Global Kids Clothing Market Size, Share, Growth Analysis By Age Group (Infants (0-2 years), Kids (5-12 years), Toddlers (2-5 years)), By Product Type (Tops, Activewear, Outerwear, Bottoms, Dresses, Others), By Gender (Boys Clothing, Unisex Clothing, Girls Clothing), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153793

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

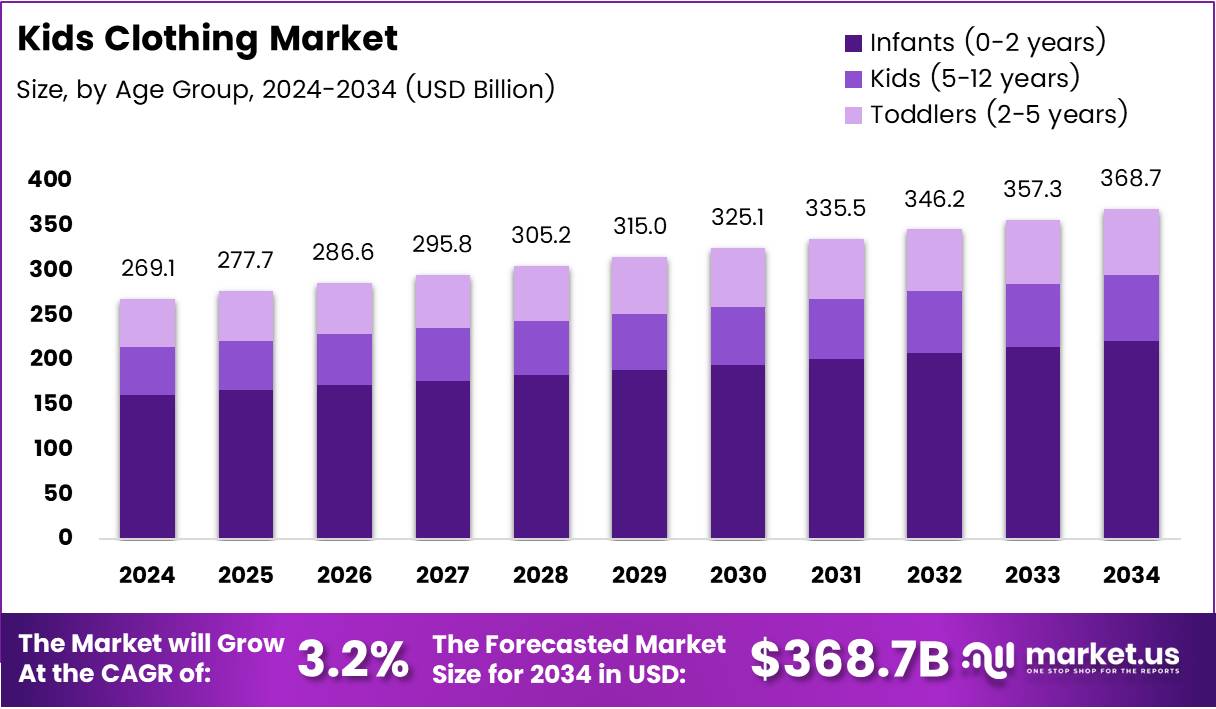

The Global Kids Clothing Market size is expected to be worth around USD 368.7 Billion by 2034, from USD 269.1 Billion in 2024, growing at a CAGR of 3.2% during the forecast period from 2025 to 2034.

The kids clothing market refers to the apparel segment designed for children between 0 to 14 years. It includes daily wear, festive outfits, sportswear, and school uniforms. Demand is driven by fast-changing fashion trends, rising disposable incomes, and growing awareness about children’s comfort, health, and sustainability in clothing materials.

The kids clothing industry is expanding due to rising birth rates and urbanization in emerging markets. Parents now demand both fashion and function, encouraging brands to innovate with softer fabrics and safer dyes. Companies are also launching gender-neutral collections and adaptive clothing for special needs, reflecting a shift in consumer expectations.

