Global Keloid Treatment Market By Treatment Type (Corticosteroid injections, Compression Therapy, Topical Products, Keloid surgery, Laser skin resurfacing, Cryotherapy and Others), By End-User (Hospitals, Dermatology & Aesthetic Clinics and Homecare), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176115

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

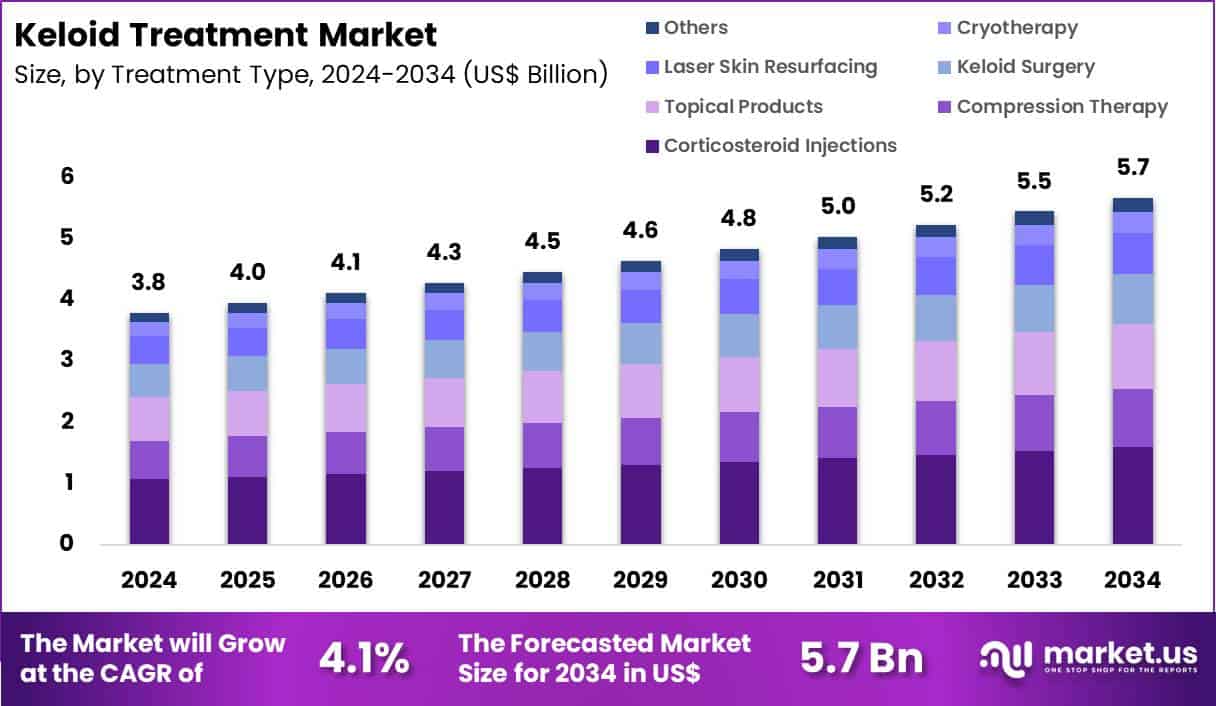

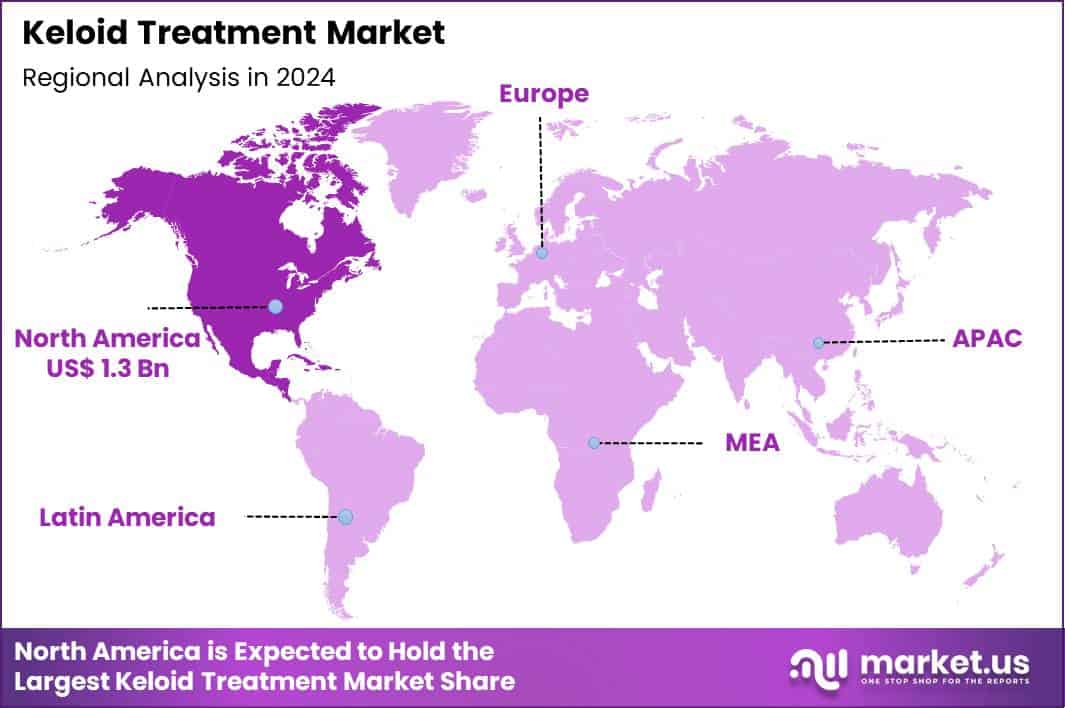

Global Keloid Treatment Market size is expected to be worth around US$ 5.7 Billion by 2034 from US$ 3.8 Billion in 2024, growing at a CAGR of 4.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 35.2% share with a revenue of US$ 1.3 Billion.

Rising prevalence of keloid scarring from surgical procedures, trauma, acne, and burns propels the keloid treatment market as patients seek effective interventions that minimize recurrence and improve cosmetic outcomes. Dermatologists increasingly apply intralesional corticosteroid injections to reduce inflammation and collagen deposition in early-stage keloids, achieving softening and flattening in hypertrophic scars on the chest, shoulders, and earlobes.

These treatments support cryotherapy sessions that freeze keloid tissue, disrupting abnormal fibroblast activity and promoting regression in smaller lesions on the face and neck. Clinicians utilize silicone gel sheets and pressure garments as first-line or adjunctive therapies, exerting mechanical compression to suppress excessive collagen synthesis in postoperative scars and earlobe piercings.

Laser therapies, including pulsed dye and fractional CO2 systems, target vascular components and remodel collagen architecture in mature keloids, enhancing texture and pigmentation for visible improvement. Radiation therapy combined with surgical excision serves high-risk patients, delivering low-dose postoperative radiation to inhibit fibroblast proliferation in recurrent or large keloids on the trunk and extremities.

Manufacturers pursue opportunities to develop advanced combination therapies that integrate intralesional agents with novel delivery systems, expanding applications in refractory keloids resistant to conventional modalities. Developers advance topical formulations with anti-fibrotic compounds and growth factor modulators, offering non-invasive options for maintenance therapy after primary interventions.

These innovations facilitate personalized treatment algorithms based on keloid size, location, and patient skin type, optimizing outcomes in diverse presentations. Opportunities emerge in minimally invasive microneedling devices that enhance drug penetration and stimulate controlled remodeling in early hypertrophic scars.

Companies invest in bioactive dressings and injectable biomaterials that modulate wound healing pathways, reducing keloid formation risk in high-tension areas. Recent trends emphasize multimodal approaches combining physical, pharmacological, and energy-based modalities, positioning the market for sustained innovation in scar management and aesthetic dermatology.

