Global Iron Casting Market By Product (Gray Cast Iron, Malleable Cast Iron, and Ductile Cast Iron), By Application (Automotive, Railways, Machinery & Tools, Power Generation, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb 2024

- Report ID: 65006

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

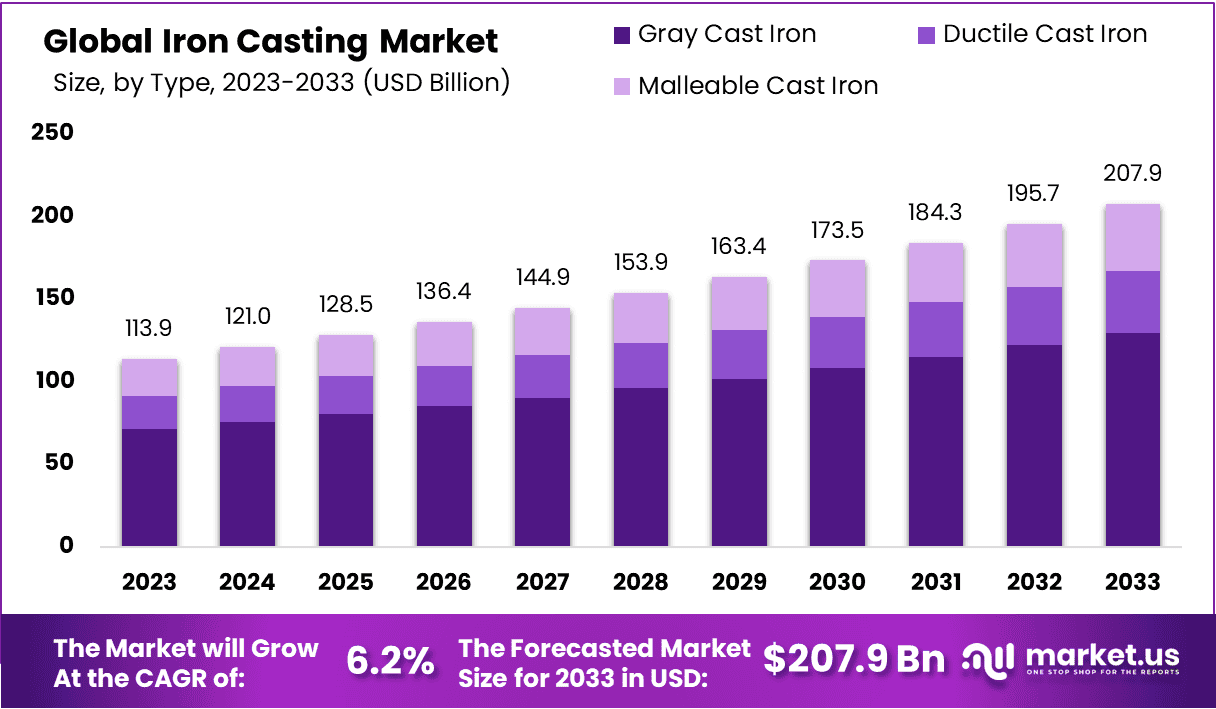

The Global Iron Casting Market size is expected to be worth around USD 207.9 Billion by 2033, From USD 113.9 Billion by 2023, growing at a CAGR of 6.20% during the forecast period from 2024 to 2033.

Iron casting is a versatile manufacturing process utilized across various industries for producing components with complex shapes and high strength. It involves pouring molten iron into a mold cavity, which solidifies to form the desired shape.

This method offers excellent dimensional accuracy, surface finish, and cost-effectiveness, making it suitable for the mass production of automotive parts, machinery components, and infrastructure elements.

Different types of iron, such as gray iron, ductile iron, and malleable iron, cater to diverse applications, providing flexibility and performance characteristics tailored to specific requirements. Iron casting continues to be a cornerstone of modern manufacturing, driving innovation and advancement in industrial processes.

Key Takeaways

- Market Growth: The Iron Casting Market is poised for substantial growth, with the market value projected to surge from USD 113.9 billion in 2023 to USD 207.9 billion in 2033, reflecting a commendable Compound Annual Growth Rate (CAGR) of 6.2%.