Moreover, the rise of e-commerce has allowed wider access to affordable kidswear. Digital platforms and mobile shopping apps offer seasonal discounts and subscriptions. This shift benefits both busy parents and small brands competing in a saturated market. Direct-to-consumer (DTC) models have further personalized the customer journey with better fit, style guides, and flexible returns.

In addition, government policies supporting textile manufacturing, especially in countries like India, Bangladesh, and Vietnam, are bolstering production capabilities. Tax benefits, export subsidies, and training programs are attracting new investments. These actions improve supply chain efficiency while reducing costs for retailers, thereby making kids clothing more affordable across segments.

Sustainability remains a strong growth driver. Many parents now prefer organic, biodegradable, and ethically made children’s apparel. This demand has led to increased use of materials like organic cotton and recycled fabrics. Brands aligning with sustainable practices gain better loyalty and command higher margins in eco-conscious urban centers.

COVID-19 accelerated demand for comfort-based clothing over traditional style preferences. Consequently, there’s a growing market for athleisure and soft loungewear for children. Brands are adapting by designing versatile pieces that can transition from home use to school and casual outings, making them more attractive to budget-conscious buyers.

Looking at behavioral trends, 48% of parents prioritize affordability over brand value when purchasing kidswear, as per Baker City Herald. Additionally, 39% emphasize quality and design. This indicates a rising preference for well-made but reasonably priced clothing over luxury labels. It’s shaping how retailers price and market their collections.

Interestingly, 37% of parents buy holiday clothes months ahead, reflecting a shift to early seasonal shopping, also according to Baker City Herald. This signals opportunities for retailers to target early planners with pre-seasonal collections and bundled offers, increasing repeat purchases and building stronger brand loyalty.

Key Takeaways

- The Global Kids Clothing Market is projected to reach USD 368.7 Billion by 2034, growing from USD 269.1 Billion in 2024 at a CAGR of 3.2% between 2025 and 2034.

- Infants (0-2 years) accounted for 32.4% of the market in 2024, driven by rapid growth and frequent clothing replacements.

- Tops dominated the product type segment with a 25.8% share in 2024, fueled by universal usage and frequent wardrobe refreshes.

