Global Laparotomy Sponge Market By Product (Radiopaque laparotomy sponges, Traditional (conventional) laparotomy sponges and Radio-Frequency Identification (RFID) Laparotomy Sponge), By Sterility (Sterile laparotomy sponges and Non-sterile laparotomy sponges), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170685

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

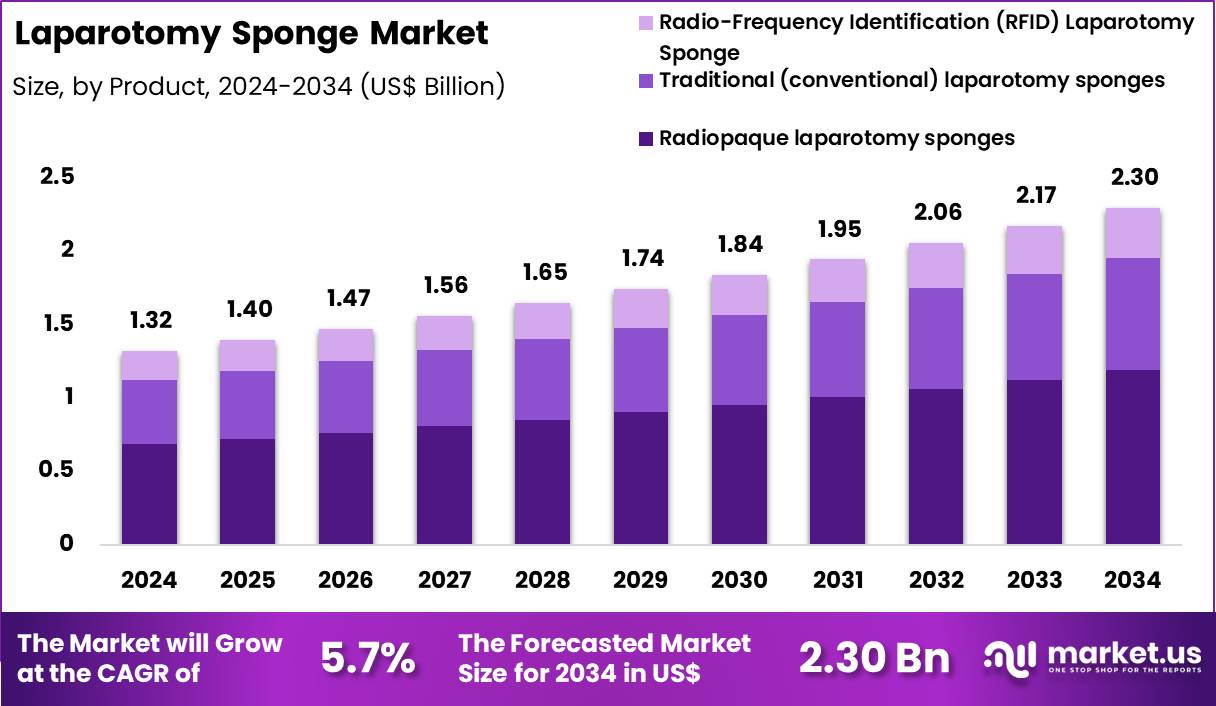

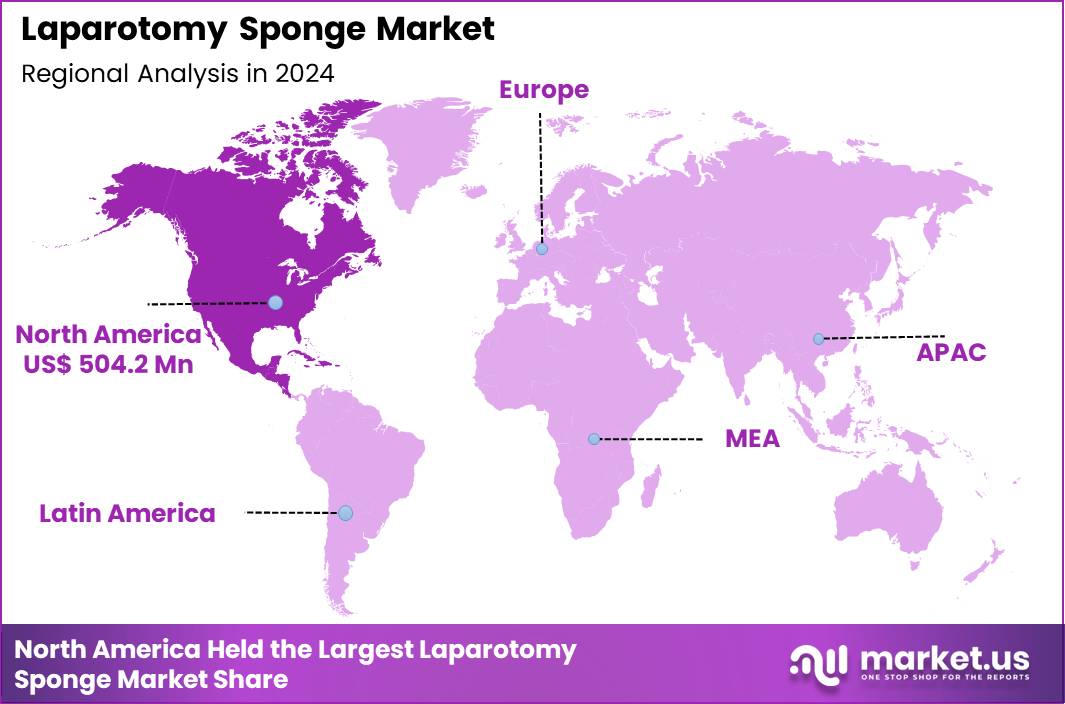

The Global Laparotomy Sponge Market size is expected to be worth around US$ 2.30 Billion by 2034 from US$ 1.32 Billion in 2024, growing at a CAGR of 5.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.2% share with a revenue of US$ 504.2 Million.

A laparotomy sponge, also known as a lap sponge or abdominal pad, is a large, highly absorbent surgical gauze made from 100% cotton, designed for major open procedures like abdominal or thoracic surgeries. It absorbs significant blood and fluids to maintain a clear surgical field, isolates organs, and controls bleeding while minimizing contamination through folded, stitched construction.

The Laparotomy Sponge Market represents a vital segment of surgical consumables used across abdominal, gastrointestinal, obstetric, gynecological, trauma, and emergency surgeries. Laparotomy sponges remain indispensable for absorbing blood, maintaining visibility inside the surgical field, retracting organs, and preventing retained surgical items (RSIs). Growing global surgical volumes, strict operating-room safety regulations, and the rising adoption of radiopaque and RFID-enabled detection systems continue to drive this market.

More than 310 million surgeries are performed globally every year, according to WHO, and over 15% involve abdominal or pelvic interventions directly supporting laparotomy sponge demand. Hospitals also follow strict guidelines for sponge counting and visibility, reinforced by national patient-safety authorities such as the Joint Commission and the WHO Surgical Safety Checklist program. Increasing surgical volumes in oncology, bariatric care, trauma stabilization, cesarean births, and gastrointestinal disease management further elevate sponge utilization across all surgical settings.

Manufacturers continue to develop advanced safety-integrated sponges with radiopaque tagging and RFID detection to eliminate retained surgical items. In several regions, hospitals are transitioning toward electronic sponge-tracking systems after studies showed that up to 1 in every 8,000 procedures may result in a retained item without enhanced detection. Innovation in absorbent multilayer fabrics, low-lint materials, and high-visibility woven markers strengthen performance in high-blood-loss procedures.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.32 billion, with a CAGR of 5.7%, and is expected to reach US$ 2.30 billion by the year 2034.

- The Product segment is divided into Radiopaque laparotomy sponges, Traditional (conventional) laparotomy sponges, and Radio-Frequency Identification (RFID) Laparotomy Sponge, with Radiopaque laparotomy sponges taking the lead in 2024 with a market share of 51.8%