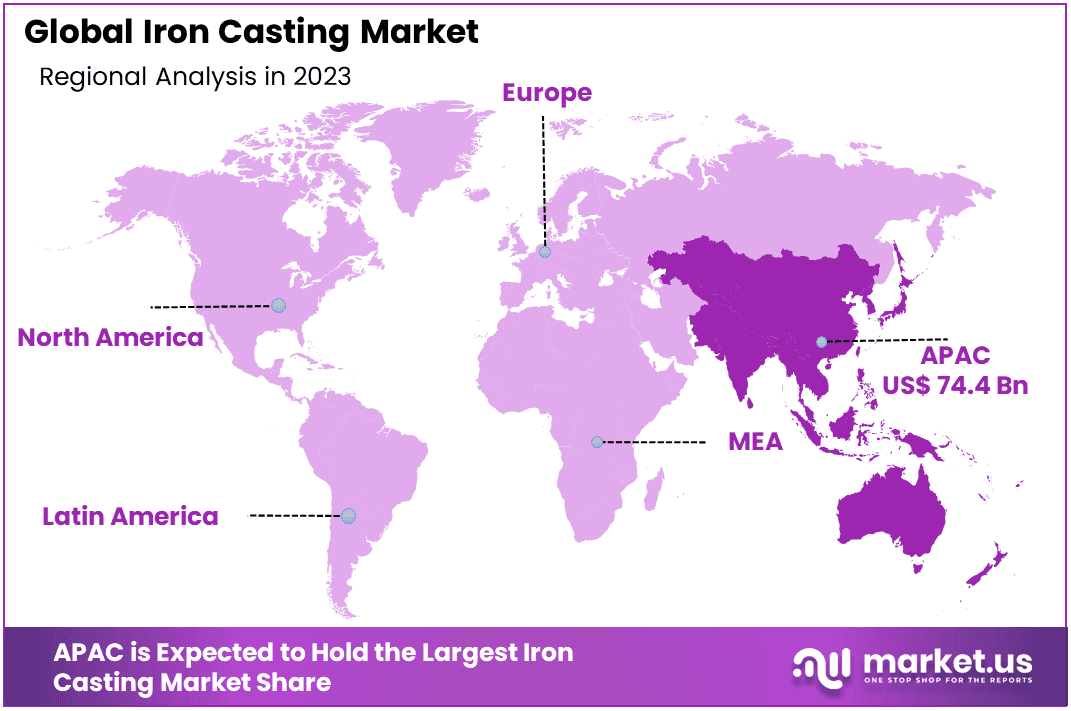

- Regional Dominance: Asia-Pacific (APAC) emerges as the dominant region, commanding a significant 65.4% share. This highlights APAC’s pivotal role as a major hub for iron casting production and consumption, driven by robust industrial activities and infrastructure development.

- Segmentation Insights:

- Type Leadership: Gray Cast Iron emerges as the dominant type, capturing a substantial 62.4% share. This underscores the widespread utilization of gray cast iron across various industries owing to its excellent machinability and cost-effectiveness.

