Global Isobutene Market By Type (MTBE Cracking, and Tert-butanol (TBA)), By Application (Butyl Rubber, MMA, and PIB), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 39795

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

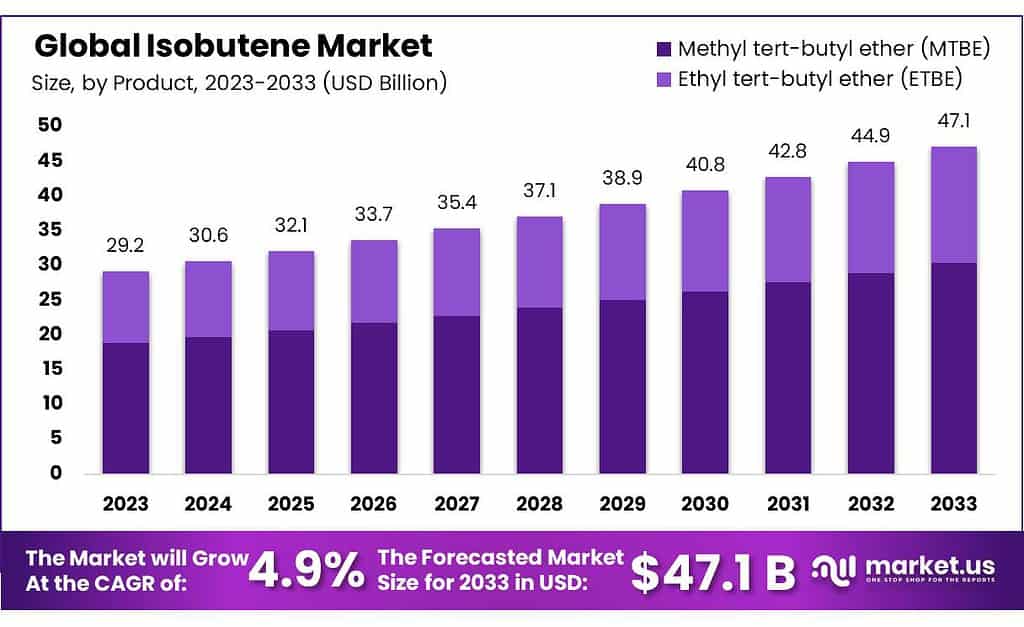

The Isobutene Market size is expected to be worth around USD 47.1 billion by 2033, from USD 29.2 Bn in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

The industry is expected to grow due to high demand from the aerospace and automotive industries. This chemical is used extensively in rubber tires and tubes, as well as in fuel additives in aerospace applications.

Note: Actual Numbers Might Vary In The Final Report

Key Takeaways

- Market Size Projection: Isobutene market estimated to reach USD 47.1 billion by 2033 from USD 29.2 billion in 2023, with a growth rate (CAGR) of 4.9% during 2023-2033.

- Application Dominance: Methyl tert-butyl ether (MTBE) claimed over 57.5% market share in 2023 due to its cost-effectiveness and versatility in fuel additives, solvents, and chemical manufacturing.

- Environmental Shifts: Ethyl tert-butyl ether (ETBE) gaining attention as a more eco-friendly alternative to MTBE, primarily for its reduced emissions, influencing market dynamics.