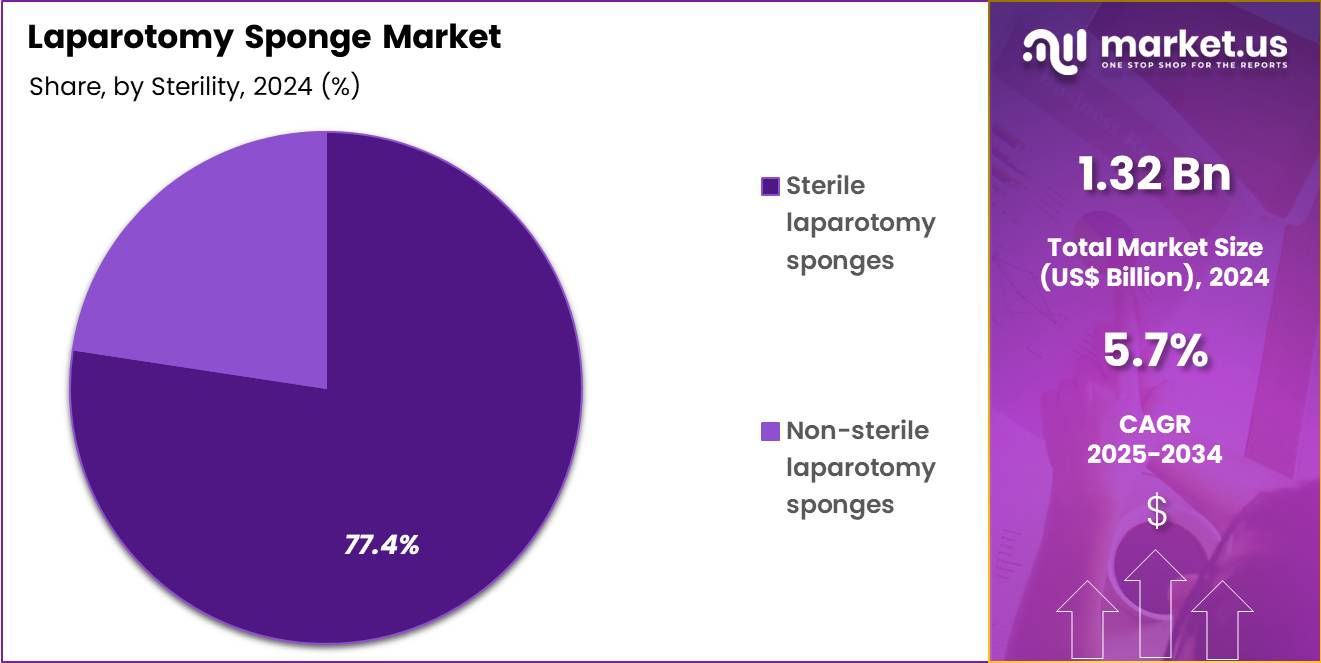

- The Sterility segment is divided into Sterile laparotomy sponges, and Non-sterile laparotomy sponges, with Sterile laparotomy sponges taking the lead in 2024 with a market share of 77.4%

- The End-User segment is divided into Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others, with Hospitals taking the lead in 2024 with a market share of 64.8%

- North America led the market by securing a market share of 38.2% in 2024.

Product Analysis

Radiopaque sponges represent the dominant category accounting for 51.8% market share in 2024 due to strict global safety mandates requiring X-ray–detectable markers for all intraoperative absorbents. Radiopaque stripes significantly reduce the risk of retained surgical items, which account for thousands of preventable adverse events annually. Countries such as the US, UK, Germany, Japan, and Australia mandate radiopaque materials in nearly all abdominal surgeries.

Studies published in surgical-safety journals confirm that up to 70–80% of surgical departments rely exclusively on radiopaque sponges for open procedures. These sponges are heavily used in trauma centers, neurosurgical units, hepatobiliary surgeries, cesarean sections, and oncology operations due to high bleeding risk and extensive field visibility requirements. In March 2020, Endologix® Inc., a developer and marketer of advanced aortic disorder treatments, announced that it received FDA approval for its Alto™ Abdominal Stent Graft System which comprises of abdominal pads and laparotomy sponges.

Traditional sponges are used primarily in cost-sensitive markets and low-risk procedures. They maintain relevance in smaller surgical units and resource-limited settings where radiopaque systems are not mandatory. They are also used in non-invasive wound packing, bedside procedures, or minor surgeries where imaging confirmation is not required. RFID-enabled laparotomy sponges represent the fastest-growing segment.

Operating rooms increasingly adopt electronic sponge-tracking systems after reports indicated that RSIs can cost hospitals millions annually in litigation and corrective action. RFID systems significantly reduce human-counting errors. Case studies from US hospitals show near-zero RSI incidents after implementing RFID systems, prompting rapid adoption in high-volume surgical centers.

Sterility Analysis

Sterile laparotomy sponges account for most of the total usage accounting for 77.4% market share in 2024 due to mandatory aseptic requirements in every surgical intervention. Sterile sponges are individually packed or pre-arranged in sterile kits for open abdominal procedures. Intraoperative use requires maintaining sterility at every stage from incision to closure making sterile absorbents essential. High procedure rates such as globally rising cesarean births (over 29 million annually), appendectomies, cancer resections, cholecystectomies, and gastrointestinal surgeries directly contribute to the high consumption of sterile variants.

