Global Isolated Industrial Interface Market Size, Share, Industry Analysis Report By Type (Isolate I2C, Isolate CAN Transceivers, Isolate RS-485 Transceivers, Others), By Application (Power Management and Distribution, Motor Control Systems, Measurement and Testing Equipment, Communication Systems, Robotics and Automation Systems, Others), By Region, Global Opportunity Analysis, Future Outlook and Industry Trends Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 158925

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

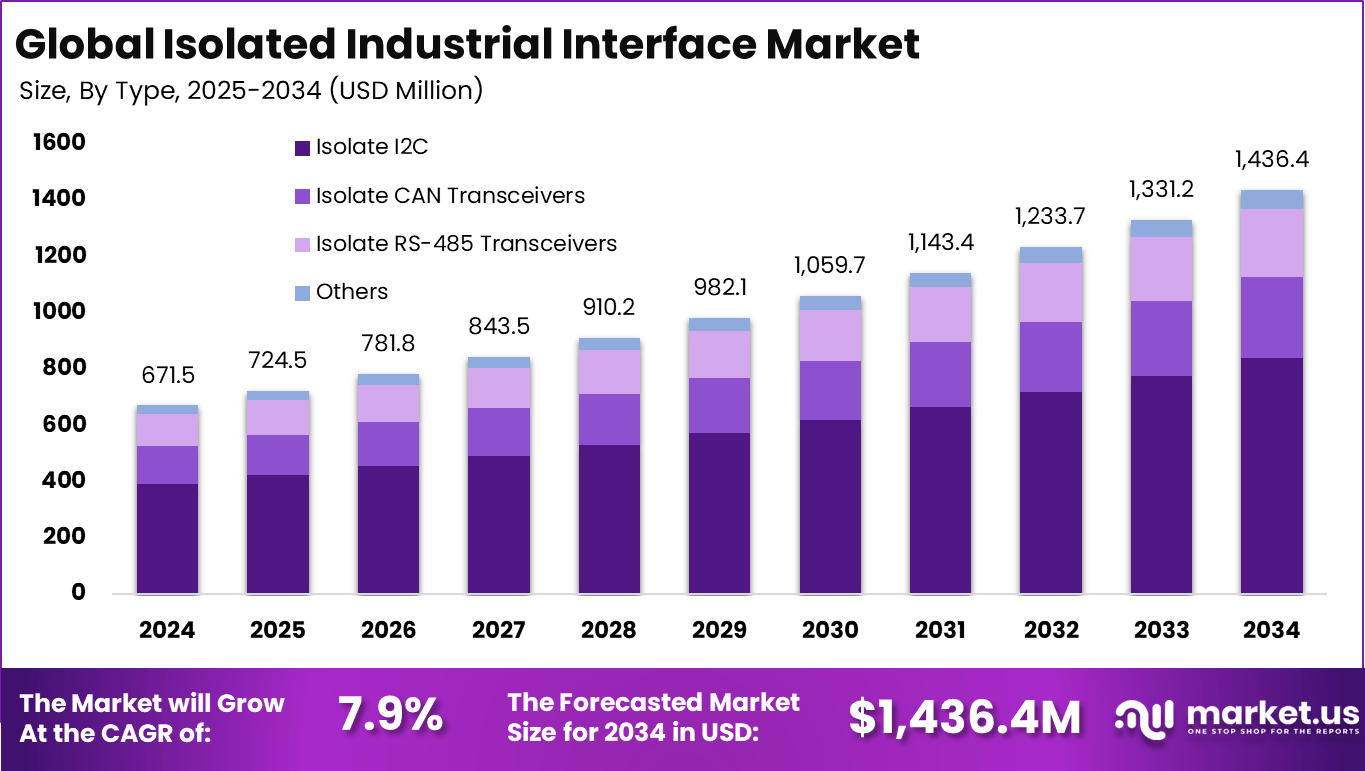

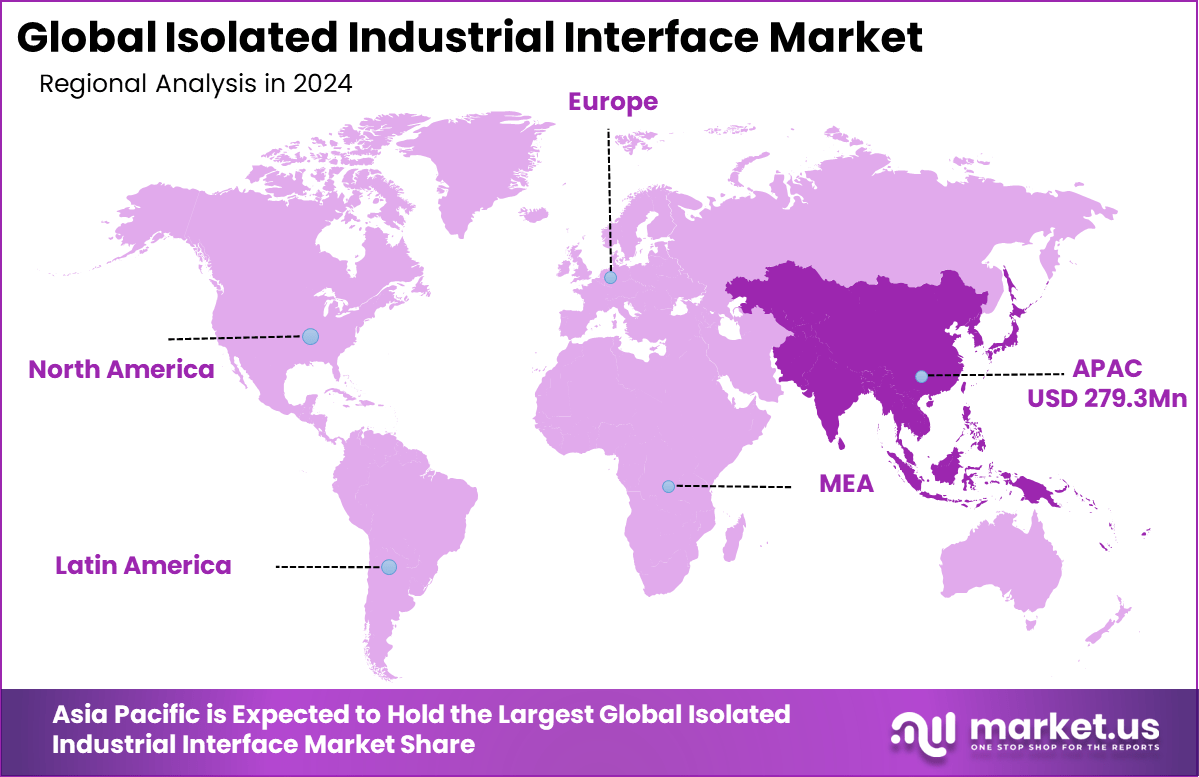

The Global Isolated Industrial Interface Market size is expected to be worth around USD 1,436.4 million by 2034, from USD 671.5 million in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. Asia Pacific held a dominant market position, capturing more than a 41.6% share, holding USD 279.3 million in revenue.

The Isolated Industrial Interface Market refers to devices and solutions designed to provide electrical isolation between different sections of industrial systems while enabling safe and reliable communication. These interfaces prevent ground loops, reduce noise interference, and protect sensitive equipment from voltage surges and faults. They include isolated amplifiers, isolated data transceivers, optocouplers, and digital isolators.

One of the top driving factors is the rising adoption of Industry 4.0 and Industrial Internet of Things (IIoT) technologies. As connected devices proliferate in industrial processes, the need for reliable data transmission without electrical interference increases significantly. For example, industrial automation systems demand robust isolation to protect control circuits from voltage spikes and ground loops, preventing costly downtime.

For instance, in September 2024, NXP Semiconductors acquired shares in the newly founded VisionPower Semiconductor Manufacturing Company Pte. Ltd. (VSMC), which will build and operate a new 300mm wafer manufacturing facility in Dresden, Germany. This investment strengthens NXP’s position in the semiconductor manufacturing sector, supporting the growing demand for isolated industrial interfaces.

Key Takeaway

- In 2024, the Isolate I2C segment led the market, holding a 58.4% share, reflecting its importance in secure and reliable industrial communication.