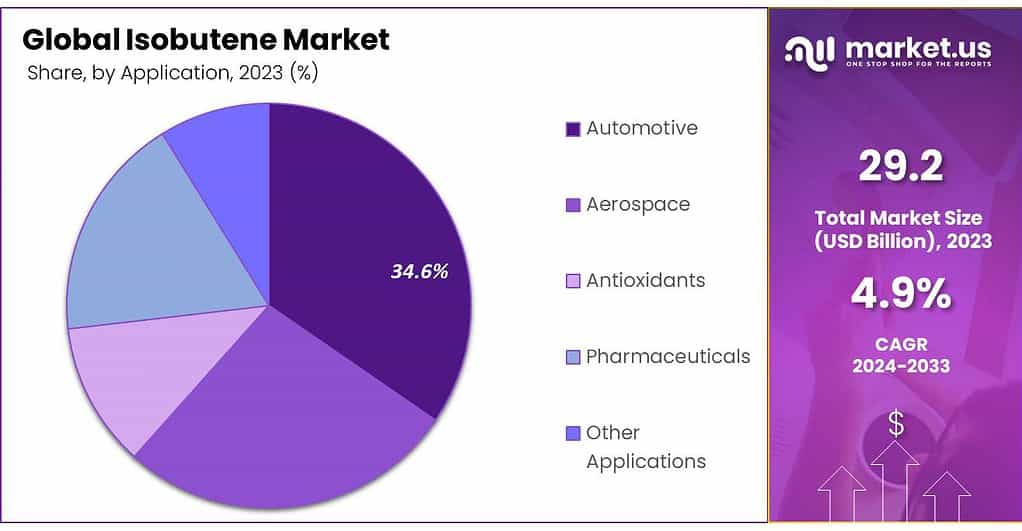

- End-Use Significance: Automotive segment held over 36.5% of the market in 2023, driven by isobutene’s role in enhancing fuel efficiency and durability in automotive components.

- Industry Drivers: Growing demand for synthetic rubber, especially butyl rubber produced using isobutene, and the rise of bio-based isobutene from plant glucose, reflecting an eco-friendly shift in the market.

- Challenges Faced: Price volatility due to petroleum ties, stringent environmental regulations, and production costs for bio-based alternatives are key constraints impacting market growth.

- Opportunities Ahead: Emphasis on sustainable fuel solutions fosters potential for bio-based isobutene adoption. Technological advancements and collaborations offer avenues for innovation and market expansion.

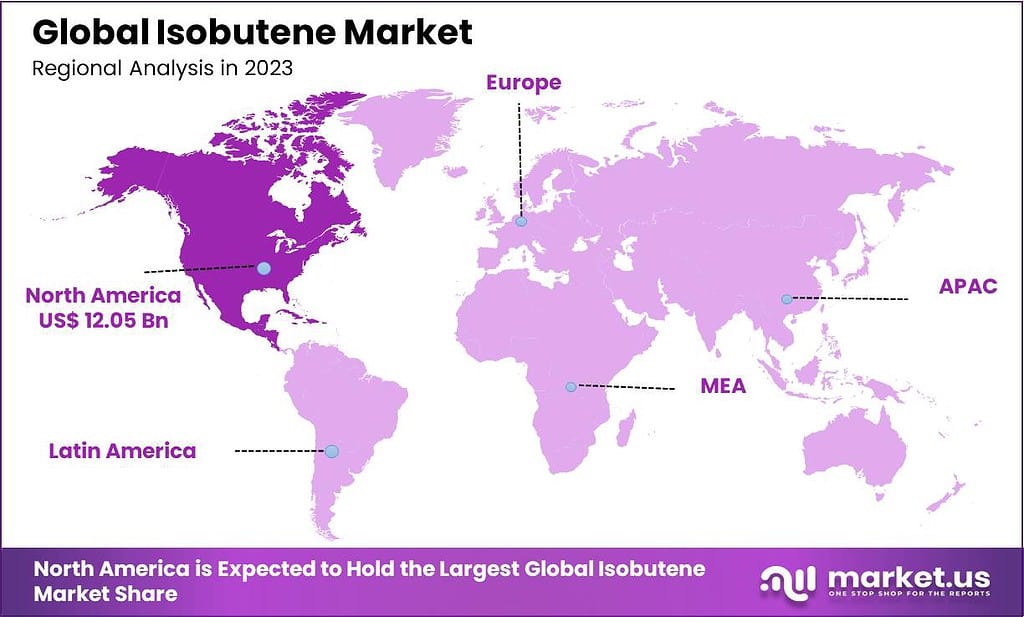

- Regional Insights: North America leads with over 41.3% revenue in 2023, while APAC’s strong manufacturing growth and rising income drive market growth, especially in Southeast Asian countries.

- Key Players: Evonik, ExxonMobil, Global Bioenergies, among others, are integral players in the market, engaging in innovation and maintaining strong supply chains.

