Knee Osteoarthritis Treatment Market By Treatment Type (Non-Surgical Treatments (Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), Corticosteroids, Analgesics, Hyaluronic Acid Injections, Platelet-Rich Plasma (PRP) Therapy, Stem Cell Injections, Physical Therapies, Assistive Devices, Others), Surgical Treatments (Arthroscopy, Osteotomy and Knee Replacement)), By Route of Administration (Oral, Parenteral and Topical), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151629

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

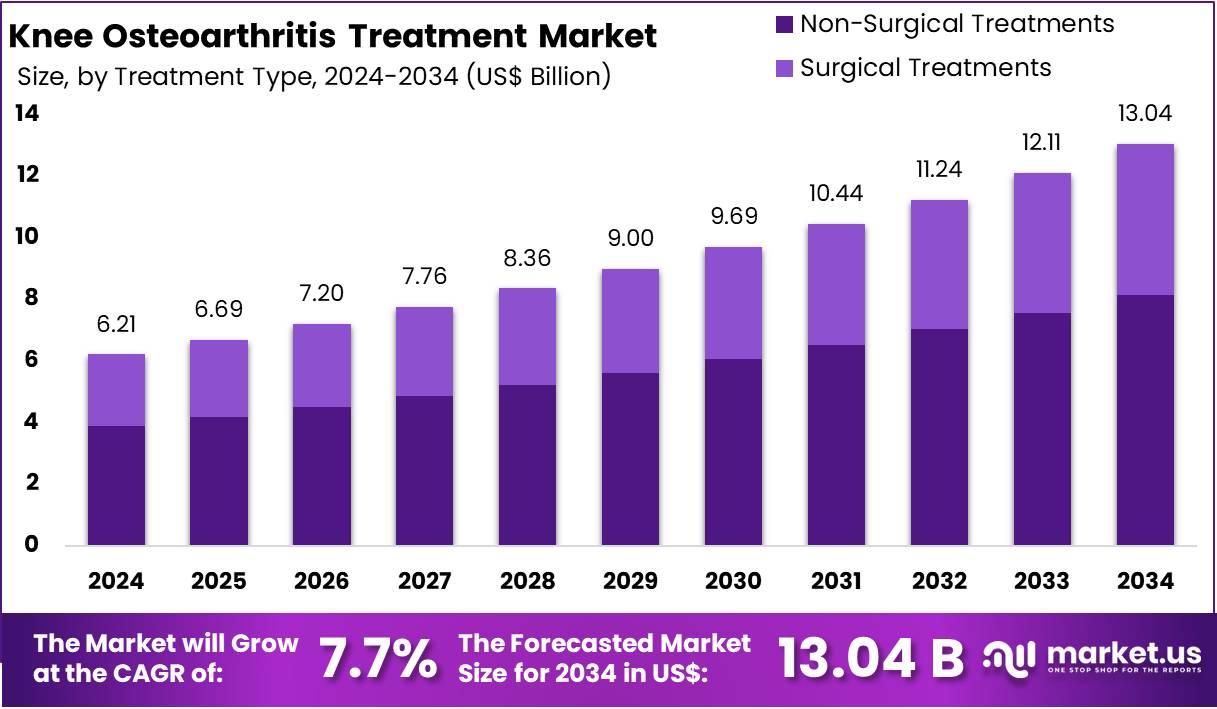

The Knee Osteoarthritis Treatment Market Size is expected to be worth around US$ 13.04 billion by 2034 from US$ 6.21 billion in 2024, growing at a CAGR of 7.7% during the forecast period 2025 to 2034.

Knee osteoarthritis (OA), often referred to as degenerative joint disease of the knee, is primarily caused by wear and tear and the gradual breakdown of articular cartilage. It is most prevalent in older adults. There are two types of knee osteoarthritis: primary and secondary. Primary osteoarthritis occurs without any clear underlying cause, leading to articular degeneration. Secondary osteoarthritis, on the other hand, arises due to factors such as abnormal force distribution on the joint, often following trauma, or conditions like rheumatoid arthritis (RA) that affect the cartilage. Osteoarthritis is generally a progressive condition that can eventually result in disability.

