Global Proton Therapy Market By Product Type (Patient Positioning System, Nozzle and Image Viewers, Beam Transport System, Beam Delivery System, and Accelerator), By Application (Prostate Cancer, Head and Neck Cancer, CNS Cancer, Breast Cancer, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140705

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

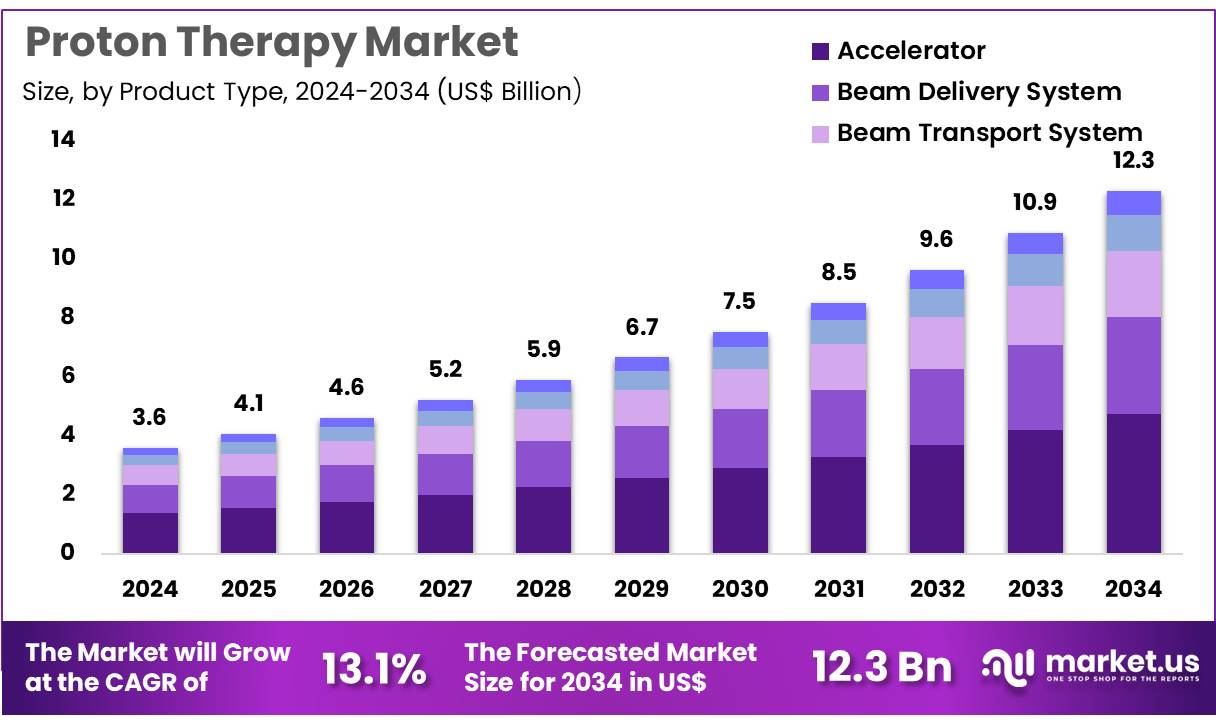

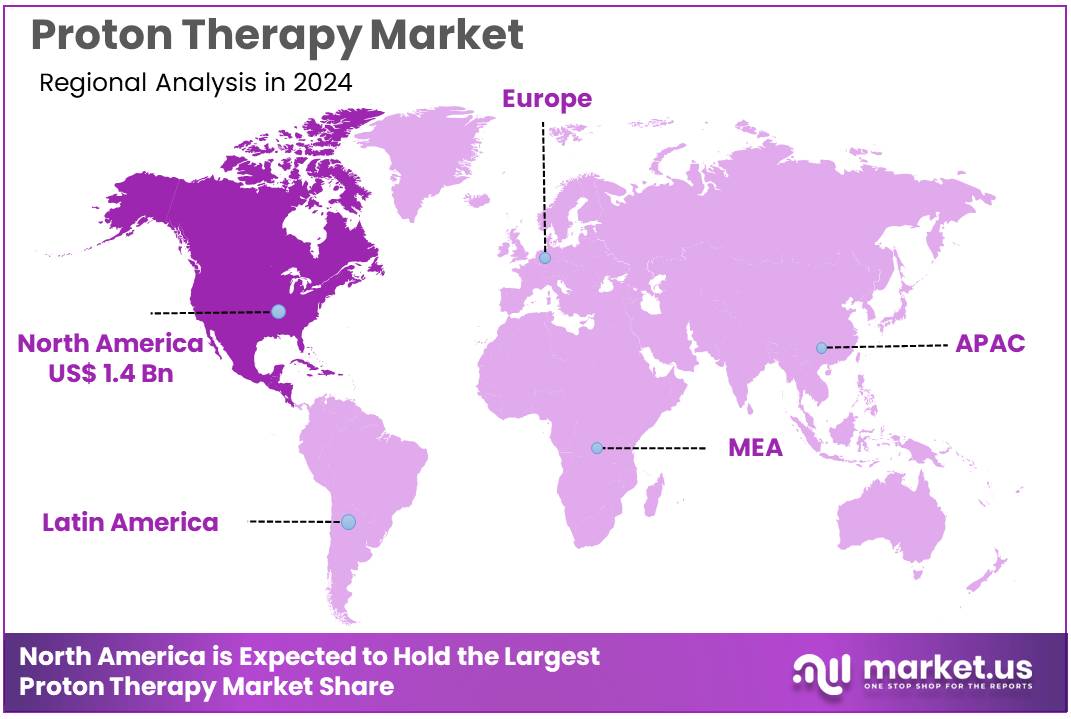

Global Proton therapy Market size is expected to be worth around US$ 12.3 billion by 2034 from US$ 3.6 billion in 2024, growing at a CAGR of 13.1% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 38.6% share with a revenue of US$ 1.4 Billion.

Increasing demand for advanced, precise cancer treatments is driving the growth of the proton therapy market. Proton therapy uses high-energy protons to target and destroy cancer cells with high precision, minimizing damage to surrounding healthy tissues. This technique is particularly effective for treating tumors near critical structures, such as brain, spinal cord, and eye cancers, as well as pediatric cancers, where minimizing radiation exposure is crucial.

The growing prevalence of cancer, highlighted by the American Cancer Society’s statistic that individuals aged 85 with no prior history of cancer have a 16.4% lifetime risk of developing the disease, contributes significantly to the market’s expansion. Recent trends indicate a shift toward personalized cancer treatments, where proton therapy plays a key role in offering customized, targeted therapy based on tumor size, location, and type.

Additionally, the increasing availability of proton therapy centers and advancements in technology, such as the development of compact, cost-effective proton therapy systems, are opening new opportunities for broader adoption.

The integration of proton therapy with other treatment modalities, such as chemotherapy and immunotherapy, further enhances its effectiveness, providing more comprehensive cancer care. As research continues to demonstrate the benefits of proton therapy, the market is poised for significant growth, driven by innovations in treatment efficiency and patient outcomes.

Key Takeaways

- In 2023, the market for proton therapy generated a revenue of US$ 6 billion, with a CAGR of 13.1%, and is expected to reach US$ 12.3 billion by the year 2033.

- The product type segment is divided into patient positioning system, nozzle and image viewers, beam transport system, beam delivery system, and accelerator, with accelerator taking the lead in 2023 with a market share of 38.4%.

