Global Life Sciences BPO Market Analysis By Service Types [Pharmaceutical Outsourcing (Contract Manufacturing Market (API, Finished Dose Form, Packaging), Contract Research Organizations (Drug discovery, Preclinical studies, Clinical trial studies, Regulatory services, Others), Medical Devices Outsourcing(Contract Manufacturing Market (Electronic Manufacturing Services, Finished Goods, Others), Contract Research Organizations (Regulatory Consulting Services, Product Design and Development Services, Product Testing Services, Product Implementation Services, Product Upgrade Services, Others), Contract Sales & Market Outsourcing, Other Services], By Application (Pharmaceuticals, Research and development, Biopharmaceuticals, Other Applications) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 74674

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

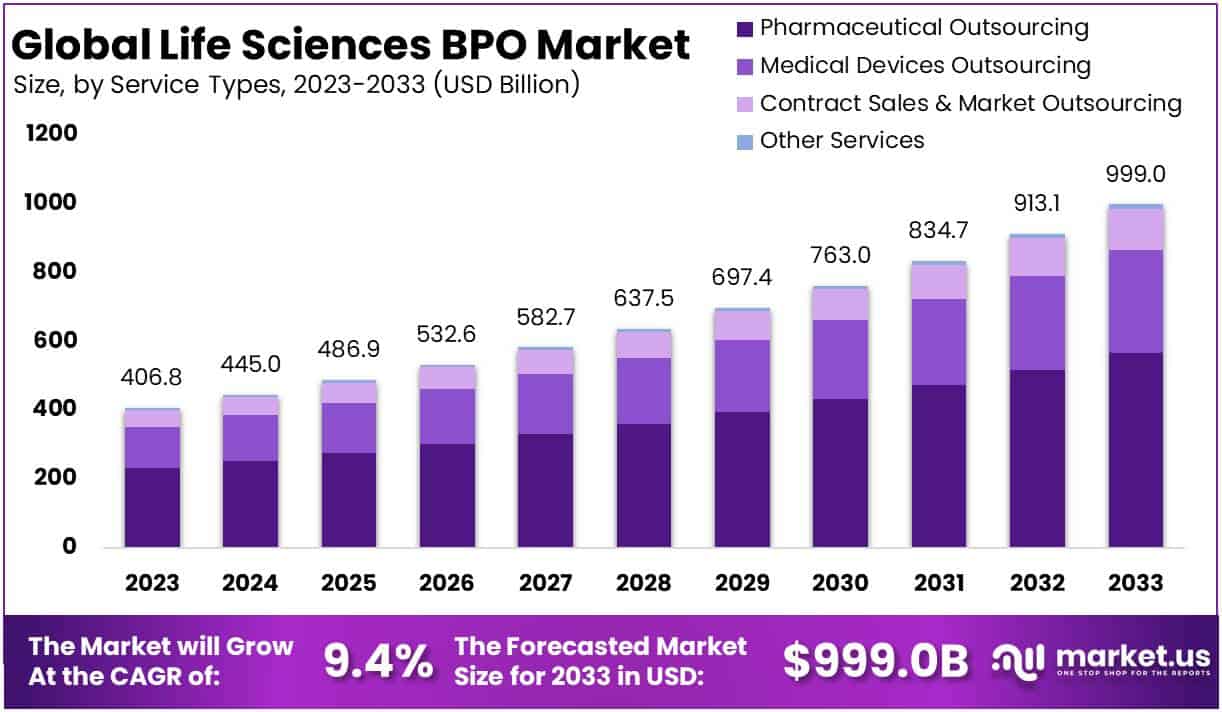

The Life Sciences BPO Market Size is projected to show substantial growth, with an anticipated value of approximately USD 999 billion by 2033, compared to its 2023 value of USD 406.8 billion. This represents a steady Compound Annual Growth Rate (CAGR) of 9.4% expected during the forecast period spanning from 2024 to 2033.

Life Sciences BPO involves outsourcing specific processes within the pharmaceutical, biotech, and healthcare industries to external service providers. This strategic move allows companies in the life sciences sector to concentrate on core functions like research and development. Outsourced areas encompass clinical research, drug discovery support, regulatory affairs, pharmacovigilance, and more.

