Global Full-Service Restaurants (FSR) Market Size, Share Analysis Report By Type (Chain Restaurants, Independent Restaurants), By Dining Experience (Counter Service, Self-Service, Table Service), By Service Type (Dine-in, Takeaway, Online Delivery, Catering Services), By Restaurant Size (Large Chains, Medium-Sized Restaurants, Small Restaurants), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147671

- Number of Pages: 232

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Impact of AI

- Expansion of the U.S. Market

- North America Forecast Expansion

- By Type Analysis

- By Dining Experience Analysis

- By Service Type Analysis

- By Restaurant Size Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

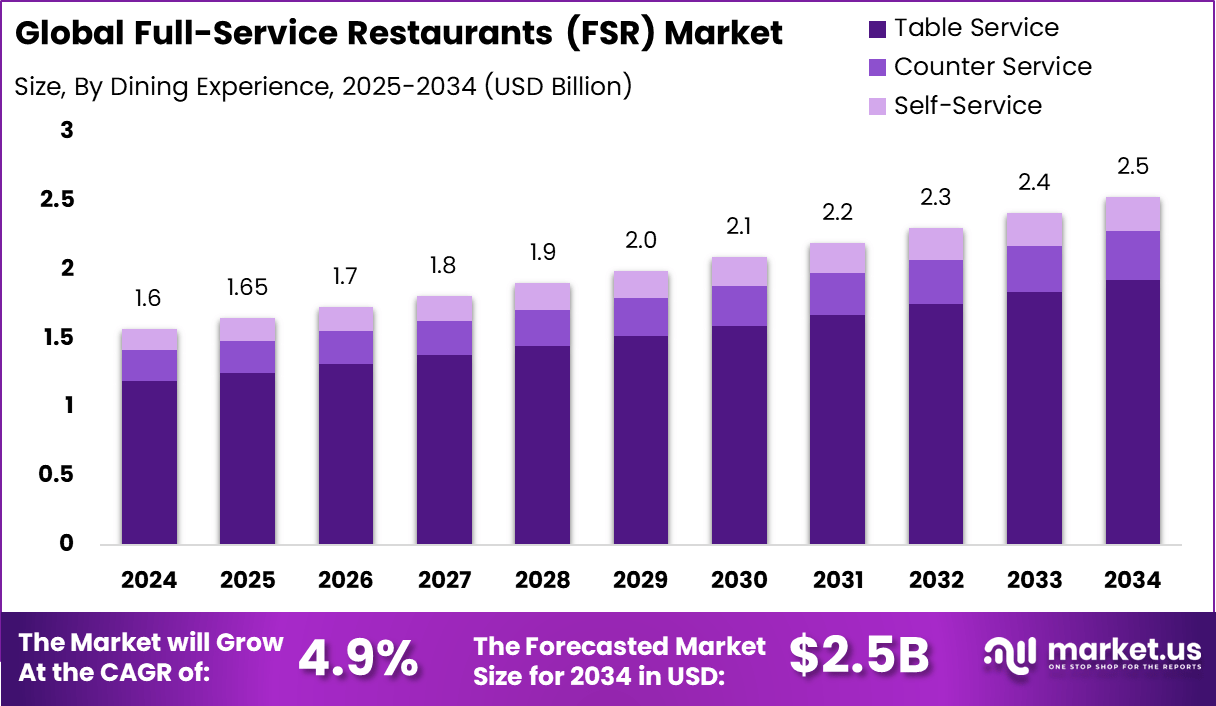

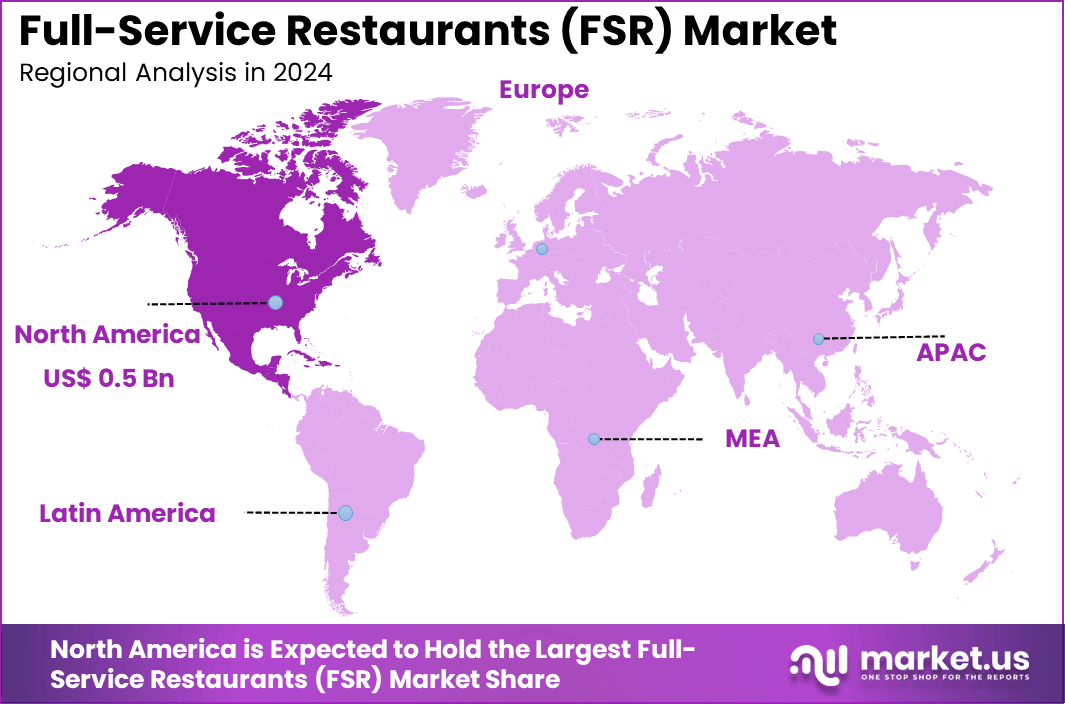

The Global Full-Service Restaurants (FSR) Market size is expected to be worth around USD 2.5 Billion By 2034, from USD 1.6 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 34% share, holding USD 0.5 Billion revenue.

A Full-Service Restaurant (FSR) is an establishment where customers are seated at tables, order from a menu, and are served by waitstaff. These restaurants offer a comprehensive dining experience, including a variety of food and beverage options, table service, and often a more elaborate ambiance. FSRs range from casual dining venues to fine dining establishments, catering to diverse customer preferences.