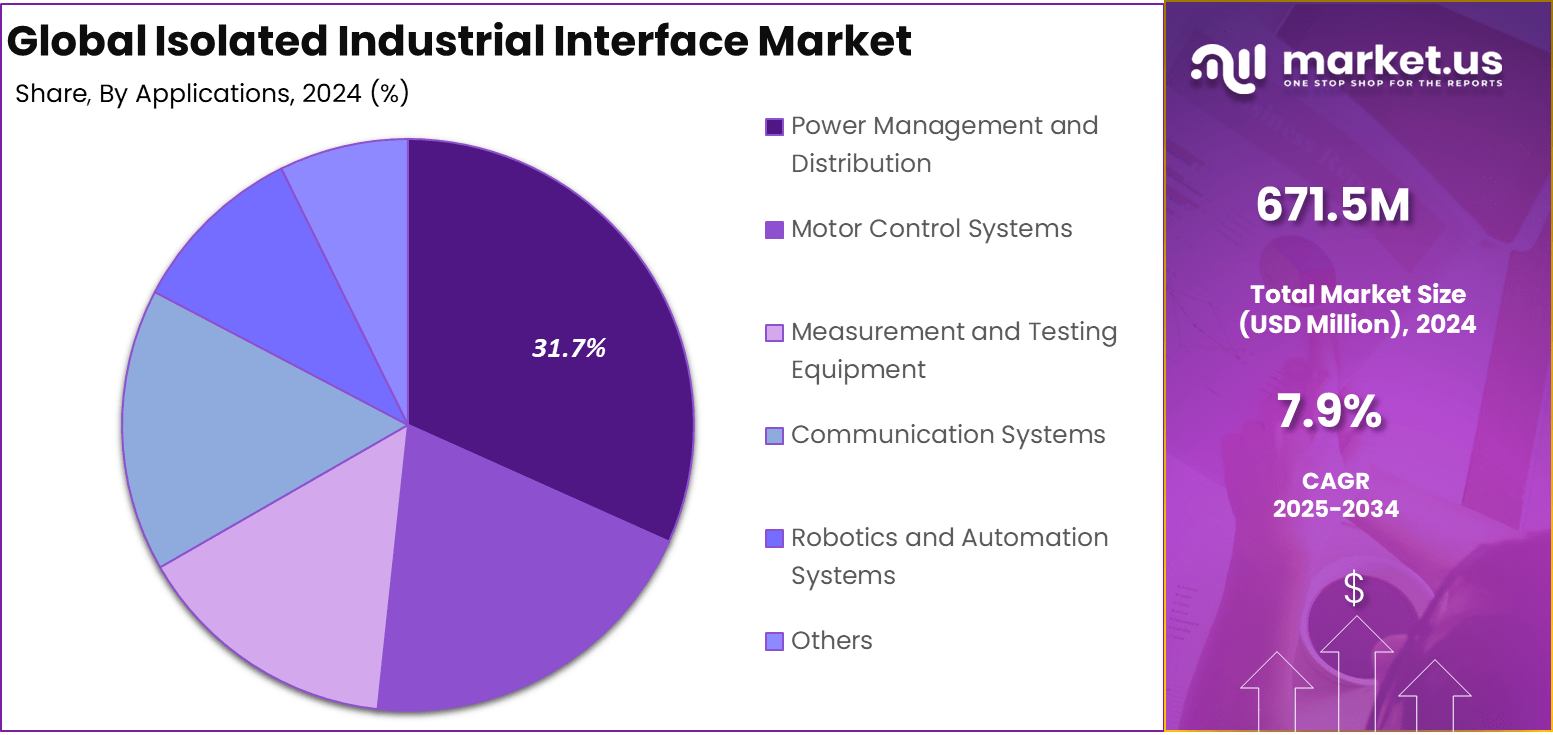

- By application, the Power Management and Distribution segment captured 31.7% share, highlighting its critical role in industrial efficiency and safety.

- Regionally, Asia Pacific dominated with 41.6% share in 2024, driven by strong industrial automation initiatives and electronics manufacturing growth.

