Global Lactose-Free Butter Market By Product Type (Spreadable Butter, Non-spreadable Butter), By Type (Salted, Unsalted Butter), By Nature ( Organic Butter, Conventional Butter), By Source (Cream, Milk, Skimmed, Others), By End-use (HoReCa or Foodservice Sector, Household or Retail Sector, Food Industry, Bakery and Confectionery Industry, Meat Products Industry, Infant Formula Industry, Dessert Making, Others), By Distribution Channel (Hypermarkets or Supermarkets, Convenience Stores, Specialty Stores, Independent Retailers, Online Retailers, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158574

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

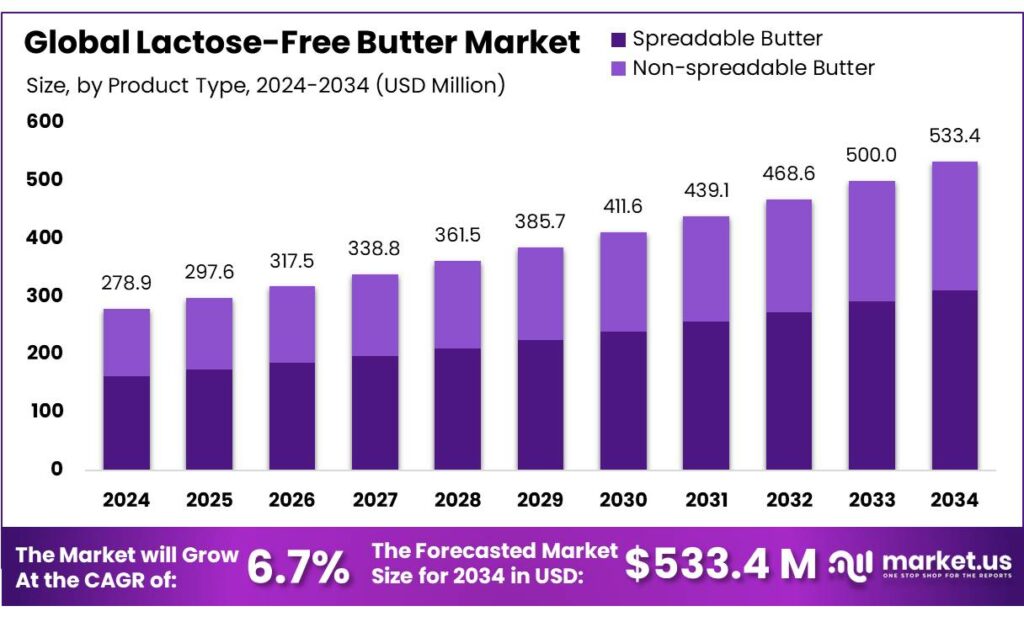

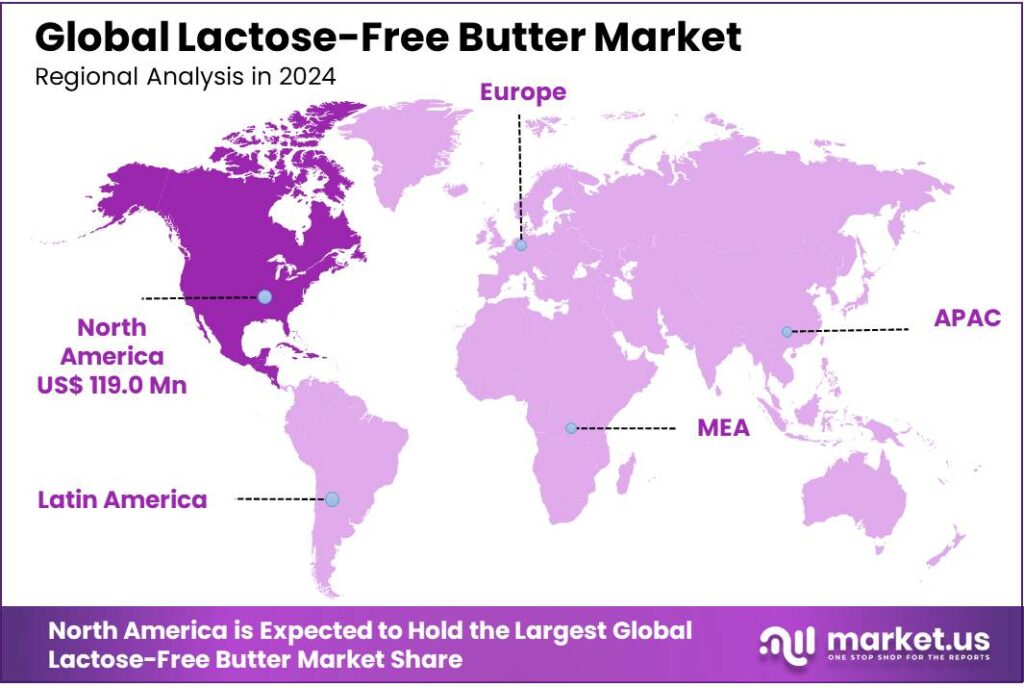

The Global Lactose-Free Butter Market size is expected to be worth around USD 533.4 Million by 2034, from USD 278.9 Million in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.7% share, holding USD 119 Million in revenue.