The Full-Service Restaurants (FSR) Market encompasses the global industry of establishments providing seated dining experiences with table service. This market is characterized by its diverse offerings, including various cuisines, dining formats, and service levels. The FSR market is influenced by factors such as consumer dining habits, economic conditions, and cultural trends, and it plays a significant role in the broader foodservice industry.

The expansion of the FSR market is primarily driven by increasing consumer demand for experiential dining, the globalization of cuisines, and a growing middle class with higher disposable incomes. Urbanization has led to lifestyle changes, with more people dining out for convenience and social engagement. Additionally, the tourism industry’s growth contributes to higher patronage of full-service establishments.

Consumer preferences are shifting towards healthier options, sustainability, and unique dining experiences. FSRs are adapting by offering organic, locally sourced ingredients and diverse menu options to cater to these demands. The desire for personalized service and ambiance continues to attract customers seeking more than just a meal.

Key factors boosting demand include the rise of food tourism, increased interest in global cuisines, and the social aspect of dining out. Special occasions and business meetings often take place in FSRs, emphasizing their role in social and professional settings. Moreover, the integration of technology for reservations and personalized marketing enhances customer engagement.

Key Takeaways

- The global Full-Service Restaurants (FSR) market is projected to grow from USD 1.6 billion in 2024 to around USD 2.5 billion by 2034, reflecting a steady CAGR of 4.9%, supported by rising urban dining preferences and lifestyle shifts.