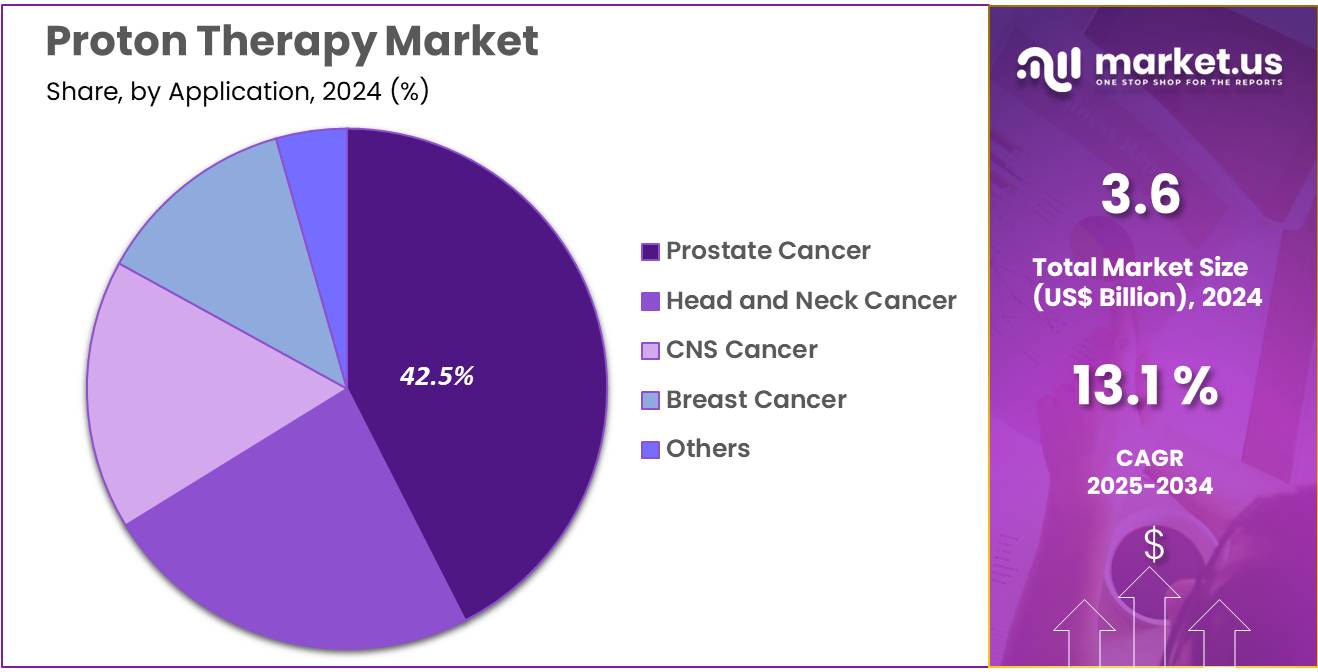

- Considering application, the market is divided into prostate cancer, head and neck cancer, cns cancer, breast cancer, and others. Among these, prostate cancer held a significant share of 42.5%.

- North America led the market by securing a market share of 38.6% in 2023.

Product Type Analysis

The accelerator segment led in 2023, claiming a market share of 38.4% owing to the increasing demand for advanced and precise cancer treatment technologies. Proton accelerators play a crucial role in generating proton beams for cancer therapy, ensuring targeted radiation delivery while minimizing damage to surrounding healthy tissue. The growing adoption of proton therapy, especially for complex tumors, is anticipated to drive the demand for advanced proton accelerators.

Technological advancements in accelerator design, such as improved beam control and faster treatment times, are likely to further support the growth of this segment. Additionally, the increased number of proton therapy centers and the expansion of proton therapy facilities worldwide are projected to boost the adoption of accelerators in the market.

Application Analysis

The prostate cancer held a significant share of 42.5% due to as proton therapy offers a highly targeted treatment for this prevalent cancer type. Proton therapy’s precision in delivering radiation directly to prostate tumors while minimizing exposure to nearby healthy tissue has made it a preferred treatment for prostate cancer patients. As the incidence of prostate cancer rises globally, the demand for advanced, non-invasive treatments like proton therapy is likely to increase.

Furthermore, the growing recognition of proton therapy’s potential benefits, including fewer side effects compared to traditional radiation therapies, is anticipated to drive the adoption of proton therapy for prostate cancer, contributing to the expansion of this segment.

Key Market Segments

Product Type

- Patient Positioning System

- Nozzle and Image Viewers

- Beam Transport System

- Beam Delivery System

- Accelerator

Application

- Prostate Cancer

- Head and Neck Cancer

- CNS Cancer

- Breast Cancer

- Others

Drivers

Growing Prevalence of Cancer Driving the Proton Therapy Market

Growing prevalence of cancer is anticipated to drive the proton therapy market significantly. In 2022, the World Health Organization reported 20 million new cancer cases globally, resulting in 9.7 million deaths. Additionally, 53.5 million individuals survived for at least five years following a cancer diagnosis, underscoring the widespread impact of the disease.