Key Takeaways

- In 2024, the market generated a revenue of US$ 3.8 Billion, with a CAGR of 4.1%, and is expected to reach US$ 5.7 Billion by the year 2034.

- The treatment type segment is divided into corticosteroid injections, compression therapy, topical products, keloid surgery, laser skin resurfacing, cryotherapy and others, with corticosteroid injections taking the lead with a market share of 28.1%.

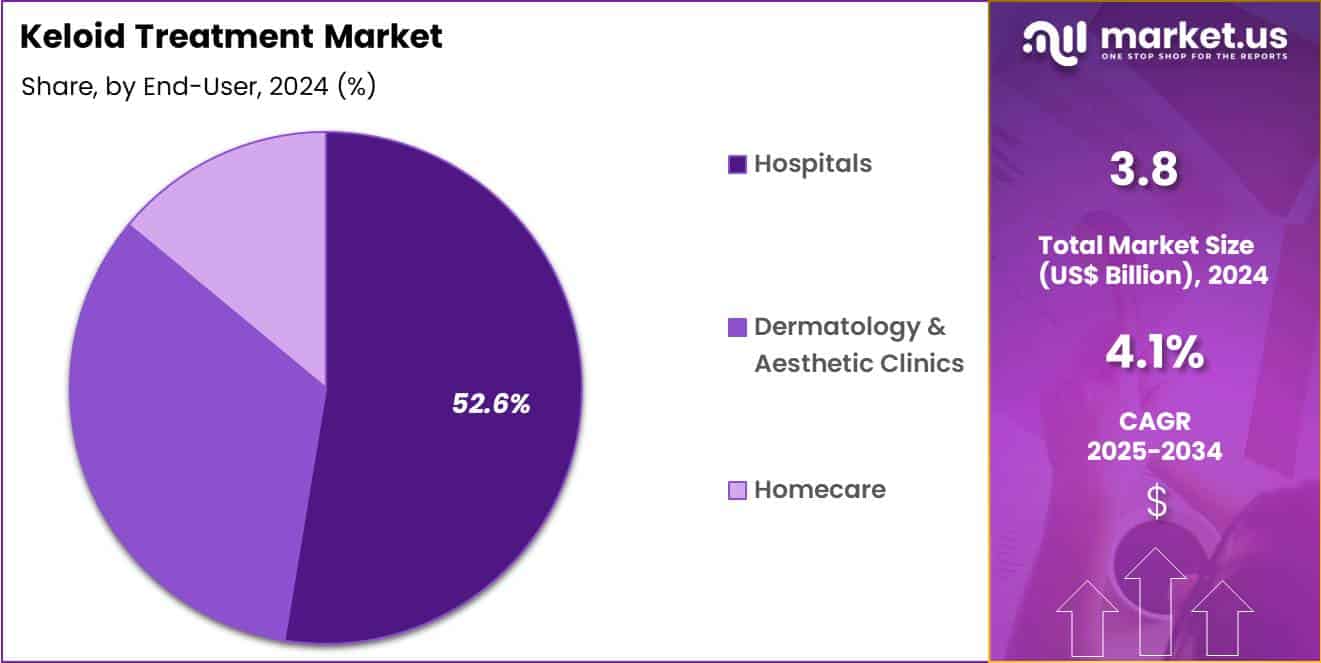

- Considering end-user, the market is divided into hospitals, dermatology & aesthetic clinics and homecare. Among these, hospitals held a significant share of 52.6%.

- North America led the market by securing a market share of 35.2%.

Treatment Type Analysis

Corticosteroid injections contributed 28.1% of growth within treatment type and led the keloid treatment market due to their proven effectiveness in reducing inflammation, scar thickness, and associated symptoms.

Dermatologists and surgeons frequently rely on corticosteroid injections because they suppress fibroblast activity and collagen overproduction, which directly addresses the biological drivers of keloid formation. Patients favor this treatment due to its minimally invasive nature and outpatient suitability. High recurrence risk associated with untreated keloids encourages early intervention using injectable corticosteroids as a first-line therapy.

