Global AI in Quick Service Restaurants Market Size, Share, Statistics Analysis Report By Technology (Machine Learning, Computer Vision, Natural Language Processing, Robotics & Automation, Others), By Deployment (Cloud, On-premises), By Application (Automated Ordering Systems, AI-powered Chatbots and Customer Service Platforms, Optimization of Food Preparation, Inventory Management, Others), By Restaurant Type (Chained, Independent), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148063

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Impact Of AI

- Business Benefits

- US Market Rise

- North America Economic Growth

- Technology Analysis

- Deployment Analysis

- Application Analysis

- Restaurant Type Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Emerging Trends

- Key Player Analysis

- Top Opportunities for Players

- Recent Developments

- Report Scope

Report Overview

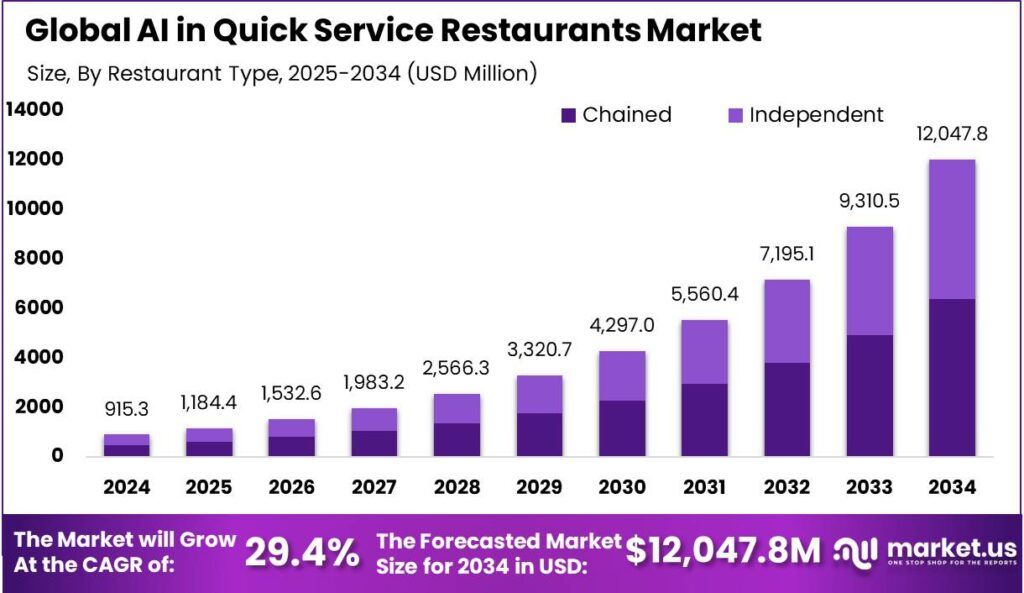

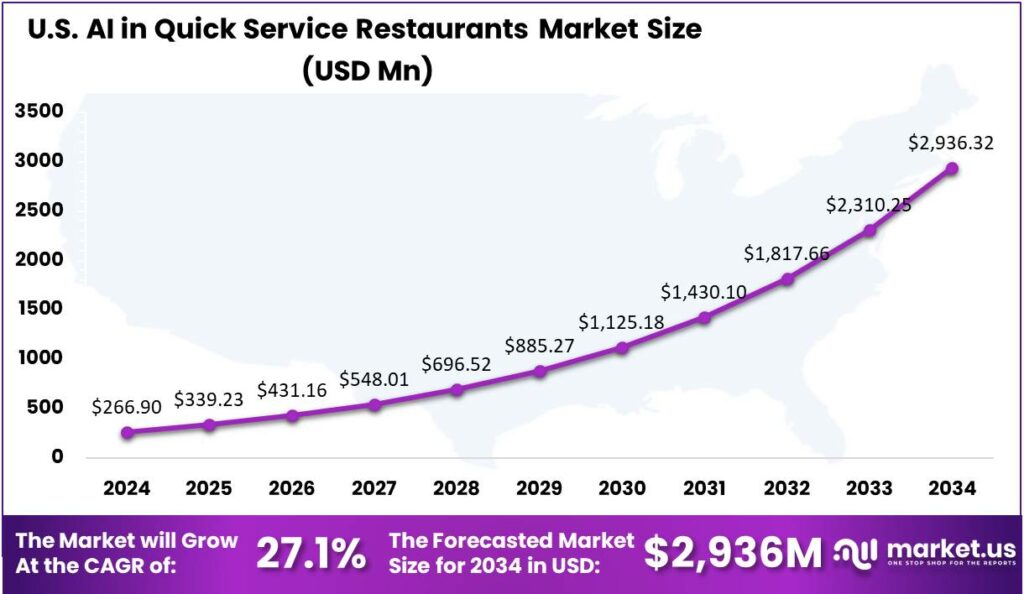

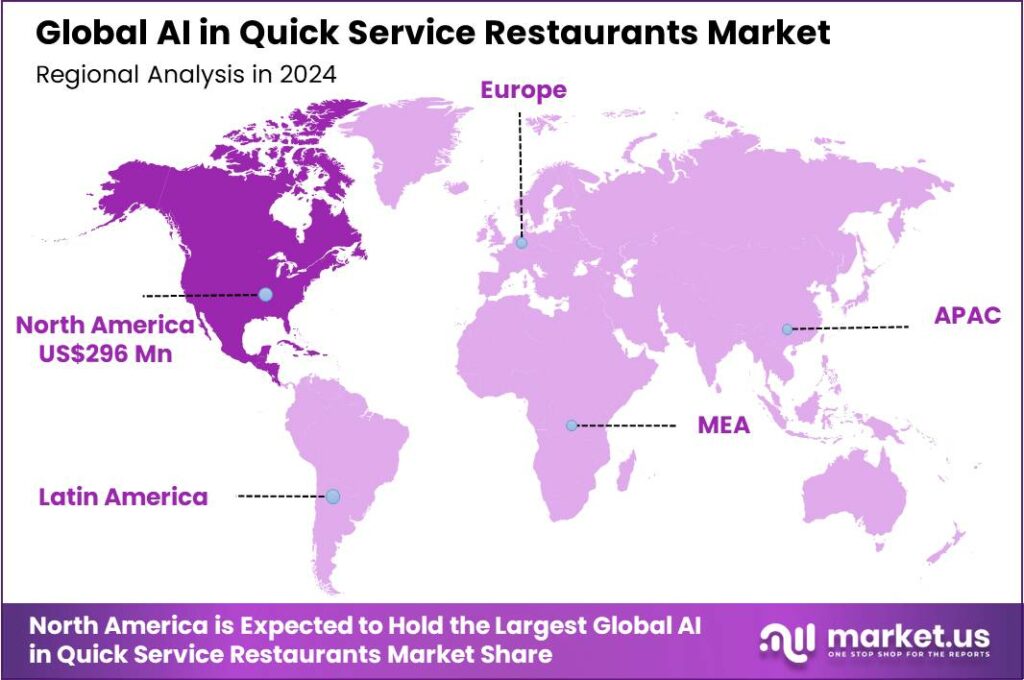

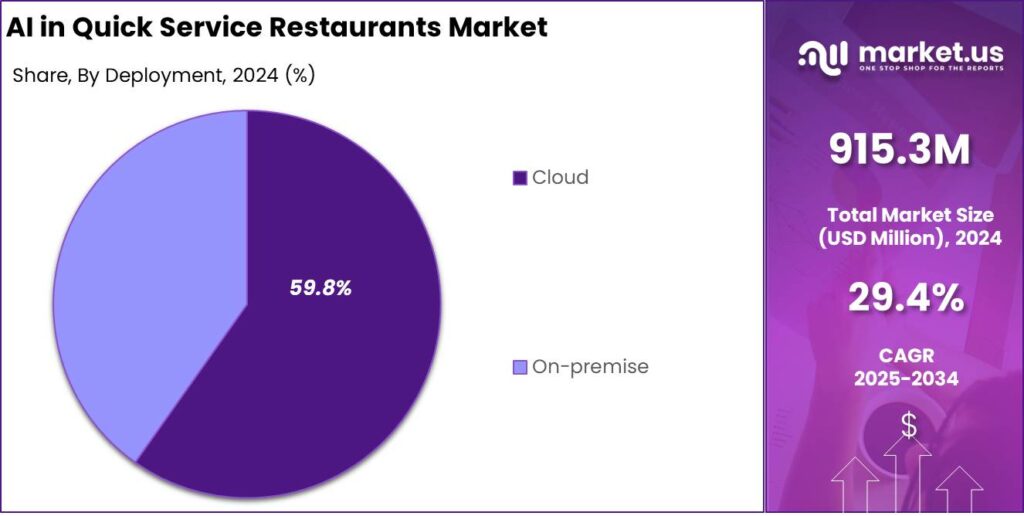

The AI in Quick Service Restaurants Market size is expected to be worth around USD 12,047.8 Mn By 2034, from USD 915.3 Mn in 2024, growing at a CAGR of 29.40% during the forecast period from 2025 to 2034. In 2024, North America led the market with over 32.4% share, generating around USD 296 million in revenue. The U.S. market alone was valued at approximately USD 266.9 million, with a projected CAGR of 27.1%.

AI in Quick Service Restaurants (QSRs) involves using technologies like machine learning, computer vision, natural language processing, and robotics to enhance operations. These tools automate and optimize functions such as order taking, kitchen processes, personalized marketing, supply chain management, and customer engagement.