Non-sterile sponges are mainly used in preoperative skin preparation, postoperative dressing, wound cleaning, and bedside procedures outside sterile surgical fields. They are valuable in emergency departments for trauma triage, burn units, and routine post-op care. Although they account for lower usage compared to sterile versions, their role is essential in continuous postoperative fluid absorption and wound-care management across hospitals, long-term care facilities, and outpatient surgical units.

End-User Analysis

Hospitals represent the largest end-user segment with a majority market share of 64.8% in 2024 owing to their role as primary centers for major abdominal surgeries. Global hospital surgical volumes continue rising due to higher incidences of colorectal cancer, obstetric surgeries, trauma admissions, and gastrointestinal diseases. Large tertiary hospitals may use thousands of laparotomy sponges daily across ORs, ICUs, trauma bays, transplant units, and emergency theaters. Teaching hospitals and referral centers with high surgical throughput maintain extensive stockpiles and adopt advanced detection systems to eliminate retained surgical items.

ASCs represent the second major segment as minimally invasive abdominal and gynecologic procedures expand. Ambulatory units increasingly manage laparoscopic cholecystectomies, hernia repairs, and gynecologic surgeries that still require laparotomy sponges for port-site bleeding management and intraoperative fluid absorption.

ASCs value cost-efficient sterile sponges and are gradually incorporating radiopaque variants to comply with standardized surgical protocols. Specialty clinics including OB/GYN centers, digestive care units, oncology clinics, and day-surgery facilities use laparotomy sponges for select procedures such as biopsies, hysterectomies, endometriosis surgeries, cyst removals, and other controlled surgical interventions.

Key Market Segments

By Product

- Radiopaque laparotomy sponges

- Traditional (conventional) laparotomy sponges

- Radio-Frequency Identification (RFID) Laparotomy Sponge

By Sterility

- Sterile laparotomy sponges

- Non-sterile laparotomy sponges

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

Drivers

Rising Global Surgical Volumes and Strengthened OR Safety Regulations

Growing global surgical activity is one of the most powerful forces expanding the Laparotomy Sponge Market. According to the World Health Organization, more than 310 million surgeries are performed worldwide every year, and up to 15–20% involve abdominal, pelvic, trauma, or gastrointestinal interventions where laparotomy sponges are mandatory.

Cesarean deliveries alone exceeded 29 million annually, making them one of the most common abdominal procedures globally. Trauma-related surgical demand continues rising, supported by WHO data showing 1.19 million deaths and tens of millions of nonfatal injuries from road accidents each year, many requiring emergency laparotomies.

Safety regulations have accelerated sponge adoption: the Joint Commission identifies retained surgical items (RSIs) as one of the top preventable medical errors, with an estimated 1 in 8,000 cases reporting a retained sponge event when manual counts are used without radiopaque or RFID tracking.

Hospitals in the US, UK, Japan, Australia, and Germany mandate radiopaque tagging for all absorbent surgical materials, creating a global shift toward detectable sponges. Large surgical centers may use hundreds of sponges per operating room per day, reinforcing sustained demand across general surgery, oncology, gynecology, obstetrics, and trauma departments.

Restraints

High Cost of RFID Systems and Operational Challenges in Low-Resource Environments

Despite the strong clinical need, adoption of advanced laparotomy sponge technologies especially RFID-enabled detection systems faces financial and logistical barriers. RFID systems require substantial capital for scanners, tagged sponges, workflow integration, and OR staff training. A single RFID console can exceed USD 25,000–40,000 (equipment cost reference range), making it difficult for small hospitals or facilities in low- and middle-income countries to justify investment. In regions where annual surgical budgets are already strained, hospitals rely heavily on low-cost traditional sponges, increasing RSI risk.

WHO estimates that 5 billion people lack access to safe surgical care, and limited infrastructure in South Asia, Africa, and parts of Latin America constrains adoption of radiopaque or RFID technologies. Operational challenges also persist: manual counting remains error-prone, with studies indicating that up to 88% of retained sponges occur despite count protocols being documented as “correct.”

Staff shortages further amplify this risk, as overstretched OR teams may deviate from best practices. Disposal challenges add regulatory pressure blood-soaked sponges contribute significantly to infectious waste volumes, and improper disposal increases contamination risk. These cumulative restraints slow uniform global adoption of advanced sponge technologies.

Opportunities

Acceleration in RFID-Integrated Surgical Safety and Innovation in Absorbent Materials

The next major growth wave lies in technological modernization of operating rooms. RFID-integrated laparotomy sponges offer near-zero rates of retained surgical items, an issue that previously cost hospitals millions in litigation and corrective action.

