Global Kojic Acid Market By Type(Normal, Ultra-high Pure), By Process(Fermentation, Chemical Reaction), By Function(Anti-Bacterial Agent, Anti-Oxidizing Agent, Colour Protectant, Flavor Enhance, Bleaching Agent, Others), By Application(Cosmetics, Food Additive, Medicine Material, Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast; 2024-2033

- Published date: Feb 2024

- Report ID: 14973

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

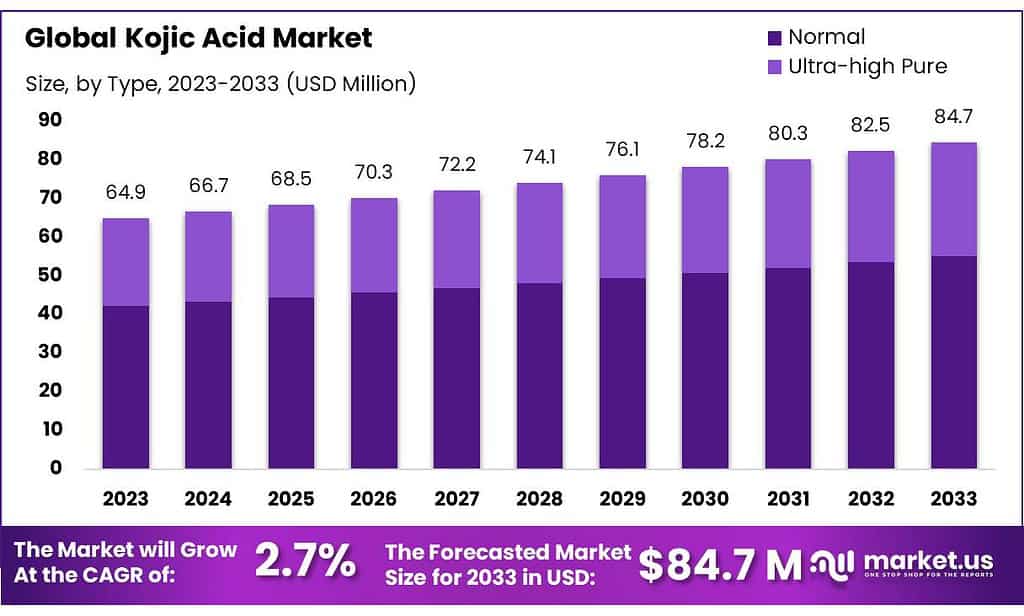

The Kojic Acid Market size is expected to be worth around USD 84.7 Mn by 2033, from USD 64.9 Mn in 2023, growing at a CAGR of 2.7% during the forecast period from 2023 to 2033.

This global market continues to grow due to an increased demand for kojic acid in the cosmetics and food industry. Moreover, the exponential growth rate of the cosmetic grade and food sector, particularly across developing nations, is slated to impact the sector’s expansion profoundly.

Kojic acid is a chemical produced by Aspergillus oryzae, which is one of the species of Aspergillus fungus. Generally a by-product of the fermentation process of malting rice. It has the chemical name 5-hydroxy-2-hydroxymethyl-4-pyrone. It is used in the manufacturing of Japanese rice wine named Sake. It helps to reduce the production of melanin by preventing the formation of tyrosine which is essential for the formation of melanin, a skin pigment.

It also has antibacterial, color-protectant, and anti-oxidative properties. Kojic acid got its name from the Japanese word koji, which is the name of the Aspergillus oryzae fungus. It is widely consumed in Japan due to its health benefits. It is used in the cosmetics, food, and medicine grade Industry due to its various properties.

Key Takeaways

- Market Expansion: Expected to grow from USD 64.9 million in 2023 to USD 84.7 million by 2033, at a CAGR of 2.7%.

- Product Dominance: The “Normal” type of Kojic Acid led the market with over 65.4% share in 2023, valued for its wide applicability.

- Preferred Production Method: Fermentation dominated production, holding more than 53.4% of the market share, due to its eco-friendly approach.