By Application

In 2023, Methyl tert-butyl ether (MTBE) was the big cheese in the market, grabbing over 57.5% of the pie. Its widespread use and reliability made it the go-to choice for many industries. Its dominance stemmed from being cost-effective and versatile, meeting the demands of various sectors like fuel additives, solvents, and chemical manufacturing.

This substantial market hold indicated a strong preference for MTBE due to its efficiency and compatibility across different applications.

MTBE has been historically utilized as an additive in gasoline to elevate its octane level, which contributes to better engine performance. Its inclusion in fuel formulations aimed to improve combustion efficiency and reduce engine knocking, thus enhancing overall vehicle operation. Due to concerns over its effects on groundwater and the environment, its usage has decreased gradually over time in some regions.

Conversely, Ethyl tert-butyl ether (ETBE) is another derivative of isobutene used as an additive in gasoline. ETBE’s primary advantage lies in its reputation for being more environmentally friendly compared to MTBE. It serves a similar purpose in boosting gasoline’s octane rating, yet it is favored for its ability to reduce harmful emissions from vehicles, aiding in the reduction of air pollution.

While both MTBE and ETBE originate from isobutene and play roles in improving fuel quality, their distinct properties and environmental impacts have led to shifts in their usage patterns. ETBE, with its perceived environmental advantages, has gained attention as a potentially more sustainable alternative to MTBE in certain markets.

The evolution of fuel standards and environmental regulations continues to shape the dynamics of the isobutene market, influencing the adoption and demand for these derivative products.

By End-Use

In 2023, the Automotive segment ruled the market, snatching up over 36.5% of the spotlight. Its supremacy signaled a major sway in consumer preferences towards automotive products and services.

This segment’s dominance was fueled by a surge in demand for vehicles, spare parts, and associated services, showcasing a strong inclination towards automotive-related offerings among consumers.

The chemical properties of the material are critical to its performance as an anti-knocking agent in automotive fuel. Brominated isobutylene-co-para methyl styrene has similar properties to brominated isobutylene-co-para methyl styrene, but it also has inherent ozone resistance.

These characteristics make it ideal for inner liners, dynamic parts, and hoses in automobiles.

Isooctane is the result of combining butane and isobutene. Its primary application is as an aviation fuel additive. Lower fares, increased foreign direct investments, and trade liberalization are all driving significant growth.

Manufacturers of aircraft engines recommend oil for a variety of applications including engine design and climate. In the last two decades, rapid urbanization has resulted in the rapid growth of the aviation industry.

Note: Actual Numbers Might Vary In The Final Report

Key Market Segments

By Application

- Methyl Tert-Butyl Ether

- Ethyl Tert-Butyl Ether

By End-Use

- Automotive

- Pharmaceutical

- Oil and Gas

- Other Applications

Drivers

The isobutene market is being driven by a variety of factors, with one major force being the increasing demand for synthetic rubber. Isobutene plays a vital role in creating butyl rubber, which stands out for its exceptional impermeability to gases and moisture.

This rubber offers flexibility, durability, and resistance to various harsh elements like heat, chemicals, and weathering. Its use in producing tire components, gloves, and diverse products underscores its significance in multiple industries.

Another significant driver is the rise of bio-based isobutene, derived from natural plant glucose using specific enzymes. This eco-friendly alternative is gaining attention as a potential replacement for conventional gasoline additives like MBTE, offering a greener solution and contributing to cleaner fuel formulations.

Collaborations and innovations within the industry are also propelling market growth. Collaborative ventures, such as the partnership between Global Bioenergies and SkyNRG, are exploring the creation of sustainable aviation fuel using bio-based isobutene. This represents a step towards aligning with stringent industry standards while embracing eco-friendly solutions.

The commitment of industry players to invest in new technologies and partnerships, as seen in joint ventures like Sibur and Reliance Industries, signals a concerted effort to meet growing demands and expand the market reach of isobutene. These developments underscore the market’s evolution, driven by a combination of technological advancements, environmental consciousness, and a push for more sustainable solutions across various sectors.