- North America led the global FSR market in 2024 with over 34% share, generating close to USD 0.5 billion, driven by mature restaurant infrastructure and strong consumer spending in the U.S. and Canada.

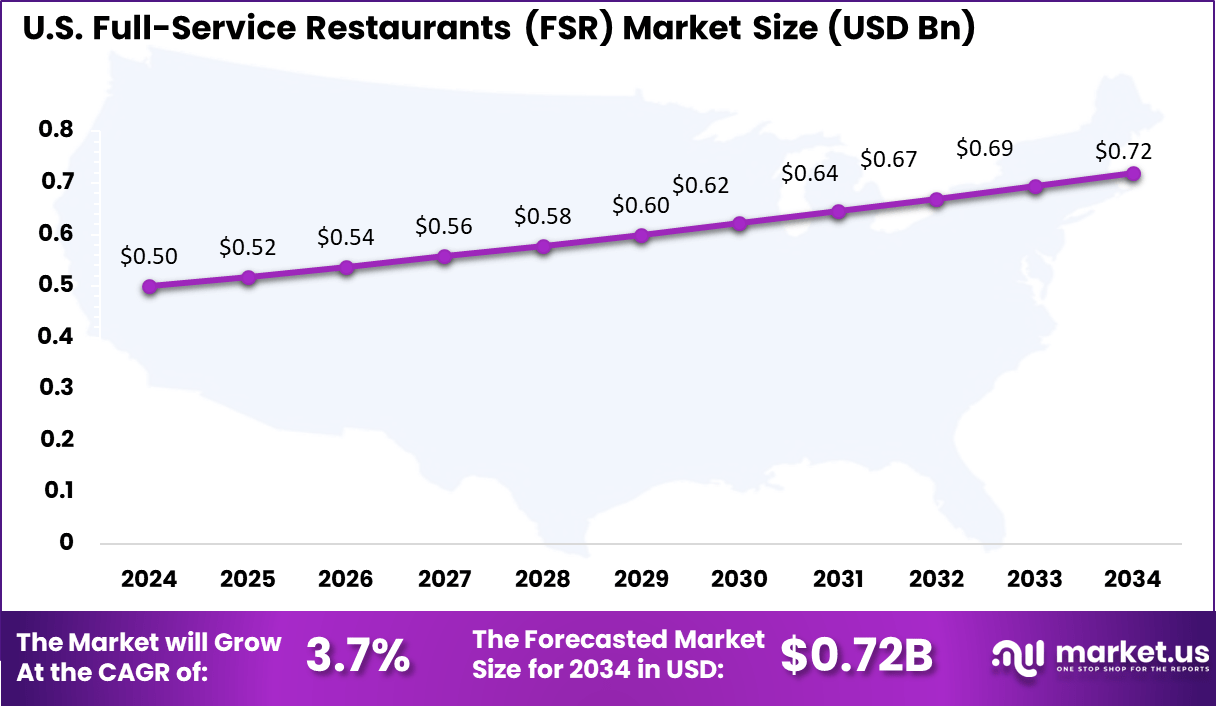

- The U.S. FSR market alone is forecast to expand from USD 0.52 billion in 2025 to USD 0.72 billion by 2034, maintaining a stable CAGR of 3.7%, backed by a loyal dine-in customer base and premium dining experiences.

- In 2024, Chain Restaurants dominated with more than 58% market share, underpinned by brand recognition, menu consistency, and nationwide expansion strategies.

- Table Service formats commanded over 76% of the market in 2024, signaling strong consumer demand for personalized and full-course dining experiences.

- Dine-in services held a solid 62% share in 2024, highlighting a clear post-pandemic rebound in on-site restaurant visits and consumer preference for ambiance and service.

