Global Isopropyl Alcohol Market, By Application (Antiseptic & Astringent, Cleaning Agent, Solvent, Chemical Intermediate, and Other Applications), By End-User (Pharmaceutical, Cosmetics & Personal Care, Paints & Coatings, Chemical, Food & Beverages, and Other End-Users), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 57761

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

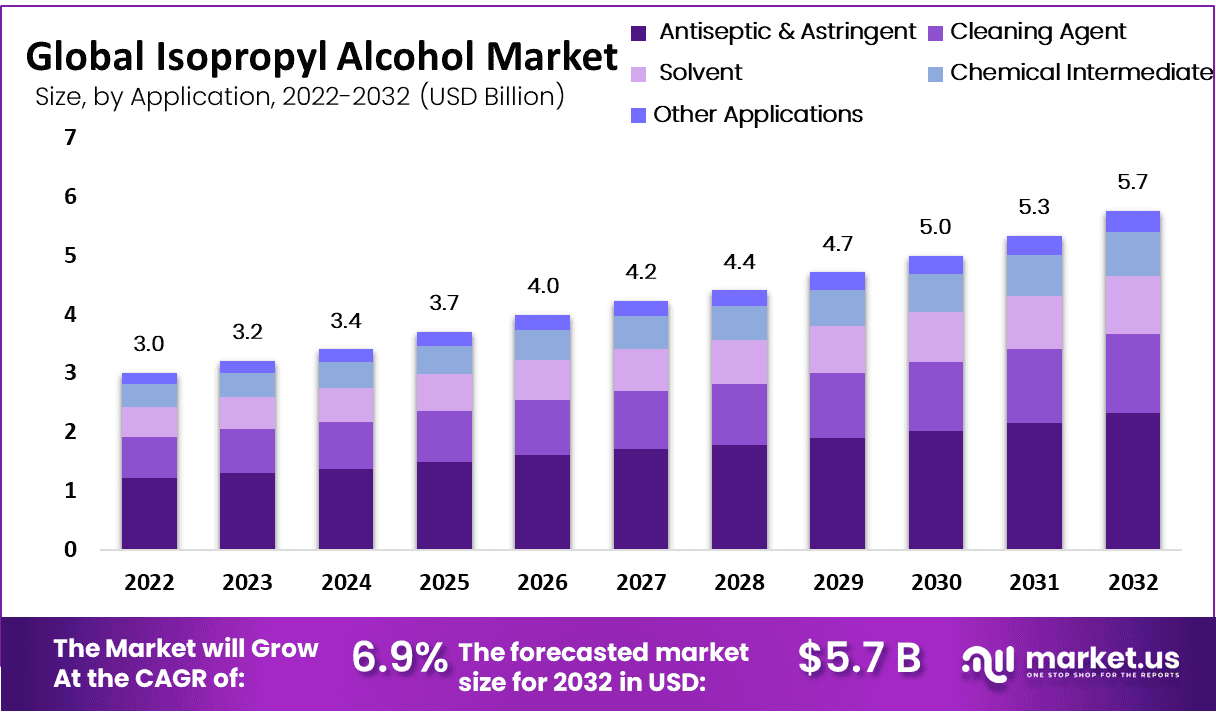

The Global Isopropyl Alcohol Market size is expected to be worth around USD 5.7 Billion by 2032 from USD 3.00 Billion in 2022, growing at a CAGR of 6.90% during the forecast period from 2023 to 2032.

Isopropyl alcohol provides high solvency characteristics, making it one of the most important solvents in all end-use sectors. Due primarily to its disinfection qualities, the chemical is also a vital component utilized in several medical facilities, pharmaceutical products, and medical devices.

The global isopropyl alcohol market has had significant growth over the years. The market size is influenced by various factors such as increasing industrial applications rising demand for cleaning and salinization products, and the expanding pharmaceutical and healthcare sectors.

The global isopropyl alcohol market offers numerous advantages that contribute to its rapid expansion. Some key benefits of the global isopropyl alcohol market include its cleaning and disinfection properties as isopropyl alcohol has antimicrobial properties which help destroy bacteria, viruses, and fungi effectively. Its use in healthcare, labs, and cleanrooms contributes to maintaining hygiene and preventing the spread of infections.