Services may range from clinical trial management to manufacturing and supply chain operations. This approach enhances efficiency, cuts costs, and accelerates product development. By leveraging specialized expertise, life sciences companies can navigate regulatory complexities effectively, ensuring compliance and timely market entry for their products.

Key Takeaways

- Market Growth Projection: Life Sciences BPO market set to reach USD 999 billion by 2033, with a steady 9.4% CAGR from 2024-2033, up from USD 406.8 billion in 2023.

- Service Types Dominance: In 2023, Pharmaceutical Outsourcing commands 56.7% market share, driven by diverse services like Contract Manufacturing and CROs.

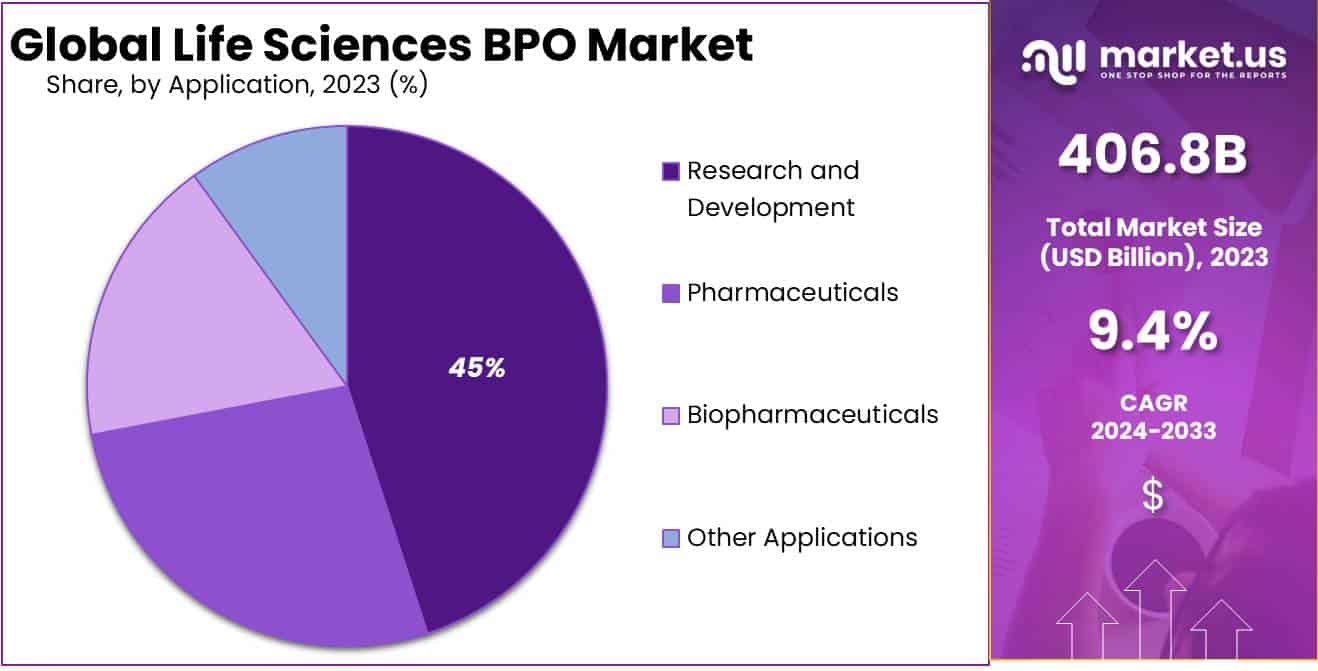

- Application Dominance: Research and Development (R&D) claims a dominant 45% market share, serving as a key innovation driver in life sciences outsourcing.