Key factors driving rapid AI adoption in the QSR sector include growing customer demand for faster service and personalization, labor shortages and rising wage costs pushing operators to automate tasks, and advancements in cloud computing and data analytics making large-scale AI implementation more accessible and cost-effective.

The increasing adoption of technologies such as AI-powered chatbots, voice recognition systems, and predictive analytics tools is transforming the QSR landscape. These technologies facilitate seamless ordering processes, efficient inventory management, and data-driven decision-making. For example, AI-driven voice assistants can take customer orders accurately, while predictive analytics help in forecasting demand and optimizing supply chains.

The primary reasons for adopting AI in QSRs include the desire to enhance customer satisfaction, improve operational efficiency, and remain competitive in a rapidly evolving market. AI solutions enable restaurants to offer personalized experiences, reduce wait times, and streamline operations, leading to increased profitability and customer loyalty.

According to Market.us, The global Quick Service Restaurants (QSR) market is projected to witness robust expansion, with its market size expected to reach USD 1867.3 billion by 2033, up from USD 760.4 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 9.4% during the forecast period from 2023 to 2033.

The business benefits of implementing AI in QSRs are substantial. AI technologies help in reducing operational costs, minimizing errors, and enhancing customer experiences. By automating routine tasks and providing data-driven insights, AI enables restaurants to make informed decisions, optimize resources, and increase profitability.

