Global Kinase Inhibitors For Cancer Treatment Market By Product Type (EGFR Inhibitors, m-TOR Inhibitors, BRAF and MEK Inhibitors, Angiogenesis Inhibitors and Others), By End-User (Hospitals and Research Organizations), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173894

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

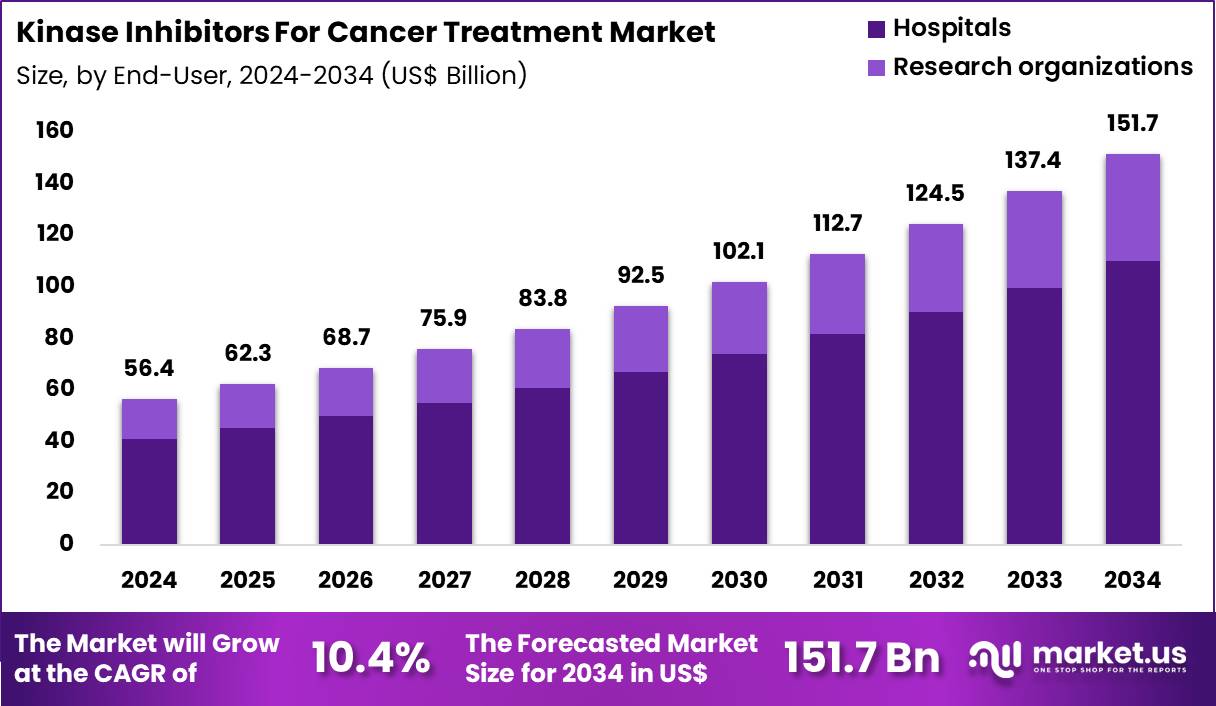

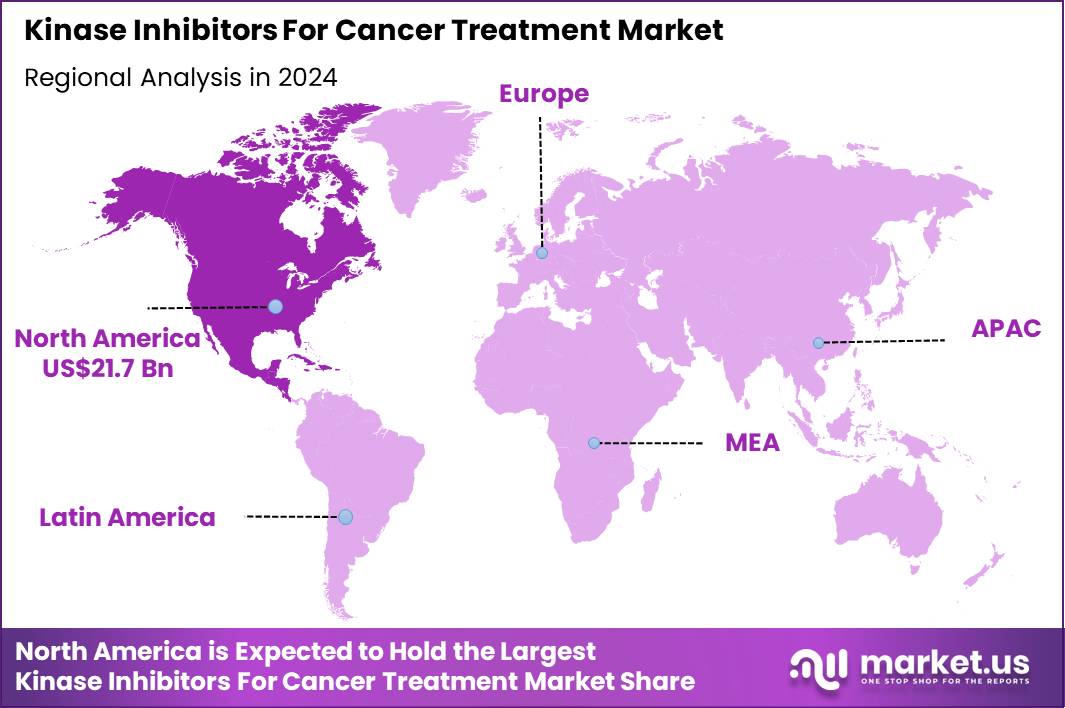

The Global Kinase Inhibitors For Cancer Treatment Market size is expected to be worth around US$ 151.7 Billion by 2034 from US$ 56.4 Billion in 2024, growing at a CAGR of 10.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.5% share with a revenue of US$ 21.7 Billion.

Growing prevalence of kinase-driven malignancies propels pharmaceutical companies to advance kinase inhibitors that selectively target aberrant signaling pathways in cancer cells. Oncologists increasingly prescribe these agents for EGFR-mutant non-small cell lung cancer, achieving durable responses by blocking epidermal growth factor receptor activation. These inhibitors demonstrate efficacy in chronic myeloid leukemia through BCR-ABL inhibition, restoring normal hematopoiesis in patients with Philadelphia chromosome-positive disease.

Clinicians administer multi-kinase inhibitors to treat advanced renal cell carcinoma, disrupting vascular endothelial growth factor and platelet-derived growth factor pathways to inhibit tumor angiogenesis. These therapies also support treatment of BRAF-mutant melanoma, halting constitutive mitogen-activated protein kinase signaling that drives proliferation.