The Knee Osteoarthritis (KOA) Treatment Market is expanding rapidly due to the rising prevalence of osteoarthritis, particularly among the aging population. KOA, characterized by the degeneration of cartilage in the knee joint, leads to pain, stiffness, and loss of mobility. With the global population aging and lifestyle-related factors such as obesity on the rise, the incidence of KOA is expected to increase, thereby driving demand for effective treatment options. The market is segmented into non-surgical and surgical treatments, with medications (such as NSAIDs, corticosteroids, and hyaluronic acid injections), physical therapies, and assistive devices making up the non-surgical segment. Surgical interventions, including knee replacement surgeries (Total Knee Replacement and Unicompartmental Knee Arthroplasty), form the surgical segment.

The emergence of advanced therapies, including regenerative medicine such as stem cell therapy and platelet-rich plasma (PRP), is significantly transforming the treatment landscape, providing alternatives to traditional approaches. Additionally, wearable devices and mobile health technologies are integrating into the market, offering new ways to monitor and manage KOA symptoms. However, high treatment costs, particularly for surgery and long-term management, remain a key barrier. Despite these challenges, the market offers substantial opportunities for growth, driven by innovations in minimally invasive surgeries, biologics, and digital health solutions.

Key Takeaways

- In 2024, the market for Knee Osteoarthritis Treatment generated a revenue of US$ 21 billion, with a CAGR of 7.7%, and is expected to reach US$ 13.04 billion by the year 2034.

- The Treatment Type segment is divided into Non-Surgical Treatments and Surgical Treatments with Non-Surgical Treatments taking the lead in 2023 with a market share of 62.5%.

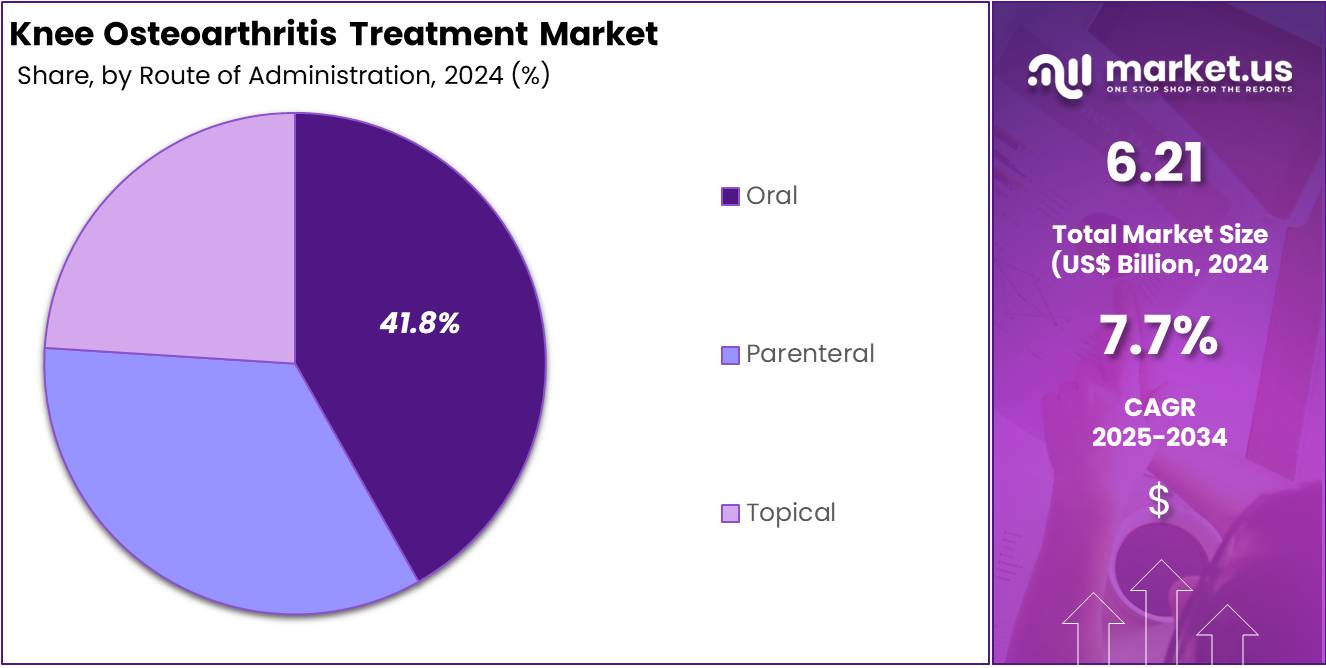

- By Route of Administration, the market is bifurcated into Oral, Parenteral and Topical with Oral leading the market with 41.8% of market share.

- Furthermore, concerning the End User segment, the market is segregated into Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, and Others. The Hospitals stands out as the dominant segment, holding the largest revenue share of 46.3% in the Knee Osteoarthritis Treatment market.