Restraints

The isobutene market faces certain restraints that affect its growth trajectory, with two prominent challenges being price volatility and stringent environmental regulations. Isobutene, being a derivative of petroleum, is susceptible to price fluctuations stemming from changes in crude oil prices.

These shifts in the source material directly impact the overall isobutene market, making it sensitive to variations in crude oil costs. Regulators add yet another constraint. Isobutene’s hazardous nature necessitates stringent regulations that restrict its release into the atmosphere; compliance with such requirements necessitates specific protocols and procedures, adding operational complexities and cost for both manufacturers and users alike.

While bio-based isobutene holds promise as a sustainable alternative, its production faces its own set of challenges. The cost associated with separating ethanol from the water it produces during biofuel ethanol manufacturing constitutes a significant portion of the overall manufacturing cost.

This cost component represents a hurdle in scaling up the production of bio-based isobutene, impacting its competitiveness in the market. These restraints in price volatility, stringent regulations, and production costs for bio-based alternatives pose challenges for the isobutene market.

Overcoming these hurdles would necessitate innovative approaches in cost-effective manufacturing processes, technological advancements, and a proactive approach to compliance with environmental regulations, enabling the market to navigate these constraints and sustain its growth momentum.

Opportunities

The isobutene market presents several promising opportunities amidst its challenges. One key avenue lies in the growing demand for alternative and sustainable fuel solutions. Bio-based isobutene, derived from renewable sources like plant glucose, holds immense potential as a green alternative to conventional petroleum-based isobutene.

The rising global emphasis on eco-friendly fuels opens doors for the adoption and expansion of bio-based isobutene in fuel additives, potentially transforming the market landscape.

Additionally, advancements in technology and research offer opportunities for innovative applications of isobutene derivatives. The versatility of isobutene in producing various chemicals and materials presents avenues for its utilization in diverse industries. Exploring novel uses in sectors such as pharmaceuticals, specialty chemicals, and advanced materials could unlock new market segments and drive further growth.

Collaborations and strategic partnerships within the industry can foster innovation and market expansion. Collaborations that aim to enhance production processes, develop new applications, or research sustainable practices may drive market expansion. Partnerships between technology firms, biofuel producers, and research institutions hold the potential to advance bio-based isobutene technology and its uses.

The increasing awareness and regulatory focus on reducing greenhouse gas emissions and promoting sustainable practices offer another opportunity for isobutene-derived products. The demand for environmentally friendly materials and chemicals continues to rise, creating a niche for bio-based alternatives and driving market demand for eco-friendly isobutene derivatives.

By capitalizing on these opportunities through innovation, collaboration, and a focus on sustainability, the isobutene market can unlock new avenues for growth and establish itself as a crucial player in the evolving landscape of renewable energy and eco-conscious industries.

Challenges

The isobutene market faces several challenges that impact its development. Price volatility due to its ties to crude oil prices remains a significant hurdle, affecting the market’s stability and influencing overall profitability. Moreover, stringent environmental regulations, driven by isobutene’s hazardous nature, require strict adherence to prevent environmental contamination, adding complexities and costs to production and compliance efforts.

The production of bio-based isobutene, while promising, encounters challenges related to the cost of separating ethanol from its water byproduct in biofuel manufacturing. This cost factor poses a significant obstacle in scaling up bio-based isobutene production, affecting its competitiveness in the market.

These challenges—price volatility linked to crude oil, stringent environmental regulations, and production costs for bio-based alternatives—present hurdles for the isobutene market. Overcoming these obstacles will require innovative approaches in cost-effective manufacturing, technological advancements, and proactive strategies to comply with environmental standards, enabling the market to navigate these constraints and foster sustainable growth.

Geopolitical and Recession Impact Analysis

Geopolitical Impact Analysis

- Trade Shake-Ups: When countries argue or impose taxes, it messes with getting Isobutene. That means it might cost more for companies and users. Companies might need to rethink how they buy and sell Isobutene.

- Rules Change: If politics change, the rules for making and using Isobutene might change too. New laws might slow down making and using this stuff. Companies working in different places might face different rules.

- Getting Into New Markets: Political issues might stop Isobutene companies from growing in new areas. Conflicts or limits might block them from new markets. They might need to sell Isobutene in different places.

