Laboratory Centrifuge Market By Product Type (Equipment and Accessories), By Technology (Floor-Standing Centrifuges and Benchtop Centrifuges), By Application (Microbiology, Proteomics, Diagnostics, Genomics, and Others), By End-use (Preclinical Centrifuges, General Purpose Centrifuges, and Clinical Centrifuges), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144485

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Application Analysis

- End-Use Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in the Laboratory Centrifuge Market

- Recent Developments

- Report Scope

Report Overview

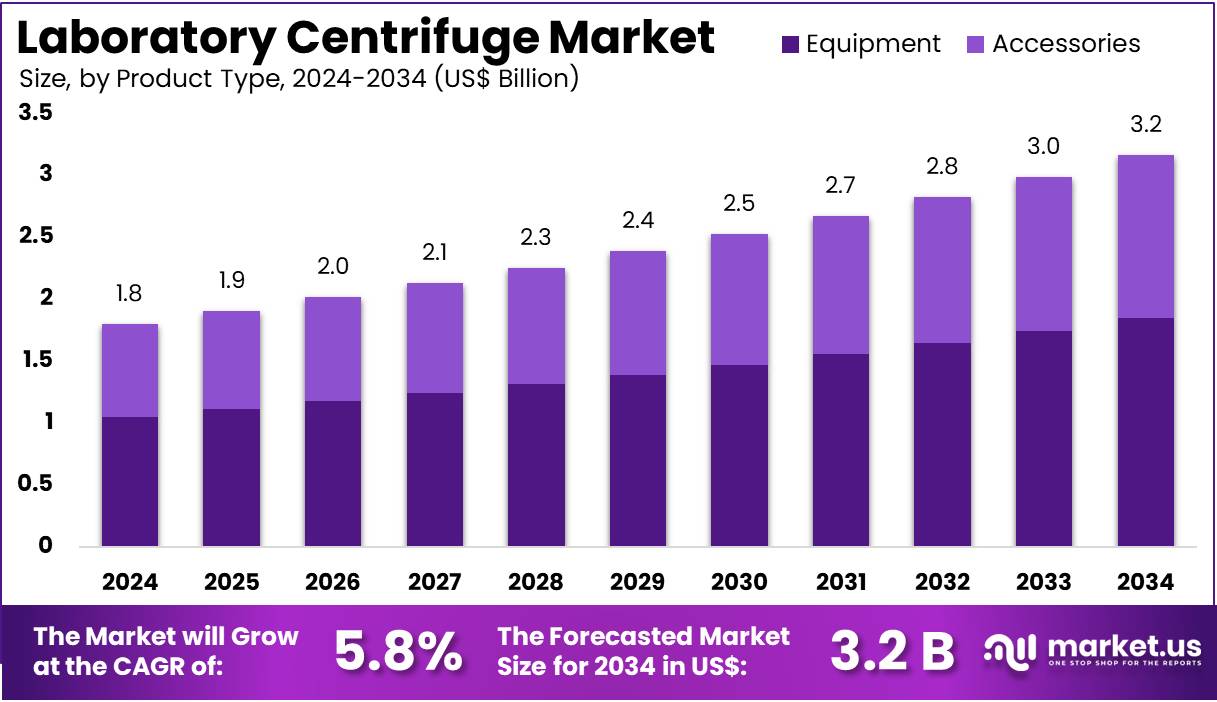

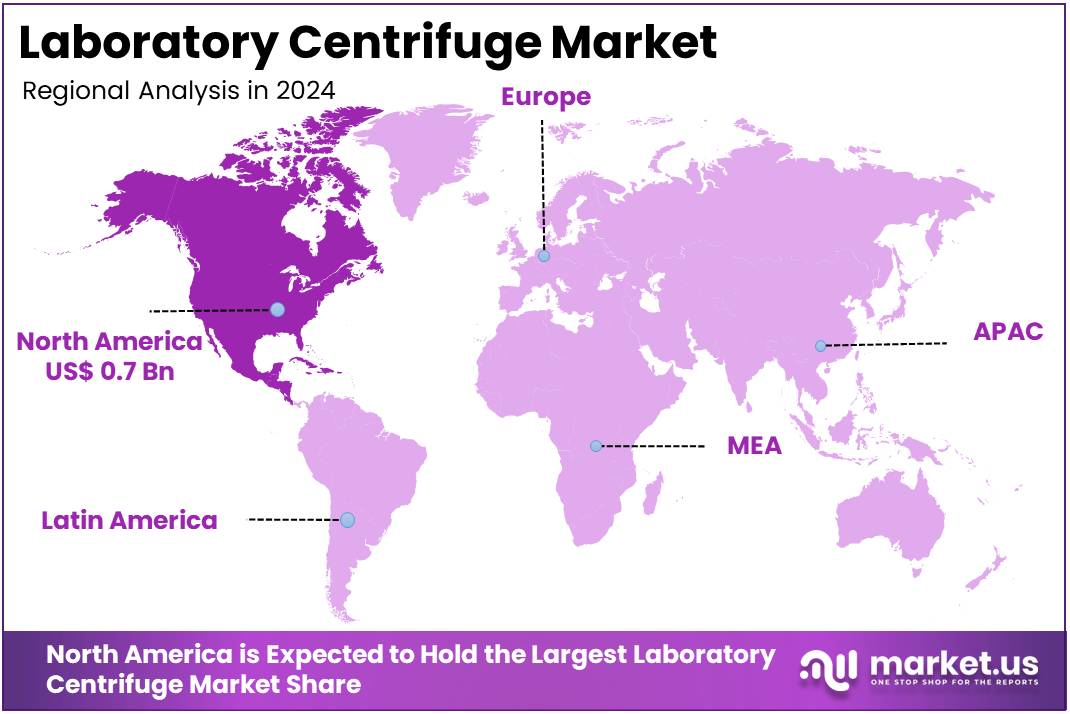

The Laboratory Centrifuge Market Size is expected to be worth around US$ 3.2 billion by 2034 from US$ 1.8 billion in 2024, growing at a CAGR of 5.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 41.1% share, and holds a US$ 0.7 Billion market value for the year.

Growing demand for precision in scientific research and healthcare applications is driving the laboratory centrifuge market. These versatile devices are essential for separating different components of liquids, such as plasma, serum, and cells, which is crucial in fields like biotechnology, clinical diagnostics, and pharmaceutical research. Laboratory centrifuges support applications in areas including cell biology, molecular biology, and clinical laboratories, where accurate separation of substances is critical for analysis.

In January 2024, Hettich Group expanded its capabilities by acquiring Kirsch Medical, a company specializing in laboratory cooling and freezing technologies. This acquisition enhances Hettich’s product portfolio, particularly in improving the development of advanced laboratory centrifuges and creating new solutions for healthcare and research laboratories.

Additionally, the growing emphasis on personalized medicine and biotechnology research provides ample opportunities for market growth, as laboratories require more advanced equipment to process specialized samples. Technological advancements, such as automation and integrated systems, are expected to improve the efficiency and performance of laboratory centrifuges, further supporting their widespread adoption across industries.

Key Takeaways

- In 2024, the market for laboratory centrifuge generated a revenue of US$ 1.8 billion, with a CAGR of 5.8%, and is expected to reach US$ 3.2 billion by the year 2033.

- The product type segment is divided into equipment and accessories, with equipment taking the lead in 2024 with a market share of 58.3%.