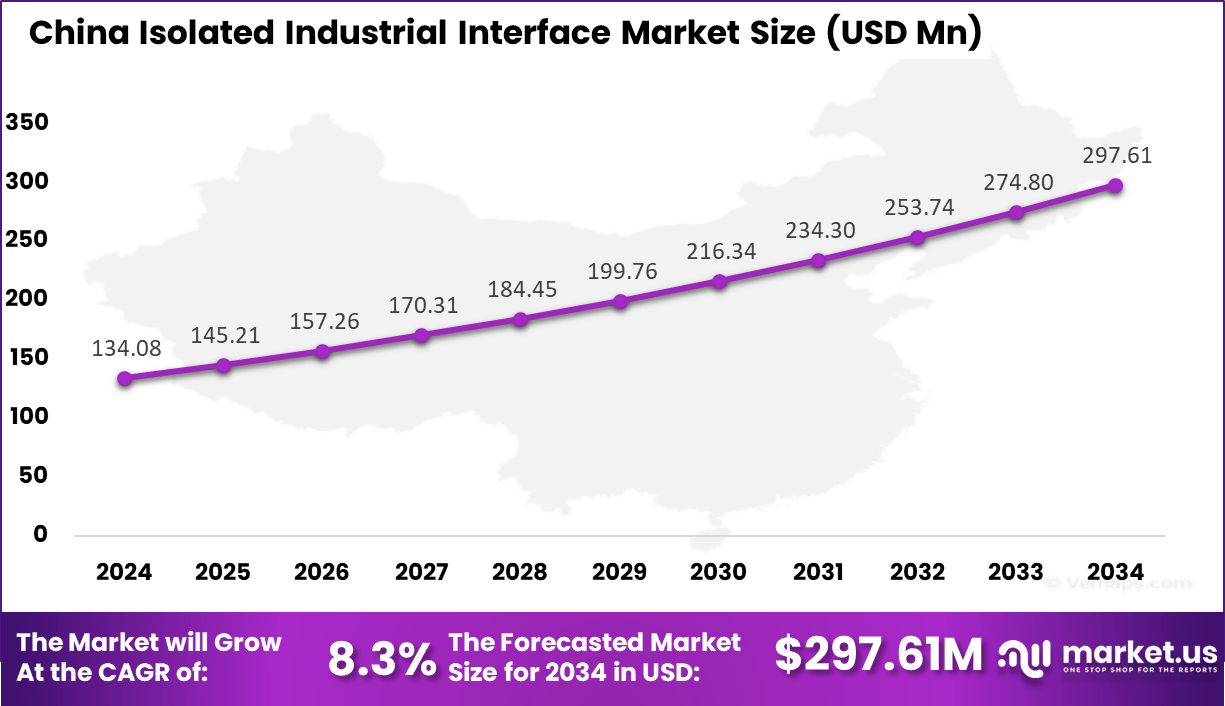

- Within Asia Pacific, China’s market was valued at USD 134.08 Million in 2024, expanding at a healthy CAGR of 8.3%, underlining its role as a key growth hub.

Analysts’ Viewpoint

Demand is strongest in industrial automation and process control, where isolated interfaces ensure reliable operation of programmable logic controllers, sensors, and motor drives. The energy sector is a significant adopter, using isolated interfaces in solar inverters, wind turbines, and energy storage systems.

Automotive manufacturers are increasingly adopting them for electric drivetrains, charging stations, and battery management systems. Healthcare equipment manufacturers also rely on isolated interfaces to ensure patient safety and compliance with regulatory standards.

The market is witnessing growing adoption of digital isolation technologies, which offer higher data rates, lower power consumption, and smaller form factors compared to traditional optocouplers. Integration of isolation with system-on-chip solutions is becoming common, reducing design complexity and cost.

Advances in silicon carbide (SiC) and gallium nitride (GaN) power electronics are driving demand for high-performance isolation. Additionally, IoT-enabled monitoring systems are incorporating isolated interfaces to ensure secure and interference-free communication in connected factories.

China Market Size

The market for Isolated Industrial Interface within China is growing tremendously and is currently valued at USD 134.08 million, the market has a projected CAGR of 8.Analysts’ Viewpoint3%. The market is growing rapidly due to the country’s fast-paced industrial expansion and increasing adoption of advanced technologies.

