Global Large Synchronous Motor Market By Rated Power(25 to 40 MW, 40 to 60 MW, 60 to 80 MW), By Application(Compressor, Pump, Fans, Extruder, Mixers, Conveyors or Belts, Other Applications), By End User(Oil & Gas, Metal & Mining, Paper & Pulp, Chemicals & Petrochemicals, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: April 2024

- Report ID: 73698

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

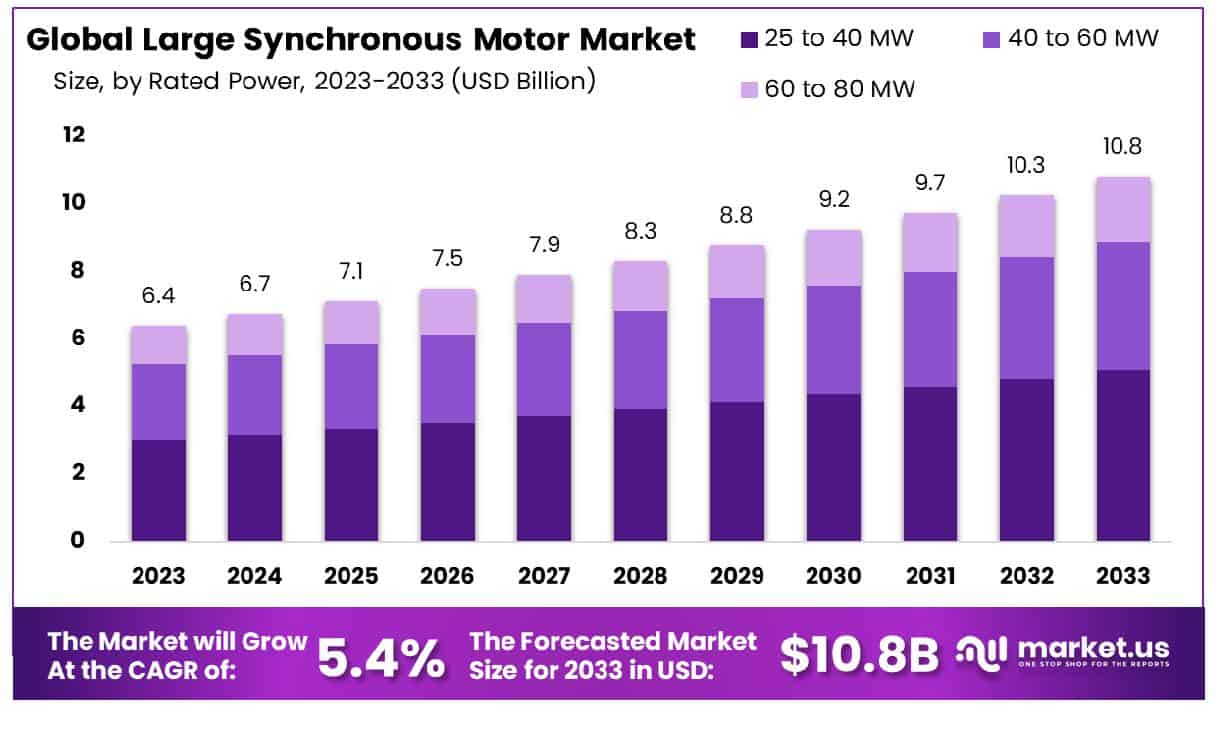

The Global Large Synchronous Motor Market size is expected to be worth around USD 10.8 Billion by 2033, From USD 6.4 Billion by 2023, growing at a CAGR of 5.40% during the forecast period from 2024 to 2033.

The Large Synchronous Motor Market encompasses a specialized segment of the industrial machinery sector, primarily focusing on the production and distribution of synchronous motors of significant power capacity. These motors, characterized by their ability to operate at a constant speed up to their full load, are indispensable in applications requiring precise speed and position control.