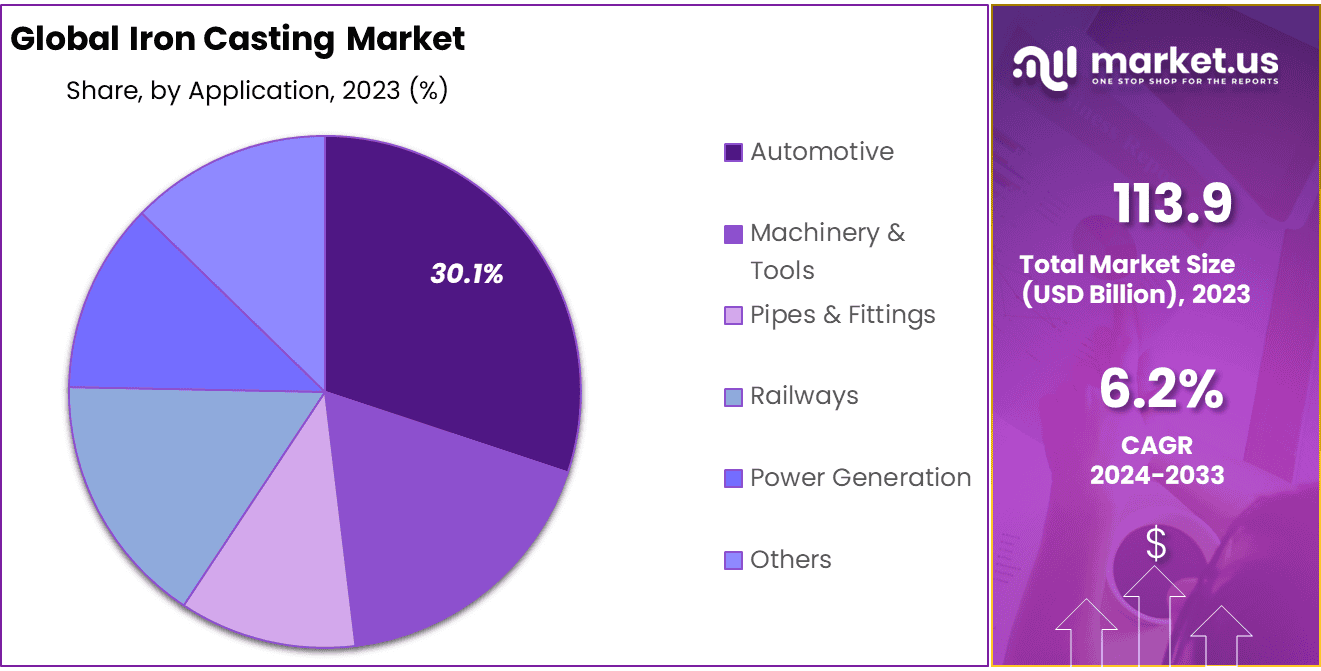

- Application Significance: The automotive sector dominates the application segment with a notable 30.1% share. This indicates the extensive use of iron castings in automotive manufacturing, ranging from engine components to chassis parts.

Market Dynamics:

- Steady Market Expansion: The market displays a steady growth trajectory, propelled by the continuous demand for iron castings across diverse industrial sectors, particularly in rapidly industrializing regions like APAC.

- APAC’s Manufacturing Hub: APAC’s dominance underscores its status as a key manufacturing hub, fueling demand for iron castings in various infrastructure, automotive, and machinery applications.

Industry Analysis:

- Resilient Market Demand: The consistent CAGR reflects enduring demand for iron castings, driven by their indispensable role in manufacturing processes across industries.

- Automotive Sector Focus: The dominance of iron castings in the automotive sector highlights their critical importance in vehicle manufacturing, contributing to structural integrity and performance.

Driving Factors

Resilient Growth in the Iron Casting Market: A Comprehensive Analysis of Global Demand and Regional Dynamics

This analysis underscores the Iron Casting Market’s robust growth outlook, driven by sustained demand from diverse end-use sectors, particularly in regions like Asia-Pacific. The steady CAGR and dominance of gray cast iron in key applications signal a resilient market with enduring relevance in industrial production processes. Market growth will be driven by factors such as favorable government policies and investments in rail infrastructure. Due to increased demand for better railway connectivity, governments around the world have invested in rail infrastructure projects. The French government announced in October 2021 that it would double rail freight by 2032.

Strategic Investments in Rail Infrastructure and Industrial Development: Catalysts for the U.S. Iron Casting Market Expansion

Because of the large presence of many manufacturers and end users in the United States, the U.S. holds a significant share of the North American iron cast market. Large-scale automobile plants, machinery and tool manufacturers, rising demand for pipes & fixtures owing to the expanding petroleum industry, infrastructural development, and large-scale automobile manufacturing are all driving the demand. In 2021, The U.S. government approved a US$ 1,000 billion Bipartisan Plan to modernize the nation’s infrastructure. It included water systems and roads as well as railways, power infrastructure, and power infrastructure. It is predicted that this will drive the country’s market growth for the period.

Restraining Factors

Navigating Market Dynamics: Capacity Expansion and M&A Trends in Iron Casting

Due to the increased demand for castings, market players are being forced to undertake initiatives such as capacity expansions or mergers & acquisitions. Victaulic Inc., acquired Waupaca Foundry Inc., a ductile-iron foundry, to increase its U.S. manufacturing capacity. It has two foundry molding machines, which are expected to allow the company to produce at a greater scale. The automotive industry has been a significant end-user of iron casting. This market is the largest in terms of both revenue and volume share. The market is facing a constant challenge as global vehicle production has declined over the past few decades.