Proton therapy offers a highly targeted radiation treatment, minimizing damage to surrounding healthy tissues and reducing side effects. This precision is particularly beneficial for treating tumors located near vital organs or in pediatric patients. The increasing global cancer burden creates a pressing demand for advanced treatment modalities like proton therapy. Healthcare providers prioritize adopting innovative therapeutic approaches to enhance patient outcomes and improve quality of life.

Technological advancements in compact and cost-efficient systems further accelerate the deployment of proton therapy centers worldwide. Collaboration between cancer research institutions and technology developers strengthens the integration of this cutting-edge treatment into clinical practice. These factors highlight the vital role of proton therapy in addressing the rising incidence of cancer.

Restraints

High Costs Are Restraining the Proton Therapy Market

High costs associated with proton therapy systems are restraining the market. Setting up a proton therapy center involves substantial capital investment, often exceeding $20 million, making it difficult for smaller healthcare facilities to adopt the technology. Operational expenses, including maintenance, specialized staffing, and energy requirements, add to the financial burden.

Limited insurance coverage for proton therapy in many regions discourages patient access to this advanced treatment. Economic disparities restrict the availability of proton therapy to high-income countries, leaving underserved populations without access to this effective modality.

The lengthy construction time for proton therapy facilities further delays their deployment, hindering market growth. Efforts to address these challenges include developing compact and cost-efficient systems, increasing insurance reimbursement rates, and expanding funding for facility construction.

Opportunities

Advancements in Cancer Treatment as an Opportunity for the Proton Therapy Market

Increasing advancements in cancer treatment present significant opportunities for the proton therapy market. In June 2022, IBA Radiopharma Solutions partnered with the Eugene M. & Christine E. Lynn Cancer Institute to install the ProteusONE compact proton therapy system. This collaboration reflects the growing focus on equipping cancer centers with advanced treatment technologies. Innovations in imaging and beam delivery systems improve the precision and efficacy of proton therapy.

Researchers are developing adaptive treatment techniques that adjust to tumor changes in real-time, enhancing patient outcomes. Expanding applications of proton therapy in treating complex cases, such as recurrent tumors and pediatric cancers, further drive adoption. Government funding for oncology research and advancements in artificial intelligence for treatment planning bolster the market’s growth.

Partnerships between hospitals and technology providers expedite the deployment of cutting-edge solutions. These trends emphasize the transformative potential of advancements in cancer treatment to expand the reach and effectiveness of proton therapy globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the proton therapy market. On the positive side, increasing global healthcare investments, particularly in cancer treatment, fuel demand for advanced therapies like proton therapy. As cancer rates rise and more patients seek targeted treatments with fewer side effects, proton therapy becomes an attractive option. However, economic recessions or budget constraints in healthcare systems may limit access to high-cost proton therapy systems, particularly in developing regions.

Geopolitical factors such as trade policies, regulatory variations, and political instability can disrupt the supply chain, delaying the delivery of equipment or increasing costs. Furthermore, fluctuations in government spending on healthcare infrastructure could affect the implementation and affordability of proton therapy centers. Despite these challenges, the growing push for personalized and effective cancer treatments ensures sustained demand and a positive outlook for the proton therapy market.

Latest Trends

Surge in Partnerships and Collaborations Driving the Proton Therapy Market:

Rising partnerships and collaborations are playing a significant role in driving the proton therapy market. High demand for advanced cancer treatment solutions and the complex nature of proton therapy are expected to drive companies to work together and share resources.

These collaborations allow healthcare providers and technology companies to expand their capabilities, improve access, and streamline the development of new treatment solutions. Increasing interest in expanding proton therapy centers and making this advanced technology available to more patients is likely to boost market growth. On February 15, 2023, Moffitt Cancer Center joined forces with IBA Radiopharma Solutions to expand access to advanced cancer treatment.

The partnership will establish proton therapy capabilities at Speros FL, Moffitt’s state-of-the-art 775-acre Global Innovation Center in Pasco County, Florida. As more collaborations take place, the market is expected to experience greater accessibility and continued innovation, driving further advancements in proton therapy technology.

Regional Analysis

North America is leading the Proton therapy Market

North America dominated the market with the highest revenue share of 38.6% owing to advancements in technology and collaborative research efforts in adaptive radiation therapy. The partnership announced on April 18, 2023, between the University of Texas at San Antonio (UTSA) and the University of Pittsburgh, explored the potential of artificial intelligence in improving tumor analysis and treatment techniques. This initiative underscored the region’s commitment to integrating AI with precision cancer treatments.