Key Takeaways

- Market Size and Growth: The Isopropyl Alcohol Market is expected to grow from USD 3.00 billion in 2022 to approximately USD 5.7 billion by 2032, with a compound annual growth rate (CAGR) of 6.90% during the forecast period from 2023 to 2032.

- Applications of Isopropyl Alcohol: Isopropyl alcohol is a versatile solvent used in various applications, including as an antiseptic and astringent, cleaning agent, solvent, chemical intermediate, and other applications. It is an essential component in the pharmaceuticals, cosmetics, paints, coatings, chemicals, food and beverage, and other industries.

- Factors Driving Market Growth: The growth of the Isopropyl Alcohol Market is attributed to factors such as increased industrial applications, rising demand for cleaning and sanitization products, and the expansion of the pharmaceutical and healthcare sectors. Isopropyl alcohol is highly sought after for its effectiveness in disinfection.

- Challenges and Regulatory Concerns: Prolonged or repeated exposure to isopropyl alcohol can lead to health issues such as headaches, nausea, and respiratory irritation, which raises concerns about consumer safety. The market is also subject to strict controls from regulatory authorities.

- Growth Opportunities: Companies are exploring the production of bio-based isopropyl alcohol, which is anticipated to meet the demand for greener and more sustainable chemicals. Initiatives in manufacturing isopropanol through fermentation are underway, aiming to promote sustainability.

- Application Analysis: In 2022, astringent and antiseptics held the largest market share at 40.4%. The demand for isopropyl alcohol as an antiseptic and astringent increased significantly during the pandemic, with a rise in the use of sanitizers and personal care products.

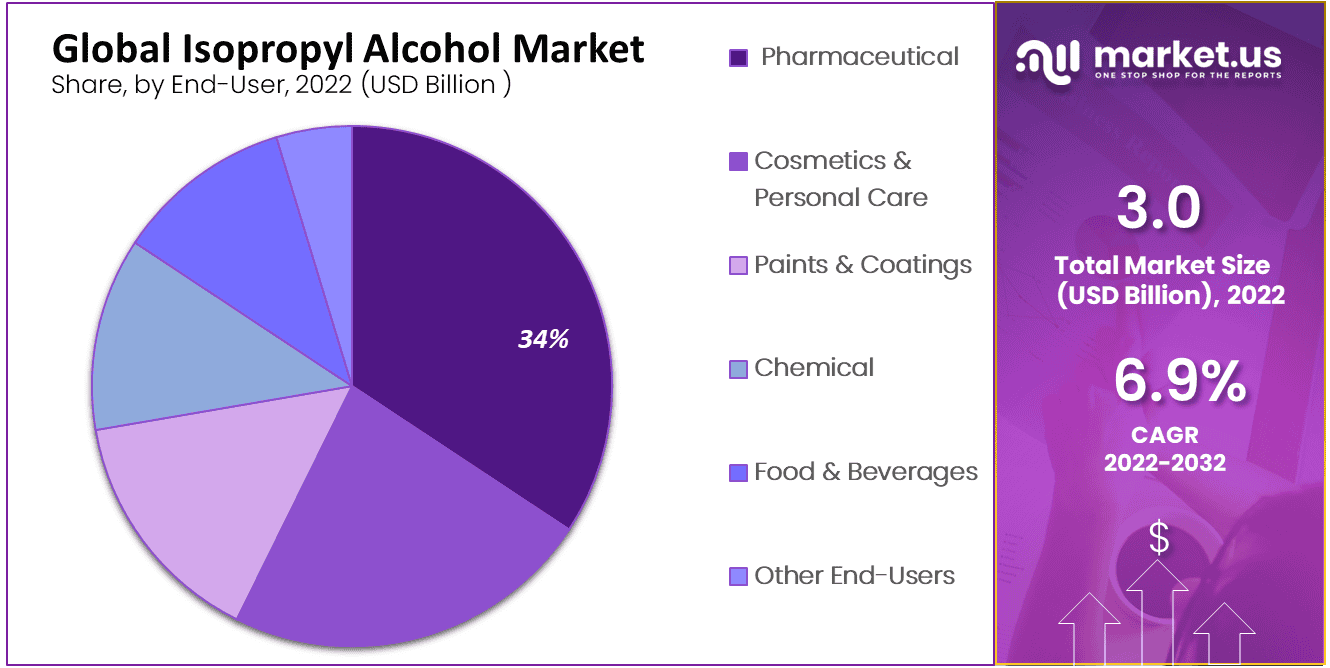

- End-User Analysis: The pharmaceutical industry had the highest share, accounting for 34% of the market’s revenue. Isopropyl alcohol is widely used in pharmaceuticals due to its high alcohol content. The cosmetics and personal care sector is also growing rapidly.