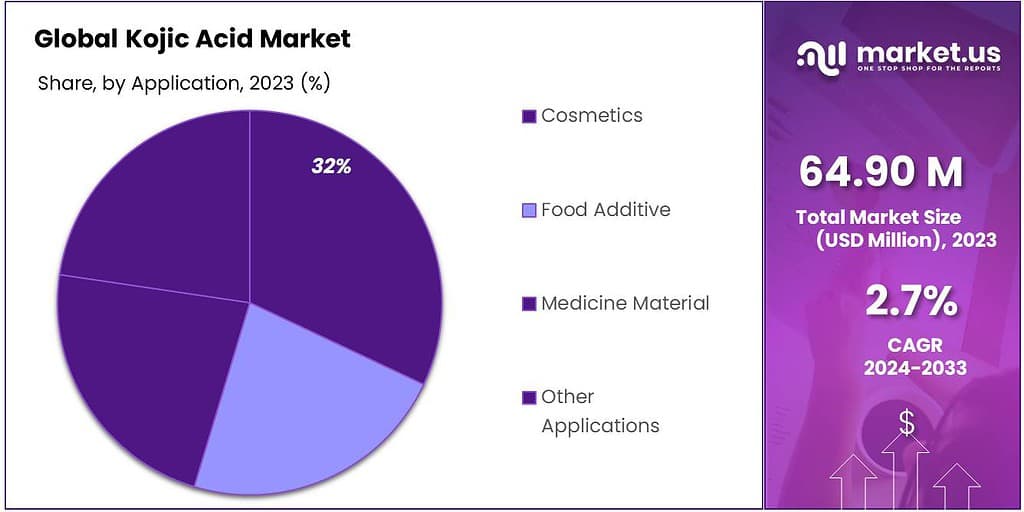

- Cosmetics Application: Over 56.7% of Kojic Acid was used in cosmetics, highlighting its key role in skin lightening and beauty products.

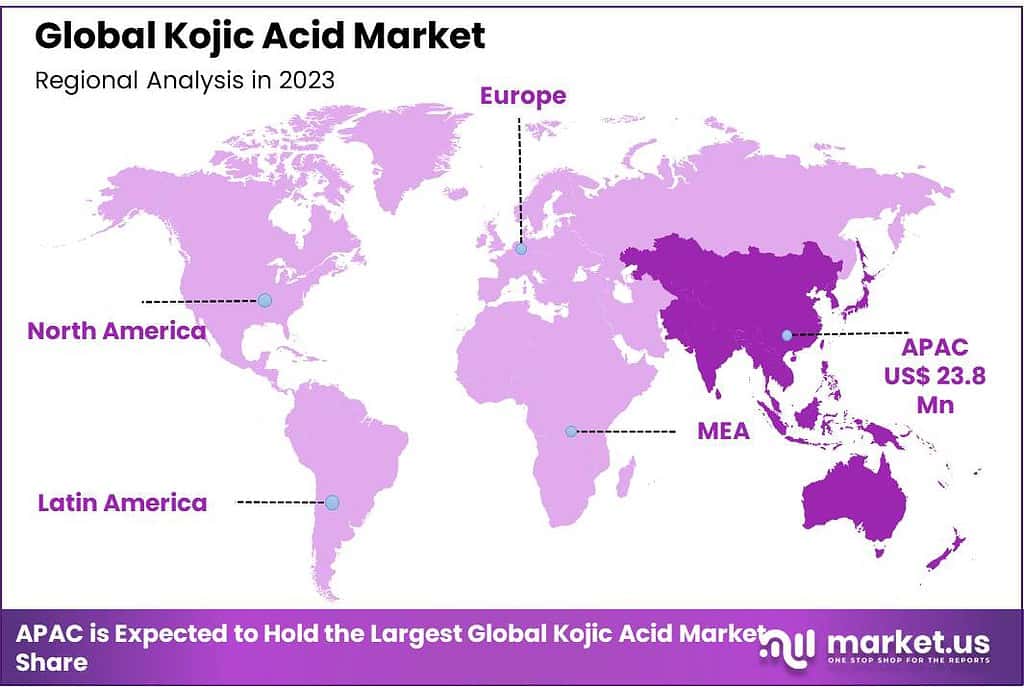

- Leading Region: Asia-Pacific topped the market with a 36.3% revenue share, driven by high demand in China, Japan, and South Korea.

Product Type Analysis

In 2023, the “Normal” type held the top spot in the Kojic Acid market, securing a dominant position by capturing more than 65.4% of the market share. The Normal type of Kojic Acid became super popular because it was easy to find and could be used in lots of different things. It was everywhere, from skincare and cosmetics to medicine and even food processing.