In May 2023, Zion Pharma Limited entered a global agreement with Roche to jointly develop and commercialize an orally administered HER2 tyrosine kinase inhibitor engineered to cross the blood–brain barrier. The program addresses a critical unmet need in HER2-positive metastatic breast cancer by targeting brain metastases, a major cause of morbidity. This collaboration underscores growing industry focus on next-generation kinase inhibitors with enhanced tissue penetration and expanded oncologic utility.

Manufacturers pursue opportunities to develop brain-penetrant kinase inhibitors that overcome sanctuary site limitations, expanding applications in HER2-positive breast cancer with central nervous system involvement. Developers engineer selective RET inhibitors for RET fusion-positive lung and thyroid cancers, offering high potency with improved tolerability compared to multi-kinase agents.

These innovations facilitate use in FGFR-altered cholangiocarcinoma, where targeted inhibition reduces tumor burden and extends progression-free survival. Opportunities emerge in combination regimens that pair kinase inhibitors with immune checkpoint inhibitors, enhancing antitumor activity in microsatellite-stable colorectal cancers.

Companies advance covalent inhibitors designed for KRAS G12C mutations, providing new therapeutic options in previously undruggable pancreatic and lung adenocarcinomas. Firms invest in next-generation ALK inhibitors that maintain activity against resistance mutations, prolonging benefit in ALK-rearranged non-small cell lung cancer.

Industry leaders refine selectivity profiles to minimize off-target effects, enabling safer long-term administration in chronic leukemias and solid tumors. Developers prioritize oral bioavailability improvements that support outpatient management across multiple kinase-driven indications. Market participants advance biomarker-driven strategies that identify patients most likely to respond, optimizing resource allocation in precision oncology.