Case studies from US hospitals show that RFID adoption helped eliminate RSI incidents entirely across tens of thousands of monitored procedures, enabling hospitals to align with stringent Joint Commission guidelines. As global surgical volume rises, hospitals in Europe, Japan, Singapore, and the Gulf countries are evaluating RFID systems for standardized OR modernization.

In parallel, demand is increasing for super-absorbent, low-lint, antimicrobial-coated multilayer sponges, particularly for high-blood-loss procedures such as liver resections, bariatric surgeries, gynecologic oncology operations, and trauma stabilization. Countries scaling surgical access such as India, Brazil, Indonesia, and Vietnam are constructing new specialty hospitals, creating strong procurement opportunities for sterile radiopaque materials. The growing emphasis on digital OR ecosystems, AI-assisted surgical workflow monitoring, and automated sponge‐count systems directly supports technological upgrades.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic volatility and geopolitical disruption significantly influence the Laparotomy Sponge Market by affecting raw-material availability, production stability, and cross-border logistics. Laparotomy sponges rely heavily on high-quality cotton, and price fluctuations caused by climate extremes in major cotton-producing regions such as India, China, and the US can raise manufacturing costs by 10–25% during volatile seasons.

Geopolitical tensions, port congestion, and trade-route restrictions further delay the shipment of sterile surgical consumables, extending hospital procurement cycles by weeks. During global emergencies, countries frequently impose temporary export bans on surgical supplies, creating sudden shortages for import-dependent regions. Inflationary pressure increases costs for sterilization, packaging films, and radiopaque markers, influencing hospital purchasing behavior.

Workforce shortages in healthcare intensified after the COVID-19 period also increase surgical backlog, indirectly raising sponge usage as procedure volumes rebound. Military conflicts and humanitarian crises escalate demand for trauma surgery materials, further tightening supply chains and amplifying global demand.

Latest Trends

Rapid Shift Toward Smart, Detectable, and High-Performance Surgical Sponges

A major trend shaping the Laparotomy Sponge Market is the global transition toward “smart safety consumables,” driven by digitization of perioperative workflows. Hospitals are shifting from traditional cotton absorbents to radiopaque and RFID-tagged sponges as new studies confirm that detectable materials reduce RSI incidence by up to 97% in high-volume ORs. Several surgical centers now integrate sponge tracking with electronic medical record (EMR) systems, enabling real-time confirmation of sponge counts during closure.

Demand for high-performance sponges with enhanced absorbency, mesh-woven visibility markers, and low-lint fabrics is increasing, especially for oncology, hepatobiliary, and obstetric surgeries. Military and disaster-response medical teams also use high-capacity laparotomy pads for battlefield trauma and hemorrhage control, aligning with global increases in humanitarian surgical missions.

Sustainability is emerging as a secondary trend, with manufacturers exploring biodegradable cotton blends and reduced-waste packaging systems. Meanwhile, specialty hospitals in Japan, Singapore, UAE, and Europe are early adopters of RFID technology as part of “zero-error OR” initiatives. Combined, these innovations reflect a broader movement toward safer, more efficient, tech-enabled operating rooms worldwide.

Regional Analysis

North America is leading the Laparotomy Sponge Market

North America leads the global Laparotomy Sponge Market with 38.2% market share in 2024 due to its exceptionally high surgical load, advanced hospital infrastructure, and strict adherence to operating-room safety protocols. The United States performs more than 50 million surgeries annually, including millions of abdominal, gynecologic, colorectal, trauma, and oncologic procedures where laparotomy sponges are essential. Cesarean deliveries exceed 1.2 million per year, further reinforcing sponge consumption across obstetric departments.

Regulatory oversight from bodies such as the Joint Commission and the American College of Surgeons requires rigorous sponge-count verification, making radiopaque materials the national standard. Many US hospitals have adopted RFID systems to eliminate retained surgical items, after studies showed that RSIs remain among the most reported sentinel events in surgery. High-intensity trauma centers, transplant units, and cancer hospitals maintain large daily sponge inventories. Canada follows similar patient-safety frameworks, with rising surgical volumes linked to aging populations and increased chronic-disease surgical interventions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region, driven by rapid expansion of surgical capacity, population growth, and increasing incidence of cancer, gastrointestinal disease, and trauma cases. India and China together conduct tens of millions of abdominal and obstetric surgeries annually, supported by growing hospital networks and improved access to surgical care.Cesarean deliveries alone in India exceed 5 million per year, significantly increasing sponge utilization in maternity wards. Rising road-traffic injuries over 2.3 million annual serious injuries across South and Southeast Asia also boost demand for high-absorbency sponges in emergency surgeries. Governments in Japan, South Korea, Singapore, and Australia enforce strict surgical-safety standards, accelerating adoption of radiopaque and RFID-enabled detection systems.