As China continues to modernize its manufacturing sector and embrace Industry 4.0, there is a rising demand for reliable communication systems that ensure safety and efficiency. The rapid development of smart factories, automation, and the Internet of Things (IoT) in China has created a need for high-quality isolated interfaces to protect sensitive equipment and maintain system integrity.

In 2024, Asia Pacific held a dominant market position in the Global Isolated Industrial Interface Market, capturing more than a 41.6% share, holding USD 279.3 million in revenue. This dominance is due to its rapid industrialization and strong focus on automation.

Countries like China, Japan, and India are investing heavily in modernizing their manufacturing sectors, driving the demand for reliable communication systems. Additionally, the region’s growing adoption of advanced technologies such as IoT, smart grids, and robotics has further fueled the need for isolated industrial interfaces to ensure safe and efficient operations across various industries.

For instance, in January 2024, Infineon Technologies partnered with Sinexcel to enhance energy storage systems’ performance and reliability. The collaboration aims to improve energy efficiency and grid stability, supporting industrial applications that require isolated interfaces. Focused on meeting the growing demand for reliable energy solutions, the partnership targets the rapidly developing Asia Pacific market.

Type Analysis

In 2024, the Isolate I2C segment held a dominant market position, capturing a 58.4% share of the Global Isolated Industrial Interface Market. This dominance is due to its ability to provide reliable, low-power communication for various industrial applications.

Its ease of integration, cost-effectiveness, and efficiency in connecting multiple devices in automated systems have made it a popular choice. Additionally, the growing demand for miniaturized, energy-efficient systems in industries like automotive, electronics, and manufacturing further boosts leadership.

For Instance, In December 2024, Per-Simon Saal introduced the world’s smallest I2C isolator with integrated power for Qwiic and STEMMA QT projects. The device supplies up to 1W of isolated power with selectable 3.3V or 5V I2C signals, ensuring stable communication in applications prone to noise or requiring galvanic isolation.

Application Analysis

In 2024, the Power Management and Distribution segment held a dominant market position, capturing a 31.7% share of the Global Isolated Industrial Interface Market. This dominance is due to the increasing need for efficient and reliable power management in industries like energy, manufacturing, and utilities.

Isolated interfaces play a crucial role in protecting sensitive equipment from electrical surges, ensuring smooth power distribution. As industries focus on improving energy efficiency and system reliability, the demand for advanced power management solutions continues to grow.

For instance, In May 2022, Texas Instruments launched solid-state relays like TPSI3050-Q1 and TPSI2140-Q1, combining power and signal transfer with up to 5 kV isolation to protect EVs and industrial power systems from high-voltage spikes while ensuring safe, efficient operation.

Key Market Segments

By Type

- Isolate I2C

- Isolate CAN Transceivers

- Isolate RS-485 Transceivers

- Others

By Application

- Power Management and Distribution

- Motor Control Systems

- Measurement and Testing Equipment

- Communication Systems

- Robotics and Automation Systems

- Others

Drivers

Growing Need for Safety and Signal Integrity

One key driver for the isolated industrial interface market is the increasing demand for operational safety and signal integrity in industrial automation. As industrial environments become more complex with the integration of Industry 4.0 and smart factories, there is a critical need to protect sensitive equipment from electrical interference and ground faults.

Isolated interfaces help ensure reliable data transmission by preventing electrical noise from affecting system signals, thus maintaining high operational safety and preventing costly failures. For instance, industries such as automotive manufacturing and process automation rely heavily on isolated interfaces to safeguard control systems from voltage fluctuations and surges.

This driver is reinforced by stringent safety regulations and standards that mandate the use of isolation for electrical equipment. The growing adoption of automation and IoT devices in industrial settings further propels the demand for isolated industrial interfaces as essential components for secure and uninterrupted communication

For instance, in September 2024, Renesas strengthened its presence in industrial automation and Industry 4.0 with advanced solutions designed to support the growing demand for isolated industrial interfaces. Their portfolio, including industrial motor control ICs, power devices, and communication systems, addresses critical needs in factory automation, functional safety, and industrial IoT.