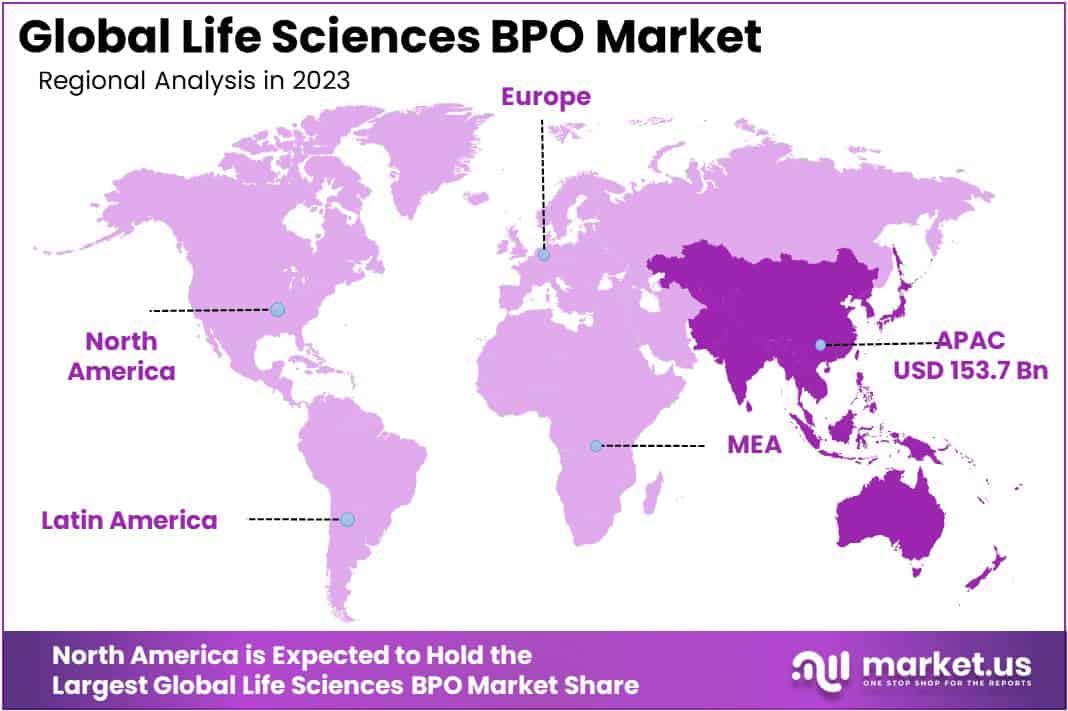

- Regional Market Influence: Asia-Pacific (APAC) secures a leading market position with a substantial 37.8% share in 2023, valued at USD 153.7 billion.

- Cost Efficiency and Focus on Core Competencies: Life Sciences companies outsource non-core functions to reduce operational costs and concentrate on core competencies, fostering innovation.

- Regulatory Compliance Drive: Stringent regulatory requirements propel the demand for BPO services, helping life sciences companies navigate complex landscapes and ensure compliance.

- Technological Advancements Impact: Rapid technological advancements in life sciences necessitate specialized expertise provided by BPO providers, ensuring competitiveness in a dynamic market.

- Globalization’s Role: Global expansion leads life sciences companies to seek BPO services for efficient management of operations, market entry, and localization.

- Data Security Concerns: Sensitive data in life sciences raises concerns, impacting the outsourcing of critical processes due to the risk of breaches and regulatory non-compliance.

- APAC Growth Opportunities: Asia-Pacific offers growth prospects with a skilled workforce, government initiatives, and a favorable regulatory environment, maintaining an influential position in the Life Sciences BPO market.

Service Types Analysis

In 2023, the Pharmaceutical Outsourcing segment emerged as the frontrunner in the Life Sciences BPO Market, commanding a substantial market share of over 56.7%. This dominance can be attributed to its diverse array of services, encompassing Contract Manufacturing, which includes Active Pharmaceutical Ingredients (API), Finished Dose Form, and Packaging.

The Contract Research Organizations (CROs) within the Pharmaceutical Outsourcing segment played a pivotal role, covering essential aspects like Drug Discovery, Preclinical Studies, Clinical Trial Studies, and Regulatory Services. These services not only streamline the drug development process but also ensure compliance with regulatory standards, fostering efficiency and adherence to quality.

Furthermore, the Medical Devices Outsourcing sector exhibited notable growth, encompassing Contract Manufacturing services such as Electronic Manufacturing Services and Finished Goods production. The Contract Research Organizations within this segment offered crucial support through Regulatory Consulting Services, Product Design and Development Services, Product Testing Services, Product Implementation Services, and Product Upgrade Services.

In addition to the core segments, the Contract Sales & Market Outsourcing played a vital role in enhancing market reach and customer engagement for life sciences companies. This segment facilitated effective market penetration and promotional strategies, contributing to the overall growth of the Life Sciences BPO Market.

The comprehensive market landscape also included various other services, highlighting the industry’s dynamic nature. As of 2023, the pharmaceutical outsourcing segment remains a key player, steering the Life Sciences BPO Market towards continued expansion and innovation.