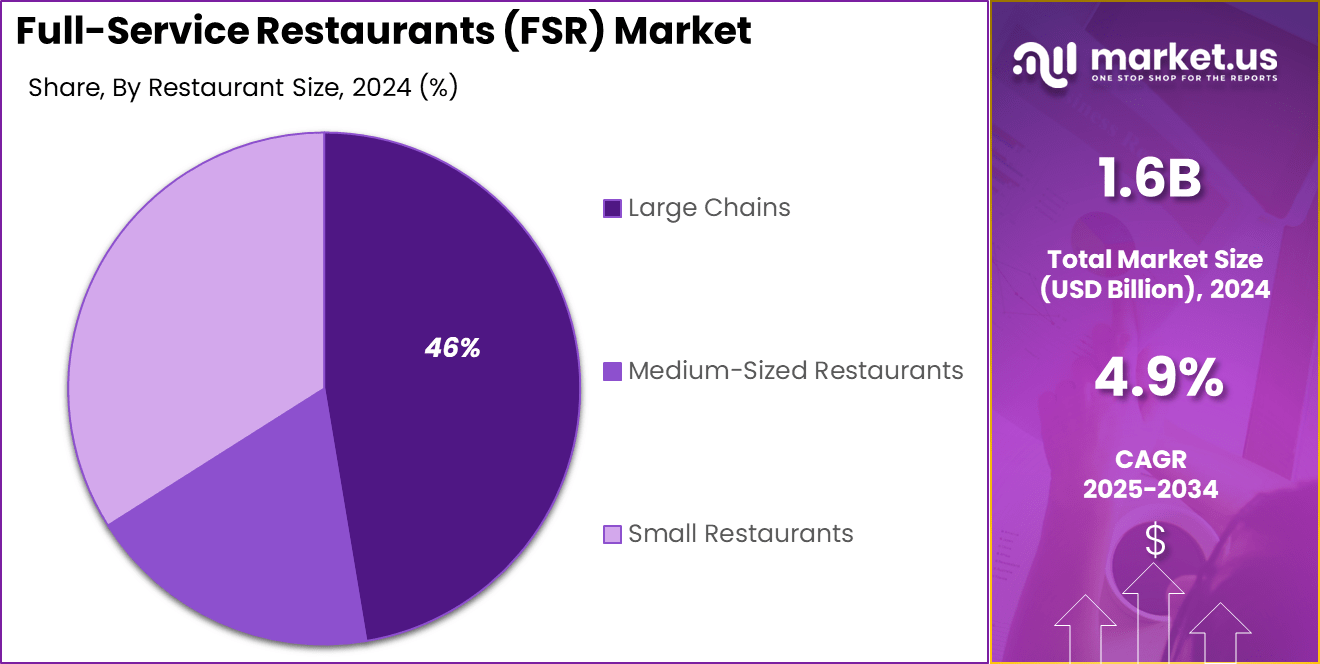

- Large Chains accounted for more than 46% of the FSR market in 2024, benefiting from economies of scale, robust marketing, and diverse menu offerings.

Analysts’ Viewpoint

Current trends in the FSR market involve a focus on sustainability, with restaurants adopting eco-friendly practices and sourcing. There’s a growing emphasis on health-conscious menus, including plant-based and allergen-free options. Additionally, the fusion of different culinary traditions is becoming popular, offering innovative dining experiences.

FSRs are increasingly implementing technologies such as digital reservation systems, contactless payment options, and data analytics to enhance operational efficiency and customer experience. These technologies help in managing customer preferences, optimizing menu offerings, and streamlining service delivery.

Investors are finding opportunities in the FSR market due to its steady growth and adaptability. Areas such as franchise models, technology integration, and niche dining experiences offer potential for profitable investments. Emerging markets with expanding middle-class populations present new avenues for expansion.

FSRs operate under regulations concerning food safety, labor laws, health codes, and licensing requirements. Compliance with these regulations is essential to maintain operational standards and avoid legal issues. Staying informed about changes in regulations ensures sustained business operations.