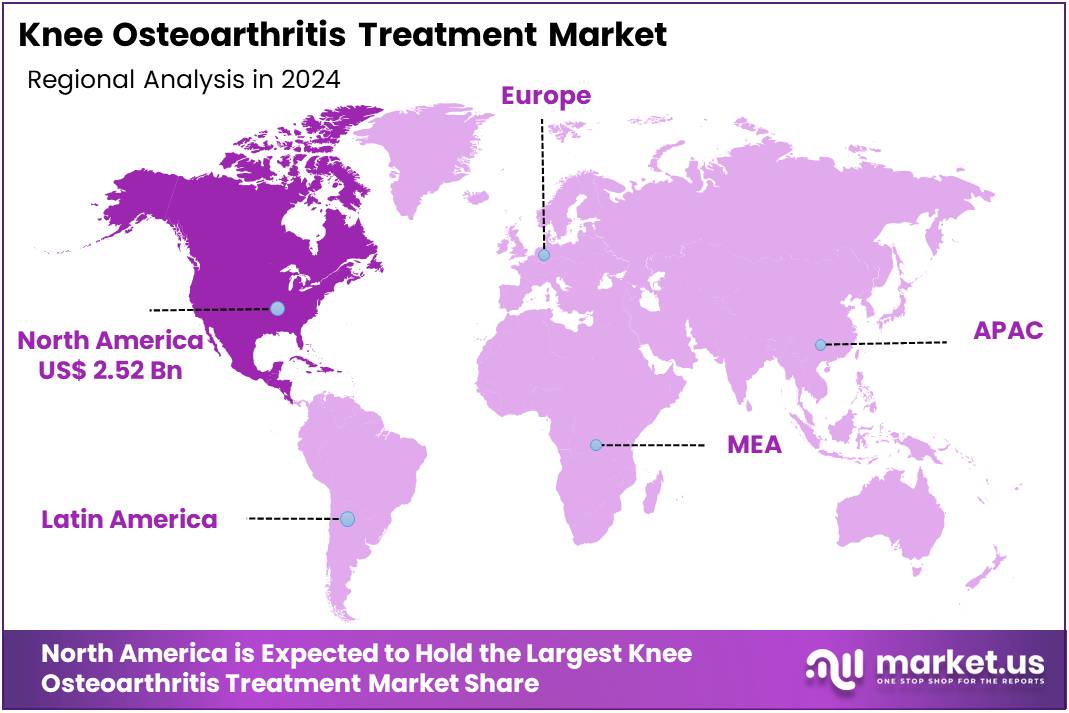

- North America led the market by securing a market share of 62.5% in 2023.

Treatment Type Analysis

Non-surgical treatments dominated the Knee Osteoarthritis Treatment Market with a market share of 62.5% due to their accessibility, lower costs, and ability to manage symptoms without the need for invasive procedures. Among these, Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) are the most commonly prescribed for pain relief and inflammation control, making them a key component of the treatment plan for OA patients. Corticosteroids and analgesics also play a significant role in managing pain and inflammation in patients with moderate to severe knee OA.

In addition to pharmaceutical options, Hyaluronic Acid Injections are widely used to provide lubrication and reduce friction in the knee joint, offering pain relief and improved mobility. The use of Platelet-Rich Plasma (PRP) Therapy and Stem Cell Injections is becoming increasingly popular due to their regenerative capabilities, targeting the underlying cause of cartilage degradation.

Physical therapies are critical in strengthening the knee and improving joint function, while assistive devices such as knee braces and orthotic supports help alleviate pressure on the joint, enhancing patient mobility and comfort. This segment’s dominance is driven by the increasing preference for less invasive, cost-effective, and long-term management strategies for KOA patients, particularly in the early stages of the disease.

Route of Administration Analysis

Oral administration is the dominant route with a market share of 41.8% in the Knee Osteoarthritis Treatment Market with a Parenteral market share due to its convenience, ease of use, and cost-effectiveness. Oral medications, including NSAIDs and analgesics, are the first line of defense for managing knee osteoarthritis symptoms. These medications are widely accessible, often available over-the-counter, and are typically used for long-term management of pain and inflammation.

Oral drugs are generally preferred by patients due to their simple administration, as they do not require medical supervision, injections, or specialized equipment. This makes them an attractive option for managing symptoms in patients who seek to avoid more invasive treatments. Additionally, oral formulations of corticosteroids and hyaluronic acid are increasingly popular, offering patients an easier, non-invasive solution to managing their condition. The widespread use of oral drugs is also supported by their affordability and well-established efficacy in treating pain and inflammation associated with OA.

