Global Laundry Care Market Report By Product Type (Laundry Detergents, Laundry Aides, Fabric Softeners & Conditioners, Other Product Types), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 65572

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

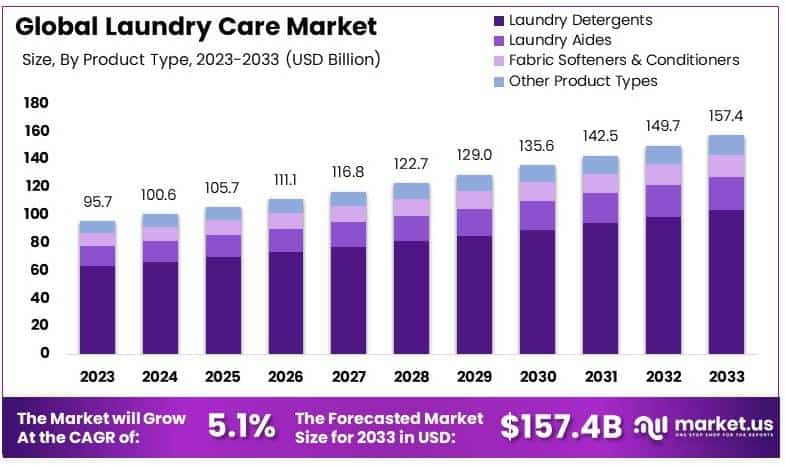

The Global Laundry Care Market size is expected to be worth around USD 157.4 Billion by 2033, from USD 95.7 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Laundry care refers to the products and processes used to clean clothes and fabrics. This includes items like detergents, fabric softeners, and stain removers. These products help in removing dirt, stains, and odors while maintaining the fabric’s quality. Consumers use laundry care products for personal and household laundry tasks to ensure cleanliness and hygiene.

The laundry care market is the global industry that produces and sells products related to washing clothes and fabrics. This market includes detergents, fabric conditioners, stain removers, and other laundry-related items. The market is driven by household needs, product innovations, and consumer preferences for convenient and effective cleaning solutions.

The growth of the laundry care market is influenced by several factors. Rising urbanization and the busy lifestyles of consumers have increased demand for convenient, easy-to-use laundry solutions. Innovations like concentrated detergents, eco-friendly products, and smart packaging have attracted a broad range of consumers. Additionally, the increasing awareness of hygiene and cleanliness is boosting the demand for laundry products across various regions.

Demand for laundry care products remains strong, as these are essential items in every household. The demand is driven by population growth, rising income levels, and changing consumer habits. There is also growing interest in eco-friendly and organic laundry care products as more consumers become conscious of the environmental impact of cleaning products. E-commerce platforms have made it easier for consumers to access a wide variety of laundry care brands, boosting sales.

Eco-friendly detergents, which use natural ingredients like coconut oil or soap nuts, are gaining popularity for their ability to deliver effective cleaning while being gentler on the environment. These products can clean up to 100 loads per package at a cost of around 21 cents per load, making them both cost-effective and sustainable.

Rising access to washing machines globally is also contributing to market growth. In developed regions, ownership of washing machines is high, with around 90% of households in the U.S. and Western Europe having access. In developing countries, access is increasing rapidly. In China, over 70% of households now own a washing machine, and similar trends are emerging in India.

Government regulations related to environmental sustainability are influencing the laundry care industry. In many countries, governments are promoting eco-friendly products by providing incentives for manufacturers to reduce chemical use and adopt biodegradable packaging. These regulations encourage companies to innovate and produce environmentally friendly laundry care products that meet regulatory standards while catering to the eco-conscious consumer base.

Key Takeaways

- Laundry Care Market was valued at USD 95.7 Billion in 2023, and is expected to reach USD 157.4 Billion by 2033, with a CAGR of 5.1%.

- In 2023, Laundry detergents dominate with 66%, reflecting their essential role in everyday household care.