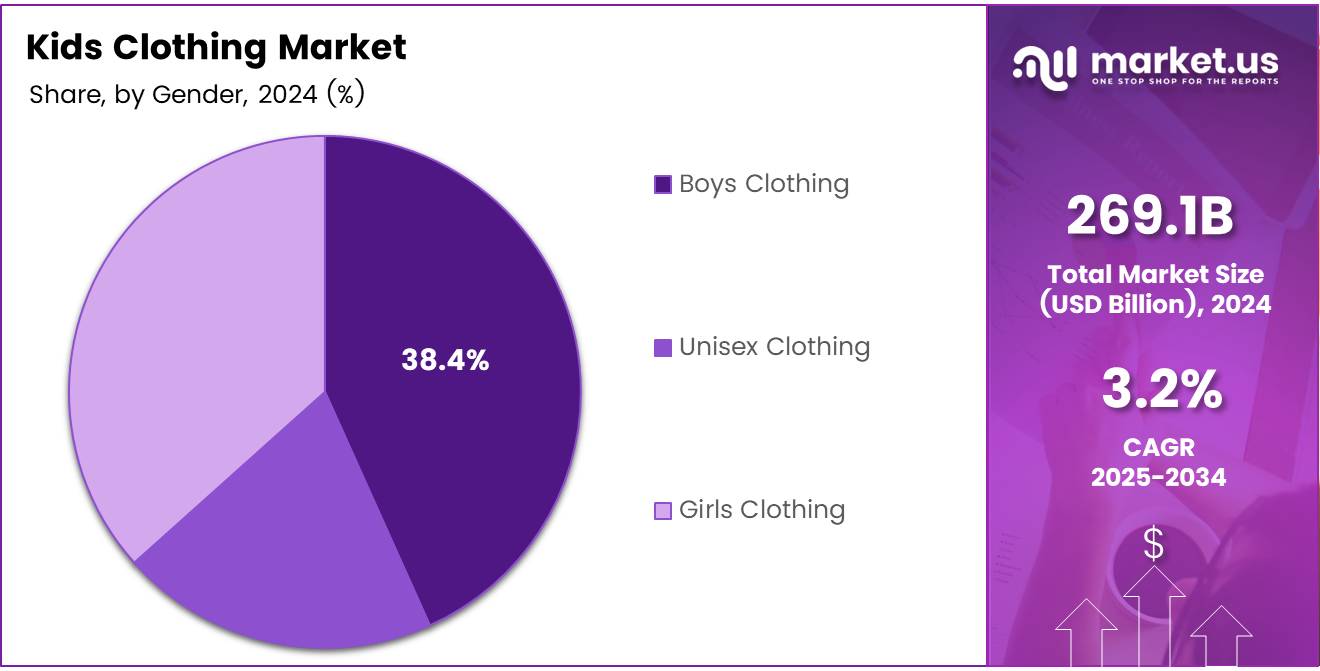

- Boys Clothing held a leading 38.4% share in 2024 due to high demand for durable, multipurpose garments.

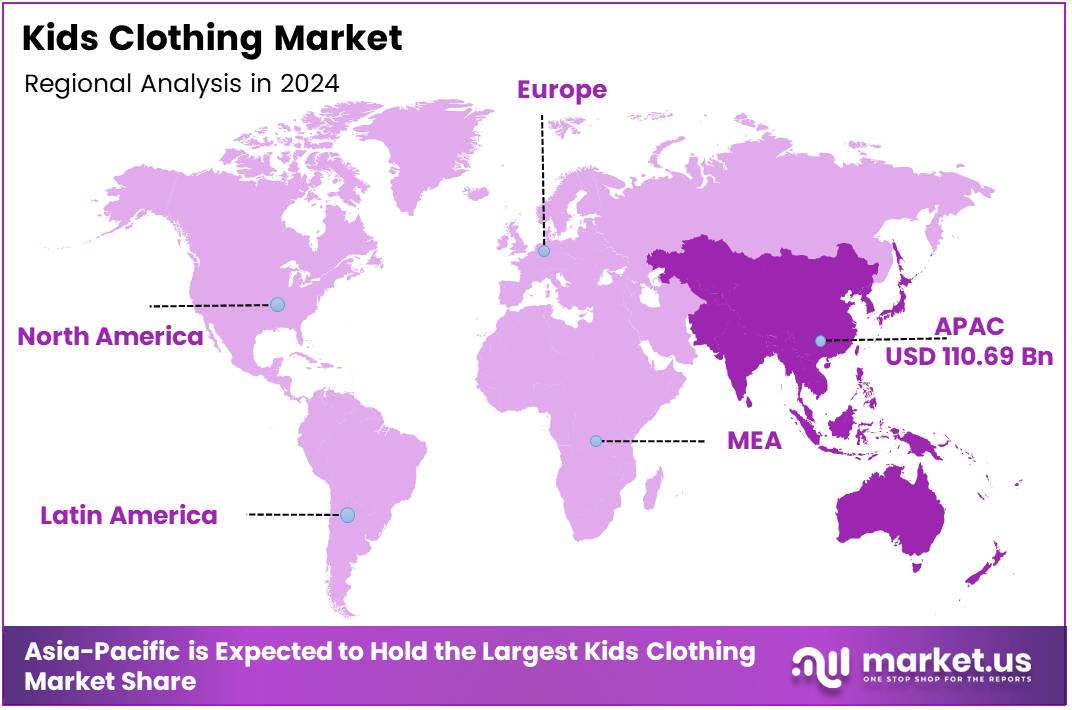

- Asia Pacific led the market with 41.3% share, valued at USD 110.9 Billion, supported by urbanization, rising middle-class spending, and strong e-commerce presence.

Age Group Analysis

Infants (0-2 years) lead with 32.4% due to high demand for essential, fast-replaceable garments.