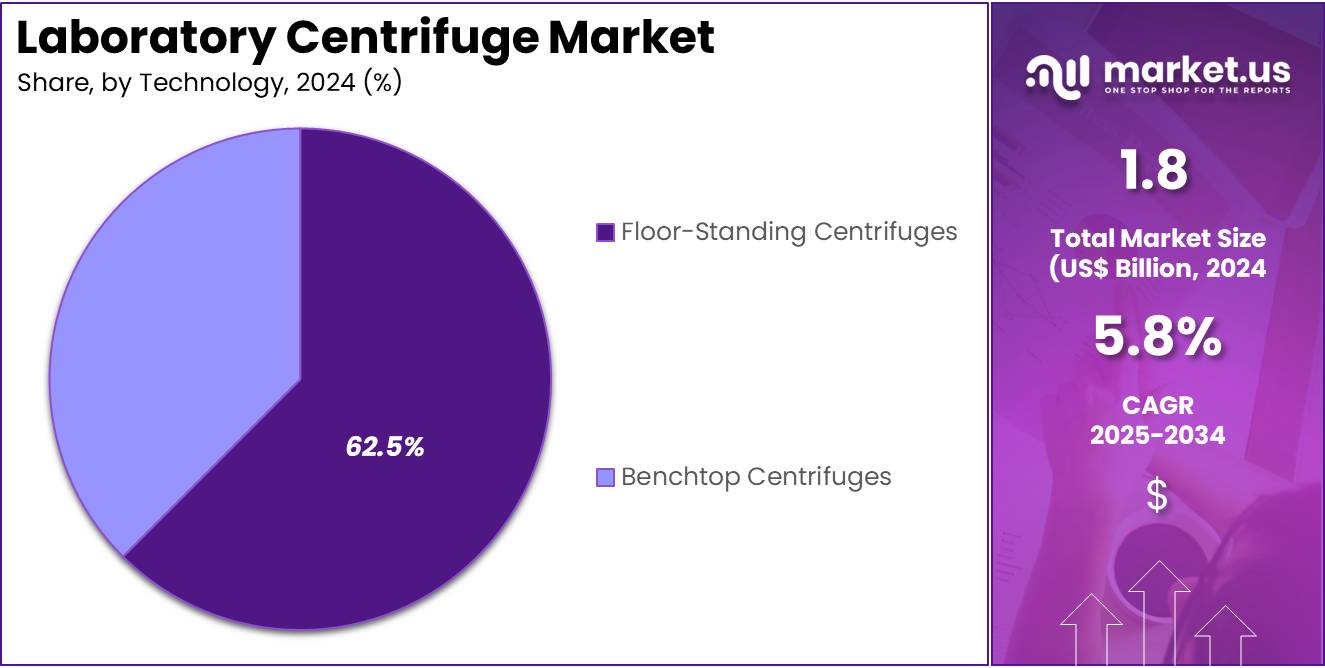

- Considering technology, the market is divided into floor-standing centrifuges and benchtop centrifuges. Among these, floor-standing centrifuges held a significant share of 62.5%.

- Furthermore, concerning the application segment, the market is segregated into microbiology, proteomics, diagnostics, genomics, and others. The microbiology sector stands out as the dominant player, holding the largest revenue share of 47.3% in the Laboratory Centrifuge market.

- The end-use segment is segregated into preclinical centrifuges, general purpose centrifuges, and clinical centrifuges, with the clinical centrifuges segment leading the market, holding a revenue share of 55.2%.

- North America led the market by securing a market share of 41.1% in 2024.

Product Type Analysis

The equipment segment led in 2024, claiming a market share of 58.3% as laboratories continue to require precise and reliable tools for sample preparation and analysis. Centrifuge equipment plays a crucial role in various applications, including separating blood components, isolating DNA, and purifying proteins. As laboratory practices evolve, the demand for more advanced and efficient centrifuge equipment is likely to rise, particularly in research settings and clinical diagnostics.

Furthermore, the growing focus on automating laboratory processes and increasing throughput in research and medical facilities is projected to drive the growth of the equipment segment, as centrifuges are key components in high-throughput screening and diagnostics.

Technology Analysis

The floor-standing centrifuges held a significant share of 62.5% due to the increased need for high-capacity and powerful centrifugation systems in laboratories. Floor-standing centrifuges, which offer higher speeds and larger sample volumes compared to benchtop models, are likely to see growing adoption in research facilities, clinical labs, and pharmaceutical applications.

As the complexity of experiments and the volume of samples increase, researchers will seek out larger, more efficient centrifuges. Additionally, the demand for high-throughput testing in various sectors, including genomics and biotechnology, is expected to drive the growth of the floor-standing centrifuges segment, offering enhanced performance and versatility for large-scale applications.

Application Analysis

The microbiology segment had a tremendous growth rate, with a revenue share of 47.3% owing to the increasing need for centrifugation in microbiological research and diagnostics. Centrifuges are widely used to separate and isolate microbial cultures, blood samples, and other biological materials, which are essential for accurate diagnostics and research.

As the global demand for faster and more accurate diagnostic testing grows, particularly in the wake of public health crises, the role of centrifuges in microbiology labs is expected to expand. Additionally, the growing focus on infectious disease detection, antibiotic resistance studies, and microbial genomics is likely to drive the demand for advanced laboratory centrifuges in microbiology applications.

End-Use Analysis

The clinical centrifuges segment grew at a substantial rate, generating a revenue portion of 55.2% as clinical laboratories and healthcare facilities continue to expand their diagnostic and testing capabilities. Clinical centrifuges are essential for processing blood and urine samples, isolating plasma, and preparing samples for diagnostic analysis.

With the rise in chronic diseases, aging populations, and the increasing need for diagnostic testing, the demand for clinical centrifuges is expected to increase. Furthermore, as healthcare providers move toward more personalized medicine and faster diagnostic processes, the use of clinical centrifuges is likely to grow. These factors, along with the push for automation and efficiency in clinical labs, are projected to drive the growth of the clinical centrifuge segment.