Growth also strengthens as combination treatment approaches increasingly include corticosteroid injections alongside surgery, laser therapy, or cryotherapy to reduce relapse rates. Clinical guidelines and physician familiarity reinforce consistent usage across hospital and clinic settings.

Repeat dosing protocols increase overall treatment volumes. Accessibility and relatively low procedural cost further support adoption. The segment is projected to remain dominant as clinicians prioritize reliable, evidence-backed interventions for long-term keloid management.

End-User Analysis

Hospitals accounted for 52.6% of growth within end-user and dominated the keloid treatment market due to their ability to manage complex and recurrent scar cases. These facilities handle patients requiring multidisciplinary evaluation, advanced imaging, and procedural interventions under controlled clinical conditions.

Hospitals serve as referral centers for severe or treatment-resistant keloids, which increases procedural concentration. Availability of surgical and injectable treatment options under one roof strengthens patient throughput. Investment in dermatology and plastic surgery departments supports sustained growth within hospital settings. Post-surgical scar management protocols further drive treatment demand.

Hospitals also manage complications and recurrence monitoring, which extends patient engagement timelines. Insurance coverage and reimbursement familiarity favor hospital-based care. The segment is expected to remain the primary growth driver as hospitals continue to anchor comprehensive scar treatment and long-term follow-up services.

Key Market Segments

By Treatment Type

- Corticosteroid injections

- Compression Therapy

- Topical Products

- Keloid surgery

- Laser skin resurfacing

- Cryotherapy

- Others

By End-User

- Hospitals

- Dermatology & Aesthetic Clinics

- Homecare

Drivers

Increasing prevalence of keloids in diverse populations is driving the market.

The rising occurrence of keloids, particularly among individuals with darker skin tones, has amplified the demand for effective therapeutic interventions in dermatological care. Genetic predispositions and environmental factors contribute to higher keloid formation rates in specific ethnic groups, prompting greater clinical focus.

According to a study published by the National Institutes of Health in 2024, utilizing data from January 2013 to March 2022, 24,453 patients were identified with keloids, highlighting the condition’s significant impact. This extensive cohort analysis reveals that Black and Asian patients exhibited higher instances of multiple or larger keloids compared to white patients.

Healthcare systems are responding by prioritizing accessible treatments to manage this chronic scarring disorder. The correlation between surgical procedures and keloid development further escalates the need for preventive and remedial solutions. Public health efforts emphasize education on risk factors to facilitate early intervention.

Key industry participants are channeling resources into research to develop targeted therapies for affected demographics. This driver enhances collaboration between clinicians and manufacturers for improved patient management. Ultimately, the prevalence trend bolsters sustained innovation in keloid therapeutics.

Restraints

High cost of advanced keloid therapies is restraining the market.

The elevated pricing of specialized keloid treatments, including radiation and surgical options, restricts accessibility for patients in various socioeconomic strata. Manufacturing intricacies for devices like superficial radiotherapy systems contribute to substantial end-user expenses. Insurance limitations often result in partial coverage, deterring widespread utilization in outpatient settings.

Regulatory mandates for safety evaluations further inflate development and deployment costs. In public healthcare frameworks, budget allocations favor essential services over premium scar management. Patients may postpone treatments due to financial burdens, impacting overall market uptake. This restraint challenges scalability for innovative modalities in cost-conscious regions.

Collaborative pricing models aim to alleviate these barriers incrementally. Despite therapeutic advancements, economic constraints hinder equitable access. Addressing affordability through subsidies is imperative for mitigating this market obstacle.

Opportunities

Growth in superficial radiotherapy adoption is creating growth opportunities.

The broadening application of superficial radiotherapy for keloid prevention and treatment opens avenues in oncology and dermatology practices. Enhanced clinical evidence supports its efficacy in reducing recurrence post-excision, attracting investment in specialized equipment.