Key Takeaways

- The Global AI in Quick Service Restaurants (QSR) Market size is projected to reach USD 12,047.8 Million by 2034, up from USD 915.3 Million in 2024, growing at a CAGR of 29.40% during the forecast period from 2025 to 2034.

- In 2024, the Robotics & Automation segment dominated the market, holding more than 29.4% of the share in the AI in Quick Service Restaurants (QSR) sector.

- The Cloud segment led the market in 2024, accounting for more than 59.8% of the AI in Quick Service Restaurants (QSR) market share.

- The Automated Ordering Systems segment held a major position in 2024, commanding more than 36.7% of the market share within the AI in Quick Service Restaurants (QSRs) sector.

- In 2024, the Chained segment was the market leader, capturing more than 53.1% of the market share in the AI in Quick Service Restaurants (QSR) sector.

- North America dominated the global AI in Quick Service Restaurants (QSRs) market in 2024, holding more than 32.4% of the market, which translated to approximately USD 296 million in revenue.

- The U.S. AI in Quick Service Restaurants (QSRs) market was valued at around USD 266.9 million in 2024, with a projected CAGR of 27.1%.

Impact Of AI

- Enhanced Order Accuracy: AI, using computer vision and speech recognition, enhances order accuracy, reducing human errors and ensuring customers get exactly what they want, boosting satisfaction. The Zendesk Customer Experience Trends Report 2024, reveals that 51% of consumers now prefer bots over humans for quick assistance, reflecting the growing embrace of AI.