End User Analysis

Hospitals are the dominant end users in the Knee Osteoarthritis Treatment Market accounting for 46.3% market share, driven by their comprehensive infrastructure and advanced capabilities for both surgical and non-surgical interventions. Hospitals cater to a large volume of patients with severe or complex knee osteoarthritis, offering both inpatient and outpatient services. They are equipped with cutting-edge technology, such as imaging systems and surgical equipment, to perform procedures like knee replacement surgeries and arthroscopy, which are required for advanced stages of OA.

Additionally, hospitals provide a wide array of non-surgical treatments, including physical therapy, injections, and pain management, ensuring that patients have access to a complete range of options for managing their condition. The specialized orthopedic departments within hospitals also play a crucial role in offering tailored treatment plans, including regenerative therapies like PRP injections and stem cell therapy, which are increasingly integrated into hospital-based treatment protocols. The accessibility of multidisciplinary care teams, including orthopedic surgeons, physiotherapists, and pain specialists, further contributes to the dominance of hospitals as the leading end-user segment.

Key Market Segments

By Treatment Type

- Non-Surgical Treatments

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Corticosteroids

- Analgesics

- Hyaluronic Acid Injections

- Platelet-Rich Plasma (PRP) Therapy

- Stem Cell Injections

- Physical Therapies

- Assistive Devices

- Others

- Surgical Treatments

- Arthroscopy

- Osteotomy

- Knee Replacement

By Route of Administration

- Oral

- Parenteral

- Topical

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Homecare

- Others

Drivers

Rising Prevalence of Knee Osteoarthritis

The increasing prevalence of knee osteoarthritis (KOA) is one of the primary drivers of the market. As the global population ages, particularly in developed nations, the incidence of KOA rises. As per the data released by WHO in 2023, approximately 528 million people globally were affected by osteoarthritis, marking an increase of 113% since 1990. Around 73% of individuals living with osteoarthritis are aged 55 or older, with 60% of those affected being female.

The knee is the most commonly impacted joint, with a prevalence of 365 million cases, followed by the hip and hand. Additionally, 344 million people with osteoarthritis experience moderate to severe symptoms, which could potentially benefit from rehabilitation. Age-related wear and tear of the knee joints, combined with factors like obesity, sedentary lifestyles, and high-impact sports injuries, contribute to the growing number of affected individuals. According to research, KOA affects nearly 25% of individuals over the age of 60, with the condition becoming more prevalent as life expectancy increases.

This growing patient base drives the demand for effective treatments, including both non-surgical (medications, physical therapies) and surgical interventions (knee replacement, osteotomy). The rise in chronic conditions, especially in the elderly population, further accelerates the need for advanced therapeutic solutions. Consequently, the market for KOA treatments continues to expand as healthcare providers invest in novel therapies and surgical procedures to address this widespread issue.

Restraints

High Costs of Knee Osteoarthritis Treatment

One significant restraint to the Knee Osteoarthritis Treatment Market is the high cost of advanced treatments, particularly surgical options like total knee replacement (TKR) and unicompartmental knee arthroplasty (UKA). These procedures are expensive due to the complexity of the surgery, the need for advanced medical technology, and post-surgical rehabilitation.

The cost can reach thousands of dollars, making it inaccessible for some patients, particularly in emerging economies or for those without comprehensive healthcare coverage. Moreover, the cost of long-term management through medications, physical therapy, and joint injections (like hyaluronic acid and PRP therapies) can also be burdensome. As a result, there is a growing push for cost-effective alternatives, such as non-invasive treatments and the development of generics, but high treatment costs still remain a major challenge for widespread access and adoption of newer technologies.

For example, patients who undergo knee arthroplasty incurred a median knee osteoarthritis–related cost of approximately US$ 19,911 over a four-year period, which is about 11 times higher than the cost for patients who received hyaluronic acid injections and did not have surgery. Hyaluronic acid injections (viscosupplementation), which can cost around US$ 880 per dose for self-pay patients, though this is still much less expensive than surgery.

Opportunities

Advancements in Regenerative Medicine

Regenerative medicine presents a promising opportunity in the Knee Osteoarthritis Treatment Market. Technologies such as stem cell therapy and platelet-rich plasma (PRP) are emerging as innovative alternatives to traditional treatments. These therapies focus on healing the damaged cartilage and improving joint function, potentially slowing the progression of the disease and even reversing some of the damage.