- Teamwork Problems: When countries don’t get along, working together on Isobutene projects becomes harder. Sharing ideas slows down, making it tough to create new Isobutene stuff. Companies might need new partners to work with.

Recession Impact Analysis

- Money Woes: During a recession, people might not have much money to spend. They might not want to buy Isobutene when they’re saving money.

- Harder to Get Funds: When times are tough, getting money for Isobutene projects might be tricky. Companies might struggle to get money to make more Isobutene.

- Delivery Problems: Recessions mess up making and delivering Isobutene. That might mean delays in getting it to people, making it tough to use.

- Government Changes: During a recession, governments might change how they help industries like Isobutene. That could mean less help, slowing down its progress.

Regional Analysis

North America held the highest revenue share at over 41.3% in 2023. Product demand is expected to rise in APAC as a result of strong manufacturing growth and rising disposable income per capita. Consumer confidence has risen as a result of these factors, and spending on passenger and light vehicles has increased.

Southeast Asian countries such as Malaysia, Thailand, and Vietnam will have a significant impact on the market. The developing countries in the region are working hard to develop their automotive industries. The governments of these countries are constantly focusing on trade.

The U.S. automotive sector has seen a steady rise in sales and production, despite the economic downturn. Consumer confidence is increasing, and they are choosing to buy individual passenger cars while savoring more luxurious models due to rising disposable income.

These factors will drive MTBE consumption of rubber tubes, tires, and other automotive components during the forecast period.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Evonik and Lyondell Basell N.V., two major companies, are integrated throughout the value chain to supply raw materials as well as other products made from Isobutene for other end-use sectors. These companies have an advantage in terms of raw materials availability and maintain direct contact with their end-users.

Isobutene’s key manufacturers are Evonik, ExxonMobil, Honeywell International, ABI Chemicals Praxair, Syngip BV LanzaTech, and Lyondell Basell Industries.

Маrkеt Кеу Рlауеrѕ

- BASF

- Evonik

- ExxonMobil

- ABI Chemicals

- Global Bioenergies

- Syngip BV

- LanzaTech

- Honeywell International

- LyondellBasell Industries

- Other Key Players

Recent Developments

In July 2023, Exxon Mobil Corporation announced its acquisition of Denbury Inc. with this move forming the largest carbon dioxide (C02) pipeline network in America.

In June 2022, Global Bioenergies was awarded its inaugural contract from Shell to conduct tests on bio-isobutene derivatives, an antimicrobial substance with various applications from cosmetics and fine chemicals to commodities and fuels.

Report Scope

Report Features Description Market Value (2023) USD 29.2 Bn Forecast Revenue (2033) USD 47.1 Bn CAGR (2023-2032) 4.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product(Methyl tert-butyl ether (MTBE), Ethyl tert-butyl ether (ETBE)), Application(Automotive, Aerospace, Antioxidants, Pharmaceuticals, Other Applications) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape BASF, Evonik, ExxonMobil, ABI Chemicals, Global Bioenergies, Syngip BV, LanzaTech, Honeywell International, LyondellBasell Industries, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Isobutene?Isobutene, also known as isobutylene, is a colorless and odorless gas used in various industries, particularly in the production of chemicals like plastics, rubber, and fuel additives.

How is Isobutene Produced?Isobutene is often derived from crude oil refining or natural gas processing. It can also be produced through processes like catalytic dehydrogenation of isobutane or by cracking butanes.

What Are the Key Applications of Isobutene?Isobutene finds application in the manufacturing of various products. It's used to create materials like polyethylene, butyl rubber, lubricants, antioxidants, and gasoline additives.

What Impact Does a Recession Have on the Isobutene Market?During a recession, industries might reduce production or face financial constraints, affecting the demand for Isobutene-derived products. Tightened budgets and reduced consumer spending can influence market growth.

-

-

- BASF

- Evonik

- ExxonMobil

- ABI Chemicals

- Global Bioenergies

- Syngip BV

- LanzaTech

- Honeywell International

- LyondellBasell Industries

- Other Key Players