- Optimized Staffing and Labor Management: AI-driven analytics assist in forecasting peak hours and customer flow, enabling better staff scheduling. By predicting busy periods, restaurants can allocate resources more efficiently, reducing wait times and improving service quality.

- Personalized Customer Engagement: AI analyzes customer data to offer personalized recommendations and promotions, boosting loyalty and sales by tailoring marketing strategies to individual preferences.

- Streamlined Kitchen Operations: AI technologies facilitate real-time monitoring of kitchen activities, ensuring efficient food preparation and inventory management. AI optimizes order patterns and stock levels, reducing waste and ensuring popular items are always in stock, boosting operational efficiency.

- Improved Drive-Thru and Delivery Services: AI applications in drive-thru and delivery services enhance speed and accuracy. Voice recognition systems and predictive analytics streamline order taking and fulfillment, reducing errors and wait times.

Business Benefits

AI reduces manual labor for repetitive tasks, allowing staff to focus on customer-centric roles and improving service quality. This shift cuts labor costs, boosts efficiency, and increases revenue. According to the Livelytics report, Chipotle used AI to segment customers and send personalized ads, which led to a 65% jump in online sales.

AI-driven personalization helps QSRs tailor recommendations and promotions to customers, boosting satisfaction and repeat visits. AI chatbots and voice assistants also provide quick, accurate responses, enhancing the dining experience. As per the same report, 73% of organizations say AI has improved their customer experience, making guests more likely to return.

AI provides QSRs with valuable insights by analyzing vast amounts of data from various sources. These insights inform strategic decisions related to menu design, pricing, and marketing campaigns. As a result, restaurants can make informed choices that align with customer preferences and market trends.

US Market Rise

In 2024, the U.S. Artificial Intelligence (AI) in Quick Service Restaurants (QSRs) market was valued at approximately USD 266.9 million, marking a significant step in the digital transformation of the foodservice industry.

The market shows a growing reliance on AI to streamline operations and improve customer experiences in fast-paced environments like burger chains and coffee shops. QSR operators are adopting AI tools such as predictive ordering, voice assistants, smart kiosks, and robotic kitchens to meet rising consumer expectations for speed, personalization, and convenience.

The sector is projected to grow at a robust compound annual growth rate (CAGR) of 27.1% from 2025 onwards, indicating strong momentum for adoption in the coming decade. This growth is driven by factors like rising labor costs, pushing restaurants toward automation and AI-driven systems. AI boosts upselling, automates inventory, and enables dynamic pricing, while integrating with delivery apps, chatbots, and loyalty programs to enhance engagement, retention, and ticket size.

As QSRs evolve into digital ecosystems, AI investment is now essential. U.S. players are piloting AI to boost efficiency and customer interaction, with more collaborations with tech firms, cloud providers, and data analytics companies. With mobile ordering, digital payments, and zero-contact service on the rise, AI will shape the future of responsive quick-service restaurants.

North America Economic Growth

In 2024, North America held a dominant position in the global AI in Quick Service Restaurants (QSRs) market, capturing more than a 32.4% share, which translated to approximately USD 296 million in revenue. These brands use AI to streamline operations, optimize drive-thru speed, improve mobile ordering, and personalize customer interactions, all essential in a market focused on convenience and speed.

North America’s dominance is driven by fast AI adoption and robust tech infrastructure. U.S. QSRs use AI systems like voice recognition, dynamic menus, robotic assistants, and predictive analytics for inventory and staffing. Cloud platforms and data analytics enable seamless AI integration, while strong venture capital and R&D support fuel innovation in food tech.

Assitioally, North America’s lead is fueled by changing consumer behavior, with Millennials and Gen Z preferring digital-first, contactless experiences. QSRs are adopting AI solutions like loyalty apps and chatbots to enhance engagement. The post-pandemic shift to automation in kitchens improves efficiency and accuracy, ensuring North America remains a leader in AI-driven QSR transformation.