Stem cell therapies, for example, can regenerate damaged tissues and reduce the need for invasive procedures like knee replacements. This opportunity is further driven by increasing research and clinical trials, coupled with growing investment in regenerative treatments. These advancements offer an effective solution for patients seeking alternatives to surgery, particularly those in the early stages of OA. As these treatments become more refined and accessible, they hold the potential to change the treatment landscape of KOA, offering long-term benefits at a lower cost.

In March 2024, Pacira BioSciences, Inc., a leader in non-opioid pain management and regenerative health solutions, has announced that the U.S. Food and Drug Administration (FDA) has granted Regenerative Medicine Advanced Therapy (RMAT) designation to PCRX-201 (enekinragene inzadenovec). This innovative, intra-articular helper-dependent adenovirus (HDAd) gene therapy product candidate is designed to code for interleukin-1 receptor antagonist (IL-1Ra) and is intended for the treatment of knee osteoarthritis.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the Knee Osteoarthritis (KOA) Treatment Market, affecting both the demand for treatments and the ability of patients to access care. On the macroeconomic front, economic downturns and recessions can lead to reduced healthcare spending, which may impact the affordability and accessibility of advanced treatments such as knee replacement surgeries and biologics like stem cell and PRP therapies.

In lower-income regions, the cost of treatments can be a major barrier, limiting access to both non-surgical and surgical interventions. For example, in countries experiencing economic instability, patients may delay or forgo expensive medical procedures, opting for more affordable, over-the-counter solutions like NSAIDs or physical therapy.

Geopolitical factors, such as trade policies, tariffs, and international relations, can also impact the availability of medical supplies and treatments. Restrictions on the import and export of medical devices, pharmaceuticals, and biologic products can disrupt supply chains and increase the costs of critical materials used in treatments, including prosthetics for knee replacements and biologics for injections. Geopolitical tensions, such as conflicts or trade wars, can further exacerbate these challenges by restricting access to essential treatments or raw materials.

Latest Trends

Integration of Digital Health Technologies

The integration of digital health technologies in managing knee osteoarthritis is a growing trend. Wearable devices, mobile apps, and telemedicine platforms are being used to monitor and manage KOA more efficiently. These technologies help track patient progress, pain levels, mobility, and treatment outcomes, allowing for personalized care plans. Wearables, such as smart knee braces or sensors, enable continuous monitoring of knee joint movement, providing real-time data to both patients and clinicians.

Mobile apps allow patients to follow customized exercise regimens, get medication reminders, and receive educational content. Additionally, telehealth platforms enable remote consultations, reducing the need for frequent hospital visits, which is particularly beneficial for elderly patients with mobility issues. This trend is expected to enhance patient engagement, improve treatment adherence, and reduce healthcare costs by providing more efficient care management, while also making the treatment process more accessible, especially in underserved areas.

Regional Analysis

North America is leading the Knee Osteoarthritis Treatment Market

The Knee Osteoarthritis (KOA) Treatment Market in North America is expanding significantly, driven by a combination of demographic shifts and advancements in medical technology. The aging population in the region, particularly in the U.S. and Canada, is one of the primary contributors to the growing prevalence of knee osteoarthritis. As the population ages, the incidence of joint-related conditions, including OA, continues to rise, thereby increasing the demand for effective treatments.

In North America, non-surgical treatments such as physical therapy, medications (NSAIDs, corticosteroids), and injectable therapies like hyaluronic acid are commonly used to manage symptoms in the early to mid-stages of the disease. Furthermore, regenerative treatments, such as Platelet-Rich Plasma (PRP) and stem cell therapies, are gaining popularity as alternatives to surgery, as they target the underlying causes of joint degeneration and offer potential long-term relief.

Hospitals remain the dominant end-users of KOA treatments in North America, offering both surgical and non-surgical solutions. Surgical interventions, including knee replacement surgeries, continue to be a primary treatment for patients with advanced OA. The region benefits from advanced healthcare infrastructure, making it a hub for the development and adoption of innovative treatment options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Knee Osteoarthritis Treatment market include Pfizer Inc., Sanofi S.A., Novartis AG, AbbVie Inc., Amgen Inc., Boehringer Ingelheim International GmbH, Merck & Co., Inc., Horizon Therapeutics, Flexion Therapeutics, Inc., Genascence Corporation, Relation Therapeutics, Zimmer Biomet, Stryker Corporation, Smith & Nephew, Össur, Mathys Ltd Bettlach, Anika Therapeutics Inc., Bioventus, Ferring B.V., Teva Pharmaceutical Industries Ltd., and Other Key Players.