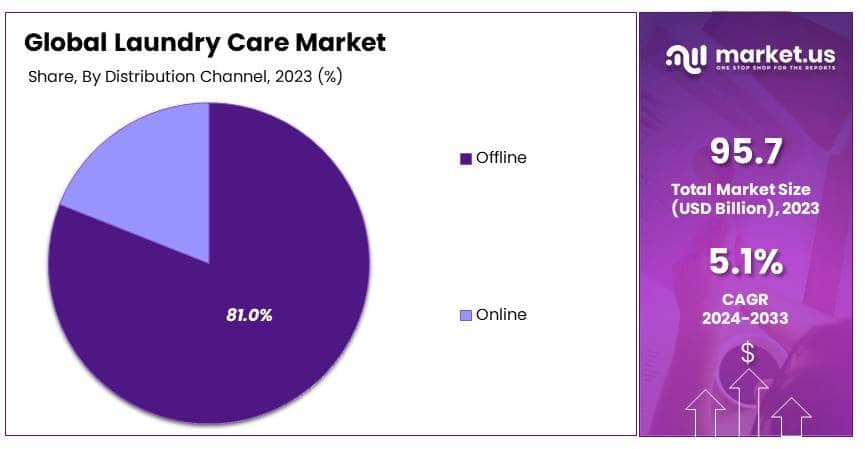

- In 2023, Offline sales lead with 81%, indicating strong customer preference for purchasing laundry care products in physical stores.

- In 2023, Asia Pacific leads with 41% market share, driven by growing population and consumer spending on household products.

Type Analysis

Laundry Detergents dominate with 66% due to high effectiveness and consumer preference.

The laundry care market is broadly categorized by product type, among which Laundry Detergents emerge as the dominant sub-segment, holding a significant 66% market share. This prominence can be attributed to their core effectiveness and the deep-rooted consumer trust established over decades.

Laundry detergents have evolved significantly, incorporating bio-based chemicals and catering to the increasing demand for eco-friendly products. This evolution plays a crucial role in their sustained market dominance, as consumers increasingly prefer products that combine efficiency with environmental responsibility.

Beyond the primary segment of laundry detergents, other product types like Laundry Aides, Fabric Softeners, and Conditioners also contribute to the market dynamics. Laundry Aides, which include stain removers, bleach, and fabric whiteners, enhance the basic functionalities of detergents and are essential for targeted cleaning needs.

Fabric Softeners and Conditioners, known for their attributes that enhance fabric feel and fragrance, cater to a different consumer preference, focusing on comfort and luxury beyond mere cleanliness.

Each of these sub-segments supports the overall growth of the laundry care market by meeting diverse consumer demands and adapting to changing lifestyle trends. The expansion of product lines and innovation in each category—whether for enhanced cleaning power, fabric care, or eco-friendliness—drives the market forward. Companies continue to invest in research and development to improve product efficacy and environmental sustainability, ensuring each sub-segment contributes to the broader market growth.

Distribution Channel Analysis

Offline dominates with 81% due to accessibility and consumer buying habits.

In terms of distribution channels, the Offline segment holds a commanding lead with an 81% share of the laundry care market. This dominance is primarily due to the widespread accessibility of supermarkets, hypermarkets, and convenience stores, which offer consumers the advantage of immediate product access and the ability to physically verify product quality and suitability. Traditional shopping habits also play a significant role, as many consumers prefer purchasing cleaning products during routine shopping trips.

While the Offline channel is predominant, the Online segment is growing rapidly, driven by the digital transformation of retail and the increasing comfort of consumers with online shopping. This shift is supported by the broadening logistics networks and the convenience of home delivery.

The online segment, though smaller in proportion, is vital for future market expansion. It caters to the tech-savvy demographic and is crucial in regions where physical retail infrastructure is less developed.

The relationship between Offline and Online distribution channels is essential for reaching the full spectrum of consumers. The growth in the Online segment does not necessarily cannibalize the Offline market but rather expands the overall market base by providing additional purchasing options.

Key Market Segments

By Product Type

- Laundry Detergents

- Laundry Aides

- Fabric Softeners & Conditioners

- Other Product Types

By Distribution Channel

- Online

- Offline

Driver

Eco-Friendly Product Demand Drives Market Growth

The growing demand for eco-friendly products is a key driver of the laundry care market. Consumers are becoming more aware of environmental concerns, pushing brands to offer biodegradable and plant-based surfactants. This shift towards sustainability has prompted leading companies to innovate and introduce greener products, which are appealing to environmentally conscious consumers.

Technological advancements in detergent formulas have increased the efficiency of eco-friendly products, making them as effective as traditional ones. Increased disposable income, particularly in emerging markets, has also contributed to the demand for premium and eco-friendly products.

Furthermore, aggressive marketing strategies and brand loyalty programs have created consistent demand, leading to market expansion. All these factors are intertwined, fueling steady growth in the laundry care industry, with brands positioning themselves to meet consumer expectations for effective, safe, and environmentally responsible cleaning solutions.

Restraint

Price Sensitivity and Competition Restraints Market Growth

One of the primary restraining factors in the laundry care market is price sensitivity among consumers. Many customers, particularly in price-conscious markets, are reluctant to pay premium prices for detergents, especially given the abundance of low-cost alternatives.