In 2024, Infants (0-2 years) held a dominant market position in the By Age Group Analysis segment of the Kids Clothing Market, accounting for a share of 32.4%. This dominance is largely attributed to the frequent need for clothing replacements in this age group, driven by rapid growth rates, diaper changes, and seasonal sensitivity. Parents tend to prioritize comfort and safety, pushing demand for soft, breathable fabrics in this segment.

Toddlers (2-5 years) follow as a key market segment, as this age group experiences swift physical and social development, influencing the purchase of expressive, colorful, and comfortable attire. Playwear and adaptable fits are popular due to active movement and growing independence in dressing.

Meanwhile, Kids (5-12 years) also represent a strong segment as school uniforms, extracurricular wear, and seasonal collections play a critical role in shaping demand. Branded and character-themed clothing also gains traction in this category due to rising influence from media and peer groups.

Product Type Analysis

Tops dominate with 25.8% owing to their versatility and high purchase frequency.

In 2024, Tops held a dominant market position in the By Product Type Analysis segment of the Kids Clothing Market, capturing a 25.8% share. The category’s stronghold is supported by its universal usage across all age groups and genders, with styles ranging from casual tees to collared shirts and blouses. Parents frequently purchase tops due to their wear-and-tear cycle, fashion rotation, and layering flexibility.

Activewear has seen increased attention, especially among school-going kids and toddlers, who require comfort-centric apparel for play and physical education. This segment benefits from the rising trend of athleisure and health-conscious parenting.

Outerwear is seasonally driven and appeals in colder regions, whereas Bottoms and Dresses represent staple and occasion-specific demand. The Others category includes specialty items like sleepwear and ethnic wear, filling out wardrobes for special events and cultural needs.

Gender Analysis

Boys Clothing leads with 38.4% due to greater volume in essentials and casualwear.

In 2024, Boys Clothing held a dominant market position in the By Gender Analysis segment of the Kids Clothing Market, claiming a 38.4% share. The segment benefits from consistent demand for T-shirts, shorts, jeans, and uniforms—garments purchased more frequently due to active lifestyles and wear cycles. Parents often seek durable, multipurpose pieces, leading to recurring sales in boys’ segments.

Unisex Clothing is emerging as a modern choice, especially among urban parents. Its adaptability and gender-neutral design philosophy appeal to sustainability-conscious buyers. Items like hoodies, joggers, and bodysuits fall into this trend, reducing the need for gender-specific inventories.

Girls Clothing, while vibrant and style-driven, tends to feature varied buying behaviors centered around aesthetic preference and special occasions. Dresses, tunics, and fashion-forward designs dominate this segment, with notable peaks during holidays, birthdays, and festive seasons.

Key Market Segments

By Age Group

- Infants (0-2 years)

- Kids (5-12 years)

- Toddlers (2-5 years)

By Product Type

- Tops

- Activewear

- Outerwear

- Bottoms

- Dresses

- Others

By Gender

- Boys Clothing

- Unisex Clothing

- Girls Clothing

By Distribution Channel

- Online

- Offline

Drivers

Rising Disposable Incomes Driving Demand for Premium Kids Clothing

As more families experience increased disposable income, there’s a noticeable rise in spending on premium kids clothing. Parents are now more willing to invest in high-quality, stylish outfits for their children, considering them a reflection of family status and comfort standards.

The growing popularity of e-commerce platforms is another strong driver for the kids clothing market. These platforms offer wide selections, competitive prices, and home delivery options, making it convenient for parents to shop for children’s apparel without visiting physical stores.

Sustainability is becoming a core value in parenting choices, and this trend is shaping the kids clothing industry. Parents are increasingly choosing eco-friendly and organic fabrics for their children, creating new opportunities for brands that prioritize ethical sourcing and green production.

Additionally, the expanding middle-class population, especially in developing countries, is fueling global demand. With more households able to afford quality clothing, manufacturers are seeing new growth in both urban and semi-urban markets worldwide.