This market caters to a diverse array of industries, including manufacturing, energy, mining, and utilities, offering solutions that enhance efficiency, reduce energy consumption, and optimize operational reliability. Key stakeholders, including Product Managers, are pivotal in driving innovations, strategic investments, and adoption of these motors to meet evolving industrial demands and sustainability goals.

The landscape of the Large Synchronous Motor Market is increasingly influenced by the pivotal role renewable energy sources play in the global energy matrix. In 2022, the renewable energy sector witnessed a significant expansion, notably within the solar photovoltaic (PV) domain, which emerged as the preeminent technology in terms of growth, contributing to over half of the new electricity generating capacity.

This surge has elevated solar PV’s contribution to global electricity generation from approximately 3.6% in 2021 to around 4.5% in 2022. Noteworthy is the fact that carbon-neutral generation sources, encompassing nuclear, hydropower, solar PV, wind, and other renewables, constituted over 80% of the capacity expansions observed in the past three years, with solar PV and wind alone driving more than three-quarters of this growth.

The year 2023 marked a continuation of this trend, with renewable electricity capacity additions reaching an estimated 507 gigawatts (GW), nearly 50% higher than the previous year. Looking ahead, forecasts indicate that by 2028, renewables are expected to become the principal power generation source in 68 countries, accounting for 17% of global demand. However, to actualize the ambition of tripling global renewable capacity, a markedly accelerated deployment rate is imperative, particularly within emerging and developing economies.

Key Takeaways

- Market Growth: The Global Large Synchronous Motor Market size is expected to be worth around USD 10.8 Billion by 2033, From USD 6.4 Billion by 2023, growing at a CAGR of 5.40% during the forecast period from 2024 to 2033.

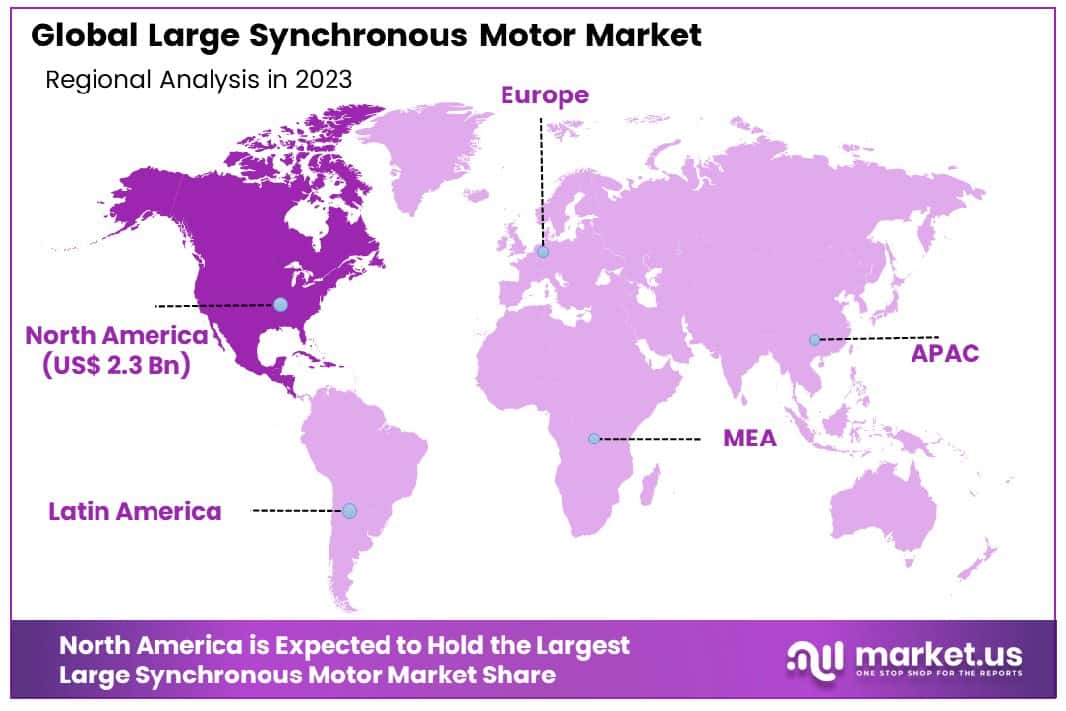

- Regional Dominance: North America holds a 36% share of the Large Synchronous Motor Market.