Lactose-free butter has emerged as a significant segment within India’s dairy industry, catering to the growing number of lactose-intolerant consumers. This product is produced by enzymatically treating traditional butter to break down lactose, making it digestible for individuals with lactose sensitivity. The demand for lactose-free dairy products has been rising, driven by increased awareness of lactose intolerance and a shift towards health-conscious dietary choices.

Driving factors for this market include the increasing prevalence of lactose intolerance, which affects a significant portion of the global population. In the United States, for example, the lactose-free and lactose-reduced dairy milk market has seen a 14% growth over the past year, with products like Fairlife and Lactaid contributing to this surge.

In India, the dairy sector is undergoing a transformation, with regions like Gujarat emerging as key agro-dairy hubs. The state government has identified North Gujarat as a focal point for agro-dairy development, emphasizing the importance of dairy value chains. Under the One District One Product (ODOP) initiative, Aravalli district is promoting potato-based products, including sugar-free potatoes, which have been exported to 12 countries in 2024-25. Additionally, Banaskantha district, known for its substantial potato production, is also a significant player in the dairy industry, supported by over 1,600 cooperatives and more than 300,000 farmers.

The demand for lactose-free butter is primarily driven by the growing prevalence of lactose intolerance, which affects a significant portion of the global population. For instance, in Latin America, particularly in Brazil, approximately 50 to 60% of the population is lactose intolerant, leading to increased demand for lactose-free dairy products. Furthermore, the rise of veganism and plant-based diets contributes to the popularity of lactose-free butter as a suitable alternative for those avoiding traditional dairy products.

- For instance, the Odisha state government plans to distribute 10,000 high-yielding cows to farmers under the Mukhyamantri Kamadhenu Yojana, aiming to increase daily milk production from 72 lakh litres to 165 lakh litres by 2036 and 274 lakh litres by 2047.

Key Takeaways

- Lactose-Free Butter Market size is expected to be worth around USD 533.4 Million by 2034, from USD 278.9 Million in 2024, growing at a CAGR of 6.7%.

- Spreadable lactose-free butter is projected to command a significant portion of the market, capturing approximately 55% of the global share.

- Salted lactose-free butter captured a dominant 67.9% share of the global lactose-free butter market.

- Conventional lactose-free butter is projected to dominate the market, capturing approximately 78% of the global share.

- Cream-based lactose-free butter is projected to hold a dominant position in the global market, capturing more than a 57.5% share.

- Household or Retail sector is projected to hold a dominant position in the global lactose-free butter market, capturing more than a 44% share.

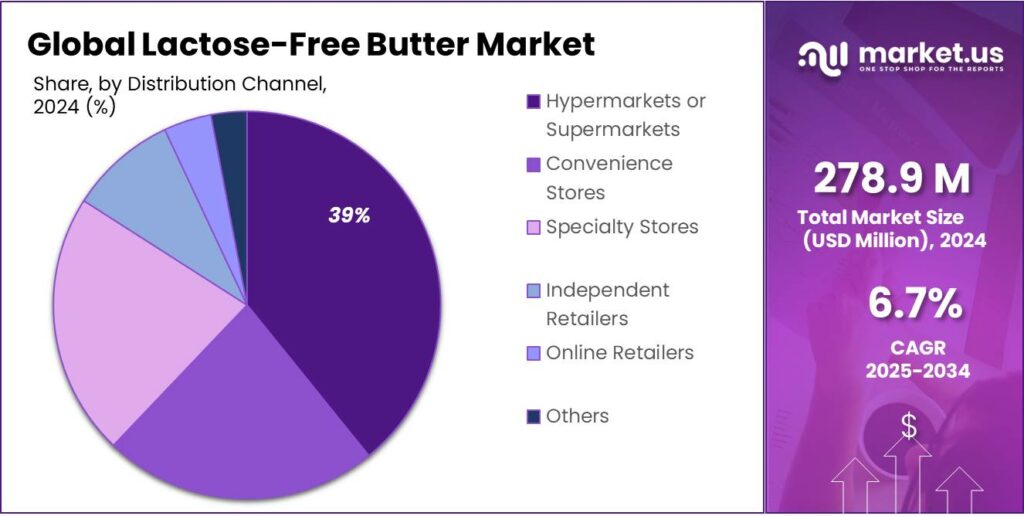

- Hypermarkets and supermarkets captured a dominant 39.3% share of the global lactose-free butter market.