Restraint

High Cost of Advanced Isolation Technologies

A significant restraint in the isolated industrial interface market is the relatively high cost associated with advanced isolation components. These devices often incorporate sophisticated semiconductor technologies that increase manufacturing expenses. This cost sensitivity can limit adoption, especially in price-conscious sectors or applications where margins are tight.

For example, small and medium-sized manufacturers may find it difficult to justify the investment required for high-performance isolated interfaces, opting instead for less costly alternatives, even if they offer lower reliability. Additionally, integration of these components into existing legacy systems can involve added engineering complexity and costs, posing further barriers to entry.

Opportunities

Expansion of Industrial IoT and Smart Manufacturing

The rise of Industrial Internet of Things (IIoT) and smart manufacturing presents a major opportunity for isolated industrial interfaces. As more devices and sensors become interconnected in factories, the need for reliable, safe, and interference-free data communication increases significantly.

Isolated interfaces play a crucial role in protecting these networks by eliminating ground loop issues and ensuring data integrity. For instance, the continuous monitoring systems and predictive maintenance solutions in smart factories rely on isolated interfaces to provide accurate and noise-free signals.

This trend opens avenues for innovation, such as developing more compact, energy-efficient isolated interface ICs that fit the growing demand for miniaturization. Expanding IIoT adoption across regions like Asia Pacific, with its strong manufacturing base, further fuels market expansion opportunities.

For instance, in December 2023, Atreyo launched the ADI-301, an Isolated USB to USB interface designed for industrial environments. It is powered directly via the USB port, eliminating the need for external power supplies. This innovation caters to industries in the Asia Pacific region, where rapid industrialization and demand for reliable, secure communication solutions are driving the growth of isolated industrial interfaces.

Challenges

Price Volatility and Regulatory Uncertainty

Fluctuating raw material prices and uncertain regulatory landscapes across different regions pose significant challenges to the isolated industrial interface market. Volatile material costs can strain manufacturers’ budgets, potentially raising the final price of products and impacting profitability.

Meanwhile, shifting regulations, particularly in highly regulated industries like energy and healthcare, can create uncertainty and complicate market expansion strategies. Businesses need to adapt quickly to these external factors to remain competitive and ensure consistent product delivery.

For instance, In January 2025, National Instruments highlighted the importance of isolation and safety standards in industrial electronics, ensuring compliance with IEC 61010 and UL 1577 to protect systems from surges, ground loops, and signal interference while enhancing reliability.

Emerging Trends

The isolated industrial interface market is evolving with key trends shaping its future. Miniaturization and low-power designs enable more compact industrial equipment, meeting space and energy constraints. Integration of multiple isolation technologies, such as combining capacitive and magnetic isolation, optimizes performance across applications.

AI-powered diagnostics embedded within the interfaces offer continuous health monitoring, reducing unplanned outages. Wireless isolated interfaces that securely transmit data without physical connections are also emerging, providing flexibility in industrial layouts.

Additionally, enhanced cybersecurity features are being built into isolation technologies, adding physical security layers against cyber threats. Increased adoption of Industrial Internet of Things (IIoT) devices fuels demand for reliable, uninterrupted data transmission.

Growth Factors

Several factors drive growth in this market. The expanding use of Industry 4.0 technologies and smart manufacturing fuels demand for isolated interfaces to protect sensitive data and equipment from electrical interference. Automation levels rising with advanced robotics and AI-driven controls increase the need for high-performance isolation.

Compliance with stringent safety regulations, including functional safety standards, compels industrial sectors to adopt reliable isolation solutions. Electrification trends, especially in transport and heavy industries, boost demand for voltage and current isolation.

Additionally, the push for faster industrial network speeds creates opportunities for innovative isolation technologies supporting high data rates. However, cost sensitivity and integration challenges with legacy systems may restrain adoption in some segments.

Regional Trends

North America Market Trends

North America remains a significant market for isolated industrial interfaces, driven largely by automation and digital transformation efforts in manufacturing and energy sectors. The region saw an estimated market size of USD 3.5 billion in 2024 with sustained growth projections.