Challenges in the Iron Casting Market: Addressing Raw Material Volatility and Regulatory Compliance

The Iron Casting Market faces several restraining factors that impact its growth trajectory. One significant challenge is the volatility of raw material prices, particularly for iron ore and scrap metal, which directly affects production costs. Additionally, stringent environmental regulations aimed at reducing emissions and waste disposal pose compliance challenges for foundries. Competition from alternative materials and manufacturing processes, such as aluminum casting and additive manufacturing, also presents a barrier to market expansion. Moreover, the cyclical nature of end-use industries, such as automotive and construction, can lead to fluctuations in demand, affecting investment decisions and capacity utilization in the iron casting sector. Overcoming these obstacles requires strategic cost management, sustainable practices, and innovation in product development.

By Product Analysis

Gray Cast Iron Dominated The Product Segment, Leading Market Trends.

Gray cast iron had the largest share of revenue at 62.4% for 2023 on the global market. It’s a popular product due to its high cost, durability, strength, and ability to withstand heat cycling, high deformation resistance, and high tensile strength. It is used to manufacture engine and brake components in the automotive industry due to its excellent vibration-damping ability.

In terms of revenue, Ductile Cast Iron will experience the fastest growth rate. This product has several advantages including its ability to be bent and twisted without breaking. This product is widely used in manufacturing tractors and implements parts such as crankshafts, shafts, cylinder heads switch boxes, electrical fittings, and motor frames.

The segment growth is expected to be driven by the increasing demand for ductile casting iron in pipes and fittings. Welspun Corp Ltd. planned to invest US$ 212 million to establish a Greenfield facility in Anjar, India in June 2021 to enter the ductile-iron pipe business. It has a microstructure that makes it suitable to be used in applications that require machinability or toughness.

It is widely used across many industries, including automotive, tools & equipment, and metal & mining. It’s used in the manufacture of electrical fittings and machinery, washers, brackets, hand tools, mining hardware, and pipe fittings, as well as machine parts.

By Application Analysis

Automotive Applications Led, Representing The Largest Market Share By Application.

The global automotive market held a significant revenue share of 30.1% in 2023. It is preferred because of its cost-efficiency, durability, strength, ability to resist high internal pressures, and greater horsepower. Iron castings are not as widely used in the automotive sector, and aluminum castings have replaced them, which has negatively impacted their demand. The market segment of machines and tools also contributed considerably in 2021.

The high wear resistance, machinability, high strength, and durability of iron castings make them a popular choice for manufacturing machinery and tools. In the future, there will be an increase in investment in machinery and manufacturing tools.

The railway market is another important application segment. It is predicted to grow at the fastest CAGR during the forecast period. Due to their strength and low wear characteristics, iron castings are widely used by the railway industry in manufacturing components. Market growth will be influenced by increasing investments in railway infrastructure.

Key Market Segments

By Product

- Gray Cast Iron

- Malleable Cast Iron

- Ductile Cast Iron

By Application

- Automotive

- Railways

- Machinery & Tools

- Pipes & Fittings

- Railways

- Power Generation

- Other Applications

Growth Opportunities

Innovative Iron Casting: Meeting Demand for Lightweight, High-Strength Components

The Iron Casting Market presents promising growth opportunities driven by several factors. One key opportunity lies in the increasing demand for lightweight and high-strength components in industries such as automotive, aerospace, and construction. Iron casting processes can be optimized to produce complex, lightweight parts with improved mechanical properties, meeting the evolving needs of these sectors.

Technological Advancements and Sustainability: Future Opportunities in Iron Casting

Furthermore, advancements in casting technology, such as digital simulation and additive manufacturing, offer opportunities to enhance process efficiency, reduce lead times, and customize component designs. Additionally, the growing emphasis on sustainable manufacturing practices and the circular economy presents avenues for innovation and market expansion in the iron casting industry.

Latest Trends

Sustainability and Digital Innovation: Transforming the Iron Casting Industry

The Iron Casting Market is experiencing notable trends that are reshaping the industry landscape. There’s a growing emphasis on sustainability, with a shift towards eco-friendly casting processes to minimize waste and energy consumption. Integration of digital technologies and automation is enhancing efficiency and precision in casting operations.

Customization, Reshoring, and Material Innovations: Key Trends in Iron Casting

Customization and personalization are becoming increasingly important to meet diverse customer demands, particularly in sectors like automotive and aerospace. Reshoring initiatives are driving local production, mitigating supply chain risks, and supporting domestic economies. Material innovations continue to drive advancements, with a focus on developing alloys with enhanced properties to address evolving industry requirements.