Impact of AI

The integration of Artificial Intelligence (AI) into Full-Service Restaurants (FSRs) is significantly reshaping the operational and customer experience landscape across the dining industry. In 2024, the global FSR market is being transformed by AI-driven innovations, particularly in areas such as order processing, inventory tracking, and personalized dining experiences.

Operational efficiency has been one of the most immediate benefits of AI in FSRs. Restaurants are increasingly relying on AI-powered tools for sales forecasting and staff scheduling, with over 41% of establishments planning to invest in these solutions in 2024.

These systems help reduce overstaffing, minimize food waste, and enhance inventory management by forecasting shortages and automatically reordering supplies. Furthermore, dynamic pricing engines, used by nearly 29% of small restaurants, are helping to optimize menu prices based on real-time factors such as ingredient costs and consumer demand. These efficiencies collectively reduce operational expenses and support consistent service delivery.

On the consumer side, AI is elevating the dining experience through personalized menu suggestions, chatbot-based reservation management, and seamless digital ordering systems. A recent report indicated that 65% of consumers now feel comfortable using tablets for payment, while 63% prefer to place orders via mobile apps. This shift not only enhances customer convenience but also increases order accuracy and average ticket size.

Expansion of the U.S. Market

The US Full-Service Restaurants (FSR) Market is valued at approximately USD 0.5 Billion in 2024 and is predicted to increase from USD 0.52 Billion in 2025 to approximately USD 0.72 Billion by 2034, projected at a CAGR of 3.7% from 2025 to 2034.

The dominance of the U.S. in the global FSR market can be attributed to its expansive and varied culinary scene, coupled with a strong culture of dining out. Major metropolitan areas such as New York City, Los Angeles, and Chicago serve as hubs for a wide array of dining experiences, from casual eateries to upscale fine dining establishments.

This diversity not only caters to a broad spectrum of consumer tastes but also fosters innovation and competition within the industry. Furthermore, the resilience of the U.S. FSR sector, demonstrated by its recovery and growth following economic challenges, underscores its integral role in the nation’s economy and cultural fabric.

North America Forecast Expansion

In 2024, North America held a dominant market position in the Full-Service Restaurants (FSR) sector, capturing more than a 34% share and generating approximately USD 0.5 Billion in revenue. This leadership can be credited to the region’s strong consumer culture around dining out, particularly in the United States, where eating at restaurants is deeply embedded in urban and suburban lifestyles.

The widespread presence of high-income households, a growing interest in premium dining experiences, and a shift toward healthier and locally sourced menu options have all significantly boosted the market. Moreover, post-pandemic recovery efforts, including digitized reservation systems and contactless dining, have accelerated the return of footfall in FSRs across major cities.

The region’s competitive edge also stems from the high level of innovation and investment in the foodservice ecosystem. North America is home to a vast range of culinary styles, from traditional American diners to upscale global cuisines, which provides consumers with a wide spectrum of choices and keeps the market highly dynamic.

By Type Analysis

In 2024, the Chain Restaurants segment held a dominant position in the Full-Service Restaurants (FSR) market, capturing more than a 58% share. This leadership is primarily due to the standardized dining experiences, consistent quality, and widespread brand recognition that chain establishments offer.

Consumers often gravitate towards these restaurants for their reliability and familiarity, knowing they can expect a certain level of service and menu offerings regardless of location. Additionally, chain restaurants benefit from economies of scale, allowing them to implement cost-effective measures in procurement, marketing, and operations, which independent restaurants may find challenging to match.

Moreover, chain restaurants have been at the forefront of adopting technological advancements to enhance customer experience and operational efficiency. Innovations such as digital ordering systems, loyalty programs, and mobile payment (USD 1,934.9 Billion by 2033; CAGR of 38.5%) options have streamlined the dining process, catering to the modern consumer’s preference for convenience.

The ability to swiftly adapt to changing market trends and consumer behaviors has further solidified their position in the market. While independent restaurants offer unique and localized experiences, the scalability and resource advantages of chain restaurants have enabled them to maintain a significant lead in the FSR sector.

