications account for the largest market share at 46.1%, fueled by e-commerce growth and urbanization.

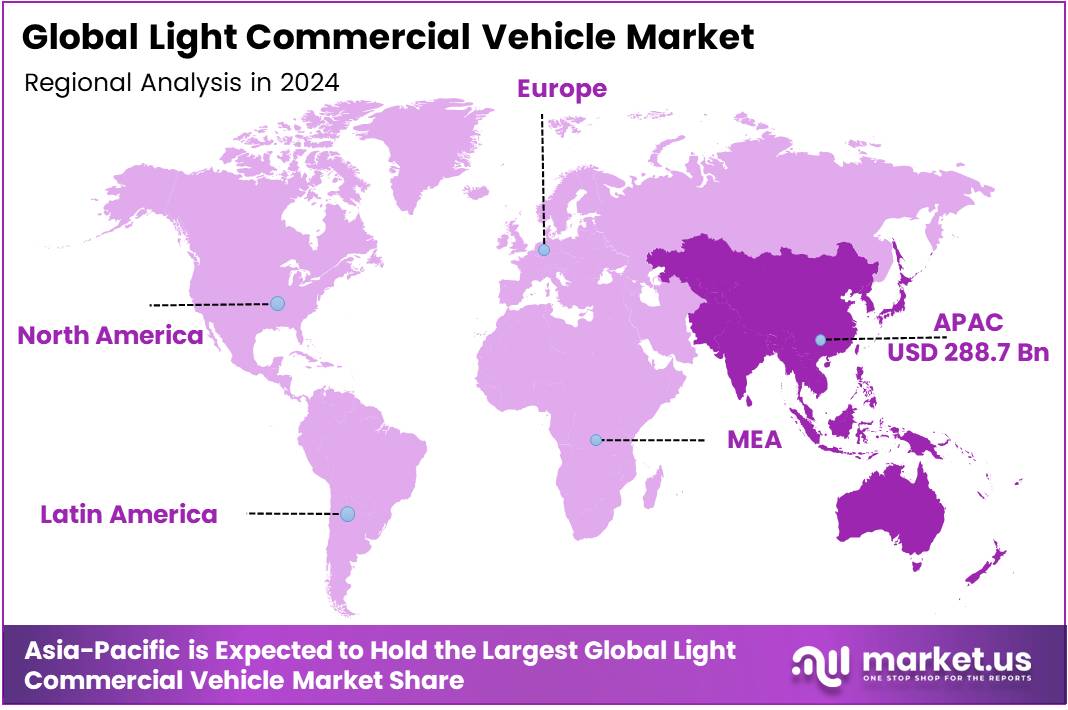

- Asia Pacific holds the largest share of the LCV market at 53.8%, valued at USD 288.7 Billion, driven by urbanization and green technology adoption.

By Vehicle Analysis

Vans dominate with 42.5% due to their versatility and urban delivery efficiency.

Vans consistently lead the light commercial vehicle market, capturing a significant 42.5% market share. Their dominance stems from exceptional adaptability across various business applications, particularly in urban logistics and last-mile delivery services. Furthermore, vans offer optimal cargo space utilization while maintaining maneuverability in congested city environments.

Pickup trucks represent a substantial market segment, driven by their dual-purpose functionality for both commercial and personal use. Additionally, their robust construction and towing capabilities make them indispensable for construction, agriculture, and small business operations requiring versatile transportation solutions.

Light-duty trucks complement the commercial vehicle ecosystem by serving specialized industrial applications. Moreover, these vehicles bridge the gap between smaller vans and heavy-duty trucks, offering enhanced payload capacity while maintaining operational flexibility for medium-scale commercial operations.

By Gross Weight Analysis

6000-9000 lbs category dominates with 53.8% due to optimal balance between payload and fuel efficiency.

The 6000-9000 lbs gross weight category commands the largest market share at 53.8%, representing the sweet spot for commercial vehicle operators. This weight range provides sufficient payload capacity for most business applications while maintaining reasonable fuel consumption and operational costs. Consequently, businesses find this category ideal for urban delivery and service operations.

The 9000-12000 lbs segment serves medium-duty commercial applications requiring enhanced payload capabilities. These vehicles typically support construction, wholesale distribution, and specialized service industries. Additionally, this category offers improved durability and performance for demanding operational environments while remaining accessible to small and medium enterprises.