Innovators explore irreversible inhibitors that form covalent bonds with kinase domains, achieving prolonged suppression in resistant populations. Companies emphasize rational combination approaches that address pathway redundancy, elevating response rates in complex malignancies. Ongoing research focuses on novel scaffolds that target emerging resistance mechanisms, sustaining therapeutic relevance in evolving cancer landscapes.

Key Takeaways

- In 2024, the market generated a revenue of US$ 56.4 Billion, with a CAGR of 10.4%, and is expected to reach US$ 151.7 Billion by the year 2034.

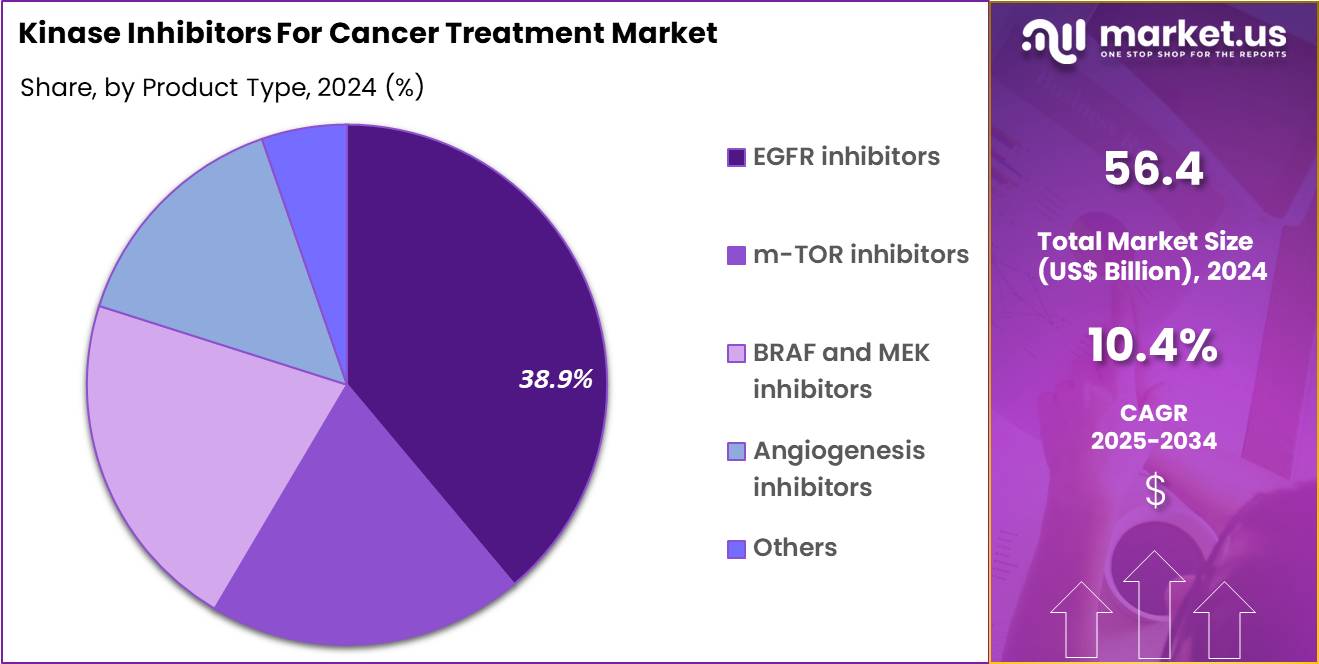

- The product type segment is divided into EGFR inhibitors, m-TOR inhibitors, BRAF and MEK inhibitors, angiogenesis inhibitors and others, with EGFR inhibitors taking the lead in 2024 with a market share of 38. 9%.

- Considering end-user, the market is divided into hospitals and research organizations. Among these, hospitals held a significant share of 72.6%.

- North America led the market by securing a market share of 38.5% in 2024.

Product Type Analysis

EGFR inhibitors accounted for 38.9% of growth within the product type category and represent the leading class in the Kinase Inhibitors for Cancer Treatment market. High prevalence of EGFR-mutated tumors, particularly in lung and colorectal cancers, drives sustained demand. Precision oncology approaches increasingly prioritize molecularly targeted therapies. EGFR testing adoption expands patient identification rates. Clinicians favor EGFR inhibitors due to well-defined biomarker alignment.