Technology Analysis

In 2024, Robotics & Automation segment held a dominant market position, capturing more than a 29.4% share in the AI in Quick Service Restaurants (QSR) market. This leadership can be attributed to the widespread deployment of robotic systems and automated devices in food preparation, cooking, and delivery operations.

The surge in demand for contactless and efficient service post-pandemic has also played a key role in boosting the robotics segment. Robotic servers and self-cleaning bots have been particularly useful in addressing labor shortages and maintaining operational continuity in high-traffic outlets. These systems are now being scaled across multiple store locations, setting a precedent for the broader industry.

Moreover, advancements in robotics hardware and AI integration have drastically lowered the cost barriers for adoption, making these solutions accessible even to mid-sized franchises. Innovations in embedded AI, computer vision-assisted robots, and multi-functional automation platforms have transformed single-purpose machines into versatile solutions capable of handling a variety of tasks.

The demand for real-time adaptability in kitchen and customer operations has boosted the appeal of AI-powered robotics. These systems can adjust to order volumes, kitchen load, and preferences, reducing wait times and optimizing workflows. As customer expectations for speed, safety, and consistency grow, the Robotics & Automation segment is set to remain a leader in the QSR market.

Deployment Analysis

In 2024, the Cloud segment held a dominant market position, capturing more than a 59.8% share in the AI in Quick Service Restaurants (QSR) market. To minimize upfront costs, many small- and mid-sized restaurants are turning to cloud platforms, offering a more accessible and cost-efficient way to adopt tech-driven solutions.

The dominance of cloud-based AI in QSRs was further driven by its ability to enable real-time data processing and centralized control across multiple locations. For large QSR brands operating hundreds or thousands of outlets globally, the cloud offers a unified system that collects and analyzes customer behavior, operational data, and inventory trends from each location.

Another major factor contributing to the cloud segment’s leadership is the rising use of AI-powered customer engagement tools such as virtual assistants, recommendation engines, and loyalty programs. These tools rely on cloud architecture to function seamlessly across various customer touchpoints, including mobile apps, kiosks, and drive-thru systems.

Cloud-based AI platforms integrate smoothly with third-party tools such as payment systems and CRM software, forming a unified digital ecosystem for QSR operations. This integration streamlines workflows, supports contactless experiences, and enhances analytics, helping QSR operators meet tech-savvy consumers’ demands for speed, personalization, and reliability.

Application Analysis

In 2024, the Automated Ordering Systems segment held a dominant market position, capturing more than a 36.7% share in the AI in Quick Service Restaurants (QSRs) market. This dominance is largely attributed to the growing consumer preference for self-service and speed, especially in busy urban locations where time efficiency significantly influences dining choices.

The widespread deployment of AI-enabled ordering solutions by major QSR chains has further solidified the segment’s leadership. Brands like McDonald’s and Taco Bell have integrated smart kiosks that learn from user behavior, recommend items based on past purchases, and display dynamic menus according to the time of day or promotional campaigns.

From the operational perspective, automated ordering systems reduce human error, lower staff dependency, and enhance overall efficiency in high-traffic environments. By streamlining front-of-house processes, these solutions free up employees to focus on food preparation and quality control, leading to better resource allocation.

The growth of the segment is driven by the rising adoption of digital-first models in foodservice. As QSRs shift to hybrid models with dine-in, takeaway, and delivery, automated ordering is key to enabling seamless omnichannel service. AI systems are favored for their reliability, scalability, and data insights, helping operators modernize and stay competitive.

Restaurant Type Analysis

In 2024, Chained segment held a dominant market position, capturing more than a 53.1% share in the AI in Quick Service Restaurants (QSR) market. Chained restaurants, with access to large capital and customer data, have quickly adopted AI systems, boosting efficiency, service speed, and personalized experiences at scale.

Chained QSRs, with multiple locations, enable uniform AI adoption, boosting ROI in areas like automated ordering, robotic food assembly, and demand analytics. They’ve implemented AI-driven voice ordering at drive-thrus and are piloting smart kitchens with robotic fry stations, giving them a significant tech advantage over independent restaurants.