Light commercial vehicles in the 12000-14000 lbs range cater to heavy-duty applications within the light commercial segment. Furthermore, these vehicles provide maximum payload capacity while maintaining the operational advantages of lighter commercial vehicles, making them suitable for specialized industrial and construction applications.

By Fuel Analysis

Gasoline dominates with 52.3% due to lower initial costs and widespread refueling infrastructure.

Gasoline-powered light commercial vehicles maintain market leadership with 52.3% share, primarily due to lower acquisition costs and extensive refueling infrastructure. Their widespread availability and familiar maintenance requirements make them attractive to small businesses and fleet operators. Moreover, gasoline engines offer reliable performance and easier servicing across diverse geographical locations.

Diesel engines represent a significant market segment, particularly favored for heavy-duty applications and long-distance operations. Additionally, diesel vehicles provide superior fuel economy and torque characteristics, making them ideal for construction, logistics, and utility services requiring consistent high-performance capabilities and operational efficiency.

Electric light commercial vehicles are rapidly emerging as a transformative market segment, driven by environmental regulations and sustainability initiatives. Furthermore, electric vehicles offer reduced operational costs, lower maintenance requirements, and zero emissions, making them increasingly attractive for urban delivery services and environmentally conscious businesses.

By Application Analysis

Logistics & Transportation dominates with 46.1% due to e-commerce growth and urban delivery demands.

Logistics and transportation applications command the largest market share at 46.1%, driven by explosive e-commerce growth and urbanization trends. The increasing demand for last-mile delivery services has significantly boosted this segment’s importance. Additionally, the shift toward online retail has created unprecedented demand for efficient urban delivery solutions and flexible logistics networks.

Construction and mining applications represent a robust market segment, requiring durable and versatile commercial vehicles for material transportation and site operations. These industries demand vehicles capable of handling challenging terrain and heavy loads. Furthermore, infrastructure development and construction activities continue driving demand for reliable commercial vehicle solutions.

Utility services form an essential market segment, encompassing telecommunications, electrical, and municipal services requiring specialized commercial vehicles. Additionally, these applications often require customized vehicle configurations with specialized equipment mounting capabilities, creating distinct market requirements and opportunities for commercial vehicle manufacturers.

Rental and leasing services provide flexible commercial vehicle access for businesses requiring temporary or seasonal transportation solutions. Moreover, this segment offers cost-effective alternatives for small businesses and startups needing commercial vehicles without significant capital investment commitments.

Other applications encompass diverse commercial vehicle uses including agriculture, retail, and specialized service industries. Furthermore, these applications demonstrate the versatility and adaptability of light commercial vehicles across various business sectors and operational requirements.

Key Market Segments

By Vehicle

- Vans

- Pickup Trucks

- Light-Duty Trucks

By Gross Weight

- 6000-9000 lbs

- 9000-12000 lbs

- 12000-14000 lbs

By Fuel

- Gasoline

- Diesel

- Electric

By Application

- Logistics & Transportation

- Construction & Mining

- Utility Services

- Rental & Leasing

- Others

Drivers

Increasing Urbanization and Demand for Last-Mile Connectivity Drives Market Growth

Cities around the world are growing rapidly, creating more demand for delivery services within urban areas. As more people move to cities, businesses need efficient ways to transport goods to customers quickly. Light commercial vehicles are perfect for navigating narrow city streets and making multiple stops throughout the day.

The rise of online shopping has changed how people buy products. E-commerce companies like Amazon and local delivery services need reliable vehicles to bring packages directly to customers’ doors. This growing trend of online ordering means more delivery trucks are needed on the roads.

Environmental concerns are pushing businesses to choose cleaner vehicles. Many companies now prefer light commercial vehicles that use less fuel or run on electricity. These eco-friendly options help reduce pollution in crowded cities while keeping operating costs lower for business owners.

Governments in many countries offer financial incentives to encourage businesses to buy light commercial vehicles. These programs include tax breaks, subsidies, and reduced registration fees. Such support makes it easier for small businesses to afford new delivery vehicles and expand their operations.