- North America emerged as the dominant region in the global lactose-free butter market, capturing a substantial 42.7% share, equivalent to approximately USD 119 million.

By Product Type Analysis

Spreadable Butter Leads with 55% Market Share in 2025

In 2025, spreadable lactose-free butter is projected to command a significant portion of the market, capturing approximately 55% of the global share. This dominance is attributed to its convenience and versatility, making it a preferred choice among consumers seeking easy-to-use, lactose-free alternatives. The spreadable form aligns well with the increasing demand for products that cater to lactose-intolerant individuals without compromising on taste or texture.

The rise in popularity of spreadable lactose-free butter is also influenced by changing dietary habits and a growing awareness of lactose intolerance. As more consumers seek lactose-free options, manufacturers have responded by enhancing the spreadability and flavor profiles of their products, thereby expanding their appeal. This trend is expected to continue, with spreadable lactose-free butter maintaining a leading position in the market in the coming years.

By Type Analysis

Salted Lactose-Free Butter Dominates with 67.9% Market Share in 2024

In 2024, salted lactose-free butter captured a dominant 67.9% share of the global lactose-free butter market. This preference is primarily driven by its versatility and familiarity in culinary applications, making it a staple in households and foodservice establishments alike. The salted variant’s ability to enhance flavor profiles in cooking and baking has contributed significantly to its widespread adoption.

This growth is fueled by increasing consumer awareness of lactose intolerance and a growing demand for dairy alternatives that do not compromise on taste or functionality. The salted variant’s established presence in the market positions it well to capitalize on these trends.

By Nature Analysis

Conventional Lactose-Free Butter Leads with 78% Market Share in 2025

In 2025, conventional lactose-free butter is projected to dominate the market, capturing approximately 78% of the global share. This substantial market presence is attributed to its affordability and widespread availability, making it a preferred choice among consumers seeking lactose-free alternatives without a premium price tag. Compared to organic options, conventional lactose-free butter is more accessible to a broader range of consumers, contributing to its dominance in the market.

The affordability of conventional lactose-free butter appeals to individuals with lactose intolerance who wish to maintain the sensory and culinary qualities of butter without experiencing digestive discomfort. This has led to a significant increase in demand, particularly in regions where lactose intolerance is prevalent. The product’s widespread acceptance and familiarity among consumers further bolster its market position.

By Source Analysis

Cream-Based Lactose-Free Butter Captures 57.5% Market Share in 2025

In 2025, cream-based lactose-free butter is projected to hold a dominant position in the global market, capturing more than a 57.5% share. This preference is primarily attributed to the rich texture and superior mouthfeel that cream imparts to the butter, making it a preferred choice among consumers and manufacturers alike. Established manufacturers often opt for cream as a source due to its consistency and the high-quality product it yields.

The use of cream in lactose-free butter production aligns with consumer expectations for taste and texture, which are crucial factors in the adoption of lactose-free alternatives. As awareness of lactose intolerance continues to rise, the demand for lactose-free products that do not compromise on sensory qualities is expected to grow, further solidifying the position of cream-based butter in the market.

By End-use Analysis

Household & Retail Sector Leads with 44% Market Share in 2025

In 2025, the Household or Retail sector is projected to hold a dominant position in the global lactose-free butter market, capturing more than a 44% share. This significant market presence is primarily driven by increasing consumer awareness of lactose intolerance and a growing preference for lactose-free alternatives in home cooking and baking. As more individuals seek to manage their dietary restrictions without compromising on taste or convenience, lactose-free butter has become a staple in many households.

The rise in demand for lactose-free butter in the retail sector is also supported by the expansion of distribution channels. Supermarkets, hypermarkets, and specialty stores have increasingly stocked lactose-free options, making them more accessible to a broader consumer base. Additionally, the growth of e-commerce platforms has further facilitated consumer access to these products, catering to the increasing preference for online shopping.

By Distribution Channel Analysis

Hypermarkets & Supermarkets Lead with 39.3% Market Share in 2024

In 2024, hypermarkets and supermarkets captured a dominant 39.3% share of the global lactose-free butter market. This significant presence is attributed to their extensive reach, established consumer trust, and the ability to offer a wide range of lactose-free butter products. These retail formats provide consumers with convenient access to lactose-free options, catering to the growing demand driven by increasing awareness of lactose intolerance.