Restraints

Rising Raw Material Costs Impacting Kids Clothing Prices

The rise in the prices of raw materials like cotton and synthetic fibers is directly increasing the cost of kids clothing. This makes it harder for many families to afford premium apparel, forcing brands to balance pricing and quality.

Frequent changes in kids fashion trends pose inventory management challenges for retailers. Styles that are popular today may become outdated quickly, resulting in unsold stock and financial losses for manufacturers and sellers.

Moreover, the market is facing stiff competition from low-cost fast fashion brands. These companies attract price-sensitive consumers with trendy, affordable options, putting pressure on traditional and sustainable kidswear producers to compete on both style and price.

Growth Factors

Surge in Demand for Customizable and Personalized Kids Clothing

There is a noticeable increase in demand for kids clothing that reflects individuality. Parents are opting for personalized outfits that include names, characters, or unique prints, making clothing feel more special and child-specific.

Activewear and athleisure clothing for children are becoming more popular due to their comfort and versatility. With kids involved in sports and outdoor activities, parents prefer clothing that supports movement while staying stylish.

Gender-neutral clothing is gaining acceptance among modern parents who value inclusivity and simplicity. These unisex designs offer long-term use and convenience, allowing clothes to be shared among siblings regardless of gender.

Online subscription-based services are growing, offering curated kids clothing delivered regularly. These services provide size-appropriate selections and style variety, meeting the evolving needs of growing children efficiently.

Emerging Trends

Influence of Social Media Influencers on Kids Fashion Choices

Social media influencers have become trendsetters in kids fashion. Parents follow popular parenting and fashion accounts that promote stylish outfits for children, creating higher awareness and faster trend adoption.

Virtual try-on technologies are making online shopping for kids clothing more interactive. These tools help parents visualize how outfits will fit their children, reducing return rates and improving customer satisfaction.

The introduction of smart textiles and wearable tech in children’s apparel is gaining interest. These include temperature-regulating fabrics or garments with tracking features, appealing to tech-savvy parents focused on functionality.

Multi-functional clothing is also trending, with outfits designed to adjust to weather changes. Jackets that can be converted into vests or pants with removable layers are increasingly appreciated by parents looking for value and versatility.

Regional Analysis

Asia Pacific Dominates the Kids Clothing Market with a Market Share of 41.3%, Valued at USD 110.9 Billion

Asia Pacific leads the kids clothing market with 41.3%, Valued at USD 110.9 Billion, driven by a rising middle-class population, rapid urbanization, and increasing spending on children’s fashion in countries such as India and China. Changing family structures and higher parental spending on fashion-forward clothing further accelerate regional growth. The strong presence of local textile industries and a booming e-commerce ecosystem also enhance market penetration.

North America Kids Clothing Market Trends

In North America, the market continues to grow due to a high preference for premium, branded clothing and sustainable apparel choices among parents. Demand is bolstered by the increasing influence of digital media and children’s fashion influencers, driving trends and sales. Additionally, rising awareness of organic and eco-friendly fabrics contributes to consumer preferences in this region.

Europe Kids Clothing Market Insights

Europe sees steady growth supported by strong demand for fashionable and high-quality clothing among style-conscious parents. The region is also known for stringent quality regulations, pushing brands to deliver sustainable and ethically produced clothing lines. Government regulations promoting child safety in garments further support market credibility and consumer trust.

Middle East and Africa Kids Clothing Market Overview

The kids clothing market in the Middle East and Africa is experiencing gradual growth driven by increasing birth rates and a growing youth population. Urbanization and rising household income in GCC nations are leading to greater demand for Western-style and designer children’s wear. Cultural preferences and regional retail expansions also support market momentum.

Latin America Kids Clothing Market Dynamics

In Latin America, growing consumer spending and a young demographic profile are pushing the kids clothing market forward. The rise of online platforms and digital payment systems is making kids apparel more accessible across urban and semi-urban areas. Moreover, awareness around comfortable, climate-friendly fabrics is shaping new product preferences among parents.