High levels of competition within the market also intensify this issue, with many brands offering similar products, leading to price wars. This competitiveness reduces profit margins for companies, limiting the budget for innovation and marketing.

Furthermore, raw material costs can be volatile, which poses a challenge for maintaining stable pricing. Regulatory restrictions around environmental standards add another layer of complexity, increasing production costs for companies trying to comply with eco-friendly packaging and product guidelines.

Opportunity

Innovation in Organic and Specialty Products Provides Opportunities

The increasing demand for organic and specialty laundry care products offers a significant opportunity for market players. Consumers are more interested in hypoallergenic, fragrance-free, and organic detergents, particularly those that cater to specific needs such as sensitive skin or eco-friendliness.

This shift opens the door for brands to create niche products that address these growing preferences. Additionally, the rising popularity of subscription services for laundry products presents a unique opportunity to capitalize on the convenience trend.

This direct-to-consumer model allows companies to build brand loyalty while reducing reliance on traditional retail channels. Furthermore, expanding into developing markets, where consumer spending is rising, offers significant growth potential for laundry care brands.

Challenge

Raw Material Volatility and Regulatory Compliance Challenges Market Growth

The volatility of raw material costs presents a major challenge in the laundry care market. Many ingredients used in detergents, including petrochemicals, are subject to price fluctuations, which can directly impact production costs.

Furthermore, regulatory compliance adds complexity, as companies must adhere to stringent environmental laws, particularly around biodegradable packaging and formulations. Meeting these requirements often requires additional investment in research and development, which can strain resources.

Additionally, keeping pace with technological advancements is essential for maintaining competitiveness, but it requires significant financial commitment. Finally, the threat of counterfeit products remains a challenge, particularly in developing markets, where cheap alternatives can undermine brand credibility and consumer trust.

Growth Factors

Increased Disposable Income and Urbanization Are Growth Factors

The increase in disposable income and rapid urbanization are key growth factors in the laundry care market. As household incomes rise, particularly in emerging markets, consumers are more willing to spend on premium and specialized laundry products.

This trend is also tied to urbanization, where busy city dwellers seek out convenient, ready-to-use products such as detergent pods and stain removers that save time. The expansion of modern retail formats like supermarkets and online shopping platforms is further boosting sales, making it easier for consumers to access a variety of laundry care products.

Additionally, as more households gain access to washing machines, particularly in developing regions, the demand for laundry detergents and related products is increasing. These factors contribute to the overall market growth, creating opportunities for brands to capitalize on evolving consumer lifestyles and preferences.

Emerging Trends

Sustainable Packaging and Natural Ingredients Are Latest Trending Factor

Sustainable packaging and the use of natural ingredients are among the latest trends driving the laundry care market. With increasing environmental awareness, consumers are looking for products that come in eco-friendly packaging, such as recyclable or biodegradable plastics.

This trend has encouraged many brands to reformulate their packaging strategies to attract green-conscious buyers. Additionally, the use of natural ingredients like essential oils, plant-based surfactants, and organic enzymes is growing, appealing to consumers seeking safer and more eco-friendly products.

Another emerging trend is the popularity of cold-water detergents, which help conserve energy by allowing effective cleaning at lower temperatures. The rise of smart laundry care solutions, such as detergent pods and auto-dosing washing machines, also reflects a shift toward convenience and sustainability.

Regional Analysis

Asia Pacific Dominates with 41% Market Share

Asia Pacific leads the global Laundry Care Market with a 41% market share valued at USD 39.24 Billion. This dominance is driven by a large population base, increasing urbanization, and rising disposable incomes in countries like China and India. The region’s demand for laundry care products is also fueled by changing consumer lifestyles, where convenience and hygiene have become top priorities.

Key factors contributing to this high market share include rapid industrialization and the availability of affordable laundry care products. Consumers in Asia Pacific are increasingly shifting from traditional laundry methods to modern solutions, such as liquid detergents and fabric softeners. The growing influence of e-commerce platforms further boosts product accessibility, expanding the reach of international and local brands across the region.

Market dynamics in Asia Pacific are influenced by diverse consumer preferences, where both premium and budget-friendly laundry products find strong demand. The rise of nuclear families and working professionals in urban areas has led to increased reliance on convenient, time-saving laundry solutions. Moreover, the increasing focus on sustainable products and eco-friendly formulations is pushing manufacturers to innovate.