The dominance of hypermarkets and supermarkets is further supported by their strategic locations, often situated in high-traffic areas, which enhance visibility and accessibility for consumers. Additionally, these retail channels frequently feature promotional activities and discounts, making lactose-free butter more appealing to budget-conscious shoppers.

Key Market Segments

By Product Type

- Spreadable Butter

- Non-spreadable Butter

By Type

- Salted

- Unsalted Butter

By Nature

- Organic Butter

- Conventional Butter

By Source

- Cream

- Milk

- Skimmed

- Others

By End-use

- Hotel, Restaurant, & Café (HoReCa) or Foodservice Sector

- Household or Retail Sector

- Food Industry

- Bakery and Confectionery Industry

- Meat Products Industry

- Infant Formula Industry

- Dessert Making

- Others

By Distribution Channel

- Hypermarkets or Supermarkets

- Convenience Stores

- Specialty Stores

- Independent Retailers

- Online Retailers

- Others

Emerging Trends

Growing Demand for Lactose-Free Butter

Lactose-free butter is emerging as a significant trend in the global dairy market, driven by increasing consumer awareness of lactose intolerance and a growing demand for dietary inclusivity. As more individuals seek alternatives to traditional dairy products, lactose-free butter is gaining popularity among consumers who wish to enjoy the rich taste of butter without the digestive discomfort associated with lactose.

Government initiatives and industry support play a crucial role in promoting the availability and accessibility of lactose-free dairy products. Policies aimed at increasing awareness of lactose intolerance and supporting the production of specialty dairy products contribute to the growth of the lactose-free butter market. Additionally, collaborations between dairy producers and retailers are enhancing the distribution of lactose-free butter, making it more accessible to a broader consumer base.

Manufacturers are responding to consumer demand by introducing a variety of lactose-free butter products. Innovations include unsalted and skimmed versions, catering to health-conscious consumers aiming to control sodium and fat intake. Additionally, the availability of lactose-free butter in convenient formats like sticks is enhancing its appeal for baking and cooking purposes

Drivers

Rising Prevalence of Lactose Intolerance

Lactose intolerance is a significant global health concern, affecting approximately 68% of the world’s population. This condition arises from the body’s inability to digest lactose, a sugar found in milk and dairy products, leading to symptoms like bloating, diarrhea, and abdominal pain. The prevalence varies by region, with higher rates observed in Asia and Africa, and lower rates in Northern Europe. This widespread issue has led to an increased demand for lactose-free dairy products, including butter, as consumers seek alternatives that align with their dietary needs.

In response to this growing demand, several government initiatives have been implemented to support the dairy industry and promote the production of lactose-free products. For instance, the Government of India has launched the Rashtriya Gokul Mission (RGM) to enhance milk production and improve the genetic quality of dairy animals. Additionally, the National Programme for Dairy Development (NPDD) aims to modernize dairy infrastructure and promote value-added dairy products. These initiatives not only support the dairy sector but also encourage the development of specialized products like lactose-free butter to cater to the needs of lactose-intolerant consumers.

The increasing prevalence of lactose intolerance, coupled with supportive government policies, is driving the growth of the lactose-free butter market. As awareness of lactose intolerance rises and more consumers seek suitable alternatives, the demand for lactose-free butter is expected to continue its upward trajectory. This trend presents opportunities for dairy producers to innovate and expand their product offerings to meet the evolving needs of the market.

Restraints

High Production Costs: A Key Challenge for Lactose-Free Butter

One of the primary challenges hindering the widespread adoption of lactose-free butter is its elevated production cost compared to traditional butter. The process of removing lactose from dairy products involves advanced techniques such as enzymatic hydrolysis, where lactase enzymes are added to break down lactose into simpler sugars. This enzymatic treatment can increase production expenses by up to 30%, making the final product more expensive for consumers

This cost disparity is particularly pronounced in developing markets, where price sensitivity is higher, and consumers may be less willing to pay a premium for lactose-free options. For instance, in India, the average price of regular butter is approximately ₹400 per kilogram, while lactose-free butter can cost up to ₹600 per kilogram, representing a 50% price increase. Such a significant price difference can deter potential buyers, limiting the market’s growth potential.