Pfizer Inc. is a global leader in the development of medications for various inflammatory conditions, including Knee Osteoarthritis (KOA). The company offers a range of pain relief solutions, such as NSAIDs, and continues to explore innovative treatments to manage KOA symptoms and improve patient outcomes through research in biologics and new therapies.

Sanofi S.A. is committed to advancing treatments for inflammatory diseases, including KOA. The company’s portfolio includes biologic therapies for joint pain and inflammation management. Sanofi focuses on developing novel treatments aimed at improving long-term outcomes for KOA patients and enhancing their quality of life through both traditional and innovative therapies.

Novartis AG is actively engaged in the research and development of treatments for knee osteoarthritis. The company is exploring novel biologic and regenerative therapies to slow the progression of KOA, including investigational medications that target inflammation and joint degeneration. Novartis aims to provide patients with advanced treatment options beyond conventional pain management.

Top Key Players in the Knee Osteoarthritis Treatment Market

- Pfizer Inc.

- Sanofi S.A.

- Novartis AG

- AbbVie Inc.

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- Horizon Therapeutics

- Flexion Therapeutics, Inc.

- Genascence Corporation

- Relation Therapeutics

- Zimmer Biomet

- Stryker Corporation

- Smith & Nephew

- Össur

- Mathys Ltd Bettlach

- Anika Therapeutics Inc.

- Bioventus

- Ferring B.V.

- Teva Pharmaceutical Industries Ltd.

- Other Key Players

Recent Developments

- In May 2025, OrthoTrophix, Inc., a privately held biopharmaceutical company, has announced the start of a Phase 2b clinical trial for TPX-100, its lead therapeutic candidate, in patients with mild to severe knee osteoarthritis (OA) in the United States. TPX-100 is being developed as a potential disease-modifying osteoarthritis drug (DMOAD), a therapy designed not only to relieve symptoms but also to slow or halt the progression of the disease.

- In July 2024, LG Chem has announced that its Chinese partner, Yifan Pharmaceutical, has introduced LG Chem’s single-injection osteoarthritis treatment, Synovian (marketed as Hyruan One in China), to the Chinese market. Synovian is a cross-linked hyaluronic acid (HA) treatment for knee osteoarthritis, developed using LG Chem’s proprietary technology and first launched in Korea in 2014. The key advantage of Synovian is its ability to provide therapeutic effects comparable to multi-injection formulations with just a single injection.

- In April 2023, Moximed, a medical device company announced that the U.S. Food and Drug Administration (FDA) has granted marketing authorization for the MISHA Knee System. This implantable shock absorber (ISA) is designed to treat patients with medial knee OA who have not found relief from non-surgical or surgical treatments, continue to experience pain that interferes with daily activities, and are either ineligible for or unwilling to undergo joint replacement due to age or the absence of advanced OA.

Report Scope

Report Features Description Market Value (2024) US$ 6.21 billion Forecast Revenue (2034) US$ 13.04 billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Non-Surgical Treatments (Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), Corticosteroids, Analgesics, Hyaluronic Acid Injections, Platelet-Rich Plasma (PRP) Therapy, Stem Cell Injections, Physical Therapies, Assistive Devices, Others), Surgical Treatments (Arthroscopy, Osteotomy and Knee Replacement)), By Route of Administration (Oral, Parenteral and Topical), By End User (Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer Inc., Sanofi S.A., Novartis AG, AbbVie Inc., Amgen Inc., Boehringer Ingelheim International GmbH, Merck & Co., Inc., Horizon Therapeutics, Flexion Therapeutics, Inc., Genascence Corporation, Relation Therapeutics, Zimmer Biomet, Stryker Corporation, Smith & Nephew, Össur, Mathys Ltd Bettlach, Anika Therapeutics Inc., Bioventus, Ferring B.V., Teva Pharmaceutical Industries Ltd., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Knee Osteoarthritis Treatment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Knee Osteoarthritis Treatment MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer Inc.

- Sanofi S.A.

- Novartis AG

- AbbVie Inc.

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- Horizon Therapeutics

- Flexion Therapeutics, Inc.

- Genascence Corporation

- Relation Therapeutics

- Zimmer Biomet

- Stryker Corporation

- Smith & Nephew

- Össur

- Mathys Ltd Bettlach

- Anika Therapeutics Inc.

- Bioventus

- Ferring B.V.

- Teva Pharmaceutical Industries Ltd.

- Other Key Players