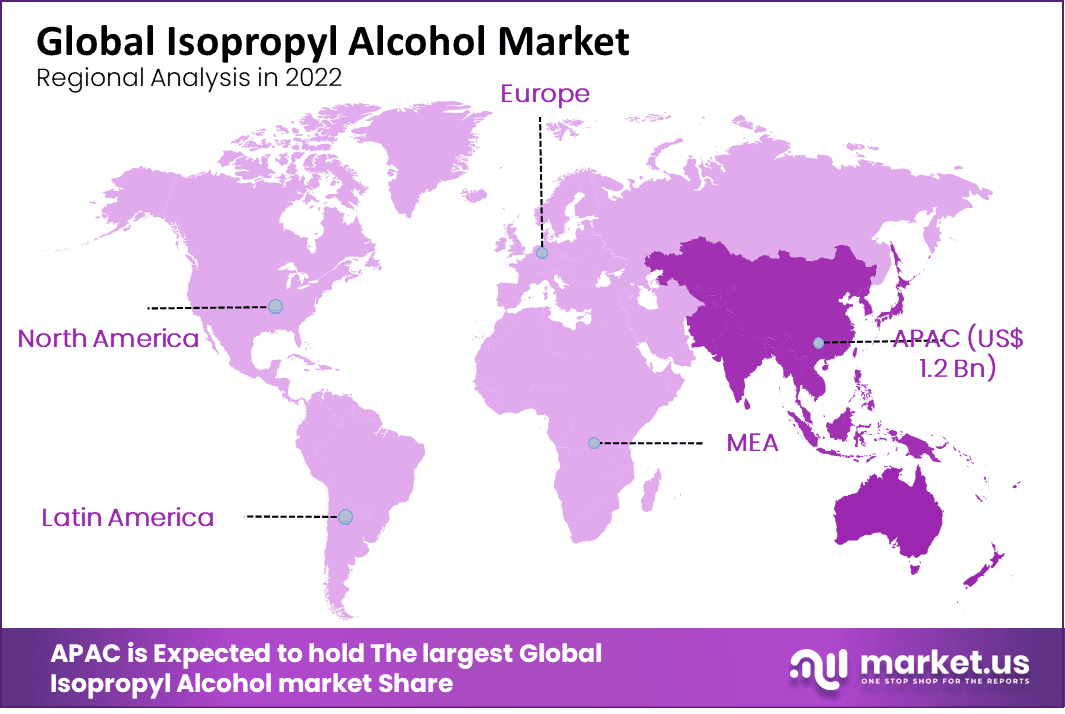

- Regional Dominance: The Asia-Pacific region dominates the Isopropyl Alcohol Market due to rising demand for pharmaceutical products, investments in the chemical industry, and strong expansion in the construction sector. Europe has also seen significant demand for isopropyl alcohol, especially for hand sanitizers and personal care products.

- Key Players: The market is characterized by leading producers such as INEOS Corporation, ExxonMobil Corporation, Dow Chemical, LyondellBasell Industries, and others. These companies are investing in research and development, expanding manufacturing capacities, and engaging in innovative product development.

Driving Factors

Isopropyl alcohol is the most widely used disinfectant in several sectors all over the world. Due to its many solutions, which produce disinfecting and cleaning products that rapidly destroy pathogens, isopropyl alcohol is one of the most efficient disinfectants and a universal cleanser. In many different sectors, isopropyl alcohol is high in demand as a cleaning agent. Cleaning agents often use it. The market will be driven by rising income, growing populations, fast urbanization, industrial growth, and changes in consumer lifestyle.