Regional Analysis

The Asia Pacific Region Holds A Commanding 65.4% Market Share In The Iron Casting Market.

The Asia Pacific had a revenue share of 65.4% in the global market in 2023. Over the forecast period, iron castings will be in high demand due to increasing requirements for them in the machine and tools, railways, renewables, and machine & equipment industries. North America held the second-largest revenue share of the global market in 2023. The investment in renewable energy is expected to increase product demand.

Europe is committed to improving its water supply and sanitation and is therefore investing in its infrastructure development. The European Investment Bank has invested EUR 19.8 million (US$ 21.86 million in 2021), in the construction and operation of wastewater management systems. In the future, these investments will help to accelerate the growth of iron casting in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

As of my last update, the Iron Casting Market is characterized by a diverse landscape of key players contributing to varying market shares. Prominent companies such as Waupaca Foundry, Inc., American Axle & Manufacturing Holdings, Inc., and Grede Holdings LLC are significant players in the global market.

These companies leverage their extensive manufacturing capabilities, technological advancements, and strategic partnerships to maintain competitive positions and capture substantial market shares. Other notable players include Neenah Foundry Company, Metal Technologies Inc., and Benton Foundry Inc.

Market share analysis varies by region and segment, with each player contributing to the overall growth and dynamics of the Iron Casting Market.

Маrkеt Кеу Рlауеrѕ:

- Newby Foundries Ltd

- Georg Fischer Ltd

- OSCO Industries, Inc

- LIAONING BORUI MACHINERY CO., LTD

- Hitachi Metals, Ltd

- Chamberlin plc

- Casting P.L.C

- CALMET

- Crescent Foundry

- Xinxing Cast Pipe Co., Ltd

- Brakes India Private Limited

- Grupo Industrial Saltillo

Recent Developments:

- Sustainability Push:

- 2022: Increased focus on using recycled materials and energy-efficient production processes to minimize environmental impact.

- 2023: Growing adoption of bio-based binders and exploration of renewable energy sources for melting furnaces.

- Technological Advancements:

- 2022: Rise of near-net-shape casting technologies to reduce material waste and machining costs.

- 2023: Advancements in additive manufacturing for complex iron castings with improved design freedom and lighter weight.

Report Scope:

Report Features Description Market Value (2023) USD 113.9 Billion Forecast Revenue (2033) USD 207.90 Billion CAGR (2024-2033) 6.20% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Gray Cast Iron, Malleable Cast Iron, Ductile Cast Iron), By Application(Automotive, Railways, Machinery & Tools, Pipes & Fittings, Railways, Power Generation, Other Applications) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, Japan, South Korea, India, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, United Arab Emirates, and Rest of Middle East & Africa. Competitive Landscape Newby Foundries Ltd, Georg Fischer Ltd, OSCO Industries Inc., LIAONING BORUI MACHINERY CO., LTD, Hitachi Metals Ltd, Chamberlin plc, Casting P.L.C, CALMET, Crescent Foundry, Xinxing Cast Pipe Co., Ltd, Brakes India Private Limited, Grupo Industrial Saltillo Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User license (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

Q: List the segments encompassed in this report on the Iron Casting market?A: Market.US has segmented the Iron Casting market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, the market has been segmented into Gray Cast Iron, Malleable Cast Iron, and Ductile Cast Iron. By Application, the market has been further divided into Automotive, Railways, Machinery & Tools, Power Generation, and Other Applications.

Q: Which region is more appealing for vendors employed in the Iron Casting market?A: APAC is expected to account for the highest revenue share of 61%. Therefore, the Iron Casting industry in APAC is expected to garner significant business opportunities over the forecast period.

Q: Name the key areas of business for Iron Casting?A: The US, India, China, Canada, UK, Japan, & Germany are key areas of operation for the Iron Casting Market.

-

-

- Newby Foundries Ltd

- Georg Fischer Ltd

- OSCO Industries, Inc

- LIAONING BORUI MACHINERY CO., LTD

- Hitachi Metals, Ltd

- Chamberlin plc

- Casting P.L.C

- CALMET

- Crescent Foundry

- Xinxing Cast Pipe Co., Ltd

- Brakes India Private Limited

- Grupo Industrial Saltillo