Customer expectations for faster service and digital interactions are easily met by chain restaurants. AI-backed loyalty programs, recommendation engines, and real-time inventory systems enhance satisfaction. Additionally, AI insights aid in strategic decisions on promotions, staffing, and new products, strengthening their market dominance.

Independent restaurants often face budget and technical constraints, slowing their AI adoption. Unlike chained QSRs, they operate on thinner margins and lack centralized infrastructure for consistent AI implementation. This puts chained QSRs ahead in innovation and operational transformation, reinforcing their dominance in the AI QSR market.

Key Market Segments

By Technology

- Machine Learning

- Computer Vision

- Natural Language Processing

- Robotics & Automation

- Others

By Deployment

- Cloud

- On-premises

By Application

- Automated Ordering Systems

- AI-powered Chatbots and Customer Service Platforms

- Optimization of Food Preparation

- Inventory Management

- Others

By Restaurant Type

- Chained

- Independent

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhanced Operational Efficiency

AI significantly boosts operational efficiency in QSRs by automating routine tasks and optimizing resource allocation. For instance, AI-powered systems can analyze historical sales data to predict peak hours, enabling better staff scheduling and inventory management.

This predictive capability ensures that restaurants are adequately staffed during busy periods, reducing wait times and improving customer satisfaction. Additionally, AI-driven kitchen automation, such as robotic arms for food preparation, streamlines cooking processes, ensuring consistency and speed in service delivery. These advancements not only reduce labor costs but also minimize human errors, leading to improved overall efficiency.

Restraint

Data Privacy Concerns

The deployment of AI in QSRs necessitates the collection and analysis of vast amounts of customer data to personalize experiences and optimize operations. However, this raises significant data privacy concerns. Customers may be apprehensive about how their data is collected, stored, and used, especially if there is a lack of transparency.

Moreover, stringent data protection regulations, such as the General Data Protection Regulation (GDPR), impose strict requirements on data handling practices. Non-compliance can lead to substantial fines and damage to a brand’s reputation. Therefore, QSRs must implement robust data governance frameworks and ensure transparency in their data practices to build and maintain customer trust.

Opportunity

Personalized Customer Experiences

AI offers QSRs the opportunity to deliver highly personalized customer experiences, thereby enhancing customer loyalty and increasing sales. By analyzing customer data, AI can provide tailored recommendations, promotions, and loyalty rewards.

For example, AI-driven chatbots can interact with customers in real-time, offering personalized menu suggestions based on previous orders and preferences. This level of personalization not only improves the customer experience but also encourages repeat business and higher spending per visit. Furthermore, AI can assist in developing targeted marketing campaigns, ensuring that promotional efforts reach the most receptive audiences.

Challenge

Implementation and Integration Complexity

Integrating AI technologies into existing QSR operations presents significant challenges. Many QSRs operate with legacy systems that may not be compatible with new AI solutions, necessitating substantial investments in infrastructure upgrades.

Implementing AI in QSRs comes with challenges. Staff may need extensive training to manage AI systems, which can be resource-intensive. Transitioning can also disrupt operations, and integrating AI across ordering, payment, and kitchen processes requires careful planning. Without proper execution, these complexities can limit AI’s effectiveness and impact overall performance.

Emerging Trends

A key trend in quick-service restaurants is the use of AI-powered voice assistants in drive-thrus to speed up service and reduce wait times. Chains like Taco Bell and Pizza Hut are adopting these systems to handle orders efficiently, freeing up staff for other tasks. Additionally, AI aids inventory management by predicting demand, minimizing waste, and maintaining optimal stock levels.

Another development is the use of AI in kitchen operations. For instance, a California-based restaurant has introduced robots capable of assembling burgers in just 27 seconds. These robots work alongside human staff, enhancing speed and consistency in food preparation .

AI is also being utilized to personalize customer experiences. By analyzing customer data, AI can suggest menu items based on individual preferences, leading to increased satisfaction and sales. This personalization extends to mobile apps, where AI-driven recommendations enhance the ordering process .

Key Player Analysis

Several tech companies are leading AI in Quick Service Restaurants Market transformation by providing AI tools tailored for the fast-food industry.