- Segmentation Insights:

- By Rated Power: The market segment for turbines rated 25 to 40 MW commands a significant 47% share.

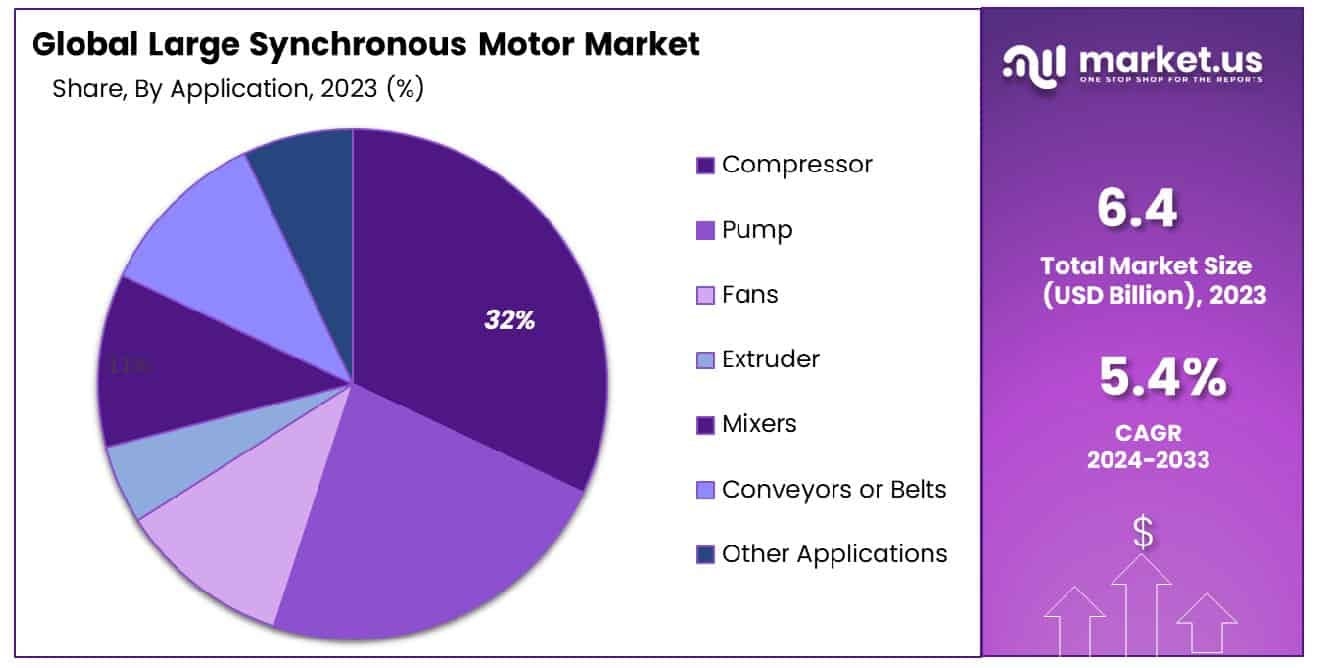

- By Application: In the application category, compressors emerge as a leading sector, capturing 32% of the market.

- By End User: The oil and gas industry constitutes 24% of the end-user segment, showcasing focused demand

- Growth Opportunities: The global large synchronous motor market is set for growth, driven by the integration of renewable energy and the expansion of automation in manufacturing sectors, enhancing efficiency and sustainability.

Driving Factors

Acceleration Through Industrialization and Infrastructure Development

The growth of the Large Synchronous Motor Market is significantly propelled by the ongoing global industrialization and infrastructure development. As economies expand, there’s a marked increase in the demand for high-efficiency, high-torque motors capable of supporting large-scale manufacturing processes and infrastructure projects.

Large synchronous motors, known for their precise speed control and reliability, are increasingly employed in heavy industries such as mining, metals, and energy. This trend not only reflects the direct correlation between industrial growth and demand for these motors but also highlights the pivotal role of synchronous motors in enhancing operational efficiencies and productivity in various sectors.