By Dining Experience Analysis

In 2024, the Table Service segment held a dominant position in the Full-Service Restaurants (FSR) market, capturing more than a 76% share. This leadership is primarily due to the personalized dining experiences that table service offers, which many customers prefer for special occasions and leisurely meals.

The attentive service, ambiance, and the opportunity for guests to relax while their meals are served contribute to the enduring popularity of this dining format. Moreover, table service establishments often provide a diverse and comprehensive menu, catering to a wide range of culinary preferences.

This variety, combined with the ability to accommodate specific dietary needs and preferences, enhances customer satisfaction and loyalty. The emphasis on hospitality and the overall dining experience in table service restaurants continues to attract patrons seeking more than just a meal, thereby sustaining the segment’s leading position in the FSR market.

By Service Type Analysis

In 2024, the Dine-in segment held a dominant position in the Full-Service Restaurants (FSR) market, capturing more than a 62% share. This leadership is primarily due to consumers’ enduring preference for in-person dining experiences that offer ambiance, personalized service, and social interaction.

Despite the rise of delivery and takeaway options, many patrons continue to value the unique atmosphere and hospitality that dine-in establishments provide. Moreover, dine-in services allow restaurants to showcase their culinary offerings more effectively, enhancing customer satisfaction and loyalty.

The opportunity for immediate feedback and the ability to address customer needs in real-time contribute to a more refined dining experience. Additionally, the communal aspect of dining in, where friends and family gather to share meals, reinforces the cultural significance of restaurants as social hubs. These factors collectively sustain the prominence of the Dine-in segment within the FSR market.

By Restaurant Size Analysis

In 2024, the Large Chains segment held a dominant position in the Full-Service Restaurants (FSR) market, capturing more than a 46% share. This leadership is primarily due to the operational efficiencies and brand recognition that large chains offer. Their standardized menus, consistent quality, and widespread presence appeal to consumers seeking reliable dining experiences.

Moreover, large chains benefit from economies of scale, allowing them to implement cost-effective measures in procurement, marketing, and operations, which independent restaurants may find challenging to match. Additionally, large chains have been at the forefront of adopting technological advancements to enhance customer experience and operational efficiency.

Innovations such as digital ordering systems, loyalty programs, and mobile payment options have streamlined the dining process, catering to the modern consumer’s preference for convenience. The ability to swiftly adapt to changing market trends and consumer behaviors has further solidified their position in the market.

Key Market Segments

By Type

- Chain Restaurants

- Independent Restaurants

By Dining Experience

- Counter Service

- Self-Service

- Table Service

By Service Type

- Dine-in

- Takeaway

- Online Delivery

- Catering Services

By Restaurant Size

- Large Chains

- Medium-Sized Restaurants

- Small Restaurants

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Experiential Dining and Consumer Demand for Unique Food Experiences

The growth of the full-service restaurant (FSR) market is significantly influenced by the rising consumer preference for experiential dining. This trend encompasses not only the quality of food but also the ambiance, service, and overall dining experience.

Consumers are increasingly seeking unique and memorable experiences that go beyond traditional dining, leading to a surge in demand for restaurants that offer thematic settings, interactive dining, and personalized services.

Furthermore, the integration of technology to streamline operations and enhance customer engagement has become a pivotal factor in attracting and retaining patrons. Features such as digital menus, online reservations, and interactive ordering systems contribute to a seamless and engaging dining experience, aligning with the expectations of modern consumers.

Restraint

Rising Operational Costs and Economic Pressures

Despite the positive growth trajectory, the FSR industry faces significant challenges due to escalating operational costs and economic pressures. Factors such as inflation, increased labor costs, and supply chain disruptions have led to higher expenses for restaurant operators.

For instance, In the 12 months leading up to March 2025, Australia recorded a 3.2% increase in food prices, reflecting sustained inflationary pressure across essential consumer goods. Similarly, the United Kingdom experienced a 3.0% rise in food prices during the same period

These cost increases have compelled many restaurants to adjust their pricing strategies, which can impact customer affordability and demand. Additionally, labor shortages remain a critical issue, with restaurants struggling to find and retain qualified staff.