Restraining Factors

Isopropyl alcohol exposure that is prolonged or repeated can lead to headaches, nausea, and respiratory irritation. This may raise questions about consumer safety and the need for isopropyl alcohol among regulatory bodies. The cost of isopropyl alcohol depends on the cost of raw materials like propylene, which is subject to supply and demand fluctuations. Any abrupt changes in the cost of raw materials may have an impact on the price of isopropyl alcohol, which may have an impact on the demand for it. It may be challenging for businesses to operate in the market because isopropyl alcohol is subject to strict controls from several regulatory authorities

Growth Opportunities

In anticipation of the demand for greener, more sustainable chemicals, several investigations have been done on processing renewable feedstocks to produce platform molecules and downstream end products. Green Biologics plans to sell high purity 100% bio-based isopropyl alcohol in addition to a variety of specialty esters of isopropanol, n-butanol, and other bio-based alcohols. Through ongoing and upcoming collaborations, the company is actively seeking prospects in specialized solvents, plasticizers, monomers, food additives, and cosmetics.

Initiatives and research into manufacturing isopropanol through fermentation have also been reported on by Mitsui Chemicals, INC. These breakthroughs for bio-based isopropyl alcohol are anticipated to change the trend toward sustainability in the future years. To capture a significant market share, bio-based solvents must economically compete with well-established petrochemical solvents.

Trending Factors

In order to identify the most potential investment opportunities, this report gives an analytical representation of the isopropyl alcohol sector together with current trends and future projections. The construction of an additional 45,000-ton isopropyl alcohol facility by Seqens has started. The French Roussillon platform, a best-in-class competitiveness platform completely dedicated to a low-carbon energy transition, will serve as the foundation for the new isopropanol unit.

In order to reduce the country’s reliance on imports, Deepak Nitrite, a division of Deepak Phenolics, has advantage of the growing isopropyl alcohol (IPA) from acetone at a 30,000 MT (year) factory in Dahej. Due to the rise in demand for hand sanitizers, Shell restarted production at its 75,000-ton-per-year isopropyl alcohol facility in Singapore.

Application Analysis

According to revenue in 2022, astringent and antiseptics held the largest share with 40.4%. Demand for the product as an astringent and antiseptic has rapidly increased as a result of the pandemic. The global use of sanitizers, personal care items, and other pharmaceutical formulations will increase as a direct result of the virus pandemic in order to preserve personal cleanliness. This is anticipated to represent a significant demand for both personal care and medicinal product formulation.

As it has strong disinfectant characteristics, one of the compound’s main uses is in the formulation of antiseptics. The substance is also used in the manufacture of cleaning agents, where it is employed as a surface disinfectant, and home solvent. Isopropyl alcohol is also widely used as an astringent, which helps to reduce skin pores. Isopropyl alcohol’s use as a solvent is one of its main uses. Herbicide and pesticide formulation, inks manufacture, surface coatings, and resin synthesis are a few of its direct uses.

End-User Analysis

The pharmaceutical industry had the highest share, at 34%, when measured in terms of revenue. Isopropyl alcohol has several uses in a wide range of industries, which is supported by the product’s high alcohol content. Across the world, demand for chemicals is increasing rapidly from the pharmaceutical, personal care, cosmetics, chemical, food and beverage, and paints and coatings sectors. The second-largest share was held by the cosmetics and personal care sector, which is also expected to increase at the quickest rate throughout the predicted period.

IPA, commonly known as rubbing alcohol, is widely utilized in the creation of cosmetics, toiletries, hair care, aftershave lotions, and skincare products. It is frequently used in the manufacturing of hand washes, surgical hand scrubs, sanitizers, and antiseptic skin preparation for patients. The chemical is also widely used as an inert solvent in paints and thinners in the wood furnishing and coatings sector.

Key Market Segments

Based on Application

- Antiseptic & Astringent

- Cleaning Agent

- Solvent

- Chemical Intermediate

- Other Applications

Based on End-User

- Pharmaceutical

- Cosmetics & Personal Care

- Paints & Coatings

- Chemical

- Food & Beverages

- Other End-Users

Regional Analysis

The market as a whole was dominated by the Asia-Pacific region. The isopropyl alcohol market is anticipated to develop as a consequence of a variety of factors, including the region’s rising need for pharmaceutical products, the chemical industry’s investment, the building sector’s strong expansion, and investments in the cosmetics and chemical industries.

In terms of volume, Asia Pacific held the highest market in 2022 during the projected period. Yet, given the current state of the world, Europe has seen the biggest usage of hand sanitizers and other personal care items, followed by the United States and China.