Electrification of Transportation: A New Frontier

The expansion of the electric vehicle (EV) and hybrid electric vehicle (HEV) market serves as a crucial driving factor for the large synchronous motor market. EVs and HEVs rely on efficient, high-performance motors for propulsion, with synchronous motors being preferred due to their high efficiency and power density. This preference is attributed to their ability to operate at variable speeds and maintain efficiency across a wide range of operating conditions.

As global efforts to reduce carbon emissions intensify, the demand for EVs and HEVs is expected to surge, further fueling the demand for large synchronous motors. This shift towards electrified transportation underscores the strategic importance of synchronous motors in supporting sustainable mobility solutions.

Navigating Through Competitive Waters: Alternative Technologies

The market is also shaped by competition from alternative motor technologies, particularly permanent magnet synchronous motors (PMSMs). PMSMs are gaining traction due to their higher efficiency, smaller size, and lower maintenance requirements compared to traditional synchronous motors. This competitive pressure is prompting manufacturers of large synchronous motors to innovate and improve their offerings, focusing on enhancing efficiency, reducing costs, and meeting the evolving needs of a broad range of industrial applications. The competition not only drives technological advancements but also encourages market players to differentiate themselves through unique value propositions, thereby contributing to the overall growth and dynamism of the Large Synchronous Motor Market.

Restraining Factors

Financial Barriers: The High Cost of Synchronous Motors

The growth of the Large Synchronous Motor Market faces a notable challenge due to the high cost associated with these motors. The advanced manufacturing processes, high-quality materials, and sophisticated control systems required for synchronous motors contribute to their elevated price point. This financial barrier can deter potential adopters, particularly in emerging economies and small to medium-sized enterprises (SMEs) that may find the initial investment prohibitive.

Moreover, the cost factor becomes even more significant when considering large-scale industrial applications that require multiple motors. Despite the long-term savings and efficiency gains offered by these motors, the upfront cost remains a substantial hurdle, impacting the adoption rate and, consequently, the market growth.

The Awareness Gap: Understanding the Benefits of Synchronous Motors

Another critical factor restraining the market growth is the lack of awareness about the benefits of synchronous motors among potential users. Despite their superior efficiency, reliability, and precise speed control capabilities, synchronous motors are often overlooked in favor of more familiar technologies. This knowledge gap is particularly evident in sectors that are traditionally slow to adopt new technologies or in regions where access to information and technical expertise is limited.

The underappreciation of the long-term operational savings and performance enhancements that synchronous motors can offer impedes their market penetration. Addressing this awareness gap through education and demonstrative projects could significantly mitigate this restraining factor, fostering a more favorable environment for market growth.

By Rated Power Analysis

The market share for gas turbines with a rated power of 25 to 40 MW is 47%.

In 2023, the Large Synchronous Motor Market was segmented by rated power into three main categories: 25 to 40 MW, 40 to 60 MW, and 60 to 80 MW. Among these, the 25 to 40 MW category held a dominant market position, capturing more than a 47% share. This segment’s prominence can be attributed to its optimal balance between power output and efficiency, making it highly suitable for a wide range of industrial applications. The versatility and reliability of motors within this power range have facilitated their adoption across various sectors, driving their significant market share.

The 40 to 60 MW segment, while substantial, did not achieve the same level of dominance, reflecting a market preference for the slightly less powerful but more adaptable 25 to 40 MW motors. These mid-range motors are often selected for applications requiring higher power outputs without a significant increase in size or operational costs. However, the specific demands of such applications can vary widely, leading to a more fragmented market share within this segment.

Meanwhile, the 60 to 80 MW segment caters to niche applications that demand high power outputs, such as large-scale industrial processes and heavy machinery operations. Despite its critical role in these specialized areas, the segment represents a smaller portion of the market, likely due to the limited number of applications that require such high levels of power.

By Application Analysis

In the application segment, compressors hold a 32% share of the gas turbine market.