The rising prevalence of cancer, coupled with increasing awareness of the benefits of proton therapy, significantly boosted demand for this advanced treatment modality. Proton therapy’s ability to deliver targeted radiation with minimal damage to surrounding tissues made it a preferred choice for treating pediatric cancers and tumors near vital organs. Expanding healthcare infrastructure and the growing number of proton therapy centers across the U.S. and Canada also contributed to market growth.

Substantial government funding for cancer research and treatment innovation further supported the adoption of proton therapy. Additionally, collaborations between healthcare providers and technology companies accelerated the introduction of state-of-the-art equipment and techniques, enhancing treatment outcomes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing cancer prevalence and expanding healthcare investments. In July 2022, IBA Radiopharma Solutions partnered with Chengdu New Radiomedicine Technology Co., Ltd. (CNRT) to install a Cyclone IKON system in Sichuan Province, China, emphasizing the region’s focus on theragnostics and personalized treatments.

Growing awareness of advanced cancer therapies among healthcare providers and patients is likely to drive demand. Expanding healthcare infrastructure in countries like China, India, and Japan is expected to improve access to cutting-edge treatment options. Government initiatives promoting the development of advanced radiation technologies are anticipated to attract significant investments.

Local manufacturers and global companies are projected to collaborate, introducing cost-effective proton therapy systems to meet regional demand. Medical tourism in Asia Pacific, supported by affordable yet high-quality cancer treatments, is expected to further boost adoption. The growing focus on research and development in oncology is likely to enhance the availability of innovative therapies, supporting robust market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the proton therapy market focus on advancing technologies such as pencil beam scanning and image-guided therapy to improve treatment precision and outcomes. Companies invest heavily in research and development to introduce compact and cost-effective systems, making the therapy more accessible to healthcare providers.

Collaborations with hospitals and research institutions drive the adoption of new systems and expand their clinical applications. Geographic expansion into emerging markets with increasing cancer prevalence supports broader market penetration. Many players also prioritize patient-centric solutions, offering personalized treatment plans and integrated software for enhanced care delivery.

IBA Proton Therapy, a leading company in this market, specializes in proton therapy solutions like the Proteus ONE, a compact system designed for accessibility and efficiency. The company focuses on innovation and collaboration, providing tailored solutions to meet the needs of hospitals and cancer centers globally. IBA’s commitment to advancing cancer treatment and its strong global presence make it a key player in the industry.

Top Key Players

- Sumitomo Heavy Industries, Ltd.

- Siemens Healthcare GmbH

- Provision Healthcare.

- Optivus Proton Therapy, Inc.

- Mevion Medical Systems

- IBA Radiopharma Solutions

- Hitachi Ltd

Recent Developments

- In June 2022, IBA Radiopharma Solutions launched the ConformalFLASH Alliance, aimed at advancing the implementation of ConformalFLASH Proton Therapy for cancer patients. This innovative technique combines the ultra-high dose rates of FLASH radiotherapy with the precise Bragg Peak properties of protons, offering a cutting-edge approach to treatment.

- In April 2021, Siemens Healthcare GmbH finalized its acquisition of Varian Medical Systems, Inc., a strategic move to strengthen Siemens’ oncology portfolio and expand its capabilities in cancer treatment solutions.

Report Scope

Report Features Description Market Value (2024) US$ 3.6 billion Forecast Revenue (2034) US$ 12.3 billion CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Patient Positioning System, Nozzle and Image Viewers, Beam Transport System, Beam Delivery System, and Accelerator), By Application (Prostate Cancer, Head and Neck Cancer, CNS Cancer, Breast Cancer, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sumitomo Heavy Industries, Ltd., Siemens Healthcare GmbH, Provision Healthcare., Optivus Proton Therapy, Inc., Mevion Medical Systems, IBA Radiopharma Solutions, and Hitachi Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sumitomo Heavy Industries, Ltd.

- Siemens Healthcare GmbH

- Provision Healthcare.

- Optivus Proton Therapy, Inc.

- Mevion Medical Systems

- IBA Radiopharma Solutions

- Hitachi Ltd