Sensus Healthcare reported revenues of $41.8 million in 2024, a 71% increase from $24.4 million in 2023, reflecting heightened demand for their SRT systems. This financial uptick underscores the expanding role of non-invasive technologies in scar management. Partnerships with surgical centers facilitate integrated care protocols for high-risk patients.

The technology’s versatility for non-melanoma skin conditions complements its use in keloid therapy. Government endorsements for radiation safety standards bolster market confidence. Key firms are expanding distribution networks to reach underserved clinics. This opportunity aligns with global efforts to minimize invasive procedures. Strategic marketing can amplify penetration in emerging dermatological markets.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the keloid treatment market through healthcare spending patterns, patient out of pocket capacity, and clinic level investment decisions. Inflation and higher interest rates reduce discretionary dermatology visits, which slows uptake of elective and combination therapies.

Geopolitical tensions affect supplies of corticosteroids, medical devices, and laser components, increasing procurement risk and extending lead times. Current US tariffs on imported devices, consumables, and specialty ingredients raise treatment delivery costs and pressure provider margins. These factors can limit access in price sensitive settings and delay technology adoption.

On the positive side, trade pressure encourages domestic sourcing, local manufacturing, and tighter supplier diversification. Rising awareness of scar management and demand for minimally invasive options support steady patient flow. With disciplined pricing, broader treatment portfolios, and continued clinical innovation, the market retains a clear path to sustainable growth.

Latest Trends

Development of combination therapy approaches is a recent trend in the market.

In 2024, researchers at the University of Cape Town’s Hair and Skin Research Laboratory introduced a targeted combination therapy for keloid disease, addressing specific biomarkers. This method integrates multiple modalities to disrupt the scarring process more effectively than monotherapy. Preclinical evaluations demonstrated improved outcomes in reducing keloid size and recurrence rates.

The approach incorporates existing reagents with novel agents to enhance cellular targeting. Regulatory pathways are being explored for clinical translation in affected populations. Industry focus on personalization tailors combinations to individual genetic profiles.

Collaborations refine protocols for broader applicability in diverse ethnic groups. The trend emphasizes reduced side effects through synergistic mechanisms. These innovations support long-term remission in chronic cases. This evolution establishes combination strategies as foundational in advancing keloid care.

Regional Analysis

North America is leading the Keloid Treatment Market

North America holds a 35.2% share of the global Keloid Treatment market, indicating strong growth in 2024 supported by greater emphasis on minimally invasive procedures and combination therapies that address recurrent scarring effectively.

Leading manufacturers such as Sonoma Pharmaceuticals and Alliance Pharma have unveiled enhanced intralesional corticosteroid formulations and bioengineered dressings, optimizing outcomes for patients with hypertrophic and keloid formations post-surgery or trauma. The area’s comprehensive insurance frameworks have broadened coverage for outpatient treatments, encouraging more individuals to seek specialized dermatological care for aesthetic and functional improvements.

Initiatives from bodies like the American Academy of Dermatology have promoted education on keloid prevention, leading to earlier interventions and reduced complication rates. Expanding telemedicine services have connected remote patients with experts, increasing procedure uptake in underserved communities.

Joint efforts between pharmaceutical entities and research centers have advanced gene therapy explorations, targeting fibroblast overactivity in scar-prone individuals. Moreover, heightened focus on multicultural populations, where keloids occur more frequently, has driven tailored product development. The FDA approved 7 new dermatologic therapies in 2024, bolstering innovations in managing skin disorders like excessive scarring.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts expect marked evolution in the scar therapy domain across Asia Pacific throughout the forecast period, since authorities bolster dermatological services with expanded budgets for specialized clinics and equipment procurement. Firms in India and South Korea innovate hybrid laser systems that integrate radiofrequency for deeper tissue remodeling, while professionals in Australia refine injection protocols to minimize recurrence in high-risk groups.

Healthcare networks in the Philippines prioritize community outreach that educates on early wound care, curbing severe fibrosis development among burn victims. Investors in Vietnam fund trials for botanical extracts that inhibit collagen excess, complementing standard regimens with natural alternatives. Regulators in Japan streamline import processes for advanced gels, enabling quicker integration into hospital protocols.