Improved progression-free survival outcomes strengthen prescribing confidence. Continuous pipeline development introduces next-generation EGFR inhibitors with enhanced selectivity. Resistance management strategies increase treatment duration. Combination regimens extend EGFR inhibitor use across disease stages. Oral availability supports long-term outpatient therapy. Favorable safety profiles compared with cytotoxic chemotherapy improve tolerability.

Regulatory approvals across multiple indications expand addressable populations. Clinical guidelines increasingly position EGFR inhibitors as first-line options. Growing use in earlier disease settings supports volume growth. Aging populations increase cancer incidence in EGFR-driven malignancies. Companion diagnostics integration improves treatment efficiency.

Reimbursement frameworks support targeted oncology drugs. Real-world evidence reinforces clinical effectiveness. Oncology centers emphasize personalized treatment pathways. The segment is projected to remain dominant due to molecular targeting relevance and clinical outcomes.

End-User Analysis

Hospitals represented 72.6% of growth within the end-user category and dominate the Kinase Inhibitors for Cancer Treatment market. Cancer diagnosis and treatment primarily occur in hospital settings. Multidisciplinary oncology teams coordinate targeted therapy decisions. Hospitals manage complex diagnostic workflows including molecular testing.

Initiation of kinase inhibitor therapy often requires inpatient or supervised outpatient care. Oncology departments handle high patient volumes across tumor types. Hospitals provide infrastructure for adverse event monitoring. Formularies prioritize evidence-based targeted therapies. Treatment protocols integrate kinase inhibitors into standard care pathways. Hospital pharmacies support dispensing and adherence management. Combination therapies and dose adjustments require clinical oversight.

Tertiary care centers attract advanced cancer cases. Referral networks concentrate oncology care in hospitals. Clinical trial participation increases early adoption of novel inhibitors. Insurance authorization processes operate efficiently within hospitals. Supportive care services enhance treatment continuity.

Teaching hospitals disseminate best practices in targeted therapy use. Digital oncology records improve treatment tracking. Hospitals manage resistance and progression through sequential therapy planning. The segment is anticipated to maintain leadership due to care complexity and centralized oncology services.

Key Market Segments

By Product Type

- EGFR inhibitors

- m-TOR inhibitors

- BRAF and MEK inhibitors

- Angiogenesis inhibitors

- Others

By End-user

- Hospitals

- Research Organizations

Drivers

Increasing number of kinase inhibitor approvals for cancer is driving the market

The kinase inhibitors for cancer treatment market is significantly driven by the increasing number of approvals, which expand therapeutic options for various malignancies and encourage investment in research and development. Regulatory agencies prioritize kinase inhibitors due to their targeted mechanism, allowing for precise intervention in oncogenic signaling pathways.

Healthcare providers adopt these drugs to improve patient outcomes in cancers like non-small cell lung cancer and chronic myeloid leukemia, where traditional therapies fall short. Pharmaceutical companies accelerate pipeline development to capitalize on approval trends, focusing on multi-kinase inhibitors for broader efficacy. Clinical protocols integrate newly approved inhibitors into combination regimens, enhancing survival rates in advanced stages.

Global health initiatives support access to these treatments in underserved regions, sustaining market momentum. Academic research validates the clinical benefits of approved inhibitors, driving further innovation. Patient care benefits from personalized approaches enabled by kinase profiling in tumor samples.

Economic factors, including high reimbursement for targeted therapies, further propel market growth. The U.S. Food and Drug Administration approved four kinase inhibitors in 2024, including deuruxolitinib, ensartinib, and lazertinib, reflecting ongoing expansion in oncology.

Restraints

High cost of kinase inhibitors is restraining the market

The kinase inhibitors for cancer treatment market is restrained by the high cost of these therapies, which limits accessibility for patients and strains healthcare budgets in both developed and developing regions. Manufacturers face elevated production expenses due to complex synthesis and quality control requirements, passing these onto consumers. Regulatory compliance for clinical trials and post-approval monitoring adds to financial burdens, deterring smaller firms from entering the market.

Healthcare systems implement cost-containment measures, favoring generics over branded inhibitors where possible. Clinical adoption slows in low-resource settings, where affordability issues lead to underutilization of effective treatments. Global disparities in pricing exacerbate inequities in cancer care, restricting market penetration.