This type of Kojic Acid was flexible, meeting the needs of many industries, which helped it grab a big part of the market. It was well-known and used a lot because it was easy to get and had been around for a long time. Companies and people liked it because they could trust it to always be good quality. That’s why lots of manufacturers and people prefer using it.

The Normal variant’s effectiveness in various applications and its compatibility with different formulations solidified its leading position within the Kojic Acid market. While the Ultra-high Pure type existed in the market, the dominance of the Normal type underscored its widespread acceptance and utilization.

However, the Ultra-high Pure type, known for its exceptionally high purity levels, might carve its niche due to its specialized applications or specific industry requirements. Nonetheless, in 2023, the Normal type maintained its stronghold, showcasing its significance and widespread use within the Kojic Acid market.

By Process

In 2023, Fermentation held a dominant market position in the Kojic Acid Market, capturing more than a 53.4% share. This natural process, utilizing microorganisms to convert sugars present in agricultural products into kojic acid, appeals to consumers and manufacturers seeking eco-friendly and sustainable production methods.

Fermentation’s popularity is bolstered by the growing demand for natural ingredients in the cosmetic, pharmaceutical, and food industries, reflecting a broader shift towards environmentally conscious manufacturing practices.

Chemical Reaction, as an alternative process for producing kojic acid, also plays a significant role in the market. This method involves synthetic pathways to create kojic acid, offering advantages in terms of scalability and consistency in product quality.

Although it represents a smaller share compared to fermentation, chemical synthesis is valued for its ability to meet high-volume demands efficiently, serving industries that require large quantities of kojic acid with uniform purity.

By Function

In 2023, Pharmacies & Drug Stores held a dominant market position in the Activated Charcoal Supplement Market, capturing more than a 45.6% share. This segment’s success is attributed to consumer trust in professional healthcare advice available at these outlets and the immediate availability of supplements for urgent needs.

Supermarkets and Hypermarkets also played a significant role, contributing substantially to market distribution with their wide reach and the convenience of one-stop shopping for consumers. This channel benefits from high foot traffic and the ability to offer a diverse range of health-related products alongside daily necessities.

Online Retailers have seen remarkable growth, offering easy access to a vast selection of activated charcoal supplements. The convenience of home delivery, competitive pricing, and the abundance of product information and reviews online support this segment’s expansion. Consumers appreciate the ability to compare products and prices, contributing to the growing preference for online purchases.

Application Analysis

In 2023, the Kojic Acid market saw the Cosmetics segment securing a significant share of over 56.7%, marking its dominance among various applications. Kojic Acid became famous in cosmetics because it could make skin lighter and help with problems like dark spots and uneven skin tone.

People loved it in skincare products and makeup because of its ability to tackle these issues. It became a valuable ingredient in lots of beauty items, making it super important in the cosmetics world.

While Cosmetics took the lead, Kojic Acid found application in other sectors as well, albeit to a lesser extent. It served as a food additive for preserving colors or enhancing stability in certain food products and also found usage in medical materials.

However, the dominance of Kojic Acid in cosmetics underscored its primary and most valued application, illustrating its significance in the beauty and skincare industry during 2023. The Cosmetics segment’s substantial market share highlighted the widespread recognition and trust placed in Kojic Acid for its beneficial properties within the realm of skincare and beauty products.

Its extensive use in cosmetics emphasized its pivotal role, positioning Kojic Acid as a key ingredient in the formulation of various skincare solutions, reinforcing its prominence and demand within the market.

Key Market Segments

By Type

- Normal

- Ultra-high Pure

By Process

- Fermentation

- Chemical Reaction

By Function

- Anti-Bacterial Agent

- Anti-Oxidizing Agent

- Colour Protectant

- Flavor Enhance

- Bleaching Agent

- Others

By Application

- Cosmetics

- Food Additive

- Medicine Material

- Other Applications

Regional Analysis

Asia Pacific (APAC) had the largest revenue share at over 36.3% in 2023. China, South Korea, India, and Japan are key markets in the Asia-Pacific. China has the highest market share for kojic acid in the Asia-Pacific region, followed by Japan and South Korea.