Medical tourism hubs such as Thailand and Malaysia further increase surgical throughput, particularly in bariatric, gynecologic, and gastrointestinal procedures. Growing private hospital investments and OR modernization initiatives continue to position Asia Pacific as the region with the strongest long-term growth momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Medtronic plc, Owens & Minor, Inc., Integra LifeSciences, Medical Action Industries, Inc., B. Braun Melsungen AG, Cardinal Health, DeRoyal Industries, Inc., Stryker Corporation, Dynarex Corporation, BSN Medical GmbH, VWR International, Derma Sciences, Prestige Ameritech, Medline Industries, LP, Smith & Nephew, 3M Company, and Others.

Medtronic plc plays an influential role in the surgical consumables ecosystem through its extensive presence in operating-room solutions, surgical technologies, and standardized procedural kits that often include laparotomy sponges. Its strong integration in general surgery, gynecology, and gastrointestinal procedures reinforces procurement continuity across major hospitals worldwide.

Owens & Minor, Inc. is one of the largest global distributors of sterile surgical supplies, providing high-volume laparotomy sponge distribution to hospitals, ambulatory centers, and integrated delivery networks. Its ability to manage large-scale logistics, sterile packaging, and OR-specific product lines ensures consistent availability across the US and international markets.

Integra LifeSciences contributes through its advanced surgical products portfolio, including wound management materials, specialty absorbents, and OR safety solutions used in trauma, neurosurgery, and complex abdominal procedures. Its focus on high-performance surgical tools and hospital partnerships strengthens its relevance in the laparotomy sponge demand chain, particularly in specialty surgical centers.

Top Key Players

- Medtronic plc

- Owens & Minor, Inc.

- Integra LifeSciences

- Medical Action Industries, Inc.

- B. Braun Melsungen AG

- Cardinal Health

- DeRoyal Industries, Inc.

- Stryker Corporation

- Dynarex Corporation

- BSN Medical GmbH

- VWR International

- Derma Sciences

- Prestige Ameritech

- Medline Industries, LP

- Smith & Nephew

- 3M Company

- Others

Recent Developments

- In November 2024, Stryker introduced the next-generation SurgiCount+ platform, which unifies sponge tracking and blood loss assessment to enhance surgical safety and streamline operating room workflows. The system merges SurgiCount’s RFID-based sponge monitoring with Triton’s real-time blood loss measurement, helping cut surgical counting errors and saving as much as 10 minutes per procedure.

- In November 2021, the Hartmann Group introduced its new ‘Vivano’ abdominal pad, designed with a highly absorbent core and a non-adherent wound contact layer to support effective wound care. The launch strengthens the company’s portfolio by adding a more advanced and efficient solution for its customer base.

- In June 2021, 3M rolled out its Tegaderm Absorbent Clear Acrylic Dressing pad to support improved wound management. The introduction broadens the company’s wound care portfolio and strengthens its overall market position.

Report Scope

Report Features Description Market Value (2024) US$ 1.32 Billion Forecast Revenue (2034) US$ 2.30 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Radiopaque laparotomy sponges, Traditional (conventional) laparotomy sponges and Radio-Frequency Identification (RFID) Laparotomy Sponge), By Sterility (Sterile laparotomy sponges and Non-sterile laparotomy sponges), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic plc, Owens & Minor, Inc., Integra LifeSciences, Medical Action Industries, Inc., B. Braun Melsungen AG, Cardinal Health, DeRoyal Industries, Inc., Stryker Corporation, Dynarex Corporation, BSN Medical GmbH, VWR International, Derma Sciences, Prestige Ameritech, Medline Industries, LP, Smith & Nephew, 3M Company, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medtronic plc

- Owens & Minor, Inc.

- Integra LifeSciences

- Medical Action Industries, Inc.

- B. Braun Melsungen AG

- Cardinal Health

- DeRoyal Industries, Inc.

- Stryker Corporation

- Dynarex Corporation

- BSN Medical GmbH

- VWR International

- Derma Sciences

- Prestige Ameritech

- Medline Industries, LP

- Smith & Nephew

- 3M Company

- Others