The introduction of Industry 4.0 principles and smart factory ecosystems has reinforced the need for high-performance isolated interfaces to enable secure and noise-free data transmission. Furthermore, regulatory mandates concerning industrial safety and electromagnetic compatibility bolster the adoption of these products.

North American companies are particularly focused on developing interfaces with improved voltage isolation and signal accuracy to meet strict compliance standards. Investments in advanced manufacturing technologies and digital infrastructure upgrading continue to energize the market.

Europe Market Trends

Europe’s isolated industrial interface market is supported by increasing industrial automation initiatives across manufacturing sectors, including automotive and heavy machinery. The region’s focus on energy efficiency and sustainable industrial practices boosts the requirement for reliable isolation solutions in power and control systems.

The market is influenced by stringent safety standards and a push toward reducing operational risks in complex industrial setups. Digital transformation efforts and the integration of IIoT technologies are further encouraging the deployment of isolated interfaces.

As manufacturing moves toward data-intensive smart systems, Europe’s emphasis on innovation and compliance with environmental regulations ensures growing acceptance of these components. The market is marked by steady investment in research to enhance device performance and resilience.

Latin America Market Trends

Latin America is emerging as a promising market due to increasing industrial automation in sectors such as mining, oil and gas, and manufacturing. Countries like Brazil, Mexico, and Argentina are witnessing expanding infrastructure spending which has led to stronger demand for isolated industrial interfaces that ensure operational safety and data integrity.

This market is characterized by gradual adoption of smart automation systems and growing awareness about the benefits of isolation technology in reducing downtime and protecting costly equipment. While previously challenged by slower industrial modernization, Latin America is rapidly catching up with regional peers by investing in industrial digitalization and enhanced communication protocols, supporting sustained market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the isolated industrial interface market, Texas Instruments, Analog Devices (ADI), Infineon, and NXP Semiconductors are the leading players. Their dominance comes from strong portfolios in isolation technology, power management, and industrial connectivity.

Other established semiconductor firms such as Renesas, NVE, and NOVOSENSE contribute with specialized isolation and sensing technologies. Their solutions are widely used in motor control, renewable energy, and industrial IoT applications.

Emerging and regional players including CHIPANALOG, 2Pai Semiconductor, Silicon IoT, ZLG, and UTEK Technology strengthen the market with cost-effective and customized offerings. Their focus on meeting local demand, particularly in Asia-Pacific, provides competitive alternatives to global leaders.

Top Key Players in the Market

- Texas Instruments

- Infineon

- NXP Semiconductors

- CHIPANALOG

- NOVOSENSE

- Renesas

- ADI

- NVE

- 2Pai Semiconductor

- Silicon loT

- ZLG

- UTEK TECHNOLOGY

- Other Major Players

Recent Developments

- In September 2024, Analog Devices and Tata announced a strategic alliance to explore joint opportunities for the semiconductor ecosystem in India. This collaboration aims to foster innovation and strengthen the supply chain for isolated industrial interfaces in the region.

- In May 2023, NOVOSENSE showcased its latest advancements in isolated industrial interfaces at PCIM Europe 2023. The company highlighted its isolators, interface drivers, and sensors designed for automotive and industrial applications, including electric vehicles, energy storage, and industrial automation.

Report Scope

Report Features Description Market Value (2024) USD 671.5 Mn Forecast Revenue (2034) USD 1,436.4 Mn CAGR(2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Isolate I2C, Isolate CAN Transceivers, Isolate RS-485 Transceivers, Others), By Application (Power Management and Distribution, Motor Control Systems, Measurement and Testing Equipment, Communication Systems, Robotics and Automation Systems, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Texas Instruments, Infineon, NXP Semiconductors, CHIPANALOG, NOVOSENSE, Renesas, ADI, NVE, 2Pai Semiconductor, Silicon LoT, ZLG, UTEK TECHNOLOGY, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Isolated Industrial Interface MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Isolated Industrial Interface MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Texas Instruments

- Infineon

- NXP Semiconductors

- CHIPANALOG

- NOVOSENSE

- Renesas

- ADI

- NVE

- 2Pai Semiconductor

- Silicon loT

- ZLG

- UTEK TECHNOLOGY

- Other Major Players