Regional Mentions:

- North America: North America’s laundry care market is driven by innovation in eco-friendly products and a preference for high-quality, premium detergents. Consumers are increasingly focused on sustainable solutions.

- Europe: Europe’s market emphasizes sustainability, with strong demand for biodegradable and eco-friendly laundry care products. Regulatory frameworks on environmental protection influence product formulations.

- Middle East & Africa: The Middle East & Africa are emerging markets for laundry care, supported by rising urbanization and the increasing availability of modern household products.

- Latin America: Latin America’s laundry care market is gradually expanding, driven by economic recovery and increased access to international brands. Consumer preference leans towards affordable and functional laundry products.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Laundry Care Market is dominated by Procter & Gamble, Unilever, and Henkel AG & Co. KGaA, three global leaders that have established strong market positions through innovation, brand loyalty, and extensive distribution networks. Their strategic focus on product differentiation and sustainability has solidified their leadership in the industry.

Procter & Gamble is a major player in the laundry care market with its iconic brands like Tide and Ariel. P&G’s commitment to innovation and sustainability has allowed it to maintain a significant market share. The company continuously develops new product formulations, such as concentrated detergents and eco-friendly packaging, to meet evolving consumer preferences.

Unilever is another key player, known for its diverse product portfolio, including well-known brands like Persil and Surf. Unilever’s strong focus on sustainability and innovation helps it stay competitive, particularly with the growing demand for environmentally friendly laundry products. Its global reach and strong marketing strategies make it a dominant force in both developed and emerging markets.

Henkel AG & Co. KGaA rounds out the top three with its popular laundry brands like Persil and Purex. Henkel focuses on developing high-performance products that cater to a wide range of consumer needs. Its emphasis on sustainability, particularly in packaging and ingredients, has made it a key player in the shift toward eco-friendly laundry solutions.

These companies dominate the global laundry care market through their strong brands, commitment to sustainability, and innovation, driving growth and maintaining customer loyalty.

Top Key Players in the Market

- Procter & Gamble (Cascade)

- Henkel AG & Co. KGaA (Pril)

- Unilever

- Colgate-Palmolive Company

- SC Johnson and Son Inc.

- Reckitt Benckiser Group PLC (Finish)

- The Clorox Company

- Kao Corporation

- Phoenix Brands

- Other Key Players

Recent Developments

- Samsung: August 2024 – Samsung teased its India-specific AI-powered washing machine, promising to revolutionize laundry routines with advanced features like AI Control and AI Wash. The machine is designed to make washing more efficient and convenient by offering smart features such as real-time adjustments based on load and fabric type, along with energy-saving options through the SmartThings app. This launch continues Samsung’s legacy of innovation in home appliances, targeting the specific needs of Indian consumers.

- Persil and Christian Siriano: 2024 – Persil Laundry Detergent and fashion designer Christian Siriano launched a 24-hour wardrobe refresh hotline via TikTok Live. The hotline allows users to seek quick tips and fashion advice while learning how Persil products can help maintain the freshness of their garments. This campaign is aimed at promoting both the brand’s cleaning efficiency and Siriano’s design expertise in an interactive, real-time platform.

- Procter & Gamble (P&G): 2024 – Procter & Gamble’s professional division expanded its laundry care lineup by adding new products from Tide and Downy. This expansion includes commercial-grade formulations designed to deliver superior cleaning and fabric care for businesses such as hotels and healthcare facilities. P&G aims to provide high-performance, efficient solutions to meet the growing demand for professional-grade laundry products.

- Unilever: 2024 – Unilever introduced the Persil Wonder Wash range, specifically designed for short laundry cycles. These products are optimized to deliver a deep clean in less time, addressing the needs of consumers looking for quicker, energy-efficient laundry options. This launch reflects a growing trend toward sustainability and convenience in household cleaning products.

Report Scope

Report Features Description Market Value (2023) USD 95.7 Billion Forecast Revenue (2033) USD 157.4 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Laundry Detergents, Laundry Aides, Fabric Softeners & Conditioners, Other Product Types), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Procter & Gamble (Cascade), Henkel AG & Co. KGaA (Pril), Unilever, Colgate-Palmolive Company, SC Johnson and Son Inc., Reckitt Benckiser Group PLC (Finish), The Clorox Company, Kao Corporation, Phoenix Brands, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble (Cascade)

- Henkel AG & Co. KGaA (Pril)

- Unilever

- Colgate-Palmolive Company

- SC Johnson and Son Inc.

- Reckitt Benckiser Group PLC (Finish)

- The Clorox Company

- Kao Corporation

- Phoenix Brands

- Other Key Players