Application Analysis

In 2023, the Life Sciences BPO market showcased a robust landscape, with various applications driving its growth. Among these, the Research and Development (R&D) segment emerged as a frontrunner, commanding a dominant market position by capturing over 45% of the overall market share.

The Research and Development segment serves as the backbone of innovation in the life sciences sector. Companies heavily rely on outsourcing to streamline their research processes, enhance efficiency, and tap into specialized expertise. This segment’s prominence can be attributed to its pivotal role in accelerating drug discovery, fostering technological advancements, and ensuring compliance with stringent regulatory requirements.

Pharmaceuticals, another key application in the Life Sciences BPO market, closely followed the Research and Development segment in market share. With an integral role in drug manufacturing, quality control, and supply chain management, pharmaceutical companies leverage BPO services to optimize costs, maintain regulatory compliance, and enhance overall operational efficiency.

Biopharmaceuticals emerged as a noteworthy segment, showcasing substantial growth in 2023. This application involves the production of therapeutic biological products, such as vaccines and monoclonal antibodies. Outsourcing in the biopharmaceutical sector facilitates scalability, flexibility, and access to specialized skills, contributing to the segment’s market presence.

Beyond the core applications, the Life Sciences BPO market caters to Other Applications, representing a diverse range of services that contribute to the industry’s dynamic ecosystem. These applications may include clinical trials, data management, and regulatory affairs outsourcing. The flexibility offered by BPO services in addressing various aspects of life sciences operations underscores the importance of this segment.

Key Market Segments

Service Types

- Pharmaceutical Outsourcing

- Contract Manufacturing Market

- API

- Finished Dose Form

- Packaging

- Contract Research Organizations

- Drug discovery

- Preclinical studies

- Clinical trial studies

- Regulatory services

- Others

- Contract Manufacturing Market

- Medical Devices Outsourcing

- Contract Manufacturing Market

- Electronic Manufacturing Services

- Finished Goods

- Others

- Contract Research Organizations

- Regulatory Consulting Services

- Product Design and Development Services

- Product Testing Services

- Product Implementation Services

- Product Upgrade Services

- Others

- Contract Manufacturing Market

- Contract Sales & Market Outsourcing

- Other Services

Application

- Pharmaceuticals

- Research and development

- Biopharmaceuticals

- Other Applications

Drivers

Cost Efficiency and Focus on Core Competencies

Life Sciences companies outsource non-core functions to BPO service providers to reduce operational costs and allow internal resources to focus on core competencies like research, development, and innovation.

Increasing Regulatory Compliance Requirements

Stringent regulatory requirements in the life sciences industry drive the demand for BPO services. Outsourcing helps companies navigate complex regulatory landscapes and ensures compliance with changing global standards.

Rapid Technological Advancements

The evolving nature of technology in the life sciences sector necessitates specialized expertise. BPO providers offer access to cutting-edge technologies and skilled professionals, enabling companies to stay competitive in a dynamic market.

Globalization and Market Expansion

Life Sciences companies expanding globally seek BPO services to manage diverse operations efficiently. BPO providers with a global presence facilitate market entry, localization, and management of business processes across different regions.

Restraints

Data Security and Privacy Concerns

The sensitive nature of data in the life sciences industry raises concerns about data security and privacy. Companies may be hesitant to outsource critical functions due to the risk of data breaches and regulatory non-compliance.

Dependency on External Partners

Heavy reliance on BPO partners makes life sciences companies vulnerable to disruptions in case of service provider issues, such as financial instability, operational challenges, or geopolitical uncertainties.

Resistance to Change within Organizations

Internal resistance to outsourcing can be a significant barrier. Employees may resist changes to established workflows, leading to challenges in the adoption of BPO services within life sciences organizations.

Intellectual Property Risks

Life sciences companies deal with proprietary information and intellectual property. Concerns about safeguarding intellectual assets may hinder the outsourcing of certain critical processes to third-party BPO providers.

Opportunities

Emerging Markets and Untapped Regions

Expansion into emerging markets and untapped regions presents significant growth opportunities for life sciences BPO providers. Access to a diverse talent pool and potential for market growth drive the exploration of new geographical areas.

Increasing Demand for Pharmacovigilance Services

The growing emphasis on drug safety and regulatory compliance fuels the demand for pharmacovigilance services. BPO providers specializing in safety monitoring and reporting are well-positioned for growth.