To address these challenges, various government initiatives have been introduced to support the dairy industry and promote the production of specialized products like lactose-free butter. In the United States, the Dairy Business Innovation (DBI) Initiatives provide direct technical assistance and subawards to dairy businesses, including those focusing on niche dairy products such as lactose-free butter. These initiatives aim to assist in the development, production, marketing, and distribution of dairy products, thereby helping to offset some of the additional costs associated with specialized dairy production

Opportunity

Government Support and Infrastructure Development: Catalysts for Lactose-Free Butter Growth

A significant opportunity for the lactose-free butter market lies in the robust support provided by government initiatives aimed at enhancing dairy infrastructure and promoting specialized dairy products. In India, for instance, the government has introduced several schemes to bolster the dairy sector, including the Rashtriya Gokul Mission (RGM), which focuses on improving the genetic quality of indigenous cattle, and the National Programme for Dairy Development (NPDD), which aims to modernize dairy infrastructure and promote value-added dairy products. These initiatives not only support the dairy industry but also create an enabling environment for the production of specialized products like lactose-free butter.

In Gujarat, North Gujarat has emerged as a key agro-dairy hub, supported by over 1,600 cooperatives and more than 3 lakh farmers. The region is home to Banas Dairy, India’s largest dairy, and produces a wide range of dairy products, including lactose-free butter. The state’s focus on dairy development, coupled with the One District One Product (ODOP) initiative, which promotes the export of value-added products, has further bolstered the growth of the lactose-free butter market in the region.

Such government support and infrastructure development play a crucial role in reducing production costs, enhancing product availability, and fostering innovation in the lactose-free butter segment. As these initiatives continue to evolve, they are expected to drive further growth and expansion of the lactose-free butter market, making it more accessible to a broader consumer base.

Regional Insights

North America Leads the Lactose-Free Butter Market with 42.7% Share in 2024

In 2024, North America emerged as the dominant region in the global lactose-free butter market, capturing a substantial 42.7% share, equivalent to approximately USD 119 million in market value. This significant market presence is primarily driven by a growing awareness of lactose intolerance among consumers and an increasing preference for lactose-free alternatives in dietary choices.

The United States, in particular, plays a pivotal role in this regional dominance, with a substantial consumer base actively seeking lactose-free products. The rise in demand is further supported by the expansion of distribution channels, including supermarkets, hypermarkets, and online retail platforms, making lactose-free butter more accessible to a broader audience.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Land O’Lakes is a prominent U.S.-based cooperative known for its dairy products, including lactose-free butter options. The company offers a range of lactose-free butter products, catering to consumers with dietary restrictions. Their products are widely available across various retail channels, making them accessible to a broad audience.

Arla Foods is a major dairy cooperative offering lactose-free butter products under the Arla Lactofree brand. Their lactose-free butter is made from natural ingredients and is designed to provide the taste and texture of regular butter without lactose. Arla Foods emphasizes sustainability and quality in their production processes.

Ornua is Ireland’s largest exporter of dairy products, including lactose-free butter. Their butter is made from the milk of grass-fed cows, offering a rich and creamy taste. Ornua’s lactose-free butter products are available in various markets, reflecting the company’s global reach and commitment to quality.

Top Key Players Outlook

- Land O’Lakes, Inc.

- Lactalis Group

- Arla Foods

- Ornua Co-operative Limited

- Organic Valley

- Flora Food Group

- Miyoko’s Creamery

- Daiya Foods

- Upfield

- Challenge Dairy Products

Recent Industry Developments

In 2024, Ornua reported a group turnover of €3.4 billion and an operating profit of €149.8 million, reflecting a solid performance despite challenging market conditions

In 2024 Arla Foods, reported a total revenue of €13.8 billion and a net profit of €401 million, reflecting its robust financial performance.

Report Scope

Report Features Description Market Value (2024) USD 278.9 Mn Forecast Revenue (2034) USD 533.4 Mn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Spreadable Butter, Non-spreadable Butter), By Type (Salted, Unsalted Butter), By Nature ( Organic Butter, Conventional Butter), By Source (Cream, Milk, Skimmed, Others), By End-use (HoReCa or Foodservice Sector, Household or Retail Sector, Food Industry, Bakery and Confectionery Industry, Meat Products Industry, Infant Formula Industry, Dessert Making, Others), By Distribution Channel (Hypermarkets or Supermarkets, Convenience Stores, Specialty Stores, Independent Retailers, Online Retailers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Land O’Lakes, Inc., Lactalis Group, Arla Foods, Ornua Co-operative Limited, Organic Valley, Flora Food Group, Miyoko’s Creamery, Daiya Foods, Upfield, Challenge Dairy Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Land O'Lakes, Inc.

- Lactalis Group

- Arla Foods

- Ornua Co-operative Limited

- Organic Valley

- Flora Food Group

- Miyoko's Creamery

- Daiya Foods

- Upfield

- Challenge Dairy Products