Presto is a leader in using AI to power voice technology in QSRs, especially at drive-thrus. Presto uses NLP to take customer orders without human cashiers, cutting wait times and boosting accuracy. It stands out by serving major chains like Del Taco and Checkers, proving it can scale. Its key strength is delivering practical, reliable voice AI for high-volume restaurants.

Omilia is known for its deep AI voice technology that feels almost like talking to a human. It uses advanced machine learning and natural conversation models, which are already trusted in industries like banking and customer support. In QSRs, Omilia brings that same powerful AI to create a seamless ordering experience.

Brightloom focuses on customer insights and personalization. Unlike others that target voice tech, Brightloom helps restaurants use AI to understand customer behavior and send targeted promotions. Its platform combines AI with customer data to increase loyalty and boost sales through smarter recommendations. Brightloom’s unique edge is its AI-powered personalization engine built specifically for the restaurant industry.

Top Key Players in the Market

- Presto

- Omilia

- Conversable

- Brightloom

- ClearObject

- Restoke

- Owner.com

- Zebra Medical Vision

- Qube

- DeepVision

- Rex Animal

- Simbe Robotics

- Fritz AI

- Others

Top Opportunities for Players

- Enhanced Sales Forecasting and Scheduling: AI tools are being utilized to predict customer demand patterns, enabling restaurants to optimize staffing schedules and reduce labor costs. AI analyzes sales data and external factors to forecast demand, helping restaurants optimize staffing and adjust operations for peak and slow periods.

- Personalized Customer Engagement: AI-driven systems analyze customer preferences and purchasing behaviors to deliver personalized marketing campaigns and loyalty programs. By tailoring promotions to individual customers, restaurants can increase engagement and drive repeat business. This level of personalization enhances the customer experience and fosters brand loyalty.

- Automation in Food Preparation: The adoption of robotics and AI in food preparation processes is streamlining kitchen operations. Automated systems perform repetitive tasks like assembling burgers or preparing drinks, boosting speed and consistency while enabling staff to focus on complex, customer-focused duties.

- Optimized Inventory Management: AI applications are being used to monitor inventory levels in real-time, predicting stock requirements based on sales trends and reducing food waste. By ensuring that ingredients are available when needed and minimizing overstocking, restaurants can manage costs effectively and maintain product freshness.

- Improved Drive-Thru and Ordering Systems: AI-powered voice recognition and ordering systems are enhancing the speed and accuracy of drive-thru services. By automating order taking, these systems reduce wait times and improve order accuracy, leading to higher customer satisfaction. Additionally, AI can suggest upsell opportunities based on customer preferences, increasing average order value.

Recent Developments

- In September 2024, Restoke.ai, an AI-powered restaurant management platform, secured approximately $3.49 million in a funding round led by Rampersand in September. The investment aims to expand Restoke’s capabilities in automating restaurant operations.

- In November 2024, SoundHound AI’s voice technology is now powering drive-thrus, phone orders, kiosks, and apps at seven of the top 20 quick-service restaurants, helping boost efficiency, support staff, and drive upsells across the industry.

Report Scope

Report Features Description Market Value (2024) USD 915.3 Mn Forecast Revenue (2034) USD 12,047.8 Mn CAGR (2025-2034) 29.40% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Technology (Machine Learning, Computer Vision, Natural Language Processing, Robotics & Automation, Others), By Deployment (Cloud, On-premises), By Application (Automated Ordering Systems, AI-powered Chatbots and Customer Service Platforms, Optimization of Food Preparation, Inventory Management, Others), By Restaurant Type (Chained, Independent) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Presto, Omilia, Conversable, Brightloom, ClearObject, Restoke, Owner.com, Zebra Medical Vision, Qube, DeepVision, Rex Animal, Simbe Robotics, Fritz AI, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI in Quick Service Restaurants MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

AI in Quick Service Restaurants MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Presto

- Omilia

- Conversable

- Brightloom

- ClearObject

- Restoke

- Owner.com

- Zebra Medical Vision

- Qube

- DeepVision

- Rex Animal

- Simbe Robotics

- Fritz AI

- Others