In 2023, the Large Synchronous Motor Market witnessed significant activity across its varied application segments, namely Compressor, Pump, Fans, Extruder, Mixers, Conveyors or Belts, and Other Applications. Among these, the Compressor segment emerged as the preeminent category, securing a dominant market position with more than a 32% share. This prominence can be attributed to the critical role that compressors play in various industrial processes, including air supply for pneumatic tools, refrigeration cycles, and gas compression in the oil and gas sector, thereby driving the demand for large synchronous motors within this application.

Following the Compressor segment, the Pump and Fans categories also exhibited substantial market shares, driven by their essential functions in facilitating fluid movement and ventilation across multiple industries. The Extruder segment, crucial for the plastics and metals industries, along with Mixers, which are vital in the food, pharmaceuticals, and chemicals industries, demonstrated notable market presence, underlining the diverse applications of large synchronous motors.

Conveyors or Belts, essential for material handling across manufacturing units, warehouses, and the logistics sector, further underscored the importance of large synchronous motors in automating and streamlining operations. The ‘Other Applications’ segment, encompassing a broad range of industrial uses, also contributed to the market dynamics, highlighting the versatility and indispensability of large synchronous motors.

By End User Analysis

Gas turbines were found to be the largest end user in the oil and gas sector at 24%.

In 2023, the Large Synchronous Motor Market witnessed significant segmentation by end-user industries, showcasing diverse applications and demand across various sectors. The breakdown of market share by key segments was as follows: Oil & Gas, Metal & Mining, Paper & Pulp, Chemicals & Petrochemicals, Automotive, and Others.

Oil & Gas held a dominant market position, capturing more than a 24% share. This prominence can be attributed to the sector’s requirements for high efficiency, reliability, and the ability to operate in demanding conditions, where large synchronous motors play a critical role in ensuring operational continuity and energy efficiency.

Following closely, the Metal & Mining sector demonstrated a robust demand for large synchronous motors, driven by the need for high torque and precise speed control in heavy-duty applications. This sector’s reliance on large synchronous motors underscores the critical nature of these components in the extraction and processing of minerals.

The Paper & Pulp industry also presented a notable demand, leveraging these motors for their high efficiency and reliability in continuous operation environments. Similarly, the Chemicals & Petrochemicals sector utilized large synchronous motors for their precision and durability, essential in environments requiring stringent control over process conditions.

The Automotive sector’s adoption of large synchronous motors highlighted the industry’s shift towards more energy-efficient and reliable manufacturing processes. Lastly, the “Others” category, encompassing various industries, reflected the versatility and broad application spectrum of large synchronous motors.

Key Market Segments

By Rated Power

- 25 to 40 MW

- 40 to 60 MW

- 60 to 80 MW

By Application

- Compressor

- Pump

- Fans

- Extruder

- Mixers

- Conveyors or Belts

- Other Applications

By End User

- Oil & Gas

- Metal & Mining

- Paper & Pulp

- Chemicals & Petrochemicals

- Automotive

- Others

Growth Opportunities

Renewable Energy Integration

The integration of renewable energy sources presents significant growth opportunities for the global large synchronous motor market. As the world shifts toward sustainable energy solutions, the deployment of large synchronous motors in renewable energy applications, notably in wind turbines and hydroelectric power plants, has seen a substantial increase. These motors are integral in converting natural energy sources into electrical power, offering a reliable and efficient solution for energy generation.

The expansion of renewable energy projects across the globe, driven by governmental policies and environmental concerns, further bolsters the demand for large synchronous motors. Consequently, the market is poised to witness robust growth, underscored by the rising imperative for clean and sustainable energy production.

Automation in Manufacturing

The proliferation of automation across various manufacturing sectors, including automotive, aerospace, and electronics, is another key driver for the large synchronous motor market. The precision and efficiency required in these industries necessitate the use of large synchronous motors. These motors provide the essential torque and speed control needed for high-precision tasks, thereby enhancing production efficiency and product quality.