As of late 2024, 61% of hospitality businesses in the United Kingdom reported ongoing staffing shortages, highlighting a critical challenge for the sector’s post-pandemic recovery. These shortages are increasingly affecting service quality, operational hours, and revenue potential. In Australia, approximately 45% of food service operators acknowledged that they lacked sufficient staff to meet current customer demand.

Opportunity

Expansion of Delivery Services and Digital Ordering Platforms

The expansion of delivery services and digital ordering platforms presents a significant opportunity for growth in the FSR market. The convenience and accessibility of online ordering have transformed consumer dining habits, with many opting for takeout or delivery options. Full-service restaurants are capitalizing on this trend by integrating delivery services and enhancing their digital presence.

Moreover, the implementation of AI-powered systems aids in inventory management, order processing, and customer service, contributing to operational efficiency and customer satisfaction . Embracing these technological advancements enables restaurants to adapt to evolving consumer preferences and enhance their competitive edge.

Challenge

Labor Shortages and Workforce Management

Labor shortages and workforce management remain pressing challenges for the FSR industry. The sector continues to grapple with difficulties in recruiting and retaining staff, exacerbated by factors such as low wages, demanding work environments, and limited career advancement opportunities.

A report highlights that 62% of restaurants lacked sufficient staff in 2023, with managers and workers alike experiencing burnout. The reliance on a tip-dependent wage structure, particularly in states with a minimum wage of $2.13 per hour, contributes to financial instability for employees and affects job satisfaction.

Addressing these challenges requires a multifaceted approach, including offering competitive compensation, providing comprehensive training programs, and fostering a supportive work culture. Some establishments have implemented measures such as equitable pay, humane scheduling, and mental health resources to improve employee well-being and retention .

Growth Factors

The Full-Service Restaurant (FSR) market is experiencing steady growth, driven by several key factors. One significant contributor is the increasing consumer demand for dining out experiences. As urbanization continues and disposable incomes rise, more individuals are seeking the convenience and enjoyment of dining in restaurants.

Another growth factor is the integration of technology in restaurant operations. Digital ordering systems, AI-driven customer personalization, and sustainability initiatives such as plant-based offerings and zero-waste kitchens are reshaping the industry. These technological advancements not only enhance the customer experience but also improve operational efficiency, leading to increased profitability for restaurant owners.

Emerging Trends

The FSR industry is witnessing several emerging trends that are shaping its future. One notable trend is the shift towards experiential dining. Consumers are increasingly seeking unique and immersive dining experiences, leading to the rise of theme and interactive restaurants. This trend is evident in the growing popularity of restaurants that offer live music, art, and a dynamic atmosphere .

Another emerging trend is the emphasis on sustainability and health-conscious dining. Restaurants are responding to consumer demand by offering locally sourced, organic, and plant-based menu options. This shift not only caters to health-conscious consumers but also aligns with global efforts to promote environmental sustainability.

Business Benefits

Operating a Full-Service Restaurant offers numerous business benefits. One primary advantage is the potential for higher profit margins compared to quick-service establishments. FSRs can offer a diverse and comprehensive menu, allowing for premium pricing and increased revenue per customer.

The personalized service and ambiance provided in FSRs contribute to customer satisfaction and loyalty, leading to repeat business and positive word-of-mouth referrals. Moreover, FSRs have the opportunity to build strong brand recognition and a loyal customer base. By focusing on quality food, exceptional service, and a unique dining experience, FSRs can differentiate themselves in a competitive market.

The integration of technology, such as AI-driven menu recommendations and efficient reservation systems, further enhances operational efficiency and customer engagement. These factors collectively contribute to the long-term success and sustainability of Full-Service Restaurants in the evolving foodservice industry.