Key Market Segments

By Product Type

- Equipment

- Accessories

By Technology

- Floor-Standing Centrifuges

- Benchtop Centrifuges

By Application

- Microbiology

- Proteomics

- Diagnostics

- Genomics

- Others

By End-use

- Preclinical Centrifuges

- General Purpose Centrifuges

- Clinical Centrifuges

Drivers

Rising Demand for Advanced Diagnostics is Driving the Market

The increasing need for advanced diagnostic techniques is a major driver for the laboratory centrifuge market. Centrifuges play a critical role in medical research, drug development, and clinical diagnostics, particularly in areas like genomics, proteomics, and blood sample analysis. The COVID-19 pandemic accelerated the demand for centrifuges, as they were essential for vaccine development and testing.

In 2022, Thermo Fisher Scientific reported a significant increase in sales of their centrifuges, driven by demand from biopharmaceutical companies and research institutions. The US National Institutes of Health also highlighted the importance of centrifugation in advancing biomedical research, further fueling market growth. This trend continues into 2024, with key players like Eppendorf and Beckman Coulter expanding their product portfolios to meet the growing demand.

Restraints

High Costs and Maintenance Requirements are Restraining the Market

The high initial cost and ongoing maintenance requirements of laboratory centrifuges act as significant restraints. Advanced centrifuges, especially ultracentrifuges, can cost tens of thousands of US dollars, making them inaccessible for smaller laboratories and research facilities. Additionally, regular maintenance and the need for specialized training increase operational costs.

In 2023, a survey conducted by the American Association for Clinical Chemistry revealed that 40% of small laboratories cited cost as a barrier to adopting high-performance centrifuges. Companies like Sigma Laborzentrifugen have acknowledged these challenges, focusing on developing cost-effective models to address affordability concerns. Despite these efforts, the high cost remains a limiting factor, particularly in developing regions.

Opportunities

Expansion in Biopharmaceutical Research is Creating Growth Opportunities

The biopharmaceutical sector presents significant growth opportunities for the laboratory centrifuge market. Centrifuges are indispensable in processes like cell culture, protein purification, and vaccine production. The global push for biopharmaceutical innovation, driven by increasing investments in R&D, has boosted demand for advanced centrifugation technologies.

In 2023, the European Federation of Pharmaceutical Industries and Associations reported a 15% increase in R&D spending, directly impacting the demand for centrifuges. Companies like Sartorius and Andreas Hettich have introduced specialized centrifuges tailored for biopharmaceutical applications, catering to this growing market. This trend is expected to continue, with the biopharmaceutical sector driving innovation and adoption of centrifugation technologies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the laboratory centrifuge market. Economic growth in emerging markets, such as India and Brazil, has increased investments in healthcare infrastructure, driving demand for centrifugation equipment. However, rising inflation and supply chain disruptions, exacerbated by geopolitical tensions, have led to increased production costs and delayed deliveries.

For instance, the Russia-Ukraine conflict disrupted the supply of critical components like motors and rotors in 2022, impacting manufacturers globally. On the positive side, government initiatives in North America and Europe, such as increased funding for biomedical research, have created new opportunities. Despite challenges, the market remains resilient, with technological advancements and strategic collaborations ensuring sustained growth.

Latest Trends

The adoption of Compact and Benchtop Models is a Recent Trend

The shift toward compact and benchtop centrifuges is a prominent trend in the market. These models are gaining popularity due to their space-saving design, ease of use, and versatility. In 2023, Eppendorf launched a new line of benchtop centrifuges, reporting a 20% increase in sales within the first six months. Similarly, Beckman Coulter introduced a compact model designed for small laboratories, which saw strong demand in emerging markets.

The trend aligns with the growing need for portable and efficient laboratory equipment, particularly in settings with limited space. This innovation is reshaping the market, with manufacturers focusing on developing user-friendly and space-efficient solutions to meet diverse customer needs.

Regional Analysis

North America is leading the Laboratory Centrifuge Market

North America dominated the market with the highest revenue share of 41.1% owing to increased demand in biomedical research, pharmaceuticals, and clinical diagnostics. The National Institutes of Health (NIH) reported a 12% rise in funding for life sciences research in 2024, with a significant portion allocated to advanced laboratory equipment, including centrifuges.