As manufacturers continue to invest in advanced automation technologies to stay competitive and meet increasing consumer demands, the adoption of large synchronous motors is expected to surge. This trend indicates a promising growth trajectory for the market, fueled by the continuous advancements in manufacturing technologies and the increasing reliance on automation for operational excellence.

Latest Trends

Technological Advances in Manufacturing

Technological advancements within the manufacturing sector have significantly influenced the demand for large synchronous motors in 2023. Innovations in manufacturing technologies have led to the development of more efficient, powerful, and compact synchronous motors. These improvements not only enhance the operational efficiency of various industrial applications but also contribute to energy savings and reduced operational costs.

The incorporation of smart technologies and IoT (Internet of Things) capabilities into large synchronous motors allows for real-time monitoring and control, further driving their adoption across industries. As manufacturing processes become more sophisticated, the demand for technologically advanced large synchronous motors is expected to rise, reflecting the industry’s move towards automation and digitalization.

Focus on High Reliability and High Performance

Market players in the large synchronous motor sector are increasingly focusing on delivering products that offer high reliability and exceptional performance. This trend is in response to the growing demands of industries where downtime can result in significant financial losses. High-performance synchronous motors are being developed to operate under extreme conditions, ensuring uninterrupted production processes.

Additionally, the emphasis on reliability is leading to the production of motors that require minimal maintenance, thereby reducing the total cost of ownership. This shift towards high reliability and performance is not only a response to customer demands but also a strategic move by manufacturers to differentiate their products in a competitive market. As a result, the large synchronous motor market is witnessing the introduction of innovative solutions that promise enhanced operational efficiency and productivity for end-users.

Regional Analysis

North America holds a 36% share of the global large synchronous motor market, indicating robust demand.

The Large Synchronous Motor Market exhibits distinct characteristics and trends across various regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each contributing uniquely to the global market landscape.

In North America, the market is driven by robust industrial automation and the burgeoning renewable energy sector, commanding a dominant 36% share of the global market. The adoption of large synchronous motors in this region is bolstered by advanced manufacturing practices and a strong focus on energy efficiency, particularly in the United States and Canada.

Europe follows closely, with a significant emphasis on innovation and sustainability. The region’s stringent energy consumption regulations and the push for greener manufacturing processes have catalyzed the adoption of energy-efficient large synchronous motors, especially in Germany, France, and the UK. The integration of Industry 4.0 technologies further augments the market’s growth.

The Asia Pacific region is characterized by rapid industrialization and expanding manufacturing sectors, particularly in China, India, and Southeast Asia. This region’s market is propelled by the escalating demand for electric vehicles (EVs), renewable energy installations, and infrastructural development projects, making it a critical area for future market expansion.

The Middle East & Africa, with its growing focus on diversification from oil & gas to renewable energy sources and infrastructure development, shows promising growth potential for the adoption of large synchronous motors, especially in GCC countries and South Africa.

Latin America, though smaller in comparison, is witnessing gradual growth driven by the modernization of its power and manufacturing sectors, particularly in Brazil and Mexico. The region’s focus on energy efficiency and sustainable industrial practices contributes to the demand for large synchronous motors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Large Synchronous Motor Market has witnessed significant development in 2023, with a diversified range of key players contributing to its expansion. ABB, Toshiba Mitsubishi-Electric, and General Electric have been at the forefront, driving innovation with their advanced synchronous motor solutions. These corporations have leveraged their vast resources and extensive R&D capabilities to introduce highly efficient and reliable motors, which are crucial for applications in heavy industries.

Industrial Systems Corporation and Toshiba Corporation have also made notable contributions to the market, particularly in enhancing the energy efficiency and operational reliability of synchronous motors. Their focus on integrating cutting-edge technologies has facilitated the development of motors that meet the increasing demands for sustainability and lower energy consumption.

Hyundai Electric & Energy Systems Co., Ltd, along with VEM Group and Rockwell Automation, have strengthened the market’s competitive landscape by offering a wide range of products tailored to meet the specific needs of diverse industrial sectors. Their commitment to quality and innovation has been instrumental in addressing the evolving challenges of industrial applications.