Practitioners in Indonesia collaborate on multicenter studies that validate cryosurgical techniques, improving efficacy for diverse ethnicities. Entrepreneurs in Thailand launch mobile apps that track healing progress, empowering users to adhere to follow-up plans. China’s NMPA approved 65 innovative medical devices in 2024, advancing tools for precise scar intervention.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the keloid treatment market pursue growth by broadening therapeutic portfolios with advanced modalities such as laser systems, corticosteroid delivery platforms, and silicone-based solutions that improve patient outcomes. They invest in clinical research and evidence generation to validate efficacy, strengthen payer acceptance, and differentiate offerings in a fragmented care landscape.

Companies also cultivate strategic partnerships with dermatology networks and aesthetic clinics to embed their solutions into standard practice and boost recurring demand. Expanding into high-growth regions like Asia Pacific and the Middle East helps them capture rising awareness and unmet treatment needs while diversifying revenue sources.

Galderma positions itself as a leading dermatology-focused company with a strong suite of scar management and cosmetic dermatology products, robust global distribution, and a commercialization approach centered on clinician education. The firm reinforces its competitive stance through targeted R&D funding, proactive market engagement, and a disciplined focus on aligning product value with evolving clinical preferences.

Top Key Players

- Novartis AG

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Mölnlycke Health Care AB

- Galderma S.A.

- Sensus Healthcare

- Perrigo Company plc (ScarAway)

- Alliance Pharma PLC (Kelo-Cote)

- Cynosure Inc.

- Cutera Inc.

- Bio Med Sciences

- Lumenis

- Sonoma Pharmaceuticals

- Smith & Nephew PLC

Recent Developments

- In 2025, Sensus Healthcare, Inc. reported that its revenues for the first half of the year reached US$ 15.7 million, largely driven by the adoption of its Superficial Radiation Therapy (SRT) systems. These systems are frequently utilized as a non-surgical alternative or a post-surgical prophylactic treatment to prevent the recurrence of keloids, which are notoriously difficult to treat. According to recent clinical developments, the company’s SRT-100 technology has become a staple in dermatology practices for managing keloid scarring with high success rates in reducing recurrence compared to traditional excision alone.

- In 2025, Sonoma Pharmaceuticals, Inc. reported annual revenues of US$ 14.3 million for its fiscal year ending March 31, 2025, focusing on its proprietary Microcyn technology. This technology is utilized in various products for the management of scars and keloids, providing a stabilized hypochlorous acid solution that aids in wound healing and minimizes abnormal collagen buildup. According to the company’s financial records, there was a notable increase in its international sales, particularly in Europe and Latin America, where demand for advanced dermatological wound care and scar management solutions continues to rise among healthcare professionals and consumers.

Report Scope

Report Features Description Market Value (2024) US$ 3.8 Billion Forecast Revenue (2034) US$ 5.7 Billion CAGR (2025-2034) 4.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Corticosteroid injections, Compression Therapy, Topical Products, Keloid surgery, Laser skin resurfacing, Cryotherapy and Others), By End-User (Hospitals, Dermatology & Aesthetic Clinics and Homecare) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis AG, Pfizer Inc., F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Bristol-Myers Squibb Company, Mölnlycke Health Care AB, Galderma S.A., Sensus Healthcare, Perrigo Company plc, Alliance Pharma PLC, Cynosure Inc., Cutera Inc., ScarAway, Bio Med Sciences, Lumenis, Sonoma Pharmaceuticals, Smith & Nephew PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novartis AG

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Mölnlycke Health Care AB

- Galderma S.A.

- Sensus Healthcare

- Perrigo Company plc (ScarAway)

- Alliance Pharma PLC (Kelo-Cote)

- Cynosure Inc.

- Cutera Inc.

- Bio Med Sciences

- Lumenis

- Sonoma Pharmaceuticals

- Smith & Nephew PLC