Academic analyses highlight the impact of costs on adherence, contributing to suboptimal outcomes. Patient out-of-pocket expenses remain a barrier, reducing demand for long-term therapies. Economic models project continued restraint without pricing reforms or biosimilar competition. According to industry reports, the high cost of kinase inhibitors serves as a significant restraint on market growth in the 2022-2024 period.

Opportunities

Expansion to new indications and biosimilars is creating growth opportunities

The kinase inhibitors for cancer treatment market presents growth opportunities through expansion to new indications, allowing for broader application in diseases beyond traditional oncology targets like inflammatory conditions. Developers can repurpose existing inhibitors for novel uses, leveraging established safety profiles to accelerate clinical trials.

Regulatory pathways for label expansions facilitate quicker market entry, encouraging investment in combination studies. Healthcare providers gain versatile tools for treating comorbidities in cancer patients, improving integrated care. Pharmaceutical partnerships focus on biosimilar development to reduce costs and increase accessibility. Clinical research explores kinase inhibition in rare cancers, opening niche markets.

Global adoption in emerging economies aligns with infrastructure growth for targeted therapies. Academic collaborations refine inhibitor selectivity for minimized off-target effects in new indications. Patient populations benefit from affordable biosimilars enabling sustained treatment. The U.S. Food and Drug Administration approved a record 18 biosimilars in 2024, creating avenues for kinase inhibitor diversification.

Impact of Macroeconomic / Geopolitical Factors

Thriving worldwide economies pour investments into oncology research pipelines, accelerating the kinase inhibitors market by fueling demand for targeted cancer therapies amid rising global cancer incidences. Executives target affluent markets where disposable incomes support premium pricing for drugs like imatinib and osimertinib, driving consistent revenue upticks.

Unfortunately, unchecked inflation globally inflates clinical trial and raw material expenses, curtailing accessibility for patients in lower-income brackets. Sharpening geopolitical rivalries in Asia and Europe fracture API supply routes, delaying drug development milestones for multinational pharma giants. Pioneers adapt by relocating production to geopolitically stable hubs, which trims vulnerabilities and unlocks fresh partnership avenues.

Today’s US tariffs, hitting 100% on imported branded pharmaceuticals since October 2025, compound cost pressures for overseas innovators reliant on U.S. markets. Native biotech firms exploit this shift to bolster U.S.-centric facilities, accelerating tech transfers and creating high-skilled jobs domestically. Advancements in next-generation inhibitors, including multi-kinase blockers, steadfastly propel the industry forward, securing robust valuations and transformative patient benefits in the long run.

Latest Trends

FDA approval of the 100th small-molecule kinase inhibitor is a recent trend

In 2025, the kinase inhibitors for cancer treatment market has exhibited a prominent trend toward continued exploration of the kinome for new drug targets, culminating in the FDA approval of the 100th small-molecule kinase inhibitor. Manufacturers are focusing on untapped kinases to develop therapies for resistant cancers, enhancing precision oncology. Healthcare professionals are integrating these new inhibitors into regimens for advanced malignancies like non-small cell lung cancer.

Regulatory milestones highlight industry persistence in kinase targeting, 24 years after imatinib’s landmark approval. Clinical trials are evaluating next-generation inhibitors for improved selectivity and reduced toxicity. Academic studies are mapping kinome interactions to identify novel therapeutic opportunities. Global research networks are advancing multi-kinase strategies for combination therapies.

Patient therapies gain from expanded options addressing unmet needs in rare tumors. Ethical protocols are ensuring equitable access to these advancements. The U.S. Food and Drug Administration approved the 100th small-molecule kinase inhibitor in 2025, underscoring the trend in ongoing kinome exploration.

Regional Analysis

North America is leading the Kinase Inhibitors For Cancer Treatment Market

In 2024, North America held a 38.5% share of the global kinase inhibitors for cancer treatment market, propelled by surging oncology caseloads and accelerated regulatory pathways that facilitate rapid access to targeted therapies for precision medicine in lung, breast, and leukemia indications. Oncologists increasingly prescribed next-generation inhibitors like tyrosine kinase variants to overcome resistance mutations, supported by biomarker-driven protocols that optimize outcomes in metastatic settings.

Pharmaceutical advancements in multi-kinase blockers addressed unmet needs in rare tumors, while reimbursement expansions under Medicare encouraged adoption in community practices. Demographic increases in smoking-related malignancies amplified demands for EGFR and ALK inhibitors, prompting integrated care models with companion diagnostics. Biotech collaborations refined allosteric inhibitors for enhanced selectivity, minimizing off-target toxicities in elderly patients.