Advanced Analytics and Data Management Services

The increasing reliance on data-driven decision-making in the life sciences sector creates opportunities for BPO providers offering advanced analytics, data management, and real-time insights.

Outsourcing of Clinical Trial Operations

Life sciences companies are increasingly outsourcing clinical trial operations to improve efficiency and reduce costs. BPO providers offering end-to-end clinical trial services stand to benefit from this trend.

Trends

Adoption of Robotic Process Automation (RPA)

The integration of RPA in life sciences BPO processes enhances efficiency by automating routine tasks, reducing errors, and improving overall productivity.

Focus on Patient-Centric Services

BPO providers are aligning their services with a patient-centric approach, emphasizing services that enhance patient engagement, support, and overall experience throughout the product lifecycle.

Collaborations and Partnerships

Increasing collaborations between life sciences companies and BPO providers result in strategic partnerships. This trend fosters innovation, shared resources, and joint efforts in addressing industry challenges.

Customization and Flexibility in Service Offerings

BPO providers are offering more customized and flexible solutions to cater to the specific needs of life sciences clients. This trend reflects the industry’s demand for tailored services that align with unique business requirements.

Regional Analysis

In 2023, the Life Sciences BPO market in the Asia-Pacific (APAC) region showcased a strong performance, securing a dominant market position with an impressive share of over 37.8%. The market’s value in this region reached a substantial USD 153.7 billion for the year.

One of the key factors contributing to APAC’s leading position is the region’s burgeoning pharmaceutical and biotechnology industries. Rapid advancements in research and development activities, coupled with a growing emphasis on outsourcing non-core functions, have fueled the demand for Life Sciences BPO services.

Additionally, the availability of a skilled and cost-effective workforce in countries like India and China has made APAC an attractive hub for outsourcing life sciences processes. This cost advantage has further propelled the region’s market standing, attracting both domestic and international players.

Furthermore, government initiatives supporting the life sciences sector, coupled with favorable regulatory environments, have played a pivotal role in establishing APAC as a powerhouse in the Life Sciences BPO market. The region’s commitment to fostering innovation and collaboration within the life sciences domain has attracted significant investments, further bolstering its market position.

Looking ahead, the Asia-Pacific region is poised for continued growth in the Life Sciences BPO market, driven by a conducive business environment, robust infrastructure, and a sustained focus on technological advancements. As the global life sciences landscape evolves, APAC is likely to maintain its influential position in the market, presenting lucrative opportunities for industry participants.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Atos SE plays a crucial role in the Life Sciences BPO Market, leveraging its expertise in digital transformation and technology solutions. With a focus on innovation, Atos facilitates streamlined processes and efficient data management within the life sciences sector. The company’s commitment to technological advancements positions it as a key player driving digital evolution in life sciences business process outsourcing.

Boehringer Ingelheim International GmbH brings a wealth of experience to the Life Sciences BPO Market, particularly in pharmaceuticals. Known for its research-driven approach, Boehringer contributes significantly to the industry’s growth by fostering collaborations, ensuring compliance, and maintaining high-quality standards. The company’s emphasis on research and development sets it apart as a pivotal player influencing the trajectory of life sciences outsourcing.

Catalent Inc. is a notable player in the Life Sciences BPO Market, specializing in providing advanced delivery technologies and development solutions. With a customer-centric approach, Catalent excels in contract development and manufacturing, offering end-to-end solutions for pharmaceutical and biotechnology companies. The company’s focus on enhancing drug delivery and formulation services positions it as a key enabler of efficiency in life sciences outsourcing.

Parexel International Corporation holds a significant position in the Life Sciences BPO Market, offering comprehensive clinical research and consulting services. With a global presence, Parexel supports the industry by navigating regulatory complexities, conducting clinical trials, and ensuring product success. The company’s commitment to advancing the drug development process underscores its vital role in shaping the landscape of life sciences business process outsourcing.

Beyond the mentioned key players, other contributors in the Life Sciences BPO Market play diverse roles, offering specialized services crucial to the industry’s dynamics. These players bring unique perspectives and capabilities, ranging from data management to regulatory compliance, contributing to the overall growth and innovation within the life sciences outsourcing sector. As the market evolves, the collective impact of these players continues to shape the industry’s landscape, fostering a dynamic and collaborative ecosystem.