The demand for beauty care and cosmetics, food, and medicine sectors is growing exponentially in these countries. Due to this, the demand will be high in these countries. This product is extensively used in skincare and food additives. The benefits of Kojic acid are slated to be in high demand due to its extensive use in cosmetics, food additives, and medicines.

The Kojic Acid Market exhibits varied dynamics across global regions, with the Asia-Pacific leading due to its extensive use in skincare products, particularly in Japan where kojic acid originated. This region benefits from a significant consumer base and a cultural focus on skin health.

North America follows, driven by a demand for safe skincare alternatives and stringent safety regulations, particularly in the United States. Europe’s market is bolstered by rigorous EU cosmetic regulations and consumer preference for natural ingredients, making countries like France, Germany, and the UK key players.

Latin America, with Brazil and Mexico at the forefront, shows growth potential through an expanding cosmetics sector and rising skincare expenditure. The Middle East & Africa region, though still developing, is expected to grow due to increasing awareness and income levels, alongside a climate that necessitates effective skincare solutions, positioning kojic acid as a valuable component in addressing hyperpigmentation and sun damage.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- The UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The key players in the kojic acid market have a dominant position in the Asia-Pacific region. These companies have a presence globally in developed and developing countries. The key players in the market focus on increasing their market share and expanding their production capacity. Most companies in the kojic acid market are from the Asia-Pacific region.

Market Key Players

- Sansho Seiyaku

- Xian Hao-Xuan Bio-tech Co

- Hubei Artec Biotechnology Co

- Syder

- Sichuan Huamai Technology Co

- Chengdu Jinkai

- Hubei Hongjing

- Hubei Xinxinjiali Bio-Tech

- Hubei Xiangxi Chemical

- Kose Corporation

- Triveni Interchem

- Other Key Players

Recent Developments

Sansho Seiyaku:

- 2023: Expanded its product portfolio with new kojic acid derivatives for cosmetic applications.

- 2022: Strengthened its presence in Southeast Asian markets through strategic partnerships.

Xian Hao-Xuan Bio-tech Co.:

- 2023: Invested in R&D for environmentally friendly kojic acid production methods.

- 2022: Received regulatory approval for a new high-purity kojic acid product.

Hubei Artec Biotechnology Co.:

- 2023: Increased production capacity to meet the growing demand for kojic acid in the pharmaceutical industry.

- 2022: Launched a digital platform for online sales and distribution of kojic acid products.

Report Scope

Report Features Description Market Value (2023) USD 64.9 Mn Forecast Revenue (2033) USD 84.7 Mn CAGR (2023-2032) 2.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type(Normal, Ultra-high Pure), By Process(Fermentation, Chemical Reaction), By Function(Anti-Bacterial Agent, Anti-Oxidizing Agent, Colour Protectant, Flavor Enhance, Bleaching Agent, Others), By Application(Cosmetics, Food Additive, Medicine Material, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sansho Seiyaku, Xian Hao-Xuan Bio-tech Co, Hubei Artec Biotechnology Co, Syder, Sichuan Huamai Technology Co, Chengdu Jinkai, Hubei Hongjing, Hubei Xinxinjiali Bio-Tech, Hubei Xiangxi Chemical, Kose Corporation, Triveni Interchem, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Kojic Acid Market?Kojic Acid Market size is expected to be worth around USD 84.7 Mn by 2033, from USD 64.9 Mn in 2023

What is the Kojic Acid Market growth?The global Kojic Acid Market is expected to grow at a compound annual growth rate of 2.7%.Who are the key companies/players in the Kojic Acid Market?Sansho Seiyaku, Xian Hao-Xuan Bio-tech Co, Hubei Artec Biotechnology Co, Syder, Sichuan Huamai Technology Co, Chengdu Jinkai, Hubei Hongjing, Hubei Xinxinjiali Bio-Tech, Hubei Xiangxi Chemical, Kose Corporation, Triveni Interchem, Other Key Players

-

-

- Sansho Seiyaku

- Xian Hao-Xuan Bio-tech Co

- Hubei Artec Biotechnology Co

- Syder

- Sichuan Huamai Technology Co

- Chengdu Jinkai

- Hubei Hongjing

- Hubei Xinxinjiali Bio-Tech

- Hubei Xiangxi Chemical

- Kose Corporation

- Triveni Interchem

- Other Key Players