United States Kids Clothing Market Overview

The U.S. market remains highly mature, characterized by frequent seasonal buying and high-value purchases. Parents prioritize affordability and design, especially during back-to-school and holiday seasons. With digital retail shaping most consumer journeys, U.S. shoppers increasingly rely on online reviews, social media, and influencer endorsements to guide their kids’ clothing purchases.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kids Clothing Company Insights

In 2024, leading players in the global kids clothing market are continuing to diversify their product lines and invest in both online and offline retail strategies to remain competitive.

The Children’s Place, Inc. has maintained its dominance through aggressive digital transformation, focusing on omnichannel growth and value pricing to target middle-income families seeking affordable yet trendy apparel. It has also optimized inventory flow to align with seasonal demand.

Gap Inc. is leveraging its global recognition by expanding its kidswear segments under the Gap Kids and Old Navy brands. Its sustainable product launches and focus on gender-neutral designs have resonated well with socially conscious parents, helping the company capture a broader customer base across the U.S. and international markets.

Under Armour, Inc. continues to innovate in performance wear for children, combining its core sportswear identity with comfort-oriented everyday apparel. The brand’s push toward youth sports and fitness has helped it create a loyal customer base among young athletes and active kids.

Benetton Group is capitalizing on its strong design heritage and expanding its kidswear collection with vibrant, multicultural fashion lines. The brand’s strategic retail expansion across emerging markets and renewed focus on eco-friendly fabrics reflect its adaptive approach to evolving consumer preferences.

Together, these companies are shaping the direction of the kids clothing market by aligning brand identity with evolving fashion trends, digital advancements, and changing consumer values. Their distinct positioning and innovation-led strategies are expected to influence how the market evolves over the next few years.

Top Key Players in the Market

- The Children’s Place, Inc.

- Gap Inc.

- Under Armour, Inc.

- Benetton Group

- OshKosh B’gosh

- Boohoo Group PLC

- Next PLC

- Primark Stores Limited

- Puma SE

- H&M Hennes & Mauritz AB

- Carter’s, Inc.

- Zara (Inditex)

- Lands’ End, Inc.

- Nike, Inc.

- Adidas AG

Recent Developments

- In January 2024, kidswear brand Kidbea secured US$1 million in a pre-Series A funding round, which was led by Venture Catalysts. The investment aims to strengthen its product portfolio and expand its retail footprint across India.

- In June 2024, Urth Apparel Inc. announced the acquisition of Paper Cape, a premium kids and baby clothing brand. This move enhances Urth’s presence in the high-end children’s apparel segment.

- In November 2024, Suditi Industries completed the acquisition of renowned Indian kidswear brand Gini & Jony. The strategic deal is expected to boost Suditi’s retail network and diversify its branded offerings.

- In October 2024, Go Global Retail and Janie and Jack jointly acquired HATCH Collection, a premium maternity fashion brand. The acquisition strengthens their positioning in the luxury maternity and family fashion segments.

Report Scope

Report Features Description Market Value (2024) USD 269.1 Billion Forecast Revenue (2034) USD 368.7 Billion CAGR (2025-2034) 3.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Age Group (Infants (0-2 years), Kids (5-12 years), Toddlers (2-5 years)), By Product Type (Tops, Activewear, Outerwear, Bottoms, Dresses, Others), By Gender (Boys Clothing, Unisex Clothing, Girls Clothing), By Distribution Channel (Online, Offline) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape The Children’s Place, Inc., Gap Inc., Under Armour, Inc., Benetton Group, OshKosh B’gosh, Boohoo Group PLC, Next PLC, Primark Stores Limited, Puma SE, H&M Hennes & Mauritz AB, Carter’s, Inc., Zara (Inditex), Lands’ End, Inc., Nike, Inc., Adidas AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Children's Place, Inc.

- Gap Inc.

- Under Armour, Inc.

- Benetton Group

- OshKosh B’gosh

- Boohoo Group PLC

- Next PLC

- Primark Stores Limited

- Puma SE

- H&M Hennes & Mauritz AB

- Carter’s, Inc.

- Zara (Inditex)

- Lands' End, Inc.

- Nike, Inc.

- Adidas AG