Key Player Analysis

Darden Restaurants, a prominent player in the U.S. FSR market, expanded its portfolio by acquiring Chuy’s Holdings for $605 million. This acquisition added 101 Chuy’s restaurants across 15 states to Darden’s existing brands, including Olive Garden and LongHorn Steakhouse. The move aligns with Darden’s strategy to diversify its offerings and enhance its presence in the casual dining segment.

Yum! Brands, known for KFC, Pizza Hut, and Taco Bell, has focused on international expansion and technological integration. In December 2023, Yum! announced the acquisition of 218 KFC restaurants from its largest franchisee, EG Group, in the UK and Ireland. This move aims to consolidate operations and strengthen its market presence in these regions.

Jubilant FoodWorks, the master franchisee for Domino’s Pizza in India, has pursued both domestic and international growth. The company acquired a 10.76% stake in Barbeque Nation Hospitality Limited and expanded its footprint by increasing its stake in DP Eurasia NV, the master franchisee for Domino’s in Turkey, Russia, Azerbaijan, and Georgia, to 41.32%

Top Key Players in the Market

- 21c Museum Hotels

- American Cruise Lines

- Amici Partners Group, LLC

- BBQ Holdings, Inc.

- Best Western International, Inc.

- BJ’s Restaurants, Inc.

- Bloomin’ Brands, Inc.

- Brinker International, Inc.

- Carnival Corporation & PLC

- Darden Concepts, Inc.

- Dine Brands Global, Inc.

- Four Seasons Hotels Limited

- Golden Corral Corporation

- Groupe Barrière

- Hilton Worldwide Holdings Inc.

- Hyatt Hotels Corporation

- IHOP Restaurants LLC

- Marriott International, Inc.

- Others

Recent Developments

- In August 2024, Four Corners Property Trust announced the acquisition of 19 Bloomin’ Brands restaurant properties, including Outback Steakhouse and Carrabba’s Italian Grill locations, for $66.4 million. This transaction reflects Bloomin’ Brands’ strategy to optimize its real estate portfolio.

- In 2024, BWH Hotels announced the addition of over 100 new properties to its portfolio during the first half of the year. This expansion reflects the company’s ongoing growth and commitment to providing diverse lodging options worldwide.

- In early 2024, Brinker International reported a significant increase in comparable-restaurant sales, driven by the revitalization of its Chili’s brand. Efforts included menu enhancements, improved operations, and value promotions, leading to a resurgence in customer traffic.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 2.5 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Chain Restaurants, Independent Restaurants), By Dining Experience (Counter Service, Self-Service, Table Service), By Service Type (Dine-in, Takeaway, Online Delivery, Catering Services), By Restaurant Size (Large Chains, Medium-Sized Restaurants, Small Restaurants) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 21c Museum Hotels, American Cruise Lines, Amici Partners Group, LLC, BBQ Holdings, Inc., Best Western International, Inc., BJ’s Restaurants, Inc., Bloomin’ Brands, Inc., Brinker International, Inc., Carnival Corporation & PLC, Darden Concepts, Inc., Dine Brands Global, Inc., Four Seasons Hotels Limited, Golden Corral Corporation, Groupe Barrière, Hilton Worldwide Holdings Inc., Hyatt Hotels Corporation, IHOP Restaurants LLC, Marriott International, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Full-Service Restaurants (FSR) MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Full-Service Restaurants (FSR) MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 21c Museum Hotels

- American Cruise Lines

- Amici Partners Group, LLC

- BBQ Holdings, Inc.

- Best Western International, Inc.

- BJ's Restaurants, Inc.

- Bloomin’ Brands, Inc.

- Brinker International, Inc.

- Carnival Corporation & PLC

- Darden Concepts, Inc.

- Dine Brands Global, Inc.

- Four Seasons Hotels Limited

- Golden Corral Corporation

- Groupe Barrière

- Hilton Worldwide Holdings Inc.

- Hyatt Hotels Corporation

- IHOP Restaurants LLC

- Marriott International, Inc.

- Others