Several European nations, including Germany and Italy, the United States, and Asian nations, including Japan, China, and India, have seen strong demand for safety and hygiene products. With many businesses utilizing the IPA solvent for the manufacture of personal care goods as well as medicinal applications, the demand for IPA is certainly very strong throughout these regions.

Also, a large portion of the solvents are used in the creation of paints and coatings because of the growth of healthcare facilities in Europe, North America, and Asia-Pacific. Demand for IPA is anticipated to increase gradually in these nations over the projection period due to the substance’s broad use as a food preservative and coloring agent.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The sector has been characterized by the emergence of leading producers with a service that includes and large product portfolio holding due to significant investments in research and development. INEOS Corporation announced that it would use all of the sanitizer production capacity at its two sites in Germany by the first quarter of 2020. This heavily depends on IPA.

Companies with U.S. operations have also improved their manufacturing capacities to meet the rising demand for hand sanitizers and personal care products in the relevant local markets. Joint ventures and innovative product development targeted at new application industries are major strategies pursued by industry participants.

Market Key Players

- INEOS Corporation

- ExxonMobil Corporation

- Dow Chemical

- LyondellBasell Industries

- Mistral Industrial Chemicals

- ReAgent Chemicals Ltd.

- Royal Dutch Shell

- Linde Gas

- Ecolab

- Guangfu Fine Chemicals

- Tokuyama Corporation

- Huate Gas

- Other Key Players

Recent Developments

- Exxon Mobil announced the development of its healthcare solutions portfolio in September 2022 to address the evolving demands of the health sector for clean and safe material options. ExxonMobil isopropyl alcohol is part of a portfolio of specialty and performance polymers that are used in a wide range of industries, such as medical equipment, products for preventing infections, and pharmaceutical and laboratory supplies.

- ExxonMobil will sell its share of the joint venture Area Energy in 2022. All of ExxonMobil’s holdings in the California oil production operation Area were to be sold by affiliates of the company to Green Gate Resources E, LLC, and a division of IKAV.

Report Scope

Report Features Description Market Value (2022) USD 3.0 Bn Forecast Revenue (2032) USD 5.7 Bn CAGR (2023-2032) 6.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application, By End-User. Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape INEOS Corporation, ExxonMobil Corporation, Dow Chemical, LyondellBasell Industries, Mistral Industrial Chemicals, ReAgent Chemicals Ltd., Royal Dutch Shell, Linde Gas, Ecolab, Guangfu Fine Chemicals, Tokuyama Corporation, Huate Gas, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: What are the segments covered in the Isopropyl Alcohol Market report?A: Market.US has segmented the Global Isopropyl Alcohol Market Value (US$ Mn) Analysis by Region, 2022 market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type, market has been segmented into Antiseptic & Astringent, Cleaning Agent, Solvent and other applications. By End-Uses, market has been further divided into Cosmetics and Personal Care, Pharmaceutical, Food and Beverages, and Other Key players.

Q: Who are the key players in the Isopropyl Alcohol Market?A: Dow Chemical, Mistral Industrial Chemicals, INEOS Corporation, ReAgent Chemicals Ltd., LyondellBasell Industries, Linde Gas, Ecolab, Royal Dutch Shell, Other Key Players are the key vendors in the Isopropyl Alcohol market

Q: Which region is more attractive for vendors in the Isopropyl Alcohol Market?A: APAC is accounted for the highest revenue share of 43.8% among the other regions. Therefore, the Isopropyl Alcohol Market in APAC is expected to garner significant business opportunities for the vendors during the forecast period.

Q: What are the key markets for advanced ceramics?A: Key markets for Isopropyl alcohol are The U.S., Germany, U.K., China, India, Brazil.

Q: Which segment has the largest share in the Isopropyl Alcohol Market?A: In the Isopropyl Alcohol Market, vendors should focus on grabbing business opportunities from the antiseptic and astringent segment as it accounted for the largest market share in the base year.

-

-

- INEOS Corporation

- ExxonMobil Corporation

- Dow Chemical

- LyondellBasell Industries

- Mistral Industrial Chemicals

- ReAgent Chemicals Ltd.

- Royal Dutch Shell

- Linde Gas

- Ecolab

- Guangfu Fine Chemicals

- Tokuyama Corporation

- Huate Gas

- Other Key Players