The US Food and Drug Administration (FDA) approved over 50 new biologics and biosimilars in 2023, many of which required centrifugation for development and quality control, as highlighted in their annual report. Additionally, the Centers for Disease Control and Prevention (CDC) expanded its use of centrifuges for pathogen analysis and vaccine development, with a 15% increase in equipment procurement in 2022.

The Canadian Institutes of Health Research (CIHR) also invested US$30 million in 2023 to upgrade laboratory infrastructure, including high-speed centrifuges, to support cutting-edge research. These factors, combined with advancements in centrifuge technology and the growing emphasis on precision medicine, have significantly contributed to the market’s expansion in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding healthcare infrastructure, rising pharmaceutical production, and increasing research activities. The Indian Council of Medical Research (ICMR) announced a 20% increase in funding for biomedical research in 2023, with a focus on advanced laboratory equipment. Similarly, the Chinese Academy of Sciences (CAS) reported a 25% rise in the deployment of centrifuges for drug discovery and genomics research in 2022.

Japan’s Ministry of Health, Labour, and Welfare (MHLW) allocated US$45 million in 2023 to enhance laboratory capabilities, including the procurement of high-performance centrifuges. The Australian Government’s National Health and Medical Research Council (NHMRC) invested US$45 million in 2023 to enhance laboratory capabilities, including the procurement of high-performance centrifuges.

Additionally, the NHMRC invested US$35 million in 2022 to support research infrastructure, emphasizing the need for modern centrifugation systems. These investments, alongside rapid advancements in biotechnology and increasing government support for scientific research, are expected to drive significant growth in the laboratory centrifuge market across the Asia Pacific region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the laboratory centrifuge market focus on product innovation, technological advancements, and expanding their global footprint to drive growth. They invest in developing high-performance, energy-efficient centrifuges with enhanced capabilities, such as temperature control and automated features, to meet the growing demands of the research and healthcare sectors.

Companies also diversify their product offerings to cater to various industries, including pharmaceuticals, biotechnology, and clinical diagnostics. Strategic collaborations with research institutions, hospitals, and universities help accelerate product adoption and expand market reach. Additionally, targeting emerging markets with increasing investments in research and healthcare infrastructure supports further market expansion.

Eppendorf AG, headquartered in Hamburg, Germany, is a leading global provider of laboratory equipment, including centrifuges, pipettes, and bioreactors. The company’s centrifuges are widely used in clinical, research, and industrial applications for tasks such as cell separation and DNA extraction. Eppendorf focuses on innovation and precision, offering both traditional and high-speed centrifuges designed to meet the needs of diverse laboratory environments. The company continues to expand its global presence through strategic partnerships, product development, and a strong focus on sustainability and customer satisfaction.

Top Key Players in the Laboratory Centrifuge Market

- Sigma Laborzentrifugen GmbH

- Sartorius AG

- QIAGEN

- KUBOTA Corporation

- Hettich Group

- HERMLE Labortechnik GmbH

- Eppendorf

- Cardinal Health

Recent Developments

- In July 2024, the Hettich Group, known for its laboratory centrifuges, formed a strategic alliance with Bregal Unternehmerkapital. This collaboration will leverage Bregal’s global network to drive Hettich’s expansion, particularly targeting new growth opportunities in regions such as Asia and the U.S., enhancing both organic and inorganic development efforts.

- In April 2023, Eppendorf introduced the Centrifuge 5427 R, a groundbreaking microcentrifuge that incorporates hydrocarbon-based cooling. This environmentally friendly innovation features a natural refrigerant with a near-zero Global Warming Potential (GWP), reflecting Eppendorf’s commitment to sustainability. The centrifuge supports a wide range of molecular and cell biology applications while minimizing the ecological footprint.

Report Scope

Report Features Description Market Value (2024) US$ 1.8 billion Forecast Revenue (2034) US$ 3.2 billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Equipment and Accessories), By Technology (Floor-Standing Centrifuges and Benchtop Centrifuges), By Application (Microbiology, Proteomics, Diagnostics, Genomics, and Others), By End-use (Preclinical Centrifuges, General Purpose Centrifuges, and Clinical Centrifuges) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sigma Laborzentrifugen GmbH, Sartorius AG, QIAGEN, KUBOTA Corporation, Hettich Group, HERMLE Labortechnik GmbH, Eppendorf, and Cardinal Health. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Laboratory Centrifuge MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Laboratory Centrifuge MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sigma Laborzentrifugen GmbH

- Sartorius AG

- QIAGEN

- KUBOTA Corporation

- Hettich Group

- HERMLE Labortechnik GmbH

- Eppendorf

- Cardinal Health