Restraints

Insufficient Charging Infrastructure for Electric Light Commercial Vehicles Limits Market Expansion

One major challenge facing the light commercial vehicle market is the lack of charging stations for electric vehicles. Many businesses want to switch to electric delivery trucks but worry about finding places to charge them during long working days. Without enough charging points in cities and along highways, companies hesitate to invest in electric commercial vehicles.

Meeting environmental regulations has become increasingly expensive for vehicle manufacturers. New emission standards require costly technology upgrades and extensive testing procedures. These regulatory compliance costs are often passed on to buyers, making light commercial vehicles more expensive for small businesses to purchase.

The vehicle manufacturing industry faces a shortage of trained workers who understand modern automotive technology. Building light commercial vehicles requires skilled technicians who can work with advanced engines, electronic systems, and safety features. This workforce shortage can slow down production and increase manufacturing costs, ultimately affecting vehicle availability and pricing in the market.

Growth Factors

Expansion of Shared Mobility and Ride-Hailing Services Creates New Market Opportunities

The growth of ride-sharing services like Uber and Lyft is creating new opportunities for light commercial vehicles. Many drivers need larger vehicles to transport passengers and their luggage comfortably. Additionally, new services that combine passenger transport with package delivery are emerging, requiring versatile commercial vehicles.

Self-driving technology is advancing rapidly in the commercial vehicle sector. Companies are developing autonomous light commercial vehicles that can make deliveries without human drivers. This technology could revolutionize the logistics industry by reducing labor costs and improving delivery efficiency, especially for routine routes.

There is growing interest in electric light commercial vehicles as businesses seek to reduce fuel costs and environmental impact. Battery technology improvements are making electric vehicles more practical for commercial use, with longer driving ranges and faster charging times becoming available.

Vehicle manufacturers are forming partnerships with logistics companies and fleet operators to develop specialized commercial vehicles. These collaborations help create customized solutions that meet specific industry needs, opening up new market segments and revenue opportunities for manufacturers.

Emerging Trends

Rise of Connectivity Features and Telematics in Commercial Vehicles Shapes Market Trends

Modern light commercial vehicles are becoming smarter with advanced connectivity features. Fleet managers can now track vehicle locations, monitor fuel consumption, and schedule maintenance using smartphone apps. These telematics systems help businesses operate more efficiently by providing real-time data about their vehicle fleets.

Safety technology is becoming a standard feature in light commercial vehicles. Advanced driver assistance systems like automatic braking, lane departure warnings, and collision detection help prevent accidents. These safety features are particularly important for commercial vehicles that spend many hours on busy roads.

Hybrid powertrains are gaining popularity as a middle ground between traditional gasoline engines and full electric vehicles. These systems combine electric motors with conventional engines to improve fuel efficiency while maintaining the driving range that commercial operators need for their daily routes.

Fleet management software is transforming how businesses operate their vehicle fleets. Companies can now optimize delivery routes, track driver performance, and predict maintenance needs using sophisticated logistics solutions. This technology helps reduce operational costs and improve customer service by ensuring faster, more reliable deliveries.

Regional Analysis

APAC Dominates the Light Commercial Vehicle Market with a Market Share of 53.8%, Valued at USD 288.7 Billion

Asia Pacific holds the largest share of the Light Commercial Vehicle (LCV) market, contributing 53.8%, valued at USD 288.7 Billion. The region’s dominance is driven by rapid urbanization, increased demand for logistics and e-commerce delivery, and the adoption of green technologies in commercial vehicles. China and India play pivotal roles in the expansion, with their large manufacturing bases and growing middle class.

North America Light Commercial Vehicle Market Trends

North America is a significant player in the LCV market, contributing to a considerable portion of the global demand. The market is projected to continue growing with an increased focus on fuel efficiency, safety standards, and electric vehicle integration. The U.S. remains the primary market for LCVs, bolstered by government incentives and infrastructure development.

Europe Light Commercial Vehicle Market Trends

Europe is witnessing steady growth in the LCV market, driven by stringent emissions regulations and consumer preference for environmentally friendly vehicles. The European market is also influenced by the increasing adoption of electric LCVs and a growing focus on reducing carbon footprints, which aligns with the region’s sustainability goals.

Latin America Light Commercial Vehicle Market Trends

In Latin America, the demand for LCVs is gaining traction, particularly in countries such as Brazil and Mexico. The market is supported by the rise in e-commerce and urbanization, although it faces challenges such as political instability and economic fluctuations, which impact consumer purchasing power.