Guideline revisions from professional societies endorsed combination regimens with immune checkpoint blockers, bridging gaps in refractory cases. Supply chain enhancements ensured biologic stability for intravenous formulations, aligning with high-volume infusion centers. The National Cancer Institute estimates that 2,001,140 new cancer cases were diagnosed in the United States in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders envision substantial momentum in kinase inhibitors for cancer treatment throughout Asia Pacific over the forecast period, as epidemiological transitions intensify demands for affordable targeted agents amid lifestyle-driven tumor surges. Physicians integrate selective inhibitors into frontline protocols for hepatocellular carcinoma, customizing therapies to prevalent HBV-associated mutations in endemic zones.

Governments subsidize access through national formularies, equipping tertiary facilities to manage ALK-positive lung cancers in young smokers. Biotech innovators develop pan-TRK blockers with improved blood-brain barrier penetration, tailoring them to ethnic genomic profiles in brain metastases. Regional alliances validate BRAF/MEK combinations through trials, fostering efficacy in melanoma cohorts exposed to UV risks.

Pharmaceutical manufacturers localize production of HER2 inhibitors, complying with harmonized safety norms to sustain supply in humid climates. Policy drives promote biomarker testing integration, empowering rural clinics with diagnostic tools for early intervention. The Global Cancer Observatory documented 9,826,539 new cancer cases in Asia in 2022.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Kinase Inhibitors For Cancer Treatment market drive growth by expanding precision oncology portfolios that target well-defined molecular pathways across solid tumors and hematologic malignancies. Companies strengthen pipelines through biomarker-driven development, combination regimens, and lifecycle extensions that address resistance and broaden labeled indications.

Commercial strategies emphasize close collaboration with oncologists and cancer centers to integrate targeted therapies into personalized treatment algorithms. Innovation priorities focus on improving selectivity, tolerability, and oral bioavailability to enhance long-term patient adherence and outcomes.

Market expansion targets regions increasing access to molecular diagnostics and reimbursement for targeted cancer therapies. Novartis stands out as a leading participant through its deep oncology R&D capabilities, global clinical development infrastructure, and a strong portfolio of kinase inhibitors that support sustained growth across multiple cancer indications.

Top Key Players

- Takeda Pharmaceutical

- Roche

- Pfizer

- Novartis

- Merck

- Incyte

- Eli Lilly and Company

- Bristol Myers Squibb

- Bayer

- AstraZeneca

Recent Developments

- In October 2025, researchers at UVA Health Care Center developed an advanced clinical algorithm designed to rapidly identify cancer patients most likely to respond to kinase inhibitor therapies. By integrating patient-specific molecular and clinical data, the model supports more precise treatment selection, reduces trial-and-error prescribing, and accelerates time to effective therapy. This innovation strengthens the kinase inhibitor landscape by improving real-world utilization efficiency and reinforcing the role of data-driven decision tools in precision oncology.

- In July 2024, Novartis introduced Scemblix (asciminib) for adults with newly diagnosed Philadelphia chromosome-positive chronic myeloid leukemia. Unlike traditional ATP-competitive agents, asciminib targets the ABL myristoyl pocket, offering a differentiated mechanism that improves molecular response outcomes and tolerability. The launch reinforces continued innovation within the kinase inhibitor class and expands therapeutic options for first-line leukemia management.

Report Scope

Report Features Description Market Value (2024) US$ 56.4 Billion Forecast Revenue (2034) US$ 151.7 Billion CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (EGFR Inhibitors, m-TOR Inhibitors, BRAF and MEK Inhibitors, Angiogenesis Inhibitors and Others), By End-User (Hospitals and Research Organizations) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Takeda Pharmaceutical, Roche, Pfizer, Novartis, Merck, Incyte, Eli Lilly and Company, Bristol Myers Squibb, Bayer, AstraZeneca. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Kinase Inhibitors For Cancer Treatment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Kinase Inhibitors For Cancer Treatment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Takeda Pharmaceutical

- Roche

- Pfizer

- Novartis

- Merck

- Incyte

- Eli Lilly and Company

- Bristol Myers Squibb

- Bayer

- AstraZeneca