Market Key Players

- Atos SE

- Boehringer Ingelheim International GmbH

- Catalent Inc.

- Parexel International Corporation

- IQVIA Inc.

- Lonza Group

- Genpact

- Infosys Limited

- ICON plc

- IBM

Recent Developments

- In October 2023, IQVIA, a prominent healthcare data and analytics company, announced the successful acquisition of CorTrials, a specialized provider of electrocardiogram (ECG) management services. This strategic move is set to fortify IQVIA’s presence in the cardiac clinical trial market, enabling the company to offer comprehensive end-to-end services encompassing ECG data collection, analysis, and reporting.

- In November 2023, Syneos Health, a global contract research organization (CRO), introduced its cutting-edge AI-powered platform named ‘Syneos Reach.’ This innovative platform is meticulously designed to enhance patient recruitment for clinical trials through the utilization of advanced analytics and machine learning. By leveraging these technologies, Syneos Reach aims to identify and engage potential participants more efficiently.

- In December 2023, WNS Global, a leading provider of IT services and Business Process Outsourcing (BPO), inaugurated a state-of-the-art digital lab exclusively dedicated to advancing innovative solutions for the life sciences BPO market. The digital lab’s primary focus revolves around the development of groundbreaking solutions in areas such as robotic process automation (RPA), data analytics, and artificial intelligence. This initiative by WNS Global aims to streamline and enhance life sciences BPO processes through automation and optimization.

Report Scope

Report Features Description Market Value (2023) USD 406.8 Bn Forecast Revenue (2033) USD 999 Bn CAGR (2024-2033) 9.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Types [Pharmaceutical Outsourcing (Contract Manufacturing Market (API, Finished Dose Form, Packaging), Contract Research Organizations (Drug discovery, Preclinical studies, Clinical trial studies, Regulatory services, Others), Medical Devices Outsourcing(Contract Manufacturing Market (Electronic Manufacturing Services, Finished Goods, Others), Contract Research Organizations (Regulatory Consulting Services, Product Design and Development Services, Product Testing Services, Product Implementation Services, Product Upgrade Services, Others), Contract Sales & Market Outsourcing, Other Services], By Application (Pharmaceuticals, Research and development, Biopharmaceuticals, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Atos SE, Boehringer Ingelheim International GmbH, Catalent Inc., Parexel International Corporation, IQVIA Inc., Lonza Group, Genpact, Infosys Limited, ICON plc, IBM and other Key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Life Sciences BPO market in 2023?The Life Sciences BPO market size is USD 406.8 billion in 2023.

What is the projected CAGR at which the Life Sciences BPO market is expected to grow at?The Life Sciences BPO market is expected to grow at a CAGR of 9.4% (2024-2033).

List the segments encompassed in this report on the Life Sciences BPO market?Market.US has segmented the Life Sciences BPO market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Service Types the market has been segmented into Pharmaceutical Outsourcing (Contract Manufacturing Market (API, Finished Dose Form, Packaging), Contract Research Organizations (Drug discovery, Preclinical studies, Clinical trial studies, Regulatory services, Others), Medical Devices Outsourcing(Contract Manufacturing Market (Electronic Manufacturing Services, Finished Goods, Others), Contract Research Organizations (Regulatory Consulting Services, Product Design and Development Services, Product Testing Services, Product Implementation Services, Product Upgrade Services, Others), Contract Sales & Market Outsourcing, Other Services. By Application the market has been segmented into Pharmaceuticals, Research and development, Biopharmaceuticals, Other Applications.

List the key industry players of the Life Sciences BPO market?Atos SE, Boehringer Ingelheim International GmbH, Catalent Inc., Parexel International Corporation, IQVIA Inc., Lonza Group, Genpact, Infosys Limited, ICON plc, IBM and other Key players

Which region is more appealing for vendors employed in the Life Sciences BPO market?North America is expected to account for the highest revenue share of 37.8% and boasting an impressive market value of USD 153.7 billion. Therefore, the Life Sciences BPO industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Life Sciences BPO?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Life Sciences BPO Market.

-

-

- Atos SE

- Boehringer Ingelheim International GmbH

- Catalent Inc.

- Parexel International Corporation

- IQVIA Inc.

- Lonza Group

- Genpact

- Infosys Limited

- ICON plc

- IBM