Middle East and Africa Light Commercial Vehicle Market Trends

The Middle East and Africa LCV market is expected to experience moderate growth. Key drivers include infrastructural development, the growth of the logistics and transportation sectors, and an increasing demand for commercial fleets. However, challenges such as high fuel prices and political instability in certain regions may hinder market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Light Commercial Vehicle Company Insights

The global Light Commercial Vehicle (LCV) market is highly competitive, with several key players contributing to its growth and development.

Fiat Chrysler Automobiles (FCA) remains a prominent player in the LCV market, offering a diverse range of commercial vehicles, with a focus on fuel-efficient models. FCA’s strategic alliances and constant innovation in design help maintain its competitive edge.

Ford Motor Company holds a significant share of the market, recognized for its wide portfolio of LCVs, particularly in North America. Known for its high-performing and durable trucks, Ford continues to dominate with its popular Transit and Ranger models, which cater to various commercial applications and customer needs.

General Motors Company, through its Chevrolet and GMC brands, has cemented its position in the LCV market. Its vehicles, such as the Chevrolet Express and GMC Savana, are widely used for commercial purposes, especially in logistics and delivery sectors. GM is focused on expanding its electric vehicle offerings, aligning with the growing trend for greener solutions in the LCV segment.

Hino Trucks, a subsidiary of Toyota Motor Corporation, is a leading player in the global LCV market, particularly in Asia. Known for its heavy-duty trucks and reliable performance, Hino focuses on fuel efficiency and the development of electric and hybrid models. Its strong presence in emerging markets further strengthens its position in the industry.

Top Key Players in the Market

- Fiat Chrysler Automobiles (FCA)

- Ford Motor Company

- General Motors Company

- Hino Trucks

- Isuzu Commercial Truck of America

- Mercedes-Benz (Daimler AG)

- Toyota Motor Corporation

- Volkswagen Group

- Ashok Leyland Limited

- BAIC Motor Corporation Ltd.

- BYD Auto Co. Ltd.

Recent Developments

- In July 2025, Tata Motors announced the acquisition of Iveco Group in a deal valued at €3.8 billion. This move aims to create a major global player in the commercial-vehicle sector, expanding Tata Motors’ market presence and enhancing its product offerings across various regions.

- In August 2025, Mahindra & Mahindra completed the acquisition of a 58.96% controlling stake in SML Isuzu. This strategic acquisition strengthens Mahindra’s foothold in the commercial vehicle market, with a focus on expanding its range of light and medium trucks.

- In June 2023, Wiers acquired LTM Auto Truck & Trailer in Pontiac, MI. The acquisition enhances Wiers’ operational capabilities in the truck and trailer service industry, supporting its growth in vehicle fleet maintenance and repair services.

- In May 2024, AURELIUS Private Equity completed the acquisition of Dayco’s Propulsion Solutions Business. This acquisition expands AURELIUS’s portfolio in the automotive sector, particularly in the manufacturing of propulsion systems and solutions for the global automotive market.

Report Scope

Report Features Description Market Value (2024) USD 536.7 Billion Forecast Revenue (2034) USD 979.4 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle (Vans, Pickup Trucks, Light-Duty Trucks), By Gross Weight (6000-9000 lbs, 9000-12000 lbs, 12000-14000 lbs), By Fuel (Gasoline, Diesel, Electric), By Application (Logistics & Transportation, Construction & Mining, Utility Services, Rental & Leasing, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Fiat Chrysler Automobiles (FCA), Ford Motor Company, General Motors Company, Hino Trucks, Isuzu Commercial Truck of America, Mercedes-Benz (Daimler AG), Toyota Motor Corporation, Volkswagen Group, Ashok Leyland Limited, BAIC Motor Corporation Ltd., BYD Auto Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Light Commercial Vehicle MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Light Commercial Vehicle MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Fiat Chrysler Automobiles (FCA)

- Ford Motor Company

- General Motors Company

- Hino Trucks

- Isuzu Commercial Truck of America

- Mercedes-Benz (Daimler AG)

- Toyota Motor Corporation

- Volkswagen Group

- Ashok Leyland Limited

- BAIC Motor Corporation Ltd.

- BYD Auto Co. Ltd.