Siemens AG and Ndec Corporation have emerged as key innovators, focusing on the digitalization of motor solutions. Their emphasis on smart and connected synchronous motors has opened new avenues for optimization and control, enhancing the operational efficiency of industrial processes.

Emerson Electric, along with other key players, has played a pivotal role in advancing the Large Synchronous Motor Market by focusing on customization and flexibility. Their ability to deliver tailored solutions has been critical in meeting the unique requirements of their clients, further driving the market’s growth.

Market Key Players

- ABB

- Toshiba Mitsubishi-Electric

- General Electric

- Industrial Systems

- Corporation

- Toshiba Corporation

- Hyundai Electric & Energy Systems Co., Ltd

- VEM Group

- Rockwell Automation

- Siemens AG

- Ndec Corporation

- Emerson Electric

- Other Key Players

Recent Development

- In January 2024, Electric motor technology showcased at CES 2024 included ZF and Schaeffler’s efficient self-excited synchronous machines, Schaeffler’s innovative direct-injected slot cooling for enhanced cooling, and Magna’s fourth-gen e-motor achieving 96.3% efficiency with optimized cooling and pulse patterns.

- In October 2023, China’s new energy vehicle (NEV) industry leads globally, with major contributions from CATL and BYD in battery production, and NIO, Xpeng, and Li Auto in NEV manufacturing and technological innovation.

- In September 2023, Volkswagen unveiled updates to the ID.4 and ID.5 electric SUV series at IAA Mobility, including more powerful motors, improved batteries, chassis adjustments, and enhanced interior features with the MIB4 infotainment system.

Report Scope

Report Features Description Market Value (2023) USD 6.4 Billion Forecast Revenue (2033) USD 10.8 Billion CAGR (2024-2033) 5.40% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Rated Power(25 to 40 MW, 40 to 60 MW, 60 to 80 MW), By Application(Compressor, Pump, Fans, Extruder, Mixers, Conveyors or Belts, Other Applications), By End User(Oil & Gas, Metal & Mining, Paper & Pulp, Chemicals & Petrochemicals, Automotive, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB, Toshiba Mitsubishi-Electric, General Electric, Industrial Systems, Corporation, Toshiba Corporation, Hyundai Electric & Energy Systems Co., Ltd, VEM Group, Rockwell Automation, Siemens AG, Ndec Corporation, Emerson Electric, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Large Synchronous Motor Market in 2023?The Global Large Synchronous Motor Market size is USD 6.4 Billion in 2023.

What is the projected CAGR at which the Global Large Synchronous Motor Market is expected to grow at?The Global Large Synchronous Motor Market is expected to grow at a CAGR of 5.40% (2024-2033).

List the segments encompassed in this report on the Global Large Synchronous Motor Market ?Market.US has segmented the Global Large Synchronous Motor Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa).By Rated Power(25 to 40 MW, 40 to 60 MW, 60 to 80 MW), By Application(Compressor, Pump, Fans, Extruder, Mixers, Conveyors or Belts, Other Applications), By End User(Oil & Gas, Metal & Mining, Paper & Pulp, Chemicals & Petrochemicals, Automotive, Others)

List the key industry players of the Global Large Synchronous Motor Market?ABB, Toshiba Mitsubishi-Electric, General Electric, Industrial Systems, Corporation, Toshiba Corporation, Hyundai Electric & Energy Systems Co., Ltd, VEM Group, Rockwell Automation, Siemens AG, Ndec Corporation, Emerson Electric, Other Key Players

Name the key areas of business for Global Large Synchronous Motor Market?The US, Canada, Mexico are leading key areas of operation for Global Large Synchronous Motor Market.

Large Synchronous Motor MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

Large Synchronous Motor MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Toshiba Mitsubishi-Electric

- General Electric

- Industrial Systems

- Corporation

- Toshiba Corporation

- Hyundai Electric & Energy Systems Co., Ltd

- VEM Group

- Rockwell Automation

- Siemens AG

- Ndec Corporation

- Emerson Electric

- Other Key Players